Professional Documents

Culture Documents

Internal Audit Department Audit Program For Cash: Audit Scope: Audit Objectives

Uploaded by

Rijo Jacob75%(4)75% found this document useful (4 votes)

2K views3 pagesBank confirmations should be sent to all banking relationships. Trace outstanding items listed on bank reconciliation to subsequent month's bank statement. Trace deposits in transit listed on the bank reconciliation.

Original Description:

Original Title

CashAuditProgram

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBank confirmations should be sent to all banking relationships. Trace outstanding items listed on bank reconciliation to subsequent month's bank statement. Trace deposits in transit listed on the bank reconciliation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

75%(4)75% found this document useful (4 votes)

2K views3 pagesInternal Audit Department Audit Program For Cash: Audit Scope: Audit Objectives

Uploaded by

Rijo JacobBank confirmations should be sent to all banking relationships. Trace outstanding items listed on bank reconciliation to subsequent month's bank statement. Trace deposits in transit listed on the bank reconciliation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

Internal Audit Department

Audit Program for Cash

Audit Scope:

Audit Objectives:

Risks

• Cash transactions may not be recorded accurately

• Cash may not exist

Audit Procedures Done by Date W/P Ref

1. Confirm selected bank accounts and special

arrangements

Select bank accounts for confirmation in order to

obtain a moderate to low level of assurance that the

aforementioned audit objectives are achieved. Bank

confirmations should be sent to all banking

relationships to identify accounts not included in the

general ledger.

Confirmation requests should be sent under our

control and, second requests and, where warranted,

third requests should be mailed when responses to

confirmation requests have not been received within a

reasonable time.

Consider sending a special inquiry letter to ascertain

the existence of special arrangements or restrictions,

for example, compensating balance arrangements,

security arrangements, written guarantees.

2. Review confirmation replies

For confirmations returned:

a) agree account information and account balance to

comparative summary;

b) investigate all discrepancies reported or questions

raised in review and determine whether any

adjustments are necessary; and

c) assess impact of special arrangements or

restrictions identified and determine whether

disclosure is appropriate.

3. Test accounts where there is no confirmation

In the unusual situation where we do not receive a

bank confirmation and are willing to forego the receipt

of the bank confirmation, consider performing the

following procedures to obtain a high level of

assurance that the aforementioned audit objectives

are achieved:

a) obtain subsequent month bank statement, bank

reconciliation and supporting documentation.

Consider obtaining information directly from the bank;

b) test the mathematical accuracy of the bank

reconciliation; (accuracy)

c) trace outstanding items listed on the bank

reconciliation to the subsequent month's bank

statement and for those not traced, trace to the cash

disbursements records for the period prior to the

balance sheet date; (accuracy and

existence/occurrence)

d) trace deposits in transit listed on the bank

reconciliation to the subsequent month's bank

statement and for those not traced, trace to the cash

receipts records for the period prior to the balance

sheet date; (accuracy and existence/occurrence)

e) obtain explanation for large, unusual reconciling

items and trace to supporting documentation and/or

entries in the cash records, as appropriate; (accuracy

and existence/occurrence)

f) review the date the above items cleared the bank or

were recorded in the client's books to ensure

appropriate recording period. Trace to supporting

documentation as necessary; and (cut-off)

g) investigate items such as, long outstanding items,

dishonoured checks and significant adjustments in the

subsequent month, and record adjustments as

necessary. (accuracy and existence/occurrence)

4. Test bank reconciliations

Test bank reconciliation in order to obtain a moderate

to low level of assurance that the aforementioned

audit objectives are achieved by performing the

following:

a)test the mathematical accuracy of the reconciliation;

(accuracy)

b) trace book balances on the client's bank

reconciliation to the comparative summary; (accuracy)

c) trace bank balances on the client's bank

reconciliation to the bank statement; (accuracy)

d) test reconciling items on the bank reconciliation by

performing the following:

i) obtain subsequent month bank statement and

supporting documentation. Consider obtaining

information directly from the bank;

ii) trace outstanding items listed on the bank

reconciliation to the subsequent month's bank

statement and for those not traced, trace to the

cash disbursements records for the period prior

to the balance sheet date; (accuracy and

existence/occurrence)

iii) trace deposits in transit listed on the bank

reconciliation to the subsequent month's bank

statement and for those not traced, trace to

the cash receipts records for the period prior to

the balance sheet date; (accuracy and

existence/occurrence)

iv) obtain explanation for large, unusual

reconciling items and trace to supporting

documentation and/or entries in the cash

records, as appropriate; (accuracy and

existence/occurrence)

v) review the date the above items cleared the

bank or were recorded in the client's books to

ensure appropriate recording period. Trace to

supporting documentation as necessary; and

(cut-off)

vi) investigate items such as, long outstanding

items, dishonored checks and significant

adjustments in the subsequent month, and

record adjustments as necessary (accuracy

and existence/occurrence).

e) review client's bank reconciliation for review and

approval by appropriate management and timely

completion of reconciliation.

(Signature of Manager or Supervisor)

You might also like

- Audit Program - CashDocument1 pageAudit Program - CashJoseph Pamaong100% (6)

- Audit Cash and Accounts ReceivableDocument9 pagesAudit Cash and Accounts Receivablejanyanjanyan67% (3)

- Accounts Receivable Audit ProgramDocument3 pagesAccounts Receivable Audit Programaliraz101100% (2)

- Audit Objectives and Financial Statements Assertions for Cash and Accounts ReceivableDocument63 pagesAudit Objectives and Financial Statements Assertions for Cash and Accounts ReceivableSarah Hashem100% (1)

- Audit ProgramDocument16 pagesAudit Programanon_806011137100% (4)

- Cash Audit ProgramDocument7 pagesCash Audit Program구니타67% (3)

- 1 Audit Program ExpensesDocument14 pages1 Audit Program Expensesmaleenda100% (3)

- ABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-GeneralDocument7 pagesABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-Generalvarghese200779% (14)

- Audit Program Cash and Bank BalancesDocument4 pagesAudit Program Cash and Bank Balances구니타100% (1)

- AP Cash Purchases Audit ProgramDocument5 pagesAP Cash Purchases Audit ProgramYvonne Granada0% (1)

- Audit Program For Liabilities Format in The PhilippinesDocument2 pagesAudit Program For Liabilities Format in The PhilippinesDeloria Delsa100% (1)

- Audit ProgramsDocument492 pagesAudit ProgramsNa-na Bucu100% (7)

- Substantive Testing of Cash AssertionsDocument35 pagesSubstantive Testing of Cash AssertionsPamimoomimap Rufila100% (1)

- Audit Program For Other IncomeDocument3 pagesAudit Program For Other IncomeCollins O.71% (7)

- Auditing Accounts ReceivableDocument3 pagesAuditing Accounts Receivables1mz100% (4)

- Final Accounts Payable Audit ProgramDocument5 pagesFinal Accounts Payable Audit Programjeff100% (3)

- CORPORATE PURCHASES AUDITDocument3 pagesCORPORATE PURCHASES AUDITCristina Rosal100% (6)

- Audit Accrued Expenses ProgramDocument10 pagesAudit Accrued Expenses ProgramPutu Adi NugrahaNo ratings yet

- Accruals Audit ProgramDocument4 pagesAccruals Audit Programvivek1119No ratings yet

- Purchasing Audit ProgramDocument3 pagesPurchasing Audit ProgramBernie LeBlanc100% (1)

- Audit Program For InventoriesDocument2 pagesAudit Program For InventoriesRex Munda Duhaylungsod71% (7)

- Test of Control Working PaperDocument4 pagesTest of Control Working PaperMich Angeles50% (2)

- Audit Program: Property Plant and EquipmentDocument8 pagesAudit Program: Property Plant and EquipmentAqib Sheikh100% (3)

- Ap Audit DocumentDocument7 pagesAp Audit DocumentAnna Tran100% (1)

- Audit procedures cash receivables inventories payablesDocument5 pagesAudit procedures cash receivables inventories payablesAna RetNo ratings yet

- Audit Program For Fixed Assets: Form AP 35Document9 pagesAudit Program For Fixed Assets: Form AP 35Adrianna LenaNo ratings yet

- Cash Receipts Audit ProgramDocument2 pagesCash Receipts Audit ProgramVineet Jain100% (3)

- Audit of Cash On Hand and in BankDocument2 pagesAudit of Cash On Hand and in Bankdidiaen100% (1)

- Purchasing Audit ProgrammeDocument12 pagesPurchasing Audit ProgrammemercymabNo ratings yet

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- AP 15 Accounts Receivable and Sales PDFDocument8 pagesAP 15 Accounts Receivable and Sales PDFDicky Affri SandyNo ratings yet

- Purchases Audit ProgramDocument3 pagesPurchases Audit Programvarghese200795% (22)

- Test of Controls and Substantive ProceduresDocument16 pagesTest of Controls and Substantive ProceduresAdeel Sajjad100% (5)

- AP 50 Accounts Payable and PurchasesDocument6 pagesAP 50 Accounts Payable and PurchasesSyarah AnlizaNo ratings yet

- Accounts Receivable Audit ProceduresDocument5 pagesAccounts Receivable Audit ProceduresVivien NaigNo ratings yet

- Sample Audit Programs ManualDocument30 pagesSample Audit Programs ManualAldrin Jeff Alejandro Subia100% (3)

- Chapter03 - Audit of The Revenue and Collection Cycle - UnlockedDocument13 pagesChapter03 - Audit of The Revenue and Collection Cycle - UnlockedMark Kenneth Chan BalicantaNo ratings yet

- Audit Program For Inventory Legal Company Name Client: Balance Sheet DateDocument3 pagesAudit Program For Inventory Legal Company Name Client: Balance Sheet DateHannah TudioNo ratings yet

- Philippine International Trading Corporation Audit ProgramDocument2 pagesPhilippine International Trading Corporation Audit ProgramNephtali Gonzaga100% (2)

- Audit Program Cash and Bank BalancesDocument4 pagesAudit Program Cash and Bank BalancesGrace Unay100% (1)

- Audit Program Bank and CashDocument4 pagesAudit Program Bank and CashFakhruddin Young Executives0% (1)

- Audit of Sales and ReceivablesDocument5 pagesAudit of Sales and ReceivablesTilahun S. Kura100% (1)

- Internal Audit ProgramDocument3 pagesInternal Audit ProgramTakogee100% (1)

- Financial Controls Audit of Payroll ProcessesDocument2 pagesFinancial Controls Audit of Payroll ProcessesEric Gunthe100% (8)

- Audit Programme 1Document20 pagesAudit Programme 1Neelam Goel0% (1)

- 09 - Cash and Bank BalancesDocument4 pages09 - Cash and Bank BalancesAqib SheikhNo ratings yet

- Revenue Cycle Audit Program Final 140810Document11 pagesRevenue Cycle Audit Program Final 140810Pushkar Deodhar100% (1)

- Internal Audit ProgramDocument8 pagesInternal Audit ProgramKrishna Khandelwal100% (3)

- Audit of The Revenue and Collection CycleDocument5 pagesAudit of The Revenue and Collection CycleLalaine ReyesNo ratings yet

- Audit Program For Property, Plant and Equipment Agency Name: Balance Sheet DateDocument7 pagesAudit Program For Property, Plant and Equipment Agency Name: Balance Sheet DateZosimo Solano100% (3)

- Audit ProgramDocument2 pagesAudit ProgramMocs Macaraya MamowalasNo ratings yet

- Prob. 1 Audit 4Document2 pagesProb. 1 Audit 4Annalyn AlmarioNo ratings yet

- Case 030615Document2 pagesCase 030615Claude PeñaNo ratings yet

- AUDIT OF CASH AND BANKDocument9 pagesAUDIT OF CASH AND BANKkadama abubakarNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Cash ProgramDocument13 pagesCash Programapi-3828505No ratings yet

- Audit ProgrammeDocument12 pagesAudit ProgrammeCA Nagendranadh TadikondaNo ratings yet

- Substantive Procedures-CashDocument3 pagesSubstantive Procedures-CashEll VNo ratings yet

- Cash and BankDocument19 pagesCash and BankJatinNo ratings yet

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- A Company Secretary Acts As A Mediator Between The CompanyDocument2 pagesA Company Secretary Acts As A Mediator Between The CompanyRijo JacobNo ratings yet

- SCM Improves Product Availability & ROIDocument20 pagesSCM Improves Product Availability & ROIRijo JacobNo ratings yet

- Module 2 - Retail MKT StrategyDocument31 pagesModule 2 - Retail MKT StrategyRijo JacobNo ratings yet

- Audit FirmsDocument8 pagesAudit FirmsRijo JacobNo ratings yet

- Groups and TeamsDocument15 pagesGroups and TeamsRijo JacobNo ratings yet

- Lesson B - 4 Ch02 Outsourcing The IT FunctionDocument19 pagesLesson B - 4 Ch02 Outsourcing The IT FunctionBlacky PinkyNo ratings yet

- QA Standards, Audits & Care ImprovementDocument25 pagesQA Standards, Audits & Care ImprovementInes100% (1)

- Fees Booklet 2023Document237 pagesFees Booklet 2023Wilhem Hatutale FabregasNo ratings yet

- MCQ Questions On Strategy EvaluationDocument6 pagesMCQ Questions On Strategy Evaluationsyedqutub1683% (6)

- Chap 8 Tests of Controls.Document81 pagesChap 8 Tests of Controls.Thùy Linh Lê ThịNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument13 pagesChapter 1 The Accountancy ProfessionLaiza Mae LasutanNo ratings yet

- N C O B A A: Ational Ollege F Usiness ND RTSDocument9 pagesN C O B A A: Ational Ollege F Usiness ND RTSNico evansNo ratings yet

- Sample of Internal Audit Manual TemplateDocument51 pagesSample of Internal Audit Manual TemplateOlayinka OnimeNo ratings yet

- Accounting principles overviewDocument17 pagesAccounting principles overviewPatrick John AvilaNo ratings yet

- Risk of Material Misstatement Worksheet - Overview General InstructionsDocument35 pagesRisk of Material Misstatement Worksheet - Overview General InstructionswellawalalasithNo ratings yet

- Auditing Theory Review Questions For Revisit by Dario Oyam JRDocument5 pagesAuditing Theory Review Questions For Revisit by Dario Oyam JRDario Jr OyamNo ratings yet

- ISO 15189:2012 Documentation Kit - Manual, Procedures in EnglishDocument10 pagesISO 15189:2012 Documentation Kit - Manual, Procedures in EnglishCertification Consultancy100% (2)

- Securities Commision Act 1993Document52 pagesSecurities Commision Act 1993wws3322No ratings yet

- Meghana Resume UpdatedDocument2 pagesMeghana Resume UpdatedTAX DESTINATION100% (1)

- UpDeFi Code Security Assessment ReportDocument69 pagesUpDeFi Code Security Assessment ReportUlu WatuNo ratings yet

- Rahul Updated CVDocument3 pagesRahul Updated CVAnonymous TOs01xiNo ratings yet

- Supplier Manual Supplier Manual Supplier Manual Supplier ManualDocument15 pagesSupplier Manual Supplier Manual Supplier Manual Supplier ManualTran HuyenNo ratings yet

- Audit Checklist in Production AreaDocument5 pagesAudit Checklist in Production AreaPrince Moni100% (2)

- Ansuisa 18.2 2009Document80 pagesAnsuisa 18.2 2009Sohail Iftikhar100% (1)

- Specimen Internal Audit Report: Appendix 15Document5 pagesSpecimen Internal Audit Report: Appendix 15Selva Bavani SelwaduraiNo ratings yet

- ENERGY AUDITING: IDENTIFYING OPPORTUNITIES TO IMPROVE EFFICIENCYDocument27 pagesENERGY AUDITING: IDENTIFYING OPPORTUNITIES TO IMPROVE EFFICIENCYVijay RajuNo ratings yet

- Towards Blockchain Based Accounting & AssuranceDocument18 pagesTowards Blockchain Based Accounting & AssuranceAndre DiazNo ratings yet

- Jai Club: Candidate Name Contact:-E-mailDocument2 pagesJai Club: Candidate Name Contact:-E-mailRaghavNo ratings yet

- Cfas NotesDocument15 pagesCfas NotesGio BurburanNo ratings yet

- SECTION 07 27 27 Fluid-Applied Membrane Air Barriers, Vapor RetardingDocument11 pagesSECTION 07 27 27 Fluid-Applied Membrane Air Barriers, Vapor RetardingJuanPaoloYbañezNo ratings yet

- Comparative Analysis of Financial Status and Performance Evaluation of Himalayan Bank Ltd. and Nabil Bank Ltd. in The Framework of "Camels" Rating SystemDocument84 pagesComparative Analysis of Financial Status and Performance Evaluation of Himalayan Bank Ltd. and Nabil Bank Ltd. in The Framework of "Camels" Rating SystemNauty Nitesh88% (8)

- DIO 01.4. Odobrenje Proizvođača I Uslužnih Tvrtki July 2020Document12 pagesDIO 01.4. Odobrenje Proizvođača I Uslužnih Tvrtki July 2020Samo SpontanostNo ratings yet

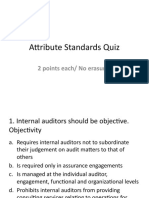

- Attribute Standards QuizDocument16 pagesAttribute Standards QuizJao FloresNo ratings yet

- Now On Now: How Servicenow Has Transformed Its Own GRC ProcessesDocument13 pagesNow On Now: How Servicenow Has Transformed Its Own GRC ProcessesdavidprasadNo ratings yet

- Investigative Interview Methods FerraroDocument17 pagesInvestigative Interview Methods FerraroGiovanni De SantisNo ratings yet