Professional Documents

Culture Documents

East Coast Yachts Goes International

Uploaded by

Aries MayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

East Coast Yachts Goes International

Uploaded by

Aries MayaCopyright:

Available Formats

East Coast Yachts Goes International

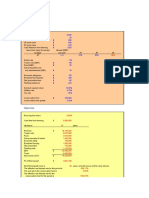

Larissa Warren, the owner of East Coast Yachts, has been in discussion with a

yacht dealer in Monaco about selling the company’s yachts in Europe. Jarek Jachowitcz,

the dealer, wants to ass East Coast Yachts to his current retail line. Jarek has told Larissa

that he feels the retail sales will be approximately €5 million per month. All sales will be

made in euros, and Jerek will retain 5 percent of the retail sales as commission, which

will be paid in euros. Since the yachts will be customized to order, the first sales will

take place in one month. Jarek will pay EastCoast Yachts for the order 90 days after it is

filled. This payment schedule will continue for the length of the contract between the

two companies.

Larissa is confident the company can handle the extra volume with its existing

facilities, but she is unsure about any potential financial risks of selling its yachts in

Europe. In her discussion with Jarek, she found that the current exchange rate is $1.20/€.

At this exchange rate, the company would spend 70 percent of the sales income on

production costs. The number does not reflect the sales commission to be paid to Jarek.

Larissa has decided to ask Dan Ervin, the company’s financial analyst, to prepare an

analysis of the proposed international sales. Specifically, she asks Dan to answer the

following questions:

1. What are the pros and the cons of the international sales plan? What additional risks

will the company face?

2. What happens to the company’s profits if the dollar strengthens? What if the dollar

weakens?

3. Ignoring taxes, what are East Coast Yachts projected gains or losses from this

proposed arrangement at the current exchange rate of $1.20/€? What happens to profits if

the exchange rate changes to $1.30/€? At what exchange rate will the company break

even?

4. How could the company hedge its exchange rate risk? What are the implications for

this approach?

5. Taking all factors into account, should the company pursue international sales further?

Why or why not?

You might also like

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- EAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFDocument2 pagesEAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFGhoul GamingNo ratings yet

- Stock Valuation: Answers To Concept Questions 1Document15 pagesStock Valuation: Answers To Concept Questions 1Sindhu JattNo ratings yet

- Chapter 7 BVDocument2 pagesChapter 7 BVprasoonNo ratings yet

- Ch5 Stock EvaluationDocument3 pagesCh5 Stock EvaluationShafiq Ur RehmanNo ratings yet

- Behavioral Finance and Technical Analysis ProblemsDocument13 pagesBehavioral Finance and Technical Analysis ProblemsBiloni Kadakia100% (1)

- Bond Performance Measurement and Evaluation: Chapter SummaryDocument21 pagesBond Performance Measurement and Evaluation: Chapter Summaryasdasd50% (2)

- Should You Lease or Buy an Expensive Nuclear ScannerDocument1 pageShould You Lease or Buy an Expensive Nuclear ScannerrajbhandarishishirNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Lecture 2 - Answer Part 2Document6 pagesLecture 2 - Answer Part 2Thắng ThôngNo ratings yet

- Case Study Daiwa BankDocument5 pagesCase Study Daiwa BankTharakh Chacko0% (1)

- CHAPTER 8 Interest Rates and Bond Valuation - TB SolutionsDocument2 pagesCHAPTER 8 Interest Rates and Bond Valuation - TB SolutionsVangara Harish100% (1)

- AFIN1Document6 pagesAFIN1Abs PangaderNo ratings yet

- Chapter One: Mcgraw-Hill/IrwinDocument17 pagesChapter One: Mcgraw-Hill/Irwinteraz2810No ratings yet

- Minimizing Contracting Costs Under PATDocument4 pagesMinimizing Contracting Costs Under PATKrithika NaiduNo ratings yet

- Fair Value Accounting: ©2018 John Wiley & Sons Australia LTDDocument42 pagesFair Value Accounting: ©2018 John Wiley & Sons Australia LTDSonia Dora DemoliaNo ratings yet

- FSA 8e Ch04 SMDocument63 pagesFSA 8e Ch04 SMmonhelNo ratings yet

- Chapter 3Document12 pagesChapter 3HuyNguyễnQuangHuỳnhNo ratings yet

- Jacobs Division PDFDocument5 pagesJacobs Division PDFAbdul wahabNo ratings yet

- Analyze Financial Statements and RatiosDocument11 pagesAnalyze Financial Statements and Ratiosnpiper29100% (1)

- Chapter 12: Calculating Cost of Capital and Project RiskDocument29 pagesChapter 12: Calculating Cost of Capital and Project RiskazmiikptNo ratings yet

- Case SPMDocument4 pagesCase SPMainiNo ratings yet

- Mini Case: Bunyan Lumber, LLC: Disusun OlehDocument5 pagesMini Case: Bunyan Lumber, LLC: Disusun OlehricaNo ratings yet

- Escanear 0003Document8 pagesEscanear 0003JanetCruces0% (4)

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- PCL TVDocument4 pagesPCL TVEm MonteNo ratings yet

- Capital Asset Pricing ModelDocument18 pagesCapital Asset Pricing ModelSanjeevNo ratings yet

- Caso Dupont - Keren MendesDocument17 pagesCaso Dupont - Keren MendesKeren NovaesNo ratings yet

- Ross. Westerfield. Jaffe. Jordan Chapter 30 TestDocument12 pagesRoss. Westerfield. Jaffe. Jordan Chapter 30 TestLrac Olegna Arevir0% (1)

- Financial Reporting and Changing PricesDocument6 pagesFinancial Reporting and Changing PricesFia RahmaNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Tiger Brands' Strategic Approach and BCG Matrix for Hyundai ChinaDocument2 pagesTiger Brands' Strategic Approach and BCG Matrix for Hyundai ChinaAomame Fuka-Eri67% (3)

- Hitungan Kuis 7 Bunyan - Lumber - CaseDocument15 pagesHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- Summary Chap 12, MKL, Findi Kumala DewiDocument5 pagesSummary Chap 12, MKL, Findi Kumala Dewiresty auliaNo ratings yet

- MBA711 - Chapter 10 - Answers To All QuestionsDocument18 pagesMBA711 - Chapter 10 - Answers To All QuestionsWajiha Asad Kiyani100% (2)

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Global InvestorsDocument36 pagesGlobal InvestorsIda Agustini50% (2)

- Chapter 17 Homework ProblemsDocument5 pagesChapter 17 Homework ProblemsAarti JNo ratings yet

- Options and Corporate Finance QuestionsDocument2 pagesOptions and Corporate Finance QuestionsbigpoelNo ratings yet

- Integrative Case 10 1 Projected Financial Statements For StarbucDocument2 pagesIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyNo ratings yet

- Chap009 131230191204 Phpapp01Document41 pagesChap009 131230191204 Phpapp01AndrianMelmamBesyNo ratings yet

- Lecture 10 (Chapter 8) - Relationship Among Inflation, Interest Rate and Exchage RateDocument21 pagesLecture 10 (Chapter 8) - Relationship Among Inflation, Interest Rate and Exchage RateTivinesh MorganNo ratings yet

- Fabozzi CH 03 Measuring Yield HW AnswersDocument5 pagesFabozzi CH 03 Measuring Yield HW AnswershardiNo ratings yet

- Chapter OneDocument18 pagesChapter OneBelsti AsresNo ratings yet

- EXAM 1 IPM Solutions Spring 2012 (B)Document12 pagesEXAM 1 IPM Solutions Spring 2012 (B)kiffeur69100% (6)

- Practice QuestionsDocument2 pagesPractice QuestionskeshavNo ratings yet

- Case 42 West Coast DirectedDocument6 pagesCase 42 West Coast DirectedHaidar IsmailNo ratings yet

- Analysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142Document7 pagesAnalysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142ice1025No ratings yet

- Bkm9e Answers Chap006Document13 pagesBkm9e Answers Chap006AhmadYaseenNo ratings yet

- Carrefour S.A.: Ruskin Lisa Crystal WeiDocument16 pagesCarrefour S.A.: Ruskin Lisa Crystal WeiThái Hoàng NguyênNo ratings yet

- Solution To E5-9&11Document2 pagesSolution To E5-9&11Adam0% (1)

- Tugas FMCM Minggu 10 Richard Andrew - 8312419003 FixDocument6 pagesTugas FMCM Minggu 10 Richard Andrew - 8312419003 FixsNo ratings yet

- International Banking and Money MarketDocument37 pagesInternational Banking and Money MarketBeer g[upiN100% (1)

- CHAPTER 16 Capital Structure Decisions the Basics cvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvDocument62 pagesCHAPTER 16 Capital Structure Decisions the Basics cvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvarushjaNo ratings yet

- CF - Chap009-Stock ValuationDocument28 pagesCF - Chap009-Stock ValuationSharmila Devi0% (1)

- Rosario FinalDocument13 pagesRosario FinalDiksha_Singh_6639No ratings yet

- Larissa Warren The Owner of East Coast Yachts Has BeenDocument1 pageLarissa Warren The Owner of East Coast Yachts Has BeenAmit PandeyNo ratings yet

- East Coast InternationalDocument3 pagesEast Coast InternationalKobe1450% (2)

- 1 What Are The Pros and Cons of The InternationalDocument2 pages1 What Are The Pros and Cons of The InternationalAmit PandeyNo ratings yet

- Answer For End ChapterDocument4 pagesAnswer For End ChapterAnura Kumara100% (1)