Professional Documents

Culture Documents

US Internal Revenue Service: f13615

Uploaded by

IRSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f13615

Uploaded by

IRSCopyright:

Available Formats

Department of the Treasury – Internal Revenue Service Cat. No.

38847H

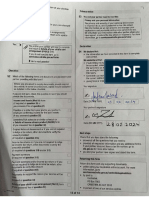

Form 13615

(Rev. 7-2007)

Volunteer Agreement

Standards of Conduct – VITA/TCE Programs

The mission of the VITA/TCE Program is to provide free basic tax return preparation for eligible taxpayers.

Volunteers are the program's most valuable resource. To establish the greatest degree of public trust

Volunteers have a responsibility to provide high quality service and uphold the highest of ethical standards.

Instructions: To be completed by all volunteers in the VITA/TCE program.

As a participant in the VITA/TCE Program, I agree to the following standards of conduct:

• I will treat all taxpayers professionally, with • I will exercise reasonable care in the use

courtesy and respect. and protection of equipment and supplies.

• I will safeguard the confidentiality of • I will not solicit business from taxpayers I

taxpayer information. assist or use the knowledge I have gained

about them for any direct or indirect

• I will apply the tax laws equitably and

personal benefit for me or any other

accurately to the best of my ability.

specific individual.

• I will only prepare returns for which I am

certified. (Basic, Advanced, etc.) • I will not accept payment from taxpayers

for the services I provide. I may receive

compensation as an employee of a

program sponsor.

Volunteer Information

Print Full Name Signature and Date

Home Street Address Daytime Telephone

City, State and Zip Code E-mail Address

Site and/or Partner Name

This form is to be retained at the Site or by the Partner.

Volunteer position(s)

(screener, preparer, interpreter, reviewer, etc.)

(Partner Use Only) Test Results – Only volunteers preparing federal tax returns, answering tax law

questions, or reviewing federal tax returns for accuracy are required to be certified.

Foreign Student/Scholars

Basic Intermediate Advanced Military International

Part 1 Part 2 Part 3

Volunteer’s Test Score

Certification level –

Mark the appropriate box

Privacy Act Notice–The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we

are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary,

required to obtain a benefit, or mandatory.

Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or

participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who

coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective

controls, send correspondence and recognize volunteers.

Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these

programs.

Cat. No. 38847H Form 13615 (Rev. 7-2007)

You might also like

- US Internal Revenue Service: p4299Document16 pagesUS Internal Revenue Service: p4299IRSNo ratings yet

- 2008 Volunteer Reporting and Certification Process Partner Use DEC 29 2008Document9 pages2008 Volunteer Reporting and Certification Process Partner Use DEC 29 2008Vita Volunteers WebmasterNo ratings yet

- Welcome To Unemployment Insurance Benefits Online!Document3 pagesWelcome To Unemployment Insurance Benefits Online!Carol Melissa AquinoNo ratings yet

- Standards of Conduct TrainingDocument17 pagesStandards of Conduct TrainingCenter for Economic ProgressNo ratings yet

- p5101 - 2019-10-00 1Document53 pagesp5101 - 2019-10-00 1api-495108136No ratings yet

- Centrelink Authorisation Form ss313 - 1005enDocument6 pagesCentrelink Authorisation Form ss313 - 1005enWilliam Alister Young0% (1)

- Application To Participate in Selection Process - Adviser Acquisition - Online4 - Feb 2022Document16 pagesApplication To Participate in Selection Process - Adviser Acquisition - Online4 - Feb 2022anelisampande8No ratings yet

- Authority To Act SS313Document6 pagesAuthority To Act SS313Matthew Davies0% (1)

- THESIS Survey QuestionnaireDocument3 pagesTHESIS Survey QuestionnaireArianne June AbarquezNo ratings yet

- Vetting Request FormDocument4 pagesVetting Request Formjafari100% (1)

- DS7002 Training-Internship Placement Plan - 4 Phases - SDocument10 pagesDS7002 Training-Internship Placement Plan - 4 Phases - Sk65dxmk8kjNo ratings yet

- Tax QuestDocument10 pagesTax QuestSierra MarquardtNo ratings yet

- 2014 Personal ChecklistDocument3 pages2014 Personal ChecklistjeyaNo ratings yet

- Application For Employment: Personal Data Form ADocument4 pagesApplication For Employment: Personal Data Form Apjm351No ratings yet

- Tax Compliance Survey QuestionnaireDocument4 pagesTax Compliance Survey QuestionnaireJennelyn Abella76% (21)

- TFN Declaration Form N3092Document6 pagesTFN Declaration Form N3092mct5s8wdrkNo ratings yet

- Dependent Room and Board Benefit Limit Remarks/CategoryDocument6 pagesDependent Room and Board Benefit Limit Remarks/CategoryEdrick TarucNo ratings yet

- Strats TFN Declaration FormDocument6 pagesStrats TFN Declaration Formysw2vvr9m5No ratings yet

- Tax Dec Le Ration FormDocument9 pagesTax Dec Le Ration Formruby.matas83No ratings yet

- Veterans Handbook: How to Get the Benefits You Deserve - 2015 EditionFrom EverandVeterans Handbook: How to Get the Benefits You Deserve - 2015 EditionNo ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormTim DunnNo ratings yet

- Authorising A Person or Organisation To Enquire or Act On Your BehalfDocument13 pagesAuthorising A Person or Organisation To Enquire or Act On Your BehalfNikos Antreas PapanikolaouNo ratings yet

- Tax File Number Declaration - RuviniDocument6 pagesTax File Number Declaration - RuviniruviniogodapolaNo ratings yet

- 2023 Apprenticeship Application and Agreement January 2023Document6 pages2023 Apprenticeship Application and Agreement January 2023Danny MahomaneNo ratings yet

- Trusted Helper FormDocument5 pagesTrusted Helper FormbhargavkakaniNo ratings yet

- TFN Declaration Form PDFDocument6 pagesTFN Declaration Form PDFrsdommetiNo ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormMaiko KimberlyNo ratings yet

- WellnessDocument2 pagesWellnessNikhil AgarwalNo ratings yet

- SMART Joining KitDocument15 pagesSMART Joining KitVijay PrakashNo ratings yet

- Aus TFN DeclarationDocument6 pagesAus TFN DeclarationjessepurcelltamihanaNo ratings yet

- Encep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariDocument1 pageEncep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariEncep SuryanaNo ratings yet

- TFN Declaration Form N3092Document6 pagesTFN Declaration Form N3092Randhawa SukhmanNo ratings yet

- Confirmation Page: Important - Print This PageDocument4 pagesConfirmation Page: Important - Print This Pagemozollis22No ratings yet

- Work & Travel USA Job OfferDocument2 pagesWork & Travel USA Job OfferNeluCeorniiNo ratings yet

- Instructions For Volunteers and InternsDocument6 pagesInstructions For Volunteers and Internsapi-345593837No ratings yet

- Get Right With Your Taxes: Acilitator's Guide For Prisoner Re-Entry Educational ProgramDocument5 pagesGet Right With Your Taxes: Acilitator's Guide For Prisoner Re-Entry Educational Programpeanut7717No ratings yet

- WorkplaceDocument6 pagesWorkplaceJollibeeNo ratings yet

- ApointeeDocument8 pagesApointeeaymanNo ratings yet

- JobPlanDocument2 pagesJobPlanHarrison KerrNo ratings yet

- NM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)Document7 pagesNM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)ShellyJacksonNo ratings yet

- Application For EmploymentDocument8 pagesApplication For Employmentmuhammed suhailNo ratings yet

- WAT - Job Offer Form - 2016 - SummerDocument2 pagesWAT - Job Offer Form - 2016 - SummerAlina DaniciNo ratings yet

- Standards of Conduct Training (2017)Document25 pagesStandards of Conduct Training (2017)Center for Economic ProgressNo ratings yet

- NO207 MembershipApplication V41Document6 pagesNO207 MembershipApplication V41Md Zahidul HaqueNo ratings yet

- ss313 1807en FDocument6 pagesss313 1807en Fammar naeemNo ratings yet

- JobPlanDocument2 pagesJobPlanwigginjimmyNo ratings yet

- Bri English PDFDocument21 pagesBri English PDFWillowNo ratings yet

- Surrender Form SummaryDocument3 pagesSurrender Form SummaryDevendra RawoolNo ratings yet

- Partner Details: This Form Lets Us Know About Your Partner's DetailsDocument21 pagesPartner Details: This Form Lets Us Know About Your Partner's DetailsEric ApplefordNo ratings yet

- AXIS Ckyc FormDocument2 pagesAXIS Ckyc FormSwapnil LilkeNo ratings yet

- QC 16161Document12 pagesQC 16161john englishNo ratings yet

- Authorising A Person or Organisation To Enquire or Act On Your BehalfDocument7 pagesAuthorising A Person or Organisation To Enquire or Act On Your Behalfcnjfkc6p96No ratings yet

- Standards of Conduct Training (2015)Document25 pagesStandards of Conduct Training (2015)Center for Economic ProgressNo ratings yet

- The Tax-Help Directory: A Do-It-Yourself Guide to Tax ResolutionFrom EverandThe Tax-Help Directory: A Do-It-Yourself Guide to Tax ResolutionNo ratings yet

- Ci Benefits Rights InformationDocument15 pagesCi Benefits Rights InformationBladimir LoraNo ratings yet

- EFP LifestyleQuestionnaire Electronic 0214Document28 pagesEFP LifestyleQuestionnaire Electronic 0214sanjaifromusaNo ratings yet

- Modp 2303en f MergedDocument17 pagesModp 2303en f MergedAliyana SmolderhalderNo ratings yet

- modp-2303en-f-Document16 pagesmodp-2303en-f-Aliyana SmolderhalderNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ROTARY CLUB OF COTABATO CITY (Certificates)Document4 pagesROTARY CLUB OF COTABATO CITY (Certificates)marlynNo ratings yet

- Government of West Bengal Office of The Commissioner of Police Howrah OrderDocument2 pagesGovernment of West Bengal Office of The Commissioner of Police Howrah OrderVARSHA BHARTINo ratings yet

- Crim Case DigestDocument2 pagesCrim Case DigestChi OdanraNo ratings yet

- NEM P&P Cardbacks - Singles ISO With BleedDocument165 pagesNEM P&P Cardbacks - Singles ISO With BleedWilliam ElrichNo ratings yet

- COA Authority Over NEA Salary IncreasesDocument2 pagesCOA Authority Over NEA Salary IncreasescarmelafojasNo ratings yet

- DTC Agreement Between United Kingdom and Gambia, TheDocument36 pagesDTC Agreement Between United Kingdom and Gambia, TheOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Development INsurance Corp Vs IAC July 16, 1986Document2 pagesDevelopment INsurance Corp Vs IAC July 16, 1986Alvin-Evelyn GuloyNo ratings yet

- Advice To A Young Person Interested in A Career in The LawDocument55 pagesAdvice To A Young Person Interested in A Career in The Lawfreah genice tolosaNo ratings yet

- PAGCOR charter constitutionality challengedDocument53 pagesPAGCOR charter constitutionality challengedJanine Prelle DacanayNo ratings yet

- Pat Villanueva Reviewer PDFDocument68 pagesPat Villanueva Reviewer PDFYieMaghirangNo ratings yet

- Notice To The Florida Bar-Telephone Recording-Oct-30-2008Document7 pagesNotice To The Florida Bar-Telephone Recording-Oct-30-2008Neil GillespieNo ratings yet

- Tony L. Kight v. R.R. Donnelley & Sons Company, 11th Cir. (2013)Document3 pagesTony L. Kight v. R.R. Donnelley & Sons Company, 11th Cir. (2013)Scribd Government DocsNo ratings yet

- Bildner Vs IlusorioDocument30 pagesBildner Vs IlusorioLawrence SantiagoNo ratings yet

- ZameenExpo2019 AgreementDocument3 pagesZameenExpo2019 AgreementMuhammad AbdullahNo ratings yet

- GenCanna LawsuitDocument7 pagesGenCanna LawsuitAnonymous tlNuMVvNo ratings yet

- Prisma Construction Vs Menchavez G. R. No. 160545Document6 pagesPrisma Construction Vs Menchavez G. R. No. 160545milleranNo ratings yet

- NHA motion dismissal caseDocument3 pagesNHA motion dismissal caseGuillermo Olivo IIINo ratings yet

- Pelaksanaan Atau Eksekusi Putusan Badan Arbitrase Syariah Nasional (Basyarnas) Sebagai Kewenangan Pengadilan Agama Ummi UzmaDocument19 pagesPelaksanaan Atau Eksekusi Putusan Badan Arbitrase Syariah Nasional (Basyarnas) Sebagai Kewenangan Pengadilan Agama Ummi UzmaWildanul AkhyarNo ratings yet

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 130Document5 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 130Justia.comNo ratings yet

- Lenny Kravitz v. CinderBlock - TrademarkDocument8 pagesLenny Kravitz v. CinderBlock - TrademarkMark JaffeNo ratings yet

- 11 Cathay Pacific Steel Corp. v. CADocument16 pages11 Cathay Pacific Steel Corp. v. CAkimNo ratings yet

- No Separate Suit Can Be Filed To Ascertain The Validity of A Compromise MemoDocument11 pagesNo Separate Suit Can Be Filed To Ascertain The Validity of A Compromise MemoLive LawNo ratings yet

- Moa Investment ProposalDocument4 pagesMoa Investment ProposalTim Smirnoff100% (2)

- 16 Eastern Telecommunications Philippines, Inc. v. International Communication CorporationDocument2 pages16 Eastern Telecommunications Philippines, Inc. v. International Communication CorporationRem SerranoNo ratings yet

- Nasious v. Ray, 10th Cir. (2001)Document6 pagesNasious v. Ray, 10th Cir. (2001)Scribd Government DocsNo ratings yet

- PEOPLE OF THE PHILIPPINES V CLARO Detailed DigestDocument3 pagesPEOPLE OF THE PHILIPPINES V CLARO Detailed DigestJane Galicia100% (1)

- Complaint for Bigamy Case Law SummaryDocument15 pagesComplaint for Bigamy Case Law SummaryAmelyn Albitos-Ylagan Mote100% (1)

- Government of Philippines Islands vs. El Monte de Piedad December 13, 1916 CASE DIGESTDocument2 pagesGovernment of Philippines Islands vs. El Monte de Piedad December 13, 1916 CASE DIGESTShe100% (1)

- REMREV-Saint Louis University Vs CobarrubiasDocument11 pagesREMREV-Saint Louis University Vs CobarrubiasGladys Bustria OrlinoNo ratings yet

- Sales Agency Agreement - BMSDocument3 pagesSales Agency Agreement - BMSRenjumul MofidNo ratings yet