Professional Documents

Culture Documents

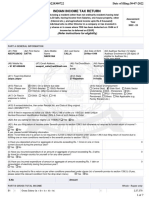

Form No 24 Annual Return of "Salaries" Under Section 206 of The Income-Tax Act, 1961 For The Year Ending 31st March 1

Uploaded by

smvpdyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No 24 Annual Return of "Salaries" Under Section 206 of The Income-Tax Act, 1961 For The Year Ending 31st March 1

Uploaded by

smvpdyCopyright:

Available Formats

Form No 24

[See section 192 and rule 37]

Annual return of “Salaries” under section 206 of the Income-tax Act, 1961 for the year ending 31st March

1. (a) Tax Deduction Account No.

(b) Permanent Account No.

2. (a) Name of the Employer

(b) Type of employer1

(c) Address of the Employer Flat/Door/

Block Number

Name of the Premises/Building

Road/Street/Lane

Area/Locality

Town/City/District

State

Pin Code

3.* Has address of the employer/person responsible for paying salary changed since filing the last return Tick

as applicable

Employer Yes No Person responsible for paying salary Yes No

* If address has changed give changed address in column 2(b)/4(b)

4. (a) Name of the person responsible for paying

salary (if not the employer)

(b) Address of the person responsible for paying salary

Flat/Door/Block Number

Name of the Premises/Building

Road/Street/Lane

Area/Locality

Town/City/District

State

Printed from www.taxmann.com

Pin Code

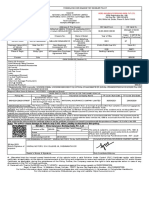

5. Details of salary paid and tax deducted thereon from the employees

Serial Permanent Account Name of the employee Period for which employed during Total amount of Total amount of house

Number Number (PAN) of the financial year salary, excluding rent allowance and

the employee amount required to be other allowances to the

shown in columns extend chargeable to

206 and 207 (see note tax [See section

4) 10(13A)] read with rule

2A and section 10(14)

Date from Date To

(201) (202) (203) (204) (205) (206)

Serial Value of perquisites Amount of allowances Total of columns 205, 206 and 207 Total deductions Income chargeable

Number and amount of and perquisites claimed under section 16(i), under the head

accretion to as exempt and not 16(ii) and 16(iii) “Salaries” (Column

Employee’s included in columns (specify each 209 minus 210)

Provident Fund 206 and 207 deduction separately)

Account as per

Annexure

(201) (207) (208) (209) (210) (211)

Printed from www.taxmann.com

Serial Income (including Gross total income Amount deductible under section Amount deductible Amount deductible

Number loss from house (Total of columns 211 80G in respect of donations to under section 80GG under any other

property) under any and 212) certain funds, charitable in respect of rents provision of Chapter

head other than institutions paid VI-A (indicate relevant

income under the section and amount

head “Salaries” deducted)

offered for TDS

[Section 192(2B)]

(201) (212) (213) (214) (215) (216)

Serial Total amount Total taxable income Income-tax on total income Income-tax rebate Income-tax Rebate

Number deductible under (Column 213 minus under section 88 on under section 88B

Chapter VI-A (total column 217) life insurance

of columns 214, premium,

215 and 216) contribution to

provident fund etc.

(See Note 5)

(201) (217) (218) (219) (220) (221)

Printed from www.taxmann.com

Serial Income-tax Rebate Income-tax Rebate Total Income-tax payable (column Income-tax relief Net tax payable

Number under section 88C under section 88D 219 minus total of columns 220, under section 89, (column 224 minus

221, 222 and 223 including when salary etc. is column 225)

surcharge and education cess paid in arrear or in

advance

(201) (222) (223) (224) (225) (226)

Serial Tax deducted at Surcharge Education cess Total income-tax Tax Remark (See Notes 6 and

Number source – Income- deducted at payable/refundable 7)

tax source (Total of (Difference of

columns 227, 228 columns 226 and

and 229) 230)

(201) (227) (228) (229) (230) (231) (232)

6. Details of tax deducted and paid to the credit of the Central Government.

S. No. TDS Surcharge Education Cess Interest Others

Rs. Rs. Rs. Rs.

Printed from www.taxmann.com

(233) (234) (235) (236) (237) (238)

S. No. Total tax deposited Cheque/DD No. (if BSR Code Date on which tax Transfer Whether TDS

Rs. any) deposited voucher/challan deposited by book

(234+235+236+237+238) serial No.2 entry? Yes/No3

(233) (239) (240) (241) (242) (243) (244)

7. I certify that :

(i) the above return consists of ____________ pages serially numbered from ___________to ____________ and furnishes the prescribed particulars in

respect of _______________ (given number) employees;

(ii) the above return contains complete details of total amount chargeable under the head “salaries” paid by ______________ to all persons whose

income for the year under the head “Salaries” exceeded the maximum amount which is not taxable under the Finance Act of the year.

(iii) the amount of tax shown in column 230 has been paid to the credit of the Central Government vide particulars given in item number 6 above.

(iv) all the particulars furnished in the return and the Annexure are correct.

Place : ___________ Name and Signature of the employer/person responsible for paying salary

Date : ___________ Designation :

Notes :

1. Indicate the type of employer “Government/Others”.

2. Government deductors to give particulars of transfer vouchers; other deductors to give particulars of challan No. regarding deposit into bank.

3. Column is relevant only for Government deductors.

Printed from www.taxmann.com

4. Salary includes wages, annuity, pension, gratuity, fees, commission, bonus, repayment of amount deposited under the Additional Emoluments

(Compulsory Deposit) Act, 1974, or profits in lieu of or in addition to salary or wages, including payments made at or in connection with

termination of employment, advance of salary or any other sums chargeable to income-tax under the head “Salaries”.

5. Where an employer deducts from the emoluments paid to an employee or pays on his behalf any contributions of that employee to any approved

superannuation fund, all such deductions or payments should be included in the return.

6. Where tax has been deducted at a lower rate or no tax has been deducted on the basis of a certificate given by the Assessing Officer under

section 197(1), this should be indicated in this column and a copy of such order should be attached along with the return.

7. Please record on every page the totals of each of the columns.

ANNEXURE

Particulars of value of perquisites and amount of accretion to Employees’ Provident Fund Account for the year ending 31st March,

Value of rent-free accommodation or value of any concession in rent for the accommodation provided by the employer (give basis of

computation)

Where accommodation is furnished

Name of Employee Employee's serial No. Where Value as if Cost of furniture Perquisite value of Total of columns 248 Rent, if any, paid by

in column 201 of accommodation accommodation is (including TV sets, furniture (10% of and 250 the employee

Form No. 24 is unfurnished unfurnished radio sets, column 249)

refrigerators, other

household appliances

and air-conditioning

plant or equipment)

(245) (246) (247) (248) (249) (250) (251) (252)

Name of Employee Value of perquisite (Column 247 minus Where any conveyance has been Remuneration paid by the employer for Value of free or concessional passages

Column 252 or Column 251 minus provided by the employer free or at a domestic and personal services on home leave and other travelling to

Column 252 as may be applicable) concessional rate or where the provided to the employee (give details) the extent chargeable to tax (give

employee is allowed the use of one or details)

more motor-cars owned or hired by the

employer or where the employer incurs

the running expenses of a motor-car

owned by employees estimated value

of perquisite (give details)

Printed from www.taxmann.com

(245) (253) (254) (255) (256)

Name of Employee Estimated value of any other benefit or Employer's contribution to recognised Interest credited to the assessee's Total of columns 253 to 259 carried to

amenity provided by the employer free provident fund in excess of 12% of the account in recognised provident fund column 207 of Form No. 24

of cost or at concessional rate not employee's salary in excess of the rate fixed by Central

included in the preceding columns Government

(give details)

(245) (257) (258) (259) (260)

Place ________________ Name and Signature of employer/person

responsible for paying salary

Date ________________ Designation

Printed from www.taxmann.com

You might also like

- Transfer of Certificate of InsuranceDocument3 pagesTransfer of Certificate of InsuranceAnkur ChopraNo ratings yet

- Great Pacific Life Assurance Company Vs CADocument2 pagesGreat Pacific Life Assurance Company Vs CAJenny Ruth GorgonioNo ratings yet

- Microeconometrics Using StataDocument733 pagesMicroeconometrics Using Statadhaniela00150% (2)

- Youthbuild Business PlanDocument24 pagesYouthbuild Business PlanRachel CloutierNo ratings yet

- Smith, Bell, and Co. V. COA G.R. No. 110668, February 6, 1997 Case DigestDocument3 pagesSmith, Bell, and Co. V. COA G.R. No. 110668, February 6, 1997 Case DigestVera Denise Padrones100% (1)

- 2825100207112402000Document4 pages2825100207112402000bipin012No ratings yet

- Motor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لDocument8 pagesMotor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لGcvffNo ratings yet

- ITCreport Accounts 2012Document215 pagesITCreport Accounts 2012sadafkhan21No ratings yet

- Form No 10eDocument3 pagesForm No 10eIncome Tax Department JindNo ratings yet

- Form 10E - Filed FormDocument3 pagesForm 10E - Filed Formnaveenksharma27No ratings yet

- Form 10E - Filed FormDocument4 pagesForm 10E - Filed FormAtul DeshmukhNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- US Internal Revenue Service: f8390 - 1993Document4 pagesUS Internal Revenue Service: f8390 - 1993IRSNo ratings yet

- Statement of Comprehensive Income /income Statement/: - in EURDocument3 pagesStatement of Comprehensive Income /income Statement/: - in EURAdnan KusturaNo ratings yet

- Form PDF 788420380311221Document6 pagesForm PDF 788420380311221VinuNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- AnilDocument2 pagesAnilaruncaoffice1979No ratings yet

- Asmt IIT 002 2022 2023 EDocument15 pagesAsmt IIT 002 2022 2023 EChamika Madushan ManawaduNo ratings yet

- Ministry of Finance (Department of Revenue) (Central Board of Direct Taxes) NotificationDocument11 pagesMinistry of Finance (Department of Revenue) (Central Board of Direct Taxes) NotificationINFO ACCNo ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- US Internal Revenue Service: f4970 - 1996Document2 pagesUS Internal Revenue Service: f4970 - 1996IRSNo ratings yet

- U.S. Information Return Trust Accumulation of Charitable AmountsDocument4 pagesU.S. Information Return Trust Accumulation of Charitable AmountsIRSNo ratings yet

- Allocation of Income and Expenses Under Section 936 (H) (5) : Schedule P (Form 5735)Document2 pagesAllocation of Income and Expenses Under Section 936 (H) (5) : Schedule P (Form 5735)IRSNo ratings yet

- Form No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningDocument3 pagesForm No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningSantosh Kumar JaiswalNo ratings yet

- Form PDF 141540220090721Document6 pagesForm PDF 141540220090721navdeepdecentNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- US Internal Revenue Service: f4970 - 2000Document2 pagesUS Internal Revenue Service: f4970 - 2000IRSNo ratings yet

- Summary of Dispositions of Capital Property (2011 and Later Tax Years)Document4 pagesSummary of Dispositions of Capital Property (2011 and Later Tax Years)Bryan WilleyNo ratings yet

- 317 Form16 (2005 06)Document6 pages317 Form16 (2005 06)sachin584No ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Schedule 2Document3 pagesSchedule 2anilbsnl1990No ratings yet

- Amit Singh-Payslip - Apr-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Apr-2021-Unlocked PDFamitNo ratings yet

- US Internal Revenue Service: f5227 - 1995Document4 pagesUS Internal Revenue Service: f5227 - 1995IRSNo ratings yet

- IncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021Document1 pageIncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021deepanshu sapraNo ratings yet

- US Internal Revenue Service: f8390 - 1991Document4 pagesUS Internal Revenue Service: f8390 - 1991IRSNo ratings yet

- Details of InvestmentsDocument1 pageDetails of InvestmentsAlok GoelNo ratings yet

- Form No. 24 in Excel Format of Income Tax Annual Statement - XLDocument25 pagesForm No. 24 in Excel Format of Income Tax Annual Statement - XLPranab BanerjeeNo ratings yet

- PART B (Annexure) Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesPART B (Annexure) Details of Salary Paid and Any Other Income and Tax DeductedFuture ArtistNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- Form PDF 468763070040922Document6 pagesForm PDF 468763070040922kxd7mknq2fNo ratings yet

- Form PDF 457810310271221Document6 pagesForm PDF 457810310271221Pankaj GuptaNo ratings yet

- 1w1212notification 54 2020Document4 pages1w1212notification 54 2020Adrian ŠainaNo ratings yet

- Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Document4 pagesForm For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Dilip KumarNo ratings yet

- US Internal Revenue Service: f1041sj - 1992Document2 pagesUS Internal Revenue Service: f1041sj - 1992IRSNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument5 pagesForm 16 Part A: WWW - Taxguru.inDarshan PatelNo ratings yet

- Form 12B (Previous Employer Income)Document4 pagesForm 12B (Previous Employer Income)Ranga.SathyaNo ratings yet

- 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDocument6 pages1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSNo ratings yet

- Form 8582Document3 pagesForm 8582Mira HuNo ratings yet

- US Internal Revenue Service: f4970 - 1997Document2 pagesUS Internal Revenue Service: f4970 - 1997IRSNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Isaac Joel RajNo ratings yet

- Form PDF 819165010311221Document6 pagesForm PDF 819165010311221Vikas KumarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pradip kr BhattacharyaNo ratings yet

- Annex 6 - Form 12B PDFDocument3 pagesAnnex 6 - Form 12B PDFAnonymous Q1Y71rNo ratings yet

- US Internal Revenue Service: f5227 - 1999Document4 pagesUS Internal Revenue Service: f5227 - 1999IRSNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Director GGINo ratings yet

- US Internal Revenue Service: F1120idk - 2001Document5 pagesUS Internal Revenue Service: F1120idk - 2001IRSNo ratings yet

- Form PDF 401621100220322Document6 pagesForm PDF 401621100220322Aravai BDONo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- Form PDF 277466220300722Document7 pagesForm PDF 277466220300722Swapnil CallaNo ratings yet

- US Internal Revenue Service: f1120sph - 1992Document2 pagesUS Internal Revenue Service: f1120sph - 1992IRSNo ratings yet

- Form PDF 588379620210723Document10 pagesForm PDF 588379620210723govindadv75No ratings yet

- BBTPN4386D Partb 2022-23Document3 pagesBBTPN4386D Partb 2022-23basit.000No ratings yet

- Form No. 12B: Prabhakarappa ShashidharDocument1 pageForm No. 12B: Prabhakarappa ShashidharAmbika BpNo ratings yet

- 2nd BatchDocument26 pages2nd BatchJessiel DiamanteNo ratings yet

- 859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesDocument9 pages859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesShivNo ratings yet

- Capitalism Beyond The Crisis Amartya Sen March 26Document12 pagesCapitalism Beyond The Crisis Amartya Sen March 26storontoNo ratings yet

- ABSLI Guaranteed Milestone Plan - PPT - ExternalDocument15 pagesABSLI Guaranteed Milestone Plan - PPT - ExternalanusprasadNo ratings yet

- DGA July 2012 8872Document121 pagesDGA July 2012 8872Mike SchrimpfNo ratings yet

- LearnersMaterial PhilHealthDocument20 pagesLearnersMaterial PhilHealthMarielleBermas100% (1)

- Supporting Service of CTC LogisticsDocument8 pagesSupporting Service of CTC LogisticsTweetie MâdhùNo ratings yet

- Mitsubishi Motors Phils. Salaried Employees Union Vs Mitsubishi Motors Phils. Corp PDFDocument11 pagesMitsubishi Motors Phils. Salaried Employees Union Vs Mitsubishi Motors Phils. Corp PDFRubierosseNo ratings yet

- BrokerDocument1 pageBrokerWilson ThomasNo ratings yet

- Nicl Exam GK Capsule: 25 March, 2015Document69 pagesNicl Exam GK Capsule: 25 March, 2015Jatin YadavNo ratings yet

- Hariyali Kisaan Bazaar - Case StudyDocument26 pagesHariyali Kisaan Bazaar - Case StudyVivekDevasia100% (1)

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document43 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Kier MandapNo ratings yet

- Daniel Wilhelm Named Account Manager at RT New DayDocument2 pagesDaniel Wilhelm Named Account Manager at RT New DayPR.comNo ratings yet

- Income From BusinessDocument8 pagesIncome From BusinessSuyash PrakashNo ratings yet

- Ciap Aapsi 2016Document12 pagesCiap Aapsi 2016Hoven MacasinagNo ratings yet

- 52 InsurDocument2 pages52 InsurtgaNo ratings yet

- Cyber Risk InsuranceDocument8 pagesCyber Risk InsuranceJOHN NDIRANGUNo ratings yet

- HPEB 300 Exam 3 Top 10 PDFDocument10 pagesHPEB 300 Exam 3 Top 10 PDFMaggie PustingerNo ratings yet

- United States Court of Appeals, Third CircuitDocument15 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- QuizDocument153 pagesQuizAvinandan KumarNo ratings yet

- Chapter 4Document6 pagesChapter 4Ashanti T Swan0% (1)

- Week 10 CorporationssDocument9 pagesWeek 10 CorporationssAdrian MontemayorNo ratings yet