Professional Documents

Culture Documents

Indian IT-BPO Industry 2009: NASSCOM Analysis

Uploaded by

Maruthi Krishna TuragaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian IT-BPO Industry 2009: NASSCOM Analysis

Uploaded by

Maruthi Krishna TuragaCopyright:

Available Formats

Indian IT-BPO Industry Factsheet

Indian IT-BPO Industry 2009: NASSCOM Analysis

I. Highlights

2008 was a year of transformation for the Indian IT – BPO sector as it began to re-engineer challenges

posed by macro-economic environment, with the worldwide spending aggregate estimated to reach

nearly USD 1.6 trillion, a growth of 5.6 per cent over the previous year.

- Global market

o Software and services touched USD 967 billion, an above average growth of 6.3 per cent

over past year

o Worldwide BPO grew by 12 per cent, the highest among all technology related segments

o Hardware spend is estimated to have grown by 4 per cent from USD 570 billion nearly

USD 594 billion in 2008

- Market

o Though the demand side challenges have emerged in terms of reduction in discretionary

IT spending, the upside is that outsourcing can help organizations to work through

financial and competitive challenges

o 2008 was a strong year as number of contracts, total contract value and annualized

contract values exceeded as compared to 2007.

o Among all users above average growth was witnessed in the Government, Healthcare

and manufacturing segments

II. Industry Performance

Updated Feb 2009

Indian IT-BPO Industry Factsheet

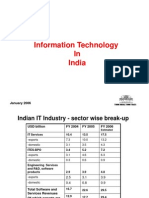

Indian IT-BPO Industry - Sector-wise revenue break-up

USD billion FY2005 FY2006 FY2007 FY2008 FY2009E

IT Services 13.5 17.8 23.3 31.0 35.2

-Exports 10.0 13.3 17.8 23.1 26.9

-Domestic 3.5 4.5 5.5 7.9 8.3

BPO 5.2 7.2 9.5 12.5 14.8

-Exports 4.6 6.3 8.4 10.9 12.8

-Domestic 0.6 0.9 1.1 1.6 1.9

Engineering Services and R&D, 3.8 5.3 6.5 8.6 9.5

Software Products

-Exports 3.1 4.0 4.9 6.4 7.3

-Domestic 0.7 1.3 1.6 2.2 2.3

Total Software and Services 22.5 30.3 39.3 52.0 59.6

Revenues

Of which, exports are 17.7 23.6 31.1 40.4 47.0

Hardware 5.6 7.1 8.5 12.0 12.1

-Exports 0.5 0.6 0.5 0.5 0.3

-Domestic 5.1 6.5 8.0 11.5 11.8

Total IT Industry (including 28.1 37.4 47.8 64.0 71.7

Hardware)

Notes:

E: Estimates

Figures may not add up due to rounding off.

Source: NASSCOM

III. Growth in Revenues

§ Indian IT-BPO grew by 12 per cent in FY2009 to reach USD 71.7 billion in aggregate revenue.

Software and services exports (includes exports of IT services, BPO, Engineering Services and

R&D and Software products) reached USD 47 billion, contributing nearly 66 per cent to the

overall IT-BPO revenue aggregate.

§ IT-BPO exports (including hardware exports) reached USD 47.3 billion in FY2009 as against USD

40.9 billion in FY2008, a growth of 16 per cent.

§ While the US (60 per cent) and the UK (19 per cent) remained the largest IT-BPO export markets

in FY2008, the industry footprint is steadily expanding to other geographies - with exports to

Continental Europe in particular growing at a CAGR of more than 51 per cent over FY2004-2008.

§ The industry’s vertical market exposure is well diversified across several mature and emerging

sectors. Banking, Financial Services and Insurance (BFSI) remained the largest vertical market

for Indian IT-BPO exports, followed by Hi-tech/ Telecom which together accounted for 61 per cent

of the Indian IT-BPO exports in FY2008.

Updated Feb 2009

Indian IT-BPO Industry Factsheet

§ Domestic IT market (including hardware) reached US D 24.3 billion in FY2009 as against USD

23.1 billion in FY2008, a growth of 5.3 per cent. Hardware grew at 2.6 per cent; Software and

services spending supported by increasing adoption, grew by almost 8 per cent.

§ Direct employment in Indian IT-BPO crossed the 2.2 million mark, an increase of about 226,000

professionals over FY2008; indirect job creation is estimated at about 8 million.

§ IT services (incl. engineering services, R&D, Software products) exports, BPO exports and

Domestic IT industry provides direct employment to 947,000, 790,000 and 500,000 professionals

respectively.

§ As a proportion of national GDP, the sector revenues have grown from 1.2 per cent in FY1998 to

an estimated 5.8 per cent in FY2009. Net value-added by this sector, to the economy, is

estimated at 3.5-4.1 per cent for FY2009.

§ Exports - Contributing 66 per cent to the overall revenue aggregate, exports remained the

mainstay of the Indian IT-BPO growth story. Software and services exports, accounting for over

99 per cent of the total exports, reached USD 47 billion and directly employed over 1.7 million

professionals in FY2009.

o Broad-based growth across all the segments of IT services, BPO, Software products and

engineering services, is reinforcing India’s leadership as the key sourcing location for a

wide range of technology related services with Increasing traction in RIM & Application

management and widening service portfolios

o IT services (excluding BPO, product development and engineering services), contributed

57 per cent to total exports to reach USD 26.9 billion.

o BPO services exports, up 18 per cent, was the fastest growing segment across software

and services exports driven by scale as well as scope. BPO service portfolio was

strengthened by vertical specialization and global delivery capabilities.

o Complementing the strong growth in IT services and BPO exports was the continued

growth across Software product development and engineering services, which also

reflected India’s increasing role in global technology IP creation. Export revenues from

these relatively high-value-added services such as engineering and R&D, offshore

product development and made-in-India software products grew at 15 per cent, and

clocked USD 7.3 billion in FY2009.

§ Domestic – In FY2009, domestic market (including hardware) grew at nearly 19 per cent in INR

terms to reach INR 1,113 billion (USD 24.3 billion); domestic software and services market

reached INR 572 billion (USD 12.5 billion).

Global Markets

While the US and the UK remain the largest export markets (accounting for about 60 per cent and 19

per cent respectively, in FY2008), the industry footprint is steadily expanding

Market FY05 FY06 FY07 FY08

Americas 68.30% 67.18% 61.40% 60%

Europe (incl. 23.10% 25.13% 30.10% 31%

UK)

Rest of the 8.60% 7.69% 8.50% 9%

World (incl.

APAC)

Growth Verticals

BFSI, Hi-Tech/ Telecom continued to account for more than 60 per cent of the market. Healthcare

industry is likely to witness increased IT investments due to increased focus on public health, making

Updated Feb 2009

Indian IT-BPO Industry Factsheet

healthcare and insurance affordable to all. Other industries that will see growth include telecom, retail

and utilities, etc.

IV. Knowledge Professionals employed in the Indian IT-BPO

sector

FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009

IT Exp. & 170,000 205,000 296,000 390,000 513,000 690,000 860,000 946,809

Services

Exports

BPO 106,000 180,000 216,000 316,000 415,000 553,000 700,000 789,806

Exports

Domestic 246,250 285,000 318,000 352,000 365,000 378,000 450,000 500,000

Market

Total 522,250 670,000 830,000 1,058,000 1,293,000, 1,621,000 2,010,000 2,236,614

*Figures do not include employees in the hardware sector

Source: NASSCOM

V. Domestic Market Matures

Technology adoption in the domestic market also reported steady gains in FY2009. This segment is

expected to reach INR 1,113 billion (USD 24.3 billion) in FY2009, reporting healthy growth across all key

segments.

Domestic IT services spends are estimated to grow 20 per cent to touch INR 380 billion (USD 8.3

billion) terms and are showing strong signs of increasing sophistication as building enterprise IT

infrastructures and applications, networking and communication become key priorities for India Inc.

Updated Feb 2009

Indian IT-BPO Industry Factsheet

Software and BPO spending growth in the domestic market is being supported by increasing adoption.

While the software product segment registered a growth 15 per cent (INR 103 billion, USD 2.3 billion),

domestic BPO segment recorded the fastest growth of about 40 per cent to reach INR 88.7 billion (USD

1.9 billion).

Hardware segment reached INR 541 billion (USD 11.8 billion) in FY2009, a growth of 17 per cent over

FY2008.

VI. Going forward

• The global technology related spending is expected to reduce for the first 2-3 quarters of 2009 on

account of the downturn but is expected to pick up in 2010.

• Greater focus on cost and operational efficiencies in the recessionary environment is expected to

enhance global sourcing

• There would be pricing pressures coupled with contract renegotiations due to the economic

uncertainty. India Inc would remain focused on tactical measures to achieve cost savings and greater

productivity

• Services and software segments are estimated to cross USD 1.2 trillion by 2012. This is more than the

5.2 per cent growth expected in the total IT spending

• The worldwide BPO market is expected to grow at a CAGR of 11.9 per cent to reach USD 181 billion

by 2012, while ITO market is expected to grow at a CAGR of 6.9 per cent and reach USD 275 billion

by 2012

• The huge potential for global sourcing is further highlighted by an addressable market size of USD

500 billion in 2008, which is more than five times bigger than the current market

• The industry will continue to diversify in terms of geographies, verticals and service lines

• SMBs are expected to emerge as a significant opportunity due to lower IT adoption currently

• Lack of working age population in the developed economies and a significant long term cost arbitrage

indicates India’s sustained cost competitiveness

• Service providers are expected to enhance focus to domestic market to de-risk business and tap

into the local growth opportunities

• India Inc. is likely to increase its focus on developing a comprehensive risks framework and identify

steps in managing them

• Key stakeholders needs to work seamlessly so as to maximise the opportunity and highlight India

on the global map, as the industry is expected to be India’s growth engine

Updated Feb 2009

You might also like

- Patent ValuationDocument35 pagesPatent ValuationKSXNo ratings yet

- Final Project WorkDocument100 pagesFinal Project WorkRaja SekharNo ratings yet

- Roadmap For LWS Pililia July 11Document3 pagesRoadmap For LWS Pililia July 11Rose ZapataNo ratings yet

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- Inventory Management (NTPC)Document118 pagesInventory Management (NTPC)Mohd Farhan Sajid33% (3)

- Total Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionDocument44 pagesTotal Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionChinh Lê Đình100% (1)

- Assignment Kunst 1600Document8 pagesAssignment Kunst 1600Sudeesh KarimbingalNo ratings yet

- California Foreclosure Law 2920-2944.7Document69 pagesCalifornia Foreclosure Law 2920-2944.7Trip Tollison100% (1)

- Business Plan Easy VapeDocument24 pagesBusiness Plan Easy VapeCharlie HolmesNo ratings yet

- Secretarial Audit Compliance CheckDocument30 pagesSecretarial Audit Compliance CheckSiddhart GuptaNo ratings yet

- Snehal KambleDocument63 pagesSnehal KambleSheeba MaheshwariNo ratings yet

- Business Plan Bolt & Nuts - Financial AspectsDocument14 pagesBusiness Plan Bolt & Nuts - Financial AspectsgboobalanNo ratings yet

- Strategic Review Feb2008Document4 pagesStrategic Review Feb2008justin_123No ratings yet

- Project On Investment AnalysisDocument69 pagesProject On Investment Analysispavsbiet07No ratings yet

- Mumbai: Trade Body and 'Voice' of The IT - BPO Industry in India NASSCOM Has AnnouncedDocument6 pagesMumbai: Trade Body and 'Voice' of The IT - BPO Industry in India NASSCOM Has AnnouncedBinaya SabataNo ratings yet

- Information Technology': GPTAIE Presentation OnDocument54 pagesInformation Technology': GPTAIE Presentation OnKaran AhujaNo ratings yet

- Infrastructure System E - Infrastructure Indian ICT Sector Overview Sector Profile & DevelopmentsDocument25 pagesInfrastructure System E - Infrastructure Indian ICT Sector Overview Sector Profile & DevelopmentsSaurabh SumanNo ratings yet

- Case Study: Igate: The Merger With Patni Computer Systems LTDDocument20 pagesCase Study: Igate: The Merger With Patni Computer Systems LTDShone ThattilNo ratings yet

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- It & Ites: November 2010Document42 pagesIt & Ites: November 2010pastrana2No ratings yet

- Global Sourcing TrendsDocument5 pagesGlobal Sourcing Trendsraghavendra38No ratings yet

- Industry & Services Information Technology and Information Technology Enabled Services (Ites)Document9 pagesIndustry & Services Information Technology and Information Technology Enabled Services (Ites)rohityadavalldNo ratings yet

- Summer Project - HarshitaDocument19 pagesSummer Project - Harshitasailesh60No ratings yet

- Information TechnologyDocument6 pagesInformation TechnologyFayazuddin EtebarNo ratings yet

- IT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthDocument30 pagesIT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthSabitavo DasNo ratings yet

- Information Technology: Review of The Ninth PlanDocument16 pagesInformation Technology: Review of The Ninth PlanAyush TripathiNo ratings yet

- IT-BPM Industry UpdateDocument8 pagesIT-BPM Industry UpdateGovinda SomaniNo ratings yet

- IT SECTOR BY HARMEET SEHGALDocument9 pagesIT SECTOR BY HARMEET SEHGALMonisha MalhotraNo ratings yet

- India's Growing IT Industry and Its Contribution to the EconomyDocument29 pagesIndia's Growing IT Industry and Its Contribution to the EconomyVaibhav GalaNo ratings yet

- It & Ites: April 2010Document40 pagesIt & Ites: April 2010anshulkulshNo ratings yet

- Information Technology in India: January 2006Document18 pagesInformation Technology in India: January 2006richdev009_106456088100% (1)

- SWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Document20 pagesSWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Ashutosh Kumar Dubey100% (1)

- Business Process OutsourcingDocument21 pagesBusiness Process OutsourcingAnsarAnsariNo ratings yet

- IT-ITes - Beacon Sector Special 2021Document32 pagesIT-ITes - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- It & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaDocument26 pagesIt & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaKavitha PeethambaranNo ratings yet

- It in IndiaDocument27 pagesIt in Indiashashank0803No ratings yet

- Analyzing Growth of India's IT IndustryDocument7 pagesAnalyzing Growth of India's IT IndustryMandar KulkarniNo ratings yet

- Studiu de Caz IndiaDocument17 pagesStudiu de Caz IndiaAngela IriciucNo ratings yet

- Mind TreeDocument10 pagesMind TreeGaurav JainNo ratings yet

- IT Sector BriefOverviewDocument11 pagesIT Sector BriefOverviewanshuldceNo ratings yet

- Marketing of Services - 1Document7 pagesMarketing of Services - 1kirtiraj sahooNo ratings yet

- Caim 99Document71 pagesCaim 99darbha91No ratings yet

- Indian Information Technology Industry: Presented By: Govind Singh KushwahaDocument14 pagesIndian Information Technology Industry: Presented By: Govind Singh KushwahadrgovindsinghNo ratings yet

- Relative Valuation RepoDocument4 pagesRelative Valuation RepoPrasanth TalluriNo ratings yet

- Market Overview, Computer and PeripheralDocument38 pagesMarket Overview, Computer and PeripheralVj ReddyNo ratings yet

- AG 2010-01 - BPO IndustryDocument3 pagesAG 2010-01 - BPO IndustryRahmath KhanNo ratings yet

- India IT-BPO Industry Performance in 2009Document6 pagesIndia IT-BPO Industry Performance in 2009gsatch4uNo ratings yet

- It Ites March 220313Document34 pagesIt Ites March 220313Doshi KevalNo ratings yet

- Make in India PresentationDocument24 pagesMake in India PresentationPsrawat RawatNo ratings yet

- Why India is a top investment destination for manufacturingDocument25 pagesWhy India is a top investment destination for manufacturingvkumar_345287No ratings yet

- India's IT-BPO Sector to Reach $88.1 Billion by FY2011Document1 pageIndia's IT-BPO Sector to Reach $88.1 Billion by FY2011Rucha_123No ratings yet

- Brazil Telecom & Tech 2009 EconomistDocument12 pagesBrazil Telecom & Tech 2009 EconomistimangoliniNo ratings yet

- Information TechnologyDocument2 pagesInformation TechnologyDhanashree PawarNo ratings yet

- Industry and Economic Analysis: Overview of Indian It IndustryDocument14 pagesIndustry and Economic Analysis: Overview of Indian It IndustryNupur SaxenaNo ratings yet

- Dynamics of Indian IT IndustryDocument42 pagesDynamics of Indian IT IndustryKhushii NaamdeoNo ratings yet

- IT Industry in India: Indian Education SystemDocument9 pagesIT Industry in India: Indian Education SystemPradeep BommitiNo ratings yet

- Market SurveyDocument3 pagesMarket SurveyJake PaulNo ratings yet

- IT Sector Contribution To GDPDocument18 pagesIT Sector Contribution To GDPShiran KhanNo ratings yet

- Industry Overview - ITDocument5 pagesIndustry Overview - ITNidhi RathodNo ratings yet

- Indian IT IndustryDocument4 pagesIndian IT IndustryPiyush GaurNo ratings yet

- It Sector in India PDFDocument77 pagesIt Sector in India PDFAnish NairNo ratings yet

- A Snap Shot of Indian IT IndustryDocument10 pagesA Snap Shot of Indian IT IndustryGanesh JanakiramanNo ratings yet

- IT Sector: in IndiaDocument36 pagesIT Sector: in IndiaSophia JamesNo ratings yet

- Case Study TCSDocument19 pagesCase Study TCSMohammed Naqi Wasif0% (1)

- Indian IT-BPO Industry: Key Highlights During FY2012Document2 pagesIndian IT-BPO Industry: Key Highlights During FY2012Sravan KarneNo ratings yet

- IT Industry. AnalysisDocument20 pagesIT Industry. AnalysisVaibhav MoreNo ratings yet

- Cellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryFrom EverandCellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandWireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 05Document50 pagesChapter 05Putri IndrianaNo ratings yet

- tmp4BCD TMPDocument260 pagestmp4BCD TMPFrontiersNo ratings yet

- India's Insurance SectorDocument7 pagesIndia's Insurance SectorSoumendra RoyNo ratings yet

- Cash Book ObjectivesDocument5 pagesCash Book ObjectivestarabhaiNo ratings yet

- Cerner Company financial statement analysis for year ending December 31, 2008Document2 pagesCerner Company financial statement analysis for year ending December 31, 2008Steff100% (3)

- Introduction of Indian Rupee 1) Introduction of Indian RupeeDocument33 pagesIntroduction of Indian Rupee 1) Introduction of Indian RupeeRajesh GuptaNo ratings yet

- Auditing & Cost AccountingDocument10 pagesAuditing & Cost AccountingSachin MoreNo ratings yet

- Unit 7 Business Accounting and Finance Key TermsDocument36 pagesUnit 7 Business Accounting and Finance Key TermsAndrei AndreeaNo ratings yet

- The Wide Angle - Predictions of A Rogue DemographerDocument16 pagesThe Wide Angle - Predictions of A Rogue DemographersuekoaNo ratings yet

- VITTA Global Asset MGMT 02.06.2017 PDFDocument20 pagesVITTA Global Asset MGMT 02.06.2017 PDFTejpal Singh RathoreNo ratings yet

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Your MaterialsNo ratings yet

- SMCH 18 BeamsDocument19 pagesSMCH 18 BeamsAtika DaretyNo ratings yet

- AAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance IndustryDocument3 pagesAAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance Industryshahidameen2No ratings yet

- CFR TMB Insolvency Request To Remove Borza and Audit 35760-3-2006 28 Nov 2014Document21 pagesCFR TMB Insolvency Request To Remove Borza and Audit 35760-3-2006 28 Nov 2014Hassan AwdiNo ratings yet

- Types of Banks in IndiaDocument20 pagesTypes of Banks in Indiavenkatsri1No ratings yet

- Curve RidingDocument3 pagesCurve RidingbakausoNo ratings yet

- Agilent Technologies Singapore (PTE) LTD v. Integrated Silicon Technology Philippines CorporationDocument4 pagesAgilent Technologies Singapore (PTE) LTD v. Integrated Silicon Technology Philippines CorporationAnjNo ratings yet

- HW8 AnswersDocument6 pagesHW8 AnswersPushkar Singh100% (1)

- FINAL EXAM Winter 2014Document8 pagesFINAL EXAM Winter 2014denisemriceNo ratings yet

- Faysal Bank Boosts Market Share with RBS Pakistan MergerDocument6 pagesFaysal Bank Boosts Market Share with RBS Pakistan MergerUsama Jahangir BabarNo ratings yet

- Hy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Document34 pagesHy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Priyesh DoshiNo ratings yet