Professional Documents

Culture Documents

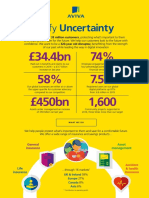

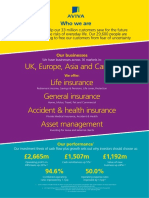

Aviva UK: The Aviva Family Finances Report, Spring 2011

Uploaded by

Aviva GroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva UK: The Aviva Family Finances Report, Spring 2011

Uploaded by

Aviva GroupCopyright:

Available Formats

The Aviva Family

Finances Report

Spring - 2011

FAM_REP_V2_31296_BRO.indd 1 13/05/2011 10:37

FAM_REP_V2_31296_BRO.indd 2 13/05/2011 10:37

The typical UK family

While 84% of the UK population lives as part of a family, it is

no longer safe to assume there is such a thing as a traditional

family unit. Aviva recognises there are various different types of

modern families (see page four for groups tracked) and looks at

their individual approaches to finances including wealth, debt

and expenditure.

In addition, this season’s report looks at how UK families are working with

their employers to save for retirement and how the introduction of pensions

auto-enrolment in 2012 will be greeted by the millions of UK citizens who

make up these family units.

Overview:

● Income – Salary increases see monthly family income rise by 6% to £2,062 (pg 5).

● Expenditure – Significant annual inflation hits major family costs – food (+5.09%), fuel and

light (+6.08%) and motoring (+11.34%) (pg 7).

● Wealth – Fewer families have no savings (28% – May 2011 vs. 33% – Jan 2011) as people

step up to the challenge (pg 9).

● Housing – More families own their own homes with a mortgage as lending increases, but

house prices fall (pg 10).

● Debt – Focus on saving sees average unsecured debt increase to £5,878 (pg 11).

● Look to the future – One in five families is concerned about potential mortgage rate

increases in the near future (pg 12).

● Employee pensions – Just 28% of full-time employed family heads in the UK has a

company pension (pg 13).

● Pension contributions – More than one in five (26%) would sacrifice 5% of their salary if

their employer matched their contributions (pg 14).

● Auto-enrolment – Encouragingly, 55% feel it would be “silly not to join” a company pension

if their employer also contributed. It is concerning however that one third (35%) feel they will

either opt out or don’t yet know what they’ll do when automatically enrolled (pg 14).

The Aviva Family Finances Report 3

FAM_REP_V2_31296_BRO.indd 3 13/05/2011 10:37

The UK modern family

Thirty years ago, it was relatively safe to assume that a nuclear family

consisted of two parents and one or more children. However, as society has

changed, this is no longer the case. In this report, Aviva looks to recognise

the most common types of modern family based on customer profiles and

Government data.

1. Living in a committed 2. Living in a committed 3. Living in a committed

relationship* with no plans relationship with plans relationship with one child

to have children to have children

4. Living in a committed 5. Divorced/separated/widowed 6. Single parent raising one

relationship with two with one or more children or more children alone

or more children

* For the purpose of this report, a committed relationship is defined as either one where people are married or living together.

The Aviva Family Finances Report 4

FAM_REP_V2_31296_BRO.indd 4 13/05/2011 10:37

Income – encouraging

increase in levels of income

Average income

The median monthly net income of a UK family (i.e. the family in the middle of the

sample) is now £2,062 (Jan 2011 – £1,937). This is a six percent increase on the

figures recorded in January and seems to indicate that after several years of austerity,

businesses may be looking to reward their staff with salary increases.

Indeed, there has been a marginal fall in those who earn below £750, from 9% (Jan

2011) to 8% (May 2011) and those who earn between £751 and £1,000 from 10%

(Jan 2011) to 8% (May 2011). We anticipate that with the national minimum wage

due to increase by 15 pence to £6.08 in October 2011, this group will also receive a

boost later in the year.

Income of those in committed relationships who have children

or plan to have children

2500

2000

Monthly Income (£)

1500

1000

500

0

Couples with plans Couples with Couples with Single, raising

to have children one child two children one or

more children

Married/committed relationship types

Of the family groups tracked, single parents receive the lowest monthly income (£874).

This fell from £906 (Jan 2011) earlier in the year and seems to indicate that for this group

– where 61% receive some type of benefit – Government cuts are starting to bite.

At the other end of the scale, those who are in a committed relationship and want

children, have the highest monthly income (£2,338). This is a seven percent increase

since January 2011 (£2,187) and seems to indicate that dual-income households

without children have benefitted most from employers’ generosity.

In addition, the number of families with a household income of more than £2,500 has

increased by four percentage points from 34% (Jan 2011) to 38% (May 2011).

The Aviva Family Finances Report 5

FAM_REP_V2_31296_BRO.indd 5 13/05/2011 10:37

Family income sources – one in five rely on state benefits

As part of the report, Aviva has looked at the various types of income that typical UK families have access to. In terms of these

sources, there is a clear reliance on the primary income earner’s full time salary which provides 68% of families with an income

compared to the full time income of the secondary earners (36%).

Eighteen per cent say part-time employment by one or another heads of the household contributes to monthly income. This

has largely remained the same since January although the percentage of people deriving income from a part-time job has fallen

marginally (-1%) possibly as work associated with the festive season has dried up.

Outside salaried work, state benefits (23%) provide some form of income to more than a fifth of UK families. Single parent families

(61% – May 2011) and those headed by divorced/widowed/separated people (42% – May 2011) are most likely to claim some form

of benefits and also have the lowest median income.

However, while the number of single parents (median income – £874) claiming benefits rose by seven percentage points, the

number of divorced/widowed/separated parents (median income – £1,138) doing so fell by the same amount over the period.

This appears to suggest that – even before the introduction of the changes outlined in the Comprehensive Spending Review –

the Government is looking to cut benefits for those who are slightly better off, while at the same time direct them to the lowest-

income groups.

While some need state support to survive, others have benefitted from increased competition in the savings market which has

seen the launch of a selection of products paying competitive interest rates. The number of families who derive some income from

savings hit 7% (4% – Feb 2011).

In addition, with 15% of families surveyed in the study saying they own a second property (see page 10), it is no surprise to see that

income from a rental property was also cited by some families (2%) as boosting their income.

The Aviva Family Finances Report 6

FAM_REP_V2_31296_BRO.indd 6 13/05/2011 10:37

Expenditure – inflation is

impacting levels of expenditure

Over the tracked period, housing remained the largest single expenditure for UK families accounting for 22% of their monthly

outgoings. While the majority of tracked family groups spend just over a fifth of their income on housing, divorced/widowed/

separated (27%) and single parent (29%) families spend significantly more.

Food is the next largest expense (11%) for the average UK family and there has been a one percentage point increase from January

2011. This is lower than might be expected – especially as annual inflation on food has risen 5.08%. However, with analysts

reporting that lower-cost supermarkets are starting to grow their share of the UK market, it appears that many families are ‘down-

shifting’ their spending on food and cutting back on luxuries.

The average UK family’s third largest monthly expense is fuel and light (6%) and there has been a considerable annual inflation

(+6.08%) when compared to January 2011 (+2.42%). This is even more extreme when considering that annual inflation to

November 2010 was actually negative (-1.88%).

Type of expenditure Average amount spent as Average amount spent as

a percentage of monthly a percentage of monthly

income May 2011 income Jan 2011

Housing (mortgage or rent) 22% 20%

Food 11% 10%

Debt repayment 10% 8%

Nursery care / out of school care 10% 9%

Fuel and Light (e.g. gas and electricity bills) 6% 6%

Motoring 6% 5%

Entertainment, recreation and holidays (Leisure Services) 5% 4%

Public transport fares and other travel costs 4% 4%

Fees for childrens activities 4% 4%

Clothing and footwear 3% 2%

“UK family finances are under pressure as we see inflationary increases on

the most basic costs – housing, food, fuel and light. However, while some

people are undoubtedly struggling, most (96%) have some additional

disposable income. Therefore it is important that they seriously consider

how this can be used to secure their families’ futures.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 7

FAM_REP_V2_31296_BRO.indd 7 13/05/2011 10:37

While not all households have a car – particularly those in inner-city areas – those that do spend 6% of their income on motoring.

While the Government did announce a one pence cut in fuel duty in the recent budget, this has done little to alleviate the pressures

on UK motorists according to the RAC.

Indeed, soaring petrol prices mean families will be feeling the 11.34% rise in annual inflation on fuel costs and we are likely to see

people cutting back on unnecessary journeys or using public transport more. However, we have seen annual inflation of 4.21% on

this mode of transport, so costs have risen here too.

While the average family only spends 3% of their income on clothing and footwear, they are likely to have found this significantly

more expensive than the same time last year, due to the 12.25% annual inflation rate.

While 90% of families surveyed do not pay private school/tuition fees, for those that do, they are a significant drain on family

finances, accounting for 12% of monthly expenditure. Far more common for all families (and only marginally less expensive) is the

monthly cost of nursery/after school care, accounting for 10% of monthly expenditure, and children’s activities (4%).

It is interesting to note that for single parents who are raising one or more children, nursery/after school care can account for up

to 25% of their income. This raises the thorny issue of whether they are financially better off working or claiming benefits, and

therefore highlights the need for affordable childcare options.

Finally, UK families are spending an average of 10% of their monthly income on debt repayment – this is two percentage points up

from January 2011. This highlights the importance that indebted families place on climbing back on to a secure financial footing.

Comparison of debt by family type

Debts on credit cards, loans & overdraft

Mortgage Debt

£120000

£100000

£80000

Total Debt

£60000

£40000

£20000

£0

Committed Committed Married/ Committed Divorced/ Single raising

relationship, no relationship committed relationship separated/ one+ children

plans to have with plans to relationship with two+ widowed alone

children have children with one child children raising one

child alone

Family Type

The Aviva Family Finances Report 8

FAM_REP_V2_31296_BRO.indd 8 13/05/2011 10:37

Family wealth – positive

increase in savings habits

The mean average that families have in savings and investments (excluding pensions and property) is £16,125 (up from £15,766 –

Jan 2011) and they save £145 per month (£122 – Jan 2011). These amounts seem robust, but are skewed by the relatively few (3%)

families who claim to have more than £100,000 in savings.

In actual fact the typical family (i.e. the family in the middle of the sample) is significantly less prepared having just £1,163 (£849 –

Jan 2011) in savings and saving £32 (£22 – Jan 2011) per month.

Nevertheless, these figures show a clear picture of UK families stepping up to the challenge and looking to build a financial safety

net in what is an uncertain economic and political environment. Indeed, we have seen the number of families with no savings drop

from 33% (Jan 2011) to 28% (May 2011) and those who save nothing each month fall from 40% (Jan 2001) to 37% (May 2011).

However, while more families have shown a keenness to start saving since the start of the year, they have not had chance to make

significant progress. The percentage of people with savings of less than £500 has risen to 15% (13% – Jan 2011) as people start to

build small pots but have yet to build a big cushion.

In addition, the typical family (i.e. the median) within the two more vulnerable groups – single parent families (51% save nothing) and

the divorced/widowed/separated (65% save nothing)– continue to save nothing each month. At the other end of the scale, those who

are in a committed relationship and want children are actively working towards this goal and save £81 per month (£55 – Jan 2011).

Product mix – basic products dominate product holdings

The most common products that families use to save are basic building society / bank savings accounts (80%), followed by a cash/

share ISA (34%), or premium bonds (22%). However, some families – generally the more affluent – also have stocks and shares

investments (14%), fixed term bonds (6%), or a buy-to-let property (3%).

It is interesting to note that the number of families with an ISA has only increased marginally from January (33%) to May (34%) – as it might

have been expected that the tax year end would encourage more people to take advantage of their 2011/2012 tax allowances. However, it

appears that the ‘easy access’ nature of basic savings accounts is more appealing to ordinary savers than the tax breaks available.

3% Buy-to-let mortgage

6% Fixed-term bonds

11% Income Protection

13% Critical illness cover

13% Private Health Insurance

14% Stocks and shares investments

17% Private pension

22% Premium bonds

34% ISA (Cash or Shares)

34% Employer pension

38% Life Insurance

47% Mortgage on your primary property

80% Basic bank/building society savings account

“It is good to see that four out of five UK families have a basic bank or building society

savings account. However, while these figures are heartening, the fact that 20% don’t

have a savings account is very worrying. While economic conditions are tough, it is

important that where possible, families work to put aside something each month.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 9

FAM_REP_V2_31296_BRO.indd 9 13/05/2011 10:37

Housing wealth – property remains

people’s biggest financial asset

The majority of families in the UK own their own home (average

value – £205,144) with a mortgage (49%) or outright (14%). In

addition, 23% live in private rental accommodation and 12%

rely on social housing.

The value of the average family home fell by 1% from

£207,548 (Jan 2011) to £205,144 (May 2011). This is 26%

above the average UK house price in April (£165,609) which is

potentially because families – due to their size – are likely to live

in larger properties than single people. The number of families

with a mortgage rose from 47% (Jan 2011) to 49% (May 2011)

as mortgage lending climbed to an eight month high in March.

This increase in the number of ‘new’ mortgages saw the mean

mortgage borrowing increase from £89,018 (Jan 2011) to

£97,408 (May 2011).

It is interesting to note that the incidence of families with

a mortgage increased for all groups except for those in a

committed relationship who don’t have children – 46% (Jan

2011) to 41% (May 2011). However, we saw an increase in

the number of people within this group who had paid off their

mortgage – 20% (Jan 2011) to 23% (May 2011) – suggesting

that they are older/have fewer financial commitments and see

paying off their mortgages as a priority. This theory is backed

up by the fact that they are among the groups with the highest

amount of housing equity (£140,944).

In addition to their main residential property, 15% of families

surveyed claim to own a second property worth on average

£182,384 (May 2011). The mean mortgage on the property is

£140,748 and the mean equity is £41,637. While this figure

seems high, it may be because some respondents’ families have

inherited a property or that couples now living together have

each owned a property in the past which they have held on to –

possibly while the housing market is in a slump.

“For most people, residential property will be the biggest asset that they

ever own. However, as we have seen over the last few years, what goes

up may come down. Therefore, it is important that people ensure they are

using other products to ensure their family’s security as well.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 10

FAM_REP_V2_31296_BRO.indd 10 13/05/2011 10:37

Debt – continued evidence

of increasing debt levels

While the typical UK family has concentrated on increasing their savings cushion, they have not necessarily looked at tackling their debts

(excluding mortgage debt). The average credit card/loan/overdraft debt has increased from £5,360 (Jan 2011) to £5,878 (May 2011).

Comparison of debt by family type

Debts on credit cards, loans & overdraft

Mortgage Debt

£120000

£100000

£80000

Total Debt

£60000

£40000

£20000

£0

Committed Committed Married/ Committed Divorced/ Single raising

relationship, no relationship committed relationship separated/ one+ children

plans to have with plans to relationship with two+ widowed alone

children have children with one child children raising one

child alone

Family Type

The main driver behind this increase appears to be the ‘squeezed middle’. Indeed, the largest increases in average debt have been

seen by those families in a committed relationship with one child (£4,404 to £5,452) or two or more children (£5,248 to £6,200).

Each family will have their own unique reasons behind their debt but – it is safe to suggest – with this group likely to find credit

more readily available than other groups, an unexpected expense – such as a new car or family holiday – may account for this

increase. In addition, those in a committed relationship with two or more children (17%) are also the most likely to have more than

£10,000 of unsecured debt.

At the other end of the scale, those in a committed relationship who do not want children have paid down their debts (-15%

to £5,736) and we have seen a four percentage point drop in those who owe more than £10,000 to 9%. Clearly for those with

‘surplus’ income, debt repayment is a key goal.

While divorced/widowed/separated parents (debts of £4,992 – May 2011) and single parents (debts of £4,696 – May 2011)

continue to have worrying income to debt ratios, both of these have cut back their borrowing. In January divorced/widowed/

separated parents had debts of £5,781, and single parents had debts of £4,820.

Finally, while 67% of UK families have some form of unsecured borrowing, 33% continue to avoid using this type of credit.

Debt is for many families just another part of their financial management strategy.

However, in an uncertain economy, it is essential to look to pay debts down where

possible and avoid additional financial obligations. It is then good news that a third

of people continue to have no unsecured debts.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 11

FAM_REP_V2_31296_BRO.indd 11 13/05/2011 10:37

Look to the future

Short term – rising fears about the rising cost of living

The typical UK family’s top three fears – rising cost of living (60%), redundancy (48%)

and unexpected expenses (39%) – stayed constant between January 2011 and May

2011. However as inflation begins to bite, people are now marginally more worried

about the rising cost of living (57% – Jan 2011) and redundancy (45% - Jan 2011)

than previously.

These fears have remained fairly steady across all groups – except for single parents

whose second biggest fear is losses/changes to the Government benefit system (58%).

Outside the top three fears, families were increasingly worried about how to service

secured and unsecured debt. Indeed, fear of higher mortgage rates rose from 13%

(Jan 2011) to 17% (May 2011) and worries around the inability to keep up debt

repayments rose from 13% (Jan 2011) to 14% (May 2011).

Those in a committed relationship with children are finding the repayment of secured

and unsecured debt to be a big concern. They are most likely of all the groups tracked

to worry about debt repayments (17% - committed relationship with one child) and

rising mortgage costs (19% - committed relationship with two or more children). This

highlights the financial pressures that families with children find themselves under or

put themselves under.

Long term – persisting concerns about the general economy

Significant increases to the basic cost of necessities (58%), redundancy (51%) and

unexpected expenses (39%) remain the top worries for UK families for the next five years.

In addition to these fears, over the long term one in five (+3% points to 20% - May

2011) are worried about rising mortgage costs and almost one in 10 (+2% points to

9% - May 2011) are concerned about meeting costs such as university fees. Those

who are widowed/divorced/separated with one or more children (15%) are most

worried about how they might meet these costs.

“The majority of families’ fears focus on factors over

which they have very little control – the increased cost

of living, unexpected expenses and redundancy. While

they cannot control these issues, they can take simple

precautions like building a savings pot.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 12

FAM_REP_V2_31296_BRO.indd 12 13/05/2011 10:37

A spotlight on Workplace

Pension Schemes

The UK is facing a pensions crisis with a rapidly ageing population, a lack of

retirement provision, over-reliance on limited state funding and increased

longevity. Research by Aviva in September 2010 found the UK’s annual

pensions shortfall stood at £318bn, making it the largest gap per person in

Europe (the shortfall being the difference between the income needed to live

comfortably in retirement, and the actual income people can currently expect).

To help combat this, the Government is introducing rules so all employees are automatically enrolled into

workplace pensions from October 2012.

This initiative will see the mandatory introduction of workplace pensions by all UK employers. In simple

terms, all employers will be required to contribute a minimum of 3% of each employee’s eligible earnings

towards the pension – assuming the employee doesn’t opt out. Employees will need to make a minimum

personal contribution of 4%, with a further 1% coming from tax relief, which means total contributions will

be a minimum of 8%. The employee will be automatically enrolled into the workplace pension, but will have

the right to opt out at any stage. This requirement will be phased in between October 2012 and 2016 –

depending on the size of the employer.

Prior to this launch, Aviva has taken a snapshot of how ordinary families currently engage with employer

pension schemes and how they might choose to engage with auto-enrolment.

More than a third (37%) of all full-time employed UK family heads claim to work for a company that does not offer

a workplace pension. There are around a million employers in the UK so the introduction of auto-enrolment in 2012

will cause a significant shift. Just 28% say they have an employer pension that they are actively paying into.

The remainder of working family heads have either chosen not to pay into it (25%), are ineligible (3%) or –

perhaps – more worryingly, simply don’t know what their employer offers (7%). Employer communication of

the benefits on offer appears to be key, with 18% of those who are not members of a scheme citing lack of

communication as the main reason behind not joining.

% of UK families enrolled in an employer pension

40%

35%

30%

25%

20%

15%

10%

5%

0%

Do not belong to Belong to Not eligible for Employer does Unsure of

employer pension employer pension employer pension not offer a whether employer

scheme scheme scheme pension scheme offers pension

scheme

The Aviva Family Finances Report 13

FAM_REP_V2_31296_BRO.indd 13 13/05/2011 10:37

Of these people who aren’t paying into a pension, the increasingly high cost of living was also highlighted as

a cause with 35% (in full-time employment) and 55% (in part-time employment) feeling that they could not

afford to give up part of their salary to put towards their retirement. Other reasons for employees to decide

not to join an employer pension scheme include worries about the rate of return (13%), ‘not having got

around to it’ (12%) and employers acting as though they don’t want people to join (3%).

Almost a third (28%) of people who do pay into a pension scheme appear to focus on the benefits they can

derive by taking this course of action. Indeed, 55% say as their companies also contribute to the scheme it

would be “silly not to join” and 44% found their company’s positive stance towards enrolment ensured they

joined the scheme.

“It’s encouraging that the vast majority of families (74%) feel they

should be able to contribute towards a workplace pension - and

good news to see that most employees (55%) feel it would be ‘silly

not to join’ a company pension if their employer also contributed. It

is concerning however that a third (35%) feel they will either opt out

or don’t yet know what they’ll do when automatically enrolled. For

the long-term interests of customers, all parties concerned need to

work hard to ensure that opt-out rates are as small as possible.”

Paul Goodwin, head of pensions marketing, Aviva

Finally, 15% said that without a company scheme they would not be saving anything for retirement and one

in eight (13%) revealed that they don’t trust the Government to look after them in their old age.

While almost one in five (18%) of all full-time employed UK family heads did not believe they could contribute

to a pension and still meet their basic living costs – even if their contributions were matched by their employers

– the majority of UK workers begged to differ.

With regular warnings in the media and Government announcements highlighting the pitfalls of not saving

for retirement, when asked how much of their salary they would be prepared to contribute, the most popular

response from full time workers was up to 5% of their salary, if matched by employers (accounting for 26%

of respondents).

For those earning the median UK salary, this would equate to them contributing £1,294 per year and - when

combined with matching employer contributions - would provide a pension pot of £113,868 over a 44-year

working life (before inflation, investment performance and salary fluctuation is factored in). Using Aviva’s

pension calculator, a customer might expect a fund of £252,438 - this takes into account inflation and

investment growth. This is significantly higher than the current average annuity pot of less than £30,000 and

would be a significant step towards eliminating the UK pensions crisis.

The Aviva Family Finances Report 14

FAM_REP_V2_31296_BRO.indd 14 13/05/2011 10:37

% of salary Contribution by employee Total over 44 year working life (employer

contributed and matching employer contributions

combined)

Monthly Annual Total pension Monthly retirement

pot using Aviva’s income, including

pension calculator state pension*

(at 9 May 2011)

1% £22 £259 £51,716 £572

2% £43 £517 £103,428 £773

3% £65 £776 £155,140 £939

4% £86 £1,035 £206,852 £1,104

5% £108 £1,294 £258,564 £1,269

6% £129 £1,553 £310,276 £1,435

7% £151 £1,812 £361,988 £1,600

* Using Aviva’s pension calculator assuming no tax-free cash is taken at retirement.

While some commentators are sceptical about auto-enrolment, the highest percentage of UK families (37%)

would be ‘pleased to be automatically enrolled’ and would even ‘feel valued by their employer’ as a result

(7%). Just 15% of UK families said that they would choose to opt out with the highest percentage of these

being single parents (22%) who were also most likely to be concerned about how their ‘take home’ pay

might be affected (28%).

Indeed, while UK family members were generally positive about auto-enrolment, there is a significant piece of

work that needs to be done to inform people of the changes and put their minds at rest. With less than two

years to go, one in five (20%) have yet to form an opinion on this issue and 12% worry that the scheme may

not be the best option for them.

It is interesting to note that women – who often have significantly less retirement provision – are more

positive about auto-enrolment than men. More (39%) are pleased to be automatically enrolled (men – 35%)

and just 14% (men – 17%) will consider opting out of the scheme.

The Aviva Family Finances Report 15

FAM_REP_V2_31296_BRO.indd 15 13/05/2011 10:37

One major hurdle that families see as stopping them from contributing to a pension is

the rising cost of living squeezing their disposable income. Indeed, 4% of UK families

claim that after living expenses, there is no additional money. Divorced/separated/

widowed families with one or more children (8%) are most likely to say this followed

by married/committed families with two or more children (5%).

However, for 96% of ordinary UK families, there is sufficient cash to spend on further

expenses. Some choose to take positive financial decisions with this surplus and pay

down unsecured debts (32%), put into a savings account (23%), put it into a long-

term savings vehicle (8%) or pay down their mortgage (7%).

Nevertheless, just 10% look to put this surplus into some form of retirement savings

vehicle. In addition, those who arguably need to take the biggest proactive steps in

this arena are least likely to do so – single parents with one or more children (4%).

However, Aviva’s latest Understanding Consumer Attitudes to Savings study (May

2011) shows that the majority of UK adults feel they will need at least half of their

regular monthly income to ‘get by’ in retirement and two thirds to be ‘comfortable’.

So there is clearly work to be done to meet these expectations.

While some take proactive steps to improve their financial position, others choose

to spend surplus on treats for the family (33%), home improvements (17%) and on

themselves (11%).

How families choose to spend any remaining money

after day-to-day living costs

Spend it on treats for my family e.g. days out 33%

Pay off debts not including mortgage (e.g credit cards / loans) 32%

Save into a bank / building society savings account 23%

Save for a specific purpose e.g. house deposit, car, holiday 23%

Spend it on my home 17%

Save for my children’s education / university fees 12%

Put aside for future expenses e.g. new school clothes 11%

Spend it on myself 11%

Save for my retirement 10%

Save into a longer-term savings vehicle e.g. ISA / bond 8%

Pay down my mortgage 7%

Other 5%

“It is sobering to note that saving for retirement ranks

ninth on the list of 12 ways to spend any ‘spare’ money.

If we are to bridge the pensions gap, we have a long

way to go.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 16

FAM_REP_V2_31296_BRO.indd 16 13/05/2011 10:37

Regional

overview

It is interesting to note that the typical UK family appears to

migrate according to its life stage. London has the highest

number of families living in committed relationships who want

children (18%), but East of England has the highest number of

people in a committed relationship with two children

(48%) followed by East Midlands (45%) and the North

East (45%). These figures appear to show that when

people have children, they look to move outside

London – possibly to return to live near one or

both of the parents’ families.

Families in London (£2,544) and the South East (£2,429)

continue to bring home the highest median income each month. At the other

end of the scale, families in Wales (£1,579) have the lowest median income.

These figures tally up with house prices as London families (£306,863) own

the most expensive properties, well above even the South East (£255,896) and

significantly higher than the average value of a family home (£205,144).

In terms of savings and investments, London families have the most, with an

average of £26,024 put away. However, there has been an improvement across

nearly all regions in terms of a reduction in the percentage of families with

no savings. The greatest change between January and May was seen by

families in the East Midlands where 32% reported having no savings in

January but just 22% claimed they still had no savings in May. The only

region reporting an increase was the North East where 40% of families now

say they have no savings – up from 37% in January.

With regards to debt, families in the South East (39%) are most likely

to be debt-free (in terms of credit cards, loans and overdraft) and

those in Wales (23%) are least likely to be debt-free. However,

families in the East Midlands have the lowest mean average debt

(£3,897), compared to those in the South West who have the

highest debt (£7,902).

% of people living in

% of people living in committed House

Region committed relationships Salary Debt

relationships who want children prices

with two or more children

East of England 10% 39% £1,981 £4,742 £193,026

London 28% 28% £2,544 £7,776 £306,863

East Midlands 14% 46% £1,960 £3,897 £180,441

West Midlands 16% 42% £2,073 £4,250 £174,148

North East 8% 42% £1,812 £4,797 £150,862

North West 14% 45% £1,954 £6,243 £172,789

Scotland 11% 41% £2,014 £4,352 £169,509

South East 16% 41% £2,429 £5,185 £255,896

South West 15% 44% £1,839 £7,902 £216,262

Wales 9% 47% £1,579 £7,527 £201,705

Yorkshire 16% 43% £1,579 £6,622 £162,740

UK 15% 41% £2,062 £5,878 £205,144

The Aviva Family Finances Report 17

FAM_REP_V2_31296_BRO.indd 17 13/05/2011 10:37

So what does this tell us?

“The second edition of the Aviva Family Finances Report highlights

that UK families are feeling the effects of the uncertain economic and

political climate. However, rather than buckling under the pressure,

they are taking positive steps to protect their loved ones. Over this

period, we have seen many increase their savings, reduce their debts

and – even some – take their first steps onto the property ladder.

“However, while these are all positive steps, many families appear

to be looking at short-term goals rather than considering how they

will prepare for their retirement. Employers have the opportunity to

play a key role in helping UK families to make positive steps towards

a financially secure retirement and we urge them to ensure their

employees understand what needs to be done.”

Paul Goodwin, head of pensions marketing, Aviva

The Aviva Family Finances Report 18

FAM_REP_V2_31296_BRO.indd 18 13/05/2011 10:37

Methodology

The Aviva Family Finances Report was designed and produced by Wriglesworth Research. As part of this 4,037 UK

consumers - aged between 18 and 55 - who live as part of one of six family groups were interviewed between

December 2010 and April 2011. This data was combined with additional information from the sources listed below

and used to form the basis of the Aviva Family Finances Report.

Additional data sources include:

● Kantar Worldpanel – Supermarket Market Shares

● British Bankers Association – March Lending Figures

● Nationwide Building Society – April Average House Price

● Office of National Statistics – Median UK Salary

● Aviva Management data – Average Annuity

● Working Life – Consumer Research on 2,400 UK consumers – July 2010

● Aviva UK Pensions Gap Report - September 2010

● Aviva Understanding Consumer Attitudes To Savings Report - May 2011

Technical Notes

● A median is described as the numeric value separating the upper half of a sample, a population, or a probability

distribution, from the lower half. Thus for this report, the median is the person who is the utter middle of a sample.

● An average or mean is a single value that is meant to typify a list of values. This is derived by adding all the values

on a list together and then dividing by the number of items on said list. This can be skewed by particularly high or

low values.

For further Information on this report and the Aviva Understanding Consumer Attitudes to Savings Report, or for a

comment, please contact Sarah Poulter at the Aviva Press Office on 01904 452828 or sarah.poulter@aviva.co.uk

The Aviva Family Finances Report 19

FAM_REP_V2_31296_BRO.indd 19 13/05/2011 10:37

FAM_REP_31296 05/2011 © Aviva plc

FAM_REP_V2_31296_BRO.indd 20 13/05/2011 10:37

You might also like

- Aviva PLC - at A Glance March 2018Document2 pagesAviva PLC - at A Glance March 2018Aviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Affidavit of Kinship - Common Law WifeDocument1 pageAffidavit of Kinship - Common Law WifeRothea Simon100% (1)

- Friedrich Hegel 3. Ethical Life: A.1) MarriageDocument3 pagesFriedrich Hegel 3. Ethical Life: A.1) MarriageTYSON DONGLANo ratings yet

- Research Article: Purchasing Intentions Toward Fast Food: The Mediating Role of Consumer Attitudes Toward Fast FoodDocument17 pagesResearch Article: Purchasing Intentions Toward Fast Food: The Mediating Role of Consumer Attitudes Toward Fast FoodCLABERT VALENTIN AGUILAR ALEJONo ratings yet

- Guide Book For Living in Korea (South Gyeongsang Province)Document292 pagesGuide Book For Living in Korea (South Gyeongsang Province)Republic of Korea (Korea.net)100% (2)

- Questions About The FamilyDocument4 pagesQuestions About The FamilyJulianNo ratings yet

- UoN Sociology of EducationDocument30 pagesUoN Sociology of EducationMaxwellNo ratings yet

- Plag Check Report 2023 05 15T11 - 58 - 23Document10 pagesPlag Check Report 2023 05 15T11 - 58 - 23Jitendra KumarNo ratings yet

- Are Children OppressedDocument8 pagesAre Children Oppressedlaura simpsonNo ratings yet

- Reducing Teen Pregnancy through Birth Control EducationDocument3 pagesReducing Teen Pregnancy through Birth Control Educationliezel napoles100% (1)

- Case Management Standards 2013Document62 pagesCase Management Standards 2013Grand OverallNo ratings yet

- AdoptionSearchAgency AspxDocument5 pagesAdoptionSearchAgency AspxSayani ChakrabortyNo ratings yet

- SSH PersonasDocument20 pagesSSH Personasapi-436857720No ratings yet

- Dowry System in IndiaDocument5 pagesDowry System in IndiaAlejandro LayNo ratings yet

- Character Reference: This Person Is Applying To Be Au Pair AbroadDocument6 pagesCharacter Reference: This Person Is Applying To Be Au Pair AbroadAstina SelenaNo ratings yet

- 2627 Fride PDFDocument82 pages2627 Fride PDFGinaAlexaCîmpianu0% (1)

- Sociology 2015 SyllabusDocument24 pagesSociology 2015 SyllabusDeniela Jamaicy HerbertNo ratings yet

- Persons Term PaperDocument28 pagesPersons Term Paperfydah sabandoNo ratings yet

- Nuclear FamilyDocument4 pagesNuclear Familyhjhjhjh ghệ artem100% (1)

- Fichas 4 y 5Document4 pagesFichas 4 y 5Spanisch LondonNo ratings yet

- 0673Document171 pages0673ZartaabKhanNo ratings yet

- Why cohabitation is a rising alternative to marriageDocument1 pageWhy cohabitation is a rising alternative to marriageAn QuanNo ratings yet

- Comunicados Individualidades Tendiendo A Lo SalvajeDocument153 pagesComunicados Individualidades Tendiendo A Lo SalvajeBlueRayThePalletsNo ratings yet

- Exceptions For Alien AdopterDocument3 pagesExceptions For Alien AdopterChil BelgiraNo ratings yet

- Sibling Sexual Abuse: A Guide For ParentsDocument10 pagesSibling Sexual Abuse: A Guide For ParentsTheBoss 20100% (1)

- Street Children in MozambiqueDocument20 pagesStreet Children in MozambiqueJossias Hélder HumbaneNo ratings yet

- 8th Eng PDFDocument162 pages8th Eng PDFvidya sagarNo ratings yet

- Philippine Law On Paternity and FiliationDocument20 pagesPhilippine Law On Paternity and FiliationChristine Ann ContiNo ratings yet

- Social GerentologyDocument205 pagesSocial GerentologyAsif Ali100% (1)

- Hindu Succession Act 1956 impact on partition conceptDocument28 pagesHindu Succession Act 1956 impact on partition conceptsailja kothariNo ratings yet

- 1000 English Collocations in 10 Minutes A DayDocument9 pages1000 English Collocations in 10 Minutes A DayNguyễn Thiên PhúcNo ratings yet