Professional Documents

Culture Documents

Untitled

Uploaded by

api-770432070 ratings0% found this document useful (0 votes)

11 views2 pagesPrior experience in tax compliance and planning at public accounting. EDUCATION Bentley university, Waltham, MA MS in Taxation. Suffolk university, Boston, MA MSA, CPA concentration GPA: 3.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrior experience in tax compliance and planning at public accounting. EDUCATION Bentley university, Waltham, MA MS in Taxation. Suffolk university, Boston, MA MSA, CPA concentration GPA: 3.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesUntitled

Uploaded by

api-77043207Prior experience in tax compliance and planning at public accounting. EDUCATION Bentley university, Waltham, MA MS in Taxation. Suffolk university, Boston, MA MSA, CPA concentration GPA: 3.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 2

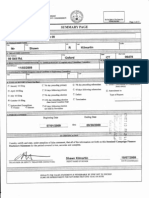

Chenran Yang (Tina)

879 Lexington Street, Apt 3A

Waltham, MA 02452

cy562edc@westpost.net

Cell: 617-412-1397

SUMMARY: I would like to utilize my prior experience in tax compliance and plann

ing at public accounting to serve your firm at my best effort

EDUCATION

Bentley University, Waltham, MA MS in Taxation

09/09-12/10

CPA in process (passed three parts)

Suffolk University, Boston, MA MSA, CPA concentration

GPA: 3.6

09/05-12/06

University of Portsmouth, Portsmouth, UK BA in Business Administration GPA: 3

.5

09/01-06/04

PROFESSIONAL EXPERIENCE

RSM McGladrey, Inc. Tax Department, Quincy, MA

Tax Associate

10/08- 04/09

* Utilized both cash and accrual method for all kinds of returns, including comp

lex C Corp return and individual return, prepared a book-tax adjustments using F

AS 109, Federal and States provision workpaper, individual and corporate year en

d planning

* Prepared extension and estimate calculation, audit-tax provision work, analyze

d unrealized tax benefit using FIN48

* Assisted group work with knowledge of depreciation deduction, including S179 a

nd bonus deduction for Federal and each States

* Calculated NOL, business credit, foreign tax credit, investment credit and R&D

credit for compliance and planning purpose

* Used Profx and Quickbook to facilitate work

KPMG LLP, Tax Department, Boston, MA

Tax Associate

01/07- 10/08

* Analyzed technical issues effectively on 1120C and S Corp, 1065, 990, 1040, 10

41 and Consolidated returns, prepared Federal and states returns using FAS 109 a

nd FIN 48; worked with team to plan engagements and timeframes of work to be com

pleted

* Responsible for updating new tax release as a technology counsellor and bring

them to attention of management team and client, knowledgeable on electronic fi

ling of returns and extensions

* Prepared the international tax return and tax credit calculation for foreign

corporate, return forms about foreign transaction and foreign corporate share/pa

rtnership interest owned by US corporate,

* Communicated effectively in team to understand task directions correctly; foll

owed up with questions, built up business structure in mind; initiated communica

tion with management on my daily progress, completed job in timely sensitive man

ner to meet time budgets; prioritized projects on hand; paid close attentions to

detail issues; worked hard and efficiently to handle the stress of long-time wo

rking during busy season

* Experience associated with exposure to E-workpaper and tax return software (E-

form, GoRS and Fast-tax),\

Hampshire House, Accounting Department, Boston, MA

Internal Auditor

05/06-09/06

* Recapped sales by area; verified variances identified through reconciling dail

y accounts by auditing cash report; sales report and credit card summary; rec

onciled the usage of petty cash and over or short of daily bank, experienced on

MAS 90 software

* Applied strategic thinking as checking trail balance and asking "what-if" que

stion in mind; issued daily sales reports to department and updated General Led

ger Account; hard and fast worker; attention to detail

* Communicated within different departments to facilitate team working; provide

d store and restaurant support for cash office balancing issues, company procedu

res and other inquiries

ADDITIONAL EXPERIENCE

Research Assistant, Suffolk University, Finance Department

09/05-12/06

* Conducted research on IPO listing dates of Chinese Domestic companies by usin

g Bloomberg software; analysed daily share volume

and daily price to find out the growth trends of Chinese domestic companies

TECHNICAL SKILLS

Computer Skills: Microsoft Word and Excel, PowerPoint, Access and database

management, Frontpage, Photoshop

Softwares: ACL, MAS 90, Bloomberg Software, E-workpaper, E-filling, E-form

, GoRS, Fast-tax, Profx and Quickbook

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New All Legit CreditCard Banks PayPal Wu Cashapp Zelle Blank Atm CC SSN Id DL Fullz Criminal Records ClearingDocument3 pagesNew All Legit CreditCard Banks PayPal Wu Cashapp Zelle Blank Atm CC SSN Id DL Fullz Criminal Records ClearingAllen Stapleton53% (15)

- Harvard Professor Benjamin Esty CVDocument8 pagesHarvard Professor Benjamin Esty CVadi2005No ratings yet

- Seec F'orm 20Document23 pagesSeec F'orm 20The Valley IndyNo ratings yet

- Stock Trak ReportDocument5 pagesStock Trak Reportnhausaue100% (6)

- ChapterDocument117 pagesChapterDipesh MagratiNo ratings yet

- Create Uniqueness How To Turn A Passion Into A BusinessDocument176 pagesCreate Uniqueness How To Turn A Passion Into A BusinessRoma DudarevNo ratings yet

- Comparative Study of Non Interest Income of The Indian Banking SectorDocument30 pagesComparative Study of Non Interest Income of The Indian Banking SectorGaurav Sharma100% (3)

- Consolidation Worksheet for Less-than-Wholly Owned SubsidiaryDocument3 pagesConsolidation Worksheet for Less-than-Wholly Owned SubsidiaryDian Nur IlmiNo ratings yet

- PF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sDocument3 pagesPF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sbhavNo ratings yet

- Book 5Document174 pagesBook 5Anonymous hsZanpCNo ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- CreditCard Transfer 918919310895Document2 pagesCreditCard Transfer 918919310895habibullahshekh620No ratings yet

- Aliso Viejo Ranch PresentationDocument14 pagesAliso Viejo Ranch PresentationavranchNo ratings yet

- Uladzislau KharashkevichDocument7 pagesUladzislau KharashkevichHarry BurgeNo ratings yet

- Yoga FuturesDocument2 pagesYoga FuturesNeha SharmaNo ratings yet

- Hewlett PackardDocument31 pagesHewlett PackardAamir Awan0% (2)

- Financial Statement Analysis Tools and TechniquesDocument6 pagesFinancial Statement Analysis Tools and TechniquesDondie ArchetaNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Prospectus - Optimal SA FundDocument45 pagesProspectus - Optimal SA FundMigle BloomNo ratings yet

- Substantive Procedures For InvestmentsDocument2 pagesSubstantive Procedures For InvestmentsChristian PerezNo ratings yet

- IPO Performance Report - Q4 2021 FINALDocument11 pagesIPO Performance Report - Q4 2021 FINALSassi BaltiNo ratings yet

- Chapter 15: Maintaining Integrity, Objectivity and IndependenceDocument11 pagesChapter 15: Maintaining Integrity, Objectivity and IndependenceMh AfNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Switzerland's Central Bank and Financial SystemDocument13 pagesSwitzerland's Central Bank and Financial SystemNikhilNo ratings yet

- Employment Vs Independent Contractor AnalysisDocument4 pagesEmployment Vs Independent Contractor AnalysisLarry HaberNo ratings yet

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiNo ratings yet

- McKnight's Pub Brew ConnoisseurDocument45 pagesMcKnight's Pub Brew ConnoisseurLesh GaleonneNo ratings yet

- Home Depot ROE decomposition 1986-1999Document11 pagesHome Depot ROE decomposition 1986-1999agnarNo ratings yet

- Current Economy Crux (Prelims) by CA Rahul Kumar IAS Prelims 2020Document44 pagesCurrent Economy Crux (Prelims) by CA Rahul Kumar IAS Prelims 2020asha manchandaNo ratings yet

- Business Finance Week 1 & 2Document38 pagesBusiness Finance Week 1 & 2Myka Zoldyck100% (6)