Professional Documents

Culture Documents

Visa OTP Caste Study Croatia - S3

Uploaded by

Nikola CvjetovićOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Visa OTP Caste Study Croatia - S3

Uploaded by

Nikola CvjetovićCopyright:

Available Formats

8 Contact

London

Visa International 1 Sheldon Square London W2 6TT London Tel: +44 (0)20 7937 8111 Fax: + 44 (0)20 7225 8160

Egypt

Visa International GIC Tower, 8th Floor, 21 Soliman Abaza Street, Mohandessin, PO Box 550, Cairo 12612, Egypt Tel: +20 (2) 37625757 Fax: +20 (2) 37625858

Morocco

Visa International Casablanca Business Centre, Lotissement Mandarouna, 300, Sidi Maarouf, 20153 Casablanca, Tel: +962 6 565 5773/4 Fax: +962 6 565 5779

Russia

Visa International 8th Floor, Office 850, Ducat Place II, 7 Gasheka UI, Moscow 123056, Russia Tel: +74957874140 Fax:+66522880

Ukraine

Visa International Suite 12B, Horizon Office Towers, 42 - 44 Shovkovynchna Street, Kiev 01004, Ukraine Tel: +380442200300

Web Prepaid card

An OTP Banka Croatia Case Study

Saudi Arabia

Visa International Abraj Building, 8th Floor North Tower, King Fahad Road, Riyadh 11437, Saudi Arabia Tel: +9661 218 0899 Fax: +9661 218 0898

Jordan

Visa International Jordan Tower Building, 2nd Floor, PO Box 941225, Anman 11194, Jordan Tel: +962 6 565 5773/4 Fax: +380442200290

UAE

Visa International City Tower II BLDG, 21st Floor Shiekh Zayed Road Dubai Tel: +97143319690 Fax: +97143322199

South Africa

Visa International 97 Central Street, Houghton, Johannesburg 2198, South Africa Tel: +271 148 3 4300 Fax: +27117283084

This document and the information contained herein is Visa confidential information. It may not be duplicated, published or disclosed without Visas prior written approval. However, the information contained herein may be shared on a need-to-know basis for the purpose of assessing the suitability of the Visa Products for your business purposes. Visa makes no recommendations or warranties about the accuracy or suitability of the information provided. You use the information at your own risk. To the extent permitted by law, Visa excludes all liability (including negligence) for any loss or damage (including special, indirect or consequential loss or damage) arising from or in connection with any use of the information provided by Visa. For more details/clarification on Visa Products please contact your local Visa representative.

CEMEA-Debit-CS0185-June-10-OTB-OTB

3 Product Launch

Executive summary

OTP Banka found that many of its Croatian customers did not feel secure using their debit or credit cards when shopping on the internet. In response, OTP Banka launched the Visa Web Prepaid card in April 2009. This type of card was new to Croatia and allowed customers to load their OTP Visa Web Prepaid card with a set amount and safely use it on the internet. As the card only allows a pre-determined the amount of funds the risk of internet fraud was greatly reduced. The OTP Visa Web Prepaid card was a huge success with customers reporting feeling more secure when shopping on the internet with their card. In fact, by December 2009 74% of all OTP Visa Web Prepaid card transactions were made on the internet. Product: A physical Visa prepaid card Positioning: Targeted for online use, as an accompaniment or lead product to a bank customer depending on segment

Revenue is generated from product and transaction fees, through increased POS transactions both in shops and online, and through attracting young customers who will remain loyal to the bank and buy more financial products over their lifetime.

OTP Banka is the eighth largest bank in Croatia, with total assets worth HRK 12.87 billion. In 2002 Dalmatinska Banka, Istarska Banka and Sisacka Banka merged to form Nova Banka. It acquired Dubrovacka Banka in 2004 and OTP Banka, nally changing its name to OTP Banka in 2005. OTP Banka now enjoys a wide network of 99 branches and 213 ATMs throughout Croatia, with 1,000 employees servicing over 40,000 retail and corporate customers and 1,150 merchants.

Market background

The majority of OTP Banka customers do not feel secure sharing their banking details on the internet. However, there is great interest in shopping on the internet especially amongst students, teenagers, frequent travellers and internet-savvy customers. Research and customer knowledge identified that there would be support for a bank product providing a secure solution.

OTP Visa Web Prepaid card

The Visa Web Prepaid card is a simple solution to reducing the risk of internet misuse. The card is linked to the OTP Visa Web account and by depositing funds in this account the customer sets a limit on their card. Because the card only holds the money the customer wishes to spend, customers can shop on the internet safe in the knowledge that the rest of their finances would be protected if their OTP Visa Web Prepaid card was compromised. In addition to this, OTP provided free fraud cover for web pre-paid cards giving the customer full fraud protection for the total transaction amount.

Why Visa Web Prepaid card?

The Visa Web Prepaid card is quick to set up and easy to administer. In addition it had already proved to be a success in instilling e-commerce confidence amongst bank customers in other countries. Customers could transfer money to their Prepaid card via their internet or phone banking at anytime, giving them a way to control their everyday expenses and finances and not just their internet shopping. A proportion of the Prepaid card users were teenagers and students so the card oered a straightforward, high-control product for parents to set up for their children. To appeal to this market, OTP Banka added an SMS control service, allowing account holder the ability to monitor all spend on their account via SMS. The youth market is particularly lucrative as young customers often remain loyal customers for life. Being issued by Visa, the card can be used at ATMs throughout Croatia and worldwide - both online and for POS transactions which provide a healthy revenue for OTP Banka. Being a new product in Croatia, the card also helped further OTP Bankas innovative image. The Visa Prepaid card enabled OTP to cross sell products to existing retail bank customers, acquire new customers, generate incremental revenue and meet overall business objectives of innovation security and customer relationship building.

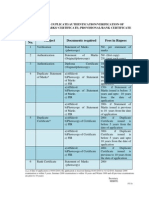

4 Product Distribution

5 Marketing Mix

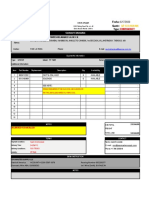

Product pricing

Considering the age of the customers and the low cost of setting up the programme, the OTP Visa Web Prepaid card had the lowest annual fee of all OTP Bankas products. Customers paid a HRK 50 fee each year to have the card plus 1% per transaction to transfer the funds from the Prepaid card back to their current account. All POS and ATM cash advance transactions attracted a 2-3% fee and charges of HRK 30 were paid for a replacement card, new PIN or emergency card. To encourage take up across the profitable student market, the card was free for customers with OTP Bankas student package and fees for using other banks ATMs were waived.

Marketing

The marketing team at OTP Banka decided the focus of the launch campaign would be security and their slogan was simple, For safe internet shopping/Za siguran internet shopping.

Why Visa?

Visa was the natural network brand for this Prepaid card as it would be linked to the OTP Visa Web account. Visa was already well known and trusted throughout Croatia, even with younger customers, and was widely accepted at ATMs, POS terminals and on the internet. The Prepaid Virtual Visa Account card typically has a low load value but with multiple replenishments. Because the Internet is a zero-oor limit environment, the Issuer can see all Virtual Account transactions and act on each one individually. A Visa Prepaid card oers consumers the convenience, security and utility of a Visa branded card for a range of needs from general everyday spending to specific payments or uses. The card provides an easy entry-point to consumers, allowing them to pay for purchases and bills, shop online and by phone, or obtain cash at ATMs when they otherwise could not. Being issued by Visa, the card can be used at ATMs throughout Croatia and worldwide.

As the product would appeal to such a wide audience in terms of age and the media they regularly consumed, the advertising campaign spanned the whole spectrum of marketing channels, including brochures, leaets, media announcements, magazine and newspaper adverts (daily, weekly and monthly), billboards, local TV, major websites, internet portals, SMS, in-branch displays, student centre restaurant advertising, ATM screens, direct mail and debit and credit card statement inserts. It was found that direct sales were the most successful because of their personal nature.

Start up planning

In January 2009 the Sales, Product, Card and Marketing departments at OTP Banka started planning the launch of Visa Web Prepaid card. As this simple product did not demand any system changes or heavy investment, a short 3 month timescale was put in place to train bank sta, develop the card software and create the marketing collateral. On 15th April 2009 the Visa Web Prepaid card was launched across Croatia using a variety of media and supported by cash sta incentives.

Who was Visa Web Prepaid card aimed at?

This new card would appeal to a very wide audience of existing and potential new customers. It would help anyone who was interested in shopping on the internet, including OTP Bankas internet banking clients and existing credit card clients. The secure aspect of this card would also appeal to frequent travellers, students and the parents of teenagers who were demanding financial independence. Being a simple Prepaid product the risk to the bank was low and the only criteria for eligibility were being a citizen of the Republic of Croatia and holding a current account with OTP Banka.

7 Outcomes and success

The success of Visa Web Prepaid card

8 months after launch, figures from 31st December 2009 showed the Visa Web Prepaid card to have been a great success. Initial targets in the first year were almost met with an average of 2 transactions per card in the last quarter of 2009 alone. Data analysis shows that the Prepaid customers are younger and make more transactions of smaller amounts than OTP Bankas traditional debit card customers. A total of 10,075 transactions, totalling a massive 2,560,750.56 HRK were made on Visa Web Prepaid cards in the 8 month period. The average spend was 251 HRK for POS transactions. Importantly the card must have instilled confidence in internet security as a total of 7,451 purchases were made on the internet, totalling over 2 million HRK. In fact 74% of all purchases made with the Visa Web Prepaid card were on the internet.

Lesson learned

Customers will use the internet for shopping when they have a secure card, and a Prepaid card is a highly eective solution. By listening to customers needs and responding with a simple solution, the rewards can be very lucrative for the bank. In fact, OTP Banka reported customers phoning the call centre to specifically request the Visa Web Prepaid card. The Prepaid card is a highly cost eective solution that oers very profitable returns for the bank. Revenue is generated from product and transaction fees, through increased POS transactions both in shops and online, and by attracting young customers who will remain loyal to the bank and buy more financial products over their lifetime. Marketing to existing customers enabled OTP to generate a significant level of interest and started to deliver revenue to the bank quickly. The innovative nature of the product also attracted a number of enquiries from non-bank customers. Distribution channels complimented the marketing mix and enabled smooth operational aspects which in turn provided an excellent customer experience ensuring cards started transacting quickly resulting in the OTP brand being enhanced. OTP Banka reported that this product had very few hurdles while planning and implementing the programme. If you have any questions about the Visa Web Prepaid card please contact your Visa representative.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Instrument TubingDocument11 pagesInstrument Tubingbab_ooNo ratings yet

- Qualman Quiz 3Document4 pagesQualman Quiz 3Laurence Ibay PalileoNo ratings yet

- Case Study Outburst & Gas ManagementDocument11 pagesCase Study Outburst & Gas ManagementAnshuman Das100% (1)

- PDFDocument76 pagesPDFRavishankarNo ratings yet

- 38 69 3 PBDocument23 pages38 69 3 PBIdethzNo ratings yet

- BDocument136 pagesBJuan Manuel Ugalde FrancoNo ratings yet

- Computer Awareness For IBPS - SBI - RRB PO & Clerks - Edu GeeksDocument3 pagesComputer Awareness For IBPS - SBI - RRB PO & Clerks - Edu GeeksVivek SharmaNo ratings yet

- Supersafari - 2 Activity BookDocument99 pagesSupersafari - 2 Activity BookShwe Yee Thet paingNo ratings yet

- Emergency Replacement Parts for Grove RT 760E CraneDocument1 pageEmergency Replacement Parts for Grove RT 760E CraneraulNo ratings yet

- St. Louis Review Center Post Test Principles of TeachingDocument8 pagesSt. Louis Review Center Post Test Principles of TeachingGibriel SllerNo ratings yet

- SAN11 Paper Guide 16-17Document4 pagesSAN11 Paper Guide 16-17ghgheNo ratings yet

- (X) Selection Guide - PowerFlex Low Voltage Drives - PFLEX-SG002K-En-P - February 2017Document178 pages(X) Selection Guide - PowerFlex Low Voltage Drives - PFLEX-SG002K-En-P - February 2017Nicolás A. SelvaggioNo ratings yet

- SOP Purchasing Manual 2011 PDFDocument220 pagesSOP Purchasing Manual 2011 PDFerpNo ratings yet

- Ingersoll Rand Rotary Screw Air Compressors 15 To 50 HP Brochure JECDocument11 pagesIngersoll Rand Rotary Screw Air Compressors 15 To 50 HP Brochure JECMardeni OliveiraNo ratings yet

- Planta Electrica Control MedicionDocument51 pagesPlanta Electrica Control MedicionjorgevchNo ratings yet

- BS WaterDocument0 pagesBS WaterAfrica OdaraNo ratings yet

- Remote Viewing, Anytime, From Anywhere: Product DetailsDocument15 pagesRemote Viewing, Anytime, From Anywhere: Product DetailsShrijendra ShakyaNo ratings yet

- Seeing Sounds Worksheet: Tuning Fork StationDocument2 pagesSeeing Sounds Worksheet: Tuning Fork StationEji AlcorezaNo ratings yet

- Fdas Technical Specs PDFDocument10 pagesFdas Technical Specs PDFotadoyreychie31No ratings yet

- Housing AffordabilityDocument13 pagesHousing Affordabilityjeanette narioNo ratings yet

- B.O Q Irrigation Items SAQQER ROAD - Xls FINALDocument1 pageB.O Q Irrigation Items SAQQER ROAD - Xls FINALDEEPAKNo ratings yet

- Metco®73F-NS-1 (-2) 10-058 PDFDocument7 pagesMetco®73F-NS-1 (-2) 10-058 PDF張政雄No ratings yet

- Modul Sitem Informasi Managemen (MAN 611)Document13 pagesModul Sitem Informasi Managemen (MAN 611)Locke Holey FristantoNo ratings yet

- Criteria DesandingDocument13 pagesCriteria Desandinglebrix100% (1)

- HSM USB Serial Driver Release NotesDocument16 pagesHSM USB Serial Driver Release NotesErnu AnatolieNo ratings yet

- Authentication Verification Letter For Portal 1Document2 pagesAuthentication Verification Letter For Portal 1pradeepajadhavNo ratings yet

- Performance Adjustment On Me Engine 20130415Document24 pagesPerformance Adjustment On Me Engine 20130415NAGENDRA KUMAR DONTULANo ratings yet

- Clerk Cum Data Entry Operator Recruitment 2018Document25 pagesClerk Cum Data Entry Operator Recruitment 2018Pankaj VermaNo ratings yet

- Yodlee CrossSell Case StudyDocument4 pagesYodlee CrossSell Case StudylocalonNo ratings yet

- Task 7 CompleteDocument1 pageTask 7 Completeapi-335293732No ratings yet