Professional Documents

Culture Documents

Credit Card Config1

Uploaded by

sonavanessOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Card Config1

Uploaded by

sonavanessCopyright:

Available Formats

Please find the relevant details related to credit Crads as follows: Overview This document attempts to explain in the

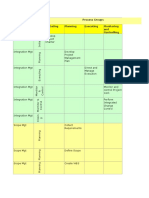

brief the credit card processi ng in SAP. SAP provides a flexible and secure payment card interface that works with the software of selected partners that provide merchant processes and clear ing house services. In SAP the credit card processing is integrated with the sales and distribution module. Payment card configuration Much of what is required for credit card processing t o work with VISA, Master Card, and American Express is already set up in SAP. Fo r all credit card configurations refer to Define Card Types Transaction SPRO IMG -> Sales and Distribution -> Billing -> Payment Cards Here we define the type o f cards that can be used in the system. A four-letter code is given for each card type. E.g. MAST for Master Card, VSAJ for Visa Japan. A function module for checking the card number is also specified here. 1. Define Card Types Credit Card Configuration And Processing In SAP Maintain Ca rd Categories (a) Define card Categories: Here we specify the card category of the payment car d. With this the system automatically determines the card category when you ente r a card number in master data or sales documents. (b) Determine card categories: Here we specify the acceptable number ranges for different card types. Also card categories are assigned to the card types. Even though SAP comes with card checking algorithms (Function Modules) for standard c ard types this configuration setting is particularly useful to those cards that do not contain any standard checking algorithm already set up in SAP. 2. Determine Card Categories Maintain Payment Card Plan Type In this step, you a ssign the payment plan type for payment cards, the payment card plan type, to al l sales document types in which you will be using payment cards. You cannot proc ess payment cards if you have not made this assignment The standard system conta ins payment plan type 03 for processing payment cards. 3. Show the screen where this assignment is done. Credit Card Configuration And Processing In SAP 3. Maintain Payment Plan Type Maintain Blocking Reasons In thi s step, you define blocking reasons for payment cards. You enter these in the pa yer master record to block cards. The standard system contains blocking reason 0 1 for lost cards. Risk Management for Payment Cards Transaction SPRO IMG -> Sale s and Distribution -> Billing -> Payment Cards -> Authorization and settlement > Risk Management for payment cards. Risk Management plays a central role within Sales, providing you with checks and functions to minimize your credit risk. In addition to letters of credit and export credit insurance, payment cards are am ong the payment guarantee forms that you can use to insure payment for sales ord er items. SAP comes with predefined payment forms of guarantee as shown below. Customer can also maintain other forms of payment suited for their line of busin ess. Credit Card Configuration And Processing In SAP Define forms of payment gua rantee 3. Define forms of payment guarantee Maintain payment guarantee procedures In th is step, you define Payment guarantee procedure. These procedure controls, which form of payment guarantee, are valid for a particular customer, and for a parti cular sales document type. The various settings done under this configuration ar e Define payment guarantee procedures Maintain customer determination procedure Maintain document determination procedure Assign sales document types Determine payment guarantee procedures Maintain authorization requirements* Here requireme nts* are set to tell the system how and when to carry out authorization when a s ales order is saved. SAP comes with two requirements Form routine 1. Carry out authorization only when the sales document is complete. The system

carries authorization when the order is saved. Form routine 2. Carry out authorization only when the sales document is complete, but the aut horization for all the complete documents is carried out in batch. Additional re quirements* can be assigned here as per the business requirements. *Requirements are ABAP/4 code. Requirements for various functions can be accessed using trans action VOFM Credit Card Configuration And Processing In SAP 4. Maintain Card Authorization Requirements Maintain Checking Groups How and whe n authorizations are carried out depends on the setting you make in the customiz ing for maintain checking group routines. The three main settings that influence authorization are: a) Authorization requirements b) Authorization horizon c) Pr eauthorization There are two settings under this setting. Define checking group: Here a checking group is defined and the authorization requirement (described i n the previous section), Authorization horizon (described below) and preauthoriz ation settings are done for this checking group. 5. Define Checking Group Credit Card Configuration And Processing In SAP Here yo u can see a checking group C1 is defined with the authorization requirement 902. Checking the pre-authorization tells the system to carryout preauthorization if the order fulfillment date falls outside the horizon. The authorization horizon specifies the number of days before the material availability date, or billing date, that the system is to initiate authorization. If a sales order is saved wi thin the authorization horizon, the system carries out authorization immediately . If a sales order is saved before the authorization horizon comes into effect, the system does not authorize at all, or carries out preauthorization. 6. Preauthorization Concept In this example, the system has been set to authoriz e one day before delivery creation. The system does not carry out authorization when the order is saved on Day 0, rather on Day 2. Note that the authorization v alidity period has been set to 14 days in Customizing IMG-> Authorization and se ttlement-> Specify authorization validity periods. The transaction will have to be reauthorized if delivery activities take longer than 14 days. Assign checking groups: Here the checking groups defined earlier are assigned to different sale s document types as shown 8. Specify authorization validity periods Here number of days that an authorization can remain valid for different card types are main tained. Refer to 9. Credit Card Configuration And Processing In SAP 8. Assign checking groups 9. Assign validity period for authorization for different card types Credit Card Configuration And Processing In SAP Account Determination Transaction SPRO IMG -> Sales and Distribution -> Billing -> Payment Cards-> Authorization and settle ment -> Maintain Clearing House In the following steps, you set the condition te chnique for determining clearinghouse reconciliation accounts for authorization and settlement. The system uses the entries here to determine the clearing accou nt for the payment card charges. When settlement is run, the postings in the rec eivable account for the payment card will be credited and a consolidated debit w ill be created and posted to the clearinghouse account. These accounts are a spe cial type of general ledger account that is posted from Sales and Distribution. Here, you maintain: -> Maintain field catalog. -> Condition tables and the field s that they contain -> Access sequences and condition types -> Account determina tion procedures -> You then assign these accounts to condition types. Add to fie ld catalog Here you maintain the fields that can be used in the condition table. 10. Shows the transaction to maintain the field catalog. 10. Maintain Field Catalog. Maintain condition tables Here condition tables are maintained with fields that are added to the field catalog. SAP comes pre-config ured with two condition tables 4 and 6. Refer 11. Credit Card Configuration And Processing In SAP 11. Maintain Condition Table Maintain access sequences In this step we define an access sequence and link the access sequence with the conditi on tables. Here an access sequence is defined. SAP comes with the access sequenc

e A001. 12. Define Access Sequence Once the new access sequence is defined, it is linked to the condition tables as shown in the next screen. Credit Card Configuration And Processing In SAP 13. Maintain Access For Access Sequence Selecting an access and clicking fields will display the fields for the selected access as shown below for access 10 as shown above. 14. Display Access Fields Maintain condition types Here condition types are defi ned and the access sequence to linked to it. Condition types are contained in ac count determination procedures and control which access sequences the system use s to find condition records. These are The condition tables. Credit Card Configu ration And Processing In SAP 15. Define condition type Maintain account determin ation procedure In this step an account determination procedure is defined and l inked to the condition type (which in turn is linked to the access sequence). De fine account determination procedure 16. Assign account determination procedure. Here an account determination procedure CC01 is defined and the condition type CC01 is assigned to it. Access sequence linked to the condition type Credit Card Configuration And Processing In SAP Assign account determination procedures In this customizing the previously set up account determination procedure is assign ed to different billing documents. Assign Accounts (G/L) G/L accounts are assign ed here for the combination of Sales organization, Card type, chart of accounts and condition types as shown in the 17. 17. Assign G/L accounts Set authorizatio n / settlement control per account Each G/L account is assigned an authorization and a settlement function module. The system will read the configuration a call the authorization and settlement function module during authorization and settl ement respectively. Credit Card Configuration And Processing In SAP 18. Set Auth orization and settlement function module Maintain merchant IDs per account A mer chant may have one or more IDs for each clearinghouse with which it does busines s. Here, you assign these different merchant IDs to their related receivables ac counts. 19. Assign Merchant ID->s Credit Card Configuration And Processing In SA P Authorization and Settlement in SAP 20. Sales Order Cycle With Credit Card Aut horization When an order is placed through the front-end system, the order infor mation, credit card information, billing information, shipping information is pa ssed to SAP. SAP processes the order calculates the taxes, the shipping costs an d reads the configuration information settings and executes the function module setup as described in Fig. 18. The function module formats the data and makes a RFC * call to the payment application**. The payment application screens the ord er for fraud, encrypts the data and communicates with the third party processor who in turns communicates with the card association and card issuer. *RFC (Remot e Function Call) *Payment Application: Middle ware between SAP and third party p rocessor/bank. Credit Card Configuration And Processing In SAP The third party p rocessor responds back with the response whether the transaction is approved or declined or referred. Note: When any item in the order does not have a confirmed quantity, then authorization is not carried out for the full amount. A small do llar amount usually ($1) is used as the authorization amount. During the resched uling run the system will check for the material availability. If the material c an be delivered within the horizon date, a full authorization for the order is c arried out. Approved: When the credit card transaction is approved the systems c hecks for the material availability, confirms the material for the ordered quant ity and saves the order. Declined: The material availability check for the mater ial is not made, and the order is rejected. Referred: The order is saved and is blocked for delivery. In this situation is merchant calls the bank checks for th e available credit on the card and a manual authorization is carried out. 21. Sa les Order Entry Screen in SAP Payment Card Information Credit Card Configuration And Processing In SAP The first line in payment card screen is the card check p erformed by SAP system, using the card check algorithm function module as descri bed in 1. And the remaining lines represent the actual authorizations that are c arried out. 22. Payment Card Screen Path Header -> Payment Cards. Settlement Leg ally the merchant can charge the credit card after the order has been completely processed. In SAP this happens after a delivery is created and the goods has be

en shipped. In case there is not enough authorization for the order to be delive red, the system goes out the get the authorization for the remaining amount. In SAP settlement is initiated using the transaction FCC1. All the valid authorizat ion is submitted in a batch to the payment application at scheduled intervals as specified by the third party processor. The payment application encrypts this d ata and communicates with the third party processor. The third party processor c hecks if the settlement request has a valid authorization against it. The third party processor then transfers the fund from the cardholder->s bank to the merch ant bank. Authorization Response Credit Card Configuration And Processing In SAP

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- SAP Accounts Payable-Supply Chain OverviewDocument18 pagesSAP Accounts Payable-Supply Chain OverviewsonavanessNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 4th Edition ITTOs at One GlanceDocument18 pages4th Edition ITTOs at One GlancesonavanessNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Sap Accounting EntriesDocument8 pagesSap Accounting Entriesashish sawantNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AR Collection Demo 05232011Document21 pagesAR Collection Demo 05232011sonavanessNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Printing Invoices-Smart FormsDocument25 pagesPrinting Invoices-Smart Formssonavaness100% (10)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Attack Heart Attack Even You Are AloneDocument7 pagesAttack Heart Attack Even You Are AloneSumanth Krishna100% (13)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 100 Moral Stories - Islamic Mobility - XKPDocument173 pages100 Moral Stories - Islamic Mobility - XKPIslamicMobility100% (4)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- EMC Backup System Sizer Release Notes - 2Document10 pagesEMC Backup System Sizer Release Notes - 2makuaaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Catalogue Master's in Global BIM ManagementDocument20 pagesCatalogue Master's in Global BIM ManagementGabriela P. Martinez100% (1)

- X X Z N N: Interval EstimateDocument10 pagesX X Z N N: Interval EstimateNa'Tashia Nicole HendersonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- MAC OS TricksDocument9 pagesMAC OS TricksCkaal74No ratings yet

- 127 Useful Keyboard Shortcuts For Windows 7Document9 pages127 Useful Keyboard Shortcuts For Windows 7Sunny GoelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Technical CommunicationDocument6 pagesTechnical CommunicationRashmi SharmaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Ashish Kumar Jha Technical Case Study of Cloud Based Offerings by Top 10 CompaniesDocument45 pagesAshish Kumar Jha Technical Case Study of Cloud Based Offerings by Top 10 CompaniesAshish Kumar JhaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Lab 1Document406 pagesLab 1Raja Isaac GaddeNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- DAIRY FARM GROUP - Redesign of Business Systems and Processes - Case AnalysisDocument5 pagesDAIRY FARM GROUP - Redesign of Business Systems and Processes - Case Analysisbinzidd0070% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- VCS cluster concepts guide for high availabilityDocument20 pagesVCS cluster concepts guide for high availabilityhalkasti100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- XIISCB-27 RAUNAK DAS - Computer Science Practical File XII - Certificate and Index PageDocument6 pagesXIISCB-27 RAUNAK DAS - Computer Science Practical File XII - Certificate and Index PageR TO THE POWER 5No ratings yet

- Open Source Hacking Tools PDFDocument198 pagesOpen Source Hacking Tools PDFLuis Alejandro Pardo LopezNo ratings yet

- DBMS Exam Questions Cover ER Diagrams, Normalization, Transactions, IndexingDocument5 pagesDBMS Exam Questions Cover ER Diagrams, Normalization, Transactions, IndexingRajib SarkarNo ratings yet

- Auto Followers FB 100 % WorkingDocument15 pagesAuto Followers FB 100 % WorkingKevin BlevinsNo ratings yet

- A Case Study On Implementing ITIL in Bus PDFDocument7 pagesA Case Study On Implementing ITIL in Bus PDFsayeeNo ratings yet

- WinCC Flexible Compatibility List DDocument2 pagesWinCC Flexible Compatibility List DmaseloNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2g Huawei Handover AlgoritmDocument7 pages2g Huawei Handover AlgoritmSofian HariantoNo ratings yet

- Rockwell Software RSView32 Recipe Pro Getting en 0811Document34 pagesRockwell Software RSView32 Recipe Pro Getting en 0811atif010No ratings yet

- Benubird PDF Quick Start GuideDocument21 pagesBenubird PDF Quick Start GuideCorrado BaudoNo ratings yet

- SAP Overview BrochureDocument4 pagesSAP Overview Brochuresdhiraj1No ratings yet

- Draft - Smart Switches IDocument3 pagesDraft - Smart Switches IRam NarayanNo ratings yet

- TriangleDocument2 pagesTriangleapi-3812198No ratings yet

- High Sullivan - Availability Options For Kronos With SQL ServerDocument38 pagesHigh Sullivan - Availability Options For Kronos With SQL ServerpmfioriniNo ratings yet

- EMMC Data Recovery From A Bricked Phone - HackadayDocument4 pagesEMMC Data Recovery From A Bricked Phone - HackadayAlainN22000% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Rename SAP Landscape Hosts Names (CAL and Replication) - SAP Q&ADocument2 pagesRename SAP Landscape Hosts Names (CAL and Replication) - SAP Q&AAbhinavkumar PatelNo ratings yet

- M160-6 Design Control ProcedureDocument20 pagesM160-6 Design Control ProcedureBrewer HouseNo ratings yet

- Delta Cad ManualDocument0 pagesDelta Cad ManualAndrei PantuNo ratings yet

- Canolengua 2020Document4 pagesCanolengua 2020singaram VenkateshNo ratings yet

- Robinson, Julia Bowman PDFDocument4 pagesRobinson, Julia Bowman PDFcreeshaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)