Professional Documents

Culture Documents

DAILY - June 14-15, 2011

Uploaded by

JC CalaycayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DAILY - June 14-15, 2011

Uploaded by

JC CalaycayCopyright:

Available Formats

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (+632)687-5071 (trunk)

DAILY WRAP & OUTLOOK _ TD115-116 _June 14-15, 2011

PSEI Pts Change % Change

Volume

Value

Advancers

Decliners

Unchanged

4,140.27

-31.27

-0.75%

2,170.29

4,712.10

32

101

41

MARKET WRAP & HIGHLIGHTS

S ECTOR ALL FIN AN CIAL IN D U S TRI AL H OLD IN G FIRM S P ROP ERTY S ERV ICES M IN I N G & OIL

P H ILIP P IN E M ARKET, D AIL Y S TATS IN D EX P t s Ch a n g e

% CH AN GE

sian markets reversed early losses after China's industrial production and inflation data eased concerns growth may have cooled in the world's second largest economy. Domestic share prices however, took an opposite route, rising off the bell before erasing all gains and breaking under a critical support level. US and European stocks were flat overnight.

2 ,9 2 6 .0 1 9 3 0 .5 2 7 ,0 1 0 .2 1 3 ,3 7 8 .9 3 1 ,4 5 7 .2 0 1 ,5 0 3 .7 6 1 7 ,3 7 8 .5 0

-2 0 .6 1 -1 0 .4 9 -4 5 .7 9 -3 9 .9 8 -1 9 .8 6 3 .0 4 -2 5 8 .2 1

-0 .7 0 % -1 .1 1 % -0 .6 5 % -1 .1 7 % -1 .3 4 % 0 .2 0 % -1 .4 6 %

The Main Philippine Equity Index wiped out a 26.19 points gain through the first half-hour off the opening bell, dropping to as COU N TRY much as -47.84 points before a mild pick up in the last 20 AS I AN REGION minutes to close the session with a -31.27 points loss at JAP AN 4,140.27, still within a step-ladder support band. JAP AN All sectors tumbled, save for Services which ended flat. Volume and value turnover neared the averages for the second straight session. However, the increased turnovers accompanying a break below an important support line invites more pessimism. Or, from another perspective, could be an indication of an approaching climax sell-off that will usher in a second round of advances heading into the second half of the year. The internal negative bias remained strong, however, with breadth widening even more as decliners routed gainers more than three-to-one. Unchanged issues were at a constant 41.

CH IN A CH IN A TAIW AN S OU TH KOREA AU S TRALIA AU S TRALIA N EW Z EALAN D TH AILAN D IN D ON ES IA IN D IA S IN GAP ORE M ALAY S IA V IETN AM

US stocks achieved a modicum of stability, following an extended decline as news of takeovers pushed reco-worries to the sidelines for the time being. Nevertheless, it failed to sustain gains of over 50 points, eventually settling with a slim 1.06 points advance. Greece is now in danger of being the first in the history of the European Union to default after the S&P pulled its credit rating to CCC, its lowest for any sovereign. This makes a second bail-out package an imperative to save the ailing economy, as it renders Greek issues as junks. Moody's for its part also downgraded Greece to Caa1, better only than Ecuador. OUTLOOK for TD_115_June 14, 2011 The break under the two-and-a-half month 4.0% trading band on increased volume and value turnover do not present an encouraging prospect moving forward. The increasingly widening negative breadth, pulling the ADL deeper into multi-year lows, adds fodder to technical pessimism. While this could be a foundation for a contrarian trading stance, the fundamentals are lacking in promise as well.

AS of 1 2 1 0 H En d of D a y AS IAN M ARKETS LATES T U P D ATE IN D EX LAS T % CH AN GE M S CI AP EX 5 0 8 8 2 .1 3 0 .9 3 % TOP IX 8 1 4 .1 9 0 .2 4 % N IKKEI 2 2 5 9 ,4 6 3 .1 8 0 .1 6 % H AN GS EN G 2 2 ,5 2 4 .8 0 0 .0 7 % S H AN GH AI 2 ,7 2 7 .0 9 0 .9 9 % TAIEX 8 ,8 1 6 .0 9 1 .1 8 % KOS P I 4 ,4 3 7 .3 4 1 .3 6 % S & P /AS X 2 0 0 4 ,5 6 9 .3 0 0 .1 6 % ALLORIN D ARIES 4 ,6 3 6 .1 0 0 .0 3 % NZ50 3 ,4 9 2 .6 5 0 .4 6 % S ET 1 ,0 2 2 .4 3 0 .6 8 % JCI 3 ,7 5 0 .4 7 0 .0 5 % BS ES N 1 8 ,2 7 6 .8 0 0 .0 6 % S t r a it s Tim e s 3 ,0 5 8 .1 1 -0 .0 3 % KLCI 1 ,5 5 0 .3 7 0 .2 9 % H O CH I M IN H 4 4 2 .6 5 -0 .0 1 % w w w .b loo m b e r g .com a s of 1 2 0 8 H 6 /1 4 /1 1

, DISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE AVAILABLE TO OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE INFORMATION HEREIN IS FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE AND IT SHOULD NOT BE RELIED UPON AS SUCH. IN ADDITION, WE SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF THE VIEWS EXPRESSED IN THIS REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDIT-WORTHINESS OR INVESTMENT PROFILE OF THE COMPANY OR THE INDUSTRIES MENTIONED. DAILY Report Page 1 of 2

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (+632)687-5071 (trunk)

DAILY WRAP & OUTLOOK _ TD115-116 _June 14-15, 2011

PSEI Pts Change % Change

Volume

Value

Advancers

Decliners

Unchanged

4,140.27

-31.27

-0.75%

2,170.29

4,712.10

32

101

41

True, most of the drag are borrowed from overseas, but it cannot be summarily written off considering most affected economies rank high among our trading partners and OFW destinations. In the 2008 recession, we had taken pride in having shifted our export markets to Europe and other countries in Asia, limiting our dependence on the US, which fell into a recession. However, it was not long after that Europe's troubles worsened and the unanticipated Middle East/North Africa tensions escalated. And of course, China's battle with inflationary pressures continue. The way things are stacked up at present, both technically and fundamentally, the heading towards the major support band of 4,070-4,100 appears highly probable. In the absence of fresh leads, the bias towards liquidating positions may be the order of the day. Alternatively, long-termed portfolios may begin taking bets as the index approaches each support level and holding through tests of the resistance marks. At this point, the long held principle of the trend is your friend remains a valid and strong wall to lean on. CORPORATE UPDATES: MUSX CORPORATION [pse: MUSX] The Company discloses the Board of Directors has agreed to acquire 51% of Total Waste Management Recovery Systems, Inc. which manages and operates waste management and recovery facilities in the country. It has also agreed to infuse php25M as advances to TWMRSI, as additional working capital. BELLE CORPORATION [pse: BEL] The Company's Board of Directors has approved a Stock Rights Offering to raise between php4.0 to php5.0 billion for its Belle Grande Manila Bay Project. ALLIANCE SELECT FOODS INTERNATIONAL, INC [pse: FOOD] Anent its earlier declared and disclosed Stock Rights Offering (subject of ACEC Market Notes issue June 13), the start of the Offer Period has been moved from July 8 to July 13, 2011. The tentative listing date of July 18 is likewise pushed back to July 25, 2011. AGP INDUSTRIAL CORPORATION [pse: AGP] The SEC has approved the Company's quasi-reorganization and equity restructuring whereby par value is reduced to php1.00 from php6.00 per share and effecting a decrease in its Authorized Capital from php132M composed of 22M shares to php22M divided into 22M shares. Simultaneously, the same is increased to php200M divided into 200M shares with the declassification of A and B shares into a single issue and a denial of stockholders' pre-emptive rights. The latter is in line with several Subscription Agreements with various investors involving 45M shares. Furthermore, the SEC has lifted its revocation order on the Company's Registration and Permit to Sell securities to the public. Thus, the shares of the Company, under the unified symbol AGP, will resume on Wednesday, June 22, 2011.

, DISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE AVAILABLE TO OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE INFORMATION HEREIN IS FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE AND IT SHOULD NOT BE RELIED UPON AS SUCH. IN ADDITION, WE SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF THE VIEWS EXPRESSED IN THIS REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDIT-WORTHINESS OR INVESTMENT PROFILE OF THE COMPANY OR THE INDUSTRIES MENTIONED. DAILY Report Page 2 of 2

You might also like

- Carter's LBO ModelDocument1 pageCarter's LBO ModelNoah100% (1)

- U.S. Market Update August 12 2011Document6 pagesU.S. Market Update August 12 2011dpbasicNo ratings yet

- A0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Document8 pagesA0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Zihad HossainNo ratings yet

- Investors' Perceptions of Equity Market Investment in ShareKhan Ltd Man!alore StudyDocument81 pagesInvestors' Perceptions of Equity Market Investment in ShareKhan Ltd Man!alore StudyWilfred Dsouza63% (8)

- AFAR8719 - Foreign Currency Transaction and TranslationDocument5 pagesAFAR8719 - Foreign Currency Transaction and TranslationSid TuazonNo ratings yet

- Mock Test 2Document15 pagesMock Test 2Diksha SharmaNo ratings yet

- Wired Weekly: Singapore Traders SpectrumDocument13 pagesWired Weekly: Singapore Traders SpectrumInvest StockNo ratings yet

- Weekly Trends March 10, 2016Document5 pagesWeekly Trends March 10, 2016dpbasicNo ratings yet

- General Motors Foreign Exchange Risk Management Policy Finance EssayDocument9 pagesGeneral Motors Foreign Exchange Risk Management Policy Finance EssayHND Assignment Help100% (1)

- CFA 2 - Mock Exam AIDocument5 pagesCFA 2 - Mock Exam AITiến Dũng MaiNo ratings yet

- Bancom - Memoirs - by DR Sixto K Roxas - Ebook PDFDocument305 pagesBancom - Memoirs - by DR Sixto K Roxas - Ebook PDFVinci RoxasNo ratings yet

- Market Balance - Daily For August 11, 2011Document3 pagesMarket Balance - Daily For August 11, 2011JC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122Document3 pagesAccord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122JC CalaycayNo ratings yet

- February 17-18, 2011 - UpdateDocument3 pagesFebruary 17-18, 2011 - UpdateJC CalaycayNo ratings yet

- Market Notes May 3 TuesdayDocument2 pagesMarket Notes May 3 TuesdayJC CalaycayNo ratings yet

- DISCLOSURES February 7 MondayDocument2 pagesDISCLOSURES February 7 MondayJC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Document2 pagesAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayNo ratings yet

- Weekly Xxviii - July 11 To 15, 2011Document2 pagesWeekly Xxviii - July 11 To 15, 2011JC CalaycayNo ratings yet

- Market Notes May 10 TuesdayDocument1 pageMarket Notes May 10 TuesdayJC CalaycayNo ratings yet

- SELECTED DISCLOSURES From December 1, 2010 - WednesdayDocument2 pagesSELECTED DISCLOSURES From December 1, 2010 - WednesdayJC CalaycayNo ratings yet

- DAILY - July 22-25, 2011Document1 pageDAILY - July 22-25, 2011JC CalaycayNo ratings yet

- Disclosures REVIEW For Period December 2 and 3, 2010Document2 pagesDisclosures REVIEW For Period December 2 and 3, 2010JC CalaycayNo ratings yet

- DISCLOSURES January 3, 2011 - MondayDocument2 pagesDISCLOSURES January 3, 2011 - MondayJC CalaycayNo ratings yet

- Market Notes Mining atDocument2 pagesMarket Notes Mining atJC CalaycayNo ratings yet

- Market Balance - Daily For August 10, 2011Document2 pagesMarket Balance - Daily For August 10, 2011JC CalaycayNo ratings yet

- DAILY - June 21-22, 2011Document1 pageDAILY - June 21-22, 2011JC CalaycayNo ratings yet

- Market Notes June 22 WednesdayDocument2 pagesMarket Notes June 22 WednesdayJC CalaycayNo ratings yet

- Market Notes May 16 MondayDocument1 pageMarket Notes May 16 MondayJC CalaycayNo ratings yet

- DAILY - June 16-17, 2011Document1 pageDAILY - June 16-17, 2011JC CalaycayNo ratings yet

- Disclosures Summary March 14 MondayDocument3 pagesDisclosures Summary March 14 MondayJC CalaycayNo ratings yet

- Market Notes - Food SroDocument2 pagesMarket Notes - Food SroJC CalaycayNo ratings yet

- Week 46 - Disclosures Update - November 17, 2010Document2 pagesWeek 46 - Disclosures Update - November 17, 2010JC CalaycayNo ratings yet

- Market Notes April 28 ThursdayDocument3 pagesMarket Notes April 28 ThursdayJC CalaycayNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- WEEK 42 Additional Notes To DAILY For October 20, 2010Document1 pageWEEK 42 Additional Notes To DAILY For October 20, 2010JC CalaycayNo ratings yet

- Week 41 - Daily For Friday - October 15, 2010 - UpdatesDocument2 pagesWeek 41 - Daily For Friday - October 15, 2010 - UpdatesJC CalaycayNo ratings yet

- Market Notes April 12 TuesdayDocument1 pageMarket Notes April 12 TuesdayJC CalaycayNo ratings yet

- WEEK 48 - DAILY - Post December 3, 2010Document1 pageWEEK 48 - DAILY - Post December 3, 2010JC CalaycayNo ratings yet

- Market Notes April 15 FridayDocument1 pageMarket Notes April 15 FridayJC CalaycayNo ratings yet

- Stock Market Daily For August 17, 2010Document1 pageStock Market Daily For August 17, 2010JC CalaycayNo ratings yet

- Disclosures Review For December 14, 2010 - TuesdayDocument2 pagesDisclosures Review For December 14, 2010 - TuesdayJC CalaycayNo ratings yet

- Disclosures Review For December 28, 2010 - TuesdayDocument2 pagesDisclosures Review For December 28, 2010 - TuesdayJC CalaycayNo ratings yet

- WEEK 39 - September 27 To October 1, 2010Document2 pagesWEEK 39 - September 27 To October 1, 2010JC CalaycayNo ratings yet

- Daily - April 5-6, 2011Document2 pagesDaily - April 5-6, 2011JC CalaycayNo ratings yet

- 2013-4-22 Golden Agri Morning NoteDocument15 pages2013-4-22 Golden Agri Morning NotephuawlNo ratings yet

- December 9, 2010 - Thursday - Disclosures SummaryDocument1 pageDecember 9, 2010 - Thursday - Disclosures SummaryJC CalaycayNo ratings yet

- WEEK 39 - Daily For September 28, 2010 - TuesdayDocument2 pagesWEEK 39 - Daily For September 28, 2010 - TuesdayJC CalaycayNo ratings yet

- WEEK 40 - Additional Notes To Daily For Thursday - October 7, 2010Document1 pageWEEK 40 - Additional Notes To Daily For Thursday - October 7, 2010JC CalaycayNo ratings yet

- Market Notes July 22 FridayDocument1 pageMarket Notes July 22 FridayJC CalaycayNo ratings yet

- MARKET REPORT End of Week 36Document1 pageMARKET REPORT End of Week 36JC CalaycayNo ratings yet

- Owl Creek Q2 2010 LetterDocument9 pagesOwl Creek Q2 2010 Letterjackefeller100% (1)

- Market Notes June 17 FridayDocument1 pageMarket Notes June 17 FridayJC CalaycayNo ratings yet

- Market Monitor Week Ending July 15 2011Document5 pagesMarket Monitor Week Ending July 15 2011Empire OneoneNo ratings yet

- Lane Asset Management Stock Market Commentary March 2012Document6 pagesLane Asset Management Stock Market Commentary March 2012Edward C LaneNo ratings yet

- Week 41 - Daily For Tuesday - October 12, 2010Document2 pagesWeek 41 - Daily For Tuesday - October 12, 2010JC CalaycayNo ratings yet

- Aquilo Capital 1Q2011 Investor LetterDocument2 pagesAquilo Capital 1Q2011 Investor Letterblanche21No ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Watch Daily 14.10Document1 pageMarket Watch Daily 14.10LBTodayNo ratings yet

- Weekly Market Commentary 02232015Document4 pagesWeekly Market Commentary 02232015dpbasicNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Technical Report 24th October 2011Document5 pagesTechnical Report 24th October 2011Angel BrokingNo ratings yet

- DAILY - June 22-23, 2011Document1 pageDAILY - June 22-23, 2011JC CalaycayNo ratings yet

- DISCLOSURES REVIEW For December 17, 2010 - FridayDocument2 pagesDISCLOSURES REVIEW For December 17, 2010 - FridayJC CalaycayNo ratings yet

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingNo ratings yet

- Daily - March 17-18, 2011Document2 pagesDaily - March 17-18, 2011JC CalaycayNo ratings yet

- Greek Equity Strategy Update: F e A T U R I N GDocument5 pagesGreek Equity Strategy Update: F e A T U R I N GAndronikos KapsalisNo ratings yet

- Weekly Xxxi - August 1 To 5, 2011Document2 pagesWeekly Xxxi - August 1 To 5, 2011JC CalaycayNo ratings yet

- DAILY - June 21-22, 2011Document1 pageDAILY - June 21-22, 2011JC CalaycayNo ratings yet

- Market Balance - Daily For August 10, 2011Document2 pagesMarket Balance - Daily For August 10, 2011JC CalaycayNo ratings yet

- Market Notes - Month Review (June 2011)Document2 pagesMarket Notes - Month Review (June 2011)JC CalaycayNo ratings yet

- Market Notes July 22 FridayDocument1 pageMarket Notes July 22 FridayJC CalaycayNo ratings yet

- Weekly Report XXX - July 25 To 29, 2011Document2 pagesWeekly Report XXX - July 25 To 29, 2011JC CalaycayNo ratings yet

- DAILY - July 22-25, 2011Document1 pageDAILY - July 22-25, 2011JC CalaycayNo ratings yet

- Market Notes Mining atDocument2 pagesMarket Notes Mining atJC CalaycayNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- DAILY - June 16-17, 2011Document1 pageDAILY - June 16-17, 2011JC CalaycayNo ratings yet

- The Philippine Stock Exchange - PseDocument2 pagesThe Philippine Stock Exchange - PseJC CalaycayNo ratings yet

- Weekly Xxviii - July 11 To 15, 2011Document2 pagesWeekly Xxviii - July 11 To 15, 2011JC CalaycayNo ratings yet

- DAILY - June 22-23, 2011Document1 pageDAILY - June 22-23, 2011JC CalaycayNo ratings yet

- Market Notes June 22 WednesdayDocument2 pagesMarket Notes June 22 WednesdayJC CalaycayNo ratings yet

- Daily - June 10, 2011 - End of WeekDocument2 pagesDaily - June 10, 2011 - End of WeekJC CalaycayNo ratings yet

- Market Notes June 17 FridayDocument1 pageMarket Notes June 17 FridayJC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Document2 pagesAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayNo ratings yet

- Daily - June 7-8, 2011Document3 pagesDaily - June 7-8, 2011JC CalaycayNo ratings yet

- Market Notes MwideDocument2 pagesMarket Notes MwideJC CalaycayNo ratings yet

- Market Notes - Food SroDocument2 pagesMarket Notes - Food SroJC CalaycayNo ratings yet

- Market Notes - June 6, 2011 - MondayDocument2 pagesMarket Notes - June 6, 2011 - MondayJC CalaycayNo ratings yet

- Weekly Report - June 6-10, 2011Document2 pagesWeekly Report - June 6-10, 2011JC CalaycayNo ratings yet

- Weekly Report - Xxii - May 30 To June 3, 2011Document4 pagesWeekly Report - Xxii - May 30 To June 3, 2011JC CalaycayNo ratings yet

- Weekly Report - Xxi - May 23 To 27, 2011Document3 pagesWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNo ratings yet

- DAILY - May 17-18, 2011Document2 pagesDAILY - May 17-18, 2011JC CalaycayNo ratings yet

- DAILY - May 16-17, 2011Document1 pageDAILY - May 16-17, 2011JC CalaycayNo ratings yet

- Market Notes May 17 TuesdayDocument2 pagesMarket Notes May 17 TuesdayJC CalaycayNo ratings yet

- Marketing Strategy - Module 2 - Creating A Plan and Assessing Its SuccessDocument28 pagesMarketing Strategy - Module 2 - Creating A Plan and Assessing Its SuccessTrần Khánh ĐoanNo ratings yet

- Financial Management Bcoc 132Document6 pagesFinancial Management Bcoc 132RahulNo ratings yet

- Inventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inDocument6 pagesInventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inleare ruazaNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 AnswerDocument12 pagesHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiNo ratings yet

- Lecture 1Document7 pagesLecture 1Hodan RNo ratings yet

- Tomasino's Kakanin Republic Financial Statement AnalysisDocument8 pagesTomasino's Kakanin Republic Financial Statement AnalysisAdam CuencaNo ratings yet

- Bus 305 AOCDocument4 pagesBus 305 AOCOyeniyi farukNo ratings yet

- 67 C 3 AccountancyDocument31 pages67 C 3 AccountancyNaghma ShaheenNo ratings yet

- Arcelor Mittal Fact Book 2022Document100 pagesArcelor Mittal Fact Book 2022Hossin ZianiNo ratings yet

- Analyzing Reverse Merger in India Ease in Tax Implication PDFDocument13 pagesAnalyzing Reverse Merger in India Ease in Tax Implication PDFDhruv TiwariNo ratings yet

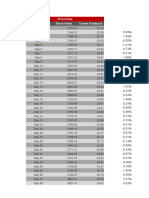

- Price Data Date Stock Index Turner FastbuckDocument14 pagesPrice Data Date Stock Index Turner FastbuckRampraveen ChamarthiNo ratings yet

- Class No 14 & 15Document31 pagesClass No 14 & 15WILD๛SHOTッ tanvirNo ratings yet

- R12 Org Blueprint for Separate Centric/BPI OUDocument6 pagesR12 Org Blueprint for Separate Centric/BPI OUqkhan2000No ratings yet

- IRM Chapter 2 Concept ReviewsDocument6 pagesIRM Chapter 2 Concept ReviewsJustine Belle FryorNo ratings yet

- Working Capital ManagementDocument44 pagesWorking Capital ManagementAnjaliMoreNo ratings yet

- Capital Market InstrumentsDocument33 pagesCapital Market InstrumentsMayankTayal100% (1)

- Unit 3 Cash ManagementDocument25 pagesUnit 3 Cash ManagementrehaarocksNo ratings yet

- Plantilla Canvas DescargableDocument8 pagesPlantilla Canvas DescargableDIEGONo ratings yet

- CHP 18 - Revenue RecognitionDocument43 pagesCHP 18 - Revenue RecognitionatikahNo ratings yet

- Principles of Taxation and Financial AccountingDocument12 pagesPrinciples of Taxation and Financial Accountingnikol sanchezNo ratings yet

- Assignment 1 FMDocument15 pagesAssignment 1 FMsyazwan AimanNo ratings yet

- Chapter 3Document12 pagesChapter 3Briggs Navarro BaguioNo ratings yet