Professional Documents

Culture Documents

Salary Structure Calculator

Uploaded by

Swati ModoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Structure Calculator

Uploaded by

Swati ModoCopyright:

Available Formats

Note: Insert CTC proposed in Cell # E15 Components Basic Pay House Rent Allowance Special Allowance Conveyance

Allowance ESI Contribution by Employer PF Contribution by Employer Gross CTC PF Contribution by Employer PF Contribution by Employee ESI Contribution by Employer ESI Contribution by Employee Total Deductions Net Take Home before TDS CTC Note: 1. Payment of Medical Allowance is subject to submission of Medical Treatment & Medicinal Expenses #VALUE! #VALUE! % age 40 20 27 Monthly 4,000 2,000 2,720 800 260 480 10,000 480 480 70 190 1,220 8,780 #VALUE! Annual 48,000 24,000 32,640 9,600 3,120 5,760 120,000 5,760 5,760 840 2,280 14,640 105,360

2. Minimum YPB @10% of Gross CTCis deducted out of monthly salary but will be paid upon completion of One y 4. Rate of TDS is subject to Declaration and submission of related information and documents by employee 5. Meal Vouchers will be disbursed by Finance Department

3. Rate of Professions Tax will vary based on Salary Scale, current rates are for Organisations located within Chenna

edicinal Expenses

paid upon completion of One year from date of appointment along with additional YPB if any

isations located within Chennai Corporation Limit

cuments by employee

Particulars EPF Employee Pension Employees' Deposit Linked Insurance Scheme(EDLIS) PF Administration Charges EDLIS administration Charges Total Salary for PF means: Basic+DA+Cash Value of Food concession+retaining allowance (if any)

Employer 3.67% 8.33% 0.50% 1.10% 0.01% 13.61%

Employee 12%

12.00%

Central Govt. 1.67%

Total 15.67% 10.00% 0.50% 1.10% 0.01%

1.67%

27.28%

Professions Tax Rates in Chennai Sl. No. Six months income (Rs.) 21000 1 2 3 4 5 21,001 30,000 30,001 45,000 45,001 60,000 60,001 75,000 75,001 and above 60 150 300 450 600 75 188 390 585 810 1st Oct 1998 - 30th 1st Oct 2003 -30th Sep 2003 Sep 2008 1st Oct 2008 onwards 0 100 235 510 760 1095

Profession Tax Collectable from the salary of August (Ist Quarter ) and January (IInd Quarter)

http://www.tn.gov.in/dtp/professional-tax.htm http://www.chennaicorporation.gov.in/online-civic-services/professionTaxCalculator.htm

1. You can get LTA only if you have applied for leave from your company and have actually traveled. However, internationa within the country.

2. The entire cost of the holiday is not covered. Only the travel costs are covered. So, whether you fly, hop on to a train or take ticket to claim your LTA. This means you will need to keep your air, rail or public transport ticket.

3. If you travel by car and it is owned by a central government organization like ITDC, the state government or the local body,

If you could not get public transport and resorted to private transport like renting a car, get a bill issued by the rental compan you can always file an income tax return, claim an exemption and get a refund. 4. LTA covers travel for yourself and your family. Family, in this case, includes yourself, parents, siblings dependent on you, children.

For children born after October 1, 1998, the exemption is restricted to only two surviving children (unless, of course, one birth and triplets).

If your family travels without you, no LTA can be claimed. You have to make the trip, either by yourself or, if claiming for you

5. LTA is not related to when you started your employment. The government fixes blocks of years. These blocks are not f are calendar years (January 1 to December 31).

The current block is 2006-09 -- January 2006 to December 2009. The earlier one was from 2002-05 -- January 2002 to Decem is entitled to two LTA claims.

6. Though you can claim two journeys in a block of four years, you can claim the LTA benefit just once in a year. You cannot c

So, while a person can get an income tax exemption for two journeys in a block of four calendar years, he can make a trip o year, you lose one. One-way out is to claim one and make your spouse claim the other.

7. You can carry forward your LTA. One LTA can be brought forward and claimed in the first year of the next block. Let's sa that you use only one LTA. Don't worry, you will be able to take the pending LTA in 2006. This means that, in the 2006-09 b journeys.

8. If you switch jobs, you can get the LTA not only from your present organization but also from your former employer, if the c

Let's say that, in the 2002-05 block, you claimed LTA in 2003. In 2004, you switched jobs. You can still claim your second j your new employer will ask to look at your earlier tax returns to see whether it has been claimed or not. 9. You must take the shortest route to your destination to be eligible for LTA.

Let's say you are going from Delhi to Mumbai on a holiday. So the cost of your travel from Delhi to Mumbai and Mumbai to D 10. If your LTA is not utilised, it gets added to your salary and you will be taxed on it.

Let's say you and your spouse are both employed and both have LTA as part of the salary package. Your LTA is Rs 20,000 and

Both of you and your child go for a holiday. The tickets for the three of you amount to Rs 15,000. You supply the tickets to yo a tax deduction; the balance Rs 5,000 will be taxed. You can claim exemption only to the tune of your expenditure.

If you claim this, your spouse will not be able to claim this same holiday from her employer. His/ Her Rs 20,000 will be t holiday and he/ she claims it.

Or, let's say, you spend Rs 30,000 on tickets but your LTA is just Rs 20,000. You can claim up to Rs 20,000 and tell your s employer.

You might also like

- Seasonal EmployeesDocument26 pagesSeasonal EmployeesAlicia Jane NavarroNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Food Premises Cleaning ScheduleDocument2 pagesFood Premises Cleaning ScheduleVikas SharmaNo ratings yet

- Show Cause Letter for Gross MisconductDocument2 pagesShow Cause Letter for Gross Misconductpaul machariaNo ratings yet

- Income Taxation Solution Manual 2019 Ed 2Document40 pagesIncome Taxation Solution Manual 2019 Ed 2Alexander DimaliposNo ratings yet

- Salary Structure For 2008-2009Document28 pagesSalary Structure For 2008-2009anon-289280No ratings yet

- Application Form: 1. Personal DetailsDocument6 pagesApplication Form: 1. Personal DetailsGareth CotterNo ratings yet

- Awiral Kumar Offer LetterDocument2 pagesAwiral Kumar Offer LetterAkansha AgrawalNo ratings yet

- Code of EthicsDocument9 pagesCode of EthicsLince WijoyoNo ratings yet

- Form 16 SummaryDocument9 pagesForm 16 SummarySujata ChoudharyNo ratings yet

- Review form for employee performance and goal settingDocument4 pagesReview form for employee performance and goal settingSapnaNo ratings yet

- Leave Travel AllowanceDocument12 pagesLeave Travel AllowanceRahul SinghNo ratings yet

- Authorization Form - Driver of Company VehicleDocument1 pageAuthorization Form - Driver of Company VehicleAR ReburianoNo ratings yet

- Mid-Year Manager EvaluationDocument3 pagesMid-Year Manager Evaluationprojectrik roomNo ratings yet

- Payslip To Print - Report Design 10-01-2020Document1 pagePayslip To Print - Report Design 10-01-2020martin avinaNo ratings yet

- Philippines Overview - Working Hours, Overtime, and Coverage of Other Mandatory Labor RightsDocument7 pagesPhilippines Overview - Working Hours, Overtime, and Coverage of Other Mandatory Labor RightsDenver TiukengNo ratings yet

- SEC Primary RegistrationDocument13 pagesSEC Primary RegistrationElreen Pearl AgustinNo ratings yet

- True or False 1Document13 pagesTrue or False 1Mary DenizeNo ratings yet

- ECS Driving Policy SummaryDocument8 pagesECS Driving Policy SummaryJulNo ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNisha_Yadav_6277No ratings yet

- SEC Compliance Guide for Starting a BusinessDocument5 pagesSEC Compliance Guide for Starting a BusinessHannah BarrantesNo ratings yet

- GST NotesDocument361 pagesGST NotesDamodar SejpalNo ratings yet

- An Introduction To Oracle R12 E-Business TaxDocument46 pagesAn Introduction To Oracle R12 E-Business TaxDavid Sparks100% (5)

- Mercury DrugDocument6 pagesMercury DrugHariette Kim TiongsonNo ratings yet

- Financial Policy For Travel and Meal Expense Reimbursement PolicyDocument7 pagesFinancial Policy For Travel and Meal Expense Reimbursement PolicyJonahNo ratings yet

- 50 Fixed Assets RegisterDocument30 pages50 Fixed Assets RegisterKiran NanduNo ratings yet

- Staff Disciplinary CodeDocument4 pagesStaff Disciplinary CodeOwunari Adaye-OrugbaniNo ratings yet

- Revised Hours of Work Policy 071021Document19 pagesRevised Hours of Work Policy 071021Faridatul MelurNo ratings yet

- Employee Reference Release AgreementDocument2 pagesEmployee Reference Release Agreementkiranrauniyar100% (1)

- Post Test Regular Income Taxation For PartnershipsDocument6 pagesPost Test Regular Income Taxation For Partnershipslena cpaNo ratings yet

- Edinburgh Napier University: Maternity PolicyDocument14 pagesEdinburgh Napier University: Maternity PolicyTejinder Singh BajajNo ratings yet

- ANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFDocument1 pageANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFRovic OrdonioNo ratings yet

- Overtime Pay Policy in 40 CharactersTITLE OTP-40 ensures fair OT payDocument3 pagesOvertime Pay Policy in 40 CharactersTITLE OTP-40 ensures fair OT payRen SyNo ratings yet

- 1.staff Evaluation FormDocument1 page1.staff Evaluation FormemeletNo ratings yet

- Employee Separation FormDocument1 pageEmployee Separation FormAlia Jae DAY6No ratings yet

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234No ratings yet

- Leicester Medical Support: Paternity Policy Paternity - Policy - v1Document3 pagesLeicester Medical Support: Paternity Policy Paternity - Policy - v1stephanieNo ratings yet

- Tax Process QuestionnaireDocument4 pagesTax Process QuestionnaireRodney LabayNo ratings yet

- ITS School Management Intern EvaluationDocument3 pagesITS School Management Intern EvaluationVishalNo ratings yet

- 62a361c98518ea5b613d4a53 - Company Vehicle PolicyDocument4 pages62a361c98518ea5b613d4a53 - Company Vehicle PolicyHermenegildo ChissicoNo ratings yet

- Tax Review Class-Msu Case DigestDocument156 pagesTax Review Class-Msu Case DigestShiena Lou B. Amodia-RabacalNo ratings yet

- CRM POS GuidelinesDocument7 pagesCRM POS GuidelinesRomer LesondatoNo ratings yet

- Attendance Management Policy: Reed Elsevier Shared Services (Philippines) IncDocument8 pagesAttendance Management Policy: Reed Elsevier Shared Services (Philippines) IncLloyd MoloNo ratings yet

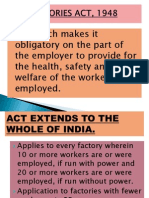

- Factory Act PresentationDocument19 pagesFactory Act PresentationShubhi SinghNo ratings yet

- FABM2 Q2 MOD3 Income and Business Taxation 1Document27 pagesFABM2 Q2 MOD3 Income and Business Taxation 1Minimi Lovely33% (3)

- Expense Claim: Personal Information Contact Number PIN Cost CentreDocument3 pagesExpense Claim: Personal Information Contact Number PIN Cost CentreMansiAroraNo ratings yet

- Al Quoz Accommodation HandbookDocument40 pagesAl Quoz Accommodation HandbookKelvinLeeNo ratings yet

- Safe Catering Recording FormsDocument13 pagesSafe Catering Recording FormsUsman IkramNo ratings yet

- Instructions: Complete An Incident Log For Each Patron Involved. If You See A Drunk Driver, Call 1-800-TELL-CHPDocument2 pagesInstructions: Complete An Incident Log For Each Patron Involved. If You See A Drunk Driver, Call 1-800-TELL-CHPKebutuhan Rumah MurahNo ratings yet

- Compensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationDocument6 pagesCompensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationSanam PathanNo ratings yet

- HR Practices of Two HotelsDocument11 pagesHR Practices of Two HotelsSonica RajputNo ratings yet

- HR Attendance Policy Circular Under 40 CharactersDocument2 pagesHR Attendance Policy Circular Under 40 CharactersKiran KumarNo ratings yet

- Supervisor Announcement Email To StaffDocument1 pageSupervisor Announcement Email To StaffRazzel Mae LorzanoNo ratings yet

- Sample No Due Certificate FormatDocument2 pagesSample No Due Certificate Formatdayadss86% (7)

- BIR Form 1701 Filing GuideDocument4 pagesBIR Form 1701 Filing GuideJazz techNo ratings yet

- VENZON SOP MANUALDocument9 pagesVENZON SOP MANUALPrecious Mercado QuiambaoNo ratings yet

- Candidate Screening TrackerDocument15 pagesCandidate Screening TrackerFeisalNo ratings yet

- Sample Policy MemosDocument21 pagesSample Policy MemosIoannis Kanlis100% (1)

- Leave TrackerDocument2 pagesLeave Trackermohammad salehNo ratings yet

- Interview Form for Hotel JobDocument2 pagesInterview Form for Hotel JobYessy TrottaNo ratings yet

- Flexible Work Arrangments: Implemintation ApproachDocument7 pagesFlexible Work Arrangments: Implemintation ApproachDr-Raghda A. YounisNo ratings yet

- Manpower Request FormDocument1 pageManpower Request FormPragathishNo ratings yet

- RFL Plastics LTD: 32mm (1") PP-R Pipe 3 M (4.6mm-5.2mm)Document1 pageRFL Plastics LTD: 32mm (1") PP-R Pipe 3 M (4.6mm-5.2mm)Gerald Neo Dorus D'CostaNo ratings yet

- The Sindh Terms of Employment (Standing Orders) Act, 2015Document17 pagesThe Sindh Terms of Employment (Standing Orders) Act, 2015Abdul Samad ShaikhNo ratings yet

- A&P Salary Adjustment TemplateDocument2 pagesA&P Salary Adjustment TemplateSachin SaxenaNo ratings yet

- Franchise Recruitment ProcessDocument1 pageFranchise Recruitment ProcesssanjeetvermaNo ratings yet

- Employee Bond / Agreement Letter Agreement Cum Appointment Letter of XXXXXXXXXDocument1 pageEmployee Bond / Agreement Letter Agreement Cum Appointment Letter of XXXXXXXXXswati vermaNo ratings yet

- Rules Regulations Granting Utilization Liquidation Cash AdvancesDocument5 pagesRules Regulations Granting Utilization Liquidation Cash AdvancesJesse JamesNo ratings yet

- What's your number? 5 ways to improve loyaltyDocument2 pagesWhat's your number? 5 ways to improve loyaltyutkarsh singhNo ratings yet

- Employment Act InsightsDocument85 pagesEmployment Act InsightsSiputs SedutNo ratings yet

- 10 MUST Knows About LTADocument2 pages10 MUST Knows About LTAarsudhindraNo ratings yet

- Leave Travel Allowance Rules and Limits in IndiaDocument4 pagesLeave Travel Allowance Rules and Limits in Indiavishal potdarNo ratings yet

- Ds Policy Schedule 11230218156300 v1.0 Removed RemovedDocument1 pageDs Policy Schedule 11230218156300 v1.0 Removed RemovedBalaji ArumugamNo ratings yet

- According To Section 44AA and Rule 6F of The Income Tax ActDocument2 pagesAccording To Section 44AA and Rule 6F of The Income Tax ActAmruta SharmaNo ratings yet

- Mehfil Restaurant QuoteDocument1 pageMehfil Restaurant QuoteMAHFIL HyderabadNo ratings yet

- uFELEKU AYENACHEWDocument50 pagesuFELEKU AYENACHEWamanualNo ratings yet

- Taxation Question BankDocument3 pagesTaxation Question BankRishikesh BhujbalNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFDocument104 pagesTest Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFKristine Lirose Bordeos100% (1)

- PRINCIPLES OF TAXATIONDocument6 pagesPRINCIPLES OF TAXATIONGerard Relucio OroNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- Bustax - Estate and Donor's TaxDocument4 pagesBustax - Estate and Donor's TaxPhoebe LunaNo ratings yet

- Appendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearDocument1 pageAppendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearKAshif UMarNo ratings yet

- Proposed Budget PlanDocument1 pageProposed Budget PlanSultan CikupaNo ratings yet

- Payslip For The Month of April, 2022: Annual Salary DetailsDocument1 pagePayslip For The Month of April, 2022: Annual Salary DetailsParveen SainiNo ratings yet

- BCAS Budget Publication Feb 2020Document56 pagesBCAS Budget Publication Feb 2020Prashant MunotNo ratings yet

- Fringe Benefit FSLGDocument92 pagesFringe Benefit FSLGkashfrNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Bir Ruling (Da 013 08)Document5 pagesBir Ruling (Da 013 08)Jake PeraltaNo ratings yet

- Polycab Cable Price ListDocument1 pagePolycab Cable Price ListnavneetNo ratings yet