Professional Documents

Culture Documents

Costing Formulae

Uploaded by

Nayana SavalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing Formulae

Uploaded by

Nayana SavalaCopyright:

Available Formats

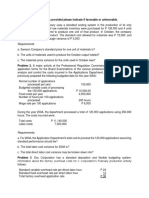

ECONOMIC ORDER QUANTITYOptimum or most favorable quantity, which should be purchased each time, the purchases are made.

[Inventory carrying costs and ordering costs are minimum and almost equal.] EOQ = [SQUAR RUTE OF] 2AP [DIVIDED BY] IC, Where A=NUAL CONSUMPTION, P= COST OF PLACING AN ORDER, I= INVENTORY CARRYING COST IN % C= COST PER UNIT OF MATERIAL. REORDER LEAVEL-

= Maximum consumption * Maximum lead-time. = [Normal/Average usage * Normal/Average lead time] + Minimum level. MINIMUM STOCK LEVEL

Level below which stocks should not be allowed to fall in normal working. [This is reserve or safety stock, which should be used only in abnormal conditions.] = ROL [normal/Average consumption * Average/ Normal Lead time. = [Maximum consumption Average consumption] * lead-time. MAXIMUM STOCK LEVEL

Stock will not increases above this level although there may be low demand or quick delivery. = ROL+EOQ [Minimum consumption* Minimum lead time] AVERAGE STOCK LEVEL

= MINIMUM LEVEL + MAXIMUM STOCK [DIVIDED BY] 2. STOCK/INVENTORY TURNOVER RATIO

= COST OF MATERIAL CONSUMED [DIVIDED BY] COST OF AVERAGE STOCK DURING THE PERIOD. [Average stock = [opening + closing stock]] INVENTORY TURNOVER RATIO IN NO OF DAYS.

=NO OF DAYS IN THE PERIOD [DIVIDED BY] INVENTORY TURNOVER RATIO [AS ABOVE]

VARIANCE ANALYSIS : The resolution into component parts, and the explanation of variances. COST VARIANCE: The difference between a budgeted cost or a slandered cost and comparable actual cost incurred during a period. REVISION VRIANCE: The amount by which a budget is revised which, as a matter of policy is not incorporated in the standard cost rate. CONTROLLABLE COST VARIANCE: A cost variance, which can be identified as the primary responsibility of a specified person. MATERIAL COST VARIANCE: The difference between slandered cost of material specified and the actual cost of material used. MARERIAL PRICE VARIANCE: The portion of the material cost variance which is due to the difference between the standard price specified and the actual price paid. MARERIAL USAGE VARIANCE: The portion of the material cost variance which due to the difference between the standard quantity specified and the actual quantity used. MATERIAL MIXTURE VARIANCE: The portion of the material usage variance, which is due to the difference between the standard and the actual composition of the mixture. WAGES VARIANCE: The difference between standard wages specified and the actual wages paid. WAGES RATE VARIANCE: The portion of the wages variance which is due to the difference between the standard labour rate specified and the actual rate paid. LABOUR EFFICIENCY VARIANCE: The portion of the wages variance which is due to the difference between the standard labour hours specified and the actual labour hours expended. EXPENSE VARIANCE: The difference between the standard expenses specified and the actual expense incurred. EXPENSE PRICE VARIANCE: The portion of the expense variance which is due to the difference between the standard price of the service specified and the actual price paid. EXPENSE UTILISATION VARIANCE: The portion of the expense variance which is due to the difference between the standard quantity of the service specified and the actual quantity of the service used. YIELD VARIANCE: The difference between the standard yield specified and the actual yield obtained. OVERHEAD VARIANCE: The difference between the standard overhead specified and the actual overhead incurred.

CALENDAR VARIANCE: The portion of the overhead variance which is due to the difference between the number of working days in the budget period and the number of working days in the period to which the budget is applied. VOLUME VARIANCE: The portion of the overhead variance, which is due to the difference between the budgeted level of output and actual level of output attained. OVERHEAD EFFICIENCY VARIANCE: The portion of the overhead variance, which is due to the difference between the budgeted efficiency of production and the actual efficiency attained. TOTAL COST VARIAVCE: The difference between the total slandered cost and the total cost. METHODS VARIANCE: The portion of the total cost variance, which is due to the use of methods other than, those specified. SALES VARIANCE: The difference between the standard value and the actual value of sales affected during a period. SALES PRICE VARIANCE: The portion of the sales value variance which is due to the difference between the slandered price specified and the specific price charged. SALES ALLOWANCE VARIANCE: The portion of the sales value variance which is due to the difference between the standards rebates, discount, etc, specified and the actual rebates, discounts ect, allowed. SALES MIXTURE VRIANCE: The portion of the sales value variance which is due to the difference between the standards and the actual inter relationship of the quantities of each product or product group of which the sales are composed.

MARGINAL COSTING Definition: A principal whereby marginal cost of cost units are ascertained. Only variable costs are charged to cost units the fixed costs attributable to a relevant period being written off ib full against the contribution for that period. MARGINAL COST SHEET: SALES [S] DIRECT MATERIAL DIRECT WAGES DIRECT EXPENSES PRIME COST ADD: ALL VARIABLE OVERHEADS [ INCLUDING VARIABLE PORTION OF SEMI VARIABLE OVERHEADS ] MARGINAL COST OR VARIABLE COST [V] CONTRIBUTION [C] i.e. [s-v] LESS : FIXED OVERHEADS [F] [ INCUDING FIXED AMOUNT OF SEMI VARIBLE OVERHEADS. PROFIT [P] [+] / LOSS[L] [-] *** *** *** *** *** *** *** *** ***

***

PROFIT VOLUME RATIO [ P/V RATIO ] P/V RATIO = CONTRIBUTION SALES.

Another formula : P/V RATIO = Change in profit [ in two period or between two levels ] Change in sales [ in two period or between two levels ] SALES VOLUME [UNITS] = FIXED COST + PROFIT CONTRIBUTION PER UNIT SALES VALUE = FIXED COST + PROFIT P/V RATIO.

IN CASE OF LOSS : SALES VOLUME [UNITS] = FIXED COST - LOSS CONTRIBUTION PER UNIT.

SALES VALUE

= FIXED COST - LOSS P/V RARIO

To earn a desired profit after income tax : SALES VOLUME [UNITS] : FIXED COST AFTER TAX PROFIT/ 1 TAX Rate Contribution per unit.

SALES VALUE = FIXED COST AFTER TAX PROFIT/ 1 TAX Rate P/v ratio For determination of profit at a particular volume of sales: PROFIT = [SALES * P/V RATIO] FIXED COST. KEY FACTOR: PROFITABILITY = CONTRIBUTION KEY FACTOR. BREAK EVEN POINT: BEP [UNITS] = F / CONTRIBUTION PER UNIT. BEP [VALUE] = F / P/V RATIO. MARGIN OF SAFTY: = TOTAL SALES SALES AT BEP. M/S RATIO = TOTAL SALES SALES AT BEP TOTAL SALES *100

With the helps of margin of safety ratio profit can be ascertained as follows: Profit = p/v ratio* m/s ratio * sales.

FORMULA FOR MATERIAL VARIANCE.

Material cost variance = standard cost actual cost i.e.[standard qty * standard rate] [actual qty *actual rate] Or = Standard cost for actual production-actual cost. Material price variance = actual quantity consumed [standard rate actual rate.] Material usage variance = standard rate [standard quantity actual quantity] Material mix variance = standard cost of standard mix * standard cost of actual mix. Material yield variance = standard yield rate [standard yield-actual yield]. Material usage other causes variance = standard rate [standard proportion for actual usage standard qty[.

FORMULA FOR LABOUR VARIANCE.

LABOUR COST VARIANCE OR DIRECT WAGES VARIANCE. = STANDARD COST ACTUAL COST i.e. [STANDARD HOURS * STANDARD RATE] [ACTUAL HOURS * ACTUAL RATE] OR = STANDARD COST FOR ACTUAL PRODUCTION ACTUAL COST. LABOUR RATE VARIANCE. =ACTUAL HOURS PAID [STANDARD RATE ACTUAL RATE]. LABOUR EFFICIANCY VARIANCE. = STANDARD RATE [STANDARD HOURS ACTUAL HOURS PAID]. LABOUR EFFICIANCY SUB VARIANCE VARIANCE. STANDARD RATE [STANDARD HOURS WORK] LABOUR IDLE TIME VARIANCE. = STANDARD RATE [ ACTUAL HOURS PAID ACTUAL HOURS WORKED]. OR = STANDARD RATE * ACTUAL HOURS OF IDLE TIME. LABOUR MIX VARIANCE. STANDARD COST OF STANDARD MIX STANDARD COST ACTUAL MIX.

VARIABLE OVERHEADS VARIANCE:VOH VARIANCE [VOH] = STANDARD VARIBLE OVERHEAD- ACTUAL VARIABLE. OVERHEAD. i.e. [ STANDARD RATE * ACTUAL OUT PUT] [ ACTUAL RATE * ACTUAL OUTPUT]. VOH EXPENDITURE VARIANCE = STANDARD VARIABLE OVERHEAD ON STANDARD PRODUCTION ACTUAL VARIABLE OVERHEAD. VOH EFFICIENCY VARIANCE= STANDARD RATE [STANDARD QUANTITY ACTUAL QUANTITY]. NOTE: STANDARED QUANTITY= STANDARD NUMBER OF ARTICLES PER HOUR * ACTUAL HOURS WORKED. FIXED OVERHEADS VARIANCE:FOH= STANDARD FIXED OVERHEAD ACTUIAL FIXED OVERHEAD. i.e. [STANDARD RATE * ACTUAL OUT PUT] [ ACTUAL RATE * ACTUAL OUTPUT]. FOH EXPENDITURE VARIANCE = BUDGETED FIXED OVERHEADS ACTUAL FIXED OVERHEADS. FOH VOLUME VARIANCE = STANDARED RATE [BUDGET QTY ACTUAL QTY] FOH EFFICIENCY VARIANCE = STANDARD RATE [STANDARD QTY- ACTUAL QTY]. FOH CAPACITY VARIANCE = STANDARD RATE [BUDGET QTY STANDARD QTY]. REVISED CAPACITY VARIANCE = STANDARD RATE [REVISED BUDGET QTY-STD QTY]. CALENDAR VARIANCE = STANDARD RATE [BUDGET QTY REVISED BUDGET QTY].

SALES VARIANCES

TOTAL SALES VALUE VARIANCE = BUDGETED SALES ACTUAL SALES. SALES RATE VARIANCE= ACTUAL QTY [ STANDARED RATE ACTUAL RATE]. SALES VOLUME VARIANCE = STANDARD RATE [BUDGET QTY ACTUAL QTY]. SALES MIX VARIANCE = REVISED STANDARED SALES STANDARD SALES. SALES QTY VARIANCE. = BUDGETED SALES - REVISED STANDARED SALES.

SALES PROFIT [MARGIN]VARIANCE.

[A] SALES PROFIT [MARGIN] VARIANCE.= BUDGETED PROFIT ACTUAL PRIFIT. WHERE, BUDGET PROFIT= [BUDGETED PRICE BUDGETED COST]= STANDARD RATE OF PROFIT * BUDGET QTY. ACTUAL PROFIT= [ACTUAL PRICE- BUDGETED COST]=ACTUAL RATE OF PROFIT*ACTUAL QTY. STANDARD PROFIT = [BUDGETED PRICE BUDGETED COST] = STANDARD RATE PROFIT* ACTUAL QTY. [B] SALES RATE OF PROFIT VARIANCE= ACTUAL QTY [STANDARD RATE OF PROFIT ACTUAL RATE OF PROFIT]. [C] SALES VOLUME VARIANCE = STANDARD RATE OF PROFIT [ BUDGETED QTY ACTUAL QTY]. [D] SALES MIX VARIANCE = REVISED STANDARD PROFIT STANDARED PROFIT. [E] SALES QTY VARIANCE = BUDGET PROFIT REVISED STANDARD PROFIT.

You might also like

- Jyotish - K.P. - Astro IQ - Easy Test PDFDocument150 pagesJyotish - K.P. - Astro IQ - Easy Test PDFshankar_bhat_3No ratings yet

- HOW KRISHNAMURTI PADHDHATI PIN POINT THE EVENTSDocument116 pagesHOW KRISHNAMURTI PADHDHATI PIN POINT THE EVENTSanmohiey100% (1)

- Sebi Rta Circular - 20.04.2018Document10 pagesSebi Rta Circular - 20.04.2018Arun Kumar SharmaNo ratings yet

- Practical Risk Analysis and Threat Modeling v.1.0Document85 pagesPractical Risk Analysis and Threat Modeling v.1.0Nayana SavalaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MBA 504 Ch11 SolutionsDocument31 pagesMBA 504 Ch11 Solutionschawlavishnu100% (1)

- Introduction To Cost Management & Basic Management ConceptsDocument3 pagesIntroduction To Cost Management & Basic Management ConceptsRandom AcNo ratings yet

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- Managerial Accounting - BADM 2010 F18 Assignment 7 Chapter 12Document3 pagesManagerial Accounting - BADM 2010 F18 Assignment 7 Chapter 12Judy1928No ratings yet

- ch04 Abc1 PDFDocument8 pagesch04 Abc1 PDFChristian Ray DetranNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Document8 pagesUniversiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Abdul HakimNo ratings yet

- Hansen AISE IM Ch08Document54 pagesHansen AISE IM Ch08Amanda Syakhina MaharaniNo ratings yet

- AE 23 - Short Term Decisions - Accounting InformationsDocument13 pagesAE 23 - Short Term Decisions - Accounting InformationsAzureBlazeNo ratings yet

- Job Order CostingDocument39 pagesJob Order CostingCharisse Ahnne Toslolado100% (1)

- Icaew Cfab Mi 2018 Sample Exam 1Document29 pagesIcaew Cfab Mi 2018 Sample Exam 1Anonymous ulFku1v100% (1)

- Ias 2 InventoriesDocument10 pagesIas 2 InventoriesHaniyaAngel100% (1)

- Amity Business School: Bba2 & Bba 3C Management AccountingDocument18 pagesAmity Business School: Bba2 & Bba 3C Management AccountingVarun AhujaNo ratings yet

- Sample Business PlanDocument17 pagesSample Business PlanNikita Garg95% (60)

- CPSM Exam Spec BridgeDocument38 pagesCPSM Exam Spec BridgePrashanth NarayanNo ratings yet

- Joc ProbDocument10 pagesJoc ProbSoothing BlendNo ratings yet

- Job Order CostingDocument2 pagesJob Order CostingMahnoor MujahidNo ratings yet

- Fiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingDocument10 pagesFiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingJeannelyn CondeNo ratings yet

- Samson Co standard costing problemDocument5 pagesSamson Co standard costing problemRaine PiliinNo ratings yet

- m2.3d Diy-Exercises (Answer Key)Document28 pagesm2.3d Diy-Exercises (Answer Key)May RamosNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 10Document26 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 10jasperkennedy083% (36)

- Budgeting Essentials for Effective PlanningDocument11 pagesBudgeting Essentials for Effective PlanningGva Umayam100% (1)

- Acc223-Standard Costing-ApplicationsDocument4 pagesAcc223-Standard Costing-ApplicationsDonabelle MarimonNo ratings yet

- Theory Based Question (10 Marks) - Decision Making: ACCT 2146 Assignment #2 CVP, Job Costing, Process CostingDocument10 pagesTheory Based Question (10 Marks) - Decision Making: ACCT 2146 Assignment #2 CVP, Job Costing, Process CostingVincentio WritingsNo ratings yet

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- Labour Cost - MA1Document24 pagesLabour Cost - MA1FATIHAH50% (4)

- Mas Test Bank QuestionDocument20 pagesMas Test Bank QuestionAsnor RandyNo ratings yet

- Business PlanDocument33 pagesBusiness PlannurinarisNo ratings yet

- Cost Chapter 1-5Document302 pagesCost Chapter 1-5chingNo ratings yet

- How Many Inches Can A Welder Weld Per DayDocument5 pagesHow Many Inches Can A Welder Weld Per Dayahmad santosoNo ratings yet

- Financial Aspects of BrandsDocument21 pagesFinancial Aspects of BrandsHitesh Jogani100% (2)