Professional Documents

Culture Documents

Growth Strategy

Uploaded by

Azuntaaba JosephOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Growth Strategy

Uploaded by

Azuntaaba JosephCopyright:

Available Formats

GROWTH STRATEGY INTRODUCTION: Businesses are not established to remain the same in size.

A business, when established needs to grow in size. If even a business does not want to grow, it is forced to do so, for if it fails to grow, this may benefit its more aggressive rivals. They may secure a greater share of the market, leaving the firm, which is not growing with reduced profits. Thus aside the goal of profit maximisation, businesses wish to grow. GROWTH & PROFITABILITY The growth rate/profitability relationship can operate in two ways: (a) Growth depends on profitability. The more profitable the firm, the more likely it is to be able to raise finance for investment. (Through ploughing-back profits, borrowing or issuing new shares) Growth affects profitability In the short-run, growth above a certain rate reduce profitability. A firm may have to sacrifice some of its short-run profits for the long-run gains that greater growth might yield. For example, some of the finance for the investment necessary to achieve growth may have to come from the firms sales revenue. A firm wishing to expand its operations in an existing market will require greater advertising and marketing; and a firm wishing to diversify may have to spend considerable sums on market research and employing managers with specialist knowledge and skills. However, the effect of growth on long-run profits will depend on the nature of growth. Growth may increase long-run profits if: Growth leads to expansion in new markets in which demand is growing. Growth leads to increased market power. Growth leads to increased economies of scale. If growth however leads to diseconomies of scale, or to investment in risky projects, then growth may be at the expense of long-run profitability. Conclusion: Greater profitability may lead to higher growth, but higher growth, at least in the short-run, may be at the expense of profits. CONSTRAINTS ON GROWTH There are several factors that can restrict the ability of a business to expand: 1. Financial Conditions Financial conditions determine the ability of a firm to fund its growth. Growth can be financed in 3 distinct ways:

(b)

(a)

By borrowing: The borrowing of finance to fund expansion may be constrained by i) ii) iii) Availability of finance in the banking sector. Cost of borrowing (interest rate). Credit worthiness of the business.

(b) (c)

Internal funds (Retaining Profits): These are funds linked to business profitability which in turn is subject to cyclical nature of economic activity (booms/slumps). Issue of new shares: Growth through the issue of new shares depends on the confidence within the stock market in general and on the stock markets assessment of the potential performance of the individual firm in particular. Finance from this source is not open to all firms. The firm should be listed on the stock market before it can do so.

2. Shareholder Confidence Whichever way growth is financed - internal funds, borrowing or issuing new shares the likely outcome in the short-run is a reduction in the firms share dividend. If the firm retains too much profit, there will be less to pay out in dividends. Similarly, if the firm borrows too much, the interest payments that it incurs are likely to make it difficult to maintain the level of dividends to shareholders. Finally, if it attempts to raise capital by a new issue of shares, the distributed profits will have to be divided between a larger number of shares. Whichever way a firm finances investment, therefore, the more it invests, the more the dividends on shares in the short-run will probably fall. This could lead shareholders to sell their shares, unless they are confident that longrun profits and hence dividends will rise again, thus causing the share price to remain high in the long-run. If shareholders do not have this confidence, they may well sell their shares. This will cause share prices to fall. If they fall too far, the firm runs the risk of being taken over. 3) Demand Conditions The growth of a business largely depends on the profitability of the business. The profitability of a business in turn depends upon market demand and demand growth. If the firm is operating in an expanding market, profits are likely to grow and finance will be relatively easy to obtain. If, on the other hand, the firms existing market becomes saturated, it will find that profits and sales are unlikely to rise unless it diversifies into related or non-related markets. One way of overcoming this demand constraint is to expand overseas, by attempting to increase export sales. 4) Managerial Conditions The growth of a firm is usually a planned process, and as such must be managed. Such management is carried out by the firms management team. The management team may be limited in respect to the number of individuals, their knowledge, and abilities. For example, the management team might lack entrepreneurial vision, or various organisational skills.

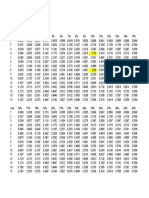

ALTERNATIVE GROWTH STRATEGIES In pursuit of growth, a firm will need to increase its capacity. This may be achieved through one or both of the following: internal expansion or external expansion. Whether a firm embarks upon internal or external expansion, a number of alternative growth paths are open to it. GROWTH OF A FIRM

Internal expansion 1. Differentiation/horizontal expansion (same product, increase in market share) 2. Vertical integration: different products, but technically related by belonging to different stages of the same productive stages 3. Conglomerate diversification: introduction of totally different and unrelated products or activities.

External expansion (mergers & takeovers) 1. Horizontal integration: mergers of firms producing the same product. 2. Vertical integration: mergers of firms producing different products at different stages of the same technical process. 3. Conglomerate diversification: merger of firms producing totally unrelated products.

Internal Expansion This is where a business looks to expand its productive capacity by adding to existing plant or by building new plant. Internal expansion may be one of these forms: a) Differentiation/ Horizontal expansion Under this, the firm can expand or differentiate its products within existing markets, by, for example, updating or restyling its products, improving its technical characteristics/features. b) Vertical expansion As second option, the business might seek to expand via vertical integration, this involves the firm expanding within the same product market, but at a different stage of production. For example, a car manufacturer might wish to produce its own components (backward vertical integration) or distribute and sell its own car models (forward vertical integration).

c)

Conglomerate integration 3

As a third option, the business might seek to expand outside of its currents product range, and move into new markets, this is known as a process of diversification. External Expansion (Mergers & Takeovers) This is when a business grows by merging with other firms or by taking them over. Similar growth paths can be pursued via external expansion. The only difference is that the business does not create the productive facilities itself, but purchases existing production. There are 3 types of mergers: (a) (b) (c) Horizontal Merger: merge. Where 2 firms at the same stage of production within an industry same

Vertical Merger: Where businesses at different stages of production within the industry merge. (Can have backward and forward vertical mergers). Conglomerate Merger: Where firms in totally unrelated industries merge.

NOTE: A business might also decide to become multinational and invest in expansion overseas. GROWTH THROUGH VERTICAL INTEGRATION Vertical integration can be of 2 types backward or forward. Backward integration (also known as upstream integration) involves the business expanding into earlier stages of the production process, such as the extraction or refinement of raw materials or the manufacture of intermediate inputs: for example various components required for the products final assembly. Forward integration (also known as downstream integration) involves the business expanding into later stages of production, or into distribution or retailing. Such expansion might involve the business co-ordinating its own haulage and managing its own retail network. Why vertical integration? The following may be cited as some of the reasons why a business might wish to expand via vertical integration: (a) Greater efficiency: Vertical integration results in a fall in a businesss long-run average cost (cost savings) because of: i) Production economies: A business may lower its costs by performing complementary stages of production within a single business unit, (e.g. saving cost of reheating if production is at one site). Co-ordination economies: The business may be able to avoid purchasing and selling expenses including those related to the marketing and advertising of the product(s). Managerial economies: Even though each production stage or division might have its own management or administrative team, economies can be gained having a single source of supervision.

ii)

iii)

iv)

Financial economies: such companies may be more able to negotiate favourable deals from key suppliers. The vertically integrated firm might offer additional security to be able to secure lower borrowing rates of interest from the financial market.

(b) Reduced uncertainty: A business that is not vertically integrated may find itself subject to various uncertainties in the market place. Examples include uncertainty over future price movements, supply reliability or access to markets. Backward vertical integration will enable the business to control its supply chain. Without such integration, the firm may feel very vulnerable, especially if there are only a few suppliers within the market. In such cases suppliers would be able to exert considerable control over price. Suppliers may be unreliable. Forward vertical integration creates greater certainty in so far as it gives the business guaranteed access to distribution and retailing on its own terms. As with supply, forward markets might be dominated by large monopsonist(s), which are able not only to dictate price, but also to threaten market foreclosure (being shut out from a market). c) Monopoly Power: Forward or backward vertical integration may allow the business to acquire a greater monopoly/monosony position in the market. Depending on the type of vertical integration, the business might be able to set prices for both final products and for factor inputs. d) Barriers to Entry: Vertical integration may give the firm greater power in the market by enabling it to erect barriers to potential competitors. For example, a firm that undertakes backward vertical integration and acquires a key input resource can effectively close the market to potential new entrants, either by simply refusing to supply a competitor, or by changing a very big price for the factor such that new firms face an absolute cost disadvantage. Problems with vertical Integration A business that integrates, either backward or forward, ties itself to particular supply sources or particular retail outlets respectively. The decision of a business to expand its operations via vertical integration means that resources will be diverted to this goal. The potential advantages from other growth strategies, such as the spreading of risk through diversification, are lost. GROWTH THROUGH DIVERSIFICATION Diversification is a process whereby a firm shifts from being a single-product to a multiproduct producer. The products need not cover the similar activities. Four (4) directions in which diversification might be undertaken: Using the existing technological base and market area. Using the existing technological base and new market area. Using new technological base and existing market area. 5

Using a new technological base and new market area.

Example: The diversification of Amstrad, the personal computer manufacturer, into the mobile phone market is a good example of where a businesss current technology and market knowledge are being applied to distinct new product. Why Diversification? There are 3 principal factors that might encourage a business to diversify. a) Stability: So long as a business produces a single product in a single market, it is vulnerable to changes in that markets conditions. For instance, if a farmer produces nothing but cocoa, and the cocoa harvest fails, the farmer is ruined. If however, the farmer produces a whole range of farm products (plantain, cocoyam, cassava, palm fruits, etc) or even diversifies into livestock, then he/she is less subject to the forces of nature and the unpredictability of the market. Diversification enables the business to spread risk. Growth: If the current market is saturated, stagnant or in decline, diversification might be the only avenue open to the business if it wishes to maintain a high growth performance. Here it is not only the level of profits that may be limited in the current market, but also the growth of sales. Maintaining profitability: Businesses may also be encouraged to diversify if they wish to protect existing profit levels. A business might be in a saturated (where current profit might be the maximum), stagnant or declining market. In such cases the business diversifies into new products to see a greater return on investment.

b)

c)

GROWTH TRHROUGH MERGER A merger is a situation in which, as a result of mutual agreement, two firms decide to bring together their business operations. A merger is distinct from a takeover in so far as a takeover involves one firm bidding for anothers shares (often against the will of the directors of the target firm). One firm thereby acquires another. In order to acquire a firm, a business will require finance, whereas a merger might simply involve two firms swapping their existing shares for shares in the newly created merged company. The acquired firm usually finds its management team dismissed following such action. Why merge? The following are some of the reasons why firms merge: a) Merger for growth: If the aims of the decision makers within the firm are to maximise growth, mergers are an obvious means. Mergers provide a much quicker means to growth than internal expansion. Not only does the firm acquire new capacity, but also it acquires additional consumer demand. Merger for economies of scale: Once a firm has successfully merged with another, the constituent parts might be more effectively co-ordinated so as to reduce production costs. This may involve a process of rationalisation: re-organising the firm so as remove any duplication of activities and to cut out waste. For example, a newly merged company will 6

b)

have only one head office, not two. On the marketing side, the two parts of the newly merged company may now share distribution and retail channels, benefiting form each others knowledge and operation in distinct market segments or geographical locations. c) Merger form monopoly power: Here the motive is to reduce competition and thereby gain greater market power and larger profits. With less competition, the firm will face a less classic demand and able to charge a higher percentage above marginal cost. What is more, the new more powerful company will be in a stronger position to regulate entry into the market by erecting effective entry barrier, thereby enhancing its monopoly position yet further. Merger for increased market valuation: A merger can benefit shareholders of both firms if it leads to an increase in the stock market valuation of the merged firm. If both sets of shareholders believe that they will make a capital gain on their shares, then they are more likely to give the go-ahead for the merger. Merger to reduce uncertainty: Firms face uncertainty at two levels. The first is in their own markets. The behaviour of rivals may be highly unpredictable. Mergers, by reducing the number of rivals, can correspondingly reduce uncertainty. At the same time, they can reduce the costs of competition (e.g. Reducing the need to advertise). Other motives: A range of other motives has been advanced, although they are not empirically tested. Businesses merge with or takeover others so as to avoid being the target of takeovers themselves. Merging with another firm so as to defend it from an unwanted predator. Asset Stripping: This is where a firm takes over another and then breaks it up, selling off the profitable bits and probably closing down the remainder. Empire building: This is where owners or managers favour takeovers because of the power or prestige of owning or controlling several (preferably well-known) companies. Geographical expansion- the motive here is to broaden the geographical base of the company by merging with a firm in a different part of the country or the world.

d)

e)

f)

Conclusion Mergers will generally have the effect of increasing the market power of those firms involved. This could lead to less choice and higher prices for the consumer. For this reason, mergers have become the target for government competition policy.

Practice Questions 1. 2. Explain the relationship between a businesss rate of growth and its profitability. Business managers must constantly tread a fine line between investing in business growth and paying shareholders an adequate dividend on their holdings. Explain why this is such a crucial consideration. What is meant by the term vertical integration? Why might business wish to pursue such a growth strategy? Distinguish between merger and takeover. Why do firms want to merge or take over others? A firm can grow by merging with or taking over another firm. Such mergers or takeovers can be of three types: horizontal, vertical or conglomerate. Which of the following is an example of which type of merger (takeover)? a) b) c) d) c) 6. 7. Guinness Ghana Limited takes over Ghana Breweries Limited. Price Waterhouse Associates (an accounting firm) merges with Coopers & Lybriant (another accounting firm). Toyota Plc of Japan (manufacturer of Toyota vehicles) takes over Toyota Ghana Limited (distributors of Toyota vehicles in Ghana). A merger between Unilever Ghana Ltd and Twifo Oil Palm Plantations (TOPP) Ltd. Coca Cola Bottling Company Ltd. merges with Kama Pharmaceutical Company Ltd.

3. 4. 5.

To what extent can we say that the Standard Chartered Bank (Ghana) Limited has diversified its operations? How successfully has GIMPA internally diversified its business over the past 5 years?

You might also like

- Assignments Weekend 1Document1 pageAssignments Weekend 1Azuntaaba JosephNo ratings yet

- Financial Management Strategy.2007 SolnDocument6 pagesFinancial Management Strategy.2007 SolnAzuntaaba JosephNo ratings yet

- Lecture 1Document8 pagesLecture 1Azuntaaba JosephNo ratings yet

- Annuity Table - PVDocument1 pageAnnuity Table - PVAzuntaaba JosephNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bgcse CourseworkDocument8 pagesBgcse Courseworkafazbsaxi100% (4)

- George Soros The Crisis of Global Capitalism Summary NotesDocument5 pagesGeorge Soros The Crisis of Global Capitalism Summary NotesShaun FantauzzoNo ratings yet

- 9 Most Essential Causes of Rural Unemployment in IndiaDocument10 pages9 Most Essential Causes of Rural Unemployment in IndiaAmit VijayNo ratings yet

- What Is OverpopulationDocument19 pagesWhat Is OverpopulationChantal Yvette FregillanaNo ratings yet

- Salamatu Chapter 1 3Document33 pagesSalamatu Chapter 1 3Ishmael FofanahNo ratings yet

- Marshall Nickles - Presidential Elections and Stock Market CyclesDocument8 pagesMarshall Nickles - Presidential Elections and Stock Market CyclesJohn SmithNo ratings yet

- Working Capital ManagementDocument84 pagesWorking Capital Managementamitvaranasigkp57% (7)

- Comparative Analysis of CrisesDocument11 pagesComparative Analysis of CrisesPhine TanayNo ratings yet

- The Long Term by Howard S. KatzDocument4 pagesThe Long Term by Howard S. Katzapi-22433340No ratings yet

- Making Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. HallsmithDocument6 pagesMaking Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. Hallsmithuser909No ratings yet

- FIN101 SyllabusDocument4 pagesFIN101 SyllabusRyan FarellNo ratings yet

- Macro5118 2017bDocument28 pagesMacro5118 2017bWong Yan LiNo ratings yet

- Monetary and Fiscal Policy in An Open EconomyDocument13 pagesMonetary and Fiscal Policy in An Open EconomySainkupar Mn MawiongNo ratings yet

- ECN 501 Final Exam Question Paper 2014 EditedDocument9 pagesECN 501 Final Exam Question Paper 2014 EditedZoheel AL ZiyadNo ratings yet

- History of Indonesian Fiscal Policy 1945-1986 - The Battle For Resources (Kuntjoro-Jakti 1988)Document48 pagesHistory of Indonesian Fiscal Policy 1945-1986 - The Battle For Resources (Kuntjoro-Jakti 1988)dharendraNo ratings yet

- Five Debates Over Macroeconomic PolicyDocument27 pagesFive Debates Over Macroeconomic Policyayushmehar22No ratings yet

- Results of 2008 Financial CrisisDocument12 pagesResults of 2008 Financial CrisislukkysreeNo ratings yet

- Princes of YenDocument90 pagesPrinces of Yenjpfunds100% (3)

- Macroeconomic VariablesDocument10 pagesMacroeconomic VariablesmahdiNo ratings yet

- Global Financial Crisis and Its Impact On The Indian EconomyDocument42 pagesGlobal Financial Crisis and Its Impact On The Indian EconomyShradha Diwan95% (19)

- Prirucnik Monetarne I Fiskalne EkonomijeDocument813 pagesPrirucnik Monetarne I Fiskalne EkonomijegarryhodgesonNo ratings yet

- NEILLH B - The Art of Contrary Thinking 1985Document214 pagesNEILLH B - The Art of Contrary Thinking 1985Livia Mouta100% (10)

- S Y B A EconomicsDocument9 pagesS Y B A EconomicsAshashwatmeNo ratings yet

- Eco551 Test 1 Okt 2014Document13 pagesEco551 Test 1 Okt 2014anne_paeNo ratings yet

- The Great Depression - Assignment # 1Document16 pagesThe Great Depression - Assignment # 1Syed OvaisNo ratings yet

- Brazil Beauty SectorDocument36 pagesBrazil Beauty SectorJosé Eduardo Amaral RodriguesNo ratings yet

- Chee-Wooi Hooy, Ruhani Ali, S. Ghon Rhee (Eds.) - Emerging Markets and Financial Resilience - Decoupling Growth From Turbulence-Palgrave Macmillan UK (2013)Document265 pagesChee-Wooi Hooy, Ruhani Ali, S. Ghon Rhee (Eds.) - Emerging Markets and Financial Resilience - Decoupling Growth From Turbulence-Palgrave Macmillan UK (2013)vadavadaNo ratings yet

- Business Life Cycle Theory: Toyota IncorporationDocument13 pagesBusiness Life Cycle Theory: Toyota IncorporationAhsan JavaidNo ratings yet

- Inflation and Trade Cycles: 1) Define Inflation. Explain Its TypesDocument7 pagesInflation and Trade Cycles: 1) Define Inflation. Explain Its TypesShreyash HemromNo ratings yet

- Business Cycle Unemployment and Inflation 2Document22 pagesBusiness Cycle Unemployment and Inflation 2GeloNo ratings yet