Professional Documents

Culture Documents

Comparative Analysis of Various Banks For Home Loans (For Self Employed People)

Uploaded by

latha20Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparative Analysis of Various Banks For Home Loans (For Self Employed People)

Uploaded by

latha20Copyright:

Available Formats

Comparative analysis of various banks for home loans ( for self employed people )

Banks Documents HDFC Bank 1. Sales Deed 2. Legal search report(Bank advocate) 3. Design & Estimate (architect) 4. Valuation report 5. ITR(last 3 years) 6. balance sheet and P/L (last 3 years ) 7. Bank statements (current & savings,6 months) 8. Business profile 9. ID proof 10.Residence proof 11. Photos 12. Property papers Rate of interest 0-30 lacs 11.25% 0-30 lacs 0-30 lacs 0-30 lacs 0-30 lacs ITR & Balance sheet (last 2 years) SAME Others same All same All same SBI IDBI AXIS ICICI

30-75 lacs 11.50% >75 lacs 12%

11.25% 30-75 lacs 11.50%

11.25% 30-75 lacs 11.50%

10.75% 30-75 lacs 11.25% >75 lacs 12% 0.5% of loan taken+ Lawyers fee For flat max years 20 For construction max years -10

11.25% 30-75 lacs 11.50% >75 lacs 12% 0.5% of loan taken

Processing fee

o.5% of loan taken

>75 lacs 12% >75 lacs 12% 0.5% 0f loan 1% of loan taken + Legal taken opinion Max 25 years repayment period Max 20 years repayment period

Repayment terns

Max 20 years repayment period

Max 20 year

Eligibility of loan amount

Based on IIR (Income installment ratio)

85% of the property or 4 times the amount of income Yes (optional) Guarantor required N/A

85% of cost of Based on property<30 gross lacs income 80% for >3o lacs Yes (optional) Not required NO Depends upon case

85% of cost of property

Insurance of the property Yes (optional) Guarantor Additional security Depends upon case N/A

Yes (optional) Not required N/A

Depends upon Depends

case Documents required Income tax returns(years) Balance sheet and income statements Six months bank statements Residence proof Pan card Business Profile Property paper Passport photographs 3 3 Required 3 3 Required 3 3 Required

upon case 2 2 3 3

Not required Required

Comparative analysis of various banks for home loans ( for employed people )

Banks Documents HDFC Bank 1. Latest original 6 months pay slips with gross and net SBI IDBI ITR & Balance AXIS ICICI

deductions 2. Latest form 16/salary copy/pf statement 3. Design & Estimate (architect) 4. Valuation report 5. ITR(last 3 years) 6. Bank statements (6 months) 7. Past employment history 8. ID proof 9.Residence proof 10. Photos 11. Property papers Rate of interest 0-30 lacs 10.25% 30-75 lacs 10.50% >75 lacs 11% 0-30 lacs 10.25% 30-50 lacs -10.50%

sheet (last 2 years) SAME Others same All same All same

0-30 lacs 11.25% 30-50 lacs 11.50%

0-30 lacs 10.75% 30-50 lacs 11.25% >50 lacs

0-30 lacs 11.25% 30-50 lacs 11.50% >50 lacs

>50 lacs 11% >50 lacs

Processing fee

o.5% of loan taken

0.5% 0f loan taken + Legal opinion Max 25 years repayment period

12% 1% of loan taken Max 20 years repayment period

12% 12% 0.5% of loan 0.5% of taken+ loan taken Lawyers fee For flat max years 20 For construction max years -10 Max 20 year

Repayment terns

Max 20 years repayment period

Eligibility of loan amount

Based on IIR (Income installment ratio)

85% of the property or 4 times the amount of income Yes (optional) Guarantor required N/A

85% of cost of Based on property<30 gross lacs income 80% for >3o lacs Yes (optional) Not required NO Depends upon case

85% of cost of property

Insurance of the property Yes (optional) Guarantor Additional security Documents required Income tax returns(years) 3 Depends upon case N/A

Yes (optional) Not required N/A

Depends upon Depends case upon case 3 2

Salary copy Six months bank statements Residence proof Pan card Past employment Property paper Passport photographs Required Required Not required

Not required Required

Formula for calculation of EMI The formula for calculation of EMI given the loan, term and interest rate is: EMI = [(p*r) (1+r)^n ] / [ (1+r)^n 1 ] p = principal (amount of loan

You might also like

- Sbi Check List Resident SbiDocument4 pagesSbi Check List Resident SbiSivakumarNo ratings yet

- Check ListDocument4 pagesCheck Listcasantosh8No ratings yet

- Loan RequirementDocument1 pageLoan RequirementGarvit ModiNo ratings yet

- All Bank Policy HL & LapDocument25 pagesAll Bank Policy HL & LapmadirajunaveenNo ratings yet

- Consumer Finance at Bank AlfalahDocument29 pagesConsumer Finance at Bank AlfalahSana Khan100% (2)

- New ROIDocument2 pagesNew ROIswapndeoNo ratings yet

- Product Training PresentationDocument8 pagesProduct Training Presentationkhenry_hims6997No ratings yet

- Terms of State Bank of IndiaDocument5 pagesTerms of State Bank of IndiaexperinmentNo ratings yet

- Home LoanDocument26 pagesHome LoanVandan SapariaNo ratings yet

- Documents required for HDFC home loan applicationDocument1 pageDocuments required for HDFC home loan applicationjain.gaurav7No ratings yet

- Check List - New Home Loan102013Document2 pagesCheck List - New Home Loan102013ShanmugamNo ratings yet

- Loan Policy CFLDocument3 pagesLoan Policy CFLsumit rathoreNo ratings yet

- Standard Chartered's Business Installment Loan helps SMEs expandDocument6 pagesStandard Chartered's Business Installment Loan helps SMEs expandMd.Azam KhanNo ratings yet

- SBI & AXIS BANK Home LOANS INFORMATIONDocument57 pagesSBI & AXIS BANK Home LOANS INFORMATIONSakshi KadamNo ratings yet

- HL Onepager Revised 05042024Document2 pagesHL Onepager Revised 05042024abhista varmaNo ratings yet

- LOANDocument2 pagesLOANRamesh AnkathiNo ratings yet

- Definition of 'Retail Banking'Document5 pagesDefinition of 'Retail Banking'bhumikasab7No ratings yet

- All Product Process - KumbeshDocument6 pagesAll Product Process - Kumbeshkirubaharan2022No ratings yet

- IBHL by Group 3Document15 pagesIBHL by Group 3Prakash ChandraNo ratings yet

- Scan 0086Document1 pageScan 0086Sanket ChouguleNo ratings yet

- sop2Document4 pagessop2Lalu VsNo ratings yet

- Mortgage Loans Check List For SalariedDocument2 pagesMortgage Loans Check List For SalariedVelagala Lokeshwara ReddyNo ratings yet

- Home Loan Complete ProcessDocument3 pagesHome Loan Complete ProcessMkb Prasanna Kumar100% (1)

- Documents Required: EligibilityDocument1 pageDocuments Required: EligibilityZeeshan AmanNo ratings yet

- Approved Legally Cleared Projects.H.L.sbi - Nov.17 (MCLR 7.95%) Check ListDocument2 pagesApproved Legally Cleared Projects.H.L.sbi - Nov.17 (MCLR 7.95%) Check ListKv KumarNo ratings yet

- Eligibility Criteria Salaried Individual: Documents RequiredDocument2 pagesEligibility Criteria Salaried Individual: Documents RequiredErica LindseyNo ratings yet

- Business Loan PolicyDocument7 pagesBusiness Loan Policyniteshparewa372No ratings yet

- P Segment Loan Products at A GlanceDocument2 pagesP Segment Loan Products at A GlanceShivam 'Singh' KaushikNo ratings yet

- LIC Housing FinanceDocument25 pagesLIC Housing Financepatelnayan22No ratings yet

- Procedures and comparison of banking productsDocument44 pagesProcedures and comparison of banking productsBhurabhai MaliNo ratings yet

- Maha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreDocument2 pagesMaha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreRohith RaoNo ratings yet

- Documents Required for Housing Loan TakeoverDocument1 pageDocuments Required for Housing Loan TakeoverRathinder RathiNo ratings yet

- Real Estate InvestingDocument32 pagesReal Estate InvestingRudra SinghNo ratings yet

- Class Assignment - Sec ADocument7 pagesClass Assignment - Sec AShraddha BhadauriaNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

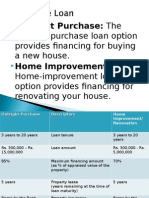

- Outright Purchase: TheDocument14 pagesOutright Purchase: TheMuhammad Umair KhalidNo ratings yet

- Motor Vehicle Checklist 2021Document2 pagesMotor Vehicle Checklist 2021francis tedescoNo ratings yet

- Nepal Bank LimitedDocument9 pagesNepal Bank LimitedSuman ThakuriNo ratings yet

- Motor Vehicle Loan ChecklistDocument2 pagesMotor Vehicle Loan ChecklistshemekaNo ratings yet

- Latest NRI CHECKLISTDocument1 pageLatest NRI CHECKLIST9tngf6dzbhNo ratings yet

- Loan Schemes Up To 30 Lacs From 30 Lacs To 75 Lacs From 75 Lacs To 1.5 CroreDocument1 pageLoan Schemes Up To 30 Lacs From 30 Lacs To 75 Lacs From 75 Lacs To 1.5 CroreSathish KumarNo ratings yet

- Scholar Loan Details For BITS PILANIDocument2 pagesScholar Loan Details For BITS PILANImdsaadiNo ratings yet

- Scholar Loan Check List: For StudentDocument2 pagesScholar Loan Check List: For StudentDaya ParasharNo ratings yet

- Icici Bank Loan RateDocument4 pagesIcici Bank Loan RaterushidudeNo ratings yet

- Interest Rates: Type Interest Rate Savings AccountDocument16 pagesInterest Rates: Type Interest Rate Savings Accountrohanfyaz00No ratings yet

- Rationalization ServiceDocument5 pagesRationalization Servicesachin9984No ratings yet

- Personal LoanDocument26 pagesPersonal LoanPravesh RajpalNo ratings yet

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocument19 pagesInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarNo ratings yet

- SBI Scholar Loan for MDI AttractionsDocument1 pageSBI Scholar Loan for MDI AttractionsSambit DashNo ratings yet

- Documents Required For Home LoanDocument3 pagesDocuments Required For Home LoanvijaysinhjagtapNo ratings yet

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Document4 pagesAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862No ratings yet

- Commercial Banking-Hdfc Housing FinanceDocument24 pagesCommercial Banking-Hdfc Housing FinancePankul KohliNo ratings yet

- FAIRCENT PL&BL POLICYDocument2 pagesFAIRCENT PL&BL POLICYmanoj.sharma110045No ratings yet

- Tax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Document22 pagesTax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Paras BhanushaliNo ratings yet

- Quick Success Series - P Segment Loan Products (February 28, 2013)Document16 pagesQuick Success Series - P Segment Loan Products (February 28, 2013)Raghu NayakNo ratings yet

- First Time BorrowersDocument4 pagesFirst Time BorrowersMuskan RaoNo ratings yet

- Fundamentals of Financial PlanningDocument6 pagesFundamentals of Financial PlanningJulius NgaregaNo ratings yet

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument5 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaS Ve SuriyaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Mobile Money Account Guide 1Document84 pagesMobile Money Account Guide 1Martins Othniel100% (1)

- Day-To-Day Banking Companion Booklet PDFDocument59 pagesDay-To-Day Banking Companion Booklet PDFowen tsangNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- Comparative Financial Analysis of SBI and HDFC BankDocument85 pagesComparative Financial Analysis of SBI and HDFC Bankshshant kashyap50% (4)

- Builders Warehouse#2Document3 pagesBuilders Warehouse#2api-19827843No ratings yet

- Akhuwat Foundation Services BreakdownDocument30 pagesAkhuwat Foundation Services BreakdownAdeel KhanNo ratings yet

- 126 UpdatedDocument112 pages126 UpdatednumantariqNo ratings yet

- Doing Business in BarbadosDocument61 pagesDoing Business in BarbadosNyirej LewisNo ratings yet

- Lending Procedures at Standard BankDocument4 pagesLending Procedures at Standard BankAshraf Uddin AhmedNo ratings yet

- Repo AccountingDocument11 pagesRepo AccountingRohit KhandelwalNo ratings yet

- Cardiff Cash Management V2.0Document108 pagesCardiff Cash Management V2.0elsa7er2000No ratings yet

- PDCP V IAC Case DigestDocument1 pagePDCP V IAC Case DigestPj PalajeNo ratings yet

- ECB European Central BankDocument12 pagesECB European Central BankHiral SoniNo ratings yet

- Namma Kalvi Accountancy Unit 3 Sura English Medium GuideDocument14 pagesNamma Kalvi Accountancy Unit 3 Sura English Medium GuideAakaash C.K.80% (5)

- 03 08 12 Motion To Consolidate Memorandum of Points and AuthoritiesDocument10 pages03 08 12 Motion To Consolidate Memorandum of Points and AuthoritiesR. Castaneda100% (2)

- Hyundai MotorsDocument2 pagesHyundai MotorssiddhantsidNo ratings yet

- What Are The Important Functions of MoneyDocument3 pagesWhat Are The Important Functions of MoneyGanesh KaleNo ratings yet

- Dubai Islamic Bank (E-Com)Document23 pagesDubai Islamic Bank (E-Com)Zain Ul Abideen100% (1)

- Quick Notes in Financial Accounting and Reporting (Far) ProblemDocument5 pagesQuick Notes in Financial Accounting and Reporting (Far) ProblemArn HicoNo ratings yet

- Philippine Financial SystemDocument35 pagesPhilippine Financial SystemGrace DimayugaNo ratings yet

- Indian Money Market 2019: An OverviewDocument50 pagesIndian Money Market 2019: An OverviewRavi Sahani100% (1)

- Lucid Software Inc.: InvoiceDocument2 pagesLucid Software Inc.: InvoiceHenry M Gutièrrez SNo ratings yet

- G.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportDocument79 pagesG.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportBoricha AjayNo ratings yet

- Statement of Account details total charges and payment due datesDocument4 pagesStatement of Account details total charges and payment due datesJay Vhee OohNo ratings yet

- CLP COP PEN NDF Docs PDFDocument31 pagesCLP COP PEN NDF Docs PDFAlex RubioNo ratings yet

- Gitex - Shopper - 2019 - 1 of 1 PDFDocument1 pageGitex - Shopper - 2019 - 1 of 1 PDFJishnu CheemenNo ratings yet

- Valix Accounting Compilation Assessment KeyDocument2 pagesValix Accounting Compilation Assessment KeyCelineNo ratings yet

- Open an Individual Tier III AccountDocument7 pagesOpen an Individual Tier III AccountHenry SimsNo ratings yet

- Manajemen Keuangan LanjutanDocument4 pagesManajemen Keuangan Lanjutancerella ayanaNo ratings yet

- UBS Global Real Estate Bubble IndexDocument24 pagesUBS Global Real Estate Bubble IndexKiva DangNo ratings yet