Professional Documents

Culture Documents

Additional Data City Adminstrator

Uploaded by

oaklocOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Data City Adminstrator

Uploaded by

oaklocCopyright:

Available Formats

CITY OF OAKLAND

AGENDA REPORT ?01!,JUl!2t^ PH i=28

TO: ATTN: FROM; DATE: RE: Office of the City Administrator P. Lament Ewell, Interim City Administrator Budget Office June 28, 2011 Technical Budget Adjustments and Additional Responses to Council Questions

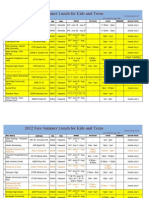

SUMMARY The purpose of this report is to provide additional budget-related information requested by the City Council and to present technical adjustments to the FY 2011-13 Proposed Policy Budget. DISCUSSION Senior Centers As presented at previous Council Budget hearings by the Department of Human Services, staff has revised the Budget A and Budget B proposals for the Senior Centers so that there will be no closure days at the Centers, but they will instead operate with reduced hours in order to achieve the necessary savings. Details of the revised proposal are as follows: Reduce City-run Senior Center hours to 30hrs/week o No closure days o Reduce to 6hrs/day (9-3, M-F) from 7.5hrs/day (8:30-4, M-F) o 20% fewer classes (approx. 16-32 classes/week from 20-40 classes/week) o Less service hours for support groups & socialization Staff Changes o Reduce (4) Center Directors to 3.20FTE from 3.76FTE o Reduce (4) Custodians to 3.00FTE from 4.00FTE o Reduce (4) administrative support positions to 1.28FTE from 3.20FTE Effect is 12hrs/week per site; keep 2 administrative assistants to be shared between two sites each

REVISED OPTIONS A & B OPTION A

Operating Schedule M-W8:30-4 T h / F 11 - 1 M-F 9 -3 Weekly Hours 26.5 30 Staff Hours Custodian Admin. 26.5 30 18 12" * $

SAVINGS - OPTION A

SC D i r . 85,364 52,719 Custodian $ $ 73,946 Admin. % 91,788 $ $ TOTAL 251,097 253,422

5C D i r . 28.5 32

Original Proposed Revised Proposal

63,023 $ 137,680

a - Two Administrative Assistants @ 24hr9/weelc, each covering two centers (12hrs/center )

OPTION B

Operating Schedule

Weekly Hours 32 35

SC Dir. 32 36

Staff Hours Custodian Admin. 32 30 24 20 $ $

SAVINGS - OPTION B

SC D i r . Custodian 52,071 63,023 $ Admin. 47,338 $ 76,488 TOTAL 152,983 154,520

Original Proposed Revised Proposal

M-Th 8 : 3 0 - 4 F 11 - 1 M-F 8:30 - 3:30

53,584 f 15,009 $

Item: Special City Council June 28, 2011

p. Lamont Ewell, City Administrator Budget Office: Technical Adjustments Page 2

East Oakland Sports Complex The FY 11-12 Proposed Budgets A and B presented a 6 month delay in the opening of the East Oakland Sports Complex from July 1, 2011 to January 1, 2012. It was believed at the time of presenting the Proposed Budgets that the delay was necessary to achieve the budget savings of $500,000 in the General Purpose Fund necessary to balance the budgets. However, staffs further analysis concludes that the East Oakland Sports Complex can open on July 1, 2011 based on the following factors: 1. The presented budgets included a duplication of funding for the maintenance of the facility. There were funds in both the Office of Parks and Recreation (OPR) and Public Works Agency (PWA) for maintenance activities (e.g., custodial, building maintenance, materials). With a reduction of the budget in OPR to remove the duplication of funding, there is a savings of $267,000. 2. OPR will delay the hiring of two Recreation Program Director positions until December 31, 2011, with a savings of $72,000. 3. OPR staff is expecting to close the facility for 10 business days during the year, including an anticipated mandatory shutdown, with an anticipated savings of $30,000. 4. PWA will eliminate a vacant Painter position producing a savings of $ 124,000 in Fund 4400-City Facilities and translates to a savings in the General Fund in the OPR budget (in the account used to pay Fund 4400). The total estimated savings is $493,000 in the General Purpose Fund. In addition, there are expected savings on the maintenance contract services and utilities during the 10 days of closure. The total estimated budget to open the East Oakland Sports Complex on July 1, 2011 is roughly $1.2 million for FY 11-12. This includes the OPR budget of $760,700 for aquatic, cultural arts and fitness programming and the PWA budget of $465,000 ($350,000 for maintenance contract services and $115,000 for utilities). In addition, if the City Council approves the pending contractual agreement for maintenance services for the new East Oakland Sports Center (EOSC) effective July 1, 2011, the Public Works Agency will need a transfer of funding from Personnel to O&M. The PTEs were originally added to support the EOSC but is not sufficient to provide the level of services . required. The positions are vacant.

Item: Special City Council June 28, 2011

p. Lamont Ewell, City Administrator Budget Office: Technical Adjustments Page 3

PROPOSED (Apnl 28}:

2NDP0Sff 32345 32346 32347 32348 CLASS Stationary Engineer Custodian, PPT Custodian, PPT Custodian. FT FY2011-12 FTE BURD roo SI 23.701 1.00 S72,974 1.00 572,974 0.50 S31,315 3.50 $300,965 555,500 533.500 S54,000 520,300 $464,265 FY 2012.13 FTE BURD 1.00 SI 25.656 1.00 574,134 1.00 S74.134 0.50 531.316 3.50 $305,250 S111.000 S57.000 573.000 544.300 1 5 0 , ^$606,050 Cut Cut Cut Cut

O&M: 30635. 53111 -Mtsc Util NP. !N02 53719 - MisceDaneous Services 54611 - Repair and Maintsnance 54919 - Services: Misc Contract \10TAL BUDGETED COSTS CONTRACT SERVICES: ACCOUNT OSM: 3.50

Revise Revise Revise Revise

per per per per

chart chart chart chart

below below below below

FY2011-12 FTE ' AIM

FY 2012-13 AMT . FTE 5111.000 530.000 5115.050 S350.000

584,265 53111 - Misc Util 30635, NP, 53114-Water 530,000 IN02 54611 - Repair and Maintenance SO 54919 - Services: Misc Contract 3350.000 TOTAL COSTS $464,265

$606,050 1

Fund 7760-PWA Overhead Project A167710

PWA requests adjustments to rebalance the internal overhead fund due to technical adjustments in other funds. The changes in staffing levels in PWA directly impact the recovery of overhead funds. Thus, as positions are reduced the overhead fund also needs to be reduced. Currently in Budget A and B (year 2), the PWA overhead will be slightly under-recovered by the so there needs to be a reduction in Fund 7760, Project A167710. The proposed adjustments downgrade an Accountant III, reconfiguring workload accordingly, and decrease O&M. Oakland Museum of California Adjustments to revenue and expenditure in PWA are needed to correspond with the pending agreement between the city and the Museum Foundation. The adjustments in revenue reflect the expectation that the Museum Foundation will reimburse the city up to $900,000 (utilities and staffing) in services in FY 11-12; and up to $500,000 in services (utilities) in FY 12-13. The expenditure adjustments reflect a transfer of $900,000 from the 56113 (ISF) account to 54919 that will be used as payment to the Museum Foundation as part of the agreement.

Item: Special City Council June 28, 2011

P. Lamont Ewell, City Administrator Budget Office: Technical Adjustments Page 4

Reduction in Fund 4400 - Facilities -FY 2012-13

POSff,: 3621 3625 ' CLASSIFiCATION ,, . v v Stationary Engineer Stationary Engineer, Chief O&M - 30534, 52919. non-proj, IN02 O&M - 30634, 54612, non-proj, IN02 r FY11-12 ; ^'FTE BURD$$ ' FY 12-13 ' FTE BURDSJf (1,00) (SI 39.287) (0.25) (S49.362) (598,553) (551,900) (1.25) ($339,102)

. 0.00;, :

;^$0 '

The LLAD fund is structurally balance in the Proposed Budget A, B & C with $18.52 million in expenditures and $18.57 million in revenues (FYl 1-12), and $18.6 million in expenditures and $18.6 million in revenues (FY 12-13). Recently, the City Council approved the Professional Services Agreement for the Museum Foundation to provide services at the Oakland Museum of California. This agreement produces a savings to the City in the LLAD that is budgeted in the Museum for landscaping, since the City will no longer perform the landscaping tasks. Thus, PWA requests to have the LLAD funding in the Museum transferred to PWA and be used for park maintenance activities throughout the City. This request includes the transfer of two (2) filled positions and some O&M fiinding.

Move LLAD Funded FTE/O&M From Museum

POS# 5154 17986 ' -CLASSfFICATlOH Gardener Crew Leader Gardener il O&M FY11-12 FTE :BURD $$ 1.00 $104,189 1.00 S37.840 560,000 2.00 : $252,030 FY 12-13. BURD$$ FTE 5106,072 1.00 889,427 1.00 560,000 _ 2.00 $255,500

Parking Division Reorganization One of the significant changes to the Finance and Management Agency (FMA) in the FY 201113 Proposed Budget is the consolidation of the Parking Division into the Revenue Division. The consolidation was proposed to utilize Revenue Division resources to augment the accounting and fiscal oversight processes of parking citation and meter revenue. The proposal would provide savings through workload realignment and position eliminations and contribute to FMA's 15% departmental reduction target. Recent review of proposals regarding installation of new parking meters prompted revisions to the original Parking Division reorganization. Various vendors have submitted proposals that would replace all of the city's single space meters with new meters containing credit card processing capabilities. The Budget Office and FMA management discussed workload reductions in parking meter collection and maintenance from implementation of new meters, and are proposing fireezing two vacant positions in the Meter Operations unit. Savingsfromfreezing Item: Special City Council June 28, 2011

P. Lamont Ewell, City Administrator Budget Office: Technical Adjustments Page 5

the positions would be offset by restoration of eliminafions in the Parking Administration, Parking Citation Assistance Center, and Parking Enforcement units. Below is a summary of the position revisions: Freeze vacant Parking Meter Repair Worker Freeze vacant Parking Meter Collector Eliminate vacant Administrative Services Manager II instead of Human Resources Manager (Parking Division Manager) Downgrade vacant Account Clerk III to Account Clerk II instead of eliminate Downgrade Parking Enforcement Supervisor II to Parking Enforcement Supervisor I instead of eliminate Parking Enforcement Supervisor I Removes elimination of Office Manager Summary of reorganization cost savings:

1010 Alternative Proposal Eliminate Eliminate Reduce Eliminate Reduce Reduce Freeze Freeze Administrative Services Manager II Administrative Assistant 1 Enforcement Supervisor II > Enforcement Supervisor 1 (step S) 1 Enforcement Supervisor 1 (1.10 FTE) Accountant III > Accountant II (step 1) Account Clerk III > Account Clerk II (step 1) Parking Meter Repair Worker Parking Meter Collector Total Target FY 11-12 178,494 75,261 33,136 112,769 19,435 37,470 76,806 71,568 605,940 617,237 1010 FY 12-13 191,175 77,789 33,704 114,941 20,151 38,437 78,345 72,990 627,532 636,736 12,955 (12,956) 13,433 (13,433) 1750 FY 11-12 1750 FY 12-13

Office of the City Clerk The Office of the City Clerk's proposal has been revised to remove the downgrade of the Assistant City Clerk and instead downgrade the Account Clerk II to an Administrative Assistant II, reduce O&M, and transfer 0.17 FTE of the Assistant City Clerk to Fund 7780 which is the consistent fund proportion for that office. This proposal is cost-neutral. Revenue Division Reorganization City Council has requested additional informafion regarding the proposed Revenue Division Reorganization. Please see the summary below. Tax Compliance Section The Revenue Division proposes to eliminate the Tax Enforcement Officers (TEO) in the Tax Compliance Section. Currently, TEOs spend 40% of their time enforcing business tax Item: Special City Council June 28,2011

p. Lamont Ewell, City Administrator Budget Office: Technical Adjustments Page 6

requirements by conducting field inspections on commercial, construction and delivery service businesses. In addition, they spend 35% of their time processing Notice of Determination and ' 25% finding new leads through various sources. Due to new data mining strategies which has been implemented in the Revenue Division it has reduced over 90% of the manual processes which had been historically conducted by TEOs. Furthermore, due to the consolidation of Customer Service functions and the streamlining of the Notice of Determination process the number of TEOs required to assist in this process have been reduced. Currently, the TEOs assigned to the Tax Compliance Section reflect $1.03 in identified additional revenue for each $1 of staff cost. Revenue lostfromreductions in the Tax Compliance Section can be mitigated through technological and operational efficiencies. Revenue Division Audit Section The Revenue Division has recently filled Tax Auditor II vacancies which require special skills in order to conduct Financial, Forensic, GIS and IT Audits. Currently, the Tax Auditor lis assigned to the Audit Section reflect $6.50 in identified additional revenue for each $1 of staff cost. Furthermore, due to their unique skills they are also involved in other special projects such as Ballot Measures, Real Estate Transfer Tax Transacfions and other Revenue Enhancement Strategies. These combined functions have resulted in $14 in identified additional revenue for each $ 1 of staff cost. ACTION REQUESTED OF THE CITY CQIJNCIL Staff requests that the City Council accept the technical adjustments to the FY 11-13 Proposed Budget. Respectfully submitted.

Sabrina Landreth Budget Director APPROVED AND FORWARDED TO THE CITY COUNCIL:

^ of the City Administrator Item: Special City Council June 28, 2011

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Doing Business in Canada GuideDocument104 pagesDoing Business in Canada Guidejorge rodriguezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MJ: The Genius of Michael JacksonDocument4 pagesMJ: The Genius of Michael Jacksonwamu8850% (1)

- Release Vehicle Motion Philippines Theft CaseDocument3 pagesRelease Vehicle Motion Philippines Theft Caseczabina fatima delicaNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Dispute Credit Report Inaccuracies FormDocument1 pageDispute Credit Report Inaccuracies FormJessica Ashley0% (1)

- Golden Tax - CloudDocument75 pagesGolden Tax - Cloudvarachartered283No ratings yet

- Checklist - Credentialing Initial DRAFTDocument3 pagesChecklist - Credentialing Initial DRAFTDebbie100% (1)

- Boie-Takeda vs. de La SernaDocument2 pagesBoie-Takeda vs. de La Sernazhengxiong100% (3)

- Ibañez v. People: GR No. 190798. January 27, 2016Document2 pagesIbañez v. People: GR No. 190798. January 27, 2016Tootsie GuzmaNo ratings yet

- Chopin SongsDocument8 pagesChopin Songsgstewart_pianoNo ratings yet

- Report in Support of Motion For CensureDocument64 pagesReport in Support of Motion For CensureoaklocNo ratings yet

- OAKLAND City Council 2013 Grand Jury ReportDocument22 pagesOAKLAND City Council 2013 Grand Jury ReportoaklocNo ratings yet

- EPI Report NeenaMurgai July2012Document28 pagesEPI Report NeenaMurgai July2012oaklocNo ratings yet

- Billboards From Master Plan Update Set 04-01-2012 CombinedDocument11 pagesBillboards From Master Plan Update Set 04-01-2012 CombinedoaklocNo ratings yet

- Oakland Crime Reduction Project Bratton Group Findings and Recommendations May 8, 2013Document6 pagesOakland Crime Reduction Project Bratton Group Findings and Recommendations May 8, 2013oaklocNo ratings yet

- 0pd TechDocument71 pages0pd TechoaklocNo ratings yet

- Henderson April 10 Order On Compliance Director's AuthorityDocument2 pagesHenderson April 10 Order On Compliance Director's Authorityali_winstonNo ratings yet

- Pat Kernighan Censure ProposalDocument9 pagesPat Kernighan Censure ProposaloaklocNo ratings yet

- Oakland City Auditor Interference Report, March 2013Document64 pagesOakland City Auditor Interference Report, March 2013oaklocNo ratings yet

- Oakland City Auditor Interference Report, March 2013Document64 pagesOakland City Auditor Interference Report, March 2013oaklocNo ratings yet

- Brockhurst Complaint 10 4 12Document22 pagesBrockhurst Complaint 10 4 12oaklocNo ratings yet

- City of Oakland Summary of Findings On Investigations of Occupy Oakland-Related DemonstrationsDocument4 pagesCity of Oakland Summary of Findings On Investigations of Occupy Oakland-Related DemonstrationsoaklocNo ratings yet

- Navigating City Data Resources OaklandDocument6 pagesNavigating City Data Resources OaklandoaklocNo ratings yet

- Burke SorensonDocument7 pagesBurke SorensonoaklocNo ratings yet

- Clarification From The Office of Chief DATE - June 27, 2012 of Police Regarding Crime Reduction Strategies and The Crime Data and Findings On Which They Are BasedDocument206 pagesClarification From The Office of Chief DATE - June 27, 2012 of Police Regarding Crime Reduction Strategies and The Crime Data and Findings On Which They Are BasedoaklocNo ratings yet

- OFPC Application 2012Document5 pagesOFPC Application 2012oaklocNo ratings yet

- Tools of Violence ResolutionDocument10 pagesTools of Violence ResolutionoaklocNo ratings yet

- 2012 Free Summer Lunch For Kids and Teens: List Sorted by Zip CodeDocument13 pages2012 Free Summer Lunch For Kids and Teens: List Sorted by Zip CodeoaklocNo ratings yet

- Designing For Social Change HowToDocument17 pagesDesigning For Social Change HowTooaklocNo ratings yet

- Open Data PDF ResolutionDocument8 pagesOpen Data PDF ResolutionoaklocNo ratings yet

- 3 15 12report Donation BoxesDocument24 pages3 15 12report Donation BoxesoaklocNo ratings yet

- Open Data PDF ResolutionDocument8 pagesOpen Data PDF ResolutionoaklocNo ratings yet

- Public Safety and RealignmentDocument112 pagesPublic Safety and RealignmentAmerican Civil Liberties Union of Southern CaliforniaNo ratings yet

- One Gohcomplaint&PCDECDocument11 pagesOne Gohcomplaint&PCDECoaklocNo ratings yet

- Campus Clothing LetterDocument3 pagesCampus Clothing LetteroaklocNo ratings yet

- 2012 Final Alameda County TEPDocument47 pages2012 Final Alameda County TEPoaklocNo ratings yet

- Oak 034264Document37 pagesOak 034264oaklocNo ratings yet

- Thrift Recycling Management, Inc. Acquires Assets of Used Bookseller Snow Lion, Inc.Document2 pagesThrift Recycling Management, Inc. Acquires Assets of Used Bookseller Snow Lion, Inc.oaklocNo ratings yet

- Classroom Without Walls New Media and Diversity: Professor Cecil BrownDocument11 pagesClassroom Without Walls New Media and Diversity: Professor Cecil BrownoaklocNo ratings yet

- March 2012 Broadway Valdez PlanDocument48 pagesMarch 2012 Broadway Valdez PlanoaklocNo ratings yet

- Reinstating the Death PenaltyDocument2 pagesReinstating the Death PenaltyBrayden SmithNo ratings yet

- Mupila V Yu Wei (COMPIRCLK 222 of 2021) (2022) ZMIC 3 (02 March 2022)Document31 pagesMupila V Yu Wei (COMPIRCLK 222 of 2021) (2022) ZMIC 3 (02 March 2022)Angelina mwakamuiNo ratings yet

- Audit SoalDocument4 pagesAudit SoalRukmayanti MunteNo ratings yet

- Etm 2011 7 24 8Document1 pageEtm 2011 7 24 8Varun GuptaNo ratings yet

- Lucas TVS Price List 2nd May 2011Document188 pagesLucas TVS Price List 2nd May 2011acere18No ratings yet

- Unit 6 LessonsDocument25 pagesUnit 6 Lessonsapi-300955269No ratings yet

- CUCAS Scam in China - Study Abroad Fraud Part 1Document8 pagesCUCAS Scam in China - Study Abroad Fraud Part 1Anonymous 597ejrQAmNo ratings yet

- 2.8 Commissioner of Lnternal Revenue vs. Algue, Inc., 158 SCRA 9 (1988)Document10 pages2.8 Commissioner of Lnternal Revenue vs. Algue, Inc., 158 SCRA 9 (1988)Joseph WallaceNo ratings yet

- Differences Between Ummah and NationDocument24 pagesDifferences Between Ummah and NationMaryam KhalidNo ratings yet

- Zambia Security Intelligence Service, 1998Document7 pagesZambia Security Intelligence Service, 1998Procha CharlesNo ratings yet

- Global Politics Paper 2 HLDocument3 pagesGlobal Politics Paper 2 HLterabaapNo ratings yet

- FRM Epay Echallan PrintDocument1 pageFRM Epay Echallan PrintSanket PatelNo ratings yet

- Pappu Kumar Yadaw's CAT Exam Admit CardDocument2 pagesPappu Kumar Yadaw's CAT Exam Admit Cardrajivr227No ratings yet

- Tax 3 Mid Term 2016-2017 - RawDocument16 pagesTax 3 Mid Term 2016-2017 - RawPandaNo ratings yet

- Lonzanida Vs ComelecDocument2 pagesLonzanida Vs ComelectimothymarkmaderazoNo ratings yet

- Central DirectoryDocument690 pagesCentral DirectoryvmeederNo ratings yet

- Mary Rieser "Things That Should Not Be"Document22 pagesMary Rieser "Things That Should Not Be"Tony OrtegaNo ratings yet

- Quotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesDocument7 pagesQuotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesTawanda KurasaNo ratings yet

- Brief History of PhilippinesDocument6 pagesBrief History of PhilippinesIts Me MGNo ratings yet

- United States v. Jackie C. Coffey, 415 F.2d 119, 10th Cir. (1969)Document4 pagesUnited States v. Jackie C. Coffey, 415 F.2d 119, 10th Cir. (1969)Scribd Government DocsNo ratings yet