Professional Documents

Culture Documents

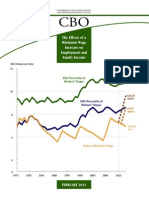

US Congressional Budget Office (CBO) Average Tax Rates (1979-2007)

Uploaded by

wmartin46Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Congressional Budget Office (CBO) Average Tax Rates (1979-2007)

Uploaded by

wmartin46Copyright:

Available Formats

Average Federal Tax Rates for All Households, by Comprehensive Household Income Quintile, 1979-2007

Year

Lowest

Quintile

Second

Quintile

Middle

Quintile

Fourth

Quintile

Highest

Quintile

All

Quintiles

Top 10%

Top 5%

Top 1%

Total Average Federal Tax Rate

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

8.0

7.7

8.3

8.2

9.1

10.2

9.8

9.6

8.7

8.5

7.9

8.9

8.4

8.2

8.0

6.6

6.3

5.6

5.8

5.8

6.1

6.4

5.1

4.7

4.6

4.3

4.3

4.5

4.0

14.3

14.1

14.7

13.8

13.7

14.6

14.8

14.8

14.0

14.3

13.9

14.6

14.2

13.7

13.5

13.1

13.4

13.2

13.6

13.0

13.3

13.0

11.5

10.8

9.8

9.9

10.1

10.2

10.6

18.6

18.7

19.2

17.9

17.5

18.0

18.1

18.0

17.6

17.9

17.9

17.9

17.6

17.4

17.3

17.3

17.3

17.3

17.4

16.8

16.9

16.6

15.3

14.8

13.8

14.1

14.2

14.2

14.3

21.2

21.5

22.1

20.6

20.1

20.4

20.4

20.5

20.2

20.6

20.5

20.6

20.5

20.2

20.2

20.4

20.5

20.3

20.5

20.4

20.5

20.5

18.9

18.3

17.4

17.3

17.5

17.5

17.4

27.5

27.3

26.9

24.4

23.9

24.3

24.0

23.8

25.8

25.6

25.2

25.1

25.3

25.6

26.8

27.4

27.8

28.0

28.0

27.6

28.0

28.0

26.7

26.0

25.0

25.2

25.8

25.8

25.1

22.2

22.2

22.4

20.7

20.4

21.0

20.9

20.9

21.6

21.8

21.5

21.5

21.5

21.5

22.0

22.3

22.6

22.7

22.9

22.6

22.9

23.0

21.4

20.7

19.8

20.1

20.6

20.7

20.4

29.6

29.0

28.2

25.3

24.8

25.2

24.7

24.3

27.2

26.7

26.3

26.1

26.6

26.9

28.6

29.4

29.8

30.1

29.9

29.3

29.7

29.6

28.5

27.9

26.8

27.1

27.6

27.6

26.7

31.8

30.8

29.4

26.0

25.6

26.1

25.4

24.6

28.5

27.8

27.2

27.0

27.6

28.1

30.5

31.3

31.8

32.0

31.6

30.8

31.2

31.0

30.0

29.5

28.5

28.7

29.2

29.1

27.9

37.0

34.6

31.8

27.7

27.7

28.2

27.0

25.5

31.2

29.7

28.9

28.8

29.9

30.6

34.5

35.8

36.1

36.0

34.9

33.4

33.5

33.0

32.8

32.8

31.7

31.4

31.6

31.3

29.5

17.4

18.2

18.2

16.9

15.6

15.6

15.4

15.5

16.8

16.6

16.3

16.0

16.0

16.3

17.0

17.1

17.7

18.3

18.5

18.7

19.3

19.7

18.7

17.9

15.8

15.9

15.9

15.9

16.2

19.0

19.7

19.6

18.3

16.9

17.0

16.7

16.6

18.5

18.2

17.7

17.5

17.6

18.0

19.1

19.2

19.8

20.5

20.6

20.6

21.3

21.6

20.8

20.0

17.7

17.6

17.6

17.4

17.6

21.8

22.3

21.5

20.4

19.4

19.3

18.9

18.3

21.5

20.7

19.9

19.9

20.6

21.2

23.2

23.0

23.7

24.2

23.8

23.4

24.0

24.2

24.1

23.7

20.4

19.7

19.3

18.9

19.0

Average Individual Income Tax Rate

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

0.0

0.2

0.5

0.4

0.4

0.7

0.5

0.4

-0.6

-1.1

-1.6

-1.0

-1.6

-2.1

-2.3

-3.9

-4.4

-5.1

-5.2

-5.4

-5.2

-4.6

-5.6

-6.0

-6.0

-6.2

-6.6

-6.6

-6.8

4.1

4.5

4.8

4.2

3.8

4.0

4.0

4.0

3.2

3.1

2.9

3.4

2.9

2.5

2.3

1.9

2.0

1.8

2.1

1.5

1.7

1.5

0.3

-0.2

-1.1

-0.9

-0.9

-0.8

-0.4

7.5

8.0

8.3

7.4

6.7

6.7

6.6

6.5

5.8

5.9

6.0

6.0

5.8

5.5

5.4

5.3

5.3

5.4

5.6

5.0

5.0

5.0

3.9

3.6

2.8

3.0

3.0

3.0

3.3

10.1

10.7

11.1

10.0

9.1

8.9

8.8

8.8

8.1

8.3

8.3

8.3

8.1

7.9

7.8

7.8

7.8

7.9

8.0

7.9

8.0

8.1

7.1

6.7

5.9

5.9

5.9

6.0

6.2

15.7

16.5

16.7

15.3

14.2

14.1

14.0

14.2

14.9

14.9

14.6

14.4

14.3

14.5

14.9

15.0

15.5

16.1

16.4

16.5

17.1

17.5

16.3

15.5

13.7

13.9

14.1

14.1

14.4

11.0

11.7

12.0

11.0

10.2

10.2

10.2

10.4

10.3

10.4

10.2

10.1

9.9

9.9

10.0

10.0

10.2

10.7

11.0

11.0

11.4

11.8

10.3

9.7

8.4

8.7

9.0

9.1

9.3

Average Federal Tax Rates for All Households, by Comprehensive Household Income Quintile, 1979-2007

Year

Lowest

Quintile

Second

Quintile

Middle

Quintile

Fourth

Quintile

Highest

Quintile

All

Quintiles

Top 10%

Top 5%

Top 1%

Average Social Insurance Tax Rate

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

5.3

5.3

5.9

5.9

6.1

6.5

6.6

6.7

6.4

6.9

7.1

7.3

7.2

7.3

7.2

7.2

7.6

7.8

8.1

8.4

8.4

8.2

8.3

8.2

8.1

8.0

8.3

8.5

8.8

7.7

7.6

8.1

8.0

7.9

8.4

8.8

8.8

8.6

9.0

8.9

9.3

9.2

8.9

8.8

8.9

9.1

9.2

9.4

9.4

9.5

9.4

9.4

9.3

9.1

9.1

9.2

9.3

9.5

8.6

8.5

9.1

8.9

8.9

9.2

9.5

9.5

9.4

9.7

9.8

9.9

9.6

9.7

9.6

9.5

9.6

9.6

9.6

9.6

9.6

9.6

9.7

9.6

9.4

9.5

9.4

9.4

9.4

8.5

8.5

9.1

9.1

9.1

9.3

9.6

9.7

9.8

10.2

10.0

10.3

10.3

10.2

10.2

10.2

10.3

10.2

10.3

10.4

10.4

10.4

10.2

10.1

9.9

9.7

9.7

9.6

9.5

5.4

5.5

6.1

6.3

6.3

6.4

6.5

6.1

6.7

6.6

6.6

6.9

7.4

7.2

7.3

7.5

7.2

6.9

6.6

6.5

6.4

6.3

7.1

7.3

7.1

6.6

6.0

5.8

5.7

6.9

6.9

7.5

7.5

7.5

7.8

7.9

7.7

8.0

8.1

8.1

8.4

8.6

8.4

8.5

8.6

8.5

8.3

8.2

8.1

8.0

7.9

8.4

8.5

8.3

8.0

7.6

7.5

7.4

4.2

4.3

4.8

5.1

5.1

5.1

5.1

4.6

5.3

5.1

5.1

5.4

6.1

5.8

6.0

6.3

6.0

5.6

5.4

5.2

5.1

5.0

5.8

6.2

6.0

5.4

4.8

4.6

4.5

2.8

3.0

3.4

3.7

3.7

3.7

3.7

3.2

3.8

3.6

3.7

4.0

4.7

4.4

4.7

4.9

4.6

4.3

4.0

3.9

3.8

3.8

4.5

4.8

4.6

4.1

3.5

3.4

3.3

0.9

1.0

1.3

1.6

1.5

1.4

1.3

1.0

1.5

1.3

1.4

1.5

2.2

1.9

2.1

2.6

2.3

2.2

2.0

1.9

1.9

1.9

2.3

2.5

2.3

1.9

1.7

1.6

1.6

7.4

5.9

4.6

2.8

3.5

3.9

3.6

3.5

4.6

4.5

4.4

4.2

3.8

4.2

5.0

5.4

5.6

5.6

5.5

4.9

4.7

4.4

3.5

3.4

4.6

5.5

6.5

6.7

5.7

9.5

7.4

5.9

3.5

4.4

4.9

4.5

4.3

5.7

5.5

5.3

5.1

4.8

5.2

6.2

6.7

6.9

6.8

6.6

5.9

5.6

5.2

4.3

4.3

5.9

6.7

7.8

8.0

6.8

13.8

10.8

8.7

5.4

6.4

7.1

6.4

5.8

7.8

7.3

7.2

7.1

6.8

7.2

8.8

9.7

9.7

9.3

8.7

7.8

7.3

6.7

6.2

6.4

8.7

9.5

10.4

10.6

8.8

Average Corporate Income Tax Rate

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

1.1

0.9

0.7

0.5

0.6

0.8

0.6

0.6

0.7

0.7

0.6

0.6

0.6

0.6

0.6

0.6

0.7

0.6

0.5

0.5

0.5

0.5

0.3

0.2

0.3

0.4

0.5

0.5

0.4

1.2

1.0

0.8

0.5

0.7

0.7

0.7

0.7

0.9

0.8

0.8

0.7

0.7

0.7

0.8

0.7

0.8

0.7

0.7

0.6

0.6

0.6

0.4

0.3

0.4

0.4

0.5

0.6

0.5

1.4

1.2

1.0

0.7

0.9

1.0

0.9

0.9

1.2

1.2

1.1

1.0

1.0

1.0

1.0

1.1

1.1

1.1

1.1

1.0

1.0

0.9

0.6

0.5

0.6

0.6

0.8

0.8

0.8

1.6

1.4

1.2

0.7

1.0

1.2

1.0

1.0

1.4

1.3

1.2

1.2

1.1

1.1

1.2

1.2

1.3

1.3

1.3

1.1

1.1

1.0

0.7

0.6

0.7

0.8

1.1

1.2

1.1

5.7

4.6

3.6

2.1

2.8

3.1

2.8

2.8

3.6

3.6

3.5

3.3

3.0

3.3

3.9

4.2

4.4

4.5

4.4

4.0

3.9

3.7

2.8

2.6

3.6

4.2

5.2

5.4

4.6

3.4

2.8

2.2

1.4

1.8

2.0

1.8

1.9

2.4

2.4

2.3

2.2

2.0

2.2

2.5

2.6

2.8

2.9

2.9

2.6

2.5

2.4

1.7

1.6

2.2

2.6

3.3

3.5

3.0

Average Federal Tax Rates for All Households, by Comprehensive Household Income Quintile, 1979-2007

Year

Lowest

Quintile

Second

Quintile

Middle

Quintile

Fourth

Quintile

Highest

Quintile

All

Quintiles

Top 10%

Top 5%

Top 1%

Average Excise Tax Rate

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

1.6

1.4

1.3

1.4

2.0

2.3

2.2

2.0

2.1

2.0

1.8

2.0

2.2

2.3

2.5

2.6

2.4

2.3

2.3

2.2

2.4

2.3

2.2

2.2

2.3

2.2

2.1

2.1

1.6

1.3

1.1

1.0

1.1

1.3

1.4

1.4

1.3

1.4

1.4

1.2

1.3

1.4

1.5

1.6

1.7

1.6

1.5

1.5

1.4

1.6

1.4

1.4

1.4

1.4

1.3

1.3

1.2

1.0

1.1

0.9

0.9

0.9

1.1

1.1

1.1

1.1

1.1

1.1

1.0

1.0

1.2

1.2

1.2

1.3

1.3

1.2

1.1

1.1

1.2

1.1

1.1

1.1

1.1

1.1

1.0

0.9

0.8

0.9

0.8

0.7

0.8

0.9

1.0

0.9

0.9

0.9

0.9

0.9

0.9

1.0

1.0

1.0

1.1

1.1

1.0

0.9

0.9

1.0

0.9

0.9

0.9

0.9

0.9

0.8

0.8

0.7

0.7

0.6

0.6

0.6

0.7

0.7

0.7

0.6

0.7

0.6

0.6

0.6

0.7

0.7

0.7

0.7

0.7

0.6

0.6

0.6

0.6

0.5

0.5

0.5

0.5

0.5

0.5

0.4

0.4

1.0

0.8

0.8

0.8

0.9

1.0

0.9

0.9

0.9

0.9

0.8

0.9

1.0

1.0

1.0

1.1

1.0

0.9

0.9

0.9

0.9

0.9

0.8

0.9

0.8

0.8

0.8

0.7

0.6

0.7

0.6

0.5

0.5

0.6

0.6

0.6

0.6

0.6

0.5

0.5

0.5

0.6

0.6

0.6

0.6

0.6

0.5

0.5

0.5

0.5

0.4

0.5

0.5

0.4

0.4

0.4

0.3

0.3

0.6

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.4

0.4

0.5

0.5

0.5

0.5

0.5

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.3

0.3

0.3

0.2

0.5

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.3

0.3

0.4

0.3

0.4

0.4

0.3

0.3

0.3

0.3

0.3

0.2

0.2

0.3

0.3

0.2

0.2

0.2

0.1

Source: Congressional Budget Office.

Notes: Average tax rates are calculated by dividing taxes by comprehensive household income.

Comprehensive household income equals pretax cash income plus income from other sources. Pretax cash income is the sum of

wages, salaries, self-employment income, rents, taxable and nontaxable interest, dividends, realized capital gains, cash transfer

payments, and retirement benefits plus taxes paid by businesses (corporate income taxes and the employer's share of Social

Security, Medicare, and federal unemployment insurance payroll taxes) and employees' contributions to 401(k) retirement plans.

Other sources of income include all in-kind benefits (Medicare, Medicaid, employer-paid health insurance premiums, food stamps,

school lunches and breakfasts, housing assistance, and energy assistance).

Income categories are defined by ranking all people by their comprehensive household income adjusted for household sizethat is,

divided by the square root of the households size. (A household consists of the people who share a housing unit, regardless of their

relationships.) Quintiles, or fifths, contain equal numbers of people. Households with negative income (business or investment

losses larger than other income) are excluded from the lowest income category but are included in totals.

Individual income taxes are attributed directly to households paying those taxes. Social insurance, or payroll, taxes are attributed to

households paying those taxes directly or paying them indirectly through their employers. Corporate income taxes are attributed to

households according to their share of capital income. Federal excise taxes are attributed to them according to their consumption of

the taxed good or service.

You might also like

- Property Tax 2.0Document27 pagesProperty Tax 2.0Eron LloydNo ratings yet

- FairTax Prebate Explained (Jan 2015)Document4 pagesFairTax Prebate Explained (Jan 2015)Daar FisherNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfam100% (1)

- IncomeEligibilityUnderACA FINAL v2Document6 pagesIncomeEligibilityUnderACA FINAL v2kirs0069No ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- How Progressive Is The U.S. Federal Tax System? A Historical and International PerspectiveDocument22 pagesHow Progressive Is The U.S. Federal Tax System? A Historical and International Perspectiveapi-25916560No ratings yet

- POS301.R - Topic7Worksheet-8-29-16 CompleteDocument3 pagesPOS301.R - Topic7Worksheet-8-29-16 Completetama00018No ratings yet

- Unit 6 MacroDocument25 pagesUnit 6 MacroDamian VictoriaNo ratings yet

- Online Genealogical Search For Missing WWII GIs.Document15 pagesOnline Genealogical Search For Missing WWII GIs.wmartin46No ratings yet

- TFS Healthcare Resource File #3Document12 pagesTFS Healthcare Resource File #3wmartin46No ratings yet

- Researching WWII and Military HistoryDocument15 pagesResearching WWII and Military Historywmartin46No ratings yet

- Foreign Interference in US ElectionsDocument21 pagesForeign Interference in US Electionswmartin46No ratings yet

- Pension Basics - Relationship Between Salaries and Pensions in Palo Alto, CADocument13 pagesPension Basics - Relationship Between Salaries and Pensions in Palo Alto, CAwmartin46No ratings yet

- Researching in The Digital AgeDocument8 pagesResearching in The Digital Agewmartin46No ratings yet

- Questions For Palo Alto City Council Candidates in Fall 2018 Election.Document1 pageQuestions For Palo Alto City Council Candidates in Fall 2018 Election.wmartin46No ratings yet

- TFS Healthcare Resource File #2.Document8 pagesTFS Healthcare Resource File #2.wmartin46No ratings yet

- City of Palo Alto Prioritization MatrixDocument44 pagesCity of Palo Alto Prioritization Matrixwmartin46No ratings yet

- US Veterans Affairs 2014 2020 Strategic Plan DraftDocument45 pagesUS Veterans Affairs 2014 2020 Strategic Plan Draftwmartin46No ratings yet

- Ad Encouraging A NO Vote To Measure E - Palo Alto TOT Tax Increase (2018)Document1 pageAd Encouraging A NO Vote To Measure E - Palo Alto TOT Tax Increase (2018)wmartin46No ratings yet

- TFS Healthcare Resource File #1Document8 pagesTFS Healthcare Resource File #1wmartin46No ratings yet

- City of Palo Alto (CA) Housing Element Draft (2015-2023)Document177 pagesCity of Palo Alto (CA) Housing Element Draft (2015-2023)wmartin46No ratings yet

- VA 2010 2014 Strategic PlanDocument112 pagesVA 2010 2014 Strategic PlanmaxwizeNo ratings yet

- US Veterans Affairs 2013 Annual ReportDocument338 pagesUS Veterans Affairs 2013 Annual Reportwmartin46No ratings yet

- Santa Clara County (CA) Grand Jury Report On Lack of Transparency in City of Palo Alto (CA) Government (May, 2014)Document18 pagesSanta Clara County (CA) Grand Jury Report On Lack of Transparency in City of Palo Alto (CA) Government (May, 2014)wmartin46No ratings yet

- Friendly Fire: Death, Delay, and Dismay at The VADocument124 pagesFriendly Fire: Death, Delay, and Dismay at The VAFedSmith Inc.No ratings yet

- Napa County (CA) Civil Grand Jury Report: A Review of County Public Employee Retirement Benefits (2014)Document14 pagesNapa County (CA) Civil Grand Jury Report: A Review of County Public Employee Retirement Benefits (2014)wmartin46No ratings yet

- Comments To Palo Alto (CA) City Council About Public Records Requests ProcessingDocument7 pagesComments To Palo Alto (CA) City Council About Public Records Requests Processingwmartin46No ratings yet

- Pension Benefit Guarantee Corporation Report (PBGC) (2013)Document54 pagesPension Benefit Guarantee Corporation Report (PBGC) (2013)wmartin46No ratings yet

- VA Office of Inspector General Interim ReportDocument35 pagesVA Office of Inspector General Interim ReportArthur BarieNo ratings yet

- Law Suits Involving The City of Palo Alto (CA) From 1982 To The Present - Source: Santa Clara County Superior Court.Document49 pagesLaw Suits Involving The City of Palo Alto (CA) From 1982 To The Present - Source: Santa Clara County Superior Court.wmartin46No ratings yet

- News Articles From Regional California Newspapers About Palo Alto (CA) /stanford (1885-1922)Document16 pagesNews Articles From Regional California Newspapers About Palo Alto (CA) /stanford (1885-1922)wmartin46No ratings yet

- The Effects of A Minimum-Wage Increase On Employment and Family IncomeDocument43 pagesThe Effects of A Minimum-Wage Increase On Employment and Family IncomeJeffrey DunetzNo ratings yet

- California Legislative Analyst's Office Presentation: Nonprofits Property Tax (2014)Document8 pagesCalifornia Legislative Analyst's Office Presentation: Nonprofits Property Tax (2014)wmartin46No ratings yet

- California Student Suspension/Expulsion Data (2011-2012)Document23 pagesCalifornia Student Suspension/Expulsion Data (2011-2012)wmartin46No ratings yet

- Lawsuits Involving The Palo Alto Unified School District (PAUSD) (Palo Alto, CA) (1983-Present)Document10 pagesLawsuits Involving The Palo Alto Unified School District (PAUSD) (Palo Alto, CA) (1983-Present)wmartin46No ratings yet

- Center For Disease Control National Vital Statistics Reports: Births: Final Data For 2012Document87 pagesCenter For Disease Control National Vital Statistics Reports: Births: Final Data For 2012wmartin46No ratings yet

- Los Angeles 2020 Commission Report #1: A Time For Truth.Document50 pagesLos Angeles 2020 Commission Report #1: A Time For Truth.wmartin46No ratings yet

- Rufino V PeopleDocument1 pageRufino V PeopleJune Karl CepidaNo ratings yet

- Insights into InsightDocument4 pagesInsights into InsightSantoz MilanistiNo ratings yet

- Jet Blue Case SummaryDocument1 pageJet Blue Case Summarynadya leeNo ratings yet

- 10 Tourist Spots For Your Ilocos Sur ItineraryDocument3 pages10 Tourist Spots For Your Ilocos Sur ItinerarySchara VictoriaNo ratings yet

- Clickstream analysis explainedDocument4 pagesClickstream analysis explainedutcm77No ratings yet

- Creativity Required To Retain Top Teachers: Turning Point' For SyriaDocument31 pagesCreativity Required To Retain Top Teachers: Turning Point' For SyriaSan Mateo Daily JournalNo ratings yet

- Disciplinary Board Reso BaldemoraDocument2 pagesDisciplinary Board Reso BaldemoraBjmp Los Banos MJ100% (1)

- Chartist Movement of BritainDocument6 pagesChartist Movement of BritainAbhishek Kumar100% (1)

- Beth Mukui Gretsa University-Past TenseDocument41 pagesBeth Mukui Gretsa University-Past TenseDenis MuiruriNo ratings yet

- Psikopatologi (Week 1)Document50 pagesPsikopatologi (Week 1)SyidaBestNo ratings yet

- Seylan Bank Annual Report 2016Document302 pagesSeylan Bank Annual Report 2016yohanmataleNo ratings yet

- General Education 2008 With AnswersDocument19 pagesGeneral Education 2008 With AnswersjenniferespanolNo ratings yet

- The Effect of Smartphones On Work Life Balance-LibreDocument15 pagesThe Effect of Smartphones On Work Life Balance-LibreNeelanjana RoyNo ratings yet

- Position Paper IranDocument1 pagePosition Paper IranIris Nieto100% (2)

- Emilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDocument15 pagesEmilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDeznan Bogdan100% (1)

- Location of Coca-Cola PlantDocument3 pagesLocation of Coca-Cola PlantKhushi DaveNo ratings yet

- Architect Consultant AgreementDocument7 pagesArchitect Consultant AgreementCzabrina Chanel AlmarezNo ratings yet

- Lecture Notes On Defective Contracts AttDocument2 pagesLecture Notes On Defective Contracts AttDora the ExplorerNo ratings yet

- User Guide: Intrinsic Value CalculatorDocument7 pagesUser Guide: Intrinsic Value CalculatorfuzzychanNo ratings yet

- Distilleries & BaveriesDocument8 pagesDistilleries & Baveriespreyog Equipments100% (1)

- Family CounsellingDocument10 pagesFamily Counsellingindians risingNo ratings yet

- 1.SPA SSS Death BenefitsDocument1 page1.SPA SSS Death BenefitsTroy Suello0% (1)

- Resolve 1418 SQL Server ErrorDocument1 pageResolve 1418 SQL Server ErrorsonicefuNo ratings yet

- The Story of AbrahamDocument3 pagesThe Story of AbrahamKaterina PetrovaNo ratings yet

- Care for Your Circulatory and Respiratory HealthDocument2 pagesCare for Your Circulatory and Respiratory HealthJamila ManonggiringNo ratings yet

- Checklist (Amp)Document7 pagesChecklist (Amp)Mich PradoNo ratings yet

- 15 Terrifying Books Jordan Peterson Urges All Smart People To Read - High ExistenceDocument14 pages15 Terrifying Books Jordan Peterson Urges All Smart People To Read - High Existencegorankos9889889% (35)

- OGL 350 - Module 1 - Reflection QuestionsDocument3 pagesOGL 350 - Module 1 - Reflection QuestionsRosie Nino100% (1)

- WTP WI Stick Diagram R4Document3 pagesWTP WI Stick Diagram R4setyaNo ratings yet

- Corporate Finance Chapter 1-2 SummaryDocument140 pagesCorporate Finance Chapter 1-2 SummarySebastian Manfred StreyffertNo ratings yet