Professional Documents

Culture Documents

Inventory Valuation Methods and Techniques

Uploaded by

sibivjohnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Valuation Methods and Techniques

Uploaded by

sibivjohnCopyright:

Available Formats

INVENTORIES Definition Inventories are assets: a. held for sale in the ordinary course of business; b.

in the process of production for such sale; or c. in the form of materials or supplies to be consumed in the production process or in the rendering of services. Inventories encompass a. goods purchased and held for resale b. finished goods produced c. work in progress being produced d. materials and supplies used in the production process e. in the case of a service provider, the cost of the service for which the enterprise has not yet recognized the related revenue. Recognition and Ownership of Inventories Inventories are recorded as assets and are reported on the balance sheet when the following conditions are met: It is probable that the future economic benefits are associated with the inventories will flow to the enterprise. The inventories have cost or value that can be measured reliably. Cost of Inventories 1. Cost of purchase Include purchase price, import duties and taxes, freight, handling and other cost Net of trade discounts and rebates. 2. Cost of conversion Include cost directly related to the units of production (ex: direct labor, allocation of fixed and variable production overhead) Fixed production overhead indirect costs of production that remains relatively constant regardless of the volume of production. Variable production overhead indirect costs of production that vary directly with the volume of production. 3. Other costs Costs incurred in bringing the inventories to their present location and condition.

The following are excluded from the cost of inventories and are recognized as expenses: 1. Abnormal amounts of wasted materials, labor and other production cost 2. Storage costs not unless these are necessary in the production process prior to a further production stage 3. Administrative overheads that do not contribute to bringing inventories to their present location and condition. 4. Selling cost Cost of Inventories of a Service Provider 1. labor and other costs of personnel directly engaged in providing the service including supervisory personnel and attributable overhead 2. costs relating to sales and general administrative personnel are not included but are recognized as expenses. Cash discounts Cash discounts are reductions in invoice price of purchases resulting from payment of accounts within the discount period. The objective of the seller in offering the discounts is to encourage early payment of accounts by the buyer. Items Included in Inventory Quantities The basic criterion is economic control rather than physical possession. Purchases should be recorded when legal title passes to the buyer. Goods in transit FOB Shipping Point legal title to (and control of) the goods is transferred at the shipping point when the seller delivers them to the shipping company. FOB Destination Point legal title (and control) is not transferred until the goods are delivered to the buyers place Summary Terms of Shipment Seller Buyer FOB Shipping Point Exclude Include FOB Destination Point Include Exclude Consigned goods Consignment is a special marketing arrangement wherein the consignee acts as the agent in charge of selling the goods. Goods out on consignment remain the property of the consignor. Sales with buyback agreements

Also referred to as parking transaction. A business sells its inventory and agrees to repurchase the merchandise at a specified price over a specified period. Inventory remains in the books of the seller. No sale is recorded.

Sales on installments A type of sale in which payment is required in periodic installments over an extended period of time. Goods sold on an installment basis are excluded from the sellers inventory. Segregated goods Pertains to special order goods manufactured according to customers specifications. These are excluded from sellers inventory (even if it is still in the possession of the seller). Goods out on approval Goods are owned by the seller until approved by the customer. RECORDING OF PURCHASES Purchases may be recorded at gross invoice price (gross method) or at gross invoice price less available cash discounts (net method). Under the gross method, cash discounts are recorded only when availed by the company and are credited to the account Purchases Discounts or Inventory. Cash discounts that were not availed are not reflected in the records. The Purchases Discounts account is reported in the income statement as deduction from gross purchases. Under the net method, cash discounts are immediately deducted from the gross invoice price. The Purchases account or Inventory account is debited for the net invoice price upon purchase of the goods. If payment of account is made after the discount period; the account Purchase Discount Lost is debited for the amount of discounts lost. The amount of discounts availed is not reflected in the records. The Purchase Discounts Lost account is reported in the income statement as other operating expense item. Inventory Accounting Systems 1. Periodic System

Also called the physical system Does not maintain continuous record of the physical quantities (or costs) of inventory on hand Physical count is taken at least once a year. Uses the account titles: Purchases, Purchase Discounts, Purchase Returns and Allowances, and Freight-in. 2. Perpetual System Maintains continuous records (detailed subsidiary records) of the movement of the items in the inventory. Uses the account titles Merchandise Inventory and Cost of Goods Sold A physical count is made at least once a year to confirm the inventory balance per books Makes use of the account Inventory Over and Short to reconcile the difference between inventory balance and the physical count. The Inventory Over and Short is usually closed to cost of goods sold because this is often the result of normal shrinkage and breakage in inventory. However, abnormal and material shortage should be separately classified and presented as other expense.

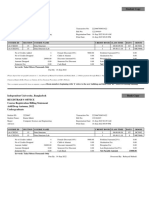

Pro-forma Entries Periodic Purchases Cash/Accounts Payable Purchase of merchandise Accounts Payable/Cash Purchase Returns & Allowances Return of merchandise to seller Accounts Payable Purchase Discount Cash Full payment within the discount period Freight-in xxx Perpetual Merchandise Inventory xxx Cash/Accounts Payable Purchase of merchandise Accounts Payable/Cash xxx Merchandise Inventory Return of merchandise to seller Accounts Payable xxx Merchandise Inventory xxx Cash Full payment within discount period Merchandise Inventory

xxx xxx xxx xxx xxx xxx

xxx

xxx

xxx

xxx

Cash Buyer pays freight: FOB SP, collect Accounts Receivable/Cash Sales Sale of merchandise xxx

xxx

Cash Buyer pays freight: FOB SP, collect Accounts Receivable/Cash Sales Cost of Goods Sold Merchandise Inventory Sale of merchandise xxx

xxx

xxx

xxx xxx xxx

Sales Returns & Allowances Accounts Receivable Return of merchandise by customer as recorded by seller

xxx xxx

Sales Returns & Allowances Accounts Receivable Merchandise Inventory Cost of Goods Sold Return of merchandise by customer as recorded by seller

xxx xxx xxx xxx

Cost Methods 1. Specific identification Specific costs are attributed to identified items of inventory Applicable for inventory with a small number and are easily distinguishable. Makes possible to manipulate net income 2. Average cost Considers goods to be indistinguishable Goods are valued at an average of the costs incurred. Weighted average (periodic system) and moving average (perpetual system). FIFO (First in First out) The first goods purchased are first sold. Ending inventory is presumed to consist of the most recent costs. There is no proper matching of costs and revenues since old costs are matched against current revenues. Favors the balance sheet because ending inventory approximates replacement costs. LIFO (Last in First out) the new standard prohibits the use of LIFO inventory

3.

4.

costing. The last goods purchased are first sold. The cost of good sold comes from the most recent purchases. Ending inventory is presumed to consist of the earlier costs. Favors the income statement because there is proper matching of costs against revenue. Valuation of Inventory 1. Inventories shall be measured at the lower of cost or net realizable value. Net realizable value the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. 2. The cost of inventories should be determined by using either the FIFO method or weighted average method. The new standards prohibit the use of LIFO inventory costing. 3. The cost of inventories that are not ordinarily interchangeable and inventories that are segregated for specific projects should be determined by using specific identification method. Lower of Cost or Net Realizable Value 1. Inventories are recorded at their original cost. 2. Inventories decline in value below its cost. 3. Reasons for the decline: Obsolescence Price level changes Damaged goods 4. Inventory should be written down to reflect the loss. 5. Inventories that experience a decline in value shall be measured at lower of cost or net realizable value. 6. Cost is the acquisition price of inventory. 7. Net Realizable Value (NRV) = Estimated Selling Price - Estimated Cost of Completion and Disposal 8. Lower of cost or net realizable value is applied on an item by item basis or individual basis. LCNRV can be consistently applied to batches of a product using a FIFO or weighted average cost flow assumptions, or groups of similar products. It is not appropriate to write inventories down on the basis of a classification of inventory, for example, finished goods, or all the inventories in a particular industry or geographical segment.

9. LCNRV is consistent with the Doctrine of Conservatism 10. Inventories of materials and supplies held for use in the production process are not written down below cost if the finished goods in which they are expected to be incorporated are expected to be sold at or above cost. 11. Only when the sale of finished goods is not expected to recover the costs are the materials and supplies written down to their net realizable value. Observation: The lower of cost and NRV rule suffers some conceptual deficiencies: Decreases in the value of the asset and the charge to expense are recognized in the period in which the loss in utility occurs, not in the period of sale. On the other hand, increases in the value of the asset are recognized only at the point of sale. This treatment is inconsistent and can lead to distortions in income data. Application of the rule results in inconsistency because the inventory of an entity may be valued at cost in one year and at net realizable value in the next year. Lower of cost and NRV values the inventory in the balance sheet conservatively, but its effect on the income statement may or may not be conservative. Profit for the year in which the loss is taken is definitely lower. Profit of the subsequent period may be higher than normal if the expected reductions in sales price do not materialize. The standard allows professional judgement. This is likely to lead to variation between companies in their implementation of the standard. Further the need for professional judgement presents an opportunity for profit manipulation. (Kieso, Fargher, Wise, Weygandt and Warfield, 2008) Pro-forma Entries Allowance Method Periodic Method Merchandise Inventory Income Summary Loss on Inventory Writedown Allowance for Inventory Writedown Perpetual Method Loss on inventory Writedown Allowance for Inventory Writedown For recoveries: Direct Method xxx xxx xxx xxx Merchandise Inventory Income Summary xxx xxx

xxx

Cost of Goods Sold xxx Merchandise Inventory

xxx xxx

Allowance for Inventory Writedown Gain on Inventory Recovery*

xxx xxx

*Gain is limited only up to the extent of the allowance balance Financial Statement Presentation Loss on Inventory Writedown Gain on Inventory Recovery Allowance for Inventory Writedown Added to cost of goods sold Deducted from cost of goods sold Contra account, deducted from Merchandise Inventory

Disclosures 1. The accounting policies adopted in measuring inventories including the cost method used. 2. The total carrying amount of inventories and the carrying amount in classifications appropriate to the enterprise. 3. The carrying amount of inventories at net realizable value. 4. The amount of reversal of any write-down that is recognized as income. 5. The circumstances or events that led to the reversal of a write-down of inventories. 6. The carrying amount of inventories pledged as security for liabilities. 7. The amount of inventories recognized as an expense during the period. Inventory Estimation Techniques Inventory estimation techniques are necessary when It is too costly to conduct a physical count (as in the case for interim reports). It is no longer possible to physically count the inventory like when the goods are destroyed by a natural disaster. Two Estimation Techniques Gross Profit Method or Gross Margin Method Gross profit may be expressed as a percentage of sales gross profit / sales a percentage of cost of goods sold gross profit / cost of goods sold It is useful in the following instances: In determining inventory amount to be reported in the interim financial

statements. In determining the amount of inventory loss caused by casualty such as fire and flood. In determining the reasonableness of inventory figures determined by the other means (gross profit test). It is not acceptable in determining inventory amount to be reported in the year-end financial statements. Retail Inventory Method Based on an assumed relationship between cost and price Widely used by retail stores Records are maintained at two amounts cost and retail.

Steps under the Gross Profit Method 1. Compute for cost of goods available for sale. 2. Apply gross profit to compute for cost of goods sold. 3. Subtract cost of goods sold from cost of goods available for sale. The estimated cost of ending inventory is calculated by following these steps: Determine the appropriate gross profit rate. The rate is normally based on previous years results of operations. Determine cost of goods sold. GP based on sales CGS = Sales x (100% - GP rate) GP based on CGS CGS = Sales / 100% + GP rate Determining estimated cost of ending inventory. Ending inventory cost = CGAS CGS Beginning inventory Add: Net cost of purchases Cost of goods available for sale Less: Estimated cost of goods sold (a) GPR is based on sales : Net sales x (100% - GPR) (b) GPR is based on cost : Net sales / (100% + GPR) Estimated cost of ending inventory P xxx xxx P xxx xxx P xxx

The cost of inventories may not be recoverable if they are damaged they have become wholly or partially obsolete their selling prices have declined the estimated costs of completion or the estimated costs to be incurred to make the sale have increased

Estimates of net realizable value are based on the most reliable evidence available at the time the estimates are made as to the amount the inventories are expected to realize the purpose for which the inventory is held The NRV of the quantity of inventory held to satisfy firm sales or service contracts is based on the contract price.

If there are undamaged or partially damaged merchandise, computation of inventory loss is as follows:

Estimated cost of ending inventory Less: Cost of undamaged merchandise Realizable value of partially damaged inventory (but not to exceed cost) Estimated inventory loss Terms Used Under the Retail Inventory Method

P xxx P xxx

xxx

xxx P xxx

1. Original retail initial sales price 2. Initial mark-up the original increase over cost 3. Additional mark-up an increase in the original retail price 4. Mark-up cancellations decreases additional markups that do not reduce sales prices below original retail 5. Net markups additional markups less markup cancellations 6. Markdowns decreases that reduce sales price below original retail 7. Markdown cancellations decreases in the markdowns that do not raise the sales prices above original retail. 8. Net markdowns markdowns less markdown cancellations. Steps under the Retail Inventory Method 1. 2. cost/CGAS at retail) 3. at estimated ending inventory 4. Compute for CGAS at cost and at retail Compute the cost to retail ratio (CGAS at Deduct sales from CGAS at retail to arrive Apply the cost to retail ratio to ending

inventory at retail to arrive at estimated ending inventory at cost. Types of Retail Inventory Method 1. Conventional/ Lower of Cost or Market 2. Average Cost 3. FIFO Under the conventional and average cost method, the cost percentage is computed as follows: Goods available for sale (GAS), at cost Goods available for sale (GAS), at retail Under FIFO method, beginning inventories are not included in the calculation of cost percentage. Thus, the cost percentage is computed as follows: GAS, at cost Beginning inventory GAS, at retail Beginning inventory Conventional Retail Method Cost P xxx xxx (xxx) (xxx) (xxx) xxx (xxx) xxx (xxx) P xxx Retail P xxx Xxx (xxx)

Beginning inventory Purchases Purchase returns Purchase discounts Purchase allowance Freight in Net markup Abnormal losses Departmental transfers in or debit Departmental transfers out or credit Cost of goods available for sale Cost to retail ratio Net sales (sales less sales returns) Net markdowns Employee discounts Normal losses (inventory shortage, spoilage, breakage) Estimated ending inventory, retail Estimated ending inventory, cost (estimated ending inventory, retail x cost to retail ratio) Estimated cost of goods sold

Xxx (xxx) Xxx (xxx) P xxx (xxx) (xxx) (xxx) (xxx) P xxx

xxx xxx

Summary (in computing the cost to retail rate) Conventional Include Include Exclude Average Include Include Include FIFO Exclude Include Include

Beginning inventory Net markups Net markdowns

Special Notes: Computation of Net Sales When Estimating Ending Inventory 1. For purposes of estimating ending inventory, sales allowances and sales discounts are ignored when computing net sales. Sales allowance and sales discount do not affect the physical inventory of goods. These are mere reductions in the sales price. 2. For purposes of estimating ending inventory, sales returns is deducted from gross sales when computing net sales. Sales returns cause an actual addition to goods on hand. 3. When the account is Sales Returns and Allowances, this is deducted from gross sales to arrive at net sales. Purchase Commitments Contracts made for the future purchase of goods at fixed prices Arrangements are made on the basis of estimated sales (commitments form customers) Title to merchandise has not passed to the buyer. Not necessary for the buyer to make any entry No asset or liability is recognized. Must be disclosed. It is an executory contract whereby the company commits itself to purchase a specified predetermined price and at a specified future date. No journal entry is required to record the commitment made by the enterprise. When the price of the goods increases as at balance sheet date and prior to the delivery date of the goods, the increase is not recognized. Hence, no journal entry is made. When the price of the goods decreases as at balance sheet date and prior to the delivery date of goods, the decline is accounted for as follows: If the contract is cancelable or the price is subject to adjustment, the decline is not recognized. If the contract is non-cancellable and the price is not subject to adjustment, the decline is recognized as a loss and a liability is recorded for the amount of the loss. When there is a full or partial recovery of the purchase price, the recovery would be recognized as a gain in the period during which the recovery takes place.

Recovery of loss on purchase commitments is reported on the income statement as other income. The amount of recovery that is taken up, however, is limited to the loss recorded in the previous period for the same purchase commitment. Estimated Loss on Purchase Commitments Estimated Liability on Purchase Commitment Purchases Estimated Liability on Purchase Commitment Cash/Accounts Payable xxx xxx xxx xxx xxx

RELATIVE SALES PRICE METHOD Different commodities are purchased at a single cost or lump sum amount. The single cost is apportioned among the commodities based on their respective sales price. This is based on the philosophy that cost is proportional to selling price. BORROWING COSTS Borrowing cost includes the following: Interest on short-term and long-term borrowing Amortization of discount or premium related to borrowing Amortization of ancillary cost incurred in connection with the arrangement of borrowing Finance charge with respect to finance lease Exchange difference arising from foreign currency borrowing to the extent that it is regarded as an adjustment to interest cost If the borrowing is directly attributable to the acquisition, construction or production of qualifying asset, the borrowing cost is required to be capitalized as cost of the asset. In other words, the capitalization of borrowing cost is mandatory for a qualifying asset. All other borrowing costs shall be expensed as incurred. In other words, if the borrowing is not directly attributable to a qualifying asset, the borrowing cost is expensed immediately. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale Examples

1. Manufacturing plants 2. Power generation facilities 3. Investment properties A qualifying asset includes inventories that require a substantial period of time to bring them to a salable condition Excluded from capitalization a. Assets measured at fair value, such as biological assets b. Inventories that are manufactured or produced in large quantities on a repetitive basis, such as manufacturing whisky, even if they take a substantial period of time to get ready for sale INVENTORIES VALUED AT SELLING PRICE In exceptional cases, inventories may be reported at fair value less disposal costs Fair value It is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable and willing parties in an arms length transaction. The following are the justification for the treatment: When cost is difficult to determine Quoted market price are available Marketability is assured Units are interchangeable The following are the application of this valuation: Cost of Agricultural Produce Harvested from Biological Assets. Inventories comprising agricultural produce that an entity has harvested from its biological assets are measured on initial recognition at their fair value less estimated point of sale costs at the point of harvest. Commodities of broker traders. It is measured at fair value less cost to sell. Broker traders are those who buy and sell commodities for others or on their own account. The inventories of broker traders are principally acquired with the purpose of selling them in the near future and generating a profit from fluctuations in price or broker-traders margin. Note: Both the inventories above are excluded from only the measurement requirements of PAS 2. USE OF MORE THAN ONE COST METHOD

In practice, many reporting enterprises have used different methods; for example FIFO for raw materials and weighted average for work in process and finished goods. PAS 2 requires that similar inventories must be given costed by the same method. Inventories used in similar fashion by a given entity, even differently sited or managed operation of a given enterprise should be costed by the same formula or method. It has held that different cost of formulae for different types of inventories, for inventories having different nature and uses, different cost formulae could be justified. Inventories having the same characteristics should be valued by means of the same cost formulae. Disclosure should be made of the accounting methods used in any event.

You might also like

- S5-42 DatasheetDocument2 pagesS5-42 Datasheetchillin_in_bots100% (1)

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- Acfn 3162 CH 2 Audit of Cash and Marketable Securities FCDocument44 pagesAcfn 3162 CH 2 Audit of Cash and Marketable Securities FCBethelhem100% (1)

- STAT100 Fall19 Test 2 ANSWERS Practice Problems PDFDocument23 pagesSTAT100 Fall19 Test 2 ANSWERS Practice Problems PDFabutiNo ratings yet

- Audit of Investment-LectureDocument15 pagesAudit of Investment-LecturemoNo ratings yet

- Investments at a GlanceDocument55 pagesInvestments at a GlanceJm SevallaNo ratings yet

- Audit Procedures for Testing Existence, Completeness, Valuation and Allocation of LiabilitiesDocument4 pagesAudit Procedures for Testing Existence, Completeness, Valuation and Allocation of LiabilitiesJohn Francis IdananNo ratings yet

- Pas 7 - Statement of Cash Flows - W RecordingDocument14 pagesPas 7 - Statement of Cash Flows - W Recordingwendy alcoseba100% (1)

- Quiz 1 Midterm InventoriesDocument6 pagesQuiz 1 Midterm InventoriesSophia TenorioNo ratings yet

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431ChristianNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- Cash and Cash Equivalents Handouts (1084)Document7 pagesCash and Cash Equivalents Handouts (1084)dian12 parksoohNo ratings yet

- Loans and Receivables ReportingDocument10 pagesLoans and Receivables ReportingElaineJrV-IgotNo ratings yet

- PSBA - GAAS and System of Quality ControlDocument10 pagesPSBA - GAAS and System of Quality ControlephraimNo ratings yet

- Correct Inventory Balances and Audit of Sales/Purchase Cut-OffDocument10 pagesCorrect Inventory Balances and Audit of Sales/Purchase Cut-OffMarkie GrabilloNo ratings yet

- MSU Cash and Cash Equivalents Pre-review ProgramDocument3 pagesMSU Cash and Cash Equivalents Pre-review ProgramAsterism LoneNo ratings yet

- Chapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankDocument8 pagesChapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankJulie Mae Caling MalitNo ratings yet

- IAS 16 Property Plant Equipment AccountingDocument6 pagesIAS 16 Property Plant Equipment AccountinghemantbaidNo ratings yet

- Applied Auditing Audit of Investment: Problem No. 1Document3 pagesApplied Auditing Audit of Investment: Problem No. 1JessicaNo ratings yet

- Examining accounting standards and conceptual frameworkDocument8 pagesExamining accounting standards and conceptual frameworkAmie Jane MirandaNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Receivable Financing Notes LoansDocument7 pagesReceivable Financing Notes Loansemman neriNo ratings yet

- PFRS15Document17 pagesPFRS15Rheneir MoraNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- Accounts Receivable (Chapter 4)Document31 pagesAccounts Receivable (Chapter 4)chingNo ratings yet

- Audit of ReceivablesDocument2 pagesAudit of ReceivablesCarmelaNo ratings yet

- Psa 600Document9 pagesPsa 600Bhebi Dela CruzNo ratings yet

- Transaction CyclesDocument7 pagesTransaction CyclesJames LopezNo ratings yet

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- Millan FAR 2017 45 Operating SegmentsDocument16 pagesMillan FAR 2017 45 Operating SegmentsPrincess Baquiran BeltranNo ratings yet

- TEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsDocument24 pagesTEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsClarisse PelayoNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Fixed Assets and Intangible Assets Test BankDocument24 pagesFixed Assets and Intangible Assets Test BankJessie jorgeNo ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsBusiness MatterNo ratings yet

- Auditing: Types of AuditDocument43 pagesAuditing: Types of Auditjohn paolo josonNo ratings yet

- AP - Loans & ReceivablesDocument11 pagesAP - Loans & ReceivablesDiane PascualNo ratings yet

- Transaction Cycles Audit TestsDocument8 pagesTransaction Cycles Audit TestsTrixie CasipleNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- Accounting Education Department Financial AssetsDocument3 pagesAccounting Education Department Financial AssetsPea Del Monte AñanaNo ratings yet

- Auditing Specialized IndustryDocument2 pagesAuditing Specialized Industryangelicadecipulo0828No ratings yet

- 05 Conversion CycleDocument24 pages05 Conversion CycleDillon Murphy100% (1)

- Lecture Notes On Inventory Estimation - 000Document4 pagesLecture Notes On Inventory Estimation - 000judel ArielNo ratings yet

- ReceivablesDocument16 pagesReceivablesJanela Venice SantosNo ratings yet

- Conceptual Framework for Financial ReportingDocument11 pagesConceptual Framework for Financial ReportingKimberly NuñezNo ratings yet

- Auditing Theory: Audit SamplingDocument11 pagesAuditing Theory: Audit SamplingFayehAmantilloBingcangNo ratings yet

- PAS 2 Summary Objective of PAS 2Document3 pagesPAS 2 Summary Objective of PAS 2Charles BarcelaNo ratings yet

- Audit 2 - TheoriesDocument2 pagesAudit 2 - TheoriesJoy ConsigeneNo ratings yet

- #16 Investment PropertyDocument4 pages#16 Investment PropertyClaudine DuhapaNo ratings yet

- 3 - Philippine Standards On Quality ControlDocument14 pages3 - Philippine Standards On Quality ControlKenneth PimentelNo ratings yet

- Audit Theory SummaryDocument17 pagesAudit Theory SummaryMarriz Bustaliño TanNo ratings yet

- TOC and Substantive Test Cyle Expenditure and Disbursement CycleDocument6 pagesTOC and Substantive Test Cyle Expenditure and Disbursement CycleGirl langNo ratings yet

- Reviewer in InventoriesDocument2 pagesReviewer in InventoriesNicole AutrizNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Investment in AssociateDocument11 pagesInvestment in AssociateElla MontefalcoNo ratings yet

- Petty Cash Fund SetupDocument5 pagesPetty Cash Fund SetupJay Lou PayotNo ratings yet

- C14 - PAS 2 InventoriesDocument20 pagesC14 - PAS 2 InventoriesAllaine ElfaNo ratings yet

- Accounting for cash and cash equivalentsDocument2 pagesAccounting for cash and cash equivalentsCj BarrettoNo ratings yet

- Pas 2 InventoriesDocument10 pagesPas 2 InventoriesAnne100% (1)

- Chapter 9 InvestmentsDocument18 pagesChapter 9 InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Inventories (PAS No. 2)Document14 pagesInventories (PAS No. 2)Da Eun LeeNo ratings yet

- PLC Networking with Profibus and TCP/IP for Industrial ControlDocument12 pagesPLC Networking with Profibus and TCP/IP for Industrial Controltolasa lamessaNo ratings yet

- Fernandez ArmestoDocument10 pagesFernandez Armestosrodriguezlorenzo3288No ratings yet

- DELcraFT Works CleanEra ProjectDocument31 pagesDELcraFT Works CleanEra Projectenrico_britaiNo ratings yet

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- HCW22 PDFDocument4 pagesHCW22 PDFJerryPNo ratings yet

- India: Kerala Sustainable Urban Development Project (KSUDP)Document28 pagesIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADNo ratings yet

- Cold Rolled Steel Sections - Specification: Kenya StandardDocument21 pagesCold Rolled Steel Sections - Specification: Kenya StandardPEng. Tech. Alvince KoreroNo ratings yet

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocument6 pagesLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0No ratings yet

- Orc & Goblins VII - 2000pts - New ABDocument1 pageOrc & Goblins VII - 2000pts - New ABDave KnattNo ratings yet

- Bharhut Stupa Toraa Architectural SplenDocument65 pagesBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNo ratings yet

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Document19 pagesMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldNo ratings yet

- ConductorsDocument4 pagesConductorsJohn Carlo BautistaNo ratings yet

- FX15Document32 pagesFX15Jeferson MarceloNo ratings yet

- Conv VersationDocument4 pagesConv VersationCharmane Barte-MatalaNo ratings yet

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorDocument20 pagesMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalNo ratings yet

- Account Statement From 30 Jul 2018 To 30 Jan 2019Document8 pagesAccount Statement From 30 Jul 2018 To 30 Jan 2019Bojpuri OfficialNo ratings yet

- Preventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Document21 pagesPreventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Desy Fitriani SarahNo ratings yet

- DNA Gel Electrophoresis Lab Solves MysteryDocument8 pagesDNA Gel Electrophoresis Lab Solves MysteryAmit KumarNo ratings yet

- Evaluating MYP Rubrics in WORDDocument11 pagesEvaluating MYP Rubrics in WORDJoseph VEGANo ratings yet

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- Catalogoclevite PDFDocument6 pagesCatalogoclevite PDFDomingo YañezNo ratings yet

- 4 Wheel ThunderDocument9 pages4 Wheel ThunderOlga Lucia Zapata SavaresseNo ratings yet

- On The Behavior of Gravitational Force at Small ScalesDocument6 pagesOn The Behavior of Gravitational Force at Small ScalesMassimiliano VellaNo ratings yet

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)