Professional Documents

Culture Documents

Cost of Capital

Uploaded by

Jp RegisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Capital

Uploaded by

Jp RegisCopyright:

Available Formats

Chapter 9.

Integrated Case Model Coleman Technologies is considering a major expansion program that has been proposed by the companys information technology group. Before proceeding with the expansion, the company needs to develop an estimate of its cost of capital. Assume that you are an assistant to Jerry Lehman, the financial vice-president. Your first task is to estimate Colemans cost of capital. Lehman has provided you with the following data, which he believes may be relevant to your task: (1) The firms tax rate is 40 percent. (2) The current price of Colemans 12 percent coupon, semiannual payment, noncallable bonds wit h 15 years remaining to maturity is $1,153.72. Coleman does not use short-term interest-bearing debt on a permanent basis.New bonds would be privately placed with no flotation cost. (3) The current price of the firms 10 percent, $100 par value, quarterly dividend, perpetual preferred stock is $111.10. (4) Colemans common stock is currently selling at $50 per share.Its last dividend (D0Colemans common stock is currently selling at $50 per share.Its last dividend (D0) wasColemans common stock is currently selling at $50 per share.Its last dividend (D0) wasColemans common stock is currently selling at $50 per share.Its last dividend (D0) was) was $4.19, and dividends are expected to grow at a constant rate of 5 percent in the foreseeable future.Colemans beta is 1.2, the yield on T-bonds is 7 percent, and the market risk premium is estimated to be 6 percent. For the bond-yield-plus-risk-premium approach, the firm uses a 4 percentage point risk premium. (5)Colemans target capital structure is 30 percent long-term debt, 10 percent preferred stock, and 60 percent common equity. To structure the task somewhat, Lehman has asked you to answer the following questions: (1) What sources of capital should be included when you estimate Colemans weighted average cost of capital (WACC)? The WACC is used primarily for making long-term capital investment decisions, i.e., for capital budgeting. Thus, the WACC should include the types of capital used to pay for long-term assets, and this is typically longterm debt, preferred stock (if used), and common stock.Short-term sources of capital consist of (1) spontaneous, noninterest-bearing liabilities such as accounts payable and accrued liabilities and (2) short-term interest-bearing debt, such as notes payable.If the firm uses short-term interest-bearing debt to acquire fixed assets rather than just to finance working capital needs, then the WACC should include a short-term debt component.Noninterest-bearing debt is generally not included in the cost of capital estimate because these funds are netted out when determining investment needs, that is, net operating rather than gross operating working capital is included in capital expenditures. (2)Should the component costs be figured on a before-tax or an after-tax basis? Stockholders are concerned primarily with those corporate cash flows that are available for their use, namely, those cash flows available to pay dividends or for reinvestment.Since dividends are paid from and reinvestment

is made with after-tax dollars, all cash flow and rate of return calculations should be done on an aftertax basis. (3)Should the costs be historical (embedded) costs or new (marginal) costs? In financial management, the cost of capital is used primarily to make decisions that involve raising new capital. Thus, the relevant component costs are todays marginal costs rather than historical costs. PART B What is the market interest rate on Colemans debt and its component cost of debt? Colemans 12 percent bond with 15 years to maturity is currently selling for $1,153.72.Thus, its yield to maturity is 10 percent: N 30 PV ($1,153.72) PMT 60 FV $1,000 I 10% The result of the RATE function must be multiplied by 2 since the coupon is paid semiannually.10% is the pre-tax cost of debt. Since interest is tax deductible, Uncle Sam, in effect, pays part of the cost, and Colemans relevant component cost of debt is the aftertax cost

You might also like

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine Linso100% (1)

- Telus Cost of CapitalDocument31 pagesTelus Cost of Capitallogwinner86% (7)

- Nike WACC AnalysisDocument8 pagesNike WACC AnalysisAnurag Sukhija100% (5)

- Estimating Walmart's Cost of CapitalDocument11 pagesEstimating Walmart's Cost of CapitalArslan HafeezNo ratings yet

- Cost of Capital Brigham Case SolutionDocument7 pagesCost of Capital Brigham Case SolutionShahid Mehmood100% (13)

- Actividad 8 en ClaseDocument2 pagesActividad 8 en Claseluz_ma_6No ratings yet

- India Russia Relations PDFDocument4 pagesIndia Russia Relations PDFAmalRejiNo ratings yet

- Case Study Idk WhereDocument2 pagesCase Study Idk WhereLily RonshakuNo ratings yet

- HOMEWORK 10Document4 pagesHOMEWORK 10Gia Hân TrầnNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- IC 11-22 AssignmentDocument9 pagesIC 11-22 Assignmentshinta anggraini putriNo ratings yet

- Tugas Af Cost of CapitalDocument8 pagesTugas Af Cost of CapitalVinni RestutiningrumNo ratings yet

- Potential Agency ProblemsDocument16 pagesPotential Agency ProblemslimsterryNo ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital Problemschandel08No ratings yet

- CFA Level 1 (Book-C)Document51 pagesCFA Level 1 (Book-C)butabuttNo ratings yet

- Weighted Average Cost of Capital (WACCDocument19 pagesWeighted Average Cost of Capital (WACCFahad AliNo ratings yet

- Chapter Three 3 (MJ)Document7 pagesChapter Three 3 (MJ)leul habtamuNo ratings yet

- Tutorial 9 Problem SetDocument6 pagesTutorial 9 Problem SetPeter Jackson0% (1)

- Cost of Capital, Debt, Equity & WACCDocument4 pagesCost of Capital, Debt, Equity & WACCCarter LeeNo ratings yet

- Cost of Capital ChapterDocument25 pagesCost of Capital ChapterHossain Belal100% (1)

- CFA Level 1 Corporate Finance E Book - Part 2Document31 pagesCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentNo ratings yet

- Cost of Capital ChapterDocument26 pagesCost of Capital Chapteremon hossainNo ratings yet

- Eco (Hons.) - BCH 2.4 (B) - GE-FINANCE - RuchikaChoudharyDocument27 pagesEco (Hons.) - BCH 2.4 (B) - GE-FINANCE - RuchikaChoudharyPrashant KumarNo ratings yet

- Cost of Capital Further DetailDocument57 pagesCost of Capital Further Detaildeigcorr22No ratings yet

- Financial Management 29Document8 pagesFinancial Management 29sourav113No ratings yet

- Cost of CapitalDocument15 pagesCost of Capitalসুজয় দত্তNo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalJoshua CabinasNo ratings yet

- Do You Know Your Cost of CapitalDocument13 pagesDo You Know Your Cost of CapitalRavi VarmaNo ratings yet

- Brooks Financial mgmt14 PPT ch11Document60 pagesBrooks Financial mgmt14 PPT ch11Jake AbatayoNo ratings yet

- Chapter 9. Integrated Case Model: RF M RFDocument6 pagesChapter 9. Integrated Case Model: RF M RFHAMMADHRNo ratings yet

- Minggu 05: Manajemen Keuangan I IDocument25 pagesMinggu 05: Manajemen Keuangan I ISalsabila KhairiNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMathilda UllyNo ratings yet

- True or False: Cost of Capital Components and WACC CalculationDocument3 pagesTrue or False: Cost of Capital Components and WACC CalculationASUS 14 A416No ratings yet

- Weighted Average Cost of Capital and Company Valuation: Individual ExerciseDocument13 pagesWeighted Average Cost of Capital and Company Valuation: Individual ExerciseMarilou Olaguir SañoNo ratings yet

- Calculating WACC for Capital Structure ChangesDocument2 pagesCalculating WACC for Capital Structure Changesmuhammad farhanNo ratings yet

- The Cost of CapitalDocument52 pagesThe Cost of CapitalChincel G. ANINo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalyukiNo ratings yet

- Paper 12Document2,606 pagesPaper 12123shru50% (4)

- Chapter 3 Cost of CapitalDocument30 pagesChapter 3 Cost of CapitalMELAT ROBELNo ratings yet

- Cost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockDocument58 pagesCost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockAerial DidaNo ratings yet

- 09 Zutter Smart PMF 16e ch09Document59 pages09 Zutter Smart PMF 16e ch09Hafez QawasmiNo ratings yet

- Ch. 9 Cost of Capital PDFDocument15 pagesCh. 9 Cost of Capital PDFadinda_shabeeraNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- Cost of Capital: VALMET530Document34 pagesCost of Capital: VALMET530Khim Ziah Velarde BarzanasNo ratings yet

- Cost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCDocument5 pagesCost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCshikha_asr2273No ratings yet

- Structure and BudgetingDocument29 pagesStructure and BudgetingYaga KanggaNo ratings yet

- FIN3004 Tutorial 2 QuestionsDocument2 pagesFIN3004 Tutorial 2 QuestionsLe HuyNo ratings yet

- Homework 2 (Shcheglova M.)Document3 pagesHomework 2 (Shcheglova M.)Мария ЩегловаNo ratings yet

- Nike Case StudyDocument4 pagesNike Case StudyNickiBerrangeNo ratings yet

- Case Study Nike IncDocument5 pagesCase Study Nike IncIshita KashyapNo ratings yet

- COST OF CAPITAL - Basic FinanceDocument21 pagesCOST OF CAPITAL - Basic FinanceAqib IshtiaqNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalAfsana Mim JotyNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- Financial Management Mini Case Chap 9Document10 pagesFinancial Management Mini Case Chap 9ammsszNo ratings yet

- AFM Unit 1Document12 pagesAFM Unit 1anushkabokkasamNo ratings yet

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine LinsoNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Cost of CaptialDocument72 pagesCost of CaptialkhyroonNo ratings yet

- BIAYA MODAL CompressedDocument89 pagesBIAYA MODAL CompressedMuh IdhamsyahNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Accounting Equations and Concepts GuideDocument1 pageAccounting Equations and Concepts Guidealbatross868973No ratings yet

- DIEGO Vs FernandoDocument2 pagesDIEGO Vs FernandoErica ManuelNo ratings yet

- Taxation-for-Development-Narrative-Report Final ReportDocument40 pagesTaxation-for-Development-Narrative-Report Final ReportJackNo ratings yet

- Nepal COSDocument45 pagesNepal COSLeo KhkNo ratings yet

- Ali Jahangir SiddiquiDocument6 pagesAli Jahangir SiddiquiPakistanRisingNo ratings yet

- IAS 33 Earnings Per ShareDocument33 pagesIAS 33 Earnings Per Shareali muzamilNo ratings yet

- ACC 430 Chapter 9Document13 pagesACC 430 Chapter 9vikkiNo ratings yet

- Consolidation Worksheet QuestionsDocument40 pagesConsolidation Worksheet QuestionsMelanie SamsonaNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/GBPDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/GBPMiir ViirNo ratings yet

- Advantages of OverpopulationDocument24 pagesAdvantages of OverpopulationVishnu RajasekharanNo ratings yet

- Excess Stock DisposalDocument28 pagesExcess Stock DisposalAnchit PatleNo ratings yet

- Fundraising Techniques and MethodsDocument22 pagesFundraising Techniques and MethodsPratyush GuptaNo ratings yet

- Barings Bank FailureDocument16 pagesBarings Bank FailureNidhu SanghaviNo ratings yet

- Economic Growth in Nehru EraDocument15 pagesEconomic Growth in Nehru Erakoushikonomics4002100% (9)

- 991財管題庫Document10 pages991財管題庫zzduble1No ratings yet

- Rit2 - RTD - Rit RTD DocumentationDocument5 pagesRit2 - RTD - Rit RTD DocumentationhiyogiyoNo ratings yet

- CA FINAL SFM Solution Nov2011Document15 pagesCA FINAL SFM Solution Nov2011Pravinn_MahajanNo ratings yet

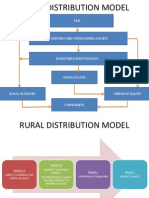

- Hul Distribution ModelDocument5 pagesHul Distribution ModelBhavik LodhaNo ratings yet

- Parking MemoDocument13 pagesParking MemojaneprendergastNo ratings yet

- Partnership Dissolution and Admission ExplainedDocument14 pagesPartnership Dissolution and Admission ExplainedMila aguasanNo ratings yet

- Sebi Main ProjectDocument36 pagesSebi Main ProjectMinal DalviNo ratings yet

- Managerial Accounting: Ray H. Garrison, Eric W. Noreen, Peter C. BrewerDocument50 pagesManagerial Accounting: Ray H. Garrison, Eric W. Noreen, Peter C. BrewermostfaNo ratings yet

- 10 Wise Co v. MeerDocument2 pages10 Wise Co v. MeerkresnieanneNo ratings yet

- Commercial Law ReviewerDocument33 pagesCommercial Law ReviewerFrancis PunoNo ratings yet

- Seminar Project HimanshuDocument10 pagesSeminar Project HimanshuKeshav KaushikNo ratings yet

- Account Monitoring: and Warning SignsDocument57 pagesAccount Monitoring: and Warning SignsAngelNo ratings yet

- Week 5: Asset PricingDocument26 pagesWeek 5: Asset Pricingmike chanNo ratings yet

- Assignment 2 CanadaDocument12 pagesAssignment 2 Canadaabdulrahman mohamedNo ratings yet

- European Economic Review: EditorialDocument2 pagesEuropean Economic Review: EditorialНаталья КотенкоNo ratings yet