Professional Documents

Culture Documents

The 6,000 Interest Charge Hidden in New Student Loans That Will Be Handed To Graduates The Day They Leave University

Uploaded by

Simply Debt SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The 6,000 Interest Charge Hidden in New Student Loans That Will Be Handed To Graduates The Day They Leave University

Uploaded by

Simply Debt SolutionsCopyright:

Available Formats

The 6,000 interest charge hidden in new student loans that will be handed to graduates the day they

leave university

Rate is 3 percentage points above inflation Typical student will be saddled with 49,404 debt

By Lauren Thompson Last updated at 1:40 AM on 9th July 2011

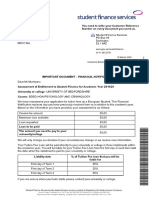

Exorbitant interest rates on new university loans mean that average middle-class students will owe 6,000 more on the day they graduate than they originally borrowed to fund their three-year course. From the moment they receive the first tranche of their loan, they will begin racking up interest at a crippling rate which is 3 percentage points above inflation and higher than at most high street banks. A Daily Mail investigation found that typical students will have to borrow 43,500 to fund their higher education over a three-year course 9,000 a year for tuition and 5,500 a year for living costs.

Looking forward: Students of Liverpool University waiting to receive their degrees can also look forward to receiving a statement on their student loans (file picture)

Before they even start work, that debt would have grown to 49,404. And interest charges would rack up year after year, with many saddled with a massive debt they can never hope to pay off, even if they have a relatively well-paid job. A Money Mail investigation into this student debt-trap has also revealed:

The Government may pocket more than 150million in interest in the first year of payback; Low-earning graduates will have to pay 41p in every pound they earn in loan repayments and tax; Higher earners could be forced to pay back double what they borrowed; Graduates who dont get a full-time job for several years will be 25,000 better off

Ian Mulheirn, of the Social Market Foundation think-tank, said: The headline figure of 9,000 a year for tuition fees is deeply misleading. With punishing interest rates this high, and kicking in so early, it is more like theyve increased from 3,000 to 12,000. From September 2012 tuition fees will rise from 3,290 to 9,000 a year at most universities. All students will qualify for a loan or a grant to cover these fees and their living expenses. How much they get depends on their household income. While they are at university the interest rate is inflation, as measured by the retail prices index (RPI), plus 3 percentage points. It remains at this rate until they graduate. IMPACT ON HOMEBUYERS Buying a house will be much harder for graduates saddled with huge amounts of student debt. The average mortgage for a first-time buyer is currently 103,000 double what many people will already owe on their student loan. The Government says a student loan is very unlikely to impact materially on getting a mortgage. But mortgage brokers point out that when applying for a mortgage, all lenders will ask about your debts including a student loan. Because the debt is likely to last for 30 years, an even bigger problem may occur if the graduate starts a family, thereby further reducing their financial ability to raise a mortgage. Currently RPI is 5.2 per cent, so the loan interest rate would be 8.2 per cent 1.5 per cent higher than on a personal loan from Marks & Spencer Money. After they leave university the interest rate on the loan will depend on earnings. Repayment does not begin until their salary tops 21,000. However, even below this salary interest continues to rack up at the rate of RPI. On earnings between 21,000 and 41,000, the interest rate gradually rises to 3 percentage points above RPI. If the loan is not repaid within 30 years, any remaining debt is written off. For our calculations, which have been compiled by financial data analysts Moneyfacts, we have assumed inflation is 3.5 per cent and that the graduates leave university with a debt of 43,500. One graduate starts work on 21,000 and receives a 5 per cent pay rise every year. Over 30 years they would pay back 68,869 of which 25,369 is interest. At the age of 50, they would still be paying 5,889 a year in student loan repayments. When the loan was finally written off the graduate would still owe 123,285. Our second example assumes the same salary but the graduate goes travelling for five years and starts earning 21,000 only on returning to Britain. They would pay back 42,954 over 30 years, 25,915 less than someone who starts earning 21,000 immediately after graduating. A massive 189,027 would be written off.

Our third is a high-flier who starts on 30,000 and earns 100,000 by the age of 50. This graduate would pay back 89,100 which means the 45,600 interest they would have paid is greater than the sum they originally borrowed. To make things worse, graduates will not be able to overpay their loan or pay it off early, although the Government may change its mind on this. It means that for every 1 they earn, graduates who are basic rate taxpayers will lose 41p in income tax, National Insurance and student loan repayments. Higher rate taxpayers would lose 52p of every 1. The extra 3 percentage points interest means that based on an intake of 400,000 students the Government would rake in more than 150million interest in the first year alone. The increase in tuition fees and new rates for living cost loans are expected to be confirmed later this year.

You might also like

- Our Invaluable Guide - How To Escape The Student Debt Trap: Charlotte BeuggeDocument5 pagesOur Invaluable Guide - How To Escape The Student Debt Trap: Charlotte BeuggeSimply Debt SolutionsNo ratings yet

- LE Impact of Student Loan Repayments On Graduate Taxation FINALDocument59 pagesLE Impact of Student Loan Repayments On Graduate Taxation FINALGahahajNo ratings yet

- You Can Afford Togotouni: Mature Students' GuideDocument28 pagesYou Can Afford Togotouni: Mature Students' GuidegregotzaNo ratings yet

- Complete Free UK Guide To Student Life and MoneyDocument16 pagesComplete Free UK Guide To Student Life and Moneybogdan negreaNo ratings yet

- Student Loans - A Guide To Terms and Conditions 2013Document25 pagesStudent Loans - A Guide To Terms and Conditions 2013ralwoNo ratings yet

- You Can Afford Togotouni: Full-Time GuideDocument19 pagesYou Can Afford Togotouni: Full-Time GuideWill TeeceNo ratings yet

- A Guide To Financial Support For Higher Education StudentsDocument5 pagesA Guide To Financial Support For Higher Education Studentsjaya19844No ratings yet

- 1) The Price of University: Questions 1-4Document4 pages1) The Price of University: Questions 1-4akhilesh sahooNo ratings yet

- Reedit Final DraftDocument21 pagesReedit Final Draftvinoothan vinohNo ratings yet

- Courses Fees For September 2013/14: ACM Bursaries 2013Document3 pagesCourses Fees For September 2013/14: ACM Bursaries 2013Luis Carlos RodriguesNo ratings yet

- Learning Infosheets Tuition Fees EuDocument6 pagesLearning Infosheets Tuition Fees Eumuerte412No ratings yet

- Busmat 1Document47 pagesBusmat 1Burning Rose0% (1)

- EU Funding 2014-15Document2 pagesEU Funding 2014-15Andi DumitruNo ratings yet

- B2 Eco-Mgmt: "Student Debt & Ozone Hole"TITLE B2 Eco-Mgmt: "Grad Debt Tips & Chile's Ozone" TITLE B2 Eco-Mgmt: "Managing Loans & Punta ArenasDocument9 pagesB2 Eco-Mgmt: "Student Debt & Ozone Hole"TITLE B2 Eco-Mgmt: "Grad Debt Tips & Chile's Ozone" TITLE B2 Eco-Mgmt: "Managing Loans & Punta ArenasKitti DömötöriNo ratings yet

- University of Liverpool Student Finance Information Booklet 2012Document10 pagesUniversity of Liverpool Student Finance Information Booklet 2012Kerry MiltonNo ratings yet

- A Guide To Terms and Conditions: Advanced Learning LoanDocument16 pagesA Guide To Terms and Conditions: Advanced Learning LoanAnca BodianNo ratings yet

- QMUL 2022/23 University Fee RegulationsDocument23 pagesQMUL 2022/23 University Fee RegulationsRetsmonNo ratings yet

- Student Visa Application Process For The UKDocument1 pageStudent Visa Application Process For The UKMd AlauddinNo ratings yet

- International Fees University of Greenwich WebDocument8 pagesInternational Fees University of Greenwich WebThomas SotoNo ratings yet

- Fees and Refund Policyaug21v2Document15 pagesFees and Refund Policyaug21v2stanhillNo ratings yet

- A Guide To Financial Support For Students Continuing in Full-Time Higher Education in 2013/2014Document18 pagesA Guide To Financial Support For Students Continuing in Full-Time Higher Education in 2013/2014sdafklwerw23ojir2No ratings yet

- Cost of gaining a degree reaches £33,500 as students cut backDocument1 pageCost of gaining a degree reaches £33,500 as students cut backvivaldivivaldiNo ratings yet

- Postgraduate Loans InformationDocument3 pagesPostgraduate Loans InformationDr Richard AnekweNo ratings yet

- Summary 1Document2 pagesSummary 1Fabiola RuggieriNo ratings yet

- Student LoansDocument1 pageStudent LoanstipharethtNo ratings yet

- Undergraduate Funding Guide For 2023Document16 pagesUndergraduate Funding Guide For 2023Aimen HakimNo ratings yet

- Key Benefit ChangesDocument15 pagesKey Benefit ChangescraigyboystewartNo ratings yet

- Contra in StsDocument26 pagesContra in StskbassignmentNo ratings yet

- How Payday Loans Can Grow Into A Debt Nightmare: Lauren ThompsonDocument2 pagesHow Payday Loans Can Grow Into A Debt Nightmare: Lauren ThompsonSimply Debt SolutionsNo ratings yet

- International Tuition Fees 2020-21Document8 pagesInternational Tuition Fees 2020-21Mit AdhvaryuNo ratings yet

- Erasmus+ Master Loan Scheme - FAQ Support To National AgenciesDocument3 pagesErasmus+ Master Loan Scheme - FAQ Support To National AgenciesTekena FubaraNo ratings yet

- General Mathematics: Quarter 2 - Module 1: Introduction To Simple and Compound InterestDocument12 pagesGeneral Mathematics: Quarter 2 - Module 1: Introduction To Simple and Compound InterestShawn Michael Bulos91% (22)

- Difference between yield to maturity and coupon rateDocument3 pagesDifference between yield to maturity and coupon ratekhushimaharwalNo ratings yet

- Financial Innovation ProjectDocument4 pagesFinancial Innovation Projectibra100% (1)

- Fact Sheet For RSCs To Send - Oct-2019Document3 pagesFact Sheet For RSCs To Send - Oct-2019RSC.SESLNo ratings yet

- Mathematical Modeling: Price For Your Future: National University of Singapore (NUS)Document7 pagesMathematical Modeling: Price For Your Future: National University of Singapore (NUS)cosmieskyNo ratings yet

- Postgraduate FAQs 2012Document2 pagesPostgraduate FAQs 2012diana_danaila4768No ratings yet

- Finance Guide WordDocument20 pagesFinance Guide WordDing DongNo ratings yet

- Week 4 Seminar Tuition FeesDocument5 pagesWeek 4 Seminar Tuition FeesalstondmendoncaNo ratings yet

- Rp167 Commentary1 Mcgettigan UniversitiesDocument7 pagesRp167 Commentary1 Mcgettigan UniversitiesMark S MarkNo ratings yet

- Eco IADocument4 pagesEco IAPhan Tien Phuc Anh (K17 HCM)No ratings yet

- Future Finance BrochureDocument2 pagesFuture Finance BrochureFuture FinanceNo ratings yet

- UK lecturers strike over pension changes impacting thousands of studentsDocument2 pagesUK lecturers strike over pension changes impacting thousands of studentsjuan1diego1sgNo ratings yet

- Memorandum Regarding Tuition Fee ProposalDocument5 pagesMemorandum Regarding Tuition Fee ProposalDevin johnstonNo ratings yet

- View DocumentDocument2 pagesView DocumentMarius MunteanuNo ratings yet

- Finance Brochure 2013 WebDocument12 pagesFinance Brochure 2013 WebZidNo ratings yet

- Private Education Loan DetailsDocument2 pagesPrivate Education Loan Detailssaksham23No ratings yet

- Student Grants and LoansDocument2 pagesStudent Grants and LoansViktor SterpuNo ratings yet

- Fair Pensions For Teachers - Fair Pensions For ALL: Pension Pot CalculatorDocument1 pageFair Pensions For Teachers - Fair Pensions For ALL: Pension Pot Calculatorapi-84365173No ratings yet

- Scholarships For International Students at UK UniversitiesDocument13 pagesScholarships For International Students at UK UniversitiesAHZ AssociatesNo ratings yet

- Financial RegulationsDocument9 pagesFinancial RegulationsAkash SarwarNo ratings yet

- Who Graduates College with Six-Figure Student Loan DebtDocument12 pagesWho Graduates College with Six-Figure Student Loan DebtJozephyrsNo ratings yet

- You Can Afford Togotouni: Student GuideDocument20 pagesYou Can Afford Togotouni: Student GuideAnca-GNo ratings yet

- Tuition Fee Schedules For Publicly-Funded Programs 2021-22: March 1, 2021 Planning & Budget OfficeDocument40 pagesTuition Fee Schedules For Publicly-Funded Programs 2021-22: March 1, 2021 Planning & Budget OfficeShahadat AfrinNo ratings yet

- Fee Information Pack - September 2022 IntakeDocument4 pagesFee Information Pack - September 2022 IntakeMuhammad TouseefNo ratings yet

- EUPR1a: Form Continuing StudentsDocument10 pagesEUPR1a: Form Continuing StudentslorddoskiasNo ratings yet

- EMA Replacement Scheme: 16-19 Bursaries and Associated Transitional ArrangementsDocument18 pagesEMA Replacement Scheme: 16-19 Bursaries and Associated Transitional ArrangementsJames MillsNo ratings yet

- Graduate UnemploymentDocument2 pagesGraduate UnemploymentlazyboiNo ratings yet

- Loan Shark Victim Given Hero Award For Helping To Jail His TormenterDocument2 pagesLoan Shark Victim Given Hero Award For Helping To Jail His TormenterSimply Debt SolutionsNo ratings yet

- The Mathematical Law That Shows Why Wealth Flows To The 1%Document2 pagesThe Mathematical Law That Shows Why Wealth Flows To The 1%Simply Debt SolutionsNo ratings yet

- UntitledDocument33 pagesUntitledSimply Debt SolutionsNo ratings yet

- Too Much Debt: Our Biggest Economic ProblemDocument4 pagesToo Much Debt: Our Biggest Economic ProblemSimply Debt SolutionsNo ratings yet

- I T's No Accident That Am Er Icans Widely Under Estim Ate Inequality. The R Ich PR Efer It That WayDocument4 pagesI T's No Accident That Am Er Icans Widely Under Estim Ate Inequality. The R Ich PR Efer It That WaySimply Debt SolutionsNo ratings yet

- UntitledDocument8 pagesUntitledSimply Debt SolutionsNo ratings yet

- The Financial Services Authority Should Regulate Banks, Not Lobby For Them!Document1 pageThe Financial Services Authority Should Regulate Banks, Not Lobby For Them!Simply Debt SolutionsNo ratings yet

- Exclusive: H Alf of Teachers Forced To Feed Pupils Going Hungry at HomeDocument3 pagesExclusive: H Alf of Teachers Forced To Feed Pupils Going Hungry at HomeSimply Debt SolutionsNo ratings yet

- Mothers Forced To Sell Their Children: Mail Reveals The Distressing Human Toll of Greece's Euro MeltdownDocument8 pagesMothers Forced To Sell Their Children: Mail Reveals The Distressing Human Toll of Greece's Euro MeltdownSimply Debt SolutionsNo ratings yet

- The Sellout of The I Vory Tower, and The Crash of 2008 (Excerpt)Document4 pagesThe Sellout of The I Vory Tower, and The Crash of 2008 (Excerpt)Simply Debt SolutionsNo ratings yet

- Crisis-Led Suicide Epidemic: Greek Mother & Son Jump To DeathDocument2 pagesCrisis-Led Suicide Epidemic: Greek Mother & Son Jump To DeathSimply Debt SolutionsNo ratings yet

- Bet On GR Eek Bonds Paid Off For Vultur e Fund': Vulture FundsDocument2 pagesBet On GR Eek Bonds Paid Off For Vultur e Fund': Vulture FundsSimply Debt SolutionsNo ratings yet

- Payday Loan Debts Killed Our Son, 18: Ollie's Train SuicideDocument2 pagesPayday Loan Debts Killed Our Son, 18: Ollie's Train SuicideSimply Debt SolutionsNo ratings yet

- Health: Debt 'Putting Off' Medical Students, BMA WarnsDocument2 pagesHealth: Debt 'Putting Off' Medical Students, BMA WarnsSimply Debt SolutionsNo ratings yet

- Italian Father Throws 14-Month-Old Daughter and Son, Four, To Their Deaths and Then Leaps From Balcony Himself in Despair After Losing His JobDocument5 pagesItalian Father Throws 14-Month-Old Daughter and Son, Four, To Their Deaths and Then Leaps From Balcony Himself in Despair After Losing His JobSimply Debt SolutionsNo ratings yet

- Financial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Document2 pagesFinancial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Simply Debt SolutionsNo ratings yet

- UntitledDocument4 pagesUntitledSimply Debt SolutionsNo ratings yet

- Wells Fargo Has Blood On I Ts Hands: Desperate M An Commits Suicide After Shocking Foreclosure M IstreatmentDocument3 pagesWells Fargo Has Blood On I Ts Hands: Desperate M An Commits Suicide After Shocking Foreclosure M IstreatmentSimply Debt SolutionsNo ratings yet

- How To Destroy Education While Making A Trillion DollarsDocument3 pagesHow To Destroy Education While Making A Trillion DollarsSimply Debt SolutionsNo ratings yet

- The New Wall Street Racket Looting Your City, One Block at A TimeDocument4 pagesThe New Wall Street Racket Looting Your City, One Block at A TimeSimply Debt SolutionsNo ratings yet

- A Gener Ation H Obbled by The Soar Ing Cost of College: Loans Life InsuranceDocument11 pagesA Gener Ation H Obbled by The Soar Ing Cost of College: Loans Life InsuranceSimply Debt SolutionsNo ratings yet

- How To Destroy Education While Making A Trillion DollarsDocument3 pagesHow To Destroy Education While Making A Trillion DollarsSimply Debt SolutionsNo ratings yet

- Police Clash With Protesters in Sydney University Sit-InDocument1 pagePolice Clash With Protesters in Sydney University Sit-InSimply Debt SolutionsNo ratings yet

- Goldman Sachs Ready To Hand Out 7bn Salary and Bonus Package... After Its 6bn Bail-OutDocument2 pagesGoldman Sachs Ready To Hand Out 7bn Salary and Bonus Package... After Its 6bn Bail-OutSimply Debt SolutionsNo ratings yet

- The Reporter Who Saw It ComingDocument6 pagesThe Reporter Who Saw It ComingSimply Debt SolutionsNo ratings yet

- Marquette Nat. Bank of Minneapolis v. First of Omaha Service CorpDocument6 pagesMarquette Nat. Bank of Minneapolis v. First of Omaha Service CorpSimply Debt SolutionsNo ratings yet

- Bond ImmunizationDocument14 pagesBond ImmunizationYasser HassanNo ratings yet

- A Project Report On Cash and Fund Flow Analysis and Ratio Analysis of DKSSKN, ChikodiDocument97 pagesA Project Report On Cash and Fund Flow Analysis and Ratio Analysis of DKSSKN, ChikodiBabasab Patil (Karrisatte)50% (6)

- HandoutDocument14 pagesHandoutJuzer ShabbirNo ratings yet

- TAN SRI LOO CHONG SING & ANOR v. DATO' SRI CHIN SEAK HUAT (2019) 1 LNS 1593 PDFDocument11 pagesTAN SRI LOO CHONG SING & ANOR v. DATO' SRI CHIN SEAK HUAT (2019) 1 LNS 1593 PDFmerNo ratings yet

- Booz Allen and Hamilton Inc Vs SBI Home Finance Lts110484COM613298Document15 pagesBooz Allen and Hamilton Inc Vs SBI Home Finance Lts110484COM613298Vishal MandalNo ratings yet

- Month To Go Moving ChecklistDocument9 pagesMonth To Go Moving ChecklistTJ MehanNo ratings yet

- IC 67 Marine Insurance Chapter 1 MCQ Questions PDFDocument8 pagesIC 67 Marine Insurance Chapter 1 MCQ Questions PDFAmi Mehta50% (2)

- Finance Module QuestionsDocument14 pagesFinance Module QuestionsMY NAME IS NEERAJ..:):)No ratings yet

- QuizDocument32 pagesQuizEloisaNo ratings yet

- An Answered Prayer: RTP (November 2009 - IPCC)Document19 pagesAn Answered Prayer: RTP (November 2009 - IPCC)Keshav TutejaNo ratings yet

- CFPB English Spanish Glossary of Financial Terms! PDFDocument77 pagesCFPB English Spanish Glossary of Financial Terms! PDFruthieNo ratings yet

- Financial Accounting ABE PDFDocument328 pagesFinancial Accounting ABE PDFVirasamy Sundy67% (3)

- The Tally Starts New NotesDocument41 pagesThe Tally Starts New NotesAnurag GoelNo ratings yet

- Accounting 5Document8 pagesAccounting 5khurramNo ratings yet

- CH 12 Cash Flow Estimatision and Risk AnalysisDocument39 pagesCH 12 Cash Flow Estimatision and Risk AnalysisRidhoVerianNo ratings yet

- Anton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 5Document683 pagesAnton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 5Meliora CogitoNo ratings yet

- Sample Preliminary ReportDocument10 pagesSample Preliminary ReportAidyl Rain SimbulanNo ratings yet

- Diversification Strategy KennyDocument5 pagesDiversification Strategy KennyThanh Tu NguyenNo ratings yet

- Microfinance Business Law SummaryDocument14 pagesMicrofinance Business Law SummaryMubashar BashirNo ratings yet

- J17 F6LSO Section B AnsDocument5 pagesJ17 F6LSO Section B Ansaswathi1No ratings yet

- The Biggest Bank Fraud in HistoryDocument4 pagesThe Biggest Bank Fraud in Historycoil100% (8)

- Living With Michael Jackson Part 4 of 9Document23 pagesLiving With Michael Jackson Part 4 of 9Karen O'HalloranNo ratings yet

- CH03Document5 pagesCH03Mohsin SadaqatNo ratings yet

- Literature ReviewDocument35 pagesLiterature ReviewSanjida100% (1)

- Janine CIV2 Edited FinalDocument84 pagesJanine CIV2 Edited FinalGiee De GuzmanNo ratings yet

- AlphaDocument18 pagesAlphaOrganic NutsNo ratings yet

- Insolvency & Bankruptcy CodeDocument56 pagesInsolvency & Bankruptcy CodeHimanshu Mene100% (2)

- Mindanao Development vs CA Express Trust DisputeDocument15 pagesMindanao Development vs CA Express Trust DisputeTinn ApNo ratings yet

- JBIC Loan Agreement for Catanduanes Circumferential Road ProjectDocument63 pagesJBIC Loan Agreement for Catanduanes Circumferential Road ProjectJo Cawaling SanchezNo ratings yet

- Obligations and Contract Notes (Midterms)Document18 pagesObligations and Contract Notes (Midterms)Michelle de los Santos100% (1)