Professional Documents

Culture Documents

Airtel Financial Analysis

Uploaded by

Pooja JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Airtel Financial Analysis

Uploaded by

Pooja JainCopyright:

Available Formats

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Financial Accounting

Project Report on

Bharti Airtel Limited

Nidhi Agarwal (u107092) Niraj Kumar Mall (u107093) Nishith Sahu(u107094)

Submitted by:

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

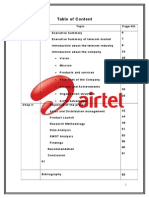

Table of Contents

1. 2. 3. 4. ACKNOWLEDGEMENTS OBJECTIVE EXECUTIVE SUMMARY ENVIRONMENT ANALYSIS 4.1 GOVERNMENT POLICIES 4.2 NEW TELECOM POLICY, 1994 4.3 NEW TELECOM POLICY, 1999 4.4 BROADBAND POLICY, 2004 5. INDIAN ECONOMY AND THE TELECOM SECTOR 5.1 GUIDELINES FOR FOREIGN DIRECT INVESTMENT IN TELECOM SECTOR 5.2 TRAI GUIDELINES AND OBJECTIVES 5.3 TELECOM DISPUTES SETTLEMENT & APPELLATE TRIBUNAL (TDSAT) 5.4 CELLULAR OPERATORS ASSOCIATION OF INDIA (COAI) 6. COMPANY ANALYSIS 6.1 ABOUT THE COMPANY 6.2 CAPITAL STRUCTURE OF BHARTI-AIRTEL 6.3 FINANCIAL STATEMENTS 6.4 ACCOUNTING POLICIES 7. Ratio Analysis 7.1 LIQUIDITY RATIOS 7.1.1 Current Ratio 7.1.2 Liquid Ratio 7.1.3 Absolute Cash Ratio 7.1.4 Debtor Days 7.1.5 Creditor Days 7.1.6 Inventory Days 7.2 SOLVENCY RATIOS 7.2.1 Debt Ratio 7.2.2 Equity Ratio 7.2.3 Debt to Equity Ratio 7.2.4 Interest Coverage Ratio 7.2.5 Debt Service Coverage Ratio 7.3 PROFITABILITY RATIOS 7.3.1 Gross Profit (PBDITA) / Sales Ratio 7.3.2 Operating Profit (PBIT) / Sales Ratio 7.3.3 Net Profit (PAT) / Sales Ratio 7.4 RETURN ON INVESTMENT 7.4.1 RONW 7.4.2 ROCE 7.4.3 ROTA 7.4.4 EPS 7.5 EFFICIENCY RATIOS 4 5 5 6 6 6 7 8 11 18 20 21 21 22 22 27 30 32 38 38 38 39 40 40 41 42 42 43 43 44 45 46 47 47 48 49 50 50 51 51 52 53

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7.5.1 Total Assets Turnover Ratio 7.5.2 Debt Turnover Ratio 7.5.3 Fixed Asset Turnover 7.5.4 Current Asset Turnover 7.5.5 Inventory Turnover 8. DUPONT ANALYSIS 8.1 THE DUPONT RATIO DECOMPOSITION 8.1.1 Profitability: Net Profit Margin (NPM: PBIT/Sales) 8.1.2 Operating Efficiency or Asset Utilization: Total Asset Turnover (Sales/Total Assets) 8.1.3 Leverage: The Leverage Multiplier (Total Assets/Capital Employed) 8.2 HIGHLIGHTS OF DUPONT ANALYSIS 9. CASH FLOW ANALYSIS 10. CALCULATION OF EVA 11. CONCLUSION 12. APPENDIX 13. REFERENCES

53 54 55 56 57 59 60 60 60 61 62 67 70 71 73 75

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

1. ACKNOWLEDGEMENTS

We wish to express our heartfelt gratitude and immense respect to Dr. D.V.Ramana, our Faculty and Mentor in Financial Accounting. His threadbare explanation of the minutest of concepts helped in generating a lot of interest in the subject. We would also like to thank XIMB for providing the necessary infrastructure which made our work easier.

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

2. OBJECTIVE

The basic objective of doing the project is to analyze the financial statements of a company, analyze the environment in which it is operating and evaluate its performance over the last 3 years. Hence a thorough Environment Industry & Company analysis is done to understand the external factors influencing the company.

3. EXECUTIVE SUMMARY

The environmental analysis would include analyzing the Indian economy, government policies, FDI norms with regard to telecom sector, TRAIs objectives & guidelines, COAI data and demography related to cellular coverage.

Industry covered Factors behind the telecom growth, Industry Structure (services), Technologies, recent growth trends in the Telecom Sector, GSM Coverage in India and Outlook for the Sector.

Then we moved to company analysis where we studied that its strategic business group primarily consists of two services namely mobile and infotel services. Infotel services can further be classified into Broadband & Telephone services, Enterprise services and Long distance services. We also studied the shareholding pattern, recent developments in the company and the accounting policies of the company.

To analyse the performance of the company specifically we covered the following topics: 1. Ratio Analysis 2. Du Pont Analysis 3. Cash Flow Analysis

We also did a thorough analysis of its competitors like BSNL & VSNL to get a feel of how the company is doing though in some places we were handicapped by the unavailability of financial statements of the competitors.

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

4. ENVIRONMENT ANALYSIS

4.1 GOVERNMENT POLICIES

The telecom sector in India is at present governed by the legislations viz, The Indian Telegraph Act, 1885 and the Indian Wireless Telegraphy Act, 1933. The reforms process in the telecom sector in India began in early 80s with allowing manufacture of customer premise equipment by private sector.

Telecom Services in the Metro cities of Delhi & Mumbai were corporatised under Mahanagar Telephone Nigam Ltd. (MTNL) and International Telecom Services were corporatised under Videsh Sanchar Nigam Ltd (VSNL). Subsequently, Center for Development of Telematics (C-DOT) was set up in 1984 to develop indigenous technology. While the initial mandate of C-DOT in 1984 was to design and develop digital exchanges and facilitate their large scale manufacture by the Indian Industry, the development of transmission equipment was also added to its scope of work in 1989. To accelerate decision making Government also set up a High Powered Telecom Commission in 1989.

To meet the resource requirement and achieve the nations telecom targets, the government decided to invite the participation of private players, and the telecom sector was opened up in 1992. The policy abolished the regime of public sector supremacy and paved the way for private participation in the economy. Gone were the days of 2 year waiting period to get a telephone connection.

4.2 NEW TELECOM POLICY, 1994

In 1994, the Government announced the National Telecom Policy which defined certain important objectives, including availability of telephone on demand, provision of world class services at reasonable prices, ensuring Indias emergence as major manufacturing /

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

export base of telecom equipment and universal availability of basic telecom services to all villages. It also announced a series of specific targets to be achieved by 1997. The NTP 1994 targeted 1 PCO per 500 urban population and coverage of all 6 lac villages.

NTP 1994 also recognized that the required resources for achieving these targets would not be available only out of Government sources and concluded that private investment and involvement of the private sector was required to bridge the resource gap. The Government invited private sector participation in a phased manner from the early nineties, initially for value added services such as Paging Services and Cellular Mobile Telephone Services (CMTS) and thereafter for Basic Telephone Services (BTS). After a competitive bidding process, licenses were awarded to 8 CMTS operators in the four metros, 14 CMTS operators in 18 state circles, 6 BTS operators in 6 state circles and to paging operators in 27 cities and 18 state circles. VSAT services were liberalized for providing data services to closed user groups. Licenses were issued to 14 operators in the private sector.

4.3 NEW TELECOM POLICY, 1999

Since some of the targets set in the telecom policy of 1994 remained unfulfilled, a new Telecom policy was brought about in 1999. The New Policy Framework focused on creating an environment, which enabled continued attraction of investment in the sector and allowed creation of communication infrastructure by leveraging on technological development. The main objectives of NTP-1999 were: Availability of affordable and effective communications for the citizens. To achieve a tele-density of 7 by the year 2005 and 15 by the year 2010; to improve rural tele-density from the level of 0.4 to 4 by the year 2010. Create a modern, efficient and world class Telecommunications infrastructure taking into account the convergence of IT, Media, Telecom and Consumer Electronics.

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Convert Public Call Offices (PCOs) into Public Tele-info Centers having multimedia capability like ISDN Services, Remote Database Access, Government and Community Information Systems etc. Transform in a time-bound manner, the Telecommunications Sector to a greater competitive environment in both urban and rural areas providing equal opportunities and level playing field for all players. Strengthen Research and Development efforts in the country and provide an Impetus to build world class manufacturing capabilities. Protect Defense and Security interest of the country. Enable Indian Telecom Companies to become truly Global Players.

Towards this end, the New Policy Framework divided the telecom service sector as follows Cellular Mobile Service Providers, Fixed Service Providers and Cable Service Providers, collectively referred to as Access Providers Radio Paging Service Providers Public Mobile Radio Trunking Service Providers National Long Distance Operators International Long Distance Operators Other Service Providers Global Mobile Personal Communication by Satellite (GMPCS) Service Providers V-SAT based Service Providers The policy led to rapid expansion of telecom services, steep reduction in tariffs, advancement of technology etc.

4.4 BROADBAND POLICY, 2004

Recognising the potential of ubiquitous Broadband service in growth of GDP and enhancement in quality of life through societal applications including tele-education, telemedicine, e-governance, entertainment as well as employment generation by way of high speed access to information and web-based communication, Government finalized a

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

policy to accelerate the growth of Broadband services. Some of the major points taken up in the policy on the technology front were: Greater emphasis on optical fibre-technologies & Digital-subscriber lines(DSL) on copper loop Cable TV network can be used as franchisee network of the service provider for provisioning Broadband services. Very Small Aperture Terminals (VSAT) and Direct-to-Home (DTH) services would be encouraged for penetration of Broadband and Internet services with the added advantage to serve remote and inaccessible areas. Invest in newer technologies and incorporate them at the earliest.

National Internet Exchange of India (NIXI) was set up by DIT, Government of India to ensure that Internet traffic, originating and destined for India, should be routed within India. The policy targets 20m broadband subscribers by 2010.

The government policies over the period can be summed up and shown as below:

Pre-reform Pre-1994

Partial Deregulation

Further Deregulation 1999 - 2002

Take-off 2002 onwards

1994-1999

MTNL Mumbai and Delhi; DTS elsewhere No mobile service NLD - DoT per/ BSNL ILD VSNL

4 private fixed service providers with less than 1% market share 2 GSM mobile players in each circle 13 players start mobile service National Telecom Policy (NTP) 1994 TRAI constituted 1997

Licenses converted to revenue sharing Private sector share less than 5% in revenue terms Competition in NLD and ILD Licenses on Revenue share 4 mobile operators / circle NTP 1999 BSNL formed 2001 Internet Telephony 2002 FDI - 49 % New Telecom Policy, 1999

Calling Party Pays CDMA launch 3-6 operators in each circle Intra-circle merger guidelines Unified Licensing

Broadband policy 2004 FDI - 74% 2005

National Telecom Policy, 1994

Unified Licensing Regime

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Some of the other policy initiatives are: Deregulation virtually complete and Unified Licensing regime Interconnection Usage Charge framework in place Exemption from customs duty for import of Mobile Switching Centres Comprehensive Spectrum policy and 3G policy on the anvil

Independent regulation has been a critical factor in the growth.

2006 Number portability Convergence TRAIs recommendations 2005 Unified Licensing Quality of Service regulation Rural Telephony 2004 Intra-circle merger guidelines Internet / broadband penetration 2003 Calling Party Pays Regime Unified Access Licensing Reference Interconnect Order 2002 ILD opened to competition Internet Telephony allowed. Reduction in License fees

Mature regulatory regime and an enabling policy framework already in place

10

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

5. INDIAN ECONOMY AND THE TELECOM SECTOR

1. The Indian Economy is galloping at a fast pace over the last few years. 2. It has clocked over 9% growth for the last many years. 3. Such a growing economy offers vast growth opportunities for the telecom industry. The telecom market has grown rapidly in the last few years.

Subscriber growth

180 164

In Millions

120 53

CAGR 38%

98 76 44

60

0 2002 2003 2004 2005 Aug-06

Revenue growth

20 15 $B illio n 10 5 0 2002 2003 2004 2005 9 10

20 15

CAGR - 21%

11

2006

Revenues ~ USD 19.5 bn (FY 2006)

11

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

o CAGR (FY 2002-06) - 21% o Have doubled in last 3 years

Subscribers ~ 160 million (Aug 2006) o CAGR (FY 2002-06) - 38 % o Nearly quadrupled since FY 02 o 5-6 million being added every month

Tele-Density - 14.8 (Aug 2006) o Has doubled in 3 years o Target set for 2007 under NTP 1999 achieved during FY 2005 And is poised to be the second-largest network globally by 2008

800

China 743

Telecom Subs cribe rs - Country w ise Decem ber 2005

m subscribers n.

600 USA 360 Japan 153 Germany 134 Rus 130 Ind 125

400

200

12

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Mobile telephony continues to be the key growth driver.

Subscriber Growth - Mobile vs Fixed

175 Mn. subscribers 140 105 70 35 0

2002 2003 2004 2005 2006

143

38 7

42 13

43 34

52 41 41

Fixed (mn. subs)

Mobile (mn. subs)

Wireless emerging as the preferred mass market format service providers focus on Internet / broadband access to improve fixed line ARPU Progressive regulation o Migration to revenue sharing o Calling Party Pays (CPP) regime o Unified access licensing o Intra-circle merger guidelines Intensifying competition o 3 to 6 players per circle o Presence of CDMA and GSM providers o Significant share of private sector Growing affordability o ARPUs among lowest in the world

13

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

o Lower cost of ownership due to Low cost / used handsets o Success of the pre-paid format

Growing network coverage is triggering further market expansion

Segment

Cellular reach (2003-04) Locations Population 200 million

Cellular reach (End 2006 - Est.) Locations ~ 4900 towns out of nearly 5200 towns Population 300 million

Urban

~ 1700 of 5200 towns

Rural

Negligible

Negligible

~ 350,000 out of 607,000 villages

450 million

Support from Universal Service Obligation Fund envisaged for shared network infrastructure creation in uncovered rural areas

14

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Vibrant and competitive telecom market

Subscribers Company Presence Fixed Government owned. Has ramped up BSNL GSM services. National presence (except Mumbai and Delhi) MTNL Government owned. Operates in Delhi and Mumbai. Integrated operator, with presence in Bharti all sectors. Largest mobile services provider. Integrated operator. Plans expansion Reliance of GSM network apart from being the largest private CDMA operators. Hutch IDEA Pure play GSM operator in 11 circles. Pure play GSM operator in 6 circles Integrated operator (along with TTS VSNL) with presence in all segments. Provides CDMA services in 20 circles Operates in 2 circles. Announced Aircel Plans to expand GSM footprint in North and North east Spice Others Total Pure play GSM player in 2 circles 0.4 50 4.0 3.0 1.4 3.8 37.4 (mn)

Jul 06

Share (%)

Mobile

Fixed

Mobile

17.7

74.7%

19.6%

2.0

7.7%

2.3%

19.6

2.7%

21.7%

17.3

6.0%

19.2%

15.4 7.4

17.0% 8.2%

4.9

8.0%

5.4%

2.6

2.9%

1.9 1.4 90

2.1%

15

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Broadband and internet connectivity are on the verge of take-off. Broadband subscriber growth 2.00

Mn. subscribers

1.5 6-fold growth 0.75 0.18 0

Mar-05

1.38

Mar-06

Nov-06

Several Indian firms are gaining a foothold in the global market. Many Indian service providers are acquiring scale in the International Long Distance market through acquisitions o Acquisitions - FLAG by Reliance, Tyco and Teleglobe by Videsh Sanchar Nigam Limited o VSNL is now the world's fifth largest carrier of voice globally o Reliances FLAG network connects with 28 countries. FLAGs FALCON cable system when completed would connect 12 countries with international cable landing stations Investments in Infrastructure o Bharti-Singtel and VSNL investments in undersea cable Emerging as Integrated telco, positioning themselves as full service providers o Tata teleservices-VSNL, Bharti, Reliance have end-to-end presence in ILD, NLD and Access; BSNL has announced plans to get into ILD o Focus on corporate connectivity - IPLCs, Frame relay, VPNs o Strong thrust on internet and broadband - both corporate and retail segments 25

16

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Key Indian Companies

BSNL - Incumbent service provider and World's 7th largest Telecommunications Company providing comprehensive range of telecom services in India Services include Wire line, CDMA mobile, GSM Mobile, Internet, Broadband, Carrier service, MPLS-VPN, VSAT, VoIP services, IN Services etc.

MTNL - State owned operator covering the cities of Mumbai an Delhi Provides both fixed and mobile services

Bharti Airtel - Integrated operator with presence in all segments Leads the mobile segment in the country

Reliance Communications - Largest player in India in the CDMA segment Plans a GSM network

Tata Teleservices - Integrated operator (with VSNL) with presence in all segments Provides CDMA services in 20 circles

17

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

5.1 GUIDELINES FOR FOREIGN DIRECT INVESTMENT IN TELECOM SECTOR

The government has liberalized the FDI rules in the telecom sector. The FDI ceiling has been raised from 49% to 74% in certain telecom services (such as Basic, Cellular, Unified Access Services, National/International Long Distance, V-Sat, Public Mobile Radio Trunked Services (PMRTS), Global Mobile Personal Communications Services (GMPCS) and other value added services). The remaining 26 per cent will be owned by resident Indian citizens or an Indian Company (i.e. foreign direct investment does not exceed 49 percent and the management is with the Indian owners). 100% FDI permitted under automatic route in the manufacturing sector The majority Directors on the Board including Chairman, Managing Director and Chief Executive Officer (CEO) shall be resident Indian citizens, enforced through licence agreement.

1. Singapore Telecom (SingTel) made an investment of US$1.07 B through a Mauritius entity for a stake in Bharti Televentures. 2. Vodafone acquired a 10% stake in Bharti Televentures for 6700 crore rupees( approximately US$ 1.5B) 3. Subsequently, Vodafone made an investment of $12 US B when it acquired a controlling 67% stake in Hutch Essar.

All these have helped the Indian telecom market grow at an astonishing pace. It is the fastest growing market in the world About 6 million mobile subscribers are added every month The mobile sector has grown from around 10 million subscribers in 2002 to reach 150 million subscribers by early 2007 registering an average growth of 90% yoy. The overall fixed and mobile subscribers have risen to more than 200 million by the first quarter of 2007.

18

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Currently, the Indian Telecom market is valued at US$100 B. Two telecom players dominate this market- Bharti Airtel with 27% market share and Reliance Communication with 20% market share.

In the mobile phone market there are basically two technologies that are used: GSM and CDMA. GSM is the dominant technology that is used.

GSM and CDMA subscription numbers: GSM GSM Annual CDMA Subscribers Subscribers growth (millions) (millions) 3.1 94% 5.05 76% 10.5 91% 0.8 22.0 110% 6.4 37.4 70% 10.9 58.5 57% 19.1 105.4 80% 44.2 180.0 71% 85.0 CDMA Annual growth 700% 70% 75% 131% 92%

Year 2000 2001 2002 2003 2004 2005 2006 2007

19

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

5.2 TRAI GUIDELINES AND OBJECTIVES

The Telecom Regulatory Authority of India (TRAI) was formed in January 1997 with a view to providing an effective regulatory framework and adequate safeguards to ensure fair competition and protection of consumer interests. The Government is committed to a strong and independent regulator with comprehensive powers and clear authority to effectively perform its functions.

Objectives Access to telecommunications is of utmost importance for achievement of the countrys social and economic goals. Availability of affordable and effective communications for the citizens is at the core of the vision and goal of the telecom policy Strive to provide a balance between the provision of universal service to all uncovered areas, including the rural areas, and the provision of high level services capable of meeting the needs of the countrys economy Encourage development of telecommunication facilities in remote, hilly and tribal areas of the country Create a modern and efficient telecommunications infrastructure taking into account the convergence of IT, media, telecom and consumer electronics and thereby propel India into becoming an IT superpower Convert PCOs, wherever justified, into Public Teleinfo centres having multimedia capability like ISDN services, remote database access, government and community information systems etc Transform in a time bound manner, the telecommunications sector to a greater competitive environment in both urban and rural areas providing equal opportunities and level playing field for all players Strengthen research and development efforts in the country and provide an impetus to build world class manufacturing capabilities Achieve efficiency and transparency in spectrum management Protect defense and security interests of the country 20

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

5.3 TELECOM DISPUTES SETTLEMENT & APPELLATE TRIBUNAL (TDSAT)

With a view to further strengthen the regulator the TRAI Act, 1997 was amended in the year 2000 and a separate body viz., The Telecom Dispute Settlement and Appellate Tribunal (TDSAT) was constituted for resolution of disputes in Telecom Sector. The appellate tribunal consists of a chairperson and two members appointed by the Indian Parliament. The selection of Chairperson and members of the Appellate tribunal is made by the Central Government in consultation with the Chief Justice of India.

The TDSAT is empowered to adjudicate any dispute between: Licensor and a Licensee. Two or more Service Providers. A Service Provider and a Group of Consumers.

5.4 CELLULAR OPERATORS ASSOCIATION OF INDIA (COAI)

The Cellular Operators Association of India (COAI) was constituted in 1995 as a registered, nonprofit, nongovernmental society dedicated to the advancement of communication, particularly modern communication through Cellular Mobile Telephone Services.

With a vision to establish and sustain a world-class cellular infrastructure and facilitate affordable mobile communication services in India, COAI main objectives are to protect the common & collective interests of its members. Keeping the mandate given to it, COAI is the official voice for the Indian Cellular industry and on its behalf it interacts with: the policy maker, the licensor, the regulator, the spectrum management agency and the industry (telecom / nontelecom) associations.

21

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

6. COMPANY ANALYSIS

6.1 ABOUT THE COMPANY

Company Profile Bharti Airtel is one of India's leading private sector providers of telecommunications services based on an aggregate of 48,853,758 customers as on August 31, 2007, consisting of 46,814,745 GSM mobile and 2,039,013 broadband & telephone customers.

The businesses at Bharti Airtel have been structured into three individual strategic business units (SBUs) - mobile services, broadband & telephone services (B&T) & enterprise services. The mobile services group provides GSM mobile services across India in 23 telecom circles, while the B&T business group provides broadband & telephone services in 94 cities. The enterprise services group has two sub-units - carriers (long distance services) and services to corporates. All these services are provided under the Airtel brand.

Company shares are listed on The Stock Exchange, Mumbai (BSE) and The National Stock Exchange of India Limited (NSE).

Vision & Promise By 2010 Airtel will be the most admired brand in India: Loved by more customers Targeted by top talent Benchmarked by more business

22

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Company History Bharti Tele-Ventures was incorporated on July 7, 1995 as a company with limited liability under the Companies Act, for promoting telecommunications services. Bharti Tele-Ventures received certificate for commencement of business on January 18, 1996. The Company was initially formed as a wholly-owned subsidiary of Bharti Telecom Limited. The chronology of events since Bharti Tele-Ventures was incorporated in 1995 is as follows: Calendar year & Events

1995 Bharti Cellular launched cellular services 'AirTel' in Delhi 1997 British Telecom acquired a 21.05% equity interest in Bharti Cellular 1998 Bharti Telecom and British Telecom formed a 51%: 49% joint venture, Bharti BT Internet for providing Internet services 2002 Comes out with issue of 18.53 crore equity shares through book building route with a floor price of Rs 45 per share, received bid for 18.55 crore shares. Through the issue, it becomes the first company in India to come out with 100% book building issue 2004 Bharti Tele-Ventures enters into a three year service agreement with Ericsson 2005 Bharti inks $125-m deal with Nokia for rural network expansion Bharti Tele Ventures announces agreement with Vodafone 2007 Bharti Airtel, telecom major, has come out with a slew of initiatives including buying out SingTel's 50 per cent stake in joint venture under sea cable company Network i2i for $110 million.

23

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Organization Structure

24

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Awards and Recognition Wireless service provider of the year 2005 at the Frost and Sulivan AsiaPacific ICT awards Competitive service provider of the year 2005 at the Frost and Sulivan AsiaPacific ICT awards The Forbes Global 2000 list for the year 2007 ranked Bharti at 1149

Market Performance Market Capitalization (as on July 13, 2007) Approx. Rs. 1,670 billion Closing BSE share price = Rs. 880.75 Sales Profits Assets Market Value : $2.62 Billion : $0.46 Billion : $4.46 Billion : $41 Billion

Highlights for Full Year ended March 31, 2007 Overall customer base crosses 3.9 crore. Highest ever-net addition of 1.8 crore customers in a year. Market leader with a market share of all India wireless subscribers at 22.9% (20.4% last year) Total Revenues of Rs. 18,520 crore (up 59% Y-o-Y) EBITDA of Rs. 7,451 crore (up 72% Y-o-Y). Cash Profit of Rs. 7,307 crore (up 79% Y-o-Y). Net Profit of Rs. 4,257 crore (up 89% Y-o-Y).

25

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

In News: Recently Sunil Bharti's Airtel launched its calling card in America especially for the NRI (Non-resident Indians) and people calling from America to India at a cheaper rate as compared to the tariff offered by other providers. On February 12, 2007 Vodafone sold its 5.6% stake in AirTel back to AirTel for US $1.6 billion; and purchased a controlling stake in rival Hutchison Essar. In its monthly press release, following statistics have been presented for end of April 2007. Bharti Airtel added the highest ever net addition of 53 lakh customers in a single quarter (Q4-FY0607) and also the highest ever net addition of 1.8 crore total subscribers in 2006-07 The company will invest up to $3.5 billion this fiscal (07-08) in network expansion. It has an installed base of 40,000 cellsites and 59% population coverage After the proposed network expansion, an additional 30,000 towers will result in the company achieving 70% population coverage Bharti has over 39 million users as on March 31, 2007 It has set a target of 125 million subscribers by 2010 Prepaid customers account for 88.5% of Bhartis total subscriber base, an increase from 82.7% a year ago ARPU has dropped to Rs 406 Non-voice revenues, (SMS, voice mail, call management, hello tunes and Airtel Live) constituted 10% of total revenues during Q4, lower than 10.7% in the Q4 of the previous year Blended monthly minutes of usage per customer in Q4 was at 475 minutes Has completed 100% verification of its subscribers and in the process disconnected three lakh subscribers

26

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

6.2 CAPITAL STRUCTURE OF BHARTI-AIRTEL

1. Capital The capital structure of Bharti-Airtel is explained below:

(In 000 Rs.) Authorised Capital Issued Capital Paid up Capital

2007 25,000,000 18,959,342 18,959,342

2006 25,000,000 18,938,793 18,938,793

2005 25,000,000 18,533,668 18,533,668

Share-holding Pattern:

% of share holding

25.05% 45.48% Promoter holding Institutional investor Others 29.47%

2. Nominal Value of Capital

Face Value The face value of shares remains constant at Rs. 10 throughout this period. Change in Face value- There is no change in the face value.

27

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

3. Issue Price of shares

Share Premium

The Share premium at the beginning of financial year 2005 is Rs. 31,254,879,000. It changed to Rs. 38,754,546,000 by the end of the financial year and to Rs. 39,259,225,000 at the end of financial year 2006. While no new shares were issued the change is due to other reasons which are illustrated below.

4. Dividend Distribution

For the year ending 2005-2006 The directors believe that there are tremendous growth opportunities available to the telecom sector and the Company should leverage these by further expanding and strengthening its existing network. This will enhance shareholder value in the long-term. Accordingly, the directors did not recommend any dividend for the year ended March 31, 2006, in view of the proposed investments in network expansion and operations.

However this does not explain the change in share capital. The change in share capital can be explained by the following: The Company allotted 2,722,125 Equity Shares of Rs. 10/- each upon merger of Bharti Cellular Limited (BCL) into the Company. During the year the Company allotted 18,242,237 equity shares upon conversion of Foreign Currency Convertible Bonds (FCCBs) by their holders. During the year ended March 31, 2006 the Company had also issued 20,088,445 equity shares of Rs. 10/- each fully paid up to M/s. Shyam Cellular Infrastructures Projects Limited upon conversion of Optionally Convertible Redeemable Debentures (OCRDs).

28

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

For the year ending 2006-2007

The company did not declare any dividends because of the reasons as mentioned previously. But during the year, The Company allotted 165400 equity shares on exercise of stock options to the employees of the company under the Companys ESOP Scheme 2005. The Company also allotted 1889453 equity shares upon conversion of Foreign Currency Convertible Bonds (FCCBs) by their holders.

Due to these the corporate actions, the issued, subscribed and paid-up equity share capital increased from 1,893,879,304 (March 31, 2006) to 1,895,934,157 equity shares as of March 31, 2007.

5. Rights Issue

No rights issue was brought out for the period 2005-2007.

6. Market Capitalisation The company had a market capitalization of over Rs. 760 billion for the year ending 31st March 2006 and was among the top 10 listed entities in India. For the year ending 31st March 2007, the Company had a market capitalisation of USD 38 bn and is among the top 5 listed entities in India.

29

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7. MV/BV Ratio 31st March 2007 Capital +Reserves (in Rs) (A) No. Of Equity Shares(B) Book Value(BV) = A/B Market Value(MV) MV/BV 12.05 10.62 7.21 730.60 412.85 206.85 60.59 38.87 28.70 1,895,934,157 1, 893,879,304 1,853,366,767 1,148,883,838,000 31st March 2006 73,623,863,000 31st March 2005 53,200,292,000

Thus we see that the MV/BV ratio has shown a positive increase over the period considered.

6.3 FINANCIAL STATEMENTS

Consolidated Balance Sheet All Figures in 000

2007 Capital Reserves LTL CL Total Fixed Assets Investments CA Total 19,259,346 95,173,342 55,474,673 98,446,711 268,354,072 216,814,497 7,058,179 44,454,766 268,327,442 2006 19,060,053 54,395,531 49,853,367 66,991,634 190,300,585 153,481,269 7,196,981 29,622,335 190,300,585 2005 18,560,889 34,639,403 50,951,920 43,199,744 147,351,956 107,594,459 9,318,953 30,438,533 147,351,945

30

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Consolidated Income Statement All Figures in 000

2007 Sales COGS Operating Expenses Depreciation PBIT Interest PBT Tax PAT 177,944,343 220,849 105,121,756 23,533,010 43,455,272 2,558,440 46,013,712 6,055,561 40,332,265 2006 112,905,793 674,043 71,445,970 14,323,385 25,113,966 2,256,011 22,857,955 2,737,160 20,120,794 2005 79,441,940 721,037 48,780,762 10,193,626 18,101,946 2,459,184 15,642,762 3,536,023 12,106,739

Consolidated Cash Flow Statement All Figures in 000

2007 Opening CIH CFF CFI CFO Closing CIH 3,074,285 3,401,320 -79,750,547 81,079,547 7,804,605 2006 3,841,352 3,763,474 -50,843,891 46,313,349 3,074,284 2005 1,316,310 -4,230,893 -23,303,010 30,058,945 3,841,352

31

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

6.4 ACCOUNTING POLICIES

1. BASIS OF PREPARATION

These financial statements have been prepared under the historical cost convention on the accrual basis of accounting, in accordance with the generally accepted accounting principles in India and the provisions of the Companies Act, 1956 as adopted consistently by the Company.

2. FIXED ASSETS

Fixed Assets are stated at cost of acquisition and subsequent improvements thereto, including taxes, duties, freight and other incidental expenses related to acquisition and installation. Capital work-in-progress is stated at cost. Site restoration cost obligations are capitalized when it is probable that an outflow of resources will be required to settle the obligation and a reliable estimate of the amount can be made. The fixed component of license fee payable by the Company for cellular and basic circles, upon migration to the National Telecom Policy (NTP 999), i.e. Entry Fee and the one time license fee paid by the Company for acquiring new licenses (post NTP-99) has been capitalized as an asset.

3. DEPRECIATION / AMORTISATION

Depreciation is provided on straight-line method at the rates and in the manner prescribed in Schedule XIV to the Companies Act, 1956 on all assets, except for the following on which depreciation is provided on straight line method to write off the cost of the fixed assets over their estimated useful lives as below:

Useful lives Building Building on Leased Land 20 years 20 years 32

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Office Equipment Computer / Software Vehicles Furniture and Fixtures Plant & Machinery Leasehold Land Leasehold Improvements

5 years/2 years 3 years 5 years 5 years 3 years / 5 years/ 10 years / 15 years Period of lease Period of lease or 10 years whichever is less

Software up to Rs. 500,000 is written off in the year placed in service. Bandwidth capacity is amortized over the period of the agreement subject to a maximum of 15 years.

Additional depreciation is provided as appropriate, towards diminution in value of assets. The Entry Fee capitalised is being amortised equally over the period of the license and the one time licence fee is being amortized equally over the balance period of licence from the date of commencement of commercial operations.

The site restoration cost obligation capitalized is being depreciated over the period of the useful life of the related asset.

4. REVENUE RECOGNITION AND RECEIVABLES

Mobile Services: Service revenue is recognised on completion of provision of services. Service revenue includes income on roaming commission and access charges passed on to other operators, and are net of discounts and waivers. Revenue, net of discount, from sale of goods is recognised on transfer of all significant risks and rewards to the customer and when no significant uncertainty exists regarding realisation of the consideration. Processing fees on recharge coupon is being recognised over the estimated customer relationship period or coupon validity period, as applicable.

Telephone and Broadband and Enterprise Services Carriers

33

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Service revenue is recognised on completion of provision of services. Revenue on account of bandwidth service is recognised on time proportion basis in accordance with the related contracts. Service Revenue includes access charges passed on to other operators, and is net of discounts and waivers. Revenue, net of discount, from sale of goods is recognized on transfer of all significant risks and rewards to the customer and when no significant uncertainty exists regarding realisation of consideration.

Enterprise Services Corporate Revenue, net of discount, from sale of goods is recognised on transfer of all significant risks and rewards to the customer and when no significant uncertainty exists regarding realisation of consideration.105 Service Revenues includes revenues from registration, installation and provision of Internet and Satellite services. Registration fees is recognised at the time of dispatch and invoicing of Start up Kits. Installation charges are recognised as revenue on satisfactory completion of installation of hardware and service revenue is recognized from the date of satisfactory installation of equipment and software at the customer site and provisioning of Internet and Satellite services. Revenue from prepaid dialup packs is recognised on the actual usage basis and is net of sales return and discount.

Activation Income Activation revenue and related direct activation costs, not exceeding the activation revenue, are deferred and amortized over the related estimated customers relationship period, as derived from the estimated customer churn period.

Investing and other activities Income on account of interest and other activities are recognised on an accrual basis. Dividends are accounted for when the right to receive the payment is established.

Provision for doubtful debts The Company provides for amounts outstanding for more than 90 days in case of active subscribers and for all amounts outstanding from customers who have been deactivated

34

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

as reduced by security deposits or in specific cases where management is of the view that the amounts are not recoverable. For receivables due from the other operators on account of their NLD and ILD traffic, IUC and roaming charges, the Company provides for amounts outstanding for more than 120 days from the date of billing net of any amounts payable to the operators or in specific cases where management is of the view that the amounts are not recoverable.

5. INVENTORIES

Inventories are valued at the lower of cost and net realisable value. Cost is determined on First in First out basis.

6. INVESTMENT Current Investments are valued at lower of cost and fair market value. Long term Investments are valued at cost. Provision is made for diminution in value to recognise a decline, if any, other than that of temporary nature.

7. LEASES

a) Operating Lease Lease rentals in respect of assets taken on 'Operating Lease' are charged to the Profit and Loss Account on a straight-line basis over the lease term.

b) Finance Lease Assets acquired on 'Finance Lease' which transfer risk and rewards of ownership to the Company are capitalized as assets by the Company at the present value of the related lease payments Amortization of capitalized leased assets is computed on the Straight Line method over the useful life of the assets. The finance charge is allocated over the lease term so as to produce a constant periodic rate of interest on the remaining balance of liability.

35

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

8. TAXATION

Tax expense for the period, comprising current tax, deferred tax and fringe benefit tax is included in determining the net profit/ (loss) for the period. Deferred tax assets are recognised for all deductible timing differences and carried forward to the extent there is reasonable certainty that sufficient future taxable profit will be available against which such deferred tax assets can be realised. Deferred tax is not recognized for such timing differences which reverse during tax holiday period. Deferred tax assets to the extent they pertain to brought forward losses and unabsorbed depreciation, are recognized only to the extent that there is virtual certainty of realisation, based on expected profitability in the future as estimated by the Company. Deferred tax assets and liabilities are measured at the tax rates that have been enacted or substantively enacted by the balance sheet date.

9. BORROWING COST

Borrowing cost attributable to the acquisition or construction of a qualifying asset is capitalised as part of the cost of that asset. Other borrowing costs are recognised as an expense in the period in which they are incurred.

10. IMPAIRMENT OF ASSETS

Assets that are subject to amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognized for the amount by which the assets' carrying amount exceeds its recoverable amount. The recoverable amount is the higher of the assets' fair value less costs to sell and value in use. For the purpose of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash generating units).

36

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

11. EARNING PER SHARE

The earnings considered in ascertaining the Company's Earnings per Share ('EPS') comprise the net profit after tax. The number of shares used in computing basic EPS is the weighted average number of shares outstanding during the year. The diluted EPS is calculated on the same basis as basic EPS, after adjusting for the effects of potential dilutive equity shares unless impact is anti dilutive.

12. PROVISIONS

Provisions are recognised when the Company has a present obligation as a result of past events; it is more likely than not that an outflow of resources will be required to settle the obligation; and the amount has been reliably estimated.

37

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7. Ratio Analysis

Various Financial Ratio Analysis are used to analyse the financial performance of Bharti Airtel Ltd. Its performance is also compared against BSNL and VSNL for 3 years from 2005 to 2007. Since the financial figures of BSNL was not available for the year 20062007, so we tracked back a year and showed its figures for the year 2003-2004.

7.1 LIQUIDITY RATIOS

Liquidity ratios help in determining the ability of a firm to meet its short term obligations.

7.1.1 Current Ratio

Current Ratio = Current Asset / Current Liability It is a simple guide to the ability of a company to meet its short term obligations. The current ratio is a good diagnostic tool as it measures whether or not your business has enough resources to pay its bills over the next 12 months. Higher the ratio higher is the liquidity.

Current Ratios

2.5 2 Current Ratio 1.5 1 0.5 0 2003-2004 2004-2005 Period 2005-2006 2006-2007 Bharti Airtel Ltd VSNL BSNL

Current Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 1.36

2004-2005 0.70 1.99 1.79

2005-2006 0.44 1.32 2.02

2006-2007 0.45 1.25 NA

38

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

The current ratio of Bharti Airtel Ltd has consistently remained less than 1. So its current liability is greater than the current assets which implies that its short term liquidity requirements might be financed by long term sources. In comparison, the current ratios of VSNL and BSNL are better.

7.1.2 Liquid Ratio

Liquid Ratio = (Current Asset Inventory) / Current Liability A better approach to measure the ability of a company to meet its short term liability is by excluding the inventory from the current asset. This is done because it is unlikely to turn inventory to cash immediately. It is thus a measure of how quickly a companys asset can be converted to cash. This ratio is also called the acid test and quick ratio.

Liquid Ratios

2.5 2 Liquid Ratio 1.5 1 0.5 0 2003-2004 2004-2005 Period 2005-2006 2006-2007 Bharti Airtel Ltd VSNL BSNL

Liquid Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 1.24

2004-2005 0.7 1.98 1.69

2005-2006 0.44 1.31 1.91

2006-2007 0.45 1.25 NA

Since the companies are all service oriented, they do not have inventories and hence the liquid ratios are almost similar to the current ratios calculated above. The liquid ratio of

39

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Bharti Airtel Ltd is well below 0.5 which indicates that it is able to meet only half of the current obligations from its current assets. The liquid ratios of VSNL and BSNL are much healthier than Bharti Airtel Ltd.

7.1.3 Absolute Cash Ratio

Absolute Cash Ratio = (Cash + Near Cash Items) / Current Ratio This ratio is still better in calculating the liquidity as it does not take into the debts in the current asset.

Absolute Cash Ratios

1.4 Absolute Cash Ratio 1.2 1 0.8 0.6 0.4 0.2 0 2003-2004 2004-2005 Period 2005-2006 2006-2007 Bharti Airtel Ltd VSNL BSNL

Absolute Current Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.58

2004-2005 0.09 0.08 1

2005-2006 0.05 0.06 1.22

2006-2007 0.08 0.14 NA

Absolute Current Ratio is very low for Bharti Airtel Ltd and VSNL. This shows that very little cash reserve is being maintained to meet the short term obligations.

7.1.4 Debtor Days

Debtor Days = Debtors / Sales per day This ratio measures the number of times that receivables turn over during the year. The lower the turnover of receivables, the shorter the time between sale and cash collection. If 40

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

a company's debtor days is significantly higher than industry norms, the underlying reason (poor collection methods, high risk customers, low sales) needs to be pinpointed. Debtor Days measures the average time in days that receivables are outstanding. The higher the number of days outstanding, the greater the collection risk. Debtor days may suggest a concern over credit control and collections

Debtor Days

90 80 70 60 50 40 30 20 10 0 2003-2004 2004-2005 Period 2005-2006 2006-2007

Debtor days

Bharti Airtel Ltd VSNL BSNL

Debtor Days Bharti Airtel Ltd VSNL BSNL

2003-2004 42.82

2004-2005 32.89 57.30 67.12

2005-2006 34.79 67.14 57.25

2006-2007 29.10 81.96 NA

The Debtor days for Bharti Airtel Ltd has decreased over the last year. In a year credit sales takes place only for 29 days and it is much lower as compared to its competitors thus indicating it has healthy debt collection practices.

7.1.5 Creditor Days

Creditor Days = Creditors / Purchase of goods per day This ratio measures the number of times that Accounts Payable turns over during the year relative to the Sales. Lower turnover rates suggest a shorter time period between purchase

41

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

and payment. Higher than industry rates may suggest cash shortages, or expansion of trade credit. Creditor days tells the average length of time trade debt is outstanding.

Creditor Days Bharti Airtel Ltd

2003-2004 -

2004-2005 40.31

2005-2006 82.98

2006-2007 133.20

Creditor days for VSNL and BSNL could not be calculated because COGS is not available for them. Bharti Airtel Ltd follows a trend of increasing Creditor days thus indicating it takes longer to pay to its creditors. In a year it makes purchases on credit for 133 days.

7.1.6 Inventory Days

Inventory Days = Inventory / COGS per day A financial measure of a company's performance that gives an idea of how long it takes a company to turn its inventory into sales. Generally, the lower (shorter) the Inventory days the better, but it is important to note that the average varies from one industry to another.

Inventory Days Bharti Airtel Ltd

2003-2004 -

2004-2005 159.88

2005-2006 96.09

2006-2007 790.24

Inventory days for VSNL and BSNL could not be calculated because COGS is not available for them. Bharti Airtel Ltd being a telecom service based company has very little inventory. In 2006-2007 the inventories were doubled but the COGS were halved.

7.2 SOLVENCY RATIOS

Its the companys ability to meet its long term obligations. Also called the capital structure it is one of the major financing decisions for the company. A proper mix of debt and equity is said to be always beneficial for the company rather than pure equity. Existence of debt disciplines the management to some extent.

42

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7.2.1 Debt Ratio

Debt Ratio = Debt / Total Assets This ratio shows how much the business is in debt, making it a good way to check the businesss long-term solvency. The lower the debt ratio, the less total debt the business has in comparison to its asset base. On the other hand, businesses with high debt ratios are in danger of becoming insolvent and/or going bankrupt.

Debt Ratios

0.4 0.35 0.3 Debt Ratio 0.25 0.2 0.15 0.1 0.05 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

Debt Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.14

2004-2005 2005-2006 2006-2007 0.35 0.01 0.11 0.26 0.02 0.08 0.21 0.03 NA

The Debt ratio of Bharti Airtel Ltd is higher as compared to VSNL and BSNL but it has a decreasing trend over the past 3 years and is at a healthy level.

7.2.2 Equity Ratio

Equity Ratio = Equity / Total Assets It helps in determining the extent of funding from equity channel.

43

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Equity Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.66

2004-2005 0.36 0.75 0.69

2005-2006 0.39 0.75 0.7

2006-2007 0.43 0.75 NA

Bharti Airtel Ltd uses a good mix of Reserves, Equities and Debts to fund its business.

7.2.3 Debt to Equity Ratio

Debt to Equity Ratio = Debt / Equity The debt to equity ratio is a financial ratio indicating the relative proportion of equity and debt used to finance a company's assets. It is considered to be a good practice to use both Debt (financial leverage) and Equities to finance the assets.

44

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Debt Equity Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.21

2004-2005 0.97 0.01 0.16

2005-2006 0.67 0.03 0.11

2006-2007 0.49 0.04 NA

Bharti Airtel Ltd has reduced the Debt to Equity ratio consistently. This is because of the company is reinvesting the Profits into the business. This shows the strong confidence on the future outlook of the business.

7.2.4 Interest Coverage Ratio

Interest Coverage Ratio = PBIT / Interest Expense A ratio used to determine how easily a company can pay interest on outstanding debt. The lower the ratio, the more the company is burdened by debt expense. When a company's interest coverage ratio is 1.5 or lower, its ability to meet interest expenses may be questionable. An interest coverage ratio below 1 indicates the company is not generating sufficient revenues to satisfy interest expenses.

45

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Interest Coverage Ratio Bharti Airtel Ltd BSNL

2003-2004 10.29

2004-2005 7.36 271.4

2005-2006 11.13 8.75

2006-2007 16.99 NA

The Interest Coverage Ratio of VSNL is not shown because its interest expense is very low as compared to its PBIT. Bharti Airtel Ltd has healthy Interest Coverage Ratio because of increased profits.

7.2.5 Debt Service Coverage Ratio

DSCR = PBIT / Total Debt Service It is the amount of cash flow available to meet annual interest and principal payments on debt. Debt service coverage ratio is used by financial lenders as a rule of thumb to give a preliminary assessment of whether a potential borrower is already in too much debt. More specifically, this ratio shows the proportion of income that is already spent on loan service payments.

DSCR Bharti Airtel Ltd VSNL

2004-2005 1.16 16.72

2005-2006 0.68 5.21

2006-2007 0.91 7.35

DSCR of BSNL could not be calculated since the loan repayments were not available. DSCR of Bharti Airtel Ltd is low because of the high loan repayments. The Long term loans are increasing every year and are being used for funding expansion plans. There is consequently a higher repayment of loans every year.

46

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7.3 PROFITABILITY RATIOS

Profitability ratios are used to analyse the profitability of the company. Different stakeholders will have different perspective on the profitability ratios. Shareholders: They may be concerned about the ability of the company to maintain and improve the value of their investments. They look to the company to generate sufficient profits for dividend payments and increase in market value of the shares they own. Lenders: They will be interested to see whether the company has the ability to pay the interests of the debts. Management and employees: They will be interested in knowing the performance of the company and its future outlook and profitability gives a good idea about the same.

7.3.1 Gross Profit (PBDITA) / Sales Ratio

Gross Profit / Sales = Profit before Depreciation Interest Tax and Amortisation / Sales This ratio helps in determining extent to which the sales are greater than the operating expenses.

47

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Gross Profit/Sales Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 55.89%

2004-2005 35.62% 33.46% 48.70%

2005-2006 34.93% 26.13% 47.08%

2006-2007 37.65% 26.11% NA

The gross profit for Bharti Airtel Ltd has improved as compared to the last year. The profitability is extremely good as it is sustained with growing sales.

7.3.2 Operating Profit (PBIT) / Sales Ratio

Operating profit / Sales = Profit before Interest Tax / Sales Operating profit is obtained by deducting the Depreciation and Amortisation from Gross profit.

Operating Profit / Sales Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 26.78%

2004-2005 22.79% 27.17% 22.03%

2005-2006 22.24% 17.17% 23.74%

2006-2007 24.42% 16.91% NA

48

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

The Operating profit of Bharti Airtel has improved over last years. The depreciation has more than doubled over last 2 years because of increase in Assets but the sales has increase in sales has ensured a healthy profit.

7.3.3 Net Profit (PAT) / Sales Ratio

Net Profit / Sales = Profit After Tax / Ratio Net profit is obtained by deducting the Tax from the operating profit. This is finally the profit that the company gets to earn after incurring all kinds of expenses.

PAT/Sales Ratios

0.3 PAT/Sales Ratio 0.25 0.2 0.15 0.1 0.05 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

Net Profit / Sales Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 17.62%

2004-2005 15.24% 19.50% 28.22%

2005-2006 17.82% 11.96% 22.25%

2006-2007 22.67% 11.01% NA

The PAT of Bharti Airtel Ltd has significantly improved in the last year. This is significant especially when the call tariffs are reducing. Increase in sales is the main contributing factor for increase in profits.

49

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7.4 RETURN ON INVESTMENT

Return on Investment shows the profits earned from investments in different perspective like Networth, Capital employed and Total assets.

7.4.1 RONW

RONW = PAT / (Capital + Reserve) This is the best measure of profitability to evaluate overall return. This ratio measures return relative to investment in the company. Return on Net Worth indicates how well a company leverages the investment in it.

RONW Bharti Airtel Ltd VSNL BSNL

2003-2004 9.00%

2004-2005 23.00% 13.00% 14.00%

2005-2006 27.00% 8.00% 11.00%

2006-2007 35.00% 7.00% NA

RONW for Bharti Airtel Ltd. is much higher as compared to its competitors. This is mainly because the company finances its future investments from its own profits and the PAT has increased by 233% over last 2 years.

50

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

7.4.2 ROCE

ROCE = PBIT / (Capital + Reserve + Long Term Liability) ROCE should always be higher than the rate at which the company borrows, otherwise any increase in borrowing will reduce shareholders' earnings.

ROCE

0.3 0.25 0.2 ROCE 0.15 0.1 0.05 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

ROCE Bharti Airtel Ltd VSNL BSNL

2003-2004 12.00%

2004-2005 17.00% 18.00% 9.00%

2005-2006 20.00% 11.00% 11.00%

2006-2007 26.00% 11.00% NA

Bharti Airtel Ltds ROCE is much higher than the borrowing rate which is around 10%. So the shareholders earnings are not reduced.

7.4.3 ROTA

ROTA = PBIT / Total Assets A ratio that measures a company's profits before interest and taxes (PBIT) against its total assets. The ratio is considered an indicator of how effectively a company is using its assets to generate earnings before contractual obligations must be paid. The greater a company's profits in proportion to its assets, the more effectively that company is said to be using its assets.

51

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

ROTA

0.18 0.16 0.14 0.12 0.1 0.08 0.06 0.04 0.02 0 2003-2004 2004-2005 2005-2006 2006-2007 Period

ROTA

Bharti Airtel Ltd VSNL BSNL

ROTA Bharti Airtel Ltd VSNL BSNL

2003-2004 0.09

2004-2005 0.12 0.14 0.07

2005-2006 0.13 0.09 0.08

2006-2007 0.16 0.08 NA

Bharti Airtel has the highest ROTA as compared to its competitors which indicates that it uses its assets most efficiently. Another positive is that its constantly in an increasing trend.

7.4.4 EPS

EPS = PAT / No of shares The portion of a company's profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company's profitability. Earnings per share is generally considered to be the single most important variable in determining a share's price. An important aspect of EPS is that the capital that is required to generate the earnings (net income) in the calculation is often ignored. Two companies could generate the same EPS number, but one could do so with less equity (investment) - that company would be

52

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

more efficient at using its capital to generate income and, all other things being equal, would be a "better" company. Investors also need to be aware of earnings manipulation that will affect the quality of the earnings number. It is therefore important not to rely on any one financial measure, but to use it in conjunction with statement analysis and other measures.

Earnings per Share

30 Earnings per Share (Rs) 25 20 15 10 5 0 2003-2004 2004-2005 Period 2005-2006 2006-2007 Bharti Airtel Ltd VSNL BSNL

EPS Bharti Airtel Ltd VSNL BSNL

2003-2004 4.78

2004-2005 6.39 26.54 8.15

2005-2006 10.61 16.83 7.15

2006-2007 21.27 16.44 NA

The EPS for Bharti Airtel Ltd has significantly increased as compared to the last year. This is because of the doubling of the profits in just 1 year. Since ROTA of Bharti Airtel Ltd is also higher as compared to its competitors so it is most efficient and profitable of the three companies.

7.5 EFFICIENCY RATIOS 7.5.1 Total Assets Turnover Ratio

Total Assets Turnover Ratio = Sales / Total Assets

53

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

This ratio tells us how efficiently the company uses its assets to generate sales.

Total Assets Turnover Ratios

Total Assets Turnover Ratio 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

Total Assets Turnover Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.35

2004-2005 0.54 0.51 0.34

2005-2006 0.59 0.5 0.35

2006-2007 0.66 0.5 NA

The above ratios indicate that Bharti Airtel Ltd is the most efficient in generating sales. This ratio has consistently increased over the last 3 years.

7.5.2 Debt Turnover Ratio

Debt Turnover Ratio = Sales / Debt This ratio would be of greater significance to the lenders as it indicates how sales of a company against the debts.

54

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Debt Turnover Ratios

45 40 35 30 25 20 15 10 5 0 2003-2004 2004-2005 Period 2005-2006 2006-2007

Debt Turnover Ratio

Bharti Airtel Ltd VSNL BSNL

Debt Turnover Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 2.6

2004-2005 1.56 38.92 3.2

2005-2006 2.26 23.13 4.47

2006-2007 3.21 15.8 NA

Bharti Airtel Ltd has been able to increase its Debt Turnover ratio due to sharp increase in its sales as compared to its borrowings.

7.5.3 Fixed Asset Turnover

Fixed Asset Turnover Ratio = Sales / Fixed Assets This ratio gives an indication of how efficiently a company uses its fixed assets in doing its business.

55

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Fixed Assets Turnover Ratios

Fixed Assets Turnover Ratio 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

Fixed Assets Turnover Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 0.49

2004-2005 0.74 1.36 0.54

2005-2006 0.74 1.27 0.63

2006-2007 0.82 1.22 NA

Bharti Airtel Ltd has improved its Fixed Turnover ratio primarily by increasing its sales as compared to the increase in Fixed assets. Its more efficient in utilizing its Fixed assets than BSNL but less as compared to VSNL.

7.5.4 Current Asset Turnover

Current Asset Turnover = Sales / Current Assets

56

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Current Assets Turnover Ratios

4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Current Assets Turnover Ratio

Bharti Airtel Ltd VSNL BSNL

Current Assets Turnover Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 1.24

2004-2005 2.61 1.09 0.92

2005-2006 3.81 1.66 0.8

2006-2007 4 1.84 NA

7.5.5 Inventory Turnover

Inventory Turnover = Sales / Inventory This financial ratio measures the number of times inventory is turned over during the year. High inventory turnover suggests good levels of liquidity. Conversely it can indicate a shortage of needed inventory for sales. Low inventory turnover can indicate poor liquidity, overstocking, or, more optimistically, a planned inventory buildup.

57

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Inventory Turnover Ratios

2500 Inventory Turnover Ratio 2000 1500 1000 500 0 2003-2004 2004-2005 2005-2006 2006-2007 Period Bharti Airtel Ltd VSNL BSNL

Inventory Turnover Ratio Bharti Airtel Ltd VSNL BSNL

2003-2004 14.47

2004-2005 251.53 1974.03 16.07

2005-2006 636.29 1055.19 14.4

2006-2007 372.16 901.27 NA

Since the three companies are in Telecom Service providers so they do not maintain a high inventory. This is the reason why the inventory ratios are very high for Bharti Airtel Ltd and VSNL.

58

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

8. DUPONT ANALYSIS

Financial statement analysis is employed for a variety of reasons. Outside investors are seeking information as to the long run viability of a business and its prospects for providing an adequate return in consideration of the risks being taken. Creditors desire to know whether a potential borrower or customer can service loans being made. Internal analysts and management utilize financial statement analysis as a means to monitor the outcome of policy decisions, predict future performance targets, develop investment strategies, and assess capital needs. As the role of the credit manager is expanded crossfunctionally, he or she may be required to answer the call to conduct financial statement analysis under any of these circumstances. The DuPont ratio is a useful tool in providing both an overview and a focus for such analysis

A comprehensive financial statement analysis will provide insights as to a firm's performance and/or standing in the areas of liquidity, leverage, operating efficiency and profitability. A complete analysis will involve both time series and cross-sectional perspectives. Time series analysis will examine trends using the firm's own performance as a benchmark. Cross sectional analysis will augment the process by using external performance benchmarks for comparison purposes. Every meaningful analysis will begin with a qualitative inquiry as to the strategy and policies of the subject company, creating a context for the investigation. Next, goals and objectives of the analysis will be established, providing a basis for interpreting the results. The DuPont ratio can be used as a compass in this process by directing the analyst toward significant areas of strength and weakness evident in the financial statements.

ROCE = (PBIT/Sales) X (Sales/Total Assets) X (Total Assets/Capital Employed)

The ratio provides measures in three of the four key areas of analysis, each representing a compass bearing, pointing the way to the next stage of the investigation.

59

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

8.1 THE DUPONT RATIO DECOMPOSITION

The DuPont ratio is a good place to begin a financial statement analysis because it measures the return on investment (ROI). A for-profit business exists to create wealth for its owner(s). ROI is, therefore, arguably the most important of the key ratios, since it indicates the rate at which owner wealth is increasing. While the DuPont analysis is not an adequate replacement for detailed financial analysis, it provides an excellent snapshot and starting point, as will be seen below.

The three components of the DuPont ratio, as represented in equation (1), cover the areas of profitability, operating efficiency and leverage (liquidity analysis needs to be conducted separately). Thus we will examine the meaning of each of these components by calculating and comparing the DuPont ratio using the financial statements for Bharti Airtel Ltd. We will be doing this by employing ROCE that is Return on Capital Employed. Then carrying out decomposition we can study the finer implications.

8.1.1 Profitability: Net Profit Margin (NPM: PBIT/Sales)

Profitability ratios measure the rate at which either sales or capital is converted into profits at different levels of the operation. The most common are gross, operating and net profitability, which describe performance at different activity levels. Of the three, net profitability is the most comprehensive since it uses the bottom line net income in its measure.

8.1.2 Operating Efficiency or Asset Utilization: Total Asset Turnover (Sales/Total Assets)

Turnover or efficiency ratios are important because they indicate how well the assets of a firm are used to generate sales and/or cash. While profitability is important, it doesn't always provide the complete picture of how well a company provides a product or service. A company can be very profitable, but not too efficient. Profitability is based 60

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

upon accounting measures of sales revenue and costs. Such measures are generated using the matching principle of accounting, which records revenue when earned and expenses when incurred. Hence, the gross profit margin measures the difference between sales revenue and the cost of goods actually sold during the accounting period. The goods sold may be entirely different from the goods produced during that same period. Goods produced but not sold will show up as inventory assets at the end of the year. A firm with abnormally large inventory balances is not performing effectively, and the purpose of efficiency ratios is to reveal that fact.

The total asset turnover ratio measures the degree to which a firm generates sales with its total asset base. As in the case of net profitability, the most comprehensive measure of performance in this particular area is being employed in the DuPont ratio (other measures being fixed asset turnover, working capital turnover, and inventory and receivables turnover). It is important to use average assets in the denominator to eliminate bias in the ratio calculation.

8.1.3 Leverage: The Leverage Multiplier (Total Assets/Capital Employed)

Leverage ratios measure the extent to which a company relies on debt financing in its capital structure. Debt is both beneficial and costly to a firm. The cost of debt is lower than the cost of equity, an effect which is enhanced by the tax deductibility of interest payments in contrast to taxable dividend payments and stock repurchases. If debt proceeds are invested in projects which return more than the cost of debt, owners keep the residual, and hence, the return on equity is "leveraged up." The debt sword, however, cuts both ways. Adding debt creates a fixed payment required of the firm whether or not it is earning an operating profit, and therefore, payments may cut into the equity base. Further, the risk of the equity position is increased by the presence of debt holders having a superior claim to the assets of the firm.

61

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

8.2 HIGHLIGHTS OF DUPONT ANALYSIS

Sound financial statement analysis is an integral part of the management process for any organization. The DuPont ratio, while not the end in itself, is an excellent way to get a quick snapshot view of the overall performance of a firm in three of the four critical areas of ratio analysis, profitability, operating efficiency and leverage. By identifying strengths and/or weaknesses in any of the three areas, the DuPont analysis enables the analyst to quickly focus his or her detailed study on a particular spot, making the subsequent inquiry both easier and more meaningful. Some caveats, however, are to be noted.

The DuPont ratio consists of very general measures, drawing from the broadest values on the balance sheets and income statements (e.g., total assets are the broadest of asset measures). A DuPont study is not a replacement for detailed, comprehensive analysis. Further, there may be problems that the DuPont decomposition does not readily identify. For example, an average outcome for net profitability may mask the existence of a low gross margin combined with an abnormally high operating margin. Without looking at the two detailed measures, understanding of the true performance of the firm would be lost. The ROCE first can be broken down into the three segments we already looked at. Then each of these can be broken up further to study the finer details. Each component comprises of several sub-components which give a complete holistic view of the workings of a company comprising its investment, financing and operating decisions. A proper decomposition is very important to actually pin-point the exact area which are outperforming or underperforming, this analysis gives us a better idea as to where exactly is the company lacking, is it something very superficial or fundamental. Thus all this can be used to understand the future prospects as well its current efficiency. Down below we have carried out the DuPont analysis for Bharti Airtel for three years. The time-series analysis in terms of ratios has already been studied in the previous segments, here we are focusing more on the finer implications of the ratios and seeing how one derives from the other and finally where does it fit in the larger picture.

62

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Return on Capital Employed 2007

ROCE 0.28 PBIT/Sales 0.28 Sales/TA 0.66 TA/CE 1.58

COGS/Sales 0.0012

Oper Exp./Sales

Sales/FA 0.92

Sales/CA 4 Sales/Stock 372.16

TA/OF 2.35

TA/LTL 5.05 TA/Capital 13.9 TA/RS 2.82

0.59 Salary/Sales 0.07

Other exp/ Sales

Sales/Debtor 12.54 Sales/Cash 22.8

0.52 Dep/Sales 0.130 Amort/Sales 0.010

Implications: As we can see from the above analysis, the company has decent profitability and efficiency figures. Also one very interesting thing to note here is that the sales turnover with relation to stock is pretty high, that tells us that the company does not maintain very huge inventories. Also the sales as a proportion of debtors are also quite high, that could also mean that the company is efficient enough in collecting its debt. And a large chunk of its sales must comprise of cash sales. Also if we see the break-up of the Sales/TA, we figure out that the Sales as a component of CA is almost four times as compared to that of FA. This can mean that the proportion of CA in comparison with FA is very less, which as we have seen earlier could be attributed to low inventories and less credit sales.

63

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Return on Capital Employed 2006

ROCE

0.19

PBIT/Sales

0.22

Sales/TA

0.37

TA/CE

2.46

COGS/Sales

0.006

Oper Exp./Sales 0.63

Sales/FA

0.74

Sales/CA

3.81

TA/OF

4.13

TA/LTL

6.08

Sales/Stock

636.29

TA/Capital

15.9

Salary/Sales

0.071

Other exp/ Sales 0.56

Sales/Debtor

10.49

TA/RS

5.57

Sales/Cash

36.73

Dep/Sales

0.127

Amort/Sales

0.011

Implications:

This year can be studied in relation to 2007. Doing that we note that in 2006 the sales as a proportion of Stock was double of what it became in 2007. And the general trend of the company, which was high reliance on current assets as compared to Fixed Assets, can be very well traced from 2006 to 2007.

64

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

One thing to note here is the break-up of Total-assets as a function of Owners Fund. We see that the TA/Capital ratio is almost triple of the TA/RS ratio. This means that the owners fund comprises mainly of profits i.e. is reserves and surplus and that the capital is almost thrice of the total reserves.

Return On Capital Employed 2005

ROCE

0.15

PBIT/Sales

0.23

Sales/TA

0.35

TA/CE

2.18

COGS/Sales

0.0091

Oper Exp./Sales

Sales/FA

0.74

Sales/CA

2.61

TA/OF

4.26

TA/LTL

4.45

0.61

Sales/Stock

251.53

TA/Capital

12.2

Salary/Sales

0.065

Other exp/ Sales

Sales/Debtor

11.1

TA/RS

6.55

0.55

Sales/Cash

20.68

Dep/Sales

0.128

Amort/Sales

0.015

65

Financial Accounting

Bharti Airtel/u107092/u107093/u107094

Implications:

All the general trends which have been discussed in the DuPont Analysis of 2007 and 2006 were found to hold good for 2005 as well. Thus we can conclude that, all these have been lasting trends and reflect the general working style of the company.