Professional Documents

Culture Documents

Per Seg B.R Interest Rates

Uploaded by

deep9242003Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Per Seg B.R Interest Rates

Uploaded by

deep9242003Copyright:

Available Formats

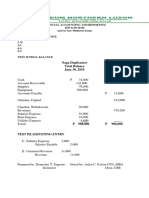

PERSONAL SEGMENT ADVANCES INTEREST RATES SBH BASE RATE- 9.50% w.e.f. 06.05.

2011

Sl. No 1 Scheme Period Amount Existing Rates at Base Rate 9.00% Housing Loan (w.e.f.23.05.2011) a) Upto 5 years Upto 30 Lacs Above 30 lacs b) 5 to 15 years Upto 30 Lacs Above 30 lacs c) 15 to 20 years Upto 30 Lacs Above 30 lacs 1.b Fixed Rate Housing Loans (Maximum Rs. 10 Lacs) Maximum term 10 years) 1.c Other Housing Loans: i) ii) VAMBAY Credit cum Subsidy Scheme Fixed at 10.00% p.a Fixed at 10.00% p.a B.R + 4.00% = 13.00% p.a B.R + 4.00% = 13.50% p.a B.R + 1.25% = 10.25% p.a Revised Rates at Base Rate 9.50% B.R + 1.25% = 10.75% p.a

B.R + 1.75% = 10.75% p.a B.R + 1.25% = 10.25% p.a

B.R + 1.50% = 11.00% p.a B.R + 1.25% = 10.75% p.a

B.R + 2.00% = 11.00% p.a B.R + 1.50% = 10.50% p.a

B.R + 1.75% = 11.25% p.a B.R + 1.25% = 10.75% p.a

B.R + 2.25% = 11.25% p.a

B.R + 2.00% = 11.50% p.a

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

iii) SBH Gruhini iv) Rajiv Gruhakalpa v) JNNURM

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

Fixed at 9.00% p.a 0.50% concession on Normal Housing Loan Interest Rates 0.50% concession on Normal Housing

Fixed at 9.00% p.a 0.50% concession on Normal Housing Loan Interest Rates 0.50% concession on Normal Housing

vi)

Rajiv-Swagruha Scheme

vii) Varun Mithra Rain Water Harvesting Scheme 2 Car Loans (w.e.f.23.05.2011) less than 3 years 3 to 5 years 5 to 7 years Old Vehicle (w.e.f.23.05.2011) Less than 3 years 3 to 5 years Upto 5.00 Lacs

As per Housing Loan Interest Rates

As per Housing Loan Interest Rates

B.R + 3.25% = 12.25% p.a

B.R +2.50% = 12.00% p.a

B.R + 3.50% = 12.50% p.a

B.R + 2.75% = 12.25% p.a

B.R + 3.75% = 12.75% p.a B.R + 6.25% = 15.25% p.a

B.R + 3.00% = 12.50% p.a B.R + 5.50% = 15.00% p.a

B.R + 6.50% = 15.50% p.a

B.R + 5.75% = 15.25% p.a

Advantage Car Loan (w.e.f.23.05.2011)

less than 3 years 3 to 5 years 5 to 7 years Above 5.00 Lacs

B.R + 3.00% = 12.00% p.a

B.R + 2.25% = 11.75% p.a

B.R + 3.25% = 12.25% p.a

B.R + 2.50% = 12.00% p.a

B.R + 3.50% = 12.50% p.a

B.R + 2.75% = 12.25% p.a

Personal Loan against Mortgage of Immovable Property- Term Loan/Overdraft Gold Loan (w.e.f. 01.06.2011) Demand Loan

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

B.R + 6.00% = 15.00% p.a

B.R + 4.50% = 14.00% p.a

Overdraft

B.R + 6.50% = 15.50% p.a

B.R + 5.00% = 14.50% p.a

Education Loan

Upto 4.00 lacs Above 4.00 lacs

B.R + 3.50% = 12.50% p.a

B.R + 3.50% = 13.00% p.a

B.R + 4.75% = 13.75% p.a

B.R + 4.75% = 14.25% p.a

Education Loan Plus Scheme

As per Education Loan

As per Education Loan

Coaching Plus Scheme Concession of 50 basis points in rate of interest on Education Loans sanctioned to girl students and all students belong to SC/ST category from 11-02-2008

As per Education Loan

As per Education Loan

SBH SARAL SCHEME

Credit Score60& above Credit Score50-60

B.R + 6.00% = 15.00 % p.a

B.R + 6.00% = 15.50 % p.a

B.R + 7.00% = 16.00% p.a

B.R + 7.00% = 16.50% p.a

7 SBH Fast Credit

With Check off Without Check off

B.R + 5.00% = 14.00% p.a

B.R + 5.00% = 14.50% p.a

B.R + 5.75% = 14.75% p.a

B.R + 5.75% = 15.25% p.a

Personal Loans to Pensioners

B.R + 5.00% = 14.00% p.a

B.R + 5.00% = 14.50% p.a

Personal Loans to Family pensioners

B.R + 5.00% = 14.00% p.a

B.R + 5.00% = 14.50% p.a

10

DL to affluent pensioners

B.R + 5.00% = 14.00% p.a B.R + 6.00% = 15.00% p.a

B.R + 5.00% = 14.50% p.a B.R + 6.00% = 15.50% p.a

11

Kanya Vivah Suvidha Scheme Udyog Bandhu Scheme SBH Tax Suvidha Scheme Adhyapak Suvidha Scheme SBH Rakshak Scheme Vanitha Gold Scheme

12

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

13

B.R + 6.50% = 15.50% p.a

B.R + 6.50% = 16.00% p.a

14

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

15

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

16

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

17

SBH Paryatan Scheme SBH Sanchar Plus Scheme SBH Rail Plus Scheme SBH Journalist Plus Scheme Credit to Credit Card holders (SBH C3 Scheme) SBH Software Professional Scheme

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

18

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

19

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

20

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

21

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

22

B.R + 5.50% = 14.50% p.a

B.R + 5.50% = 15.00% p.a

23

i)Mahila Shakthi a. Working women

B.R + 5.25% = 14.25% p.a B.R + 5.25% = 14.75% p.a

b. House wives ii)career planner a. Working women b. House wives

24

B.R + 4.00% = 13.00% p.a

B.R + 4.00% = 13.50% p.a

B.R + 3.00% = 12.00% p.a B.R + 2.25% = 11.25% p.a B.R + 7.25% = 16.25% p.a

B.R + 3.00% = 12.50% p.a B.R + 2.25% = 11.75% p.a B.R + 7.25% = 16.75% p.a

SCOOM Loan Scheme (for 2 wheelers) Loans against Public Sector Bonds Overdrafts in Public Sector Bonds Computer Loan Scheme Loans to individuals for installation of

25

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

26

B.R + 8.50% = 17.50% p.a

B.R + 8.50% = 18.00% p.a

27

B.R + 6.00% = 15.00% p.a

B.R + 6.00% = 15.50% p.a

28

B.R + 5.00% = 14.00% p.a

B.R + 5.00% = 14.50% p.a

Solar Water devices

29 30

Clean Overdrafts Loans to individual against Shares and Debentures/ Bonds/ Units/ Mutual Funds Advances against surrender value of Life Insurance Policy Loans to employees to purchase shares of their own companies under employee quota Loan against Gold Bonds

RBI Relief Bonds Adv. against Govt sec, NSC, IVP's etc Loans to landlords for const of accomodation for bank use a) Upto and inclusive of Rs. 2.00 Lacs

B.R + 8.50% = 17.50% p.a B.R + 4.50% = 13.50% p.a

B.R + 8.50% = 18.00% p.a B.R + 4.50% = 14.00% p.a

31

B.R + 3.50% = 12.50% p.a

B.R + 3.50% = 13.00% p.a

32

B.R + 1.25% = 10.25% p.a

B.R + 1.25% = 10.75% p.a

33

B.R + 4.50% = 13.50% p.a

B.R + 4.50% = 14.00% p.a

34 35

B.R + 3.50% = 12.50% p.a B.R + 3.25% = 12.25% p.a

B.R + 3.50% = 13.00% p.a B.R + 3.25% = 12.75% p.a

36

B.R + 3.50% = 12.50% p.a

B.R + 3.50% = 13.00% p.a

B.R + 4.50% = 13.50% p.a b) Above Rs. 2.00 lacs

B.R + 4.50% = 14.00% p.a

37

Loans to trainees for pilot training programme and air hostess courses (a) land and building (b) Govt sec, NSC (c) Banks TDRs/STDRs B.R + 5.25% = 14.25% p.a B.R + 5.25% = 14.75% p.a

B.R + 4.25% = 13.25% p.a 1.00 % Above the rate of interest on TDR Concession of 0.25 % on all loans other than Housing Loans

B.R + 4.25% = 13.75% p.a 1.00 % Above the rate of interest on TDR Concession of 0.25 % on all loans other than Housing Loans

38

SBH Siri Sampada Scheme

39

Reverse Mortgage Loans B.R + 3.00% = 12.00% p.a Public B.R + 2.00% = 11.00% p.a SBH Pensioners B.R + 2.00% = 11.50% p.a B.R + 3.00% = 12.50% p.a

40

Loan for Earnest money deposit for allotment of Pot/House/Flat INDIRAMMA URBAN HOUSING SCHEME NON SHG Upto 2.00 Lacs Above 2.00 Lacs

B.R + 3.50% = 12.50% p.a

B.R + 3.50% = 13.00% p.a

41

Fixed at 9.00% p.a B.R + 2.75% = 11.75% p.a

Fixed at 9.00% p.a B.R + 2.75% = 12.25% p.a

42

TL Nano Car Upto 5 years Above 5 years B.R + 2.75% = 11.75% p.a B.R + 3.00% = 12.00% p.a B.R + 2.75% = 12.25% p.a B.R + 3.00% = 12.50% p.a

43

Advances against Bank TDR ( for Domestic) a) Advance to : i) The customer(s) either singly or jointly ii) One of the partners of a partnership firm iii) The proprietor of a proprietary concern and the advance is made to such concern iv) A ward whose guardian is competent to borrow on behalf of a ward and where the advance is made to the guardian of the ward in such capacity II Advances against Bank TDRs (Domestic) b) To borrowers other than those included in a) (I to iv) Advances to third parties against Bank's own TDRs, SPL TDRs, in the name of others (irrespective of the limit) Adv. against balances in the Janata Dep. A/c a) For Public b) For staff (as laid down in the scheme approved by RBI)

1. 50 % above the interest rate allowed on the deposit

1. 50 % above the interest rate allowed on the deposit

44

i) 1.50% above the rate allowed on deposit or ii) The rate of Interest applicable to the activity financed viz. SSI/SBF/ AGR etc.( whichever is higher of the above) iii) However if the loan is granted in PER segment, rate of interest to be charged will be the same rate as applicable for clean overdrafts.

i) 1.50% above the rate allowed on deposit or ii) The rate of Interest applicable to the activity financed viz. SSI/SBF/ AGR etc.( whichever is higher of the above) iii) However if the loan is granted in PER segment, rate of interest to be charged will be the same rate as applicable for clean overdrafts.

45

B.R + 4.00% = 13.00% p.a B.R + 2.00% = 11.00% p.a

B.R + 4.00% = 13.50% p.a B.R + 2.00% = 11.50% p.a

You might also like

- Voucher Abpo 07082011Document1 pageVoucher Abpo 07082011deep9242003No ratings yet

- Aadhar Enrollment FormDocument1 pageAadhar Enrollment FormDevika BalasubramanianNo ratings yet

- The History and Evolution of Investment BankingDocument56 pagesThe History and Evolution of Investment BankingParas KumarNo ratings yet

- Mergers and AquisitionsDocument22 pagesMergers and AquisitionsAlisha AshishNo ratings yet

- Vodafone BillingDocument3 pagesVodafone Billingdeep9242003No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounting Focus NoteDocument24 pagesAccounting Focus NoteLorelyn Ebrano AltizoNo ratings yet

- Entrepreneurship Wk. 7: LessonDocument4 pagesEntrepreneurship Wk. 7: LessonJerome Benipayo78% (9)

- IT For Management: On-Demand Strategies For Performance, Growth, and SustainabilityDocument43 pagesIT For Management: On-Demand Strategies For Performance, Growth, and SustainabilityanastasiaaNo ratings yet

- Bank Practice and Procedures (Acfn2113) : Prepared By: Tewodros EDocument37 pagesBank Practice and Procedures (Acfn2113) : Prepared By: Tewodros Eመስቀል ኃይላችን ነውNo ratings yet

- Main Tasks of IDC POS CoordinatorsDocument2 pagesMain Tasks of IDC POS CoordinatorsJemal Yaya100% (1)

- KPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationDocument27 pagesKPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationRangerNo ratings yet

- Pharmaceutical Benefits Under State Medical Assistance Programs, 2003Document650 pagesPharmaceutical Benefits Under State Medical Assistance Programs, 2003National Pharmaceutical Council100% (2)

- AccountingDocument290 pagesAccountingNibash KumuraNo ratings yet

- Internal controls for production cycleDocument39 pagesInternal controls for production cycleJane GavinoNo ratings yet

- Sample Correspondent AccountDocument1 pageSample Correspondent AccountheopssNo ratings yet

- Data Aadt Car 2018Document5 pagesData Aadt Car 2018HUBERT FILOGNo ratings yet

- 2007 Private Target Deal Points Study (v.1)Document82 pages2007 Private Target Deal Points Study (v.1)Emil BovaNo ratings yet

- Pertemuan #10 Andri Budiwidodo, S.Si., M.IkomDocument38 pagesPertemuan #10 Andri Budiwidodo, S.Si., M.IkomK60 NGUYỄN XUÂN HOANo ratings yet

- Vallabhi 2018 PDFDocument196 pagesVallabhi 2018 PDFSateesh KotyadaNo ratings yet

- Life Insurance ProductsDocument6 pagesLife Insurance ProductsBharani GogulaNo ratings yet

- Benefits and drawbacks of public and private transportDocument4 pagesBenefits and drawbacks of public and private transportgerronimoNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet

- Verizon Bill PDFDocument7 pagesVerizon Bill PDFmgrtbowenNo ratings yet

- HDMF ITB - 06/23/2016Document2 pagesHDMF ITB - 06/23/2016Miyuki NakataNo ratings yet

- 5G RAN2.0 Training Course-Intra-band CADocument20 pages5G RAN2.0 Training Course-Intra-band CAalexNo ratings yet

- Yeastar S20 Basic SetupDocument4 pagesYeastar S20 Basic SetupRonnie Van DykNo ratings yet

- Sample-5.9 Million USA 38 States Database B2BDocument14 pagesSample-5.9 Million USA 38 States Database B2Brenato lreonNo ratings yet

- Empirical Statistics Related To Trade Flow: Submitted To: Rashmi Ma'am Submitted By: Salil TimsinaDocument25 pagesEmpirical Statistics Related To Trade Flow: Submitted To: Rashmi Ma'am Submitted By: Salil TimsinaSalil TimsinaNo ratings yet

- Part VIII Legal Frame of Ethiopian Capital Market Mated by DakitoDocument89 pagesPart VIII Legal Frame of Ethiopian Capital Market Mated by DakitoYibeltal AssefaNo ratings yet

- Financial Accounting and Reporting Midterm Exam KeyDocument4 pagesFinancial Accounting and Reporting Midterm Exam KeyDonita Joy T. EugenioNo ratings yet

- BRKRST 2558Document98 pagesBRKRST 2558boythanhdatNo ratings yet

- Statement overviewDocument2 pagesStatement overviewZheng YangNo ratings yet

- The Communication Media ChannelDocument27 pagesThe Communication Media ChannelElmer Lumague100% (1)

- International Banking and Future of Banking and FinancialDocument12 pagesInternational Banking and Future of Banking and FinancialAmit Mishra0% (1)