Professional Documents

Culture Documents

Financial Management

Uploaded by

Ashish PrajapatiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management

Uploaded by

Ashish PrajapatiCopyright:

Available Formats

Financial Management 1. Explain Gorden model of dividend decision. 2. What is working capital management? 3.

Explain present value and future value of a single amount. 4. Differentiate between Risk and Return. 5. What is the cost of debt capital? 6. What is the cost of Retained earning? 7. Explain internal rate of return. 8. Explain current asset and current liabilities wrt working capital 9. Explain estimate of cash requirement for working capital. 10. What is the capital budgeting? 11. What is capital structure? 12. What is sole proprietorship and partnership? 13. What is annuity? Explain the concept of future value and present value. 14. Explain traditional approach of capital structure. 15. What is the cost of equity share? 16. What is NPV? 17. Explain Working capital leverage. 18. What is operating cycle? Differentiate between operating cycle and cash cycle. 19. Explain Walter model of dividend decision. 20. Define Miller and Modigiliani approach of dividend decision. What is leverage? And what are the types of leverage? Explain operating, financial and combined leverage from following table: CASE A 500 units 5,00,000 2,50,000 2,00,000 50,000 30,000 20,000 10,000 10,000 1 CASE B 600 units 6,00,000 3,00,000 2,00,000 1,00,000 70,000 70,000 35,000 35,000 3.5

Revenue Variable Operating cost Fixed operating cost EBIT/PBIT Interest EBT Tax EAT EPS

Define Capital Structure. Explain factors affecting Capital Structure and the basis optimal capital structure?

The existing capital structure of the company is as follows: Source of capital (1) 4,000 Debenture (5%) of Rs. 100 each (2) 2,000 Cumulative preference shares of Rs. 100 each (Dividend 8%) (3) 4,000 Equity Share of Rs. 100 each Rupees 4,00,000 2,00,000 4,00,000 10, 00,000

The present earning of the company before interest and tax are 10% of the invested capital every year. The company is in need of rates 2,00,000 for purchasing a new plant and it is estimated that addition investment will also produce 10% earning before interest and tax every year. The company has asked for your advise as to whether requisite amount be obtained in the form of 5% debenture, 8% cumulative preference shares (redeemable in ten year) or Equity share rates of Rs. 100 each to be issued at par. Examine the problem in all its bearing and advise the company. Assume an income tax of 50%. Calculate operating, financial and combined leverage from following table: Sales 40,000 units @ Rs. 5 p.u. Variable Cost per unit @ Rs. 2.00 Fixed Costs Interest charge on debt capital Rs. 90,000 Rs. 5,000 Rs. 2, 00,000

Explain operating leverage and its utility? Explain financial leverage and its impact and explain combined leverage? Write short notes on: 1. Weighted Average cost of capital. 2. Cost of Debt

3. Cost of Preference Capital 4. Cost of Equity Capital

The capital Structure of X Ltd. And Y Ltd. are as under: X Ltd. Y Ltd. Rs. Rs. 4,00,000 1,50,000 1,80,000 2,50,000 1,20,000 1,50,000 80,000 30,000 1,20,000

Equity Share Capital 6% Pref. Share Capital 8% Debenture Reserve Profits and loss Appropriation

Comment upon the capital gearing of the two companies.

The capital structure of Abhinav Ltd. On 31st March, 2005 was : Rs. 8% Debentures 9% Bank Loans (Long-term) 10% Preference Shares of Rs. 10 19,000 Equity Share of Rs. 100 Reserve & Surplus 12,00,000 2,00,000 14,00,000 19,00,000 13,00,000 60,00,000

The present earning before interest and tax are Rs. 9, 00,000. Its hoped that this company will maintain the same of return. The company needs Rs. 10, 00,000 for an expense program. For this following financing alternatives are available. (1) Issue of 9% Debentures at par. (2) Issue of 10% Preference share at par. (3) Issue of Equity shares at premium of Rs. 25. Which alternative is the best for the company? Assume tax rate 50%. Define Trading on Equity? Explain introduction, objective and its types. Also explain importance and limitation

Define Working capital? Explain its components and advantages. Write its importance and factor affecting of Working capital management. Below are given the per unit selling price, costs and profits for Doaba Enterprises Ltd : Details per Unit Rs. Raw Material 160 Direct Labour 100 Overheads 140 Total Cost 400 Profit 100 Selling Price 500 The additional informations available are as follows: (1) The company sells goods to its customers on 2 months credit and purchases Raw material from its suppliers on 1 months credits. (2) The average storage period is 1 month for material, months for work-inprogress and 1 month for finished goods. (3) Time-lag in payment is month for wages and 1 month for overheads. (4) 25% of the output is sold against cash. (5) On an average a sum of Rs. 50,000 is kept as cash. (6) The management of the company has made out plan to manufacture 36,000 (7) Units in the coming year. (8) Output and sales of the company are evenly spread over throughout the year. Assuming that 5% of the working capital is kept as additional fund for contingencies, you are required to work out an estimate of the total requirements for working capital by the company. The capital invests invested in business is as follows: Rs. Fixed Capital Working capital Total This has been financed by: Equity share Capital Reserves 6% Debentures 7% Preference Share Capital 6, 00,000 4, 00,000 10, 00,000 Rs. 3, 00,000 1, 00,000 4, 00,000 2, 00,000

The company earned a profit of Rs. 2, 00,000 before interest and tax. Tax rates 50%. Work out the capital gearing ratio and test it for trading on equity.

Explain the cost of capital. What is its importance in the field of Financial Management? What are the problems financial managers faces while determining cost of capital? The following projections have been presented for consideration before the management of the company for the year 2004: (a) Annual Expence : Wages Rs. 52,000; Stores and Materials Rs. 9,600; office salaries Rs. 12,480; Rent Rs. 2,000; other expense Rs.9, 600 (b) Average amount of stock to be maintained: Stock of finished goods Rs. 1,000 Stock of store and Materials Rs. 1,000 (c) Expense paid in advance: Quarterly advance Rs. 1,600 p.a. (d) Annual Sales: Home market Rs. 62,400 Foreign Market Rs. 15,600 (e) Lag in payment of all expense: Wages- 1 weeks; Stores and Materials 1 months; Office Salaries month: Rent- 6 months; other Expense- 1 months. (f) Credit period allowed to customer : Home market Foreign Market 6 Weeks 1 Weeks

What is operating cycle concept of working capital and its importance? What are the source of working capital and make the format of the statement of working management? Differentiate among the three models of decision making in distributing profits of the company. Explain Gordon Model of dividend decision with its application in companys policies.

Explain in detail Miller and Modigiliani approach of dividend decision.

You might also like

- Cost of Capital Quiz AnswersDocument3 pagesCost of Capital Quiz Answersrks88srk50% (2)

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- CMA Question August-2013Document58 pagesCMA Question August-2013zafar71No ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- ACCA F9 Financial Management Solved Past PapersDocument304 pagesACCA F9 Financial Management Solved Past PapersSalmancertNo ratings yet

- Business Finance Assignment EnaaDocument4 pagesBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- Management Advisory Services PDFDocument50 pagesManagement Advisory Services PDFDea Lyn Bacula100% (6)

- UntitledDocument18 pagesUntitledjeralyn juditNo ratings yet

- ACC2 - Conceptual Framework and Accounting Standards Final Examination 2 Semester AY 2018-2019Document12 pagesACC2 - Conceptual Framework and Accounting Standards Final Examination 2 Semester AY 2018-2019Christopher Joselle MolatoNo ratings yet

- Question BankDocument18 pagesQuestion BankTitus ClementNo ratings yet

- ABM 801 Financial Management Question BankDocument9 pagesABM 801 Financial Management Question BankneetamoniNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementRajyalakshmi MNo ratings yet

- GTU Exam - Financial Management QuestionsDocument3 pagesGTU Exam - Financial Management QuestionsMRRYNIMAVATNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- FM - Assignment Batch 19 - 21 IMS IndoreDocument3 pagesFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNo ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Cost CalculationlDocument5 pagesCost CalculationlIshan ShingneNo ratings yet

- Dividend Policy - Problems For Class DiscussionDocument5 pagesDividend Policy - Problems For Class Discussionchandel08No ratings yet

- Pid6012 MBMDocument4 pagesPid6012 MBMSukumar ManiNo ratings yet

- Study Material of FMDocument22 pagesStudy Material of FMPrakhar SahuNo ratings yet

- Institute of Innovation Financial Management PaperDocument8 pagesInstitute of Innovation Financial Management PaperGeetika MalhotraNo ratings yet

- Financial Management CalculationsDocument26 pagesFinancial Management CalculationsamitNo ratings yet

- P2 Financial Management June 2012Document9 pagesP2 Financial Management June 2012Subramaniam KrishnamoorthiNo ratings yet

- GTU MBA Semester 2 Financial Management Exam QuestionsDocument3 pagesGTU MBA Semester 2 Financial Management Exam QuestionsAmul PatelNo ratings yet

- RTP Dec 2021 Cap II Group IIDocument106 pagesRTP Dec 2021 Cap II Group IIRoshan KhadkaNo ratings yet

- MOP-Capital Theory Assignment-020310Document4 pagesMOP-Capital Theory Assignment-020310charnu1988No ratings yet

- Finance Question Papers Pune UniversityDocument12 pagesFinance Question Papers Pune UniversityJincy GeevargheseNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalNikhil AgarwalNo ratings yet

- 2820003Document3 pages2820003ruckhiNo ratings yet

- Problems On LeverageDocument2 pagesProblems On LeverageRituparna Nath100% (2)

- Capital Structure Decisions: Assignment - 1Document18 pagesCapital Structure Decisions: Assignment - 1khan mandyaNo ratings yet

- 301 FMDocument3 pages301 FMSamrudhi ZodgeNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalmansurresyNo ratings yet

- Meaning, Concept and Policies of Working CapitalDocument10 pagesMeaning, Concept and Policies of Working CapitalRahul ShrivastavaNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document16 pagesIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikNo ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- Accounting For Managers: S. No. Questions 1Document5 pagesAccounting For Managers: S. No. Questions 1shilpa mishraNo ratings yet

- GTU MBA Financial Management Exam QuestionsDocument3 pagesGTU MBA Financial Management Exam QuestionssanketchauhanNo ratings yet

- LeverageDocument29 pagesLeverageamol_more370% (1)

- Deepak QuestionsDocument5 pagesDeepak Questionsvivek ghatbandheNo ratings yet

- Unit 4Document2 pagesUnit 4Sweta YadavNo ratings yet

- AFM Assignment (2019)Document9 pagesAFM Assignment (2019)Videhi BajajNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- Merger AcquistionDocument37 pagesMerger AcquistionManjari KumariNo ratings yet

- MBA Financial Management AssignmentDocument4 pagesMBA Financial Management AssignmentRITU NANDAL 144No ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- MB0045Document3 pagesMB0045Wael AlsawafiriNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- Institute of Professional Education and Research (Technical Campus) Financial Management Practice BookDocument3 pagesInstitute of Professional Education and Research (Technical Campus) Financial Management Practice Bookmohini senNo ratings yet

- CA FINAL SFM - NOV 2012 Question PAPERDocument8 pagesCA FINAL SFM - NOV 2012 Question PAPERPravinn_MahajanNo ratings yet

- Calculating weighted average cost of capital and optimal capital structureDocument4 pagesCalculating weighted average cost of capital and optimal capital structureMandar SangleNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- Coc Ques pt1Document4 pagesCoc Ques pt1dhall.tushar2004No ratings yet

- Capital StructureDocument6 pagesCapital StructureHasan Zahoor100% (1)

- Capital Structure Problems AssignmentDocument3 pagesCapital Structure Problems AssignmentRamya Gowda100% (2)

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Financial and Treasury Management Guide - Project Analysis, Working Capital, ForexDocument7 pagesFinancial and Treasury Management Guide - Project Analysis, Working Capital, Forexexcelsis_No ratings yet

- PT Barito Pacific TBK - Fy 2020Document210 pagesPT Barito Pacific TBK - Fy 2020Muhammad MuhammadNo ratings yet

- Acc Cia 2 PDFDocument9 pagesAcc Cia 2 PDFchahatNo ratings yet

- Dupont AnalysisDocument5 pagesDupont AnalysisTECH BABANo ratings yet

- Elements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesDocument13 pagesElements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesdeepshrmNo ratings yet

- 25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting EntriesDocument5 pages25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting Entriesmohitgaba19No ratings yet

- TRtr&NG DAI CONG NGHI$p TP. Hi CHi MINH: Industrialization in Ho Chi Minh CityDocument6 pagesTRtr&NG DAI CONG NGHI$p TP. Hi CHi MINH: Industrialization in Ho Chi Minh CityTrang LêNo ratings yet

- Financial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLDocument13 pagesFinancial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLSiddharth Rohilla (M22MS074)No ratings yet

- ch02 BusinesscombiDocument41 pagesch02 BusinesscombiNadine SantiagoNo ratings yet

- Absorption Variable SeatworkDocument2 pagesAbsorption Variable SeatworkMaxy BariactoNo ratings yet

- Crompton GreavesDocument12 pagesCrompton GreavesAngel BrokingNo ratings yet

- 4AC1 02 MSC 20210517Document11 pages4AC1 02 MSC 2021051788 88No ratings yet

- ACT1104-Final Period Quiz No. 6 With AnswerDocument12 pagesACT1104-Final Period Quiz No. 6 With AnswerPj Dela VegaNo ratings yet

- SMEs - ASSETS measurement and accountingDocument21 pagesSMEs - ASSETS measurement and accountingToni Rose Hernandez LualhatiNo ratings yet

- Unit Costing Lecture 2Document6 pagesUnit Costing Lecture 2YashaswiNo ratings yet

- Balance Sheet M&MDocument2 pagesBalance Sheet M&MRitik AggarwalNo ratings yet

- Adv Acc Sol Manual 2008Document190 pagesAdv Acc Sol Manual 2008Khey Soniga RollanNo ratings yet

- Project Report on Working Capital ManagementDocument35 pagesProject Report on Working Capital Managementomprakash shindeNo ratings yet

- Financial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsiDocument18 pagesFinancial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsifitriEmpiiNo ratings yet

- Bos 28432 CP 14Document53 pagesBos 28432 CP 14Basant Ojha100% (1)

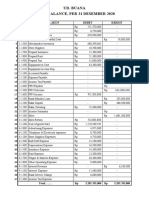

- UD. Buana Trial Balance 2020Document10 pagesUD. Buana Trial Balance 2020HusniBaroqNo ratings yet

- Lit - Ch01 - Kimmel Et Al. 2013 - Ch13-2Document28 pagesLit - Ch01 - Kimmel Et Al. 2013 - Ch13-2trinaNo ratings yet

- A Cash Conversion Cycle Approach To Liquidity AnalysisDocument8 pagesA Cash Conversion Cycle Approach To Liquidity Analysissohail0779No ratings yet

- PT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D KDocument15 pagesPT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D Kdanie RidwanNo ratings yet

- Chapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosDocument36 pagesChapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosceojiNo ratings yet

- NARUC Uniform System of Accounts for Class C Water UtilitiesDocument59 pagesNARUC Uniform System of Accounts for Class C Water UtilitiesRaquion, Jeanalyn R.No ratings yet