Professional Documents

Culture Documents

Solution To QNS-Group B

Uploaded by

melkioryfOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution To QNS-Group B

Uploaded by

melkioryfCopyright:

Available Formats

GROUP B SOLUTION TO QNS a) In an efficient market prices not only reflect currently available information but also investors

s expectations about firms expected returns, risk, and securitys liquidity. Critically discuss how the release of corporate financial statements is expected to change the firms share price in an efficient market. ANSWER Market efficient considered being efficient when Prices adjust rapidly to new information There is continuous market in which successive trade is made at a price close to the previous price, The market can absorb large amount of securities without destabilizing the prices. There are three levels of efficiency according to the type of information reflected in the prices; Weak form efficiency Share prices reflect all information contained in past price movements. Semi-strong form efficiency

Share prices fully reflect all the relevant publicly available information. This includes not only past prices movement but also earnings and dividend announcement, right issues, and technological breakthrough. Strong form efficiency

Prices reflects all the information that can be acquired by painstaking analysis of the company and the economy Based on the question, the release of financial statements will help the investors to make investment decision according to; Performance of the firm ( Income statement) 1

Status of the firm assets and financing of those assets ( Balance Sheet) Cash flows of the firm (Cashflow statement)

The price-earnings ratio Refers to the multiplier applied to earnings per share to determine current value of common stock. It indicates expectations about the future of the company. Firm expected to provide returns greater than those for the market in general with equal or less risk, often have P/E ratios higher than the market P/E ratio. The price earning ratio is influenced by Earnings The sales growth of the firm The risk ( volatility in performance) The debt equity structure of the firm The dividend payment policy and The quality of management

Since companies have various levels of earnings per share, then it allows us to compare the relative market value of many companies based on $ 1 of earnings per share. So when the firms earnings are dropping rapidly or even approaching zero, its stock price declining too, but may not match the magnitude of the fall of in earnings. Hence in an efficient market the prices will reflects all those information to investors. b) Discuss the following situations as they relate to the efficient market hypothesis. A. Your broker commented that well managed firms are better investment than poorly managed firms. Yes because a well managed firms it leads to better performance hence increasing shareholders wealth as earnings increases. So increases confidence and attract more investors.

Your broker continued to say that if the firms were well managed, they should have produced better than average returns. Assuming market efficiency, do you agree with your broker? We disputes the statement that well managed firm should have produced better than average returns because in an efficiency market prices are fairy priced but returns are unpredictable from the implication that Abnormal return are not observable in an efficient market due to the fact that all information are reflected in the prices of securities B. Consider an efficient capital market in which a particular macroeconomic variable that influences your firms earnings is positively serially correlated. Would you expect price changes in your stock to be serially correlated Why or why not Capital market Is the financial market whereby securities with maturities of more than one year are traded example debts, equity instruments. Coefficient of correlation Means the degree associated movement between two or more variables. Variables that move in the same direction are said to be positively correlated, while negatively correlated variables move in opposite direction. NO. Because the price changes in the stock will not be serially correlated with the macro variables. Moving in opposite movement. Since the lower risk mean higher price-earnings ratio this could be beneficial to investor. If were serially correlated it could be easy to predict the value in the future prices of securities using those variables. Hence return of the firm. C. Given data Number of shares to be sold = 170 Mil. Shares

Worth o those shares = $.2 Bill Offer price = $.11.59 per share Investors ready to buy = 500 institutions Selling price = $.11.70 Profit made overnight = $.15 Mill. Solution. Spread Between offer price and selling price 11.70 11.59 = 0.11 This is normal spread for dealers and is very small 0.11 * 100 = 95% 0.115 15,000, 000 2,000,000,000 Profit made = 0.11 * 170, 000, 000 = 18.700, 000.00 Overnight profit = 15, 000, 000.00 3, 700, 000.00 Meaning the transaction costs of this deal of shares mr Sachin is $. 3, 700, 000.00 So prices in an efficient market are fairy priced there is no abnormal returns observed. Hence market is efficiency D. Given data Stock price increases from 180.00 202.50 An increase of 12.50% i. No. the market is efficient because the new information the death of CEO and founder of TEllCAll Ltd causes the prices to jump from 180.00 202.50 an increase of 15% ii. The value of business depend on human assets, managers skilled workers. So CEO he dont have good reputation and was a threat to the development of the = 0.75

organization. After his death the organization attracts many investors, they are expecting higher returns from the firm.

e) The answer is C because as taken into consideration the new information arises in the market people will be worried on their return since that the firm has lost a big contract for the supply to the Government. c) Weak form of market efficiency Share prices reflect all information contained in past price movements. and past trading volume. This can be tested using; Time series model by analyzing the prices of securities over specific time so that to study the performance. Investors use the model if they are sure that it will earn values which are not much differ from the predictions. Correlation model to measure the relationship between variables whether the movement are positively correlated or negative correlated and implication to investors also Employed all statistical tests example looking week by week patterns in the returns but it appears there is few patterns. In week by week returns Semi-strong form efficiency

Share prices fully reflect all the relevant publicly available information. This includes not only past prices movement but also earnings and dividend announcement, right issues, and technological breakthrough. This can be tested as researchers measures how rapidly security prices respond to different items of news such as earnings or dividends announcements, news of takeovers or macro economic variables

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Merchandise Management - Module IVDocument7 pagesMerchandise Management - Module IVAmit SharmaNo ratings yet

- Quarterly Report On European Electricity Markets q1 2021 Final 0Document49 pagesQuarterly Report On European Electricity Markets q1 2021 Final 0saadounNo ratings yet

- HRM Distribution of Reports Per StudentDocument3 pagesHRM Distribution of Reports Per Studentclara dupitasNo ratings yet

- Warren Buffett: A Brief Biography of the Legendary InvestorDocument16 pagesWarren Buffett: A Brief Biography of the Legendary InvestorsamkumNo ratings yet

- Money Market: Chapter 6 - GROUP 1 - PresentationDocument65 pagesMoney Market: Chapter 6 - GROUP 1 - PresentationThanh XuânNo ratings yet

- Globalization and Its Socioal - Political-Economic and Cultural ImpactsDocument16 pagesGlobalization and Its Socioal - Political-Economic and Cultural ImpactsMis MishaNo ratings yet

- Uptime 201804 PDFDocument49 pagesUptime 201804 PDFCarlos IvanNo ratings yet

- The Board of Directors of The Cortez Beach Yacht ClubDocument2 pagesThe Board of Directors of The Cortez Beach Yacht ClubAmit PandeyNo ratings yet

- EY The Science of Winning in Financial ServicesDocument24 pagesEY The Science of Winning in Financial ServicesccmehtaNo ratings yet

- CA Inter Audit Q MTP 1 May 23Document7 pagesCA Inter Audit Q MTP 1 May 23Drake DDNo ratings yet

- Case. T&D GE Way - Group 3Document5 pagesCase. T&D GE Way - Group 3Sharlin DsouzaNo ratings yet

- FINS 3616 Lecture Notes-Week 1Document38 pagesFINS 3616 Lecture Notes-Week 1joannamanngoNo ratings yet

- CAT T10/ FIA - FFM - Finance PassCardDocument160 pagesCAT T10/ FIA - FFM - Finance PassCardLe Duong Huy100% (3)

- Statement of Cash FlowDocument9 pagesStatement of Cash FlowJoyce Ann Agdippa BarcelonaNo ratings yet

- Finance Internships - Sheet1Document1 pageFinance Internships - Sheet1Prathamesh DayalpawarNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- Chan KimDocument2 pagesChan KimtrugenceNo ratings yet

- Dennees CV 2019.Document2 pagesDennees CV 2019.Abhishek aby5No ratings yet

- Employee VoiceDocument8 pagesEmployee Voicemyko7No ratings yet

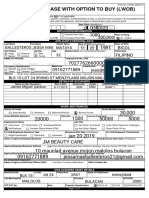

- Lwob - Application-Form Edited Edited EditedDocument2 pagesLwob - Application-Form Edited Edited Editedjessamaeballesteros21100% (1)

- CFAS Chapter 5-8 PDFDocument25 pagesCFAS Chapter 5-8 PDFKenneth PimentelNo ratings yet

- The Fulture of Food and AgricultureDocument52 pagesThe Fulture of Food and AgricultureCayo GomesNo ratings yet

- Types of Production ProcessDocument24 pagesTypes of Production ProcessPRIYANK89% (18)

- Jola PublishingDocument4 pagesJola PublishingSabrina LaganàNo ratings yet

- Global Grade Profiling StructureDocument6 pagesGlobal Grade Profiling StructuremohammadNo ratings yet

- Kelly and Optimal F PDFDocument76 pagesKelly and Optimal F PDFSandeep Bennur100% (1)

- Start Making A Difference - How To Launch A Career in International Development PDFDocument41 pagesStart Making A Difference - How To Launch A Career in International Development PDFAndry Yudha KusumahNo ratings yet

- ITR-1 Acknowledgement for AY 2022-23Document1 pageITR-1 Acknowledgement for AY 2022-23VINAY verma100% (1)

- Variable Pay and Executive Compensation PlansDocument22 pagesVariable Pay and Executive Compensation PlansDyenNo ratings yet

- q321 - Acen 17q (Final) SGDDocument127 pagesq321 - Acen 17q (Final) SGDReginaldNo ratings yet