Professional Documents

Culture Documents

PTC India: Performance Highlights

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PTC India: Performance Highlights

Uploaded by

Angel BrokingCopyright:

Available Formats

1QFY2012 Result Update | Power

August 10, 2011

PTC India

Performance Highlights

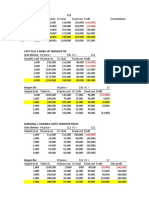

Y/E March (` cr) Net revenue Operating profit Net profit

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg qoq 19.7 38.3 35.0 1QFY2011 2,758 28 28 % chg yoy (9.8) 71.5 62.6

`76 -

1QFY2012 2,487 48 45

4QFY2011 2,079 34 34

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Power 2,636 1.1 145/75 182131 10 18,336 5,486 PTCI.BO PTCIN@IN

For 1QFY2012, PTC India (PTC) reported net profit growth of 62.6% yoy to `45cr, aided by 17% higher traded volumes and higher rebate income of `23cr (vs. `3.5cr). The company benefitted as it retained a substantial portion of rebate (2% of billed amount) received from power sellers, which was not passed on to buyers (mostly Tamil Nadu SEB) due to delayed payments. PTC still has ~`500cr recoverable from Tamil Nadu SEB, which the company hopes to recover in the next two months. Management has maintained that no fresh power sale would be made to the SEB until the amounts are fully recovered. We maintain our Neutral view on the stock. Operating profit up 71.5% yoy: PTCs 1QFY2012 power trading volumes rose by 17% yoy to 6.7BU. Net sales fell by 9.8% yoy to `2,487cr due to the decline in average power selling prices. Operating profit grew by 71.5% yoy to `48cr, mainly aided by high rebate income. Outlook and valuation: Going ahead, we expect PTC to witness healthy volume growth due to addition of ~1,300MW and ~4,600MW to its long-term trading (LTT) portfolio in FY2012 and FY2013, respectively. The company has till date signed PPAs and PSAs for ~15,000MW and ~5,400MW and is participating in various case-1 bids to sign more PSAs. We expect PTCs top line and bottom line to witness a CAGR of 22.2% and 23.2%, respectively, over FY201113E. At the CMP of `76, PTC is trading at 11.6x FY2012E and 10.6x FY2013E earnings. We maintain our Neutral view on the stock. Key financials (Standalone)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 16.3 57.8 17.4 8.5

Abs. (%) Sensex PTC

3m 3.4 1.0

1yr 6.6 (17.5)

3yr 9.6 (1.9)

FY2010 7,770 19.0 93 2.7 0.8 3.2 23.9 1.1 5.1 3.1 0.2 19.5

FY2011E 8,997 15.8 139 48.5 1.6 4.7 16.1 1.0 6.5 6.3 0.2 11.0

FY2012E 11,109 23.5 192 38.4 2.0 6.5 11.6 1.0 8.5 9.7 0.2 7.8

FY2013E 13,430 20.9 210 9.7 1.9 7.1 10.6 0.9 8.7 10.5 0.1 6.8

V Srinivasan

022-39357800 Ext 6831 v.srinivasan@angeltrade.com

Please refer to important disclosures at the end of this report

PTC India | 1QFY2012 Result Update

Exhibit 1: 1QFY2012 performance

Y/E March (` cr) Net operating income Consumption of RM (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM Interest Depreciation Other Income PBT (% of Sales) Provision for Taxation (% of PBT) Reported PAT PATM (%) EPS (`)

Source: Company, Angel Research

1QFY2012 2,487 2,431 97.7 3 0.1 6 0.2 2,440 48 1.9 1 1 17.4 63 2.5 17 27.7 45 1.8 1.5

4QFY2011 2,079 2,035 97.9 5 0.2 4 0.2 2,044 34 1.7 0 1 14 47 2.3 14 29.2 34 1.6 1.1

% Chg 19.7 19.4 (35.6) 52.7 19.3 38 26bp (14.0) 22.2 32.2 25.3 35.0 35.0

1QFY2011 2,758 2,725 98.8 3 0.1 3 0.1 2,731 28 1.0 0 1 14 40 1.5 13 31.0 27.8 1.0 0.9

% Chg (9.8) (10.8) 25.9 116.3 (10.7) 71 91bp (8.3) 26.3 55 38.6 62.6 62.4

FY2011 8,997 8,837 98.2 7.0 0.1 13 0.1 8,857 140 1.6 1 5 63 197 2.2 58 29.3 139 1.5 4.7

FY2010 7,770 7,675 98.8 18.4 0.2 13 0.2 7,707 64 0.8 0 6 74 132 1.7 38 28.6 94 1.2 3.2

% Chg 15.8 15.1 (62.3) 0.8 14.9 119.9 74bp (8.8) (15.0) 49.2 52.9 47.7 47.5

Exhibit 2: Actual vs. Angel estimates

(` cr) Net revenue Operating profit Net profit

Source: Company, Angel Research

Actual 2,487 47.6 45.2

Estimates 2,839 33.2 32.6

Variation (%) (12.4) 43.4 38.7

Exhibit 3: Operational performance

Parameter Volumes (mn units) % Growth (yoy) Realisation (`/unit) % Growth (yoy) 1QFY12 6,726 17.0 3.7 (23.0) 4QFY11 5,191 62.2 4.0 2.7 3QFY11 5,813 30.8 3.0 (20.4) 2QFY11 7,730 21.0 4.3 10.0 1QFY11 5,747 36.7 4.8 (14.3) 4QFY10 3,200 46.7 3.9 (28.1)

Source: Company, Angel Research

August 10, 2011

PTC India | 1QFY2012 Result Update

Strong volume growth in 1QFY2012

During 1QFY2012, PTC posted strong 17% yoy growth in volume to 6.7BU. Short-term trading (STT) and LTT volumes stood at 4.6bn units and 2.1bn units, respectively. On a yoy basis, LTT volumes were flat, while STT volumes rose by ~27% yoy, aided by a substantial increase in trades done through India Energy Exchange.

Exhibit 4: Operating profit performance

50 40 30 20 10 10 0 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 9 28 38 41 34 48

Source: Company, Angel Research

Conference call Key highlights

The average trading margins for 1QFY2012 excluding rebate and surcharge stood at 4.9 paise. On an average, margins on LTT stood at 6 paise, crossborder trade stood at 2.7 paise, volumes through exchange stood at 2.4 paise, and STT stood at 5 paise. Till date, PTC has signed PPAs for 15,000MW and PSAs for 5,400MW. PTC-Ashmore India Energy Infrastructure Fund, a JV with Ashmore Group Plc launched in FY2010, has been shelved, as Ashmore could not bring sufficient contribution to the fund. The company has written-off `1.7cr of expenditure incurred in relation to the launch of fund during the quarter. PTCs subsidiary, PTC Energy traded ~0.2mn tonnes of coal in 1QFY2012. Coal traded by the company is expected to be 1.4mn tonnes in FY2012. The company has targeted to trade 2.4mn tonnes p.a. from FY2013E and has entered into a five-year coal procurement agreement for this quantity with suppliers in Indonesia. PTC Energys (PTCs 100% subsidiary) tolling projects with Madhucon Projects Ltd. (200MW) and Meenakshi Energy Ltd. (300MW) would begin from 3QFY2012 and 4QFY2012, respectively.

August 10, 2011

(` cr)

PTC India | 1QFY2012 Result Update

Investment arguments

Power deficit to encourage growth

Total volume of power traded in India is just ~8% of the power generated. We expect the volume of power traded to rise at a healthy rate due to continuing power deficit and increased power generation capacity.

Favourable government policies to aid growth

The National Electricity Policy encourages about 15% of new capacities to be tied up in the short-term market. Growing emphasis on allowing open access to consumers to buy power from producers in any state augurs well for power trading companies. In January 2010, CERC had increased the cap on STT margin to 7 paise/unit from the earlier 4 paise/unit, which is a major boost to the companys profitability as the 4 paise/unit cap regime was inadequate to cover operational and market risks borne by trading companies.

PTC to maintain its market leadership position

PTC is currently the leader in power trading with a market share of 4550%. Going ahead, we expect the company to maintain its leadership position in the power trading market due to its early-mover advantage and increased volume of power traded under the LTT route, as close to 5,300MW of projects for which the company has signed PPAs are set to be operational in FY2012 and FY2013.

Outlook and valuation

Going ahead, we expect PTC to witness healthy volume growth due to addition of ~1,300MW and ~4,600MW to its long-term trading (LTT) portfolio in FY2012 and FY2013, respectively. The company has till date signed PPAs and PSAs for ~15,000MW and ~5,400MW and is participating in various case-1 bids to sign more PSAs. We expect PTCs top line and bottom line to witness a CAGR of 22.2% and 23.2%, respectively, over FY201113E. At the CMP of `76, PTC is trading at 11.6x FY2012E and 10.6x FY2013E earnings. We remain Neutral on the stock.

August 10, 2011

PTC India | 1QFY2012 Result Update

Exhibit 5: One-year forward P/E band

250 200

(Share Price `)

150 100 50 0 Apr-06 Apr-07 Price Apr-08 15x 20x Apr-09 25x Apr-10 30x Apr-11

Source: Company, Angel Research

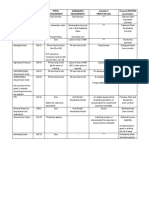

Exhibit 6: Change in estimates

(` cr) Earlier Net sales Operating exp. Operating profit Depreciation Interest PBT Tax PAT

Source: Angel Research

FY2012E Revised 11,109 10,883 226 6 1 275 84 192 Variation (%) (9.6) (9.9) 6.2 (13.9) 40.0 5.5 7.3 4.8 Earlier 14,292 14,044 248 8 2 289 87 202 12,292 12,078 213 7 1 261 78 183

FY2013E Revised Variation (%) 13,430 13,170 260 7 2 302 92 210 (6.0) (6.2) 4.9 (10.7) (12.5) 4.5 5.5 4.1

August 10, 2011

PTC India | 1QFY2012 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr) Total operating income % chg Total Expenditure Net Raw Materials Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) PBT % chg Tax (% of PBT) PAT (reported) % chg (% of Net Sales) Basic EPS (Rs) % chg FY2008 FY2009 FY2010 3,906 3.7 3,887 3,808 7 72 19 (36.9) 0.5 1 18 (38) 0.5 2 43 0.8 52 31.7 10 19.8 49 44.9 1.1 2 (8.5) 6,529 67.1 6,503 6,386 15 101 26 36.6 0.4 6 20 11 0.3 4 97 0.9 113 119.8 23 19.9 91 119.5 1.4 4 86.5 7,770 19.0 7,707 7,675 18 13 63.0 141.4 0.8 6 57 191 0.7 0 74 0.6 131 15.2 38 28.8 93 2.4 1.2 3 (20.7) FY2011 FY2012E FY2013E 8,997 15.8 8,857 8,837 7 13 140 122.5 1.6 5 135 135 1.5 1 63 0.3 197 50.6 58 29.6 139 49.0 1.5 5 48.3 11,109 23.5 10,883 10,853 13 16 226 61.5 2.0 6 220 63 2.0 1 57 0.2 275 39.9 84 30.4 192 38.4 1.7 6 38.4 13,430 21 13,170 13,135 16 20 260 15 2 7 253 15 2 2 51 0 302 10 92 30 210 10 2 7 9.7

August 10, 2011

PTC India | 1QFY2012 Result Update

Balance sheet (Standalone)

Y/E March SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 227 1,252 1,480 5 1,485 60 8 52 1 1,326 326 124 23 179 221 105 1,485 227 1,309 1,537 9 1,546 60 14 47 1 799 1,000 626 19 355 300 699 1,546 295 1,802 2,096 9 2,105 61 19 42 1 876 1,577 994 51 531 390 1,187 2,105 295 1,885 2,180 7 2,188 62 24 38 1,053 1,698 688 32 978 601 1,097 2,188 295 2,029 2,324 9 2,333 75 30 44 1 1,053 1,736 473 56 1,207 501 1,235 2,333 295 2,189 2,484 9 2,493 89 38 51 1 1,053 1,982 455 67 1,460 594 1,387 2,493 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

August 10, 2011

PTC India | 1QFY2012 Result Update

Cash flow statement (Standalone)

Y/E March Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc)/ Decin Fixed Assets (Inc)/ Dec in Investments (Inc)/ Dec in loans and adv. Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2008 FY2009 FY2010 59 1 6 43 6 18 (37) (1,115) 43 (1,109) 1,192 27 (1) 1,167 75 48 124 113 6 (77) 97 18 (72) (1) 527 97 624 41 8 (49) 502 124 626 131 6 (111) 74 38 (86) (0) (77) 74 (3) 500 41 0 458 369 626 994 FY2011 FY2012E FY2013E 197 5 (217) 63 60 (138) (1) (177) 63 (114) 0 41 15 (56) (307) 994 688 275 6 (348) 57 84 (207) (14) 0 57 43 51 (51) (215) 688 473 302 7 (171) 51 92 (4) (14) 51 37 51 (51) (18) 473 455

August 10, 2011

PTC India | 1QFY2012 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis (%) EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT/Int.) (0.1) (6.5) 8.6 (0.4) (24.0) 5.5 (0.5) (15.8) 155.3 (0.3) (4.9) 120.6 (0.2) (2.1) 157.3 (0.2) (1.8) 144.6 94 16 21 (1) 109 15 15 2 128 21 16 6 146 31 20 12 162 36 18 19 164 21 15 23 2.0 88.6 5.6 1.3 25.7 6.0 3.1 32.5 5.1 6.3 39.7 6.5 9.7 35.1 8.5 10.5 28.3 8.7 0.5 80.2 5.0 1.8 0.3 80.1 5.7 1.4 0.7 71.2 7.7 4.0 1.5 70.4 6.9 7.3 2.0 69.6 6.6 9.1 1.9 69.6 6.9 9.0 2.1 2.1 2.2 1.2 65.1 4.0 4.0 4.3 1.8 67.6 3.2 3.2 3.4 1.4 71.2 4.7 4.7 4.9 1.4 73.9 6.5 6.5 6.7 1.7 78.8 7.1 7.1 7.4 1.7 84.2 35.3 34.4 1.2 1.5 0.4 83.4 1.1 18.9 17.7 1.1 2.4 0.2 41.9 0.7 23.9 22.5 1.1 1.9 0.2 19.5 0.6 16.1 15.5 1.0 1.8 0.2 11.0 0.7 11.6 11.3 1.0 2.3 0.2 7.8 0.8 10.6 10.2 0.9 2.3 0.1 6.8 0.7 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

August 10, 2011

PTC India | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

PTC India No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 10, 2011

10

You might also like

- Tech Mahindra: Performance HighlightsDocument13 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Jyoti Structures: Performance HighlightsDocument12 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- Mahindra Satyam Result UpdatedDocument11 pagesMahindra Satyam Result UpdatedAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Infotech Enterprises: Performance HighlightsDocument13 pagesInfotech Enterprises: Performance HighlightsAngel BrokingNo ratings yet

- Madhucon Projects Result UpdatedDocument14 pagesMadhucon Projects Result UpdatedAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument11 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance HighlightsVishal AhujaNo ratings yet

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocument10 pagesPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument13 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Mahindra Satyam: Performance HighlightsDocument12 pagesMahindra Satyam: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: Company Update - Capital GoodsDocument13 pagesPerformance Highlights: Company Update - Capital GoodsAngel BrokingNo ratings yet

- MindTree Result UpdatedDocument12 pagesMindTree Result UpdatedAngel BrokingNo ratings yet

- Tech Mahindra Result UpdatedDocument12 pagesTech Mahindra Result UpdatedAngel BrokingNo ratings yet

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument11 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Persistent Systems Result UpdatedDocument11 pagesPersistent Systems Result UpdatedAngel BrokingNo ratings yet

- Hitachi Home & Life Solutions: Performance HighlightsDocument13 pagesHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNo ratings yet

- UltraTech Result UpdatedDocument10 pagesUltraTech Result UpdatedAngel BrokingNo ratings yet

- Bajaj Electricals: Performance HighlightsDocument10 pagesBajaj Electricals: Performance HighlightsAngel BrokingNo ratings yet

- TVS Srichakra Result UpdatedDocument16 pagesTVS Srichakra Result UpdatedAngel Broking0% (1)

- Infotech Enterprises: Performance HighlightsDocument13 pagesInfotech Enterprises: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 18th January 2012Document7 pagesMarket Outlook 18th January 2012Angel BrokingNo ratings yet

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Industries: Performance HighlightsDocument14 pagesReliance Industries: Performance HighlightsAngel BrokingNo ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- Idea Cellular: Performance HighlightsDocument13 pagesIdea Cellular: Performance HighlightsAngel BrokingNo ratings yet

- Idea Cellular: Performance HighlightsDocument13 pagesIdea Cellular: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument18 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- CESC Result UpdatedDocument11 pagesCESC Result UpdatedAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies Result UpdatedDocument11 pagesIndoco Remedies Result UpdatedAngel BrokingNo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India Result UpdatedDocument10 pagesGraphite India Result UpdatedAngel BrokingNo ratings yet

- Mind TreeDocument16 pagesMind TreeAngel BrokingNo ratings yet

- Market Outlook 10th August 2011Document5 pagesMarket Outlook 10th August 2011Angel BrokingNo ratings yet

- Ll& FS Transportation NetworksDocument14 pagesLl& FS Transportation NetworksAngel BrokingNo ratings yet

- Vesuvius India: Performance HighlightsDocument12 pagesVesuvius India: Performance HighlightsAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument12 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Indraprastha GasDocument11 pagesIndraprastha GasAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Jyoti Structures 4Q FY 2013Document10 pagesJyoti Structures 4Q FY 2013Angel BrokingNo ratings yet

- Bhel 4qfy2012ru 240512Document12 pagesBhel 4qfy2012ru 240512Angel BrokingNo ratings yet

- Economy News: Morning Insight July 22, 2011Document13 pagesEconomy News: Morning Insight July 22, 2011डॉ. विनय कुमार पंजियारNo ratings yet

- Market Outlook 21st December 2011Document5 pagesMarket Outlook 21st December 2011Angel BrokingNo ratings yet

- Performance Highlights: Company Update - AutomobileDocument13 pagesPerformance Highlights: Company Update - AutomobileZacharia VincentNo ratings yet

- Market Outlook 19th October 2011Document7 pagesMarket Outlook 19th October 2011Angel BrokingNo ratings yet

- Infosys Result UpdatedDocument15 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument13 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Britannia 2QFY2013RUDocument10 pagesBritannia 2QFY2013RUAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryFrom EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Executive Placement Service Revenues World Summary: Market Values & Financials by CountryFrom EverandExecutive Placement Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Fabm3 M3Document23 pagesFabm3 M3Jolina GabaynoNo ratings yet

- Baltic Group Cost Analysis and Transfer Pricing StrategiesDocument4 pagesBaltic Group Cost Analysis and Transfer Pricing StrategiesSangtani PareshNo ratings yet

- IFRS Starter KitDocument20 pagesIFRS Starter Kitmdkumarz4526No ratings yet

- Marginal costing concepts explainedDocument16 pagesMarginal costing concepts explainedFarrukhsg100% (2)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisGelo MoloNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- Partnership profit sharing, admission, withdrawal problemsDocument2 pagesPartnership profit sharing, admission, withdrawal problemsJoana TrinidadNo ratings yet

- Financial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualDocument22 pagesFinancial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualRayane M Raba'a0% (1)

- 2 Home, SA, Branch ProblemsDocument7 pages2 Home, SA, Branch ProblemsthatfuturecpaNo ratings yet

- Home Office and Branch Accounting ProblemsDocument9 pagesHome Office and Branch Accounting ProblemsMichaela QuimsonNo ratings yet

- List of Accounting Books OnlineDocument28 pagesList of Accounting Books Onlinemar_pogi100% (2)

- Examples of Questions On Ratio Analysis: A: Multiple Choice QuestionsDocument3 pagesExamples of Questions On Ratio Analysis: A: Multiple Choice QuestionsLauraNo ratings yet

- PAYROLL PROBLEM SOLUTIONDocument39 pagesPAYROLL PROBLEM SOLUTIONHazel Joy UgatesNo ratings yet

- F9 Progress Test 1 Key Financial RatiosDocument3 pagesF9 Progress Test 1 Key Financial RatiosCoc GamingNo ratings yet

- Partnership Operation Practice Problems PDFDocument11 pagesPartnership Operation Practice Problems PDFMeleen TadenaNo ratings yet

- 5 - Financial Analysis of Combine Harvester DC 70Document10 pages5 - Financial Analysis of Combine Harvester DC 70metaladhayNo ratings yet

- Chapter 9 - Valuation of StocksDocument27 pagesChapter 9 - Valuation of StocksAnubhab GuhaNo ratings yet

- Analyze financial statements with ratios and analysesDocument40 pagesAnalyze financial statements with ratios and analysesPhương Anh VũNo ratings yet

- Mock Exercise 16 July 2021 Dear Students, Submit It Using Dummy Link Provided On WBLEDocument3 pagesMock Exercise 16 July 2021 Dear Students, Submit It Using Dummy Link Provided On WBLEWen Xin GanNo ratings yet

- Distinguish Between Variable and Fixed CostsDocument7 pagesDistinguish Between Variable and Fixed CostsBianca PuglissiNo ratings yet

- 5_6338931490453195887Document11 pages5_6338931490453195887martinfaith958No ratings yet

- CoC Questions For PracticeDocument2 pagesCoC Questions For PracticeAyushi GuptaNo ratings yet

- Wholesale Bicycle Distributor Business PlanDocument32 pagesWholesale Bicycle Distributor Business Planmeftuh abdiNo ratings yet

- Cash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsDocument5 pagesCash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsMenodiado FamNo ratings yet

- Financial Accounting TheoryDocument15 pagesFinancial Accounting TheoryMarcus MonocayNo ratings yet

- Cost of Capital Reviewer For Financial Management IDocument56 pagesCost of Capital Reviewer For Financial Management Ikimjoonmyeon22No ratings yet

- Depreciation Worksheet Straightline MethodDocument12 pagesDepreciation Worksheet Straightline MethodJamie-Lee O'ConnorNo ratings yet

- Chapter 8 Implementing - Strategies - Marketing - FinanceDocument45 pagesChapter 8 Implementing - Strategies - Marketing - FinanceayuNo ratings yet

- Tire City ExhibitsDocument7 pagesTire City ExhibitsAyushi GuptaNo ratings yet

- Depreciation of Non-Current AssetsDocument21 pagesDepreciation of Non-Current AssetsMuhammad Adib100% (1)