Professional Documents

Culture Documents

Dry Creek App

Uploaded by

Ryan SloanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dry Creek App

Uploaded by

Ryan SloanCopyright:

Available Formats

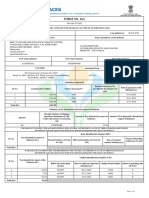

Print - APP08-0065

Print Preview - Final Application

Tax Credits, RPP Loans, and/or Tax Exempt Bond Loans

Project Description

Project Name: Dry Creek Apartment Homes Address: City: adjacent & south of 2366 SR 210 North Lillington County: Harnett Zip: 27546 Block Group: 1015

Census Tract: 708

Is project in Qualified Census Tract or Difficult to Develop Area? No Political Jurisdiction: Jurisdiction CEO Name: Jurisdiction Address: Jurisdiction City: Jurisdiction Phone: Town of Lillington First:Glenn Last: McFadden Title: Mayor

106 West Front Street, P.O. Box 296 Lillington Zip: 27546

(910)893-2654

Site Latitude: Site Longitude:

35.7810 -78.6366

Project Type: New Construction Is this project a previously awarded tax credit development? No If yes, what is the project number: Is this a request for supplemental credits? New Construction/Adaptive Reuse: Is this project a follow-on (Phase II, etc) to a previously-awarded tax credit development project? No If yes, list names of previous phase(s): Rehab: Number of residents holding Section 8 vouchers:

Will the project meet Energy Star standards as defined in Appendix B? No Does a community revitalization plan exist? No Will the project use steel and concrete construction and have at least 4 stories? No Will the project include a Community Service Facility under IRS Revenue Ruling 2003-77? No

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (1 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

If yes, please describe:

Target Population:Family Will the project be receiving project based federal rental assistance? No If yes, provide the subsidy source: and number of units: Indicate below any additional targeting for special populations proposed for this project: Mobility impaired handicapped: 5% of units comply with QAP Section IV(F)(3) (in addition to the units required by other federal and state codes.) Number of Units: 6 Persons with disabilities or homeless populations: 10% of the total units.

Number of Units: 6 Remarks: There will be a total of 6 mobility-impaired units, to comply with Federal, State and NCHFA requirements.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (2 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Applicant Information

Indicate below an individual or a validly existing entity (a corporation, nonprofit, limited partnership or LLC) as the official applicant. Under QAP Section III(C)(5) only this individual or entity will be able to make decisions with regard to this application. If awarded the applicant must become part of the ownership entity. The applicant will execute the signature page for this application. Applicant Name: Address: City: Contact: Telephone: Alt Phone: Fax: Email Address: Ilex Properties, LLC 1049 Sunset Meadows Drive Apex State: NC Zip: 27523 First: Holly Last:Smith Title:Managing Member

(919)363-1677 (919)539-1654 (919)363-1727 hollylsmith@nc.rr.com

NOTE: Email Address above will be used for communication between NCHFA and Applicant.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (3 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Site Description

Total Site Acreage: 6.0 Total Buildable Acreage: 6.0

If buildable acreage is less than total acreage, please explain:

Identify utilities and services currently available (and with adequate capacity) for this site: Storm Sewer Water Sanitary Sewer Electric

Is the demolition of any buildings required or planned? No If yes, please describe:

Are existing buildings on the site currently occupied? No If yes: (a) Briefly describe the situation:

(b) Will tenant displacement be temporary? (c) Will tenant displacement be permanent? Is the site directly accessed by an existing, paved, publicly maintained road? Yes If no, please explain:

Is any portion of the site located inside the 100 year floodplain? No If yes: (a) Describe placement of project buildings in relation to this area:

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (4 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

(b) Describe flood mitigation if the project will have improvements within the 100 year floodplain:

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (5 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Site Control

Does the owner have fee simple ownership of the property (site/buildings)?No If yes provide: Purchase Date: Purchase Price:

If no: (a) Does the owner/principal or ownership entity have valid option/contract to purchase the property?Yes (b) Does an identity of interest (direct or indirect) exist between the owner/principal or ownership entity with the option/contract for purchase of the property and the seller of the property?No If yes, specify the relationship:

(c) Enter the current expiration date of the option/contract to purchase: 11/28/2008 (D) Enter Purchase Price: 330,000

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (6 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Zoning

Present zoning classification of the site:MULTIFAMILY Is multifamily use permitted?Yes Are variances, special or conditional use permits or any other item requiring a public hearing needed to develop this proposal?Yes If yes, have the hearings been completed and permits been obtained?Yes If yes, specify permit or variance required and date obtained. If no, describe permits/variances required and schedule for obtaining them: On March 11, 2008, the site was unanimously approved for annexation into the Town of Lillington, with a concurrent rezoning to Multifamily, which permits the development of up to 66 rental units.

Are there any existing conditions of historical significance located on the project site that will require State Historic Preservation office review? No If yes, describe below:

Are there any existing conditions of environmental significance located on the project site?No If yes, describe below:

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (7 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Ownership Entity

Owner Name: Address: City: Dry Creek Apts, LLC 1049 Sunset Meadows Drive Apex State:NC Zip: 27523 (If assigned)

Federal Tax ID Number of Ownership Entity: Note: Do not submit social security numbers for individuals.

Entity Type: Limited Liability Company Entity Status: To Be Formed Is the applicant requesting that the Agency treat the application as Non-Profit sponsored? No Is the applicant requesting that the Agency treat the application as CHDO sponsored? No List all general partners, members,and principals. Specify nonprofit corporate general partners or members. Click [Add] to add additional partners, members, and principals.

Org: Address: City: Phone: EMail:

Ilex Dry Creek, LLC Last Name: Smith State: NC Function: Managing Member Zip: 27523 1049 Sunset Meadows Drive Apex

First Name: Holly

(919)363-1677 hollylsmith@nc.rr.com

Fax: (919)363-1727 Nonprofit: No

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (8 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Unit Mix

The Median Income for Harnett county is $51,500. Low Income Units Type # BRs Net Sq.Ft. Total # Units # Units Monthly Rent Utility Allowance Mandatory Serv. Fees **Total Housing Exp.

Gdn Apt 1 Gdn Apt 1 Gdn Apt 1 Gdn Apt 2 Gdn Apt 2 Gdn Apt 2 Gdn Apt 3 Gdn Apt 3 Gdn Apt 3

661 661 661 907 907 907 1117 1117 1117

4 4 8 7 7 14 4 4 8

1 1 0 1 1 0 1 1 0

286 383 441 336 451 545 388 522 600

Electric

100 100 100 128 128 128 147 147 147

Gas

0 0 0 0 0 0 0 0 0

Other Trash Collection

386 483 541 464 579 673 535 669 747

Utilities included in rents:

Water/Sewer

Employee Units (will add to Low Income Unit total) Total # Monthly Utility Mandatory **Total Type # BRs Net Sq.Ft. # Units Units Rent Allowance Serv. Fees Housing Exp. Utilities included in rents: Water/Sewer Electric Gas Other

Market Rate Units Total # Monthly Utility Mandatory **Total Type # BRs Net Sq.Ft. # Units Units Rent Allowance Serv. Fees Housing Exp. Utilities included in rents: Water/Sewer Electric Gas Other

Statistics All Units Low Income....... Market Rate....... Totals............... Gross Monthly Rental Income

Units

60

27783

60

27783

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (9 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Proposed number of residential buildings: 6 Project Includes:

Maximum number of stories in buildings: 2

Separate community building - Sq. Ft. (Floor Area): 1,797 Community space within residential bulding(s) - Sq. Ft. (Floor Area):

Elevators - Number of Elevators: Square Footage Information Gross Floor Square Footage:

58,205

Total Net Sq. Ft. (All Heated Areas): 55,641

Notes ** Please refer to the Income Limits and Maximum Housing Expense Table to ensure that Total Monthly Tenant Expenses for low income units are within established thresholds.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (10 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Targeting

Specify Low Income Unit Targeting in table below. List each applicable targeting combination in a separate row below. Click [Add] to create another row. Click "X" (at the left of each row) to delete a row. Add as many rows as needed.

# BRs 1 1 1 2 2 2 3 3 3

Units

% targeted at 40 targeted at 50 targeted at 60 targeted at 40 targeted at 50 targeted at 60 targeted at 40 targeted at 50 targeted at 60 percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by percent of median income affordable to/occupied by

4 4 8 7 7 14 4 4 8

Total Low Income Units:

60

Note: This number should match the total number of low income units in the Unit Mix section.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (11 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Funding Sources

NonAmortizing* Rate (%) Term (Years) Amort. Period (Years) Annual Debt Service

Source Bank Loan RPP Loan Local Gov. Loan - Specify: RD 515 Loan RD 538 Loan - Specify: AHP Loan Other Loan 1 - Specify: Other Loan 2 - Specify: Other Loan 3 - Specify: Tax Exempt Bonds State Tax Credit(Loan) State Tax Credit(Direct Refund) Equity: Federal LIHTC Non-Repayable Grant Equity: Historic Tax Credits Deferred Developer Fees Owner Investment Other - Specify: CDBG for offsite road widening Total Sources**

Amount

860,000 800,000

6.25 1.00

30 20

30 20

63,542

881,219

30

30

3,988,113

250,000 6,779,332

* "Non-amortizing" indicates that the loan does not have a fixed annual debt service. For these items, you must fill in 20-year debt service below. ** Total Sources must equal total replacement cost in Project Development Cost (PDC) section.

Estimated pricing on sale of Federal Tax Credits: $0. 80 Remarks concerning project funding sources: (Please be sure to include the name of the funding source(s)) The interest rate & amortization figures above are not accurate; the actual amortization of the RPP

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (12 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

loan will be based upon Net Operating Income / 1.15x - CICCAR debt service. Also, an application for a $359,000 AHP Loan will be made next month, to reduce the RPP loan by the same amount. The odds are positive that I'll get the award, based upon past experience, which will result in an RPP loan amount of $441,000. The second hearing for the HD-CDBG grant took place on April 8, 2008, and was unanimously approved by the Board of Commissioners. Iris Payne, of DCA, has visited the site and met Lillington's Town Manager, reserving the funds for Dry Creek Apartment Homes, should the development receive an allocation of credits.

Loans with Variable Amortization Please fill in the annual debt service as applicable for the first 20 years of the project life.

RPP Loan Year: Amt: Year: Amt: 1 2 3 4 5 6 7 8 9 10

16863

11

17286

12

17643

13

17927

14

18133

15

18256

16

18290

17

18228

18

18064

19

17790

20

17399

16882

16233

15441

14499

13396

12121

10666

9017

7164

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (13 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Development Costs

Item Cost Element 1 Purchase of Building(s) (Rehab / Adaptive Reuse only) 2 Demolition (Rehab / Adaptive Reuse only) 3 On-site Improvements 4 Rehabilitation 5 Construction of New Building(s) 6 Accessory Building(s) 7 General Requirements (max 6% lines 2-6) 8 Contractor Overhead (max 2% lines 2-7) 9 Contractor Profit (max 8% lines 2-7; 6% if Identity of Interest) 10 Construction Contingency (max 3% lines 2-9, Rehabs 6%) 11 Architect's Fee - Design (11 + 12 = max 3% lines 2-10) 12 Architect's Fee - Inspection 13 Engineering Costs SUBTOTAL (lines 1 through 13) 14 Construction Insurance (prorate) 15 Construction Loan Orig. Fee (prorate) 16 Construction Loan Interest (prorate) 17 Construction Loan Credit Enhancement (prorate) 18 Construction Period Taxes (prorate) 19 Water, Sewer and Impact Fees 20 Survey 21 Property Appraisal 22 Environmental Report 23 Market Study 24 Bond Costs 25 Bond Issuance Costs 26 Placement Fee 27 Permanent Loan Origination Fee 28 Permanent Loan Credit Enhancement 29 Title and Recording TOTAL COST Eligible Basis 30% PV 70% PV

480,000

480,000

3,300,000 100,000 232,800 82,256 329,024 135,722 105,000 19,900 35,000 4,819,702 4,600 27,471 186,393

3,300,000 100,000 232,800 82,256 329,024 135,722 105,000 19,900 35,000

4,600 27,471 186,393

12,000 90,000 10,000 8,500 8,000 5,700

12,000 90,000 10,000 8,500 8,000 5,700

17,700

9,687

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (14 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

SUBTOTAL (lines 14 through 29) 30 Real Estate Attorney 31 Other Attorney's Fees 32 Tax Credit Application Fees (Preliminary and Full) 33 Tax Credit Allocation Fee (0.60% of line 59, minimum $7,500) 34 Cost Certification / Accounting Fees 35 Tax Opinion 36 Organizational (Partnership) 37 Tax Credit Monitoring Fee SUBTOTAL (lines 30 through 37) 38 Furnishings and Equipment 39 Relocation Expense 40 Developer's Fee 41 42

380,051 32,000 14,500 2,200 35,300 12,000 12,000 29,000 8,000

42,000 138,000 32,000 32,000

630,000

630,000

Other Basis Expense: Bank Plan & Cost Review & Inspections Other Basis Expense: sewer & water tap fees (estimated) 27,000 250,000

43 Rent-up Expense 44 45

Other Non-basis Expense : 210 N road widening & sewer bore Other Non-basis Expense (specify)

SUBTOTAL (lines 38 through 45)

939,000 18,000 154,579

46 Rent up Reserve 47 Operating Reserve 48 49

Other Reserve (specify) Other Reserve (specify) 6,449,332 0 5,883,366

50 DEVELOPMENT COST (lines 1-49) 51 Less Federal Financing 52 Less Disproportionate Standard 53 Less Nonqualified Nonrecourse Financing 54 Less Historic Tax Credit 55 TOTAL ELIGIBLE BASIS 56 Applicable Fraction (percentage of LI Units) 57 Basis Before Boost 58 Boost for QCT/DDA (if applicable, enter 130%) 59 TOTAL QUALIFIED BASIS

0 5,883,366 100.00% 5,883,366 0 100% 0 100.00% 5,883,366 0 5,883,366 100% 5,883,366 100.00% 5,883,366

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (15 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

60 Tax Credit Rate 61 Federal Tax Credits at Estimated Rate 62 Federal Tax Credits at 9.00% or 3.75% (maximum $1,000,000) 63 Federal Tax Credits Requested 64 Land Cost 65 TOTAL REPLACEMENT COST FEDERAL TAX CREDITS IF AWARDED Comments: line 41 was included on line 12

3.40 500,086 529,503 0 330,000 6,779,332 529,503 0 0

8.50 500,086 529,503

Total Replacement Cost per unit: 77,663

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (16 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Market Study Information

Please provide a detailed description of the proposed project: Dry Creek Apartments will be located on a rectangular site, with 450' of frontage on SR 210, a moderatelytraveled 2 lane road connecting Lillington to Angier, to the North. Although traffic is moderate on this narrow two-lane road, the two residential buildings at the front of the site will be set back 60+ feet from SR 210, saving the existing wooded area and providing a good noise and privacy buffer for the residents. The proposed use--high density residential-- is positioned favorably between existing single family homes and new subdivisions located 1/10 mile north, and the retail and commercial uses to the South, at the SR 210/401/421 intersection. Just 4/10 mile south from the site is River Birch Square, a busy strip center, with banks and doctor's offices just around the corner. The SRs 210/401/421 intersection includes 5 fast food and sit-down restaurants, Food Lion, gas stations, and other retail services, just 7/10 mi south from the site. The 129-acre, Biotechnology Business Park, which includes a 50-bed, acute care hospital, just east of that intersection, will create additional housing needs for the area, when it opens in 2010. Other employers in the area include the Harnett County Gov't Complex, several car dealerships and banks, and Harnett Production Enterprises (an industrial park). There are no apartments, affordable or market-rate, in Lillington north of the Cape Fear River, where this growth is occurring. However, Lillington's growth to the south remains strong, as it benefits from the Ft. Bragg expansion. According to the 10/07 BRAC Planning Task Force report, "there is a limited supply of rental units for military families in Harnett County as evidenced by the low vacancy rate..and a lack of multifamily building activity." Fairview Pointe, a 50 unit tax credit development approved in 2007, is the only multifamily development approved in the area since 2001. According to the 11/2007 preliminary market study, including Fairview's 50 units, the proposed 60 unit complex results in an overall capture rate of 5%, further evidencing the need for additional, affordable rental units in the area.

Construction (check all that apply): Brick Vinyl Wood HardiPlank Balconies/Patios Sunrooms Front Porches

Front Gables or Dormers Other:

Wide Banding or Vertical/Horizontal Siding

High quality,energy-efficient, and low-maintenance vinyl clad windows and accents will be used. The roofing system will include 25-year, anti-fungal architectural shingles, with wrapped fascia and soffits. Porch posts & columns will be vinyl-wrapped.

Have you built other tax credit developments that use the same building design as this project?Yes If yes, please provide name and address: The plan has been used, and project successfully built, by a Kenn Boisseau tax credit client in Boiling Springs, SC.

Site Amenities: Site amenities include a covered picnic area, picnic tables and grills, outdoor seating around the playground, and tot lot, all of which are connected by sidewalks to the clubhouse and/or the parking areas & residential units. A sodded, open area, to the left of the clubhouse, will remain grassy for kids to play ball & games. Parking will be provided at the front of all buildings, with tree islands providing shade for the residents' autos.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (17 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Onsite Activities: The clubhouse includes an exercise room with machines and free weights; a kitchen area with refrigerator, sink, and microwave; a computer room with high speed internet access; a laundry room with exterior access; and, manager's office accessible from both inside, and outside, the clubhouse. The large meeting area will accomodate seminars, resident parties, games, crafts, and activities related to the supportive services program. A large outdoor covered patio area, to the rear of the meeting room, will have seating for the residents' use.

Landscaping Plans: The wooded areas in the buffers and setbacks will be saved on all boundary sides, to the extent possible, including the 60'+ of wooded frontage along SR 210. A lighted monument sign, visible to drivers from the North and South on SR 210, will be located at the property's entrance. Foundation plantings will consist of evergreens and flowering perenials, and hardwoods and evergreens will be planted in tree islands and throughout the building areas. The Clubhouse area, within the circular driveway, will be sodded and irrigated. Seasonal annuals will be planted at the entrance sign, clubhouse, and building fronts, and xeriscape concepts (very-drought-resistant plantings) will be used where possible.

Interior Apartment Amenities: A typical apartment will include VCT tiling at its entrance, kitchen, and baths, with wall to wall carpeting in other areas; GE energy-saving appliances; oak cabinetry in kitchens and baths; kitchen pantry; walk-in closets; ceiling fans in bedrooms; high-efficiency heat pumps and a/c units; and mini blinds on all windows.

Do you plan to submit additional market data (market study, etc.) that you want considered? Yes If yes, please make sure to include the additional information in your pre-application packet.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (18 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Applicant's Site Evaluation

Briefly describe your site in each of the following categories: NEIGHBORHOOD CHARACTERISTICS Trend and direction of real estate development and area economic health. Physical condition of buildings and improvements in the immediate vicinity. Concentration of affordable housing. The Lillington area's population has increased considerably over the past year, attributable to both the Ft Bragg expansion, to the South, and Wake County's economic engine, from the North. Due to Lillington's northward expansion, the subject neighborhood is in transition, evolving from older single family homes on large lots and farmland on SR 210, to new single-family subdivisions, retail, office, restaurant, medical, and professional services on SR 210, SR 421, and SR 401, all within 1.5 miles of the subject site. Despite the positive trends in population growth and job creation, there are NO apartments, affordable or market-rate, in Lillington, North of the Cape Fear River & in the subject's neighborhood. Hence the exceptional capture rate of 5.2%, the calculation of which includes the 50-unit Fairview Pointe to be constructed south of the Cape Fear River, and the proposed development. In addition to the new residential and commercial growth of the subject neighborhood, the Harnett County Government Complex, which includes the County Courthouse & Depts of Environmental Health, Public Health, Aging, Social Services, & Tax Office & Registrar of Deeds, is located less than 1.2 miles from the site on SR 401. Across from it is the new, 130-acre Biotechnology Business Park, in the planning stages, with construction for a 50-bed acute need hospital ("Harnett Health Systems" has the CON) to occur 2008 2010. The area's growth, coupled with the CON award, Walmart expansion rumors, and limited public water and sewer availability, has generally pushed land prices too high for apartment development, so it is unlikely the proposed development will meet with any competition in the near future. Because the sewer line is just now being extended up SR 210 from Lillington (completion 3/31/08), with the exception of the subject site, there are no tracts off SR 210, 401, or 421, which are suitable for apartment development and have access to public sewer. SURROUNDING LAND USES AND AMENITIES Land use pattern is residential in character (single and multifamily housing). Extent that the location is isolated. Effect of industrial, large-scale institutional or other incompatible uses, including but not limited to: wastewater treatment facilities, high traffic corridors, junkyards, prisons, landfills, large swamps, distribution facilities, frequently used railroad tracks, power transmission lines and towers, factories or similar operations, sources of excessive noise, and sites with environmental concerns (such as odors or pollution). Amount and character of vacant, undeveloped land. The subject site is located within an area of older homes on large tracts of land, with Johnson Farms S/F subdivision started in 2006, and a new S/F subdivision under construction, on Bruce Johnson Road, 1/5 mile from the site. An existing veternarian clinic is adjacent and north of the subject site, and Brookside Assisted Living, which just added more residential units,is located 3/10 mile south. A 17 ac tract of land is for sale across SR 210 from the subject site, for $1 million, and is unlikely to be developed with apartments due to its cost. Ditto for the 965 ac tract on SR 421, east of the subject, which is also "family land," won't be subdivided, and is too expensive for apartment development. There are NO wastewater treatment facilities, junkyards, prisons, landfills, swamps, distribution facilities, railroad tracks, power transmissions, or factories existing or planned in the area. SR 210 is a moderately traveled, two story road, generally limited to traffic between Angier & Lillington. SITE SUITABILITY Adequate traffic safety controls (i.e. stop lights, speed limits, turn lanes). Burden on public facilities (particularly roads). Access to mass transit (if applicable). Visibility of buildings and/or location of project sign (s) in relation to traffic corridors. The proposed site plan includes saving the 60'+- of the dense wooded area along the SR 210 frontage, consisting of evergreens and hardwoods, to provide a privacy and sound buffer for the residents of Dry Creek Apt Homes. Once the development is completed, the buffer may be augmented by more evergreens. The Sources and Uses worksheet includes a CDBG-HD grant for offsite road improvements including, right turn decel and acceleration lanes, a left turn deceleration lane, from the North, and boring under SR 210 to connect with the new sewer line going north, currently under construction on the east side of SR 210 (completion date 3/31/08). There is insufficient traffic volume to warrant a traffic light at this location, according to the DOT. A lighted monument sign will be located along SR 210, at the entrance to Dry Creek Apartment Homes.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (19 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Degree of on-site negative features and physical barriers that will impede project construction or adversely affect future tenants; for example: power transmission lines and towers, flood hazards, steep slopes, large boulders, ravines, year-round streams, wetlands, and other similar features (for adaptive re-use projectssuitability for residential use and difficulties posed by the building(s), such as limited parking, environmental problems or the need for excessive demolition). There are NO on-site or off-site, negative features that would impede construction or adversely affect future residents. It is generally flat and wooded, with an equal number of pines and hardwoods.

Similarity of scale and aesthetics/architecture between project and surroundings. The two-story, walk-up buildings will be enveloped in the existing wooded buffers surrounding the site. There are no, single-story, existing homes along any boundary of the subject site. The proposed brick veneer with vinyl accents on the building facades, will provide excellent curb appeal, and will harmonize with the new subdivision homes, Brookside Assisted Living buildings, and existing retail and commercial uses.

For each applicable neighborhood feature, enter distance from project in miles.

1.0 .4 1.2

Grocery Store Mall/Strip Center Outdoor Athletic Fields Day Care/After School

1.2

Center

Community/Senior

1.3

Hospital Pharmacy

.6

Basic Health Care

2.4

Schools Public Transportation

Stop

.8 1.2 .8 2.2

Convenience Store Public Parks Gas Station Library

Other facilities or services: Harnett Central Middle School & High School are located North on SR 210, 2.4 and 2.8 miles from the subject site. Lillington-Shawtown Elementary School is located 3.7 miles South, and Carolina Central Community College, which offers two year degrees in high tech, public service, health, industrial & engineering fields, is located 1.6 miles from the site on SR 421. Campbell University, an accredited 4-year college with pharmacy and law school curriculums, is located in Buies Creek, approximately 6 miles from the subject site. Food Lion, Peebles Dept Store, Fast Food Restaurants (KFC, McDonald's,Pizza Hut, Subway), Dollar Store,sit down restaurants, tax prep, attorneys, banks and doctors' offices are all located within 1.1 miles of the site.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (20 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Development Team

Provide contact information for development team members below:

Management Agent Company: Address: City: Phone Contact Name: Excel Property Management, Inc 1004 Bullard Court, Suite 106 Raleigh State: NC Zip: 27615 Email: rblackmon@excelpropertymanagement.com Last: Blackmon

(919)878-0522

First: Rita

Architect Company: Address: City: Phone Contact Name: Kenn Boiseau Design Group 8304 Meadow Ridge Court Raleigh State: NC Zip: 27615 Email: KBDGKEN@aol.com Last: Boisseau

(919)847-5860

First: Kenn

Attorney Company: Address: City: Phone Contact Name: Blanco Tackabery & Matamoros, P.A. 110 S. Stratford Road, Fifth Floor or P. O. Drawer 25008 Winston-Salem State: NC Zip: 27114 Email: dlm@blancolaw.com Last: McKenney

(336)293-9000

First: Deborah

Investor Company: Address: City: Phone Contact Name: Community Affordable Housing Equity Corporation 7700 Falls of Neuse Road, Suite 200 Raleigh State: NC Zip: 27615 Email: gmayo@cahec.com Last: Mayo

(919)788-1810

First: Greg

Consultant/Application Preparer (if different from developer) Company: Address: City: Phone Contact Name: First: State: Email: Last: Zip:

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (21 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

General Contractor Company: Address: City: Phone Contact Name:

Identity of Interest?

Harold K. Jordan & Company, Inc. 1086 Classic Road Apex State: NC Zip: 27539 Email: tcastillo@hkjconstruction.com Last: Castillo

(919)303-3652

First: Tony

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (22 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Projected Operating Costs

Project Operations (Year One) Administrative Expenses Advertising Office Salaries Office Supplies Office or Model Apartment Rent Management Fee Manager or Superintendent Salaries Manager or Superintendent Rent Free Unit Legal Expenses (Project) Auditing Expenses (Project) Bookkeeping Fees/Accounting Services Telephone and Answering Service Bad Debts Other Administrative Expenses (specify):

5,000 21,840 1,500

29,162

500 4,000

1,800

Training, computer services

SUBTOTAL Utilities Expense Fuel Oil Electricity (Light and Misc. Power) Water Gas Sewer SUBTOTAL Operating and Maintenance Expenses Janitor and Cleaning Payroll Janitor and Cleaning Supplies Janitor and Cleaning Contract Exterminating Payroll/Contract Exterminating Supplies Garbage and Trash Removal Security Payroll/Contract Grounds Payroll

2,500 66,302

5,000 13,000

17,000 35,000

1,500

2,880

7,980 1,500

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (23 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Grounds Supplies Grounds Contract Repairs Payroll Repairs Material Repairs Contract Elevator Maintenance/Contract Heating/Cooling Repairs and Maintenance Swimming Pool Maintenance/Contract Snow Removal Decorating Payroll/Contract Decorating Supplies Other (specify):

1,000 14,000 19,500 2,000 2,000

2,000

4,000 1,000

Miscellaneous Operating & Maintenance Expenses SUBTOTAL Taxes and Insurance Real Estate Taxes Payroll Taxes (FICA) Miscellaneous Taxes, Licenses and Permits Property and Liability Insurance (Hazard) Fidelity Bond Insurance Workmen's Compensation Health Insurance and Other Employee Benefits Other Insurance:

59,360

31,300 3,725

12,000 65 1,200 2,400

SUBTOTAL Supportive Service Expenses Service Coordinator Service Supplies Tenant Association Funds Other Expenses (specify):

50,690

2,000 400

SUBTOTAL Reserves Replacement Reserves SUBTOTAL

2,400

15,000 15,000

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (24 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

TOTAL OPERATING EXPENSES ADJUSTED TOTAL OPERATING EXPENSES (Does not include taxes, reserves and resident support services) * TOTAL UNITS (from total units in the Unit Mix section) PER UNIT PER YEAR

228,752 180,052 60 3,001

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (25 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Projected Cash Flow Year One

OPERATING INCOME Gross rental income (from Unit Mix - Total Monthly Rent) Stores and Commercial Laundry and Vending Other (specify):

333,396

2,100 9,900 345,396 24,178 321,218 228,752 92,466 80,405 12,061 1.15

Late & Pet fees, forfeited sec deps, interest inc

Total Gross Income Potential at 100% Occupancy Seven Percent Vacancy Allowance NET RENTAL/OTHER INCOME TOTAL OPERATING EXPENSES (from Projected Operating Costs) NET OPERATING INCOME DEBT SERVICE (from Funding Sources Loans) NET CASH FLOW DEBT COVERAGE RATIO (Must not be less than 1.15)

20-Year Cash Flow

Year Net Rental/Other Income* Total Operating Expenses* Debt Service Net Cash Flow Debt Coverage Ratio Year Net Rental/Other Income* Total Operating Expenses* Debt Service Net Cash Flow Debt Coverage Ratio 1 2 3 4 5 6 7 8 9 10

321,218 228,752 80,405 12,061 1.15

11

330,855 237,902 80,828 12,125 1.15

12

340,781 247,418 81,185 12,178 1.15

13

351,004 257,315 81,469 12,220 1.15

14

361,534 267,608 81,675 12,251 1.15

15

372,380 278,312 81,798 12,270 1.15

16

383,551 289,444 81,832 12,275 1.15

17

395,058 301,022 81,770 12,266 1.15

18

406,910 313,063 81,606 12,241 1.15

19

419,117 325,586 81,332 12,199 1.15

20

431,691 338,609 80,941 12,141 1.15

444,642 352,153 80,424 12,065 1.15

457,981 366,239 79,775 11,967 1.15

471,720 380,889 78,983 11,848 1.15

485,872 396,125 78,041 11,706 1.15

500,448 411,970 76,938 11,540 1.15

515,461 428,449 75,663 11,349 1.15

530,925 445,587 74,208 11,130 1.15

546,853 463,410 72,559 10,884 1.15

563,259 481,946 70,706 10,607 1.15

* Net Rental Income escalated at annual rate of 3% and expenses escalated at a rate of 4% after the first year.

Calculations:

1. "Net Rental/Other Income" comes from 1st-year cash flow, then it is escalated by 3% per year.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (26 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

2. "Total Operating Expenses" comes from 1st-year cash flow, then it is escalated by 4% per year. 3. "Debt Service" is the sum of "regular/amortized loan debt service + non-amortizing annual service" as entered by user from Funding Sources section. 4. "Net Cash Flow" is "Net Rental/Other Income" minus "Total Operating Expenses" minus "Debt Service". 5. "Debt Coverage Ratio" is ("Net Rental/Other Income" minus "Total Operating Expenses") divided by "Debt Service".

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (27 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Minimum Set-Asides

MINIMUM REQUIRED SET ASIDES (No Points Awarded): Select one of the following two options: 20% of the units are rent restricted and occupied by households with incomes at or below 50% of the median income (Note: No Tax Credit Eligible Units in the the project can exceed 50% of median income) 40% of the units are rent restricted and occupied by households with incomes at or below 60% of the median income (Note: No Tax Credit Eligible Units in the the project can exceed 60% of median income) If requesting RPP funds: 40% of the units are occupied by households with incomes at or below 50% of median income. State Tax Credit and QAP Targeting Points: Moderate Income County: At least twenty-five percent (25%) of qualified units will be affordable to and occupied by households with incomes at or below forty percent (40%) of county median income. At least fifty percent (50%) of qualified units will be affordable to households with incomes at or below fifty percent (50%) of county median income. At least fifty percent (50%) of qualified units will be affordable to and occupied by households with incomes at or below fifty percent (50%) of county median income. Tax Exempt Bonds Threshold requirement (select one): At least ten percent (10%) of qualified units will be affordable to and occupied by households with incomes at or below fifty percent (50%) of county median income. At least five percent (5%) of qualified units will be affordable to and occupied by households with incomes at or below forty percent (40%) of county median income. Eligible for targeting points (select one): At least twenty percent (20%) of qualified units will be affordable to and occupied by households with incomes at or below fifty percent (50%) of county median income. At least ten percent(10%) of qualified units will be affordable to and occupied by households with incomes at or below forty percent (40%) of county median income.

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (28 of 29)9/16/2008 1:40:16 PM

Print - APP08-0065

Full Application Checklist

PLEASE indicate which of the following exhibits are attached to your application. Others may be required as noted.

A Nonprofit Organization Documentation or For-profit Corporation Documentation B Current Financial Statements/Principals and Owners (signed copies) C Ownership Entity Agreement, Development Agreement or any other agreements governing development services D Management Agent Agreement E Owner and Management Experience & Management Questionnaire (Appendix C) F Local Government Letter or Letter from Certified Engineer or Land Surveyor Confirming Floodplain Designation with Map showing all flood zones (original on letterhead, no fax or photocopies) G Local Government Letter Confirming Zoning including any pending notices or hearings (original on letterhead, no fax or photocopies) H Letters from Local Utility Providers regarding availability and capacity (original on letterhead, no fax or photocopies) I Documentation from utility company or local PHA to support estimated utility costs J Appraisal (required for land costs greater than $15,000 and for all Adaptive Re-use and Rehab projects) K Site plan, floor plans and elevations for all projects. Scope of work for Adaptive Re-use and Rehab projects. (Full Size, 24 x 36 inches) L Hazard and structural inspection and termite reports (Adaptive Re-use and Rehab projects only) M Copy of certificate of occupancy or proof of placed-in-service date (Rehabs Only) N Proposed Relocation Plan including relocation budget and copies of notices. Required for all Rehabs and any projects involving existing occupants of any dwellings to be rehabbed or demolished. O Evidence of Permanent Loan Commitment and other sources of funds ( i.e. Equity letter, AHP, RD and local government funds). For Rehabs with existing loans provide 1) copies of loan documents, 2) current loan balances from existing lenders with reserve balances, 3) letter from lender that outlines assumption requirements. P Local Housing Authority Agreement and Project Based Rental Assistance Letter, if applicable (Sample letters provided in Appendix I). For projects with existing PBRA contracts, provide a copy of the current contract and bank statement or other documentation verifying reserve balances and annual reserve contribution requirements. Q Statement regarding terms of Deferred Developer Fee. If a nonprofit is involved, a resolution from their board approving deferral of fee is required. R Inducement Resolution (Tax-Exempt Bond Financed Projects only)

https://www.nchfa.org/Rental/RTCApp/(S(x3cnavzc...C95A458E7&SNID=972FEC1C3EC7414B867B2B3BD876CF44 (29 of 29)9/16/2008 1:40:16 PM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Condominium LawDocument15 pagesCondominium LawYuuki Rito100% (2)

- 083 Advanced Contract Law Exam Comm June2020Document7 pages083 Advanced Contract Law Exam Comm June2020Maria Alejandra MorrisNo ratings yet

- Sample Work: Winter 2012Document5 pagesSample Work: Winter 2012Ryan SloanNo ratings yet

- Willow RidgeDocument26 pagesWillow RidgeRyan SloanNo ratings yet

- September ScorecardDocument8 pagesSeptember ScorecardRyan SloanNo ratings yet

- The Crossings at Seigle PointDocument30 pagesThe Crossings at Seigle PointRyan SloanNo ratings yet

- Stewart's Creek I ApartmentsDocument25 pagesStewart's Creek I ApartmentsRyan SloanNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument27 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- Southview VillasDocument26 pagesSouthview VillasRyan SloanNo ratings yet

- Kenly Court ApartmentsDocument25 pagesKenly Court ApartmentsRyan SloanNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument26 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- Parkside ApartmentsDocument25 pagesParkside ApartmentsRyan SloanNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument25 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument25 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument26 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- Taxi PDFDocument7 pagesTaxi PDFkartik dNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- BIRMDocument2 pagesBIRMboazmashimbaNo ratings yet

- TMBI vs. MitsuiDocument2 pagesTMBI vs. MitsuiMaria Lopez100% (1)

- Completing The Tests in The Acquisition and Payment Cycle: Verification of Selected AccountsDocument46 pagesCompleting The Tests in The Acquisition and Payment Cycle: Verification of Selected AccountsFadhliatulQisthiNo ratings yet

- Northwestern Mutual - ProjectDocument29 pagesNorthwestern Mutual - Projectapi-503405082No ratings yet

- Safety Awareness2Document23 pagesSafety Awareness2nasyaa1111No ratings yet

- Accidental Death and Dismemberment RiderDocument8 pagesAccidental Death and Dismemberment RiderRicha BandraNo ratings yet

- Practical-Exam - Service-Business QuiambaoDocument22 pagesPractical-Exam - Service-Business QuiambaoDeaf PottatoNo ratings yet

- BPI Vs PosadasDocument11 pagesBPI Vs PosadasWaRynbeth MaljatoNo ratings yet

- Marine Insurance: DefinitionsDocument4 pagesMarine Insurance: DefinitionsRahat KhanNo ratings yet

- Aluminium Casthouse Shapes Market Outlook 2019 April DataDocument89 pagesAluminium Casthouse Shapes Market Outlook 2019 April DataOmkar Pranav100% (1)

- The Great Depression: Roosevelt's New Deal: 11 Grade Us History Richard CanalesDocument20 pagesThe Great Depression: Roosevelt's New Deal: 11 Grade Us History Richard Canalesapi-450506896No ratings yet

- Contact List 2020Document14 pagesContact List 2020Crawford BoydNo ratings yet

- Motor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لDocument8 pagesMotor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لGcvffNo ratings yet

- Sergio Naguiat vs. NLRCDocument15 pagesSergio Naguiat vs. NLRCEnan IntonNo ratings yet

- Chanakya National Law University: Extent of Insurer's Liability Under Motor Vehicles ActDocument19 pagesChanakya National Law University: Extent of Insurer's Liability Under Motor Vehicles ActSAURABH SUNNYNo ratings yet

- Topic 4 - Notes V1Document31 pagesTopic 4 - Notes V1Jade DilaoNo ratings yet

- Turbine Generator Lube Oil FiresDocument3 pagesTurbine Generator Lube Oil Firesman_iphNo ratings yet

- E Series CatalystDocument1 pageE Series CatalystEmiZNo ratings yet

- Artful DodgersDocument43 pagesArtful DodgersEriq GardnerNo ratings yet

- Pdf&rendition 1Document66 pagesPdf&rendition 1KARAN CHIKATENo ratings yet

- Key Man InsuranceDocument40 pagesKey Man Insurancemldc2011No ratings yet

- Future Generali India FinalDocument99 pagesFuture Generali India Finalsuryakantshrotriya67% (3)

- CILA Rebuilding CostDocument40 pagesCILA Rebuilding Cost23985811No ratings yet

- Intra Asia 20240129 083100041155315Document19 pagesIntra Asia 20240129 083100041155315joegesang07No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAkriti JhaNo ratings yet

- Mortgage Markets: Financial Markets and InstitutionsDocument41 pagesMortgage Markets: Financial Markets and InstitutionsAykaNo ratings yet