Professional Documents

Culture Documents

anthonyIM 06

Uploaded by

Jigar ShahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

anthonyIM 06

Uploaded by

Jigar ShahCopyright:

Available Formats

CHAPTER 6

COST OF SALES AND INVENTORIES

Changes from Eleventh Edition

Editorial and updated changes have been made.

Approach

This chapter can be assigned in two parts, if the instructor wishes to spend several sessions on these

topics. The second assignment can begin with the section titled Inventory Costing Methods.

By now, students will have had to deduce cost of goods sold if they have tackled the cases in previous

chapters. Nevertheless, for some students this deduction process is a difficult one to grasp, and it is

important that it be understood. Also, the mechanics of flows through a manufacturing company are

difficult to grasp. Students will encounter this topic again in Chapter 17, however, so it doesnt matter too

much if they dont get it here. This is another one of the topics that seems to be mastered only after drill

with a number of problems.

The choice between LIFO and FIFO also causes problems, perhaps because LIFO obviously does not

match the physical flow of goods. It should perhaps be emphasized that, regardless of the conceptual

merit of one method or the other, LIFO defers incomes taxes, and it defers them forever in an inflationary

economy. The discussion also provides a way of highlighting the fact that accounting focuses on the

measurement of income, even though the result is an unrealistic balance sheet (as is the case with LIFO

inventories).

Cases

Browning Manufacturing Company requires recording a complete cycle of transactions in a

manufacturing company. It is straightforward.

Lewis Corporation is a problem that contrasts FIFO and LIFO in a clear-cut way.

Morgan Manufacturing deals with the adjustment, comparison, and interpretation of financial statements

for two firms, one prepared using LIFO and the other using FIFO.

Joan Holtz (B) is the second set of discrete problems, from which the instructor can select those he or she

wants to discuss in class.

VAL Corporation deals with accounting for mileage programs.

Problems

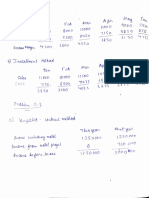

Problem 6-1

The completed table is shown below. Each deduction involves the basic inventory equation.

Ending inventory = Beginning Inventory + Purchase Shipments (COGS)

as well as the basic relationships inherent in any income statement, that is:,

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Income = Revenues Expenses

Co. W

Co. X

Co. Y

Co. Z

Sales......................................................................................................................................................................................

$2,250

$1,800

$1,350

$2,100

Cost of goods sold:................................................................................................................................................................

Beginning inventory.........................................................................................................................................................

300

225

500

300

Plus: Purchases.................................................................................................................................................................

975

975

850

1,200

Less: Ending inventory.....................................................................................................................................................

225

300

300

150

Cost of good sold.........................................................................................................................................................

1,050

900

1,050

1,350

Gross margin.........................................................................................................................................................................

1,200

900

300

750

Period expenses.....................................................................................................................................................................

300

400

150

800

Net income (Loss).................................................................................................................................................................

$ 900

$ 500

$ 150

$ (50)

Problem 6-2

The required income statement is reproduced below.

The closing entries are:

a.

Beginning inventory balance is $50,000

b.

dr. Inventory.........................................................................................................................................................

167,000

cr. Purchases....................................................................................................................................................

167,000

c.

dr. Inventory.........................................................................................................................................................

4,000

cr. Freight-in....................................................................................................................................................

4,000

d.

dr. Returns (to Suppliers).....................................................................................................................................

8,000

cr. Inventory....................................................................................................................................................

8,000

e.

dr. Cost of Goods Sold.........................................................................................................................................

135,500

cr. Inventory......................................................................................................................................................

135,500

f.

dr. Income Summary............................................................................................................................................

135,500

cr. Cost of Goods Sold.....................................................................................................................................

135,500

g.

dr. Income Summary............................................................................................................................................

95,000

cr. Other Expenses...........................................................................................................................................

95,000

h.

dr. Tax expense....................................................................................................................................................

28,350

cr. Taxes Payable.............................................................................................................................................

28,350

i.

dr. Sales................................................................................................................................................................

325,000

cr. Income Summary........................................................................................................................................

325,000

j.

dr. Income Summary............................................................................................................................................

28,350

cr. Tax Expense...............................................................................................................................................

28,350

GARDNER PHARMACY

Income Statement for the Year ----.

Sales...............................................................................................................................................................................

$325,000

Cost of goods sold:.........................................................................................................................................................

Beginning inventory.................................................................................................................................................

$ 50,000

Plus: Purchase, gross........................................................................................................................................

$167,000

2007 McGraw-Hill/Irwin

Chapter 6

Freight-in...................................................................................................................................

4,000

171,000

Less: Purchase returns.........................................................................................................................

8,000

Net purchases..............................................................................................................................................

163,000

Goods available for sale..............................................................................................................................

213,000

Less: Ending inventory........................................................................................................................

77,500

Cost of goods sold.............................................................................................................................

135,500

Gross margin.....................................................................................................................................................

189,500

Other expenses..................................................................................................................................................

95,000

Income before taxes..........................................................................................................................................

94,500

Income tax expense...........................................................................................................................................

28,350

Net income........................................................................................................................................................

66,150

Problem 6-3

a.

dr. Inventory.......................................................................................................................................

85,500

cr. Cash (or Payables)....................................................................................................................

85,500

dr. Cash (or Receivables)....................................................................................................................

133,400

cr. Sales..........................................................................................................................................

133,400

dr. Sales Returns.................................................................................................................................

1,840

Inventory........................................................................................................................................

1,200

cr. Cash (or Receivables)...............................................................................................................

1,840

Cost of Goods Sold...................................................................................................................

1,200

b.

GOULDS COMPANY

Income Statement

Gross sales..........................................................................................................................................

$133,400

Less: Sales returns........................................................................................................................

1,840

Net sales................................................................................................................................

$131,560

Cost of goods sold........................................................................................................................

85,800

Gross margin................................................................................................................................

$ 45,760

c. The perpetual inventory records indicate ending inventory should have been 673 + 5,700 5,800

+ 80 = 653 units. Inventory shrinkage has therefore been 653 610 = 43 units.

dr. Inventory Shrinkage

645

..........................................................

.................................................................................................................................................................................

cr. Inventory........................................................................................................................................................

645

The inventory shrinkage entry reduces gross margin by $645 (or shrinkage could be shown below the

gross margin line as a general expense).

Problem 6-4

Purchases:

50 units @

75 units @

Avg:

125 units @

Sales: 100 units

$14 =

$12 =

$12.80 =

$ 700

900

$1,600

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Ending inventory: 25 units

Avg. Cost

Fifo

Lifo

July 31 inventory............................................................................................................................................................................

$ 320

$ 300

$ 350

Cost of goods sold..........................................................................................................................................................................

1,280

1,300

1,250

Available for sale...........................................................................................................................................................................

1,600

1,600

1,600

Problem 6-5

a.

Fifo

Av. Cost

Lifo

Sales.....................................................................................................................................................................................

$52,125

$52,125

$52,125

Cost of goods sold................................................................................................................................................................

27,310

27,053

26,960

Gross margin........................................................................................................................................................................

$24,815

$25,072

$25,165

Fifo

Av. Cost

Lifo

b.

Gross margin percentage......................................................................................................................................................

47.6%

48.1%

48.3%

c. Net cash flow = $21,465 ($52,125 - $30,660)

No change in pretax cash flow figure using different inventory methods.

d.

Fifo

Av. Cost

Lifo

Pretax cash flow...................................................................................................................................................................

$21,465

$21,465

$21,465

Tax payment

7,445

7,522

7,550

.................................................

.............................................................................................................................................................................................

After-tax cash flow...............................................................................................................................................................

$14,020

$13,943

$13,915

The tax payment in 30 percent of the gross margin dollars. The cash flow using Fifo for tax purposes is

the lowest of the three after tax cash flow amounts because the unit cost of computers is falling,

producing the highest taxable gross margin of the three methods.

Problem 6-6

a. Ending inventory balances are:

Materials

Work in

Finished

Inventory

Process

Goods

Beginning balance........................................................................................................................................................

$ 100,000

$ 370,000

$

60,000

(1) Purchases......................................................................................................................................................................

872,000

Delivery charge............................................................................................................................................................

22,000

(2) Direct labor...................................................................................................................................................................

565,000

(3) Materials transfer..........................................................................................................................................................

(900,000)

900,000

(4) Indirect labor................................................................................................................................................................

27,000

Factory supplies............................................................................................................................................................

46,000

Depreciationfactory....................................................................................................................................................

54,000

Factory utilities.............................................................................................................................................................

147,000

DepreciationMfg........................................................................................................................................................

46,000

Property taxes...............................................................................................................................................................

14,000

(5) Finished goodstransfers..............................................................................................................................................

________

(2,035,000)

2,035,000

$ 94,000

134,000

2,095,000

Cost of goods sold........................................................................................................................................................

--(2,002,000)

Ending balance.............................................................................................................................................................

$ 94,000

$ 134,000

$

93,000

b. Gross margin was 23 percent.

4

2007 McGraw-Hill/Irwin

Chapter 6

Sales................................................................................................................................................................

$2,600,000

Cost of goods sold...........................................................................................................................................

2,002,000

Gross margin...................................................................................................................................................

$ 598,000

Problem 6-7

Item

A

B

C

D

Units

30

40

20

40

Valuation

Basis/Unit

$145

173

131

113

Historical

Cost/Unit

$150

183

134

113

Total adjustment

Total

Adjustment

$150

400

60

0

$610

Cases

Case 6-1: Browning Manufacturing Company*

Note: This case is updated from the Eleventh Edition.

Approach

This is a straightforward complete accounting cycle in a manufacturing company, although it is

considerably longer than previous cases of the same type. Students may find it helpful to refer back to the

journal entries described in the text as a guide. Tracing through these entries is intended to give the

student an understanding of what goes on in a manufacturing company and how these events are reflected

in the accounts. I make a concerted attempt to link the problems numbers to Illustrations 6-3 and 6-4 in

the text, placing the T-accounts side-by-side (if board space permits) and using arrows to denote flows

from one inventory account to another.

Simply because of its length, two days may be necessary for this case. In any event, it is desirable that

some time be left for Question 3, which asks the students to use the information they have built up.

In effect, this case is a miniature practice set and can be treated as such if desired. It is a key case.

Comments on Questions

Question 1

1.

Accounts Receivable...........................................................................................................................

2,562,000

Sales (Retained Earnings).............................................................................................................

2,562,000

Sales Returns and Allowances (R/E)

19,200

..............................................................................

............................................................................................................................................................

Accounts Receivable....................................................................................................................

19,200

Sales Discounts (R/E).........................................................................................................................

49,200

Accounts Receivable....................................................................................................................

49,200

This Teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

Accounting: Text and Cases 12e Instructors Manual

2.

(a)

(b)

Anthony/Hawkins/Merchant

Manufacturing Plant Equipment......................................................................................................................

144,000

Cash...........................................................................................................................................................

144,000

Prepaid Taxes and Insurance...........................................................................................................................

78,000

Cash...........................................................................................................................................................

78,000

Materials Inventory.........................................................................................................................................

825,000

Accounts Payable......................................................................................................................................

825,000

Supplies Inventory...........................................................................................................................................

66,000

Accounts Payable......................................................................................................................................

66,000

Direct Manufacturing Labor............................................................................................................................

492,000

Indirect Manufacturing Labor .........................................................................................................................

198,000

Social Security Taxes......................................................................................................................................

49,200

Power, Heat, and Light....................................................................................................................................

135,600

Cash...........................................................................................................................................................

874,800

Since in a manufacturing company, inventory is assumed to increase in value by the amounts spent to

convert materials into salable products, the following entry should be made; or the debit entry above

could have been made to Work in Process Inventory directly, as is done in the T-accounts to follow.

(c)

3.

4.

5.

6.

7.

8.

9.

Work in process inventory.......................................................................................................................................

874,800

Direct Manufacturing Labor..............................................................................................................................

492,000

Indirect Manufacturing Labor............................................................................................................................

198,000

Social Security Taxes........................................................................................................................................

49,200

Power, Heat, and Light......................................................................................................................................

135,600

Selling and Administrative Expense (R/E)..............................................................................................................

522,000

Cash...................................................................................................................................................................

522,000

Work in Process Inventory......................................................................................................................................

140,400

Accumulated Depreciation................................................................................................................................

140,400

Work in Process Inventory......................................................................................................................................

52,800

Prepaid Taxes and Insurance.............................................................................................................................

52,800

Work in Process Inventory......................................................................................................................................

61,200

Supplies Inventory.............................................................................................................................................

61,200

Work in Process Inventory......................................................................................................................................

811,000

Materials Inventory............................................................................................................................................

811,000

Finished Goods Inventory........................................................................................................................................

1,901,952

Work in Process Inventory................................................................................................................................

1,901,952

Cost of Goods Sold (R/E)........................................................................................................................................

1,806,624

Finished Goods Inventory..................................................................................................................................

1,806,624

Cash.........................................................................................................................................................................

264,000

Notes Payable....................................................................................................................................................

264,000

Notes Payable..........................................................................................................................................................

300,000

Cash...................................................................................................................................................................

300,000

Interest Expense (R/E).............................................................................................................................................

38,400

Cash...................................................................................................................................................................

38,400

Cash ........................................................................................................................................................................

2,604,000

Accounts Receivable.........................................................................................................................................

2,604,000

Accounts Payable....................................................................................................................................................

788,400

Cash...................................................................................................................................................................

788,400

Income Taxes Payable (2005)..................................................................................................................................

9,000

Cash...................................................................................................................................................................

9,000

Estimated Federal Income Taxes Expense (R/E)

58,000

(2006)....................................................................................................................................................................

2007 McGraw-Hill/Irwin

10.

Chapter 6

Income taxes payable (2006)................................................................................................................

5,800

Cash......................................................................................................................................................

52,200

Dividends (Retained Earnings)

30,000

..............................................................................

....................................................................................................................................................................

Cash......................................................................................................................................................

30,000

Question 2 (see pages 102 - 104.)

Question 3

1. Net sales are expected to increase 11.6 percent.

2. Gross profit margin is expected to decrease slightly from 29.8 percent of net sales in 2005 to 27.5

percent in 2006.

3. There is a l9.4 percent increase in selling and administrative expenses. This seems high, relative to

the sales increase; perhaps R&D expense in increasing.

4. The net effect of the foregoing is an anticipated decrease in profit before taxes. Profit would be

increased by judicious reductions in the anticipated selling and administrative expense, or by actions

to restore (or improve) the gross margin percentage.

5. It is expected that more funds will be tied up in inventories. Inventory turnover in 2005 was 2.82

times; it is projected at 2.55 times for 2006. Why the slowdown (about 13 days increase)?

Bal.

(6)

(7)

Bal.

Cash

118,440

(2)

264,000

(2)

2,604,000

(2)

(2)

(6)

(6)

(8)

(8)

(9)

(10)

________

Bal.

2,986,440

149,640

144,000

78,000

874,800

522,000

300,000

38,400

788,400

9,000

52,200

30,000

149,640

2,986,440

Bal.

Materials Inventory

110,520

(3)

811,000

825,000 Bal.

124,520

935,520

935,520

124,520

Bal.

(4)

Finished Goods Inventory

257,040

(5) 1,806,624

1,901,952 Bal.

352,368

Bal.

(2)

Accounts Receivable (Net)

Bal.

311,760

(1)

19,200

(1)

2,562,000

(1)

49,200

(7) 2,604,000

________

Bal.

201,360

2,873,760

2,873,760

Bal.

201,360

Work in Process Inventory

172,200

(1) 1,901,952

874,800 Bal.

210,448

140,400

52,800

61,200

811,000

________

2,112,400

2,112,400

Bal.

210,448

Bal.

(2)

(3)

(3)

(3)

(3)

Bal.

(2)

Bal.

Supplies Inventory

17,280

(3)

66,000 Bal.

83,280

22,080

61,200

22,080

83,280

Accounting: Text and Cases 12e Instructors Manual

Bal.

2,158,992

352,368

Anthony/Hawkins/Merchant

2,158,992

Bal.

(2)

Prepaid Taxes and Insurance

66,720

(3)

52,800

78,000 Bal.

91,920

144,720

144,720

Bal.

91,920

Bal.

(2)

Bal.

(8)

Ba1.

Bal.

(6)

Bal.

Accumulated Depreciation

1,047,600 Bal.

907,200

________

(3)

140,400

1,047,600

1,047,600

Bal. 1,047,600

(8)

Bal.

Accounts Payable

788,400 Bal.

185,760

288,350

(2)

825,000

________

(2)

66,000

1,076,760

1,076,760

Bal.

288,360

Capital Stock

Bal.

(1)

(1)

(2)

(5)

(6)

(9)

(10)

Bal.

1,512,000

Manufacturing Plant

2,678,400 Bal. 2,822,400

144,000

________

2,822,400

2,822,400

2,822,400

Notes Payable

300,000 Bal.

252,840

(6)

552,840

Bal.

288,840

264,000

552,840

252,840

Fed. Inc. Taxes Payable

9,000 Bal.

5,800

(9)

14,800

Bal.

9,000

5,800

14,800

5,800

Retained Earnings

19,200 Bal.

829,560

49,200

(1) 2,562,000

522,000

1,806,624

38,400

58,000

30,000

868,136

________

3,391,560

3,391,560

Bal.

868,136

6. It is planned to reduced notes payable. Whether this is wise may depend on the notes payable interest

vis--vis the return being earned on marketable securities.

7. Additions to plant are slightly greater than depreciation expense. This is not unusual in an inflationary

era.

8. The accounts receivable balance will decline by about 35 percent even though there is an expected

increase in sales. Is the collection department being overly optimistic about collections on account?

BROWNING MANUFACTURING CORPORATION

Projected Balance Sheet as of December 2006

Assets

Current Assets

Cash and marketable securities................................................................................................................................................

$ 449,640

Accounts receivable (net)........................................................................................................................................................

201,360

Inventories:..............................................................................................................................................................................

Materials............................................................................................................................................................................

$124,520

Work in process.................................................................................................................................................................

210,448

Finished goods..................................................................................................................................................................

352,368

2007 McGraw-Hill/Irwin

Chapter 6

Supplies

22,080

709,416

........................................................................

..............................................................................................................................................................................

Prepaid taxes and insurance.........................................................................................................................................

91,920

Total current assets...............................................................................................................................................

$1,452,336

Manufacturing plant....................................................................................................................................................

2,822,400

Less: Accumulated depreciation...........................................................................................................................

( 1,047,600)

1,774,800

Total assets.....................................................................................................................................................

$2,927,136

Liabilities and Shareholders Equity

Current liabilities

Accounts payable

$ 288,360

Notes payable

252,840

Income taxes payable

5,800

Total current liabilities

$ 547,000

Shareholders equity:

Capital stock

1,512,000

Retained earnings

868,136

2,380,136

Total Liabilities and Shareholders Equity

$2,927,136

BROWNING MANUFACTURING CORPORATION

Projected 2006 Income Statement

Sales..................................................................................................................................................................................

$2,562,000

Less: Sales returns and allowances..............................................................................................................................

$19,200

Sales discount allowed.......................................................................................................................................

49,200

68,400

Net sales............................................................................................................................................................................

2,493,600

Less: Cost of goods sold (per schedule)......................................................................................................................

1,806,624

Gloss margin......................................................................................................................................................................

686,976

Less: Selling and administrative expense....................................................................................................................

522,000

Operating income..............................................................................................................................................................

164,976

Less: Interest expense..................................................................................................................................................

$ 38,400

Income before federal income tax......................................................................................................................................

126,576

Less: Estimated income tax expense

58,000

...................................................................................................

....................................................................................................................................................................................

Net income........................................................................................................................................................................

$ 68,576

BROWNING MANUFACTURING CORPORATION

Projected 2006 Statement of Cost of Goods Sold

Finished goods inventory, 1/1/06.......................................................................................................................................

$ 257,040

Work in process inventory, 1/1/06.....................................................................................................................................

$ 172,200

Materials inventory, l/1/06.................................................................................................................................................

$110,520

Plus: Purchases............................................................................................................................................................

825,000

935,520

Less: Materials inventory 12/31/06.............................................................................................................................

124,520

Materials used ...................................................................................................................................................................

811,000

Plus: Factory expenses:...............................................................................................................................................

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Direct manufacturing labor................................................................................................................................................

492,000

Factory overhead:....................................................................................................................................................................

Indirect manufacturing labor.............................................................................................................................................

$198,000

Power, heat, and light........................................................................................................................................................

135,600

Depreciation of plant.........................................................................................................................................................

140,400

Social security taxes..........................................................................................................................................................

49,200

Taxes and insurance, factory.............................................................................................................................................

52,800

Supplies.............................................................................................................................................................................

61,200

637,200

2,112,400

Less: Work in process inventory, 12/31/06..............................................................................................................................

210,448

Cost of goods manufactured.................................................................................................................................................

1,901,952

2,158,992

Less: Finished goods inventory, 12/31/06................................................................................................................................

352,368

Cost of goods sold..........................................................................................................................................................................

$1,806,624

10

2007 McGraw-Hill/Irwin

Chapter 6

Case 6-2: Lewis Corporation*

Note: Updated from Eleventh Edition.

Approach

We have found it useful for students to perform some comparative FIFO/LIFO average cost calculations,

rather than only read about the differences among these methods. This case presents that opportunity,

with an emphasis on the income taxhence, cash flowimplications of the choice of a method. Via

Question 3, the student can see the impact of a sales decline causing a stripping off of LIFO layers with

the result that LIFO reports a lower cost of goods sold, and thus would result in higher income taxes that

year, than would FIFO.

Question 4 introduces the significance of the LIFO reserve. Students can discover that the LIFO reserve is

useful in analyzing financial statements. It can be used to estimate the cumulative tax savings realized by

adopting LIFO; and when trying to compare the financial performance of a company using LIFO to

another using FIFO, the LIFO reserve can be used to adjust the LIFO financial statements to a FIFO

basis. This adjustment will be explored in more detail in Case 6-3

Finally, Question 5 presents the opportunity to challenge the widely held notion that almost all companies

use LIFO (the instructor can update the text footnote on LIFO usage by referring to the latest edition of

Accounting Trends & Techniques and to discuss the reasons for many companies use of FIFO. For those

who wish to do so, this discussion can bring in the Efficient Markets Hypothesis. In our view, one reason

some companies continue to use FIFO in circumstances when LIFO would improve cash flows is that

their managements do not believe that EMH premise that the lower reported earnings from LIFO would

not diminish shareholder value.

Calculations for Questions

Question 1

The approach below reflects how most students perform these calculations. At some point I show them

(to their chagrin) that a lot of effort can be saved if the amount of each years purchases is calculated first,

and then the equation Beg. Invent + Purchases = COGS + End Invent. is applied year-by-year. With the

more detailed approach students take, class time allows showing only a couple of years for FIFO and

LIFO, and one year for average cost.

FIFO:

COGS

Inventory

LIFO:

COGS

2005

1,840

600

380

2,820

@

@

@

@

$20.00

20.25

21.00

=

=

=

$36,800.00

12,150.00

7,980.00

$56,930.00

420

400

200

1,020

@

@

@

21.00

21.25

21.50

=

=

=

8,820.00

8,500.00

4,300.00

$21,620.00

200

400

800

600

@

@

@

@

$21.50

21.25

21.00

20.25

=

=

=

=

$4,300.00

8,500.00

16,800.00

12,150.00

This Teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

11

Accounting: Text and Cases 12e Instructors Manual

AVERAGE COST:

Anthony/Hawkins/Merchant

820

2,820

20.00

16,400.00

$58,150.00

Inventory

1,020

20.00

$20,400.00

COGS

2,820

$20.456 =

$57,685.92

Inventory

1,020 @

20.456 =

$20,865.12

Note in all three cases that the sum of the cost of goods sold and ending inventory amounts is the same:

$78,550 (slightly different with average cost because of rounding errors), which is the sum of the

beginning inventory and purchases (i.e., available for sale).

FIFO:

LIFO:

AVERAGE COST:

FIFO:

2006

420

400

200

700

700

660

3,080

@

@

@

@

@

@

$ 21.00

21.25

21.50

21.50

21.50

22.00

=

=

=

=

=

=

$ 8,820.00

8,500.00

4,300.00

15,050.00

15,050.00

14,520.00

$66,240.00

Inventory

40

1,000

1,040

@

@

@

22.00

22.25

=

=

COGS

1,000

700

700

680

3,080

@

@

@

@

$ 22.25

22.00

21.50

21.50

=

=

=

=

$22,250.00

15,400.00

15,050.00

14,620.00

$67,320.00

Inventory

20

1,020

1,040

@

@

@

$ 21.50

20.00

20.00

=

=

=

COGS

3,080

$21.509

$66,247.72

Inventory

1,040

21.509

$22,369.36

2007

40

1,000

1,000

700

210

2,950

@

@

@

@

@

$ 22.00

22.25

22.50

22.75

23.00

=

=

=

=

=

@

@

23.00

23.50

=

=

$11,270.00

16,450.00

$27,720.00

COGS

COGS

Inventory

490

700

1,190

12

880.00

22,250.00

$23,130.00

430.00

20,400.00

$20,830.00

880.00

22,250.00

22,500.00

15,925.00

4,830.00

$66,385.00

2007 McGraw-Hill/Irwin

LIFO:

Chapter 6

COGS

700

700

700

850

2,950

1,020

@

@

@

@

$23.50

23.00

22.75

22.50

=

=

=

=

20.00

$16,450.00

16,100.00

15,925.00

19,125.00

$67,600.00

$20,400.00

20

150

@

@

21.50

22.50

=

=

430.00

3,375.00

COGS

1,190

2,950

$22.547

$24,205.00

$66,513.65

Inventory

1,190

22.547

$26,830.93

Inventory

AVERAGE COST:

COGS

Inventory

2005

2006

2007

2007

Check on Calculations

FIFO

$ 56,930

66,240

66,385

27,720

$217,275

LIFO

$ 58,150

67,320

67,600

24,205

$217,275

AVG.COST

$ 57,685.92

66,247.72

66,513.65

26,830.93

$217,278.22

Question 2

The calculation of the $1,406 tax difference for 2005-07 is shown below. However, this difference is

really irrelevant for deciding what to do in future years.

2005

2006

FIFO

LIFO

Sales.............................................................................................................................................................

$95,880

$95,880

COGS...........................................................................................................................................................

56,930

58,150

Gross Margin...............................................................................................................................................

38,950

37,730

Tax Expense.................................................................................................................................................

15,580

15,092

Net Income...................................................................................................................................................

$23,370

$22,638

Sales.............................................................................................................................................................

$110,110

$110,110

COGS...........................................................................................................................................................

66,240

67,320

Gross Margin...............................................................................................................................................

43,870

42,790

Tax Expense.................................................................................................................................................

17,548

17,116

Net Income...................................................................................................................................................

$ 26,322

$ 25,674

2007

Sales.............................................................................................................................................................

$105,462.50

$105,462.50

COGS...........................................................................................................................................................

66,385.00

67,600.00

Gross Muffin................................................................................................................................................

39,077.50

37,862.50

Tax Expense.................................................................................................................................................

15,631.00

15,145.00

Net Income ..................................................................................................................................................

$ 23,446.50

$ 22,717.50

Total Tax Expense Savings:

2005

$ 488

2006

432

2007

486

$1,406

13

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

An easier approach, which most students will overlook, is to note that the three-year difference in COGS

is $3,515, and 40 percent of this is $1,406. Even easier, but much more subtle, is realizing that the threeyear COGS difference is equal to the difference in 2007 year-end inventories ($27,720 - $24,205 =

$3,515).

Question 3

Purchases for 2008 forecasted at 1,910* cartons @ 24.00

FIFO

COGS

Inventory

LIFO:

COGS

Inventory

490

700

1,510

2,700

@

@

@

$23.00

23.50

24.00

=

=

=

$11,270

16,450

36,240

$63,960

400

$24.00

$9,600

1,910

150

20

620

2,700

@

@

@

@

$24.00

22.50

21.50

20.00

=

=

=

=

$45,840

3,375

430

12,400

$62,045

400

20.00

$8,000

FIFO

LIFO

2008 Sales (2,700 @ $35.75)..................................................................................................................................................

$96,525

$96,525

COGS...............................................................................................................................................................................

63,960

62,045

Gross margin.....................................................................................................................................................................

32,565

34,480

Tax expense .....................................................................................................................................................................

13,026

13,792

Net income .......................................................................................................................................................................

$19,539

$20,688

In 2008, LIFO would cause an increase in tax expense of $766.

Question 4

The LIFO reserve is the difference between inventory calculated under the FIFO method, and inventory

calculated under the LIFO method.

2005

2006

LIFO Reserve

$1,220

$2,300

=

=

=

FIFO Inventory

$21,620

$23,130

LIFO Inventory

$20,400

$20,830

Another way to look at the LIFO reserve is that it represents the cumulative difference between LIFO cost

of goods sold and FIFO cost of goods sold. We can see that in 2005, the LIFO reserve ($1,220) is equal to

the difference between LIFO cost of goods sold and FIFO cost of goods sold ($58,150 - $56,930 =

$1,220). Similarly, in 2000, the LIFO reserve ($2,300) is equal to the sum of the differences between

LIFO and FIFO cost of goods sold for 2005 and 2000, as shown on the next page.

2,700 sales + 400 ending inventory - 1,190 beginning inventory = 1,910.

14

2007 McGraw-Hill/Irwin

Chapter 6

2005

2006

LIFO cost of goods sold..............................................................................................................................................

$58,150

$67,320

FIFO cost of goods sold..............................................................................................................................................

56,930

66,240

Difference...................................................................................................................................................................

$ 1,220 +

$ 1,080 = $2,300

Therefore, if you are given LIFO cost of goods sold and inventory, and you are also given the LIFO

reserve for that year (year X) and the previous year (year X-1), you can estimate the following:

FIFO inventory (year X) = LIFO inventory (year X) + LIFO reserve (year X)

FIFO COGS (year X) = LIFO COGS (year X) - [LIFO reserve (year X) - LIFO reserve (year X-l)]

Tax savings (year X) = [LIFO reserve (year X) - LIFO reserve (year X-1)] *(1 tax rate)

Cumulative tax savings due to the use of LIFO = LIFO reserve (year X)

Most companies on LIFO report the LIFO reserve in their financial statements, often in the inventory

footnote. Understanding the significance of the LIFO reserve can be very useful when trying to compare

the financial performance of companies using different inventory accounting methods.

Question 5

See Why More LIFO? section of the text, plus comments earlier in this note.

Case 6-3: Morgan Manufacturing*

Note: Updated from Eleventh Edition.

Morgan Manufacturing is a straightforward case to illustrate how information on the LIFO Reserve can

be used to adjust the results of a company on LIFO to make them more comparable to those of a company

on FIFO. This case extends the learning developed in question 4 of Case 6-2, Lewis Corporation. Morgan

Manufacturing may not require a full class for discussion, and the instructor may want to assign it in

conjunction with Lewis Corporation.

Answers to questions:

1. Westwoods gross margin percentage = $900 divided by $2,000 = 45%; pretax return on sales = $300

divided by $2,000 = 15%; pretax return on assets = $300 divided by $2,240 = 13.4%.

2. Students will quickly recognize that both the inventory and the cost of goods sold accounts are

affected. You are likely, however, to have to guide them to recognize what other accounts and

financial items are also affected. For example, if inventory is affected, then some other balance sheet

account must be affected to keep the balance sheet balanced. Students will likely conclude it must be

retained earnings or owners equity. If cost of goods sold is affected, then clearly items such as gross

margin, pretax net income, tax expense and net income will also be affected. Typically, assuming the

norm of continuing inflation and growing inventory, LIFO produces higher cost of goods sold and

lower inventory, owners equity, gross margin, pretax net income, tax expense, and net income than

FIFO. It is possible, therefore, for two companies to have identical underlying economic

performance, but the financial measures of performance of the firm using the LIFO method will look

worse than the financial measures of the firm using the FIFO method (or the underlying economic

performance of the LIFO firm might be even better than that of the FIFO firm, and the LIFO firms

financial measures can still look worse!).

3. Adjustment to 2006 inventory: $100 LIFO inventory + $70 LIFO reserve = $170 FIFO inventory.

*

This teaching note was prepared by Julie H. Hertenstein. Copyright Julie H. Hertenstein.

15

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Adjustment to 2006 total assets: $2,170 + $70 = $2,240

Amount to adjust COGS:

$70

-10

$60

2006 LIFO reserve

2005 LIFO reserve

Difference between 2006 LIFO and FIFO COGS

Adjustment to 2006 COGS: $1,110 - $60 = $1,050

Adjustment to 2006 gross margin: $890 + $60 = $950

Adjustment to 2006 pretax net income: $290 + $60 = $350

Adjusted gross margin percentage = $950 divided by $2,000 = 47.5%

Adjusted pretax return on sales $350 divided by $2,000 = 17.5%

Adjusted pretax return on assets $350 divided by $2,240 = 15.6%

4. Once adjusted to FIFO, Morgans performance exceeds Westwoods on each of the three measures,

as shown in Exhibit 1. In addition, Morgan has paid less in taxes than Westwood.

Pedagogical Approach

You can begin with a general discussion of why we often want to compare the financial performance of

different companies and how our ability to compare companies is affected by the different accounting

choices that they make; this issue, of course, is much broader than simply the choice of LIFO or FIFO. In

Chapter 5, students encountered different revenue recognition choices which produce different financial

results for the same underlying economic events. When firms choose different inventory accounting

methods, these affect financial measures, as well. When trying to compare one company on LIFO with

another on FIFO, one is trying to compare apples and oranges. For purposes of comparison, you would

like to get the companies on a common basis. The LIFO reserve, which is frequently available in the

inventory footnote or elsewhere in the annual report of a firm using LIFO, allows you to make

adjustments to achieve a common basis for comparison.

The three key measures for Morgan are given in the case. You can write them on the board, and put up

Westwoods for comparison when students answer question 1, as shown in the first two lines of Exhibit 1.

As indicated in the answer to question 2, you may need to draw students out on which accounts and

measures will be affected by the choice of inventory accounting method, and how this choice affects the

financial statement readers ability to compare the two companies.

Before proceeding to the calculations in question 3, you may wish to first discuss, conceptually, how you

can adjust results to make them more comparable. The first point regarding the adjustments is that you

have LIFO reserve information, (and since there is not an analogous FIFO reserve), you must adjust the

LIFO company to a FIFO basis. Since the LIFO reserve is the difference between the LIFO and FIFO

inventory, it can be used directly to adjust inventory, and similarly, it is also the adjustment to total assets;

a comparable adjustment can be made to owners equity to keep the balance sheet in balance. The LIFO

reserve represents not only the difference between LIFO and FIFO inventory, but also the cumulative

difference between LIFO and FIFO cost of goods sold. Thus, the LIFO reserve for two consecutive years

can be used to compute the difference between LIFO and FIFO cost of goods sold for the more recent of

the two years, which allows you to make adjustments to the income statement as well.

You may want to raise the issue of what to do if you want to compare after-tax results, instead of the

pretax measures that the case suggests. Some students may want to adjust the tax expense of the LIFO

firm, for example, using the same ratio of tax expense to pretax net income as shown on the LIFO income

16

2007 McGraw-Hill/Irwin

Chapter 6

statement. Others may argue that the tax expense should be unchanged, reflecting the fact that the LIFO

company paid lower taxes due to its choice of the LIFO inventory accounting method, a true economic

difference between the two firms.

Following the conceptual discussion, the actual calculations can be examined and the results posted on

the board, as shown in Exhibit 1. From these results, students will quickly observe that Morgans

performance was better on all three measures. They may also conclude that the productivity

improvements that Charles Crutchfield had implemented were, indeed, reflected in Morgans financial

performance measures.

Exhibit 1

Gross Margin %

Pretax Return on Sales Pretax Return on Assets

Morgan (LIFO)..................................................................................................................................................................

44.5%

14.5%

13.4%

Westwood (LIFO)..............................................................................................................................................................

45.0%

15.0%

13.4%

Morgan (Adjusted)............................................................................................................................................................

47.5%

17.5%

15.6%

Case 6-4: Joan Holtz (B)*

Note: In discussing some of these questions. it may be useful to construct simple numerical examples,

perhaps related to the illustrations in the text. Joan Holtz (B) is an extension of Joan Holtz (A) in

Chapter 5. The case is unchanged from the Eleventh Edition.

1. The ultimate effect, over the life of an entity, is the same under all three methods. For a given

accounting period, however, the methods result in different net income. If purchase discounts are

deducted from purchases, they reduce the net purchase costs, and affect net income in the period in

which the goods are sold. If reported as other income of the period, they affect net income in an

earlier period than in the first method. If discounts not taken are recorded as an expense, cost of goods

sold reflects the full amount of the discount, and discounts not taken decrease income in what is

perhaps a later period.

Another difference is that cost of goods sold, and hence the gross margin percentage, differs under

each of these methods.

Of course, the amounts involved are usually small, so the above differences often are not material

2. There should be a credit to Inventory, to reduce it to the amount found from the physical inventory.

The debit may be either to Cost of Goods Sold or to an operating expense item. Literally, the

shrinkage cost could not have been a cost of the goods that actually were sold, for these goods were

not sold. The practice of debiting of Cost of Goods Sold is often followed, however. For management

purposes, it is desirable to identify the amount of shrinkage, wherever it is reported.

3. It is incorrect to say that the LIFO method assumes anything about the physical flow of the goods.

LIFO advocates know that physically the goods tend to move on a FIFO basis. LIFO is based on a

belief about economic flows, as explained in the text.

4. In the examples given, the economics of the operations of the automobile dealer are best reflected by

the FIFO method (or even better by the specific identification method, which probably approximates

FIFO), and the economics of the operations of the hardware dealer are best reflected by the LIFO

method. Even so, the automobile dealer would not necessarily be wrong to use LIFO; it might regard

the income tax savings as being more important than a correct showing of economic income.

*

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

17

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

5. a. This generalization is valid.

b. This generalization is usually valid, as indicated in the text. However, any such generalization

about LIFO may not be valid if the physical size of the inventory is reduced so that the original

LIFO layers are carried to Cost of Goods Sold.

c. Assuming that income tax rates remain unchanged, and that the physical size of the inventory

remains unchanged, and disregarding the present value of money, this generalization is valid.

6. Although the LIFO inventory as a whole will normally be reported at less than current costs, it can

easily happen that individual items are worth less than their LIFO cost because of obsolescence or

damage. These items should be written down.

7. Since there would be no additional revenue for four years, and since barrels, warehousing costs, and

interest are charged to expense, profit would be reduced by the amount of these additional costs. In

the first full year, these amounts of 200,000 additional gallons would be:

Barrels @ $0.70..........................................................................................................................................

$140,000

Warehousing @ $0.20................................................................................................................................

40,000

Interest @ $0.10..........................................................................................................................................

20,000

On each gallon added to inventory, the warehousing and interest costs would cumulate for four years,

and profits would be decreased correspondingly.

The argument against including these costs in inventory is that they are not costs of producing

whiskey. The production process has been completed before the whiskey is stored. The contrary

argument is that these costs are incurred in order to bring the whiskey to a salable condition and they

therefore should be included as inventory cost. This argument is strongest for the barrels, and next

strong for the warehousing costs. Many people argue that in no circumstances can interest be

considered a cost of production; rather, it is a cost of financing. Yet, if this were a four-year

construction project rather than aging whiskey, GAAP would require capitalization of construction

debt financing costs. (This is not described in the text until Chapter 7.) In any event, unless these

costs are included in inventory, profits will decrease at the very time that the increase in production

indicates that the company is prospering.

8. There is now a rule (from FASB-53) for determining cost of sales for T.V. movies. It is to amortize

film cost in the ratio of

Gross revenue for the film for the current period

Anticipated total gross revenues for the film from

the beginning of the current period until the end

of its useful life

The denominator of this ratio must be reviewed periodically to reflect current information. The new

ratio is then applied to unrecovered film costs. Arguments can be made for ratios of 10/13 or 10/16 in

the first year. The 10/16 ratio ($625,000) is perhaps better due to the belief that at least $300,000 in

revenue will come from reruns. Correspondingly, the ratio to be used in the second year would be 1/2

($300,000/$600,000). This would result in amortization of $187,500 in year two [1/2 x ($1,000,000 $625,000)], with the final $187,500 of cost matched against the final $300,000 of revenue. The

$100,000 spent on advertising and promotion of the initial showing does not benefit the future

showings of the film. This is therefore not a capitalizable cost and should be expensed in the period

incurred. Therefore it does not affect the ratios used above.

18

You might also like

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5 Joan Holtz Answer KeyDocument5 pagesCase 5 Joan Holtz Answer KeyVira CastroNo ratings yet

- Anthony Im 26Document18 pagesAnthony Im 26Aswin PratamaNo ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- Pine Tree Motel Case 3-4: Answer To Q1Document2 pagesPine Tree Motel Case 3-4: Answer To Q1Om PrakashNo ratings yet

- Citibank Performance EvaluationDocument9 pagesCitibank Performance EvaluationMohit Sharma67% (6)

- Baldwin Bicycle Company PPTFINALDocument30 pagesBaldwin Bicycle Company PPTFINALNiluh Putu Dian Rosalina100% (1)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Chap 003Document19 pagesChap 003jujuNo ratings yet

- Fruit Zone India Ltd. (B) : Case Study By, Group 1Document12 pagesFruit Zone India Ltd. (B) : Case Study By, Group 1David Augustine100% (1)

- Case 26-2Document3 pagesCase 26-2NishaNo ratings yet

- Joan Holtz (A) Case Revenue Recognition QuestionsDocument5 pagesJoan Holtz (A) Case Revenue Recognition QuestionsAashima GroverNo ratings yet

- Chap004 SolutionsDocument7 pagesChap004 Solutionsdavegeek100% (1)

- Case 16 3 Bill French Case Analysis KoDocument5 pagesCase 16 3 Bill French Case Analysis KoPankit Kedia100% (1)

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- Hafsa Bookstore Business Plan 1Document3 pagesHafsa Bookstore Business Plan 1Abdi100% (1)

- Revenue Recognition Case Study DiscussionDocument5 pagesRevenue Recognition Case Study DiscussionRahul KaulNo ratings yet

- Shea Kortes $348+ Per Day Method - My Top 8 Marketing Methods PDFDocument19 pagesShea Kortes $348+ Per Day Method - My Top 8 Marketing Methods PDFShiva RakshakNo ratings yet

- AHM Chapter 4 - SolutionsDocument24 pagesAHM Chapter 4 - SolutionsNitin KhareNo ratings yet

- Chapter 8-1 Group Report - NormanDocument6 pagesChapter 8-1 Group Report - Normanvp_zarate100% (1)

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDocument26 pagesAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- Chapter 15&16 Problems and AnswersDocument22 pagesChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Chapter 27 Management AccountingDocument19 pagesChapter 27 Management AccountingLiz Espinosa100% (1)