Professional Documents

Culture Documents

Balance Sheet of Reliance Industries

Uploaded by

Satyajeet ChauhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet of Reliance Industries

Uploaded by

Satyajeet ChauhanCopyright:

Available Formats

Balance Sheet of Reliance Industries

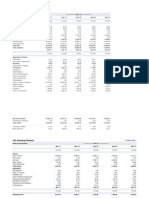

MAR;06 12MONT Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities Mar '07 12 mths Current Ratio Current Assets Current Liablities 07 year 1.11

1393.17 1393.17 0 0 43760.9 4650.19 ### 7664.9 14200.71 21865.61 71699.87 MAR'06 12MONTH

1,393.21 1,393.21 60.14 Quick Raio 0 59,861.81 2,651.97 Debtors Turnover Ratio 63,967.13 9,569.12 18,256.61 Debtors Turnover Period 27,825.73 91,792.86 Mar '07 Inventoru Turnover Ratio 12 mths Inventory Turnover period

Quick Assets Quick Liablities Net Sales Average Debtors 365 DTOR Net sales Average Inventory

0.64

28.29

12.9

10.04

Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits

84970.13 29253.38 55716.75 6957.79 5846.18 10119.82 4163.62 234.31 ### 8266.55 1906.85

99,532.77 35,872.31 long Term debts 63,660.46 Debt Equity Ratio Share Holders fund 7,528.13 16,251.34 12,136.51 EBIT 3,732.42 Return on Capital Employed Total Capital Employeed 308.35 16,177.28 EBIT 12,506.71 Interest Coverage Ration Interest 1,527.00

365 ITOR

36.36

0.44

24.74

12.19

Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities Book Value (Rs)

24696.15 0 17656.02 3890.98 21547 3149.15 0 71669.87 24897.66 324.03

30,210.99 0 24,145.19 Assets Tunrover Raio 1,712.87 25,858.06 4,352.93 0 91,792.86 Operating Profit Ratio 46,767.18 439.57 Net Profit Ratio

Net Sale Average Assets

0.28

Operating Profit Net sales Net profit after Tax Net Sales Profit After Tax Average Assests Profit After tax No. of shares Outstanding Total Dividend Distributed No. of shares Outstanding

0.18

0.11

Returrn on Assets

0.15

Earning per Share

85.71

Dividend per Share

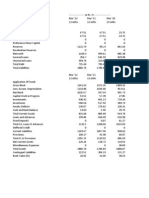

Profit & Loss account of Reliance Industries

10.34

MAR'6 12-Mar Income Sales Turnover Excise Duty Net Sales Other Income Stock Adjustments Total Income

Mar '07 Dividend Payout Ratio 12 mths Dividend Coverage Ratio Dividend per Share Earning per Share Earning per Share Dividend per Share 0.12

8.29

89124.46 118,353.71 8246.67 6,654.68 80877.79 111,699.03 546.96 236.89 Growth in Earning 2131.19 654.6 83555.94 112,590.52

EPS of current year EPS of previous year

1.32

Expenditure Raw Materials Power & Fuel Cost Employee Cost Other Manufacturing Expenses Selling and Admin Expenses Miscellaneous Expenses Preoperative Exp Capitalised Total Expenses

Return on Equity Capital ### 1146.26 978.45 668.31 5872.33 300.74 -155.14 68555.24 MAR'6 12month 80,791.65 2,261.69 2,094.09 P/E Ratio 1,112.17 5,478.10 321.23 Earning Power -111.21 91,947.72 Mar '07 Capitalization Rate 12 mths Dividend Yield 20,405.91 20,642.80 1,298.90 19,343.90 4,815.15 0 14,528.75 0.51 14,529.26 2,585.35 11,943.40 11,156.07 0 1,440.44 202.02 13,935.08 85.71 110 439.57

Profit After Tax Average Equity Market Price Earning per share EBIT Average Assets EPS Market price of share Dividend per Share Market price of share

0.21

15.99

0.06

0.01

Operating Profit PBDIT Interest PBDT Depreciation Other Written Off Profit Before Tax Extra-ordinary items PBT (Post Extra-ord Items) Tax Reported Net Profit Total Value Addition Preference Dividend Equity Dividend Corporate Dividend Tax Per share data (annualised) Shares in issue (lakhs) Earning Per Share (Rs) Equity Dividend (%) Book Value (Rs)

14458.74 15005.7 893.61 14112.09 3400.91 0 10711.18 0.88 10712.06 1642.72 9069.34 8810.95 0 1393.51 195.44 13,935.08 65.08 100 324.03

You might also like

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Balance Sheet of Reliance IndustriesDocument10 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- Kotak Mahindra Bank Balance Sheet of Last 5 YearsDocument10 pagesKotak Mahindra Bank Balance Sheet of Last 5 YearsManish MahajanNo ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- RATIOSDocument136 pagesRATIOSAadiSharmaNo ratings yet

- Hindustan Lever Chemicals Balance Sheet AnalysisDocument28 pagesHindustan Lever Chemicals Balance Sheet AnalysisLochan ReddyNo ratings yet

- Hero Motocorp: Previous YearsDocument11 pagesHero Motocorp: Previous YearssalimsidNo ratings yet

- Balance Sheet of Reliance IndustriesDocument2 pagesBalance Sheet of Reliance IndustriesPavitra SoniaNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- Balance Sheet - in Rs. Cr.Document9 pagesBalance Sheet - in Rs. Cr.Ashwin KumarNo ratings yet

- Annual Balance Sheet Report for Major CorporationDocument2 pagesAnnual Balance Sheet Report for Major CorporationRahul DevNo ratings yet

- Shoppers Stop Vs TrentDocument18 pagesShoppers Stop Vs Trentkrish_desai89No ratings yet

- LIC Housing Finance Balance SheetDocument10 pagesLIC Housing Finance Balance SheetRohit JainNo ratings yet

- Ashok LeylandDocument13 pagesAshok LeylandNeha GuptaNo ratings yet

- Mahindra and Mahindra Profit & Loss AccountDocument13 pagesMahindra and Mahindra Profit & Loss AccountwenemeneNo ratings yet

- Balance Sheet of RaymondDocument5 pagesBalance Sheet of RaymondRachana Yashwant PatneNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- JFHFFDocument18 pagesJFHFFUjjwal SharmaNo ratings yet

- Financial Status of The CompanyDocument5 pagesFinancial Status of The Companyankit_shri19No ratings yet

- Vas Infrastructure Balance Sheet and Cash Flow AnalysisDocument20 pagesVas Infrastructure Balance Sheet and Cash Flow AnalysisskalidasNo ratings yet

- Funds FlowDocument6 pagesFunds FlowhellodearsNo ratings yet

- Hindustan Unilever Key Financial RatiosDocument25 pagesHindustan Unilever Key Financial Ratiosshashank_katakwarNo ratings yet

- Tata Steel Balance Sheet MethodologyDocument6 pagesTata Steel Balance Sheet MethodologyKarrizzmaticNo ratings yet

- Financial PlanDocument15 pagesFinancial PlanIshaan YadavNo ratings yet

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoNo ratings yet

- Ashok Leyland Balance Sheet and Financial RatiosDocument11 pagesAshok Leyland Balance Sheet and Financial RatiosrssardarNo ratings yet

- Vardhman Textiles Balance Sheet AnalysisDocument11 pagesVardhman Textiles Balance Sheet AnalysisRNo ratings yet

- Financial RatioDocument12 pagesFinancial RatiomannavantNo ratings yet

- M&M Balance Sheet AnalysisDocument1 pageM&M Balance Sheet AnalysisLaila BasantiNo ratings yet

- TVS Balance SheetDocument6 pagesTVS Balance SheetNihal LamgeNo ratings yet

- Group Case #1Document3 pagesGroup Case #1Brenda Parham50% (2)

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Ba ND MTNL Balance SheetDocument2 pagesBa ND MTNL Balance SheetHarshit PoddarNo ratings yet

- Tata MotorsDocument8 pagesTata Motorssmartv90No ratings yet

- Ratio Analysis - TMDocument14 pagesRatio Analysis - TMsathishKumarNo ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- Balance Sheet of Tata MotorsDocument1 pageBalance Sheet of Tata MotorsAbhi JainNo ratings yet

- Corp Finance - Assignment - Tata SteelDocument104 pagesCorp Finance - Assignment - Tata SteelNehanitieNo ratings yet

- AAPLDocument6 pagesAAPLmangomikaNo ratings yet

- Dabur India Balance SheetDocument5 pagesDabur India Balance SheetMadhur GumberNo ratings yet

- Profit & Loss Account of Tata Steel: - in Rs. Cr.Document4 pagesProfit & Loss Account of Tata Steel: - in Rs. Cr.ruchitacharaniaNo ratings yet

- Balance Sheet Basics: AssetsDocument8 pagesBalance Sheet Basics: AssetsManish KumarNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Britania ValuationDocument28 pagesBritania ValuationSantanu DasNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement Analysisabhi4all3100% (1)

- Profitibilty RatioDocument50 pagesProfitibilty RatioAshish NayanNo ratings yet

- Financial Reporting and Analysis ProjectDocument15 pagesFinancial Reporting and Analysis Projectsonar_neel100% (1)

- Parle Product FinanciaDocument14 pagesParle Product FinanciaAbinash Behera100% (1)

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- TOPIC: Horizontal, Vertical & Ratio Analysis Assignment #04:: Saira JavaidDocument8 pagesTOPIC: Horizontal, Vertical & Ratio Analysis Assignment #04:: Saira JavaidMuddasar AbbasiNo ratings yet

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisAmandeep SinghNo ratings yet

- Raymonds Financial Statement AnalysisDocument35 pagesRaymonds Financial Statement AnalysisKevin DoshiNo ratings yet

- Searle Company Ratio Analysis 2010 2011 2012Document63 pagesSearle Company Ratio Analysis 2010 2011 2012Kaleb VargasNo ratings yet

- Preeti 149Document16 pagesPreeti 149Preeti NeelamNo ratings yet

- Target: Our Brand PromiseDocument26 pagesTarget: Our Brand Promisejennmai85No ratings yet

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaDocument24 pagesAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyNo ratings yet

- Balance Sheet Condensed TATADocument2 pagesBalance Sheet Condensed TATANona NeenaNo ratings yet

- Sources of Funds and Application of Funds AnalysisDocument12 pagesSources of Funds and Application of Funds AnalysisVishal KumarNo ratings yet

- Appendix 2 No - TitleDocument14 pagesAppendix 2 No - Titlebirjunaik23No ratings yet

- Financial Status-Siyaram Silk Mills LTD 2011-12Document15 pagesFinancial Status-Siyaram Silk Mills LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- Operations Management: Facility LocationDocument56 pagesOperations Management: Facility LocationSatyajeet ChauhanNo ratings yet

- The Mcgraw-Hill Companies, Inc., 2004Document10 pagesThe Mcgraw-Hill Companies, Inc., 2004Satyajeet ChauhanNo ratings yet

- Ibs Student Project ManagementDocument18 pagesIbs Student Project ManagementSatyajeet ChauhanNo ratings yet

- Ibs Student Jit-LeanDocument5 pagesIbs Student Jit-LeanSatyajeet ChauhanNo ratings yet

- Chap 009Document16 pagesChap 009Satyajeet ChauhanNo ratings yet

- Chap 013Document18 pagesChap 013Satyajeet ChauhanNo ratings yet

- Chap 016 TNDocument21 pagesChap 016 TNSatyajeet ChauhanNo ratings yet

- Delhi MetroDocument28 pagesDelhi MetroSatyajeet Chauhan0% (1)

- Chap 017Document31 pagesChap 017Satyajeet ChauhanNo ratings yet

- Chap 012Document40 pagesChap 012Satyajeet Chauhan100% (1)

- Chap 015Document28 pagesChap 015Mario Alejandro Charlin SteinNo ratings yet

- Chap 008Document21 pagesChap 008Satyajeet ChauhanNo ratings yet

- Chap 016Document25 pagesChap 016Satyajeet ChauhanNo ratings yet

- Chap 014Document35 pagesChap 014Satyajeet ChauhanNo ratings yet

- Chap 011Document33 pagesChap 011Satyajeet ChauhanNo ratings yet

- The Mcgraw-Hill Companies, Inc., 2004Document14 pagesThe Mcgraw-Hill Companies, Inc., 2004Satyajeet ChauhanNo ratings yet

- The Mcgraw-Hill Companies, Inc., 2004Document37 pagesThe Mcgraw-Hill Companies, Inc., 2004Satyajeet ChauhanNo ratings yet

- Chap 010Document28 pagesChap 010Satyajeet ChauhanNo ratings yet

- Chap 004 TNDocument24 pagesChap 004 TNSatyajeet ChauhanNo ratings yet

- Chap 005Document25 pagesChap 005Satyajeet ChauhanNo ratings yet

- Chap 006 TNDocument31 pagesChap 006 TNSatyajeet ChauhanNo ratings yet

- Chap 007Document27 pagesChap 007Satyajeet ChauhanNo ratings yet

- Chap 006Document18 pagesChap 006Omar TrujilloNo ratings yet

- Chap 004Document19 pagesChap 004Satyajeet ChauhanNo ratings yet

- ©the Mcgraw-Hill Companies, Inc., 2004Document10 pages©the Mcgraw-Hill Companies, Inc., 2004sshailiNo ratings yet

- Project ManagementDocument37 pagesProject ManagementsshailiNo ratings yet

- Chap 002Document22 pagesChap 002Satyajeet ChauhanNo ratings yet

- 128opertaions SchedulingDocument57 pages128opertaions SchedulingSatyajeet ChauhanNo ratings yet

- Chap 001Document19 pagesChap 001ForHer OnlineShopNo ratings yet

- Aggregate PlanningDocument46 pagesAggregate PlanningSatyajeet ChauhanNo ratings yet

- Project Bond Focus - Fundamentals 2018 FINAL v2Document8 pagesProject Bond Focus - Fundamentals 2018 FINAL v2RishitNo ratings yet

- Exam1 FIN370 Winter 2009 - A KeyDocument25 pagesExam1 FIN370 Winter 2009 - A KeyPhong NguyenNo ratings yet

- AGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and StockholdersDocument65 pagesAGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and Stockholdersrachellesg75% (12)

- Business Combination Quiz 1Document5 pagesBusiness Combination Quiz 1Ansherina AquinoNo ratings yet

- Annual Report - J Kumar Infraprojects LTD - 2015Document93 pagesAnnual Report - J Kumar Infraprojects LTD - 2015deeptiNo ratings yet

- Domain Knowledge On Stock Market or Equity MarketDocument14 pagesDomain Knowledge On Stock Market or Equity MarketPreet SinghNo ratings yet

- Forms of Business OrganisationDocument11 pagesForms of Business Organisationuche0% (1)

- Requsition Letter For Due Diligence AssignmentDocument6 pagesRequsition Letter For Due Diligence AssignmentMohammad Monowar Noor ManikNo ratings yet

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaNo ratings yet

- Multiple Choice Questions On Financial Accounting V2Document6 pagesMultiple Choice Questions On Financial Accounting V2Kate FernandezNo ratings yet

- FDocument11 pagesFAnne Marieline BuenaventuraNo ratings yet

- PROJECTED P& L Account and Balance SheetDocument7 pagesPROJECTED P& L Account and Balance SheetSimanchala DoraNo ratings yet

- Model Portfolio Client Conversation GuideDocument12 pagesModel Portfolio Client Conversation GuideGiselle1101No ratings yet

- AFFIDAVITDocument2 pagesAFFIDAVITAmit MandavilliNo ratings yet

- Hedging Strategies Using Futures: John C. Hull 2021 1Document21 pagesHedging Strategies Using Futures: John C. Hull 2021 1Sagheer MuhammadNo ratings yet

- Voting Trust AgreementDocument4 pagesVoting Trust AgreementPablo Jan Marc Filio100% (3)

- Fairness Opinions: A Flawed RegimeDocument71 pagesFairness Opinions: A Flawed RegimetimevalueNo ratings yet

- RREEF Investment Outlook 8-10Document15 pagesRREEF Investment Outlook 8-10dealjunkieblog9676No ratings yet

- Silkair Singapore Vs CirDocument15 pagesSilkair Singapore Vs Circode4saleNo ratings yet

- CAMEL Ratios ExplainedDocument2 pagesCAMEL Ratios Explainedsrinath121No ratings yet

- ValixDocument17 pagesValixAnne Hawkins100% (7)

- SEC Letter To 9/11 Commission About Foreign Reports of Insider TradingDocument2 pagesSEC Letter To 9/11 Commission About Foreign Reports of Insider Trading9/11 Document ArchiveNo ratings yet

- The Entering EsDocument95 pagesThe Entering Esthomas100% (1)

- Fidic Tendering Procedure PresentationDocument73 pagesFidic Tendering Procedure Presentationadnan100% (1)

- CAFC Law RevisionDocument126 pagesCAFC Law Revisionzubair khanNo ratings yet

- BCSVDocument8 pagesBCSVjam linganNo ratings yet

- Sharpe's Ratio - A Powerful Tool for Portfolio EvaluationDocument12 pagesSharpe's Ratio - A Powerful Tool for Portfolio EvaluationVaidyanathan RavichandranNo ratings yet

- Capital Asset Pricing ModelDocument11 pagesCapital Asset Pricing ModelrichaNo ratings yet

- Chapter 7 PDFDocument4 pagesChapter 7 PDFMISRET 2018 IEI JSCNo ratings yet