Professional Documents

Culture Documents

Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To Date

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To Date

Uploaded by

Klabin_RICopyright:

Available Formats

Quarterly Report 2Q08

Apr/May/Jun 2008

Visit our website: www.klabin.com.br

Klabin earns R$175 million in 2Q08 and R$252 million year to date

2Q08 Highlights

Net Revenue of R$780 million, 9% higher year on year. Coated board sales volume increases by 45% year on year to 132,000 metric tons. All equipment involved in the MA 1100 Expansion Project operating within the learning curve. Maintenance stoppage and general review conducted at the Correia Pinto and Otaclio Costa plants in Santa Catarina state. Paper Machine # 9 produced 71,000 metric tons of paper and board.

R$ million Net Revenue

% Exports

2Q08 780

24%

1Q08 740

28%

2Q07 715

26%

2Q08/ 1Q08 2Q08/ 2Q07 5,4% 9,2%

1H08 1.521

26%

1H07 1.405

27%

1H08/1H07 8,2%

EBITDA

EBITDA Margin

179

23%

205

28%

200

28%

-12,5%

-10,3%

384

25%

403

29%

-4,8%

Net Income

Net Debt Net Debt/EBTIDA (last 12 months) Capex

175 2.272 3,1 147 412

37%

77 2.287 3,1 211 386

42%

207 1.336 1,8 482 378

37%

126,6% -0,7%

-15,3% 70,1%

252 2.272 3,1

372 1.336 1,8 1.033 737

39%

-32,2% 70,1%

-30,4% 6,7%

-69,6% 9,1%

358 799

39%

-65,4% 8,4%

Sales Volume - 1,000 t

% Exports

Investor Relations:

Antonio Sergio Alfano, Chief Financial and Investor Relations Officer Luiz Marciano Candalaft, IR Manager Daniel Rosolen, IR Analyst Michelly Martins da Silva, Trainee Tel: +55 (11) 3046-8404/8416/8415 invest@klabin.com.br r

2Q08 Results July 22nd, 2008

Operating and Financial Performance

Production

Production of paper and coated board in grew to 416,700metric tons, 3% higher in relation to 2Q07 and 5% lower against 1Q08. All equipment involved in the MA 1100 Expansion Project is operating within the learning curve. The commissioning of the new biomass boiler is concluded, with adjustments to be finalized at the scheduled stoppage in late July. Production of the new machine continues as planned, with paper and board output of 71,000 metric tons in 2Q08.

Sales Volume

Sales volume, excluding wood, rose to 412,100 metric tons in 2Q08, up 9% year on year and 7% quarter on quarter. Export sales volume was 152,600 metric tons in the quarter, 10% higher year on year and 5% in relation to 1Q08. Sales volume to the domestic market was 259.5 thousand tons, up 8% in relation to 2Q07 and 15% in relation to 2Q08. Coated board sales accounted for 32% of sales volume in the quarter (versus 24% in 2Q07) and for 31% of sales volume year to date.

Sales Volume by Market

'000 metric tons

Sales Volume by Product - Year to Date

799 737

Industrial Bags 8%

Others 2%

39% 39%

412 386 378

Kraftliner 30% Corrugated Boxes 29%

37%

42%

37%

61%

61%

63%

58%

63%

2Q08

1Q08

Foreign Market

2Q07

1H08

Total

1H07

does not include wood

Coated Boards 31%

Net Revenue

Net revenue, including wood, came to R$780.2 million in 2Q08, growing by 9% year on year and 5% quarter on quarter. Net revenue from coated board sales accounted for 30% of net revenue in the quarter (versus 25% in 2Q07) and for 30% net revenue year to date. 2

2Q08 Results July 22nd, 2008

Net Revenue by Market

R$ million

Net Revenue by Product Year to Date

1,521 1,405

Others 2%

Wood 7%

Kraftliner 17%

26% 27%

Industrial Bags 13%

780

740

715

24%

28%

26%

74%

73%

Corrugated Boxes 31%

76%

72%

Coated Boards 29%

74%

2Q08

1Q08

Foreign Market

2Q07

1H08

Total

1H07

includes wood

Export Destinations

By Volume Year to Date

North America 5%

By Net Revenue Year to Date

North America 6%

Africa 9%

Africa 7%

Asia 15%

Latin America 42%

Asia 16%

Latin America 46%

Europe 29%

Europe 25%

Operating Result

Cost of goods sold totaled R$582.3 million in 2Q08, up 28% year on year and 14% quarter on quarter, due to the sales mix, the price increase in inputs (fuel oil, chemical products and natural gas), the depreciation of MA 1100 equipments and the costs incurred during the maintenance stoppage at the Correia Pinto and Otaclio Costa plants. Selling expenses were R$79.5 million in 2Q08, increasing by 18% year on year and 7% quarter on quarter, as a result of the expansion in sales volume and higher freight costs.

2Q08 Results July 22nd, 2008

Selling expenses were equivalent to 10% of net revenue in the quarter, remaining stable in relation to 2Q07 and 1Q08. General and administrative expenses totaled R$44.1 million in 2Q08, 8% lower year on year and 8% higher quarter on quarter, representing 6% of net revenue, versus 7% in 2Q07 and 6% the 1Q08. Operating income before the financial result (EBIT) was R$74.9 million in 2Q08, declining by 46% year on year and 33% quarter on quarter, due to the higher depreciation resulting from the MA1100 Project. Operating cash flow (EBITDA) was R$179.1 million in 2Q08, with margin of 23%.

EBITDA and EBITDA Margin 29% 25% 24% 26% 29% 28% 28% 21% 186 184 203 200 200 138 205 179 28% 23%

169

170

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

EBITDA - R$ Million

EBITDA Margin

Financial result and indebtedness

The net financial result in the quarter was net financial income of R$174.0 million, versus net financial income of R$139.1 million in 2Q07 and a net financial expense of R$10.7 million in 1Q08. In response to the appreciation in the Brazilian real against the U.S. dollar, the Company adopted a strategy of hedging export cash flow, with a short position at the end of June of US$185 million, which generated financial revenue of R$41.1 million year to date. Year to date, the Brazilian Development Bank (BNDES) disbursed R$257.5 million for the MA 1100 Expansion Project, bringing the total amount disbursed since the start of the project to R$1,659.5 million. The total amount to be financed under the project is R$1,743.7 million, at a cost of the Long-Term Interest Rate (TJLP) plus a spread of less than 2% per annum. Gross debt declined by R$81.3 million, from R$4,446.2 million on March 31, 2008 to R$4,364.6 million on June 30, 2008. Short-term debt accounted for only 5% of total debt. Foreign-denominated debt totaled R$1,999.6 million, equivalent to US$1,256.1 million. The average debt term is 52 months, or 47 months for local-currency debt and 59 months for foreign-denominated debt. Financial investments stood at R$2,093.2 million on June 30. Net debt stood at R$2,271.7 million on June 30, down R$15.5 million in relation to March 31.

2Q08 Results July 22nd, 2008

Debt (R$ million) Local Currency Foreign Currency Short Term % Short Term Local Currency Foreign Currency Long Term % Long Term Total Local Corrency % Local Currency Total Foreign Currency % Foreign Currency Gross Debt Cash and Cash Equivalents Net Debt

3/31/2008 97.0 93.8 190.8 4% 2,215.2 2,040.2 4,255.4 96% 2,312.2 52% 2,134.0 48% 4,446.2 2,159.0 2,287.2

6/30/2008 148.4 57.5 205.9 5% 2,216.9 1,942.1 4,159.0 95% 2,365.3 54% 1,999.6 46% 4,364.9 2,093.2 2,271.7

Net Debt Variation QoQ - R$ Million

2,287

-179

147

120

-174 71 2,272

Net Debt 1Q08

EBITDA

Capex

Dividends

Financial Result

Others

Net Debt 2Q08

Net Income

Net Income was R$175.0 million in 2Q08, 15% lower year on year, due to lower operating income. Net income grew by 127% versus 1Q08, driven by higher financial income.

2Q08 Results July 22nd, 2008

Business Performance

BUSINESS UNIT - FORESTRY

Klabin handled 2.1 million metric tons of pine and eucalyptus logs, woodchips and waste for energy generation in 2Q08, representing an increase in volume of 18% year on year and 1% quarter on quarter. Of this amount, 1.5 million metric tons were transferred to the plants in Paran, Santa Catarina and So Paulo. The volume of log sales to sawmills and laminators totaled 633,100 metric tons in 2Q08, up 8% year on year and stable compared to 1Q08. Net revenue from log sales to third parties in 2Q08 was R$53.0 million, down 3% year on year and 6% quarter on quarter. Klabins customers have managed to reduce their dependence on the U.S. market, increasing sales to Europe and domestic market. However, the local-currency appreciation and the contraction in U.S. the homebuilding market continue to have an adverse affect on wood sales to third parties. In May, new-home starts in the United States fell to a seasonally adjusted annual rate of 975,000 units, declining by 3% against April 2008 and by 32% against May 2007. At the end of June, planted area totaled 218,000 hectares, of which 156,000 were planted with pine and araucaria and 62,000 hectares with eucalyptus, with 183,000 hectares of permanent preservation and legal reserve areas. To support the current expansion in capacity as well as future capacity expansions, the company continues to invest in increasing its own forestry area and through partnerships, leasing agreements and development programs. The forestry unit is working on improving its genetics to boost the productivity of forests by at least 50% over the next seven years. Since 2007, a fast-growing, frost-resistant eucalyptus species has been introduced in Santa Catarina.

BUSINESS UNIT - PAPER

The volume of paper and coated board sales to third parties was 248,900 metric tons in 2Q08, growing by 20% year on year and 5% quarter on quarter. Net revenue from paper and coated board was R$364.5 million in 2Q08, up 16% year on year and 6% quarter on quarter. Exports totaled 140,500 metric tons in 2Q08, 12% higher year on year and 6% lower quarter on quarter. The quarter-on-quarter reduction was due to the increase in domestic kraftliner sales volume and the higher volume of transfers to own corrugated box units. Exports accounted for 56% of the unit's total sales volume in the quarter. Kraftliner sales volume was 117,000 metric tons in 2Q08, stable in relation to 2Q07 and down by 4% quarter on quarter. Kraftliner export sales were 87,200 metric tons in the quarter, accounting for 74% of total sales of this product. Domestic kraftliner sales rose to 29,900 metric tons in 2Q08, up 55% year on year and 50% quarter on quarter. Net revenue from kraftliner sales were R$127.4 million the 2Q08, declining by 7% year on year and 5% quarter on quarter. International kraftliner prices stabilized in the first quarter, following a slight drop early in the year in the European market. U.S. producers announced a price increase of US$55/t as of July 1, 2008. Klabin also announced a price increase in Latin America of US$45/t, implemented through incremental increases of US$15/t in each of the months of July, 6

2Q08 Results July 22nd, 2008

August and September. Meanwhile, European clients will receive a price increase of US$40/t, implemented in some countries as of July and in other countries as of August.

US$ 900 800 700 600 500 400 300 200

Kraftliner Prices x Currency

8% 720 539 2.43 2.18 1.95 -13% 602

R$/US$ 4.00

779

3.50 3.00 2.50 2.00 1.50

1.70

1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 Average Price (US$) Average FX Rate (R$/US$) Source: FOEX - Kraftliner brow n 175 g/m2 - PIX PACKAGING EUROPE Benchmark Indexes

The Company diversified its sales mix, increased the volume of sales to Latin America and substantially increased the volume of sales to the domestic market. The volume of coated board sales in 2Q08 was 131,800 metric tons, growing by 45% year on year and 15% quarter on quarter. Coated board net revenue was R$237.1 million, up 34% year on year and 13% quarter on quarter. According to the Brazilian Association of Pulp and Paper Producers (Bracelpa), Klabin's share of the domestic coated board market in the first half of this year was 18%, versus 11% in the same six-month period of 2007. Coated board exports were 53,300 metric tons in 2Q08, growing by 95% year on year and 13% quarter on quarter. In June, Tetra Pak Brasil approved the board produced by the No. 9 Paper Machine and is expected to approve the board produced in Argentina by July. In the U.S. market, the Company is expected to follow the price increase of Mead Westvaco, which will be staggered over July and August. The Company is increasing sales to the domestic market by developing new products targeting unexplored coated board markets.

BUSINESS UNIT - CORRUGATED BOXES

Preliminary data from the Brazilian Corrugated Box Association (ABPO) indicate that shipments of corrugated cardboard boxes and sheets in Brazil totaled 590,000 metric tons in 2Q08, stable year on year. Shipments year to date totaled 1,131,800 metric tons, unchanged in relation to the same period of last year. Klabins shipments in the quarter were 121,500 metric tons, up 5% year on year and down 14% quarter on quarter.

2Q08 Results July 22nd, 2008

Brazilian shipments of corrugated boxes - thousand tons 541 456 528 551 588 542 590

2Q02

Source: ABPO

2Q03

2Q04

2Q05

2Q06

2Q07

2Q08

Corrugated cardboard net revenue totaled R$249.8 million in 2Q08, growing by 6% year on year and 12% quarter on quarter. The company is rebuilding margins by implementing price increases, adjusting its fixed-cost structure and reducing variable costs.

BUSINESS UNIT - INDUSTRIAL SACKS

Sales volume of industrial sacks at the plants in Brazil and Argentina totaled 32,400 metric tons in 2Q08, declining by 5% year on year and increasing by 3% quarter on quarter. Industrial sack net revenue in the quarter was R$99.9 million, 5% higher year on year and 3% lower quarter on quarter. According to the National Cement Manufacturers Trade Union, cement consumption in the year through June was 15% higher year over year. However, sales of multiwall sacks to this segment did not enjoy the same level of growth, since infrastructure projects and some works under the Economic Stimulation Program (PAC) do not use sack cement.

National Consumption of Cement

Million tonnes

4.0

3.0

2.0 jan feb mar apr may jun jul aug sep oct nov dec

2006

Source: National Cement Industy Association (SNIC)

2007

2008

2Q08 Results July 22nd, 2008

Capital Market

At June 30th, 2008 Preferred Shares Share Price (KLBN4) Book Value Average Daily Trading Volume 2Q08 Market Capitalization 600.9 million R$ 5.99 R$ 3.26 R$ 8.0 million R$ 5.9 billion

The following chart shows the performance of Klabins preferred stock and the benchmark Ibovespa index:

KLBN4 x IBOVESPA

Inception 28/12/07 = 100 120 110 100 90 80 70

28/12/07 28/01/08 28/02/08 28/03/08 28/04/08 28/05/08 28/06/08

1.8%

-9.4%

KLBN4

IBOVESPA

In 2Q08, Klabin preferred stock (KLBN4) registered a nominal gain of 3.3%, versus the increase of 0.2% in the Ibovespa. The company's shares were traded in all trading sessions on the BOVESPA in the quarter, registering 46,588 transactions involving 76.7 million shares, for average daily trading volume of R$8.0 million, down 8.7% from the R$8.8 million registered in 2Q07. Klabin preferred stock was traded on the Bovespa at the average price of R$5.79 per share in the quarter, higher than the average price of R$5.39 per share in 1Q08. Klabin stock also trades on the U.S. market as Level I ADRs, listed on the over-the-counter under the ticker KLBAY. Klabins share capital is represented by 917.7 million shares, of which 316.8 million are common shares and 600.9 million are preferred shares. On June 30, the Company had 15.0 million shares held in treasury. 9

2Q08 Results July 22nd, 2008

Dividends

In April, R$120.0 million was paid in additional dividends relative to fiscal year 2007, or R$124.84 per thousand common shares and R$137.32 per thousand preferred shares.

Investments

The main investments made in the quarter are listed below:

R$ Million Forestry Paper mills Conversion Total

2Q08 61 76 9 147

1Q08 66 137 8 211

1S08 127 213 17 358

The power boiler, the last piece of equipment under the MA 1100 Expansion Project, started operation in mid-June and is operating almost 100% of the time powered by biomass. This boiler has steam production capacity of 250 t/hour and is currently producing between 200 and 220 t/hour. Final adjustments and equipment inspections were conducted in late July during the maintenance stoppage at the Monte Alegre plant. Accordingly, the plant is expected to operate normally in line with the capacity of the MA 1100 Project. To support the current increase in capacity and future expansions, the company continues to invest in expanding its own forest area and in the development program.

10

2Q08 Results July 22nd, 2008

Outlook

The operational startup of the power boiler only in mid-June and the maintenance stoppages at the Correia Pinto and Otaclio Costa plants frustrated the expectations for an improvement in results in 2Q08. In late July, with the general maintenance stoppage at the Monte Alegre plant, final equipment adjustments and inspections will be carried out; therefore, this unit should be operating normally by the start of August. Some factors support the expectation of better results starting in 3Q08: normalization of the operations paper and coated board plants and the increase in domestic sales volumes, with margin expansion in principal products.

Portuguese Conference Call

Wednesday, June 23, 2008 10:00 a.m. (Braslia). Password: Klabin Tel: (11) 4688-6301 Replay: (11) 46886312 Password: 592

English Conference Call

Wednesday, July 23, 2008 10:00 a.m. (U.S. ET) / 11:00 a.m. (Braslia) Password: Klabin Tel: U.S. participants: +1 (888) 700-0802 International participants: +1 (786) 924-6977 Brazilian participants: +55 (11) 4688-6301 Replay: +55 (11) 46886312 Password: 262

Webcast

A webcast of the audio of the conference call is also available over the internet. Access: www.ccall.com.br/klabin

With gross revenue of R$3.4 billion in 2007, Klabin is the largest integrated manufacturer of packaging paper in Brazil, with annual production capacity of 2.0 million metric tons. The Company has adopted a strategic focus in the following businesses: paper and coated board for packaging, corrugated box, industrial sacks and wood. Klabin is the leader in all markets in which it operates.

The statements made in this earnings release concerning the Company's business prospects, projected operating and financial results and potential growth are merely projections and were based on Managements expectations of the Companys future. These expectations are highly susceptible to changes in the market, in the state of the Brazilian economy, in the industry and in international markets, and therefore are subject to change.

11

2Q08 Results July 22nd, 2008 2Q08 Results July 22nd, 2008

Appendix 1 Statement of Consolidated Results Public Company Legislation (R$ thousand)

2Q08 Gross Revenue Net Revenue Cost of Products Sold Gross Profit Selling Expenses General & Administrative Expenses Other Revenues (Expenses) Total Operating Expenses Operating Income (before Fin. Results) Equity in net income (loss) of subsidiaries Financial Expenses Financial Revenues Net Foreign Exchange Losses Net Financial Revenues Operating Income Non Operating Revenues (Expenses) Net Income before Taxes Income Tax and Soc. Contrib. Minority Interest Net Income Depreciation/Amortization/Exhaustion EBITDA 941,643 780,296 (582,324) 197,972 (79,462) (44,142) 569 (123,035) 74,937 (3) (77,411) 84,371 167,028 173,988 248,922 591 249,513 (72,167) (2,374) 174,972 104,206 179,143 1Q08 886,406 740,354 (511,769) 228,585 (73,985) (40,809) (1,406) (116,200) 112,385 (57) (88,445) 58,486 19,279 (10,680) 101,648 181 101,829 (21,276) (3,402) 77,151 92,464 204,849 2Q07 861,386 714,496 (454,943) 259,553 (67,478) (48,177) (5,046) (120,701) 138,852 (6) (46,257) 88,419 96,911 139,073 277,919 (406) 277,513 (67,353) (3,619) 206,541 60,845 199,697 1S08 1,828,049 1,520,650 (1,094,093) 426,557 (153,447) (84,951) (837) (239,235) 187,322 (60) (165,856) 142,857 186,307 163,308 350,570 772 351,342 (93,443) (5,776) 252,123 196,670 383,992 1S07 1,683,916 1,405,036 (890,823) 514,213 (134,305) (89,973) (7,694) (231,972) 282,241 (41) (104,269) 166,239 146,488 208,458 490,658 5,592 496,250 (117,269) (6,946) 372,035 120,938 403,179 100.0% 74.6% 25.4% 10.2% 5.7% 0.1% 15.8% 9.6% 0.0% 9.9% 10.8% 21.4% 22.3% 31.9% 0.1% 32.0% 9.2% 0.3% 22.4% 13.4% 23.0% 100.0% 69.1% 30.9% 10.0% 5.5% 0.2% 15.7% 15.2% 0.0% 11.9% 7.9% 2.6% 1.4% 13.7% 0.0% 13.8% 2.9% 0.5% 10.4% 12.5% 27.7% 100.0% 63.7% 36.3% 9.4% 6.7% 0.7% 16.9% 19.4% 0.0% 6.5% 12.4% 13.6% 19.5% 38.9% 0.1% 38.8% 9.4% 0.5% 28.9% 8.5% 27.9% 100.0% 71.9% 28.1% 10.1% 5.6% 0.1% 15.7% 12.3% 0.0% 10.9% 9.4% 12.3% 10.7% 23.1% 0.1% 23.1% 6.1% 0.4% 16.6% 12.9% 25.3% % of Net Revenue 2Q08 1Q08 2Q07 1S08

12 12

2Q08 Results July 22nd, 2008 2Q08 Results July 22nd, 2008

Appendix 2 Consolidated Balance Sheet Public Company Legislation (R$ thousand)

Assets Current Assets Cash and banks Short-term investments Receivables Inventories Recoverble taxes and contributions Other receivables 6/30/2008 3,327,447 64,044 2,029,185 501,920 369,025 278,571 84,702 12/31/2007 3,062,117 224,221 1,874,420 434,357 336,146 110,821 82,152 Liabilities and StockholdersEquity Current Liabilities Loans and financing Suppliers Income tax and social contribution Taxes payable Salaries and payroll charges Dividends to pay Other accounts payable Long-Term Liabilities Loans and financing Other accounts payable Minority Interests StockholdersEquity Capital Capital reserves Revaluation reserve Profit reserve Treasury stock Accumulated profits Total 6/30/2008 684,433 205,950 234,196 89,058 39,460 67,502 0 48,267 4,309,905 4,158,975 150,930 136,379 2,993,187 1,500,000 84,696 82,067 1,147,309 (73,701) 252,816 8,123,904 12/31/2007 926,984 243,309 373,463 31,125 42,483 69,350 120,002 47,252 4,009,442 3,862,226 147,216 128,365 2,741,299 1,500,000 84,574 83,117 1,147,309 (73,701)

Long-Term Receivables Deferred income tax and soc. Contrib. Taxes to compensate Judicial Deposits Other receivables

420,832 53,969 214,887 83,466 68,510

524,136 56,512 323,177 84,574 59,873

Permanent Assets Other investments Property, plant & equipment, net Deferred charges Total

4,375,625 67,110 4,074,585 233,930 8,123,904

4,219,837 66,870 3,991,690 161,277 7,806,090

7,806,090

13 13

2Q08 Results July 22nd, 2008 2Q08 Results July 22nd, 2008

Appendix 3 Loan Repayment Schedule 03/31/08

R$ Million Bndes Finame Others Local Currency Trade Finance Others Fixed Assets Foreign Currency Gross Debt 3Q08 16.4 0.5 16.8 10.7 0.1 16.9 27.7 44.5 4Q08 12.2 1.7 13.8 10.7 0.2 2.1 13.0 26.8 2008 28.5 2.1 30.7 21.4 0.3 19.0 40.7 71.4 2009 168.6 198.5 367.1 29.4 1.3 9.9 40.6 407.7 2010 291.0 155.2 446.2 142.6 1.3 27.9 171.7 617.9 2011 291.0 16.7 307.7 226.2 1.3 43.9 271.3 579.0

R$ Million

740 724

2012 275.9 16.7 292.5 374.1 1.3 41.9 417.3 709.8

2013 251.4 17.9 269.3 407.8 1.0 61.9 470.8 740.1

2014 247.3 20.8 268.1 187.0 59.9 246.9 515.0

After 2015 322.3 61.6 383.8 43.3 296.9 340.2 724.0

Total 1,876.0 489.4 2,365.4 1,431.8 6.4 561.4 1,999.5 4,364.9

Local Currency Foreign Currency Gross Debt

Average Cost 10.5 % p.y. 5.1 % p.y.

Average Tenor 47months 59 months 52 months

710 618 579 172 417 408 41 271 247 471 515

340

446 367 308 45 28 17 3Q08 4Q08 71 27 41 31 2008 293 269 268 384

Local Currency

2009

2010

Foreign Currency

2011

2012

2013

2014

After 2015

14 14

2Q08 Results July 22nd, 2008

Appendix 4 Statement of Consolidated Cash Flow Public Company Legislation (R$ thousand)

Second Quarter 2008 2007 Cash flow from operating activities Net income Items not affecting cash and cash equivalents Depreciation, amortization and depletion Provision for loss on permanent assets Deferred income and social contribution Interest and exchange variation on loans and financing Equity and subsidiaries Exchange variation on foreign investments Reserve for contingencies Minority interest Others Decrease (increase) in assets Accounts receivable Inventories Recoverable taxes Prepaid expenses Other receivables Increase (decrease) in liabilities Suppliers Taxes and payable Deferred income and social contribution Salaries, vacation and payroll charges Other payables Net cash provided by operating activities (carry forward) Cash flow from investing activities Cash, cash equivalents and investments Purchase of property, plant and equipment Increase in deferred assets Sale of property, plant and equipment Judicial deposits Others Net cash provided by (used in) investing activities Cash from financing activities New loans and financing Amortization of financing Payment of interest Capital contribution to subsidiaries by minority shareholders Dividends paid Stock repurchase Others Net cash used in financing activities Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 174,972 0 104,206 311 2,672 (121,921) 2 1,712 2,374 7,731 (6,229) 0 (36,509) (238) (16,524) (8,740) (5,197) 0 (30,762) 3,215 66,991 12,110 823 150,999 (111,349) (34,319) 0 1,111 1,122 6,046 (137,389) 153,872 (39,212) (73,944) 0 (120,002) 0 (52) (79,338) (65,728) 2,158,957 2,093,229 (65,728) 206,541 60,845 790 19,147 (76,499) 6 (563) 3,619 2,521 0 0 (29,420) (10,161) (111,860) (6,928) (24,824) 0 135,460 8,501 47,906 11,461 17,673 254,215 (410,314) (17,760) (54,139) 571 (3,325) 0 (484,967) 527,476 (152,166) (86,883) 1,430 0 (8,515) (6,694) 274,648 43,896 2,152,815 2,196,711 43,896 First Half 2008 252,123 196,670 604 6,340 (68,621) 60 2,015 5,776 7,734 (6,229) (67,563) (31,736) (59,460) 622 (11,640) (138,766) (3,023) 56,531 (1,848) (7,074) 132,515 (280,148) (76,462) (116) 1,399 1,108 6,043 (348,176) 633,547 (160,184) (145,352) 2,292 (120,002) (52) 210,249 (5,412) 2,098,641 2,093,229 (5,412) 2007 372,035 120,938 1,672 33,762 (94,953) 41 309 6,946 2,798 (7,437) (34,932) (9,599) (173,303) (2,019) (32,238) 195,540 24,452 73,972 (4,961) 30,125 503,148 (942,555) (36,049) (54,139) 1,837 3,724 (1,027,182) 919,195 (190,733) (135,502) 2,070 (110,006) (47,822) (6,638) 430,564 (93,470) 2,290,181 2,196,711 (93,470)

15

You might also like

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- Electrical Carbon & Graphite Products World Summary: Market Sector Values & Financials by CountryFrom EverandElectrical Carbon & Graphite Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

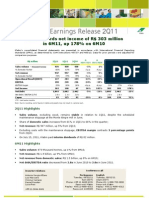

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- Anagement Eport: Initial ConsiderationsDocument8 pagesAnagement Eport: Initial ConsiderationsKlabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- Quarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Document19 pagesQuarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Klabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument7 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- iKRelease2005 4qDocument17 pagesiKRelease2005 4qKlabin_RINo ratings yet

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- 4q2009release BRGAAP InglesnaDocument22 pages4q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocument17 pagesRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RINo ratings yet

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Document18 pages1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument10 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- Earnings ReleaseDocument13 pagesEarnings ReleaseBVMF_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Document18 pagesQuarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Klabin_RINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- KPresentation2009 1Q IngDocument34 pagesKPresentation2009 1Q IngKlabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- Klabin Webcast 20083 Q08Document9 pagesKlabin Webcast 20083 Q08Klabin_RINo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- Mills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsDocument14 pagesMills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsMillsRINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- Indústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Document10 pagesIndústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Klabin_RINo ratings yet

- Klabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Document19 pagesKlabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Klabin_RINo ratings yet

- CROWN: Q1 EarningsDocument2 pagesCROWN: Q1 EarningsBusinessWorldNo ratings yet

- BM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsDocument10 pagesBM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsBVMF_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Rating Klabin - Fitch RatingsDocument1 pageRating Klabin - Fitch RatingsKlabin_RINo ratings yet

- Free Translation Klabin 31 03 2017 Arquivado Na CVMDocument70 pagesFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RINo ratings yet

- Itr 1Q17Document70 pagesItr 1Q17Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Press Klabin Downgrade Mai17Document5 pagesPress Klabin Downgrade Mai17Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Management Change (MATERIAL FACT)Document1 pageManagement Change (MATERIAL FACT)Klabin_RINo ratings yet

- Recommedation To New Chief Executive OfficerDocument1 pageRecommedation To New Chief Executive OfficerKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Notice To Debenture HoldersDocument1 pageNotice To Debenture HoldersKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- DFP 2016Document87 pagesDFP 2016Klabin_RINo ratings yet

- Release 4Q16Document18 pagesRelease 4Q16Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Notice To The Market - New Structure of The Executive BoardDocument2 pagesNotice To The Market - New Structure of The Executive BoardKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Institutional Presentation 2016Document28 pagesInstitutional Presentation 2016Klabin_RINo ratings yet

- Presentation APIMEC 2016Document44 pagesPresentation APIMEC 2016Klabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Release 3Q16Document19 pagesRelease 3Q16Klabin_RINo ratings yet

- Translation of Foreign Currency Financial StatementsDocument27 pagesTranslation of Foreign Currency Financial StatementsSurip BachtiarNo ratings yet

- Chap 3 Consolidations - Subsequent To The Date of AcquisitionDocument14 pagesChap 3 Consolidations - Subsequent To The Date of AcquisitionEunice Ang100% (8)

- A Primer On Reading Annual ReportsDocument229 pagesA Primer On Reading Annual ReportsTomas AriasNo ratings yet

- The Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketDocument2 pagesThe Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketAbgreenNo ratings yet

- Avenue Mail May 05 2017Document8 pagesAvenue Mail May 05 2017NagalingamSundararajanNo ratings yet

- Energy World Corporation LTD.: Placing Agreement With Clsa LimitedDocument1 pageEnergy World Corporation LTD.: Placing Agreement With Clsa LimitedStephanus BrievenbusNo ratings yet

- COURSE OUTLINE - Project and Infrastructure FinanceDocument6 pagesCOURSE OUTLINE - Project and Infrastructure FinanceAnkit BhardwajNo ratings yet

- The Kelly Capital Growth Investment Criterion - ContentsDocument9 pagesThe Kelly Capital Growth Investment Criterion - Contentsbastian990% (4)

- Moneylife 9 July 2015Document68 pagesMoneylife 9 July 2015dhavalmeetsNo ratings yet

- IITM PracticeApti2Document132 pagesIITM PracticeApti2RohitNo ratings yet

- P2Document20 pagesP2Jemson YandugNo ratings yet

- Hastings Group Holdings PLC Prospectus With DisclaimerDocument301 pagesHastings Group Holdings PLC Prospectus With DisclaimerMichael StefanNo ratings yet

- 24 Disbursement ChecklistDocument1 page24 Disbursement ChecklistArul Johnson100% (1)

- Mathfinance BookDocument282 pagesMathfinance BookLoodyMohammadNo ratings yet

- Company Formation and Legal AspectsDocument3 pagesCompany Formation and Legal AspectsJayan PrajapatiNo ratings yet

- 02 Does Board Gender Diversity Increase Dividend Payouts Analysis of Global EvidenceDocument26 pages02 Does Board Gender Diversity Increase Dividend Payouts Analysis of Global EvidenceLina Correa AtehortuaNo ratings yet

- IPO ReadinessDocument1 pageIPO Readinessamy14rose100% (1)

- Remedies Under The Tax Code of 1997Document7 pagesRemedies Under The Tax Code of 1997mnyngNo ratings yet

- 2009-11-02 095434 Julies Maid Cleaning ServiceDocument17 pages2009-11-02 095434 Julies Maid Cleaning ServiceabenazerNo ratings yet

- Dbfs ProfileDocument5 pagesDbfs ProfileMaza StreetNo ratings yet

- BSFFTDocument30 pagesBSFFTChoon Peng TohNo ratings yet

- PDFDocument280 pagesPDFbonat07No ratings yet

- Activity5 EntrepDocument7 pagesActivity5 EntrepFeliciano BersamiraNo ratings yet

- Morgan Rizvi PDFDocument1 pageMorgan Rizvi PDFSuttonFakesNo ratings yet

- Dechow Et Al (1995) PDFDocument34 pagesDechow Et Al (1995) PDFwawanNo ratings yet

- Case Digests Taxation: Filipinas Synthetic Fiber Corp. V CaDocument6 pagesCase Digests Taxation: Filipinas Synthetic Fiber Corp. V CaMorphuesNo ratings yet

- The Initial Public Offering (Ipo)Document38 pagesThe Initial Public Offering (Ipo)Onur YamukNo ratings yet

- Accounting Information As A Tool For Management Decision MakingDocument73 pagesAccounting Information As A Tool For Management Decision MakingGbadeyan Comfort Oluwakemisola100% (2)

- Competitiveness of BangladeshDocument3 pagesCompetitiveness of BangladeshMohammad Shahjahan SiddiquiNo ratings yet

- Investor Profile QuestionnaireDocument4 pagesInvestor Profile QuestionnaireammanairsofterNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet