Professional Documents

Culture Documents

01 Introduction To Accounting

Uploaded by

Marc PulancoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 Introduction To Accounting

Uploaded by

Marc PulancoCopyright:

Available Formats

6/17/2011

INTRODUCTION TO ACCOUNTING

L Velasco / BA 99.1

Contents

What is Accounting? Types of Business Organizations Conceptual Framework

Users of Financial Information IFRS and GAAP Qualitative Characteristics Constraints Assumptions

The Accounting Equation The Financial Statements

What is Accounting?

The Language of Business Accounting is the art of communicating financial information about a business entity to users such as shareholders and managers.

The communication is generally in the financials form statements that show in money terms the economic resources under the control of management. The art lies in selecting the information that is relevant to the user and is reliable.

6/17/2011

What is Accounting?

Accounting is defined by the American Institute of Certified Public Accountants (AICPA) as "the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of financial character, and interpreting the results thereof."

Bottomline

Accounting is an information system how to gather important data, process them and report the processed data in such a way that it is easily understandable by the intended user. Accounting encompasses three main activities:

Identification of Economic events Recording Reporting and Analysis

Types of Business Entities

Sole Proprietorship Partnership Corporation

6/17/2011

Sole Proprietorship

A business organization where there is only one owner. The owner is also the manager of the affairs of the sole proprietorship. Suitable for small business and start-ups because of substantially less capital needed to put it up.

Characteristics of a Proprietorship

Separate entity with no continuous life Unlimited liability of owner Unification of ownership and management Business Taxation

Sole Proprietorship

Advantages

Disadvantages

Less regulations by government in operating decisions Flexibility in and simplicity of decision making.

Unlimited liability of the owner. Limited capital Limited management expertise specially if there are no other professional managers

6/17/2011

Partnership

In a contract of Partnership, two or more persons bind themselves to contribute money, property or industry to a common fund, with the intention of dividing the profits among themselves. The owners and the partnership are separate juridical entities. Partners are liable prorata to creditors of the Partnership.

Partnership

Advantages

Disadvantages

Appropriate for small number of people who want to contribute capital/services to a business. Not strictly regulated. Can be formed by merely forging a contract.

More complicated transfer of ownership. Limited funds from partners. Difficult to manage the affairs if there are too many partners.

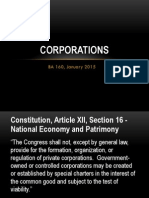

Corporation

It is an artificial being created by law with a separate judicial personality from its owners. Governed by the BOD (Board of Directors) who acts as the stewards of the company in behalf of the shareholders.

Ownership exercised through stocks.

Managed by a separate group (called Management) who are not necessarily owners of the company.

Serves at the pleasure of the BOD

6/17/2011

Corporation

Advantages

Disadvantages

Suitable for large capital requirement businesses. Limited liability of owners/shareholders Easy transfer of ownership -- > stability in ownership

A lot of documentary requirements to set up. Heavily regulated by the government Fixed tax rate of 35% Agency Problem between the shareholders and management

Generally Accepted Accounting Principles

Set of standards that are used as basis in the preparation of financial statements. A set of accounting rules accepted by the profession. Sources:

Law Securities Regulations Code, Tax Authorities, Civil Code Standard-setting bodies Financial Reporting Standards Council/International Accounting Standards Board

International Financial Reporting Standards

Historically, different countries use their own accounting standards.

Difficult for investors to compare companies that operate in different countries

The IASB has developed international standards (IFRS)

In the past, U.S. considered its GAAP to be the strongest set of standards

In November 2008, the SEC announced it will require all U.S. public companies to adopt IFRS

6/17/2011

Objective

Provide information to various users that is useful for their economic decision making

Qualitative Characteristics

Understandability

Reliability

Relevance

Comparability

Constraints

Timeliness

Balance between qualitative characteristics

Benefits versus Costs

Assumptions

Accrual Accounting Stable Monetary Unit

Going Concern Economic Entity

Elements

Assets

Liabilities

Equity

Income

Expenses

Users of Accounting Information

Investors Suppliers and trade creditors

Employees

Creditors Government and its agencies

Customers

Public

Qualitative Characteristics

Understandability

Relevance

Reliability

Comparability

6/17/2011

Constraints

Timeliness

Balance between qualitative characteristics

Benefits versus Costs

Assumptions

Transactions and other events are recognized when they occur Entity will continue to exist indefinitely

Assumptions

Transactions of owners separate from the company. Recorded at historical cost without regard to the purchasing power of the peso

21

Copyright 2011 Pearson Education South East Asia

6/17/2011

The Accounting Equation

ASSETS = LIABILITIES + OWNERS EQUITY

Assets

Liabilities Equity

Elements of Financial Statements

Assets

Resources that the company owns that has value and has the potential to bring economic benefit into the business. Examples are: Cash, Receivables, Inventory, Plant Assets. Claims against the assets of the business that is, existing debts and obligations of the entity. Examples are: Accounts Payable, Notes Payable, Unearned Revenue, etc. Residual claim over the assets of the business that is, the portion of assets that belongs to the owners. It is that portion of total assets after paying off the obligations of the company.

Liabilities

Owners Equity

The Accounting Equation

ASSETS = LIABILITIES + OWNERS EQUITY

Assets

Liabilities Owners Equity

6/17/2011

Increases and Decreases in Owners Equity

Due to Owner Transactions

INCREASE: Capital Infusion/Investment resources contributed by the owner to the business. DECREASE: Capital Drawings/Withdrawal resources taken away by the owner to the business. INCREASE: Revenue

Due to Business Operations

gross increases in owners equity resulting from business transactions entered for the purpose of earning income. It is the inflow from doing business. Cost of assets consumed or services used in the process of earning revenue. They are decreases in Owners Equity as a result of operating the business. Outflow due to doing business

DECREASE: Expenses

Increases and Decreases in Owners Equity

INCREASES

Capital Infusion/Investment assets that the owner puts into the business. Revenue gross increases in owners equity resulting from business transactions entered for the purpose of earning income.

Inflow from doing business.

DECREASES

Capital Drawings/Withdrawal assets withdrawn by owner from the business for personal use. Expenses cost of assets consumed or services used in the process of earning revenue. They are decreases in Owners Equity as a result of operating the business.

Outflow due to doing business

Expanded Accounting Equation

ASSETS = LIABILITIES + (REV + INV EXP W/DRW)

Assets

Liabilities Owners Equity

(+) Revenues Investments (-) Expenses Withdrawals

6/17/2011

Accounting for Business Transactions

Each transaction affects the fundamental accounting equation of A = L + OE Transaction analysis shows the effects of certain transactions on the accounting equation.

Complete Set of Financial Statements

Statement of Comprehensive Income/Profit or Loss

A report showing the financial performance of the firm. It shows the revenues, expense and net income for the period given. A report showing changes in owners equity investments, withdrawals and net incomeover a given period. A report showing the balances of Assets, liabilities and equity of the firm as of a given date.

Statement of Changes in Owners Equity

Statement of Financial Position

Complete Set of Financial Statements

Statement of Cash Flows

A report showing the summary of cash inflows and outflows of the firm. A report showing the details of the financial statement items.

Notes to Financial Statements

10

6/17/2011

Expanded Accounting Equation

ASSETS = LIABILITIES + (REV + INV EXP W/DRW)

Assets

Liabilities Owners Equity

(+) Revenues Investments (-) Expenses Withdrawals

11

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Introduction To ObligationsDocument30 pagesIntroduction To ObligationsMarc PulancoNo ratings yet

- Cesar E.A. Virata School of Business: Plan of Study (Sample)Document1 pageCesar E.A. Virata School of Business: Plan of Study (Sample)Marc PulancoNo ratings yet

- Excel Exam AnswersDocument28 pagesExcel Exam AnswersMarc PulancoNo ratings yet

- Types of ObligationsDocument36 pagesTypes of ObligationsMarc Pulanco100% (2)

- Fill stock trading spreadsheetDocument4 pagesFill stock trading spreadsheetMarc PulancoNo ratings yet

- Rule 7, Chapter 2Document9 pagesRule 7, Chapter 2Marc PulancoNo ratings yet

- Types of ObligationsDocument36 pagesTypes of ObligationsMarc Pulanco100% (2)

- Case 6 Sustainable Lawn CareDocument2 pagesCase 6 Sustainable Lawn CareMarc PulancoNo ratings yet

- Academic CurriculumDocument2 pagesAcademic CurriculumMarc PulancoNo ratings yet

- Introduction To ObligationsDocument30 pagesIntroduction To ObligationsMarc PulancoNo ratings yet

- Fill stock trading spreadsheetDocument4 pagesFill stock trading spreadsheetMarc PulancoNo ratings yet

- GradesDocument4 pagesGradesMarc PulancoNo ratings yet

- CorporationDocument49 pagesCorporationMarc PulancoNo ratings yet

- GradesDocument4 pagesGradesMarc PulancoNo ratings yet

- Equation of The CabinetDocument1 pageEquation of The CabinetMarc PulancoNo ratings yet

- SdfasdfDocument1 pageSdfasdfMarc PulancoNo ratings yet

- SdfasdfDocument1 pageSdfasdfMarc PulancoNo ratings yet

- Fill stock trading spreadsheetDocument4 pagesFill stock trading spreadsheetMarc PulancoNo ratings yet

- The Descriptive DesignscfsDocument10 pagesThe Descriptive DesignscfsMarc PulancoNo ratings yet

- Cesar E.A. Virata School of Business: Plan of Study (Sample)Document1 pageCesar E.A. Virata School of Business: Plan of Study (Sample)Marc PulancoNo ratings yet

- JENESYS FAQsDocument2 pagesJENESYS FAQsMarc PulancoNo ratings yet

- Japan's Cultural Impact in the PhilippinesDocument1 pageJapan's Cultural Impact in the PhilippinesMarc PulancoNo ratings yet

- PepsiCo's comparative analysis and advantages over competitors in the carbonated soft drinks industryDocument2 pagesPepsiCo's comparative analysis and advantages over competitors in the carbonated soft drinks industryMarc PulancoNo ratings yet

- Diane Lipana FInancial Detective HWDocument4 pagesDiane Lipana FInancial Detective HWihsihs7891100% (1)

- StockDocument2 pagesStockMarc PulancoNo ratings yet

- SOA FM Sample QuestionsDocument59 pagesSOA FM Sample QuestionsAdamNo ratings yet

- Business Planning Fiche de Poste Business PlannerDocument2 pagesBusiness Planning Fiche de Poste Business PlannerMarc PulancoNo ratings yet

- Business Planning Ipod Project Forecasting PromotionsDocument5 pagesBusiness Planning Ipod Project Forecasting PromotionsMarc PulancoNo ratings yet

- BA 186 - Final Paper - Executive SummaryDocument2 pagesBA 186 - Final Paper - Executive SummaryMarc PulancoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Difference Between Cost Accounting and Financial AccountingDocument3 pagesDifference Between Cost Accounting and Financial AccountingabdulrehmanNo ratings yet

- Solutions Manual To Accompany Investment 8th Edition 9780073382371Document9 pagesSolutions Manual To Accompany Investment 8th Edition 9780073382371JamieBerrypdey100% (36)

- FFC financial analysis 1978-2012Document22 pagesFFC financial analysis 1978-2012Nabeel KhaliqNo ratings yet

- Personal and Household Finance ExplainedDocument5 pagesPersonal and Household Finance ExplainedMuhammad SamhanNo ratings yet

- Lesson05 Accounting in ERP Systems - PPT 123456Document22 pagesLesson05 Accounting in ERP Systems - PPT 123456Jamaica CatiloNo ratings yet

- RURAL BANK OF SALINAS V CADocument2 pagesRURAL BANK OF SALINAS V CAJv FerminNo ratings yet

- Certificate of Increase of CsDocument3 pagesCertificate of Increase of CsAnthonette Beriso JacoboNo ratings yet

- Measuring/Managing Translation and Transaction Exposure Chapter 10 Lecture NotesDocument13 pagesMeasuring/Managing Translation and Transaction Exposure Chapter 10 Lecture NotespilotNo ratings yet

- History NismDocument3 pagesHistory NismVmani KandanNo ratings yet

- Consolidated Balance Sheet After Total AcquisitionDocument2 pagesConsolidated Balance Sheet After Total AcquisitiongabrielkollingNo ratings yet

- Powers of Corporation ExplainedDocument44 pagesPowers of Corporation ExplainedGraciela InacayNo ratings yet

- Please Show Your Calculation See The Instruction Given at The Beginning of The AssignmentDocument3 pagesPlease Show Your Calculation See The Instruction Given at The Beginning of The Assignmentzubair aliNo ratings yet

- Corpo Syllabus - Atty Fabian Week5Document2 pagesCorpo Syllabus - Atty Fabian Week5Mark Joseph VirgilioNo ratings yet

- Topic 3 Bonds Volatility New SummerDocument64 pagesTopic 3 Bonds Volatility New SummerChloe KoNo ratings yet

- 5 Min Hein Ken AshiDocument3 pages5 Min Hein Ken AshiDisha ParabNo ratings yet

- Check List For Sub Division of Shares - CA ViswaDocument3 pagesCheck List For Sub Division of Shares - CA ViswaRahul JainNo ratings yet

- SPF Managed SBLC Program OverviewDocument22 pagesSPF Managed SBLC Program OverviewPattasan UNo ratings yet

- Fundamental & Technical Analysis of Automobile StocksDocument19 pagesFundamental & Technical Analysis of Automobile StocksShahzad SaifNo ratings yet

- Court of Appeals erred in ruling tax credit basis for senior discountsDocument1 pageCourt of Appeals erred in ruling tax credit basis for senior discountsZydalgLadyz NeadNo ratings yet

- Exam1 FIN370 Winter 2009 - A KeyDocument25 pagesExam1 FIN370 Winter 2009 - A KeyPhong NguyenNo ratings yet

- Philex Mining Corporation 2016 Consolidated Audited Financial StatementDocument97 pagesPhilex Mining Corporation 2016 Consolidated Audited Financial StatementRhean Jallorina GanadenNo ratings yet

- ValixDocument17 pagesValixAnne Hawkins100% (7)

- Banking LawsDocument26 pagesBanking LawsAgnes Anne GarridoNo ratings yet

- Arvino: Bse Limited National Stock Exchange of India LimitedDocument263 pagesArvino: Bse Limited National Stock Exchange of India LimitedPrem TetambeNo ratings yet

- Class X E Book Maths Chapter VI InstalmentDocument11 pagesClass X E Book Maths Chapter VI InstalmentManish KhakhraNo ratings yet

- College of Computer Studies: Entrepreneurial MindDocument2 pagesCollege of Computer Studies: Entrepreneurial MindJE TCNo ratings yet

- Solution To Assignment 1 Winter 2017 ADM 4348Document19 pagesSolution To Assignment 1 Winter 2017 ADM 4348CodyzqzeaniLombNo ratings yet

- Equity Issue 2005 PDFDocument400 pagesEquity Issue 2005 PDFanon_299093230No ratings yet

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaDocument25 pagesUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviNo ratings yet