Professional Documents

Culture Documents

Ekonomika V Evropě Je Na Začátku Období Velmi Slabého Růstu (Dokument V AJ)

Uploaded by

Ivana LeváOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ekonomika V Evropě Je Na Začátku Období Velmi Slabého Růstu (Dokument V AJ)

Uploaded by

Ivana LeváCopyright:

Available Formats

24 August 2011 Economics Research

http://www.credit-suisse.com/researchandanalytics

European Economics

Research Analysts Christel Aranda-Hassel +44 20 7888 1383 christel.aranda-hassel@credit-suisse.com Violante Di Canossa +44 20 7883 4192 violante.dicanossa@credit-suisse.com Neville Hill +44 20 7888 1334 neville.hill@credit-suisse.com Axel Lang +44 20 7883 3738 axel.lang@credit-suisse.com Giovanni Zanni +33 1 7039 0132 giovanni.zanni@credit-suisse.com

Double whammy

We have cut our growth forecasts for this year and next. We now expect euro area GDP to grow by 1.7% in 2011 and 1.0% in 2012. UK GDP should grow 1.0% this year and 1.5% next. We expect both the ECB and BoE to keep rates on hold. It is now clear that the political uncertainty and financial turbulence of the past two months has had a negative impact on business confidence and activity in Europe. The latest round of business surveys generally show a precipitous fall in business confidence and, to a lesser degree for now, activity. For a recovery predominantly driven by business spending, such a confidence shock is likely to mean weaker growth. And we now expect output growth in both the euro area and UK to be more or less flat in H2 this year. These economies are likely to skirt recession and in the absence of a new shock: probability models suggest the chances of recession in Europe are around 40%, but those chances have risen sharply in the past few weeks. However, we expect this to be a brief pause in recovery in our central scenario, rather than a relapse back deep into recession. The financial and economic health of the corporate sector makes the prospect of deep cuts in output unlikely. However, there are considerable risks to this forecast. The biggest downside risk would be another disruptive financial shock. Unfortunately, the continued euro area government debt crisis, particularly renewed uncertainty over the Greek rescue package, provides a potential source of such a shock. And the euro areas fiscal problems mean any re-acceleration in growth in early 2012 is likely to be subdued. Despite the likelihood that growth this year and next will be lower than governments expect, we think they will continue to meet their deficit projections for 2012. But further, pro-cyclical, fiscal tightening will be needed to achieve that, which will prove an additional headwind to growth early next year. Economies without the need (Germany) or pressure (UK) to tighten policy further are likely to see a more lively rebound, in our view. In all, that means weve cut our forecasts for growth for this year and next, and now look for the euro area to grow by 1.0% and the UK by 1.5% in 2012. A prolonged period of weak growth should keep the central banks from tightening from here. But unless these economies sink back into recession, or there is a substantial financial accident, we dont anticipate any easing in monetary policy.

*The authors of this report wish to acknowledge the contribution made by Maxine Koster of Koster Economics Limited.

ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE IN THE DISCLOSURE APPENDIX. FOR OTHER IMPORTANT DISCLOSURES, PLEASE REFER TO https://firesearchdisclosure.credit-suisse.com.

You might also like

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvNo ratings yet

- The Global Economy - December 19, 2012Document3 pagesThe Global Economy - December 19, 2012Swedbank AB (publ)No ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- 2011-06-17 LLOY Data Analysis - Greek TragedyDocument4 pages2011-06-17 LLOY Data Analysis - Greek TragedykjlaqiNo ratings yet

- PIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015Document4 pagesPIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015kunalwarwickNo ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Monthly: La Reforma Del Sector Servicios OUTLOOK 2012Document76 pagesMonthly: La Reforma Del Sector Servicios OUTLOOK 2012Anonymous OY8hR2NNo ratings yet

- The Centrality of The g20 To Australian Foreign PolicyDocument15 pagesThe Centrality of The g20 To Australian Foreign PolicyLatika M BourkeNo ratings yet

- Global Insurance+ Review 2012 and Outlook 2013 14Document36 pagesGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraNo ratings yet

- 4feb11 Retrospectiva2010 Scenarii2011 PDFDocument16 pages4feb11 Retrospectiva2010 Scenarii2011 PDFCalin PerpeleaNo ratings yet

- Latin Manharlal Commodities Pvt. LTD.: Light at The EndDocument25 pagesLatin Manharlal Commodities Pvt. LTD.: Light at The EndTushar PunjaniNo ratings yet

- 18 Econsouth Fourth Quarter 2012Document6 pages18 Econsouth Fourth Quarter 2012caitlynharveyNo ratings yet

- The Forces Shaping The Economy Over 2012Document10 pagesThe Forces Shaping The Economy Over 2012economicdelusionNo ratings yet

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilNo ratings yet

- 2013 March Ernst & Yang Report German EconomyDocument8 pages2013 March Ernst & Yang Report German Economygpanagi1No ratings yet

- Return of The CrisisDocument15 pagesReturn of The CrisischarurastogiNo ratings yet

- Nordic Region Out Look 2013Document15 pagesNordic Region Out Look 2013Marcin LipiecNo ratings yet

- G P P C: Group of TwentyDocument13 pagesG P P C: Group of Twentya10family10No ratings yet

- Euro Themes - SpainDocument22 pagesEuro Themes - SpainGuy DviriNo ratings yet

- Italy Will Be Europ1Document3 pagesItaly Will Be Europ1quyên NguyễnNo ratings yet

- Monetary Policy Committee Meeting: Minutes of TheDocument10 pagesMonetary Policy Committee Meeting: Minutes of TheTelegraphUKNo ratings yet

- Euro Crisis and IndiaDocument18 pagesEuro Crisis and Indiaडॉ. शुभेंदु शेखर शुक्लाNo ratings yet

- Strategic Analysis: Is The Recovery Sustainable?Document16 pagesStrategic Analysis: Is The Recovery Sustainable?varj_feNo ratings yet

- Eurozone Autumn 2011 Main ReportDocument52 pagesEurozone Autumn 2011 Main ReportMukesh KumarNo ratings yet

- Bahrain Economy 2012Document54 pagesBahrain Economy 2012Usman MoonNo ratings yet

- Bahrain Economic Quarterly: Second Quarter 2012Document54 pagesBahrain Economic Quarterly: Second Quarter 2012GeorgeNo ratings yet

- Global Financial Crisis and Sri LankaDocument5 pagesGlobal Financial Crisis and Sri LankaRuwan_SuNo ratings yet

- ScotiaBank AUG 06 Europe Weekly OutlookDocument3 pagesScotiaBank AUG 06 Europe Weekly OutlookMiir ViirNo ratings yet

- How Vulnerable Is ItalyDocument26 pagesHow Vulnerable Is ItalyCoolidgeLowNo ratings yet

- According To Napier 10 2022Document11 pagesAccording To Napier 10 2022Gustavo TapiaNo ratings yet

- Jak Na Dluhy V EU (Dokument V AJ)Document16 pagesJak Na Dluhy V EU (Dokument V AJ)Ivana LeváNo ratings yet

- Swiss National Bank Quarterly Bulletin - September 2011Document54 pagesSwiss National Bank Quarterly Bulletin - September 2011rryan123123No ratings yet

- Prospects 2011Document7 pagesProspects 2011IPS Sri LankaNo ratings yet

- Is The New Year Too Happy?: The Global Economic and Financial Markets OutlookDocument35 pagesIs The New Year Too Happy?: The Global Economic and Financial Markets Outlookwbowen92888No ratings yet

- Market Report 2011 OctoberDocument18 pagesMarket Report 2011 OctoberAndra Elena AlexandrescuNo ratings yet

- Deutsche Bank - The Markets in 2012-Foresight With InsightDocument60 pagesDeutsche Bank - The Markets in 2012-Foresight With InsightDaniel GalvezNo ratings yet

- Barclays On Debt CeilingDocument13 pagesBarclays On Debt CeilingafonteveNo ratings yet

- Economic Insight: Monthly Briefing From Icaew'S Economic Advisers MAY 2012Document4 pagesEconomic Insight: Monthly Briefing From Icaew'S Economic Advisers MAY 2012api-125732404No ratings yet

- 2012, Challenging Times Ahead: 2012. Can't Be Worse Than 2011, Can It?Document18 pages2012, Challenging Times Ahead: 2012. Can't Be Worse Than 2011, Can It?vladvNo ratings yet

- Capital Economics European Economics Focus Euro Zone Break Up 11282011Document13 pagesCapital Economics European Economics Focus Euro Zone Break Up 11282011Jose BescosNo ratings yet

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Document18 pagesNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUNo ratings yet

- Daily Currency Briefing: A Point For TrichetDocument4 pagesDaily Currency Briefing: A Point For TrichettimurrsNo ratings yet

- Country Intelligence Report 2Document34 pagesCountry Intelligence Report 2Li JieNo ratings yet

- Atwel - Global Macro 6/2011Document15 pagesAtwel - Global Macro 6/2011Jan KaskaNo ratings yet

- Nordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Document7 pagesNordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Glenn ViklundNo ratings yet

- Economic Fact Book: Spain: Key FactsDocument8 pagesEconomic Fact Book: Spain: Key FactssovacapNo ratings yet

- Swedbank Economic Outlook June 2009Document37 pagesSwedbank Economic Outlook June 2009Swedbank AB (publ)No ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Deflation Danger 130705Document8 pagesDeflation Danger 130705eliforuNo ratings yet

- ScotiaBank JUL 26 Europe Weekly OutlookDocument3 pagesScotiaBank JUL 26 Europe Weekly OutlookMiir ViirNo ratings yet

- Today's Calendar: Friday 15 November 2013Document9 pagesToday's Calendar: Friday 15 November 2013api-239816032No ratings yet

- Autumn Statement 2011Document9 pagesAutumn Statement 2011IPPRNo ratings yet

- Financial Crisis AftermathDocument23 pagesFinancial Crisis AftermathRafay KhanNo ratings yet

- Greece Crisis and The Consequences For IndiaDocument4 pagesGreece Crisis and The Consequences For IndiaAditya KharkiaNo ratings yet

- Euro Crisis (India + The End)Document5 pagesEuro Crisis (India + The End)BEEXTCANo ratings yet

- IMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011Document12 pagesIMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011babstar999No ratings yet

- PC 2014 05 Final 1 01Document25 pagesPC 2014 05 Final 1 01BruegelNo ratings yet

- The Reform of Europe: A Political Guide to the FutureFrom EverandThe Reform of Europe: A Political Guide to the FutureRating: 2 out of 5 stars2/5 (1)

- Politico Understanding Obamacare GuideDocument112 pagesPolitico Understanding Obamacare GuideMarvinWattsNo ratings yet

- Greek Sustainability ProposalDocument9 pagesGreek Sustainability ProposalMarginCallNo ratings yet

- Eurozona 02.10.12 (Dokument V AJ)Document5 pagesEurozona 02.10.12 (Dokument V AJ)Ivana LeváNo ratings yet

- EU Summit 09.12.2011 Pohled Z Finančních Trhů (Dokument V AJ)Document3 pagesEU Summit 09.12.2011 Pohled Z Finančních Trhů (Dokument V AJ)Ivana LeváNo ratings yet

- Vyhlídky A Vývoj České Ekonomiky BNP Paribas (Dokument V AJ)Document2 pagesVyhlídky A Vývoj České Ekonomiky BNP Paribas (Dokument V AJ)Ivana LeváNo ratings yet

- Summit EU Řecko (Dokument V AJ)Document4 pagesSummit EU Řecko (Dokument V AJ)Ivana LeváNo ratings yet

- Jak Na Dluhy V EU (Dokument V AJ)Document16 pagesJak Na Dluhy V EU (Dokument V AJ)Ivana LeváNo ratings yet

- Microeconomic Theory Basic Principles and Extensions 12th Edition Nicholson Solutions Manual DownloadDocument13 pagesMicroeconomic Theory Basic Principles and Extensions 12th Edition Nicholson Solutions Manual DownloadCatherine Vasquez100% (18)

- MA-Economics SyllabusDocument20 pagesMA-Economics SyllabusSushmithaNo ratings yet

- Econ 0-Mudule 2 (2022-2023)Document8 pagesEcon 0-Mudule 2 (2022-2023)Bai NiloNo ratings yet

- Journal of Air Transport Management: Jan K. Brueckner, Chrystyane AbreuDocument8 pagesJournal of Air Transport Management: Jan K. Brueckner, Chrystyane AbreuNicolas KaramNo ratings yet

- Your Insurance Firm ProcessesDocument1 pageYour Insurance Firm ProcessesrogealynNo ratings yet

- Uopeople Entrepreneurship 2 Assignment Week 3Document1 pageUopeople Entrepreneurship 2 Assignment Week 3Frederick BrimaNo ratings yet

- Aconsumer's Willingness To Substitute One Good For Another Will Depend On The Commodities in Question. ForDocument3 pagesAconsumer's Willingness To Substitute One Good For Another Will Depend On The Commodities in Question. ForFebrian AlexsanderNo ratings yet

- WR - 7.3-Urban Giantism Problem+Case StudyDocument5 pagesWR - 7.3-Urban Giantism Problem+Case StudyArnel MangilimanNo ratings yet

- Numerical AbilityDocument7 pagesNumerical AbilityNagaraja RaoNo ratings yet

- ACYFMG1 Unit IV Formula (2022.04.04)Document5 pagesACYFMG1 Unit IV Formula (2022.04.04)KRABBYPATTY PHNo ratings yet

- Handloom - An Indian Legacy: "India As A King of Handloom"Document2 pagesHandloom - An Indian Legacy: "India As A King of Handloom"Mohit ThakurNo ratings yet

- The Enabling Role of Local GovernmentsDocument29 pagesThe Enabling Role of Local GovernmentsMary Frances M. CalvisNo ratings yet

- Unilateral ContractDocument2 pagesUnilateral ContractRejmali GoodNo ratings yet

- Revised Road Safety Design Manual - June 1, 2011Document165 pagesRevised Road Safety Design Manual - June 1, 2011gabemzaman100% (1)

- College Internship ReportDocument43 pagesCollege Internship ReportGopi Krishnan.n50% (2)

- BP Stats Review 2022 Full Report (1) PagDocument60 pagesBP Stats Review 2022 Full Report (1) PagOscar Fanti AranguNo ratings yet

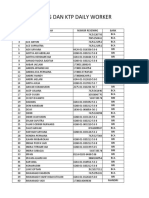

- Data Daily WorkerDocument4 pagesData Daily Workerzulmi07No ratings yet

- Cambio de Nomenclatura de Los EquiposDocument44 pagesCambio de Nomenclatura de Los Equiposjulio peña lima100% (1)

- UP Law F2021: 124 Luna v. LunaDocument1 pageUP Law F2021: 124 Luna v. LunaMarielle DeschanelNo ratings yet

- Individual Assignment# 02: Course: International Business BUS685, Section-03Document5 pagesIndividual Assignment# 02: Course: International Business BUS685, Section-03AREFIN FERDOUSNo ratings yet

- Chap005a - The Value of BondDocument35 pagesChap005a - The Value of Bondnt.phuongnhu1912No ratings yet

- Ranap CorporateDocument24 pagesRanap CorporateFiani NurbaetiNo ratings yet

- Session No. 2 / Week 2: Cities of Mandaluyong and PasigDocument13 pagesSession No. 2 / Week 2: Cities of Mandaluyong and PasigShermaine CachoNo ratings yet

- Factory OverheadDocument21 pagesFactory OverheadRey Joyce AbuelNo ratings yet

- Tutorial 7 PC & MONOPOLYDocument3 pagesTutorial 7 PC & MONOPOLYCHZE CHZI CHUAHNo ratings yet

- A. Jackie Chan Leasing Signs An Equipment Lease Contract With Chris Tucker On January 1Document2 pagesA. Jackie Chan Leasing Signs An Equipment Lease Contract With Chris Tucker On January 1Avox EverdeenNo ratings yet

- Tutorial 8 - To StudentsDocument54 pagesTutorial 8 - To StudentsVasif ŞahkeremNo ratings yet

- Pakistan Economic Reforms ProgrammeDocument44 pagesPakistan Economic Reforms ProgrammeBatoolNo ratings yet

- Janosch Sbeih (2014) - New Economic Cultures in Spain and GreeceDocument73 pagesJanosch Sbeih (2014) - New Economic Cultures in Spain and GreeceJanosch Kamal100% (1)

- Cornelius Cotton Gin Survey and Research ReportDocument31 pagesCornelius Cotton Gin Survey and Research ReportsusanvmayerNo ratings yet