Professional Documents

Culture Documents

Business Innovation Economics en

Uploaded by

bhavyataneja0 ratings0% found this document useful (0 votes)

37 views4 pagesThe document discusses the rising costs of developing and manufacturing vehicles and the need for innovation in cost reduction. It notes that vehicle prices have risen faster than incomes, highlighting the need for automakers to focus on cost innovations. Some potential strategies discussed include using new materials to lower costs, more flexible manufacturing, modular approaches to reduce R&D costs per unit, and offshoring R&D to lower engineering costs. The document emphasizes that cost innovations and lowering R&D expenses will be crucial for automakers to keep vehicles affordable and remain profitable in the future.

Original Description:

Original Title

Business Innovation Economics En

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the rising costs of developing and manufacturing vehicles and the need for innovation in cost reduction. It notes that vehicle prices have risen faster than incomes, highlighting the need for automakers to focus on cost innovations. Some potential strategies discussed include using new materials to lower costs, more flexible manufacturing, modular approaches to reduce R&D costs per unit, and offshoring R&D to lower engineering costs. The document emphasizes that cost innovations and lowering R&D expenses will be crucial for automakers to keep vehicles affordable and remain profitable in the future.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views4 pagesBusiness Innovation Economics en

Uploaded by

bhavyatanejaThe document discusses the rising costs of developing and manufacturing vehicles and the need for innovation in cost reduction. It notes that vehicle prices have risen faster than incomes, highlighting the need for automakers to focus on cost innovations. Some potential strategies discussed include using new materials to lower costs, more flexible manufacturing, modular approaches to reduce R&D costs per unit, and offshoring R&D to lower engineering costs. The document emphasizes that cost innovations and lowering R&D expenses will be crucial for automakers to keep vehicles affordable and remain profitable in the future.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Innovation Economics

No. 1 challenge in innovation management? Fulfill the cost imperative.

18

Keep the system from collapsing

In industrialized countries, the price of the average new car has risen by 100 percent over the past 20 years while average income has increased only by 50 percent and the gap between new car prices and incomes has continued to grow from year to year. The reason for this development is the increasing technological complexity that drives development and manufacturing costs, and the growing number of functions needed to differentiate the brands. This trend cannot continue much longer. Otherwise, customers could go back to smaller cars, a development that is not in the interest of the industry. Cost innovations The automotive industry must put a much stronger focus on cost innovations. Otherwise, cars will become too expensive for customers. Therefore, cost innovation is a central goal in the automotive industry, just as important as the traditional differentiation of functional innovations is. The heads of R&D at OEMs and suppliers have already embraced this new imperative. But it is difficult to change an innovation culture in an industry that is fascinated with functional enrichment. The solution to cost-saving lies in a series of issues that the automotive industry must tackle simultaneously: The use of new and more cost-efficient materials needs to be explored in order to cut material and processing costs. Flexible manufacturing concepts will enable utilization of assembly plants to be improved. Future software will have to work in several models. Intelligently devised bundles of optional extras can reduce the number of possible configurations and eliminate expensive complexity from manufacturing processes. At the same time, development costs must be lowered. All big automotive companies have launched R&D offshoring initiatives to lower engineering costs and help fuel localized development. Module approaches will reduce R&D costs per unit and enable companies to cope with a larger variety and shorter cycles of models. New design and test-bed software will also help lower the real-world costs of developing automotive components. These are just a few examples of the many initiatives needed to keep cars affordable for the broad public. Cost innovations and lower R&D costs will play a crucial role for the future growth of automotive companies and for the industry as a whole.

Cost pressure on innovations

Customers Shorter pay-back / technology diffusion Life cycles Collapse of the middle Product differentiation / model variety Legislation Stricter laws on emissions, safety, fuel, No differentiation through technology, no payment by customer

Cost pressure on innovations Risks Restricted budgets Technology competition Costs per innovation increase Industry dynamics Saturated markets Overcapacity Complexity Materials / energy prices Globalization / low-cost countries

19

Basic figures on R&D

Car Innovation 2015 has thoroughly analyzed the economics of technological innovations in the automotive industry. The figures are based on the financial data of 14 OEMs and 107 selected suppliers, covering about 90 percent of the automotive industrys turnover worldwide. The 100 largest suppliers account for 75 percent of the total R&D expenditures of the supplier industry. Between 2001 and 2005, the automotive industry showed a compound annual growth rate of 3.5 percent for OEMs and of 5.7 percent for suppliers (exchange rate fluctuations eliminated). During that time, R&D spending rose by 4.4 percent at OEMs and by 5.5 percent at suppliers, reflecting an increase in R&D outsourcing by OEMs. In 2005, the industry spent EUR 67.6 billion on R&D. By percentage of revenue, the figure was 4.3 percent for suppliers and 4.0 percent for OEMs. 60.5 percent of all R&D was done by suppliers, 31.4 percent by OEMs and 8.1 percent by engineering service providers. The highest OEM R&D spending per car produced between 2001 and 2005 was by BMW, DaimlerChrysler and Honda. The lowest was by Suzuki, Renault-Nissan and Hyundai. Top spender BMW (EUR 1,796 per car) spent 15 times more than Hyundai (EUR 120 per car). The average was EUR 783.

Suppliers spend twice as much on R&D as OEMs

Automotive R&D value flow 2005 (bn. EUR, rounded)

Value outflow (assigned projects) Segment name

0

Primary value added Value inflow (paid projects)

Engineering Service Providers 5.5

3.0 5.0 22.2

OEMs 0 21.2

2.0 2.0

19.2 Suppliers 19.2 40.9

Example: The chances of low-cost designs

In 2015, about ten percent of all automobiles in Europe, China and India will be low-cost cars with sales prices between EUR 3,000 and EUR 7,000. Naturally, the segment is under enormous cost pressure and promises only small profits. However, most OEMs will want to have a low-cost design in their portfolio to serve as an entry model, and all big companies are working on low-cost models. R&D in an all-new low-cost model will probably never pay in terms of regained sales profits but it holds tremendous promise for OEMs: To develop revolutionary materials, modules and processes that radically lower costs. Once in a mature stage, future low-cost techniques will help revolutionize other models, too. Low-cost cars could have new features such as: Reduced metal content to save on raw-material costs Foamed lightweight structures Low-cost module design Integrated small-engine power-train concepts (i.e. like motor scooters) Coated polymer windows Reduced assembly needs Centralized car electronics and simplified wiring

20

Example: Innovate your assembly concept

Worldwide, the automotive industry is plagued by overcapacities. The inflexible output of the car manufacturers capital-intensive assembly lines creates the need to sell a more or less fixed number of models each year. However, assembly represents only 12 percent of total vehicle costs for development and production, and one third of the OEMs contribution to it. The current pressure to sell certain models at huge discounts is largely homemade. A more flexible vehicle assembly concept could change this situation fundamentally. Reduce complexity to gain flexibility: An increasing number of models with more and more production variants are the driving forces of complexity and costs. A Volkswagen Golf has more than 1023 possible configurations compared with only 1,740 for a Toyota Corolla. Reducing the number of variants will help increase the number of models produced in one plant, making the system more flexible. Outsource assembly peaks: Currently, more than 99 percent of assembly value creation is in the hands of manufacturers. Outsourcing niche models to specialized suppliers (for example Karmann, Magna Steyr, Pininfarina, Valmet) would enable OEMs to adapt more smoothly to fluctuations in demand.

Implementation: Devise R&D activities to meet the cost agenda

Improvement of R&D economics Within the next ten years, the automotive industry will spend EUR 800 billion on innovations. A close look at the effectiveness and efficiency of the innovation portfolio is needed. There are two ways to enliven the automotive industrys cost imperative in R&D: develop technologies that make cars affordable and slash the rising costs of R&D itself. Encourage cost innovations: Developing new and exciting functions is still the dream of any car engineer. Doing the same things more cost-efficiently is not, and probably will never be. Add regular screening of new materials to the R&D program to find materials that can be bought or processed at lower costs Introduce an incentive program to recognize extraordinary endeavors that lower costs Set cost reduction targets at 30 percent to find completely new ways of fulfilling the function of the module Broaden engineering scope, including components that lie up- or downstream of a companys own value chain Bring down innovation costs: An average of five percent of total vehicle costs are spent on R&D. Due to cars increasing technology and complexity, R&D costs tend to be about 4.5 percent per year. In order to at least stabilize R&D costs per unit, all R&D cost levers have to be combined: 40 percent of all R&D spending is on products that do not yield a sufficient return. Rigorous screening and quality management can stop futile projects sooner. R&D offshoring and outsourcing can be applied to ten to 15 percent of the total automotive R&D budget in the long term. Savings of ten to 50 percent are possible. New possibilities for virtual tests will help keep rising test costs under control. The bookshelf approach for modules will shorten development cycles for new models and considerably lower development costs per module.

21

You might also like

- Shaking Tables Around The WorldDocument15 pagesShaking Tables Around The Worlddjani_ip100% (1)

- PLM in The Automotive IndustryDocument11 pagesPLM in The Automotive IndustryHussam AliNo ratings yet

- A Case Study of Toyota Marketing EssayDocument8 pagesA Case Study of Toyota Marketing EssayHND Assignment HelpNo ratings yet

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationFrom EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo ratings yet

- Car InovationDocument3 pagesCar InovationClaudiu KLodNo ratings yet

- Oliver Wyman Car InnovationDocument32 pagesOliver Wyman Car InnovationKhizra JamalNo ratings yet

- Hyundai 091124091217 Phpapp02Document62 pagesHyundai 091124091217 Phpapp02mbogadhiNo ratings yet

- Dissertation Topics Automobile IndustryDocument8 pagesDissertation Topics Automobile IndustryWriteMyEconomicsPaperUK100% (1)

- A001 Lean A Key Success Factor in Automobile IndustryDocument7 pagesA001 Lean A Key Success Factor in Automobile Industryarvindchopra3kNo ratings yet

- Research Papers Automobile IndustryDocument5 pagesResearch Papers Automobile Industryqbqkporhf100% (1)

- A Nano Car in Every DrivewayDocument13 pagesA Nano Car in Every DrivewayRajendra PetheNo ratings yet

- Ford Automobile Industry Case StudyDocument10 pagesFord Automobile Industry Case StudyUpendra SharmaNo ratings yet

- AutoDocument8 pagesAutoShwetank TNo ratings yet

- 2014 BCG - Accelerating InnovationDocument20 pages2014 BCG - Accelerating InnovationikhabibullinNo ratings yet

- Cost Reduction Techniques FinalDocument75 pagesCost Reduction Techniques FinalJig HiraniNo ratings yet

- Thesis AutomotiveDocument7 pagesThesis Automotiveheatherdionnemanchester100% (2)

- Mastering Engineering Service Outsourcing in The Automotive IndustryDocument40 pagesMastering Engineering Service Outsourcing in The Automotive IndustryArchitNo ratings yet

- Automotive Thesis ExampleDocument6 pagesAutomotive Thesis Examplednqjxbz2100% (2)

- Changing Trends in The Auto Ancillary Industry: FlexibilityDocument4 pagesChanging Trends in The Auto Ancillary Industry: FlexibilitymanishaNo ratings yet

- Automotive Industry Dissertation TopicsDocument4 pagesAutomotive Industry Dissertation TopicsNeedHelpWithPaperErie100% (1)

- China's Growing Auto Supply ChainsDocument40 pagesChina's Growing Auto Supply ChainsGary MaoNo ratings yet

- Research Paper On Automobile PartsDocument4 pagesResearch Paper On Automobile Partsrvpchmrhf100% (1)

- Daimler Chrysler MergerDocument49 pagesDaimler Chrysler MergerSamir Saffari100% (1)

- Sustainable Development: Opportunity or Threat For The Auto Industry?Document7 pagesSustainable Development: Opportunity or Threat For The Auto Industry?lalou4No ratings yet

- Delloite AutomotiveDocument28 pagesDelloite AutomotiveKsl Vajrala100% (1)

- Team 5 Industry PaperDocument23 pagesTeam 5 Industry Paperapi-315687330No ratings yet

- German Automobile IndustryDocument9 pagesGerman Automobile IndustryAshik ChowdhuryNo ratings yet

- 10% AssignmentDocument4 pages10% Assignment99045448No ratings yet

- Planning a 2,000 Unit A00 Class Car FactoryDocument46 pagesPlanning a 2,000 Unit A00 Class Car FactoryJesu RajNo ratings yet

- Book - Automotive Technology RoadmapDocument458 pagesBook - Automotive Technology RoadmapSunil Deshpande100% (1)

- Engine Manufacturing CompanyDocument11 pagesEngine Manufacturing CompanyperminderlbwNo ratings yet

- Mid Term P&ODocument5 pagesMid Term P&OHADLIZAN BIN MOHZAN (B19361012)No ratings yet

- India's Growing Automobile Industry Attracts Global MajorsDocument3 pagesIndia's Growing Automobile Industry Attracts Global MajorsSayan KunduNo ratings yet

- Porter's Five Forces Model On Automobile IndustryDocument6 pagesPorter's Five Forces Model On Automobile IndustryBhavinShankhalparaNo ratings yet

- Automobile IndustryDocument30 pagesAutomobile IndustrychakshuNo ratings yet

- Fdi in Automobile Sector in IndiaDocument26 pagesFdi in Automobile Sector in Indiauditnarula09No ratings yet

- European Car Market: Business Plan: Mission StatementDocument3 pagesEuropean Car Market: Business Plan: Mission Statementd445390No ratings yet

- The Automobile Manufacturing IndustryDocument3 pagesThe Automobile Manufacturing Industrysaur.latadNo ratings yet

- CtimagDocument40 pagesCtimagDeepak Chachra100% (1)

- ITT AutomotiveDocument3 pagesITT AutomotiveVisweswara Reddy100% (1)

- Industry ProfileDocument3 pagesIndustry ProfileSathish UrfriendNo ratings yet

- Knowledge Management in The Automobile Industry - FinalDocument13 pagesKnowledge Management in The Automobile Industry - FinalAshrafAbdoSNo ratings yet

- Papazoglou Webserv 2e Cs Solution Notes Part1Document26 pagesPapazoglou Webserv 2e Cs Solution Notes Part1TALALQUIDERNo ratings yet

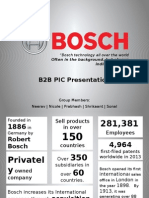

- B2B PIC Presentation: Often in The Background, But Always Indispensable."Document28 pagesB2B PIC Presentation: Often in The Background, But Always Indispensable."KiaraSinghNo ratings yet

- Car Company ReportDocument10 pagesCar Company ReportTrident ManagementNo ratings yet

- Sciencedirect: New Opportunities and Incentives For Remanufacturing by 2020 S Car Service TrendsDocument6 pagesSciencedirect: New Opportunities and Incentives For Remanufacturing by 2020 S Car Service TrendsAlexandra RenteaNo ratings yet

- A Nano Car in Every Driveway PDFDocument8 pagesA Nano Car in Every Driveway PDFAshwani MattooNo ratings yet

- Factors Affecting Four Wheeler Industries in IndiaDocument54 pagesFactors Affecting Four Wheeler Industries in IndiaRitesh Vaishnav100% (2)

- ITT AutomotiveDocument3 pagesITT AutomotiveAnuragNo ratings yet

- Market Adaptation of Volkswagen PoloDocument36 pagesMarket Adaptation of Volkswagen PoloRohit Sopori100% (1)

- A Seminar Report On "Automobile Sector of India"Document33 pagesA Seminar Report On "Automobile Sector of India"Mohammad Anwar Ali100% (1)

- Automotive Supplier Innovation Management SystemDocument13 pagesAutomotive Supplier Innovation Management Systemjmoreno434No ratings yet

- Q 02 Assignment NissanDocument17 pagesQ 02 Assignment NissankiranatifNo ratings yet

- E - Commerce in Automotive Component IndustryDocument12 pagesE - Commerce in Automotive Component IndustryfaruquepgdmNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummarySachin UmbarajeNo ratings yet

- A Study On Measuring The Service Quality of Car Dealers in AllepeyDocument66 pagesA Study On Measuring The Service Quality of Car Dealers in AllepeyshashimuraliNo ratings yet

- Ieee FileDocument4 pagesIeee FileGhanshyam PrajapatNo ratings yet

- June 2010 (v1) QP - Paper 1 CIE Economics IGCSEDocument12 pagesJune 2010 (v1) QP - Paper 1 CIE Economics IGCSEjoseph oukoNo ratings yet

- Revised approval for 132/33kV substation in ElchuruDocument2 pagesRevised approval for 132/33kV substation in ElchuruHareesh KumarNo ratings yet

- Method Statement-Site CleaningDocument6 pagesMethod Statement-Site Cleaningprisma integrated100% (1)

- Project Report SSIDocument140 pagesProject Report SSIharsh358No ratings yet

- Analysis of Marketing Mix of Honda Cars in IndiaDocument25 pagesAnalysis of Marketing Mix of Honda Cars in Indiaamitkumar_npg7857100% (5)

- Dgcis Report Kolkata PDFDocument12 pagesDgcis Report Kolkata PDFABCDNo ratings yet

- Global Trends AssignmentDocument9 pagesGlobal Trends Assignmentjan yeabuki100% (2)

- MSDS Blattanex Gel PDFDocument5 pagesMSDS Blattanex Gel PDFIsna AndriantoNo ratings yet

- ICA Ghana Exemption FormDocument1 pageICA Ghana Exemption Form3944/95No ratings yet

- GMG AirlineDocument15 pagesGMG AirlineabusufiansNo ratings yet

- Biblioteca Ingenieria Petrolera 2015Document54 pagesBiblioteca Ingenieria Petrolera 2015margaritaNo ratings yet

- Quan Tri TCQTDocument44 pagesQuan Tri TCQTHồ NgânNo ratings yet

- Indgiro 20181231 PDFDocument1 pageIndgiro 20181231 PDFHuiwen Cheok100% (1)

- Rancang Bangun Alat Mixer Vertikal Adonan Kue Donat Dengan Gearbox Tipe Bevel Gear Kapasitas 7 KilogramDocument6 pagesRancang Bangun Alat Mixer Vertikal Adonan Kue Donat Dengan Gearbox Tipe Bevel Gear Kapasitas 7 KilogramRachmad RisaldiNo ratings yet

- Microeconomics Chapter 1 IntroDocument28 pagesMicroeconomics Chapter 1 IntroMc NierraNo ratings yet

- Manufacturing Resources PlanningDocument5 pagesManufacturing Resources PlanningSachin SalvanikarNo ratings yet

- Briefing Note: "2011 - 2014 Budget and Taxpayer Savings"Document6 pagesBriefing Note: "2011 - 2014 Budget and Taxpayer Savings"Jonathan Goldsbie100% (1)

- TPS and ERPDocument21 pagesTPS and ERPTriscia QuiñonesNo ratings yet

- Tata Motors Suv Segment ProjectDocument57 pagesTata Motors Suv Segment ProjectmonikaNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Kunal Uniforms CNB TxnsDocument2 pagesKunal Uniforms CNB TxnsJanu JanuNo ratings yet

- Fair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDDocument3 pagesFair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDNarendra KumarNo ratings yet

- Proposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Document3 pagesProposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Hardy TomNo ratings yet

- Management of Environmental Quality: An International JournalDocument21 pagesManagement of Environmental Quality: An International Journalmadonna rustomNo ratings yet

- Becker Friedman Institute Annual Report 2013-14Document24 pagesBecker Friedman Institute Annual Report 2013-14bficommNo ratings yet

- MTNL Mumbai PlansDocument3 pagesMTNL Mumbai PlansTravel HelpdeskNo ratings yet

- Princeton Economics Archive Three-Faces-Inflation PDFDocument3 pagesPrinceton Economics Archive Three-Faces-Inflation PDFadamvolkovNo ratings yet

- Credit Decision ManagementDocument14 pagesCredit Decision ManagementSat50% (2)

- BELENDocument22 pagesBELENLuzbe BelenNo ratings yet