Professional Documents

Culture Documents

Accounts

Uploaded by

kshitij-aggarwal-5072Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts

Uploaded by

kshitij-aggarwal-5072Copyright:

Available Formats

Balance Sheet of Tata Motors ------------------- in Rs. Cr.

-------------------

Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities

Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets

Contingent Liabilities Book Value (Rs)

Comments on the financial soundness of tata motors.

I) It was observed from the comparative balance sheet that internal equity is comprised of Share capital and reserve & surplus ,in which increment was noticed by 14.12%. The major increment was seen in reserve & surplus by 14.95% and share capital was marginally increased by 00.03% as compared to the previous financial year. II) It was also observed that the company has increased the external equity by 56.66%. The company has raised secured loan by 21.76% and unsecured loan by 92.17% as compared to the previous financial year. Overall the company has increased its capital structure position by 70.78% as compared to previous financial year , which is a good indication for the company as the company is increasing its investment and expanding the business. III) Deferred tax liability was increased by 24.00% as compared to the previous financial year, the company should try to reduce the deferred tax liability as we know that it is the obligation for the company to pay. So , the company should not increase the fund by blocking deferred tax liability. which is not a good policy of the company. IV) It was observed that total fund employed by the company was increased by 29.40% as compared to the previous financial year. In the current year (07 company has increased the employable fund by 29.40% which is a good sign of growth of the company. V) Investment in the fixed assets was noticed by 63.46% and in investment by 98.23% as compared to the previous financial year. It was noticed that the total long term investment of the company has registered an increment of 73.17% , which indicate that the company is having a good opportunity of growth and by investing in long term , the company is intelligently grapping the opportunity. VI) The working capital of the company was decreased by 109.80% as compared to the prev sign for the company. The company is not able to manage the working capital sufficiently .th manage the working capital of the company as we know that the working capital is the bloo working capital the company will not manage to run its operation successfully.

Mar' 08 12 mths

Mar '07 12 mnths

% change

385.54 385.54 0 0 7,428.45 25.51 7,839.50 2,461.99 3,818.53 6,280.52 14,120.02

385.41 385.41 0 0 6,458.39 25.95 6,869.75 2,022.04 1,987.10 4,009.14 10,878.89

0.13 0.13 0 0 970.06 -0.44 969.75 439.95 1831.43 2271.38 3241.13

0.03% 0.03%

15.02% -1.70% 14.12% 21.76% 92.17% 56.66% 29.79%

10,830.83 5,443.52 5,387.31 5,064.96 4,910.27 2,421.83 1,130.73 750.14 4,302.70 4,831.36 1,647.17 10,781.23 0 10,040.37 1,989.43 12,029.80 -1,248.57 6.05 14,120.02

8,775.80 4,894.54 3,881.26 2,513.32 2,477.00 2,500.95 782.18 535.78 3,818.91 6,208.53 290.98 10,318.42 0 6,956.88 1,364.32 8,321.20 1,997.22 10.09 10,878.89

2055.03 548.98 1506.05 2551.64 2433.27 -79.12 348.55 214.36 483.79 -1377.17 1356.19 462.81 0 3083.49 625.11 3708.6 -3245.79 -4.04 3241.13 0

23.42% 11.22% 38.80% 101.52% 98.23% -3.16% 44.56% 40.01% 12.67% -22.18% 466.08% 4.49% 44.32% 45.82% 44.57% -162.52% -40.04% 29.79%

5,590.83 202.7

5,196.07 177.59

394.76 25.11

7.60% 14.14%

ness of tata motors.

ance sheet that internal equity is rplus ,in which increment was noticed by serve & surplus by 14.95% and share as compared to the previous financial ny has increased the external equity by an by 21.76% and unsecured loan by al year. Overall the company has .78% as compared to previous financial pany as the company is increasing its

.00% as compared to the previous duce the deferred tax liability as we know ay. So , the company should not increase hich is not a good policy of the company. d by the company was increased by al year. In the current year (07-08), the d by 29.40% which is a good sign of

d by 63.46% and in investment by al year. It was noticed that the total long red an increment of 73.17% , which opportunity of growth and by investing in ping the opportunity. decreased by 109.80% as compared to the previous financial year , which is not a good ble to manage the working capital sufficiently .the company should take special care to as we know that the working capital is the blood of the company ,without proper e to run its operation successfully.

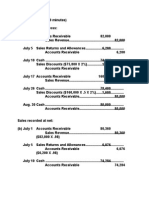

Profit & Loss account of Tata Motors ------------------- in Rs. Cr. ------------------Mar '11

Mar '08

Income Sales Turnover Excise Duty Net Sales Other Income Stock Adjustments Total Income Expenditure Raw Materials Power & Fuel Cost Employee Cost Other Manufacturing Expenses Selling and Admin Expenses Miscellaneous Expenses Preoperative Exp Capitalised Total Expenses

33,123.54 4,355.63 28,767.91 734.17 -40.48 29,461.60 20,891.33 325.19 1,544.57 904.95 2,197.49 964.78 -1,131.40 25,696.91

Operating Profit PBDIT Interest PBDT Depreciation Other Written Off Profit Before Tax Extra-ordinary items PBT (Post Extra-ord Items) Tax Reported Net Profit Total Value Addition Preference Dividend Equity Dividend Corporate Dividend Tax

3,030.52 3,764.69 471.56 3,293.13 652.31 64.35 2,576.47 0 2,576.47 547.55 2,028.92 4,805.58 0 578.43 81.25

Per share data (annualised) Shares in issue (lakhs) Earning Per Share (Rs) Equity Dividend (%) Book Value (Rs)

3,855.04 52.63 150 202.7

Mar-07

31,089.69 4,425.44 26,664.25 1,114.38 349.68 28,128.31 19,879.56 327.41 1,367.83 872.95 1,505.23 1,051.49 -577.05 24,427.42

2,033.85 -69.81 2,103.66 -380.21 -390.16 1,333.29 1,011.77 -2.22 176.74 32.00 692.26 -86.71 -554.35 1,269.49

7% -2% 8% -34% -112% 5% 5% -1% 13% 4% 46% -8% 96% 5%

2,586.51 3,700.89 455.75 3,245.14 586.29 85.02 2,573.83 -0.07 2,573.76 660.37 1,913.46 4,547.86 0 578.07 98.25

444.01 63.80 15.81 47.99 66.02 -20.67 2.64 0.07 2.71 -112.82 115.46 257.72 0.36 -17.00

17% 2% 3% 1% 11% -24% 0% -100% 0% -17% 6% 6% 0% -17%

COMMENTS ON THE FINANCIAL CONDITION OF THE TATA MO COMPARATIVE PROFIT & LOSS ACCOUNT OF THE COMPANY I) It was observed that the sales revenue was increased by 04.0 Rs 1274.45 croresas compared to the previous financial year. Re by 00.31% as compared to the previous financial year. II) The ne an increment of 04.59% as compared to the previous financial year and in terms of absolute figure by But the cost of good sold by the company was increased by 06.1 around Rs 1480.84 crores in absolute figures. Which also cause operating profit of the company by 06.64% as compared to the year. The company should put special attention to check out its goods sold ) as it was judged from the comparative P/L A/C that direct expense by the company is excess than the increment in company. III)The increment in the dividend and other incomes was notice previous financial year. which increases the PBIT (Profit before terms of absolute figure by Rs 237.99 crores . IV) The profit befo of 00.13%, whereas profit after tax (PAT) was increased by 06.0 year. The huge increment in the PAT was noticed despite of hav decrease in the payment of tax by 17.00% as compared to the p approximately realised Rs 115.46 crores in the hand of the com balance brought forward by the company was increased by 30.52% , which means that in the previous financial year the co surplus amount left in their hand after appropriating the availab increases the bottom line balance by 13.10%.

3,853.74 49.65 150 177.59

1.30 2.98 0.00 25.11

0% 6% 0% 14%

L CONDITION OF THE TATA MOTORS BY ANALYZING THE ACCOUNT OF THE COMPANY s revenue was increased by 04.00% and in terms of absolute figure by to the previous financial year. Respectively, excise duty was increased previous financial year. II) The net revenue of the company was noticed

nd in terms of absolute figure by Rs 1260.79 crores . e company was increased by 06.13% , which was solute figures. Which also cause to decrease the y by 06.64% as compared to the previous financial special attention to check out its direct cost (cost of om the comparative P/L A/C that the increment in the is excess than the increment in the net revenue of the

d and other incomes was noticed by 97.06% as compared to the ncreases the PBIT (Profit before interest and tax) by 00.51% and in 237.99 crores . IV) The profit before tax (PBT) was noticed an increment tax (PAT) was increased by 06.03% as compared to previous financial e PAT was noticed despite of having less increment in PBT due to by 17.00% as compared to the previous financial year, which 46 crores in the hand of the company. V) It was also noticed that e company was increased by he previous financial year the company have a good nd after appropriating the available funds . which nce by 13.10%.

Key Financial Ratios of Tata Motors ------------------- in Rs. Cr. -------------------

Mar '08 Investment Valuation Ratios Face Value Dividend Per Share Operating Profit Per Share (Rs) Net Operating Profit Per Share (Rs) Free Reserves Per Share (Rs) Bonus in Equity Capital Profitability Ratios Operating Profit Margin(%) Profit Before Interest And Tax Margin(%) Gross Profit Margin(%) Cash Profit Margin(%) Adjusted Cash Margin(%) Net Profit Margin(%) Adjusted Net Profit Margin(%) Return On Capital Employed(%) Return On Net Worth(%) Adjusted Return on Net Worth(%) Return on Assets Excluding Revaluations Return on Assets Including Revaluations Return on Long Term Funds(%) Liquidity And Solvency Ratios Current Ratio Quick Ratio Debt Equity Ratio Long Term Debt Equity Ratio Debt Coverage Ratios Interest Cover Total Debt to Owners Fund Financial Charges Coverage Ratio Financial Charges Coverage Ratio Post Tax Management Efficiency Ratios Inventory Turnover Ratio Debtors Turnover Ratio Investments Turnover Ratio

10 15 78.61 746.24 182.38 28.86 10.53 8.16 8.26 8.13 8.13 6.96 6.96 18.96 25.98 21.18 202.54 203.2 22.85 0.64 0.66 0.8 0.5 6.28 0.8 7.19 6.82 14.44 30.08 14.44

Fixed Assets Turnover Ratio Total Assets Turnover Ratio Asset Turnover Ratio Average Raw Material Holding Average Finished Goods Held Number of Days In Working Capital Profit & Loss Account Ratios Material Cost Composition Imported Composition of Raw Materials Consumed Selling Distribution Cost Composition Expenses as Composition of Total Sales Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit Dividend Payout Ratio Cash Profit Earning Retention Ratio Cash Earning Retention Ratio AdjustedCash Flow Times

2.69 2.06 2.69 15.08 16.81 -15.62 72.62 4.6 4.09 9.88 32.51 24.02 60.13 72.18 2.65

Earnings Per Share Book Value

52.63 202.7

Mar '07

COMMENTS ON THE FINANCIAL POSITION OF THE TATA MOTORS ANALYSIS

10 15 67.12 691.91 157.16 28.87 9.7 7.25 11.19 9.07 8.55 6.94 6.12 25.82 27.96 24.67 177.33 178 31.18 0.86 0.92 0.59 0.31 7.19 0.59 7.62 6.67 11.02 35.6 13.26

A) LIQUIDITY RATIO I) CURRENT RATIO =current assets/ current liabilities. = 10383.78/ 8667.20 =1.20 Current ratio = solvency position of the company. The Current ratio reveals the firms ability to meet its current liabilities out of current source of fund. The standard ratio is 2: 1, but in practically the standard ratio is assumed to be 1.5:1. The company is having current ratio of 1.20:1, which means that for every Re. 1 of current liabilities, the company have Re. 1.2 of current assets, which is satisfactory position but the company should try to increase the current ratio to at least 1.5:1. II) ACID TEST RATIO = current assets Inventories/ current liabilities - bank O/D = 10383.78 2421.83 / 8667.20 - NIL = 7961.95 / 8667.20 = 0.92 Acid test ratio = 0.92:1 This ratio is also used to know the solvency of the company. This ratio rev company to pay off its immediate impending liabilities. The standard ratio is 1:1 but in practically it is accepted to be 0.8:1. The company is having 0.92:1 quick ratio which is quite satisfactory. Which means that for every Re.1 of CL the company can pay immediately Re.0.92. B) PROFITABILITY RATIO I) GROSS PROFIT RATIO(GPR) = Gross profit / sales 100 =3092.32 /33093.93 This ratio indicates the relationship between the gross profit and the sales of the company. this ratio gives the information about the movement of stock and also earning capacity of the company. The more the ratio , greater is the earning capacity of the company. The company is having 09.35% of gross profit ratio which is not so satisfactory for the company as the standard ratio of gross profit is 25% .The Company should try to minimize its direct and operating cost and side by side it should put extra effort to increase its revenue by selling more output in the market. II) NET PROFIT RATIO (NPR) = Net profit / turnover 100 = 2028.92 / 33093.93 the ratio of net profit to net sales/turnover. This ratio reveals the amount of fund left for the proprietor of the company. Net profit ratio is useful to measure the operational efficiency of the management of the company. The net profit ratio is 06.14% , which is below standard .The standard ratio is 15%, the company should try to increase its net profit to increase the ratio. III) RETURN ON INVESTMENT = Net profit /capital employed 100 (ROI) = 2028.92 / 15095.74 13.45% Return on investment indicates the profit earning capacity /profitability as compare to capital employed by the company. In clear terms it indicates the rate of return on the capital employed by the company. The ROI is a very good indicator of judging the utilisation of resources and capital of the company .The standard ratio is 20%, whereas the companys return on investment is 13.45%.There is no practical norm or standard of this ratio. It depends on the objective, efficiency and capacity of the company. However, the company should try to maintain this ratio at a level over and above the standard Bank Interest Rate to cover the risk involved in the business. The Company should try to increase this ratio gradually.

5.01 2.49 3.08 17.53 17.34 26.96 74.55 3.88 4 10.18 35.34 26.16 59.9 71.32 1.7

49.65 177.59

Company should try to increase this ratio gradually. IV) OPERATING RATIO = cost of goods sold + operating expenses /net sales 100 = 25638.50+64.35+652.31+282.37 / 33093.93 100 = 26637.53 / 33093.93 100 = 80.50% Operating ratio = 80.5% This ratio shows the relationship between the operating cost and net sa company. The ratio indicates the managerial efficiency to minimize the operating cost. The lower the ratio, the greater is the management efficiency. The company is having 80.5% operating ratio. The company should try to minimize the ratio ,so that the portion of profit can be increased. C. LEVERAGE / SOLEVENCY RATIO I) DEBT EQUITY RATIO = Long term debt / shareholders equit = 2461.99 + 3818.53/ 385.41 + 6484.34 = 6380.52 / 7839.50 = 81.4:100 This ratio reveals the relation between the long term debt and Proprietors fund of the concern, it also shows the efficiency of the management in financial planning. The debt equity ratio is 81.40:100, which means that for every Rs 100 of the Proprietors fund, the long term debt stands to Rs 81.40.The standard ratio in this case is 0.33 .this means that for every Re. 1 of the proprietors fund, the long term debt should be 0.33 paise. It is assumed that the position of the creditor is uncomfortable if the ratio is higher than this. II) PROPRIETARY RATIO = Shareholders Equity / Total Assets. =Share capital + general reserve / fixed + current assets = 2461.99 + 3818.53 / 5387.31 + 10383.78 =6280.52 / 15771.09= 0.4 Proprietary ratio = 0.4:1 This ratio explains the relation between the total assets and the proprie company. This shows that how much proprietary fund is engaged in the business while financing the total assets of the company. Here the company has engaged 40% of the proprietary fund for financing its assets. This ratio also shows that how much the company is dependent on external equity while financing its total assets. Here the company is dependent on external equity to the extent of 60%.The company should gradually try to decrease the ratio of dependent on the external equity. This will in turn increase the share of profit of the company. D. ACTIVITY RATIO / TURNOVER RATIO I) INVENTORY TURNOVER RATIO = Cost of goods sold / average inventory =25638.50 / ( 2421.83 + 2500.95 / 2) = 25638.50 / 2461.39 = 10.42 times This ratio indicates the relation between the inventory and sales of the company. Which provide us the information about the velocity of stock during the year. High ratio is always desirable by the company; the high ratio indicates a good position of the company. The companys inventory turnover ratio is 10.42 times, which means the movement of stock is approximately 10.5 times in a year. II) FIXED ASSETS TURNOVER RATIO = Sales / Fixed Assets. = 33093.93 / 5387.31 = 6.14 times Fix ratio establish a relation with the fixed assets and sales of the company. Which indicates, how many times the fixed assets is utilised to achieve the sales of the company. Here the company is utilising 6.14 times of its fixed assets to achieve the sales of the company. The company should try to increase this ratio, which will increase the production and ultimately the sales of the company.

sales of the company. The company should try to increase this ratio, which will increase the production and ultimately the sales of the company. III) CURRENT ASSETS TURNOVER RATIO = Sales / current assets = 33093.93 / 10383.78 = 3.2 tim This ratio establish a relation between the current assets and sales of the company .This ratio indicates that how many times the current assets in being utilised to achieve the sales by the company. The current turnover ratio of the company is 3.2 times, which means that the company is utilising 3.2 times its current assets for achieving its sales.

OF THE TATA MOTORS WITH THE HELP OF RATIO

8/ 8667.20 =1.20 Current ratio = 1.20 : 1 This ratio is analysed to test the

ent source of fund. assumed to be 1.5:1. t for every Re. 1 of hich is satisfactory o to at least 1.5:1. bank O/D

cy of the company. This ratio reveals the actual financial ability of the

8:1. The company is ns that for every Re.1

.32 /33093.93 100 = 9.35% Gross profit ratio = 09.35% d the sales of the of stock and also the earning capacity atio which is not so t is 25% .The d side by side it utput in the market. 8.92 / 33093.93 100 = 6.14% Net Profit Ratio =06.14% This ratio indicates

it ratio is useful to ompany. The net profit 5%, the company

00 (ROI) = 2028.92 / 15095.74 100 = 13.45% Return on Investment = ity /profitability as compare to rate of return on the tor of judging the d ratio is 20%, no practical norm or d capacity of the io at a level over and d in the business. The

s /net sales 100

en the operating cost and net sales of the mize the operating cost. he company is having ratio ,so that the

g term debt / shareholders equity

Proprietors fund of the ncial planning. The 0 of the Proprietors n this case is 0.33 .this m debt should be 0.33 table if the ratio is

n the total assets and the proprietary fund of the d in the business any has engaged 40% ows that how much total assets. Here the The company should equity. This will in

s of the company. ring the year. High s a good position of imes, which means the

93.93 / 5387.31 = 6.14 times Fixed assets turnover ratio = 6.14 times. This ompany. Which the sales of the sets to achieve the atio, which will

atio, which will

= 33093.93 / 10383.78 = 3.2 times Current assets turnover ratio = 3.2 times. les of the company eing utilised to the company is 3.2 urrent assets for

You might also like

- SingaporeDocument31 pagesSingaporekshitij-aggarwal-5072No ratings yet

- Vinay Singh VB File CompleteDocument62 pagesVinay Singh VB File Completekshitij-aggarwal-5072No ratings yet

- Kshitij BCDocument5 pagesKshitij BCkshitij-aggarwal-5072No ratings yet

- Anger 1Document6 pagesAnger 1kshitij-aggarwal-5072No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Adv Assign 2Document5 pagesAdv Assign 2alemayehuNo ratings yet

- COURSE STRUCTURE AND EXAM PATTERNDocument22 pagesCOURSE STRUCTURE AND EXAM PATTERNSatheesha KNo ratings yet

- Rolling StoreDocument34 pagesRolling StoreAmie Jane MirandaNo ratings yet

- Mahindra and Mahindra LTD Financial AnalysisDocument21 pagesMahindra and Mahindra LTD Financial AnalysisAyan SahaNo ratings yet

- Cv1e SM ch06 PDFDocument10 pagesCv1e SM ch06 PDFYu FengNo ratings yet

- CH07 SolutionsDocument13 pagesCH07 Solutionsasflkhaf2No ratings yet

- Audit of Intangibles Consolidated PDFDocument29 pagesAudit of Intangibles Consolidated PDFRosemarie VillanuevaNo ratings yet

- Tata Steel - Goodwill and Acquisition of CorusDocument4 pagesTata Steel - Goodwill and Acquisition of Corushayagreevan vNo ratings yet

- Neraca PT Indofood 019,020Document2 pagesNeraca PT Indofood 019,020Nur Abdillah AkmalNo ratings yet

- CBR Analysis of The Results Structures Corresponding To A Joint Stock Company A214Document9 pagesCBR Analysis of The Results Structures Corresponding To A Joint Stock Company A214Radu CioleaNo ratings yet

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- Coca Cola Mini CaseDocument1 pageCoca Cola Mini CaseDania Sekar WuryandariNo ratings yet

- Consolidated Balance Sheet As at March 31, 2016: Godrej Industries LimitedDocument4 pagesConsolidated Balance Sheet As at March 31, 2016: Godrej Industries Limitedbhoopathi ajithNo ratings yet

- FSAPM Assignment 5Document3 pagesFSAPM Assignment 5Rachita AgrawalNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Basic Accounting - Midterm Answer SheetDocument23 pagesBasic Accounting - Midterm Answer SheetLyka GutierrezNo ratings yet

- FAC1502 - Study Unit 13 - 2021Document15 pagesFAC1502 - Study Unit 13 - 2021Ndila mangalisoNo ratings yet

- Change in PSR Test 1Document4 pagesChange in PSR Test 1Faujdar TanishkNo ratings yet

- T04 - Long-Term Construction-Type ContractsDocument11 pagesT04 - Long-Term Construction-Type Contractsjunlab0807No ratings yet

- PowerPoint PresentationsDocument26 pagesPowerPoint PresentationsKhalidNo ratings yet

- Jawaban Praktikum AkdDocument5 pagesJawaban Praktikum AkdNurhasanahNo ratings yet

- Accounting FrameworkDocument16 pagesAccounting FrameworkJoanaBalderasNo ratings yet

- Audit Cash ShortageDocument8 pagesAudit Cash ShortageEISEN BELWIGANNo ratings yet

- Ambee Pharmaceuticals Limited: First Quarter Financial Statement (Un-Audited)Document1 pageAmbee Pharmaceuticals Limited: First Quarter Financial Statement (Un-Audited)James BlackNo ratings yet

- SM PFA 2e CH 1 Accounting in Business PDFDocument63 pagesSM PFA 2e CH 1 Accounting in Business PDFellewinaNo ratings yet

- Financial Statements Ratio Analysis: Infosys Technologies LimitedDocument39 pagesFinancial Statements Ratio Analysis: Infosys Technologies LimitedTanu SinghNo ratings yet

- Molson Coors Case StudyDocument27 pagesMolson Coors Case StudyDuc Manh50% (2)

- Corporate Finances Problems Solutions Ch.18Document9 pagesCorporate Finances Problems Solutions Ch.18Egzona FidaNo ratings yet

- Materi Ke 11Document37 pagesMateri Ke 11Rahma YantiNo ratings yet

- FIN2704 Tutorial 1 Question 3 SolutionDocument5 pagesFIN2704 Tutorial 1 Question 3 SolutionAndrew TungNo ratings yet