Professional Documents

Culture Documents

Fall 2010 FIN 302 JG HW2

Uploaded by

sa3adsobOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fall 2010 FIN 302 JG HW2

Uploaded by

sa3adsobCopyright:

Available Formats

FIN 302 Managerial Finance Fall 2010 Homework Set #2 (Chs 3&4: Financial Performance & Planning) Due:

: Tues., September 7, 2010, 12 Noon

Late submissions will receive a grade of zero I will leave a turn-in box on the counter at the (Finance) BAC 5th floor reception area You may turn in the HW during the preceding T morning FIN 302 class session You may work in groups of up to 4 You must list your group members Please turn in your own individual, neat, legible, and handwritten homework assignment

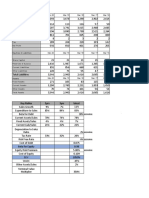

Balance Sheet Items End of Current Year Liabilities & Equity $50 Accounts Payable $100 $50 Accrued Expenses $50 $100 Short-Term Notes (or, $50 Notes Payable) Inventory $200 Long-Term Notes $400 Prepaid Expenses $50 Preferred Equity $100 Buildings, Fixtures, and $400 Common Equity (Par $200 Equipment Value) Land $150 Additional Paid-In $100 Capital Other Assets $200 Retained Earnings $200 Assets Cash & Equivalents Marketable Securities Accounts Receivable

Income Statement Items For the Current Year Sales (Assume all credit) $1,600 Costs of Goods Sold $1,200 (Non-Depreciation) Operating Expenses $200 Depreciation Expense $50 Interest Expense $50 Taxes Paid $50 Preferred Dividends Paid $10 Common Dividends Paid $20

FIN 302 Fall 2010 Garrett HW2

1. Using the above financial statement information, please calculate the following financial ratios. As we discuss in class, you will see in the slides, and also in the text, ratios may be used to evaluate one or more of the following 4 things: liquidity, efficiency, profitability, and debt/leverage. After writing down the formula for each of the ratios and calculating the ratio in question, please indicate which of the 4 things above the ratio in question is designed to measure. There may be more than one in each case! a. Current ratio b. Acid-test (also known as, quick) ratio c. Average collection period d. Accounts receivable turnover e. Inventory turnover f. Average days in inventory (mentioned in class not text) g. Accounts payable days (also known as, payable deferral period mentioned in class not text) h. Operating income return on investment i. Operating profit margin j. Total asset turnover k. Fixed asset turnover l. Debt ratio m. Times interest earned n. Return on common equity o. Gross profit margin (mentioned in class not text p. Net profit margin q. Leverage ratio (mentioned in class not text) 2. Apply the DuPont analysis to the above financial statements. Write down the DuPont formula there are 4 components. Explain how the three components on the righthand side relate to the left-hand side of the equation. 3. Use the percent of sales method to forecast future financing needs based on the above current-year financial statements. Assume a 10% sales growth rate from the current year to the next, next years net profit margin of 5%, and a dividend payout ratio of 50% (1/2 of net income available to common shareholders is paid as dividends). a. First, project the future balance sheet items that scale proportionally with sales. b. Calculate the discretionary funds needed (DFN). c. Finally, fill in the rest of next years projected balance sheet and income statement. 4. Using the firms current-year financial statements , calculate the sustainable rate of growth.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Ratios - Top 28 Financial Ratios (Formulas, Type)Document7 pagesFinancial Ratios - Top 28 Financial Ratios (Formulas, Type)farhadcse30No ratings yet

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDocument20 pagesPertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNo ratings yet

- American Greetings Case 7Document14 pagesAmerican Greetings Case 7shahzad akNo ratings yet

- Finaco1 Module 2 AssignmentDocument10 pagesFinaco1 Module 2 AssignmentbLaXe AssassinNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument35 pagesFinancial Statement Analysis: K R Subramanyam John J WildSeven seasNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- FABM2 Module 05 (Q1-W6)Document12 pagesFABM2 Module 05 (Q1-W6)Christian ZebuaNo ratings yet

- Petro Rio S.A. - June 30, 2021 Financial StatementsDocument55 pagesPetro Rio S.A. - June 30, 2021 Financial StatementsTheodore H. CallisterNo ratings yet

- Accounting & Finance Exit Exam Practice QuestionsDocument227 pagesAccounting & Finance Exit Exam Practice Questionsmiadjafar463No ratings yet

- Property Plant and EquipmentDocument32 pagesProperty Plant and EquipmentKyllie CamantigueNo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- PobDocument24 pagesPobgillyhicksNo ratings yet

- Bad Debt, Inventory, DepreciationDocument2 pagesBad Debt, Inventory, Depreciationrio_harcanNo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDocument69 pagesAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- Chapter 17 - Financial Planning & ForecastingDocument20 pagesChapter 17 - Financial Planning & ForecastingammoiNo ratings yet

- Working Capital ManagementDocument92 pagesWorking Capital ManagementJagadish Badi80% (5)

- State laws govern land ownership in IndiaDocument48 pagesState laws govern land ownership in IndiaArushi SharmaNo ratings yet

- Investment Property QuizDocument6 pagesInvestment Property QuizLeilalyn NicolasNo ratings yet

- Acc 418Document379 pagesAcc 418sigirya100% (2)

- Chapter 1Document20 pagesChapter 1Momentum PressNo ratings yet

- 03 04 Analysis Financial StatementDocument216 pages03 04 Analysis Financial StatementShanique Y. Harnett100% (1)

- CHAPTER 19 - FINANCIAL ASSET AMORTIZED COSTDocument21 pagesCHAPTER 19 - FINANCIAL ASSET AMORTIZED COSTTurksNo ratings yet

- Chap 014Document27 pagesChap 014kainattariq67% (3)

- Online Test UDE1009 With AnswerDocument5 pagesOnline Test UDE1009 With Answerathirah jamaludinNo ratings yet

- Construction Planning and Management: Submitted To: Prof. V.P.S. Nihar NanyanDocument21 pagesConstruction Planning and Management: Submitted To: Prof. V.P.S. Nihar Nanyanankur tyagiNo ratings yet

- SpicelandFA5e Chap008 SM-2Document66 pagesSpicelandFA5e Chap008 SM-2Tina AntonyNo ratings yet

- Kieso IFRS4 TB ch17Document68 pagesKieso IFRS4 TB ch17Scarlet WitchNo ratings yet

- PT Amar Sejahtera General LedgerDocument6 pagesPT Amar Sejahtera General LedgerRiska GintingNo ratings yet

- Case Study Presentation: by Group BDocument12 pagesCase Study Presentation: by Group BAyesha Hussain Shahid MughalNo ratings yet