Professional Documents

Culture Documents

Acg SG 1

Uploaded by

Cynthia TrujilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acg SG 1

Uploaded by

Cynthia TrujilloCopyright:

Available Formats

ACG2021 Chapter 1

Test 1 Review Chapters 1-4

Role of accounting in society A. Accounting: an information system that reports on the economic activities and financial condition of a business or other organization (often called the language of business) 1. Accounting provides information that is useful in answering questions about resource allocation B. The market for business resources involves 3 distinct participants 1. Consumers=> use resources

2. Conversion agents (businesses) =>transform resources such as trees into desirable products such furniture 3. Resource owners=> control the distribution of resources to conversion agents C. Investors: provide financial resources in exchange for ownership interests in businesses. Owners expect businesses to return to them a share of the business income earned D. Creditors: lend financial resources to businesses. Instead of a share of business income, creditors expect business to repay borrowed resources at a future date. E. The specific resources businesses commonly use to satisfy consumer demand are 1. Financial resources (money): needed by businesses to get started and operate. Provided by investors and creditors a) When a business ceases to operate its remaining assets are sold and the sale proceeds are returned to the investors and creditors through a process called business liquidation b) Creditors have a priority claim on theseany remaining assets are distributed to investors 2. Physical resources: In their most primitive form, physical resources are called natural resources. a) The process of transforming natural resources can include several stages and numerous independent businesses. b) In this process, one conversion agents output becomes anothers input.

ACG2021

Test 1 Review Chapters 1-4 c) Owners of physical resources seek to sell those resources to profitable businesses because they are more likely to pay higher prices and repeat purchases. 3. Labor resources: include intellectual as well as physical labor a) Workers seek relationships with businesses (conversion agents) that have high earnings potential because these businesses are better able to provide rewards (pay high wages and continued employment)

F. The U.S. economy is not purely market based. Factors other than profitability often influence resource allocation priorities Accounting providing information G. Investors, creditors, and workers rely heavily on accounting information to evaluate which businesses are worthy or receiving resources 1. The many users of accounting information are called stakeholders a) Include resource providers, brokers, attorneys, and news reporters

H. The link between conversion agents and those stake holders who provide resources is DIRECT. I. The link between conversion agents and other stakeholders (attorneys, brokers, etc) is INDIRECT J. External users accounting information needs are provided by financial accounting K. Accounting information needed by internal users (people who work within a business) is provided by managerial accounting 1. Usually more detailed than financial accounting

L. Nonprofit accounting=> for not-for-profit entities=> serves benefactors and beneficiaries, legislators, citizens, etc. Accountants M. Accountants identify, record, analyze, and communicate information about the economic events that affect organizations. They may work in either public or private accounting. N. CPA: certified public accountant

ACG2021 O.

Test 1 Review Chapters 1-4 Services typically offered by public accountants include 1. Audit Services: involve examining a companys accounting records in order to issue an opinion about whether the companys financial statements conform to GAAP 2. Tax Services: include both determining the amount of tax due and tax planning to help companies minimize tax expense 3. Consulting Services: cover a wide range of activities that includes everything from installing sophisticated computerized accounting systems to providing personal financial advice.

Measurement Rules P. Customer buys in December, will pay in Januaryhow does the company report it (in January or December) 1. Doesnt matter as long as the store owner discloses the rule the decision is based on and applies it consistently to other transactions. 2. Clear communication also requires full and fair disclosure of the accounting rules chosen Q. World economies and financial reporting practices have not evolved uniformly

R. The financial accounting standards board (FASB) is a privately funded organization with primary authority for establishing accounting standards in the U.S. 1. The rules it establishes are called the Generally Accepted Accounting Principles (GAAP) a) Companies are NOT required to follow GAAP when preparing management accounting reports Reporting Entities S. Financial Accounting reports disclose the financial activities of reporting entities

T. Business entities communicate economic information about their activities to the public through 4 financial statements 1. 2. 3. 4. Income Statements Statement of Changes in Equity Balance Sheet Statement of Cash Flows

U. Information reported in Financial statements is organized into categories known as elements

ACG2021

Test 1 Review Chapters 1-4 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Assets Liabilities Equity Contributed capital Revenue Expenses Distributions Net income Gains Losses

V. Assets: Resources that a business uses to produce earnings. (Adrian says its everything the business has) 1. These belong to the resource providers (creditors and investors) =>meaning they have claims a) Relationships between the assets and the providers claims is described by the accounting equation Assets = Claims 2. Creditors claims are called liabilities. Investors claims are called equity Therefore Assets = Liabilities + Equity

W. X.

Liabilities can be viewed as future obligations of the enterprise Equity represents two distinct sources of assets 1. 2. Assets acquired by investors Assets obtained through their owning activities

Y. The portion of assets that has been provided by earning activities and not returned as dividends is called retained earnings 1. Retained earnings is therefore a component of stockholders equity

***NOTE: We now see the 3 sources of assets; liabilities, common stock, and retained earnings.

ACG2021

Test 1 Review Chapters 1-4

Recording Business Events under the Accounting Equation Z. Accounting Event: economic occurrence that changes an enterprises assets, liabilitys or stockholders equity. AA. Transaction: Particular kind of event that involves transferring something of value between two entities BB. All transactions affect the accounting equation in at least two places (Doubleentry bookkeeping) and fall into one of four types.. 1. Asset Source Transactions: increase total assets and total claims

2. Asset Exchange Transactions: Businesses frequently trade one asset for another asset. a) The amount of one asset decreases while another increases (1) Total assets are unaffected

3. Asset Use Transactions: decrease the total amount of assets and the total amount of claims on assets (i.e. liabilities and S.E) 4. Claims exchange transaction: One claims account increases, and another claims account decreases. CC. Revenue: Represents an economic benefit a company obtains by providing customers with goods and services. DD. EE. Expenses: The assets and services consumed to generate revenue Dividends: A business transfers some or all of its assets to owners 1. Since assets distributed to stockholders are not used for the purpose of generating revenue, dividends are not expenses! 2. They are a transferring of earnings, not a return of the assets acquired from the issue of common stock. Historical Cost and Reliability Concepts FF. In general, accountants do not recognize changes in the market value.

GG. The historical cost concept requires that most assets be reports at the amount paid for them, regardless of increases in the market value. 1. Why? Reliability conceptinformation is reliable if it can be independently verified. Appraisal value is an opinion, while the historical cost is a verifiable fact.

ACG2021

Test 1 Review Chapters 1-4

Summary of transactions HH. General ledger (t-accounts): complete collection of a companys accounts.

II. The information in these accounts is used to prepare the 4 financial statements (Refer to V:B in notes)

Preparing Financial Statements JJ. Income Statements: Rev- Expenses 1. I.S. matches asset increases from operating a business with asset decreases from operating a business 2. Revenues: Asset increases resulting from providing goods and services

3. Expenses: Asset decreases resulting from consuming assets and services for the purpose of generating revenues 4. 5. 6. R>E= net income R<E=net loss

Income is measured in a time span called accounting period Dividend payments are NOT reported in the income statement.

KK. Statement of Changes in Stockholders Equity: Common Stock + (Net incomedividends) 1. Explains the effects of transactions on the stockholders equity during the accounting period 2. Starts with the beginning balance in the common stock accountthen determine the ending balance in the common stock account 3. 4. LL. Also describes the changes in retained earnings for the accounting period. REMEMBER: Equity= Common stock + Retained Earnings

Balance Sheet 1. Draws its name from the accounting equationtotal assets balances with claims on those assets 2. Assets are displayed in the balance sheet based on their level of liquidity => assets are listed in order of how rapidly they will be converted to cash

ACG2021

Test 1 Review Chapters 1-4

MM. Statement of Cash Flows: 1. Explains how a company obtained and used cash during the accounting period 2. It classifies cash receipts and payments into 3 categories a) Financing activities: include obtaining or paying cash to owners, and borrowing or repaying the principal to creditors. (1) Raises the question of interest as an expense?!?!

b) Investing activities: involve paying cash to purchase productive assets or receiving cash from selling productive assets. c) Operating Activities: involve receiving cash from revenue and paying cash for expenses (1) NN. The Closing Process 1. REMEMBER: Assets= Liabilities + Equity (Common Stock + Retained Earnings) 2. During the accounting period, data was recorded in Rev., Exp., and Dividend accountsat the end the data in these accounts (temporary accounts) is transferred to the Retained Earnings Accounts (permanent account) a) Transfer referred to as closing Includes paying interest

3. At the beginning of each new accounting period those temporary accounts have zero balances a) ON THE OTHER HAND the retained earnings account carries forward from one accounting period to the next. Extra Stuff OO. The U.S. Securities and Exchange Commission (SEC) requires public companies to file an annual report on a document known as a 10-k PP. The price earnings ratio (P/E ratio): most commonly reported measure of a companys value = companys market price (per share)/companys annual earnings (per share) 1. If investors expect one companys earnings to grow faster than another, its higher P/E ratio makes sense. QQ. Chapter 2 Percentage Growth rate= (alternative year earnings Base year earnings)/ B.Y.E

ACG2021 I.

Test 1 Review Chapters 1-4

Accounting for Accruals A. To understand financial statements you must be able to distinguish between recognition and realization 1. 2. Recognition: Showing an event in the financial statements Realization: refers to the collection of cash

3. Recognition and realization can occur in different accounting periods; all depends on whether the company uses cash or accrual basis of accounting. B. Cash Basis of Accounting: recognizes revenues and expenses in the period in which cash is collected or paid C. Accrual Accounting: recognizes revenues and expenses in the period in which they occur, regardless of when cash is collected or paid. 1. 2. Uses both accruals and deferrals Accruals: applies to events that are recognized before cash is exchanged.

3. Deferrals: applies to events that are recognized after cash has been exchanged

Accrual Accounting D. Providing Services on account: The business has completed work and sent bills to the clients, but not yet collected any cash. 1. Accrual accounting requires that companies recognize revenue in the period in which the work is done, regardless of when cash is collected 2. In this instance, the specific asset that increases is Accounts Receivable a) The balance in this account represents the amount of cash expected to be collected in the future. 3. These transactions affect the income statement (increase in revenue), but not the statement of cash flows i. These will be affected in the future when cash is actually collected E. The collection of an accounts receivable is an asset exchange transaction 1. An asset increases while another decreases

ACG2021

Test 1 Review Chapters 1-4 2. Collecting the cash did not affect the income statement a) The revenue was already recognized when the work was done

b) The statement of cash flows reflects a cash inflow from operating activities. F. Owing employees salary earned 1. Accrual accounting requires that companies recognize expenses in the period in which they are incurred regardless of when cash is paid. 2. The recognition of the salary expense decreases stockholders equity and increases the liability Salaries Payable. 3. This event is a claims exchange transaction a) The claims of creditors (liabilities) increases and the claims of stockholders (retained earnings) decrease. 4. G. Total claims remain the UNCHANGED.

Partial payment to the employees is made 1. Cash payments to creditors are asset use transactions a) b) Cash (asset account) and liability accounts decrease So, are cash payments for expenses

H. A company agrees to perform or receive a service at a later date (including in a later accounting period) 1. Services to be performed, for ex. 2009, is not recognized in the 2008 financial statements. 2. 3. Revenue is recognized for work actually completed not work expected This event does not affect any of the financial statements.

Ledger Accounts and Financial Statements I. J. Data in the ledger accounts are used to prepare the financial statements Income statement: illustrates several effects of accrual accounting 1. In expanded form expenses can be defined as decreases un assets or increases in liabilities resulting from consuming assets and services to generate revenue

ACG2021

Test 1 Review Chapters 1-4 2. Revenue can be defined as increases in assets or decreases in liabilities from providing goods and services to customers in the normal course of operations

K. Statement of Changes in Stockholders Equity: reports the effects on equity of issuing common stock, earning net income, and paying dividends to stockholders. 1. It identifies how an entitys equity increased and decreased during the period as a result of transactions with stockholders and operating business L. Balance Sheet: discloses an entitys assets, liabilities and stockholders equity at a particular point of time M. Statement of Cash Flows: explains the change in cash from the beginning to the end of accounting cycle. 1. The Closing Process N. Much of the information disclosed in a companys financial statements summarizes business activity for a specified period of time => these are accounting cycles 1. These follow one another, from the time the business is formed until the time that it dissolves. O. During the accounting cycle, revenue, expenses, and dividends are recorded in temporary accounts P. Once the financial statements are complete, these temporary accounts move to a permanent account known as retained earnings 1. Q. This transferring process is known as closing the books Can be prepared by analyzing the cash account

Revenue increases retained earnings, while expenses and dividends decrease it.

R. The balance in the temporary accounts at the beginning of the next accounting cycle is 0! S. The balance in the retained earnings account will not change again until closing of the books in the next accounting cycle. Matching Concept

ACG2021

Test 1 Review Chapters 1-4

T. Cash basis accounting can distort the measurement of net income because it sometimes ails to properly match revenue with expenses. 1. The objective of accrual accounting is to improve matching. a) The matching of revenues with expenses can still be difficult

U. When the relationship between an expense and the corresponding revenue is vague, the expense is commonly matched with the period it was incurred. 1. Even though some of that cost might generate revenue in a future accounting period. 2. Period costs: expenses that are matched with the period in which they are incurred. V. Conservatism suggests that when faced with a recognition dilemma, accountants should select the alternative that produces the lowest amount of net income. 1. It is better to underestimate and be happy with greater results than to overestimate and be disappointed a) Thus when uncertainty exists, accountants tend to delay the recognition of revenue and accelerate the recognition of expenses. Adjusting the Accounts W. When a company purchases a certificate of deposit the company is in fact lending the back money, for which the bank will pay interest on. 1. It is important to recognize that interest is earned continually even though the full amount of cash is not collected until the maturity date 2. 3. The amount of interest collected increases as time passes The amount of interest earned but not collected is called accrued interest

X. Because businesses only record accrued interest when it is time to prepare the financial statements, the accounts must be adjusted to reflect the amount of interest due as of the end of the accounting period Accounting for Notes Payable Y. Borrowing money is an asset source transaction 1. It increases the asset account cash and increases the liability account Notes Payable 2. Z. It is reported as a financing activity on the statement of cash flows

The borrower is known as the issuer of the note and the bank is the creditor

ACG2021 AA.

Test 1 Review Chapters 1-4 Repaying a loan is NOT an expense 1. Paying interest is classified as an operating activity while repaying the principal is a financing activity

Corporate governance BB. Corporate Governance: the set of relationships between the board of directors, management, shareholders, auditors, and other stakeholders that determine how a company is operated. CC. DD. The accountants role in society requires trust and credibility Sarbanes-Oxley Act of 2002 1. Credible financial reporting relies on a system of checks and balances. a) Corporate management is responsible for preparing financial reports while CPAs audit them 2. The scandals that rose from the Enron and WorldCom bankruptcies suggested major auditing failures a) These prompted congress to pass the SOX which became effective on July 30, 2002 Common features of criminal and ethical misconduct EE. The auditing profession has recognized 3 elements that are typically present when fraud occurs (the fraud triangle) 1. Opportunity: shown at the head of the triangle because without opportunity fraud could not exist. a) The most effective way to reduce opportunities for ethical or criminal misconduct is to implement an effective set of internal controls. 2. Pressure: a key ingredient of misconduct a) A manager who is told either make the numbers or you are fired is more likely to cheat than one who is told tell it like it is. 3. Rationalization: few individuals this of themselves as evil. They develop rationalizations to justify misconduct The external audit function FF. The Financial Audit: detailed examination of a companys financial statements and the documents that support those statements. 1. These are conducted by an independent auditor

ACG2021

Test 1 Review Chapters 1-4 2. Auditors are not responsible for the success or failure of a company

GG.

Materiality and Financial Audits 1. Auditors do not guarantee that the financial statements are absolutely correct, only that they are materially correct a) An error or other reporting problems, is material if knowing about it would influence the decisions of average prudent investors.

HH.

There are three basic types of audit opinions 1. An unqualified opinion: the most favorable opinion, which means that the auditor believes the financial statements are in compliance with GAAP without qualification, reservation or exception. 2. Adverse opinion: the most negative; means that one or more departures from GAAP are so material the financial statements do not present a fair picture of the companys status. 3. Qualified opinion: falls between the other two; means for the most part the companys financial statements are in compliance with GAAP, but the auditors have reservations about something in the statement. 4. Disclaimer of audit opinion: An auditor is unable to perform the audit procedures necessary to determine whether the statements are prepared in accordance with GAAP, and can therefore not express an opinion.

Chapter 3

ACG2021 I.

Test 1 Review Chapters 1-4

Accounting for Deferrals II. Deferral recognizes revenue or expense at some time after cash has been collected or paid. JJ. Deferred amounts may be recognized over several accounting periods 1. The process of assigning the total deferral to different accounting periods is called allocation KK. What if a company receives cash in advance for services to be performed at a later date?? 1. The company must defer the revenue (O.E.) recognition until the services are performedmeaning, the revenue will be reported on the income statement after the service has been rendered. a) This deferred revenue represents a liability called unearned revenue 2. This is an asset source transaction a) Both the asset account (cash) and the liability account (unearned revenue) increase.

ACG2021

Test 1 Review Chapters 1-4 3. The statement of cash flows shows an influx of cash from operating activities.

LL. What ifa company signs contracts to provide services at a later date; no cash was received?? 1. There is no realization or recognition to report in the financial statements merely upon signing the contract agreement. MM. What ifa company purchased computer equipment; it has an expected useful life; and a certain salvage value 1. Salvage Value: value expected to be recovered at the end of the equipments useful life 2. Allocation of depreciation of the equipment is computed as follows a) b) asset c) 3. 4. (Cost-Salvage) / useful life= depreciation expense Depreciation Expense: Allocated cost of using a long-term tangible Long-term: usually a period longer than one year

Recognizing depreciation expense is an asset use transaction The asset account computer equipment is not decreased directly a) Asset reduction is recorded in a contra asset account called accumulated depreciation

5. Book value of the asset difference between the balances in the equipment account and the related accumulated depreciation a) Book value= original cost accumulated depreciation

The Matching Concept NN. In the real world, perfect matching is virtually impossible 1. Accountants must settle for the best fit rather than the attainment of perfection. OO. The matching concept is applied in alternative ways in order to attain the best fit. Three matching practices include

ACG2021

Test 1 Review Chapters 1-4 1. Costs may be matched directly with the revenues they generate

2. The costs of items with short or undeterminable useful lives are matched with the period they are incurred 3. Systematic allocation of cost: The costs of long-term assets with identifiable useful lives are systematically allocated over the assets useful lives PP. Beyond matching inconsistencies, you should be aware that some information in financial reports is based on estimated rather than exact measures 1. The book value of the asset and the amounts of depreciation, expense, net income, retained earnings are therefore estimated not exact amounts QQ. The application of the concept of materiality may cause inaccuracies in financial reporting.

Accounting for Supplies RR. It is helpful to distinguish between the terms cost and expense 1. Cost can either be an asset or an expense a) If a purchased item will be used in the future to generate revenue, its cost represent an asset b) If a purchased item has already been used in the process of earning revenue, its cost represent an expense 2. Storing the cost in an asset account enables the accountant to defer the recognition of an expense until the future time when the item is used SS. It is impractical to expense supplies as they are being used. Instead accountants expense the total cost of all supplies used during the entire accounting period in a single year-end adjusting entry TT. Cost of supplies used is determined by the following formula 1. 2. Beginning Balance + Purchases= Supplies available for use Supplies available for use Ending Balance= Supplies used

ACG2021

Test 1 Review Chapters 1-4

Accounting for Pre-Paid Insurance UU. The cost of insurance is placed in an asset account called pre-paid insurance 1. Expense recognition is deferred until the insurance is used

VV. The amount of insurance used during the accounting period is computed as follows 1. 2. Cost of annual policy / 12= cost per month Cost per month x months used= insurance expense

The Financial Analyst ***How do financial analysts compare the performance of differing size companies? WW. Assessing the effective use of assets 1. Evaluating performance requires considering the size of the investment base used to produce income 2. The relationship between the level of income and the size of the investment can be expressed as return on asset ratio a) Net Income / Total Assets (1) Permits meaningful comparison between different size companies XX. Assessing debit risk 1. The level of debit risk can be measured in part by using a debt to assets ratio a) Total Debt / Total Assets

2. The relationship between net income and the stockholders equity is the return on equity ratio a) Net income / Stockholders Equity

3. Financial leverage: using borrowed money to increase the return on stockholders investment Chapter 4

ACG2021 I.

Test 1 Review Chapters 1-4

Debit/Credit terminology YY. T-accountsaccount title is written across the top 1. 2. Left side: Debits Right side: Credits

ZZ. For any given account the difference between the total debits and credits is the account balance: 1. The double entry accounting system requires that total debits always equals total credits a) However, an equality of debits and credits does NOT prove accuracy AAA. Debits increase asset accounts and credits decrease them. 1. On the other hand, debits decreases claims (liability and stockholders equity) and credits increase them.

Types of Transactions BBB. Asset Source Transactions 1. A business may obtain assets from three primary sources a) b) c) From Stockholders From creditors Through operating activities; Earning revenue

2. These transactions increase an asset account and a corresponding claims account. CCC. Asset exchange Transactions 1. 2. 3. Involve trading one asset for another asset One asset account increases and the other decreases The total amount of assets remains unchanged

ACG2021

Test 1 Review Chapters 1-4

DDD. Asset Use Transactions 1. There are three primary asset use transactions a) b) c) Expenses may use assets Settling liabilities may use assets Pay dividends use assets

EEE. Claims Exchange Transaction 1. Certain transactions involve exchanging one claims account for another claims account a) You debit the claims account which is decreasing, and credit the claims account which is increasing

Adjusting the Accounts 2. A. Adjusting entries do not affect the cash account

Accrual of Interest Revenue 1. The required adjusting entry increases both assets and stockholders equity a) b) Increase in asset (Interest Receivables) => Debited Increase in equity (Interest Revenues) => Credited

B.

Accrual of Interest expense 1. The required adjusting entry increase liabilities and decreases stockholders equity Accrual of Salary Expense 1. The required adjusting entry increases liabilities and decreases stockholders equity a) Liability: Salaries Payable

A.

B.

C.

b) Stockholders Equity: Salary Expense Equipment used to produce revenue (Depreciation Expense) 1. The adjusting entry necessary to record depreciation decreases both assets and stockholders equity 2. The decrease in assets is recorded with a credit to the contra asset account Accumulated Depreciation 3. The decrease in stockholders equity is recorded to a debit to an expense account. Office Space used to Produce Revenue 1. Decreases both stockholders equity and assets

ACG2021

Test 1 Review Chapters 1-4 a) Asset: Prepaid Rent => Credit

D.

b) S.E.: Expense => Debit Supplies used to produce Revenue (Supplies Expense) 1. Recognizing the supplies expense decreases both assets and stockholders equity. a) Assets: Supplies => credit

b) S.E.: Expense => debit NOTE: Adjusting entries always involve revenue or expense accounts. Since an asset exchange transaction involves only assets accounts, an asset exchange transaction CANNOT be an adjusting entry.

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RKMFiles Study Notes on Criminal Identification and InvestigationDocument168 pagesRKMFiles Study Notes on Criminal Identification and InvestigationTfig Fo EcaepNo ratings yet

- PAPER CODE 138Document23 pagesPAPER CODE 138Jaganmohan MedisettyNo ratings yet

- LABFORS-4 IntasDocument6 pagesLABFORS-4 IntasAlisha TurnerNo ratings yet

- SOP For OLDocument9 pagesSOP For OLTahir Ur RahmanNo ratings yet

- Reconstitution of a Partnership FirmDocument59 pagesReconstitution of a Partnership FirmKnowledge worldNo ratings yet

- RTO ProcessDocument5 pagesRTO Processashutosh mauryaNo ratings yet

- Mupila V Yu Wei (COMPIRCLK 222 of 2021) (2022) ZMIC 3 (02 March 2022)Document31 pagesMupila V Yu Wei (COMPIRCLK 222 of 2021) (2022) ZMIC 3 (02 March 2022)Angelina mwakamuiNo ratings yet

- Deposit Mobilization of Nabil Bank LimitedDocument41 pagesDeposit Mobilization of Nabil Bank Limitedram binod yadav76% (38)

- School EOEDocument1 pageSchool EOEMark James S. SaliringNo ratings yet

- LifeCycleSequencingCardsFREEButterflyandFrog 1Document11 pagesLifeCycleSequencingCardsFREEButterflyandFrog 1Kayleigh Cowley100% (1)

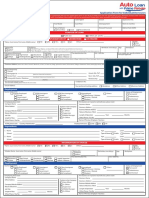

- Psbank Auto Loan With Prime Rebate Application Form 2019Document2 pagesPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- Texas Driver's Handbook On Bicycle SafetyDocument2 pagesTexas Driver's Handbook On Bicycle SafetydugbegleyNo ratings yet

- Home - ECourt India Services Harpreet Singh by JN PatelDocument2 pagesHome - ECourt India Services Harpreet Singh by JN PatelIasam Groups'sNo ratings yet

- 3000 Watt Power InverterDocument1 page3000 Watt Power InvertersimonNo ratings yet

- Operation Manual: Hermetic Sealing SystemDocument50 pagesOperation Manual: Hermetic Sealing SystemsunhuynhNo ratings yet

- Toles Higher SampleDocument13 pagesToles Higher SampleKarl Fazekas50% (2)

- 143 InchiquinDocument705 pages143 InchiquinJohn Mikla100% (2)

- Partnership Liability for Debts IncurredDocument12 pagesPartnership Liability for Debts IncurredDennis VelasquezNo ratings yet

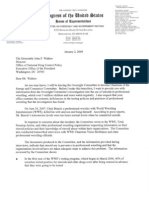

- Waxman Letter To Office of National Drug Control PolicyDocument6 pagesWaxman Letter To Office of National Drug Control PolicyestannardNo ratings yet

- Cambridge IGCSE™: Sociology 0495/22 October/November 2021Document31 pagesCambridge IGCSE™: Sociology 0495/22 October/November 2021Elizabeth VargheseNo ratings yet

- Bank StatementDocument2 pagesBank StatementZakaria EL MAMOUNNo ratings yet

- CUCAS Scam in China - Study Abroad Fraud Part 1Document8 pagesCUCAS Scam in China - Study Abroad Fraud Part 1Anonymous 597ejrQAmNo ratings yet

- Jazz - Score and PartsDocument44 pagesJazz - Score and PartsMaanueel' Liizaamaa'No ratings yet

- DocsssDocument4 pagesDocsssAnne DesalNo ratings yet

- Schnittke - The Old Style Suite - Wind Quintet PDFDocument16 pagesSchnittke - The Old Style Suite - Wind Quintet PDFciccio100% (1)

- Traffic Science TSC1125NDocument9 pagesTraffic Science TSC1125NNhlanhla MsomiNo ratings yet

- Our Native Hero: The Rizal Retraction and Other CasesDocument7 pagesOur Native Hero: The Rizal Retraction and Other CasesKrichelle Anne Escarilla IINo ratings yet

- Interpretation of TreatyDocument21 pagesInterpretation of TreatyTania KansalNo ratings yet

- 해커스토익 김진태선생님 2020년 7월 적중예상문제Document7 pages해커스토익 김진태선생님 2020년 7월 적중예상문제포도쨈오뚜기No ratings yet

- Criminology and Criminal Justice AdministrationDocument167 pagesCriminology and Criminal Justice AdministrationRahulAbHishekNo ratings yet