Professional Documents

Culture Documents

F 1040 Sa

Uploaded by

ljens09Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F 1040 Sa

Uploaded by

ljens09Copyright:

Available Formats

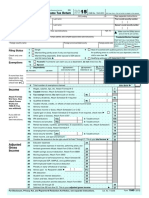

SCHEDULE A (Form 1040)

Department of the Treasury Internal Revenue Service (99) Name(s) shown on Form 1040

Attach

Itemized Deductions

to Form 1040.

See

OMB No. 1545-0074

Instructions for Schedule A (Form 1040).

Attachment Sequence No. 07 Your social security number

2010

Medical and Dental Expenses Taxes You Paid

Interest You Paid

Note. Your mortgage interest deduction may be limited (see instructions).

Caution. Do not include expenses reimbursed or paid by others. Medical and dental expenses (see instructions) . . . . . 1 Enter amount from Form 1040, line 38 2 Multiply line 2 by 7.5% (.075) . . . . . . . . . . . 3 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . State and local (check only one box): a Income taxes, or . . . . . . . . . . . 5 b General sales taxes 6 Real estate taxes (see instructions) . . . . . . . . . 6 7 New motor vehicle taxes from line 11 of the worksheet on back (for certain vehicles purchased in 2009). Skip this line if you checked box 5b . . . . . . . . . . . . . . 7 8 Other taxes. List type and amount 8 9 Add lines 5 through 8 . . . . . . . . . . . . . . . . 10 Home mortgage interest and points reported to you on Form 1098 10 1 2 3 4 5

11 Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that persons name, identifying no., and address 11 12 Points not reported to you on Form 1098. See instructions for special rules . . . . . . . . . . . . . . . . . 12 13 Mortgage insurance premiums (see instructions) . . . . . 13 14 Investment interest. Attach Form 4952 if required. (See instructions.) 14 15 Add lines 10 through 14 . . . . . . . . . . . . . . .

15

Gifts to Charity

16 Gifts by cash or check. If you made any gift of $250 or more, see instructions . . . . . . . . . . . . . . . . 16 17 Other than by cash or check. If any gift of $250 or more, see If you made a gift and got a instructions. You must attach Form 8283 if over $500 . . . 17 benefit for it, 18 Carryover from prior year . . . . . . . . . . . . 18 see instructions. 19 Add lines 16 through 18 . . . . . . . . . . . . . . .

. .

. .

. .

. .

. .

. .

Casualty and Theft Losses

19 20

20 Casualty or theft loss(es). Attach Form 4684. (See instructions.) .

Job Expenses 21 Unreimbursed employee expensesjob travel, union dues, and Certain job education, etc. Attach Form 2106 or 2106-EZ if required. Miscellaneous 21 (See instructions.) Deductions 22 Tax preparation fees . . . . . . . . . . . . . 22

23 Other expensesinvestment, safe deposit box, etc. List type and amount 24 25 26 27 28 23 Add lines 21 through 23 . . . . . . . . . . . . 24 Enter amount from Form 1040, line 38 25 Multiply line 25 by 2% (.02) . . . . . . . . . . . 26 Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . Otherfrom list in instructions. List type and amount

27

Other Miscellaneous Deductions

28

29 Add the amounts in the far right column for lines 4 through 28. Also, enter this amount Total on Form 1040, line 40 . . . . . . . . . . . . . . . . . . . . . 29 Itemized Deductions 30 If you elect to itemize deductions even though they are less than your standard deduction, check here . . . . . . . . . . . . . . . . . . .

Schedule A (Form 1040) 2010

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Cat. No. 17145C

Schedule A (Form 1040) 2010

Page 2

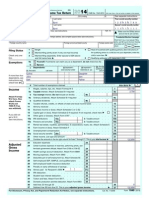

Worksheet for Line 7 New motor vehicle taxes

Before you begin:

You cannot take this deduction if the amount on Form 1040, line 38, is equal to or greater than $135,000 ($260,000 if married filing jointly). See the instructions for line 7 on page A-6.

1 Enter the state and local sales and excise taxes you paid in 2010 for the purchase of any new motor vehicle(s) after February 16, 2009, and before January 1, 2010 (see instructions) . . . . 2 Enter the purchase price (before taxes) of the new motor vehicle(s) 3 Is the amount on line 2 more than $49,500? No. Enter the amount from line 1. Yes. Figure the portion of the tax from line 1 that is attributable to the first $49,500 of the purchase price of each new motor vehicle and enter it here (see instructions). 4 Enter the amount from Form 1040, line 38 . 5 Enter the total of any Amounts from Form 2555, lines 45 and 50; Form 2555-EZ, line 18; and Form 4563, line 15, and Exclusion of income from Puerto Rico 6 Add lines 4 and 5 . . . . . . . . . . . . .

1 2

Use this worksheet to figure the amount to enter on line 7.

(Attach to Form 1040.)

}

.

}

. .

. .

. .

. .

6 7

7 Enter $125,000 ($250,000 if married filing jointly) .

8 Is the amount on line 6 more than the amount on line 7? No. Enter the amount from line 3 above on Schedule A, line 7. Do not complete the rest of this worksheet. Yes. Subtract line 7 from line 6 . . . . . . . . 8

9 Divide the amount on line 8 by $10,000. Enter the result as a decimal (rounded to at least three places). If the result is 1.000 or more, enter 1.000 . . . . . . . . . . . . . . 10 Multiply line 3 by line 9 . . . . . . . . . . . . . .

9 . . . . .

10

11 Deduction for new motor vehicle taxes. Subtract line 10 from line 3. Enter the result here and on Schedule A, line 7 . . . . . . . . . . . . . . . . . . .

11

Schedule A (Form 1040) 2010

You might also like

- F 1040 SaDocument1 pageF 1040 SaPrekelNo ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental Expensesapi-173610472No ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental ExpensesnuseNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNo ratings yet

- F 1040 SaDocument1 pageF 1040 Sahgfed4321No ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- Individual Tax Return Problem 2 Form 1040 Schedule ADocument1 pageIndividual Tax Return Problem 2 Form 1040 Schedule AHenry PhamNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNo ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- HTTPSWWW Irs Govpubirs-Pdff1040sa PDFDocument1 pageHTTPSWWW Irs Govpubirs-Pdff1040sa PDFAppaNo ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Foreign Tax Credit: A B C D eDocument2 pagesForeign Tax Credit: A B C D eSamer Mira BazziNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- Alternative Minimum Tax IndividualsDocument2 pagesAlternative Minimum Tax IndividualshujiNo ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnHamzah B ShakeelNo ratings yet

- Week 2 Form 1040Document2 pagesWeek 2 Form 1040Linda100% (2)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)api-173610472No ratings yet

- F 1040Document2 pagesF 1040Kevin RowanNo ratings yet

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- Self-Employment Tax: Schedule SeDocument2 pagesSelf-Employment Tax: Schedule SeFahad Khan SaqibiNo ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- FTF1302745105156Document5 pagesFTF13027451051562sly4youNo ratings yet

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- Form 1040Document2 pagesForm 1040karthu48No ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Dunk7No ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- Alice Tax FormDocument6 pagesAlice Tax FormShrey MangalNo ratings yet

- Chapter 10 MERGEDDocument10 pagesChapter 10 MERGEDola69% (13)

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNo ratings yet

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Document2 pagesIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472No ratings yet

- Alternative Minimum Tax-IndividualsDocument2 pagesAlternative Minimum Tax-IndividualsBenjamín Varela UmbralNo ratings yet

- F 1040 SeDocument2 pagesF 1040 SepdizypdizyNo ratings yet

- U.S. Individual Income Tax ReturnDocument3 pagesU.S. Individual Income Tax Returnyupper2014No ratings yet

- Form6251-2021-PDF Reader ProDocument2 pagesForm6251-2021-PDF Reader ProujehgjyiNo ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751No ratings yet

- BNI 1120 ReturnDocument5 pagesBNI 1120 ReturndishaakariaNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1No ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Ivan Incisor CH 2 Tax Return - For - FilingDocument4 pagesIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Tds 2021-1-4Document4 pagesTds 2021-1-4varun mahajanNo ratings yet

- 2022 Instructions For Form 1041 and Schedules A, B, G, J, and K-1 - I1041Document52 pages2022 Instructions For Form 1041 and Schedules A, B, G, J, and K-1 - I1041Mr CutsforthNo ratings yet

- Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Document1 pageIncome Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Records Section67% (3)

- Module 1 - Transfer and Business Taxation - v.1Document30 pagesModule 1 - Transfer and Business Taxation - v.1John Vincent ManuelNo ratings yet

- Residential-Agricultural Discount ProgramDocument2 pagesResidential-Agricultural Discount ProgramSean MagersNo ratings yet

- April 2021 PAYSLIPDocument1 pageApril 2021 PAYSLIPPuja ParekhNo ratings yet

- Tax Digest Mobil Philippines Vs City Treasurer of MakatiDocument2 pagesTax Digest Mobil Philippines Vs City Treasurer of MakatiCJNo ratings yet

- Welcome To Presentation On: BSRM Steels Limited (Melting-2)Document19 pagesWelcome To Presentation On: BSRM Steels Limited (Melting-2)SaikatNo ratings yet

- CGT Rollover Relief - July 2023Document3 pagesCGT Rollover Relief - July 2023maharajabby81No ratings yet

- Sarath Salary SlipDocument5 pagesSarath Salary Slipbindu mathaiNo ratings yet

- Rama Raju Final Workings 30.08.2020Document2 pagesRama Raju Final Workings 30.08.2020Varma RebalNo ratings yet

- Excite LDocument1 pageExcite LDeepak ChawlaNo ratings yet

- Form DGT-1 Pg2Document1 pageForm DGT-1 Pg2Imantoni NainggolanNo ratings yet

- Bir Form 2305Document4 pagesBir Form 2305fatmaaleahNo ratings yet

- Salary SlipDocument1,067 pagesSalary SlipManojkumaR KuchulakantI100% (1)

- Wa0037.Document2 pagesWa0037.Arshal AzeemNo ratings yet

- Wa0006.Document1 pageWa0006.Aun M RizviNo ratings yet

- Community Tax HandoutsDocument3 pagesCommunity Tax HandoutsKana Lou Cassandra BesanaNo ratings yet

- July 2022 PayslipDocument1 pageJuly 2022 Payslipalumi ghodNo ratings yet

- Tax Collection On GST Portal 2019 2020Document16 pagesTax Collection On GST Portal 2019 2020Disha MohantyNo ratings yet

- DRW 2021 Cash001cajj018598 V1Document8 pagesDRW 2021 Cash001cajj018598 V1Russell Chyle100% (1)

- Section 80 C and TaxationDocument3 pagesSection 80 C and TaxationdeepeshmahajanNo ratings yet

- Tax Form w3Document34 pagesTax Form w3hossain ronyNo ratings yet

- Abaseen Clearing and Forwarding Office No:415,4Th Floor Haji Adam Chamber, Karachi Tel: 9221-2464335Document6 pagesAbaseen Clearing and Forwarding Office No:415,4Th Floor Haji Adam Chamber, Karachi Tel: 9221-2464335Shahbaz AhmadNo ratings yet

- General Mathematics and Statistics (6401)Document14 pagesGeneral Mathematics and Statistics (6401)Chemo PhobiaNo ratings yet

- Net Pay $2,269.21 Pay DetailsDocument1 pageNet Pay $2,269.21 Pay DetailsSimonNo ratings yet

- 568 - LLC Tax Return FormDocument7 pages568 - LLC Tax Return FormAndreana Dumpling WilliamsNo ratings yet

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Document2 pagesAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNo ratings yet

- Wolves Payslip Jul23Document1 pageWolves Payslip Jul23NeelamAdengadaNo ratings yet

- Presentation of TaxationDocument10 pagesPresentation of TaxationMaaz SiddiquiNo ratings yet