Professional Documents

Culture Documents

15 G

Uploaded by

akshatkul1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

15 G

Uploaded by

akshatkul1Copyright:

Available Formats

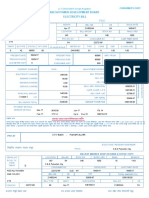

FORM NO: 15G (See rule 29C) Declaration under sub-sections (1) & (IA) of section 197A of the

Income -Tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax I/We* ___________________________________________________________ * / son / daughter / wife of: _________________________________________ resident of: _____________________________________________________ @ do hereby declare

1. *That I am a shareholder in ______ (name and address of the company)

and the shares in the said company, particulars of which are given in Schedule I below, stand in my name and are beneficially owned by me, and the dividends there from are not includible in the total income of any other person under sections 60 to 64 of the Income-Tax Act; OR #That the securities or sums, particulars of which are given in schedule II or schedule III or schedule IV below, stand in *rimy/our name and beneficially belong to *me/us and the *interest in respect of such securities or sums and/or income in respect of units is / are not includible in the total income of any other person under section 60 to 64 of the Income-tax Act, 1961; OR *That the particulars of my account under the National Savings Scheme and the amount of withdrawal are as per the Schedule V below:

2. that * my/our present occupation is _______________

3. that the tax on * my/our estimated total income, including the dividends from shares referred to in schedule I below; and/or # interest on securities, interest other than interest on securities and/or income in respect of units, referred to in schedule II, schedule III and/or schedule IV below ; and/or the amount referred to in clause (a) of sub-section (2) of section 80 CCA, mentioned in schedule V below ; computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on 31st March ______ relevant to the assessment year ________ will be NIL;

4. that *my/our income from *dividend/interest on securities/interest other

than "interest on securities" / units/amounts referred to in clause (a) of sub-section (2) of section 80CCA or the aggregate of such incomes,

computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on 31st March _________ relevant to the assessment year 20____- 20____ will not exceed the maximum amount, which is not chargeable to income-tax;

5. that * I/we have not been assessed to income-tax at any time in the past

but I fall within jurisdiction of the Chief Commissioner or Commissioner of Income-tax OR that *I was / we were last assessed to income-tax for the assessment year by the assessing officer _________________ Circle / Ward / District and the permanent account number allotted to me is ___________ the Income-tax Act, 1961;

6. That * I am / am not resident in India within the meaning of section 6 of 7. Particulars of the *shares of the company/securities/sums/account under

the national saving scheme and the amount of withdrawal referred to in paragraph 1 above, in respect of which the declaration is being made, are as under: SCHEDULE I Number of Shares Class of shares and face value of each share Total face value of shares Distinctive numbers of the shares Date(s) on which the shares were acquired by the declarant

SCHEDULE II Description of securities Number of securities Date(s) of securities Amount of securities Date(s) on which the securities were acquired by the declarant

SCHEDULE III Name and address Amount of of the person to such sums whom the sums are given on interest Vijaya Bank Date on which Period for which Rate of sums were given such sums were interest on interest given on interest

Page 2 of 4

SCHEDULE IV Name and Number address of the of units Mutual Fund Class of units and face value of each unit Distinctive number of units Income in respect of units

SCHEDULE V Particulars of the post Office where the Date on which the account under the National Savings account was opened Scheme is maintained and the account number The amount of withdrawal from the account

**Signature of the declarant VERIFICATION *I/we: __________ do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. Verified today, the ____ day of _________ Place: Date: NOTES : 1. @ Give complete postal address. 2. The declaration should be furnished in duplicate.

**Signature of the declarant

3. *Delete whichever is not applicable.

4. #Declaration in respect of these payments can be furnished by a person (not being a company or a firm) 5. **Indicate the capacity in which the declaration is furnished on behalf of a Hindu undivided family, association of persons, etc.

6. Before signing the verification, the declarant should satisfy himself that

the information furnished in the declaration is true, correct and complete

Page 3 of 4

in all respects. Any person making a false statement in the declaration shall be liable to prosecution under Section 277 of the Income-Tax Act, 1961, and or conviction be punishable -

i) in a case where tax sought to be evaded exceeds one lakh rupees,

with rigorous imprisonment which shall not be less than six months but which may extend to seven years and with fine; ii) in any other case, with rigorous imprisonment which shall not be less than three months but which may extend to three years and with fine. Part II

(FOR USE BY THE PERSON TO WHOM THE DECLARATION IS FURNISHED) 1. Name and address of the person responsible for paying income, mentioned in paragraph 1 of the declaration 2. Date on which the declaration was furnished by the declarant. 3. Date of declaration, distribution or payment of dividend / withdrawal from account number under the National Savings Scheme. 4. Period in respect of which interest is being credited or paid 5. Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6. *Rate at which interest or income in respect of units, as the case may be, is credited/paid Vijaya Bank, ________

Not applicable

Not applicable Not applicable

Forward to the Chief Commissioner or Commissioner of Income-tax: _______

Place: Date:

Signature of the person responsible for paying the income referred to in Paragraph I

Page 4 of 4

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NSNP organizations not fully exempt from taxesDocument2 pagesNSNP organizations not fully exempt from taxesJamz LopezNo ratings yet

- Tax Remedies and AdministrationDocument21 pagesTax Remedies and AdministrationexquisiteNo ratings yet

- Bibliography: A. Books / ReportsDocument4 pagesBibliography: A. Books / ReportsUjjwal MishraNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND INTEREST INCOMEDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARY AND INTEREST INCOMEshivam raiNo ratings yet

- Income Withholding DeclarationDocument2 pagesIncome Withholding DeclarationMoi EscalanteNo ratings yet

- Tax Invoice for Organic Face WashDocument1 pageTax Invoice for Organic Face WashPriyanka MahajanNo ratings yet

- DTC Example Question Stage 1Document3 pagesDTC Example Question Stage 1aqilah_abidin_1No ratings yet

- Proof of investment guidelines for claiming tax benefitsDocument17 pagesProof of investment guidelines for claiming tax benefitsDhiman Jyoti SarmahNo ratings yet

- Exceptional Broadband Bill - April2022Document1 pageExceptional Broadband Bill - April2022Raju JhaNo ratings yet

- Paper F6 Revision Questions and AnswersDocument90 pagesPaper F6 Revision Questions and AnswersAwais Anwar KhanNo ratings yet

- Airbnb Travel Receipt RCQ4YXR3ES-3Document1 pageAirbnb Travel Receipt RCQ4YXR3ES-3Lisset Cristina Colonio SotoNo ratings yet

- Blank 5Document1 pageBlank 5Abbas RizviNo ratings yet

- History of TaxDocument36 pagesHistory of TaxNicolaGalaNo ratings yet

- Aishwarya Food Production - 274Document1 pageAishwarya Food Production - 274kkundan52No ratings yet

- Benefit Payment Increase NSS - P239836957Document2 pagesBenefit Payment Increase NSS - P239836957Izzy BaeNo ratings yet

- Philippine Tax Audit ReportDocument2 pagesPhilippine Tax Audit ReportHanabishi RekkaNo ratings yet

- Customs Duty Overview: Concepts, Taxpayers, Scope and ExemptionsDocument39 pagesCustoms Duty Overview: Concepts, Taxpayers, Scope and ExemptionsLê Thiên Giang 2KT-19No ratings yet

- Multilateral Instrument (Mli) ConventionDocument8 pagesMultilateral Instrument (Mli) ConventionTaxpert Professionals Private LimitedNo ratings yet

- Taxation One Complete Updated (Atty. Mickey Ingles)Document116 pagesTaxation One Complete Updated (Atty. Mickey Ingles)Patty Salas - Padua100% (11)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ankit TripathiNo ratings yet

- ReportDocument1 pageReportxenNo ratings yet

- Estate of Reyes v. CIRDocument31 pagesEstate of Reyes v. CIRCon ConNo ratings yet

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroNo ratings yet

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićNo ratings yet

- IncomeTax Banggawan2019 Ch10Document10 pagesIncomeTax Banggawan2019 Ch10Noreen Ledda100% (1)

- MCQ Public FinanceDocument4 pagesMCQ Public FinanceWild Gaming YT100% (2)

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Taxation in EthiopiaDocument50 pagesTaxation in Ethiopiastrength, courage, and wisdom92% (12)

- List of CPIO and Appellate AuthoritiesDocument25 pagesList of CPIO and Appellate Authoritiesanshul test70No ratings yet

- Income Taxation in General (Supplement)Document4 pagesIncome Taxation in General (Supplement)Random VidsNo ratings yet