Professional Documents

Culture Documents

LIFO vs FIFO Impact on Merrimack Tractors

Uploaded by

studvabzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LIFO vs FIFO Impact on Merrimack Tractors

Uploaded by

studvabzCopyright:

Available Formats

[VAIBHAV MAHESHWARI, SEC A, ROLL PGP2011926] September 5, 2011

MERRIMACK TRACTORS AND MOWERS INC.: LIFO OR FIFO? Merrimack Tractors and Movers is a US based company. Earlier it used to assemble mowers in Nashua but after 1980 it stopped manufacturing and assembling operations and started buying its tractors and machines from China. By 2008 imports cost from China was rising because of following reasons: Increased wages and labour costs Strengthening of Chinese currency Consequences Projected net income of year 2008 was below that of 2007 and earlier years External Directors were forcing COO Rick Martino to keep incomes growing else quit Solution: James Colburn, company controller, suggested that they have been following Last-in, first-out (LIFO) method of inventory valuation and have been able to save on taxes because of it but if they changed their method from LIFO to FIFO (Firstin First-out) then they can increase income figures at the cost of increase in the taxes payable. To consider Colburns idea Rick needed detailed financial analysis which is as follows: Valuation of the Inventories for the years 2007 and 2008 on LIFO basis 2007 Cost Per Unit 900 1000 1100 1200 1300 2008 Cost Per Unit 900 1400 1500 1600 1700

Beginning Inventory Purchases, Quarter 1 Purchases, Quarter 2 Purchases, Quarter 3 Purchases, Quarter 4 Available for Sale Less: Sales Ending Inventory

Units 1500 0 1000 0 1000 0 1000 0 1000 0 5500 0 4000 0 1500 0

Cost 1350000 0 1000000 0 1100000 0 1200000 0 1300000 0 5950000 0 4600000 0 1350000 0

Units 15000 10000 10000 10000 10000 55000 40000 15000

Cost 1350000 0 1400000 0 1500000 0 1600000 0 1700000 0 7550000 0 6200000 0 1350000 0

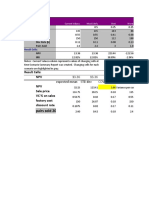

Projected Income Statements for the years 2007 and 2008 based on LIFO method: Income Statement - 2007 67000000 46000000 Income Statement - 2008 70350000 62000000

Sales Less: Cost of Goods Sold

[VAIBHAV MAHESHWARI, SEC A, ROLL PGP2011926] September 5, 2011

Gross Margin Selling and Admin Exp. Income before Taxes Income Taxes (35%) Net Income 21000000 10000000 11000000 3850000 7150000 8350000 10000000 -1650000 0 -1650000

Evaluation of inventories on FIFO basis (As suggested by Colburn): 2008 Cost Per Unit 900 1400 1500 1600 1700

Beginning Inventory Purchases, Quarter 1 Purchases, Quarter 2 Purchases, Quarter 3 Purchases, Quarter 4 Available for Sale Less: Sales Ending Inventory

Units 1500 0 1000 0 1000 0 1000 0 1000 0 5500 0 4000 0 1500 0

Cost 1350000 0 1400000 0 1500000 0 1600000 0 1700000 0 7550000 0 5050000 0 2500000 0

For preparing Income statement of year 2008 we need to take following assumptions as case do not provide data regarding them: An increase of 5 %, in sales revenue, is assumed for the year 2008 because the costs are rising and company might have increased its sales price to compensate loss in profits Selling and Administration expenses are still same as that of year 2007 Income tax percentage is also same as that of year 2007 Income Statement on FIFO basis for year 2008 Income Statement 70350000 50500000 19850000 10000000 9850000 3447500 6402500

Sales Less: Cost of Goods Sold Gross Margin Selling and Admin Exp. Income before Taxes Income Taxes (35%) Net Income

[VAIBHAV MAHESHWARI, SEC A, ROLL PGP2011926] September 5, 2011

Inference: After comparing income statements of year 2008 based on LIFO and FIFO methods we can observe a drastic impact it had on NET INCOME. NET INCOME is positive when FIFO method is used and negative when LIFO is used. As per Colburns report, real cost of switching over to FIFO is $ 5.5 million and will lead to immediate tax liability of $ 2 million but still we will be left with $ 3.5 million which will increase the income. Increasing tax burden is a concern but at least it will give Rick some time to see how real problem of rising costs can be solved. Further, after Olympics in China are over there is a possibility that wages and labour costs can come down and dollar may regain strength. Attachments:

Merrim ack_FIFO_LIF O.xls

You might also like

- Merrimack Tractors and MowersDocument4 pagesMerrimack Tractors and MowersShankar SivanNo ratings yet

- Merrimack Tractors and Movers IncDocument2 pagesMerrimack Tractors and Movers IncPranav MehtaNo ratings yet

- Merrimack Tractors and MowersDocument10 pagesMerrimack Tractors and MowersAtul Bhatia0% (1)

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- Sharing Sheet Hallstead JewelersDocument11 pagesSharing Sheet Hallstead JewelersHarpreet SinghNo ratings yet

- Tire City Case 1Document28 pagesTire City Case 1Srikanth VasantadaNo ratings yet

- Forner Carpet CompanyDocument7 pagesForner Carpet CompanySimranjeet KaurNo ratings yet

- Baria IliasDocument18 pagesBaria IliasRaquel OliveiraNo ratings yet

- Case ReichardDocument23 pagesCase ReichardDesiSelviaNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Software Associates Case AnalysisDocument8 pagesSoftware Associates Case AnalysisMuhammad AsifNo ratings yet

- Huron Automotive Company ExcelllDocument6 pagesHuron Automotive Company Excelllmaximus0903No ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Harley Davidson Case StudyDocument8 pagesHarley Davidson Case StudyfossacecaNo ratings yet

- Hallstead Jewelers Breakeven AnalysisDocument7 pagesHallstead Jewelers Breakeven Analysisanon_839867152No ratings yet

- PRESTIGE TELEPHONE COMPANY BREAK EVEN ANALYSISDocument10 pagesPRESTIGE TELEPHONE COMPANY BREAK EVEN ANALYSISSumit ChandraNo ratings yet

- Johnson BeverageDocument6 pagesJohnson BeverageShouib Mehreyar100% (1)

- Week 6 Case AnalysisDocument2 pagesWeek 6 Case AnalysisVarun Abbineni0% (1)

- Mile HighDocument8 pagesMile HighFaizan Ul HaqNo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ana Fernanda Gonzales CaveroNo ratings yet

- Prestige Telephone Company SlidesDocument13 pagesPrestige Telephone Company SlidesHarsh MaheshwariNo ratings yet

- Wilkerson Company Case Numerical Approach SolutionDocument3 pagesWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroNo ratings yet

- Sunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000Document9 pagesSunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000laale dijaanNo ratings yet

- Berkshire Toy CompanyDocument25 pagesBerkshire Toy CompanyrodriguezlavNo ratings yet

- Apple's Winning Marketing Strategy Case AnalysisDocument8 pagesApple's Winning Marketing Strategy Case AnalysisMaritess MunozNo ratings yet

- O.M Scoott and Sons Case Study HarvardDocument6 pagesO.M Scoott and Sons Case Study Harvardnicole rodríguezNo ratings yet

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Sunbeam FS EvaluationDocument5 pagesSunbeam FS EvaluationSaurav GhoshNo ratings yet

- Economic Impact of Oakland Athletics Ballpark at Howard TerminalDocument13 pagesEconomic Impact of Oakland Athletics Ballpark at Howard TerminalZennie AbrahamNo ratings yet

- JHT's SuperMud Four Year System Project Financial AnalysisDocument4 pagesJHT's SuperMud Four Year System Project Financial Analysisanup akasheNo ratings yet

- Target CorporationDocument20 pagesTarget CorporationAditiPatilNo ratings yet

- Bridgeton HWDocument3 pagesBridgeton HWravNo ratings yet

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDocument5 pagesBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedNo ratings yet

- Shouldice Hospitals CanadaDocument21 pagesShouldice Hospitals CanadaNeel KapoorNo ratings yet

- Prashanti Technologies: A Case Analysis On in Partial Fulfilment of Advanced Course in Labour Laws Submitted byDocument5 pagesPrashanti Technologies: A Case Analysis On in Partial Fulfilment of Advanced Course in Labour Laws Submitted byANUSHKA PGPHRM 2020 BatchNo ratings yet

- StrykerDocument10 pagesStrykerVeer SahaniNo ratings yet

- Seligram 2Document4 pagesSeligram 2Yvette YuanNo ratings yet

- Toyota Case StudyDocument19 pagesToyota Case StudyDat BoiNo ratings yet

- Salem Co.Document18 pagesSalem Co.abhay_prakash_ranjan75% (4)

- Toy World Case ExhibitsDocument24 pagesToy World Case ExhibitsFrancisco Aguilar PuyolNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99No ratings yet

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeDocument2 pagesAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanNo ratings yet

- Lockheed Tristar ProjectDocument1 pageLockheed Tristar ProjectDurgaprasad VelamalaNo ratings yet

- Cafe Monte BiancoDocument21 pagesCafe Monte BiancoWilliam Torrez OrozcoNo ratings yet

- Miles High Cycles Katherine Roland and John ConnorsDocument4 pagesMiles High Cycles Katherine Roland and John ConnorsvivekNo ratings yet

- Prestige Telephone CompanyDocument10 pagesPrestige Telephone CompanyDiwan BhoomikaNo ratings yet

- Vermont Ski Resort Hotel Case StudyDocument3 pagesVermont Ski Resort Hotel Case StudyNisa SasyaNo ratings yet

- SecA Group8 DelwarcaDocument7 pagesSecA Group8 DelwarcaKanishk RohilanNo ratings yet

- Pradeep MA3 SirDocument6 pagesPradeep MA3 SirPradeep Elavarasan0% (1)

- Toy WorldDocument4 pagesToy WorldDhirendra Kumar Sahu100% (1)

- Project Rosemont Hill Health CenterDocument9 pagesProject Rosemont Hill Health CenterSANDEEP AGRAWALNo ratings yet

- Johnson Beverage Inc PresentationDocument20 pagesJohnson Beverage Inc PresentationShouib MehreyarNo ratings yet

- Group 7 - Morrissey ForgingsDocument10 pagesGroup 7 - Morrissey ForgingsVishal AgarwalNo ratings yet

- Fuel SalesDocument11 pagesFuel SalesFabiola SE100% (1)

- MANAC II - Morrissey Forgings CaseDocument8 pagesMANAC II - Morrissey Forgings CaseKaran Oberoi100% (1)

- World Wide Paper CompanyDocument2 pagesWorld Wide Paper CompanyAshwinKumarNo ratings yet

- Merrimack Tractors and Mowers - BhaveshDocument3 pagesMerrimack Tractors and Mowers - BhaveshAnkita AgarwalNo ratings yet

- Lewis Corporation case study: Analysis of inventory valuation methodsDocument7 pagesLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahNo ratings yet

- HUL India EBIT Analysis 2004-2022, WACC 9.2%, Firm Value Rs. 270.8 CrDocument5 pagesHUL India EBIT Analysis 2004-2022, WACC 9.2%, Firm Value Rs. 270.8 CrMrudul DagliNo ratings yet

- Word ExcelDocument532 pagesWord ExcelGURUNo ratings yet

- Informal/Casual, Familiar/Intimate, or Ceremonial) For Each Text. Explain Your Reason For Your AnswerDocument2 pagesInformal/Casual, Familiar/Intimate, or Ceremonial) For Each Text. Explain Your Reason For Your AnswerWinston VillegasNo ratings yet

- Full Report ParamilitaryDocument32 pagesFull Report ParamilitaryRishi Raj MukherjeeNo ratings yet

- Chapter 11Document41 pagesChapter 11Muhammad AreebNo ratings yet

- Accounting Calling ListDocument4 pagesAccounting Calling Listsatendra singhNo ratings yet

- Similarity Measures For Categorical DataDocument12 pagesSimilarity Measures For Categorical DataNeti SuherawatiNo ratings yet

- The Gazette June/July 2013Document12 pagesThe Gazette June/July 2013St George's Healthcare NHS TrustNo ratings yet

- Anal IntercourseDocument16 pagesAnal Intercourseagustin cassinoNo ratings yet

- My Family HarzenDocument1 pageMy Family HarzenHazel Ommayah Tomawis-MangansakanNo ratings yet

- One Percenter Bikers Clubs Fall 05Document12 pagesOne Percenter Bikers Clubs Fall 05DamNativ1350% (2)

- Lab2 PDFDocument5 pagesLab2 PDFtrial errorNo ratings yet

- Deon Jones v. City and County of Denver, Et. Al.Document16 pagesDeon Jones v. City and County of Denver, Et. Al.Michael_Lee_RobertsNo ratings yet

- Vandana Buddhist Recitals by BMVDocument49 pagesVandana Buddhist Recitals by BMVahwah78100% (1)

- Register Transfer and MicrooperationsDocument11 pagesRegister Transfer and MicrooperationsAashish kumarNo ratings yet

- Roles of The Students and TeachersDocument15 pagesRoles of The Students and TeachersBey Bi NingNo ratings yet

- Tell A Child, Tell The World BUC Evangelism Manual PDFDocument205 pagesTell A Child, Tell The World BUC Evangelism Manual PDFShen Patalinghug100% (1)

- Ghair Muqallid Sadiq Sailkoti Ki Salat-Ur-Rasool Aik Jhooti Urdu BookDocument45 pagesGhair Muqallid Sadiq Sailkoti Ki Salat-Ur-Rasool Aik Jhooti Urdu BookMalik M Umar Awan www.learnalquran.tk 00923145144976100% (4)

- A Historical Overview of Traditional Chinese Medicine and Ancient Chinese Medical Ethics PDFDocument8 pagesA Historical Overview of Traditional Chinese Medicine and Ancient Chinese Medical Ethics PDFfredyNo ratings yet

- Tahiyyatul Masjid Our Weak PointDocument2 pagesTahiyyatul Masjid Our Weak PointtakwaniaNo ratings yet

- Inquiry Based Lesson PlanDocument8 pagesInquiry Based Lesson Planapi-295760565100% (2)

- Pooml Ghting: Contract Collection 2010Document218 pagesPooml Ghting: Contract Collection 2010Lori ChiriacNo ratings yet

- Accounting Short Question and AnswersDocument4 pagesAccounting Short Question and AnswersMalik Naseer AwanNo ratings yet

- CMSC 414 Computer and Network Security: Jonathan KatzDocument30 pagesCMSC 414 Computer and Network Security: Jonathan Katzd3toxedNo ratings yet

- Entrepreneur Aag 2017 enDocument149 pagesEntrepreneur Aag 2017 enHany FathyNo ratings yet

- Definition of Medical TreatmentDocument2 pagesDefinition of Medical Treatmentfikadu100% (1)

- 501 Geometry Questions Second EditionDocument305 pages501 Geometry Questions Second EditionContessa Petrini89% (9)

- Lord KrishnaDocument11 pagesLord KrishnaNaimish MehtaNo ratings yet

- Shri Jagannath in Yantra, Tantra and MantraDocument8 pagesShri Jagannath in Yantra, Tantra and Mantraprantik32No ratings yet

- Practicals Lab ManualDocument26 pagesPracticals Lab ManualanthorNo ratings yet

- Bca 503 PDFDocument3 pagesBca 503 PDFDARK ViSIoNNo ratings yet