Professional Documents

Culture Documents

The Central Excise Act

Uploaded by

Minu ScariaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Central Excise Act

Uploaded by

Minu ScariaCopyright:

Available Formats

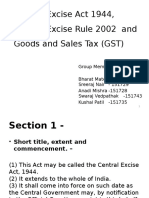

THE CENTRAL EXCISE ACT, 1944

[Act No. 1 of 1944]

[24th February, 1944] An Act to consolidate and amend the law relating to Central Duties of Excise

Whereas it is expedient to consolidate and amend the law relating to Central duties of excise on goods

manufactured or produced in certain parts of India. It is hereby enacted as follows:CHAPTER I

PRELIMINARY

SECTION 1. Short title, extent and commencement. - (1) This Act may be called the Central Excise Act, 1944. (2) It extends to the whole of India. (3) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint in this behalf. SECTION 2. context, (a) Definitions. In this Act, unless there is anything repugnant in the subject or

Adjudicating authority means any authority competent to pass any order or decision under this Act, but does not include the Central Board of Excise and Customs constituted under the Central Boards of Revenue Act, 1963 (54 of 1963), Commissioner of Central Excise (Appeals) or Appellate Tribunal;

(aa)

Appellate Tribunal means the Customs, Excise and Service Tribunal Tax constituted under section 129 of the Customs Act, 1962 (52 of 1962); broker or commission agent means a person who in the ordinary course of business makes contract for the sale or purchase of excisable goods for others; Central Excise Officer means the Chief Commissioner of Central Excise, Commissioner of Central Excise, Commissioner of Central Excise (Appeals), Additional Commissioner of Central Excise, Joint Commissioner of Central Excise, Assistant Commissioner of Central Excise or Deputy Commissioner of Central Excise or any other officer of the Central Excise Department, or any person (including an officer of the State Government) invested by the Central Board of Excise and Customs constituted under the Central Boards of Revenue Act, 1963 (54 of 1963) with any of the powers of a Central Excise Officer under this Act. curing includes wilting, drying, fermenting and any process for rendering an

(aaa)

(b)

(c)

unmanufactured product fit for marketing or manufacture; (d) excisable goods means goods specified in the First Schedule and the Second Schedule to the Central Excise Tariff Act, 1985 (5 of 1986) as being subject to a duty of excise and includes salt; Explanation - For the purposes of this clause, goods includes any article, material or substance which is capable of being bought and sold for a consideration and such goods shall be deemed to be marketable. (e) factory means any premises, including the precincts thereof, wherein or in any part of which excisable goods other than salt are manufactured, or wherein or in any part of which any manufacturing process connected with the production of these goods is being carried on or is ordinarily carried on; Fund means the Consumer Welfare Fund established under section 12C; manufacture includes any process, i) ii) iii) incidental or ancillary to the completion of a manufactured product; which is specified in relation to any goods in the Section or Chapter notes of the First Schedule to the Central Excise Tariff Act, 1985 (5 of 1986) as amounting to manufacture; or which, in relation to the goods specified in the Third Schedule, involves packing or repacking of such goods in a unit container or labelling or re-labelling of containers including the declaration or alteration of retail sale price on it or adoption of any other treatment on the goods to render the product marketable to the consumer,

(ee) (f)

and the word manufacturer shall be construed accordingly and shall include not only a person who employs hired labour in the production or manufacture of excisable goods, but also any person who engages in their production or manufacture on his own account; (ff) National Tax Tribunal means the National Tax Tribunal established under section 3 of the National Tax Tribunal Act, 2005; prescribed means prescribed by rules made under this Act; sale and purchase, with their grammatical variations and cognate expressions, mean any transfer of the possession of goods by one person to another in the ordinary course of trade or business for cash or deferred payment or other valuable consideration; Omitted Omitted Omitted

(g) (h)

(i) (j) (jj)

(k)

wholesale dealer means a person who buys or sells excisable goods wholesale for the purpose of trade or manufacture, and includes a broker or commission agent who, in addition to making contracts for the sale or purchase of excisable goods for others, stocks such goods belonging to others as an agent for the purpose of sale.

SECTION 2A. References of certain expressions. In this Act, save as otherwise expressly provided and unless the context otherwise requires, references to the expressions duty, duties, duty of excise and duties of excise shall be construed to include a reference to Central Value Added Tax (CENVAT).

Tax Planning

Tax Law

The tax laws are sets of acts and rules that govern the revenue collection system and its collection process in India. These Indian tax laws are basically directives for regulatory bodies that collect taxes from different sources. The main purpose of incorporating these tax laws in the financial administrative system of India is to provide a guideline for generating revenues for the functioning of the Government machineries. The main tax laws that guides the Indian economy are as follows -

Indian Customs Acts:

Customs Act, 1962 Customs Tariff Act, 1975 Provisional Collection of Taxes Act, 1931 Foreign Trade (Development and Regulation) Act, 1992 Foreign Trade (Regulation) Rules, 1993 Foreign Trade (Exemption from application of Rules in certain cases) Order, 1993 Central Excise Act, 1944 Central Excise Tariff Act, 1985 Taxation Laws (Amendment) Act, 2006

Indian Customs Rules:

Foreign Privileged Persons (Regulation of Customs Privileges) Rules, 1957 Customs (Attachments of Property of Defaulters for Recovery of Government Dues) Rules, 1995

Accessories (Condition) Rules, 1963 Re-Export of Imported Goods (Drawback of Customs Duties) Rules, 1995 Notice of Short-Export Rules,1963 Customs and Central Excise Duties Drawback Rules,1995 Specified Goods (Prevention of Illegal Export) Rules, 1969 Customs Tariff (Determination of Origin of Goods under the Agreement on SAARC Preferential Trading Arrangement) Rules,1995 Notified Goods (Prevention of Illegal Import) Rules, 1969 Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995 Denaturing of Spirit Rules, 1972 Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995 Customs (Publication of Names) Rules,1975 Customs( Import of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 1996 Customs Tariff (Determination of Origin of Goods under the Bangkok Agreement) Rules, 1976 Customs Tariff (Identification and Assessment of Safeguard Duty) Rules, 1997 Customs Tariff (Determination of Origin of the U.A.R. and Yugoslavia) Rules, 1976 Baggage Rules, 1998 Customs Tariff (Determination of Origin of Other Preferential Areas) Rules,1977 Customs (Settlement of Cases) Rules, 1999 Customs Valuation (Determination of Price of Imported Goods) Rules, 1988 Customs Tariff (Determination of Origin of Goods under the Free Trade Agreement Between the Democratic Socialistic Republic of Sri Lanka and the Republic of India) Rules, 2000 Rules of Determination of Origin of goods under the Agreement on South Asian Free Trade Area (SAFTA)

Indian Central Excise Acts:

Central Excise Act, 1944 Central Excise Tariff Act, 1985 National Calamity Contingent Duty (Section 136 of the Finance Act, 2001 (14 of 2001) Education Cess (Chapter VI of the Finance Bill, 2004) Additional Duties of Excise (Goods of special importance) Act, 1957 Additional Duties of Excise (Textiles and Textile Articles) Act, 1978 The Central Excise Laws (Amendment and Validation) ordinance, 2005

Indian Central Excise Rules:

Central Excise (Compounding of Offenses) Rules, 2005 The Central Excise Laws (amendment and validation) Ordinance, 2005, Dated 25/01/2005 Authority for Advance Rulings (Customs, Central Excise and Service Tax) Procedure Regulations, 2005 The Cenvat Credit Rules, 2004 The Central Excise Rules, 2002 (Section 143 of the Finance Act, 2002) The Cenvat Credit Rules, 2002 (Section 144 of the Finance Act, 2002) The Central Excise (Appeals) Rules, 2001 The Central Excise (Settlement of Cases) Rules, 2001 The Central Excise (Removal of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 2001 The Central Excise (No.2) Rules, 2001 (Superseded) The Cenvat Credit Rules, 2001 (Superseded) Central Excise Rules, 1944 (Rescinded) Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 Consumer Welfare Fund Rules, 1992 The Customs, Excise & Gold (Control) Appellate Tribunal (Procedure) Rules, 1982. The Central Excise (Advance Rulings) rules, 2002. Induction Furnace Annual Capacity Determination Rules, 1997 (Rescinded vide Notification No. 24/2000-CE (NT), dated 31.3.2000) Hot Re-rolling Steel Mills Annual Capacity determination Rules, 1997 (Rescinded vide Notification No. 24/2000-CE (NT), dated 31.3.2000) Hot Air Stenter Independent Textile Processors Annual Capacity Determination Rules, 2000 (Rescinded vide Notification No. 7/2001-CE, dt.1-3-2001)

Indian Income Tax Acts:

Finance Act, 2007- An Act to give effect to the financial proposals of the Central Government for the financial year 2007-2008

National Tax Tribunal (Amendment) Act, 2007 - An Act to amend the National Tax Tribunal Act, 2005

Taxation Laws (Amendment) Act, 2006 - An Act further to amend the Income-tax Act, 1961, the Customs Act, 1962, the Customs Tariff Act, 1975 and the Central Excise Act, 1944

Finance Act, 2006 - An Act to give effect to the financial proposals of the Central Government for the financial year 2006-2007

Taxation Laws (Amendment) Act, 2005 - An Act further to amend the Income-tax Act, 1961 and the Finance Act, 2005

National Tax Tribunal Act, 2005 - An Act to provide for the adjudication by the National Tax Tribunal of disputes with respect to levy, assessment, collection and enforcement of direct taxes and also to provide for the adjudication by that Tribunal of disputes with respect to the determination of the rates of duties of customs and central excise on goods and the valuation of goods for the purposes of assessment of such duties as well as in matters relating to levy of tax on service, in pursuance of article 323B of the Constitution and for matters connected therewith or incidental thereto

Finance Act, 2005 - An Act to give effect to the financial proposals of the Central Government for the financial year 2005-2006

Maharashtra Fiscal Responsibility and Budgetary Management Act, 2005- An Act to provide for the responsibility of the State Government to ensure inter-generational equity in fiscal management, fiscal stability

Finance (No. 2) Act, 2004 - The following Act of Parliament received the assent of the President on the 10th September, 2004, and is hereby published for general information:- An Act to give effect to the financial proposals of the Central Government for the financial year 2004-2005

Finance Act, 2004- An Act to continue for the financial year 2004-05 the existing rates of incometax and the levy of the National Calamity Contingent Duty and the National Calamity Contingent Duty of Customs on certain items

Indian Income Tax Rules:

Income-tax (Fourteenth Amendment) Rules, 2007- In exercise of the powers conferred by section 295 read with sub-section (2) of section 17 of the Income-tax Act, 1961 (43 of 1961) Income-tax (Thirteenth Amendment) Rules, 2007 Income-tax (Twelfth Amendment) Rules, 2007 Income-tax (Eleventh Amendment) Rules, 2007 Income-tax (Ninth Amendment) Rules, 2007 Income-tax Welfare Fund Rules, 2007 Wealth-tax (First Amendment) Rules, 2007 Post Office (Monthly Income Accounts) (Amendment) Rules, 2007 Directorate of Income-tax (Systems), Joint Director (Systems), Deputy Director (Systems) and Assistant Director (Systems) Recruitment (Amendment) Rules, 2007 Income-tax (Eighth Amendment) Rules, 2007

You might also like

- What Is Excise Duty1Document14 pagesWhat Is Excise Duty1dileepsuNo ratings yet

- Taxation Law: Central Excise Tariff Act, 1985Document8 pagesTaxation Law: Central Excise Tariff Act, 1985Amit GroverNo ratings yet

- Central Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)Document42 pagesCentral Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)kushal patilNo ratings yet

- Overview of Central ExciseDocument31 pagesOverview of Central ExciseMadhuree PerumallaNo ratings yet

- Export Import Trader Regulatory FrameworkDocument7 pagesExport Import Trader Regulatory FrameworkSammir MalhotraNo ratings yet

- Types of Custom DutiesDocument29 pagesTypes of Custom DutiesShikhar AgarwalNo ratings yet

- Notes On IDTDocument14 pagesNotes On IDTdeepaksatiNo ratings yet

- Import-Export Definitions and Customs DutiesDocument43 pagesImport-Export Definitions and Customs DutiesAnirudhaRudhraNo ratings yet

- Forign Trade ActDocument32 pagesForign Trade ActAnonymous OPix6Tyk5INo ratings yet

- Short Title, and Commencement. - (1) This Act May Be Called The Central Boards of RevenueDocument3 pagesShort Title, and Commencement. - (1) This Act May Be Called The Central Boards of RevenueSai BhargavNo ratings yet

- Custom ReadingsDocument43 pagesCustom ReadingsShantanu RaiNo ratings yet

- I Direct TaxDocument155 pagesI Direct TaxRajnish ShastriNo ratings yet

- Foreign Trade (Development and Regulation) Act, 1992Document24 pagesForeign Trade (Development and Regulation) Act, 1992Ravi SinghNo ratings yet

- 04 - Federal Excise Act, 2005 - The Constitution of Pakistan, 1973 Developed by Zain SheikhDocument35 pages04 - Federal Excise Act, 2005 - The Constitution of Pakistan, 1973 Developed by Zain SheikhMuhammad imranNo ratings yet

- Excise Duty Act, 2058 (2002: An Act Made To Amend and Codify The Laws Relating To Excise DutyDocument125 pagesExcise Duty Act, 2058 (2002: An Act Made To Amend and Codify The Laws Relating To Excise DutysauravNo ratings yet

- 20161025131053252FederalExciseAct2005updatedupto1 7 2016latest PDFDocument67 pages20161025131053252FederalExciseAct2005updatedupto1 7 2016latest PDFKashif Ali RazaNo ratings yet

- Historical Evolution of Tariff Classification SystemDocument23 pagesHistorical Evolution of Tariff Classification SystemYash SawantNo ratings yet

- Federal Excise Rules Updated Up To June 2006Document53 pagesFederal Excise Rules Updated Up To June 2006aazar_hNo ratings yet

- Central ExciseDocument2 pagesCentral ExciseNawab SahabNo ratings yet

- Central Excise Duty Rules for Levy in IndiaDocument9 pagesCentral Excise Duty Rules for Levy in IndiaAzhar KhanNo ratings yet

- 2 UnitDocument36 pages2 UnitIndu Prasoon GuptaNo ratings yet

- 201610251310532161FederalExciseAct2005updatedupto1 7 2016latestDocument67 pages201610251310532161FederalExciseAct2005updatedupto1 7 2016latesttylor32No ratings yet

- Excise Note 1Document2 pagesExcise Note 1Mayur UpasaniNo ratings yet

- The Gazette of India: Extraordinary Part Ii - Section IDocument53 pagesThe Gazette of India: Extraordinary Part Ii - Section I1976rkadvNo ratings yet

- 9-Legal & Tax ASP of Busn Sem - IDocument39 pages9-Legal & Tax ASP of Busn Sem - Iindrajeet_sahaniNo ratings yet

- The Central Boards of Revenue Act 1963Document3 pagesThe Central Boards of Revenue Act 1963Anil BeniwalNo ratings yet

- Introduction To Customs Duty: Brief Background of Customs LawDocument8 pagesIntroduction To Customs Duty: Brief Background of Customs LawABC 123No ratings yet

- Assam State Excise ListDocument93 pagesAssam State Excise ListJeet GogoiNo ratings yet

- Entry Tax Goods Act 2001Document17 pagesEntry Tax Goods Act 2001letmelearnthisNo ratings yet

- Karnataka Special Tax On Entry of Certain Goods Act, 2004 PDFDocument12 pagesKarnataka Special Tax On Entry of Certain Goods Act, 2004 PDFLatest Laws TeamNo ratings yet

- TAX LAW - Income From Other SourcesDocument21 pagesTAX LAW - Income From Other SourcesFahim KhanNo ratings yet

- Investment Related Laws of Myanmar - DICA PDFDocument770 pagesInvestment Related Laws of Myanmar - DICA PDFmarcmyomyint1663100% (1)

- Central Excise DutyDocument25 pagesCentral Excise DutyAbhinav SharmaNo ratings yet

- Central Excise Vizag08022021Document35 pagesCentral Excise Vizag08022021do or dieNo ratings yet

- Tamil Nadu Value Added Tax Act, 2006Document68 pagesTamil Nadu Value Added Tax Act, 2006sathya_41095No ratings yet

- CENVAT and Special Duty Rates on Excisable GoodsDocument2 pagesCENVAT and Special Duty Rates on Excisable GoodsKrishna Kumar VermaNo ratings yet

- The Imports and Exports - Control - Act 1950Document5 pagesThe Imports and Exports - Control - Act 1950Nazim Uddin RahiNo ratings yet

- INCOME TAX AND CUSTOMS DUTY LAWDocument8 pagesINCOME TAX AND CUSTOMS DUTY LAWadil_lodhiNo ratings yet

- Draft Preventive Manual Vol IDocument654 pagesDraft Preventive Manual Vol Ipooram001No ratings yet

- Chhattisgarh Commercial Tax Act1994Document80 pagesChhattisgarh Commercial Tax Act1994Latest Laws TeamNo ratings yet

- State Control Over Import and Export of GoodsDocument5 pagesState Control Over Import and Export of GoodsSumit DashNo ratings yet

- The Scheme of Advance RulingsDocument4 pagesThe Scheme of Advance RulingsSrishti DemblaNo ratings yet

- Orld Rade Rganization: G/ADP/N/1/JPN/2 G/SCM/N/1/JPN/2Document56 pagesOrld Rade Rganization: G/ADP/N/1/JPN/2 G/SCM/N/1/JPN/2Harsh GargNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument25 pagesFaculty of Law: Jamia Millia IslamiaShimran ZamanNo ratings yet

- Federal Excise Act, 2005 UpdatedDocument67 pagesFederal Excise Act, 2005 UpdatedFiza AmberNo ratings yet

- 2001sro450 - Customs RulesDocument217 pages2001sro450 - Customs RulesAazam Shahzad CasanovaNo ratings yet

- CENVAT Credit Rules GuideDocument21 pagesCENVAT Credit Rules GuideHimanshu SawNo ratings yet

- FEDeral Excise ACTPakistan Updated July 2014Document62 pagesFEDeral Excise ACTPakistan Updated July 2014aghashabeerNo ratings yet

- Customs and Excise (Common Market For Eastern and Southern Africa) (Suspension) Regulations, 2000Document2 pagesCustoms and Excise (Common Market For Eastern and Southern Africa) (Suspension) Regulations, 2000BewovicNo ratings yet

- Amendment CustomsDocument50 pagesAmendment Customsamithamp20No ratings yet

- Taxation Unit 5Document35 pagesTaxation Unit 5GITANJALI MISHRANo ratings yet

- The Central Excise Act, 1944Document10 pagesThe Central Excise Act, 1944sandeep1318100% (3)

- The Central Excise ACT, 1944: Group MembersDocument17 pagesThe Central Excise ACT, 1944: Group MembersSaddam HussainNo ratings yet

- Thai Customs Act TranslationDocument70 pagesThai Customs Act TranslationPakorn SangsuraneNo ratings yet

- Customs Modernization and Tariff Act (Cmta) : Bureau of Customs (Boc)Document23 pagesCustoms Modernization and Tariff Act (Cmta) : Bureau of Customs (Boc)Nombs NomNo ratings yet

- Project Report On Work Life Balance in Dual Career CoupleDocument16 pagesProject Report On Work Life Balance in Dual Career CoupleMinu Scaria75% (4)

- TopicsDocument2 pagesTopicsMinu ScariaNo ratings yet

- Group Dynamic1Document1 pageGroup Dynamic1Minu ScariaNo ratings yet

- Salient Features of New Industrial Policy 1991Document1 pageSalient Features of New Industrial Policy 1991Minu Scaria100% (1)

- Video gaming payments insights in Latin AmericaDocument12 pagesVideo gaming payments insights in Latin AmericacachocachudoNo ratings yet

- Real Options Real Options Real Options Real Options: J B Gupta ClassesDocument14 pagesReal Options Real Options Real Options Real Options: J B Gupta ClassesManjunatha PrasadNo ratings yet

- ECON 1012 - ProductionDocument62 pagesECON 1012 - ProductionTami GayleNo ratings yet

- Talavera Senior High School: Municipal Government of Talavera Talavera, Nueva EcijaDocument32 pagesTalavera Senior High School: Municipal Government of Talavera Talavera, Nueva Ecijaanthony tabudloNo ratings yet

- Chapter 1Document34 pagesChapter 1Aira Nhaira MecateNo ratings yet

- Company Law 2Document12 pagesCompany Law 2PRABHAT SINGHNo ratings yet

- BERLE Theory of Enterprise 1947Document17 pagesBERLE Theory of Enterprise 1947Sofia DavidNo ratings yet

- ACY4008 Financial Statement Analysis Class SyllabusDocument8 pagesACY4008 Financial Statement Analysis Class Syllabusjason leeNo ratings yet

- Macroeconomic Policy ChangesDocument12 pagesMacroeconomic Policy Changesjessica_1292No ratings yet

- Polytechnic University College Accountancy ExamDocument14 pagesPolytechnic University College Accountancy ExamEdison San Juan100% (1)

- Christopher Seifert's Portfolio ProjectDocument4 pagesChristopher Seifert's Portfolio ProjectChris SeifertNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Sales Case DigestDocument7 pagesSales Case Digestrian5852No ratings yet

- Heineken Case StudyDocument31 pagesHeineken Case StudyNitesh-sa100% (2)

- RR No. 26-2018Document3 pagesRR No. 26-2018Joseph Adrian LlamesNo ratings yet

- Older Adults and BankruptcyDocument28 pagesOlder Adults and BankruptcyvictorNo ratings yet

- Property Arts. 484 490Document7 pagesProperty Arts. 484 490Nhaz PasandalanNo ratings yet

- DGL Price/Time Projections: Resistance Support VDocument1 pageDGL Price/Time Projections: Resistance Support VRajender SalujaNo ratings yet

- Enron Scandal - Wikipedia, The Free EncyclopediaDocument31 pagesEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88No ratings yet

- Auditing HistoryDocument31 pagesAuditing HistoryRakibul islam100% (2)

- Balance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALDocument3 pagesBalance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALJessa Rodene FranciscoNo ratings yet

- Letters of Credit-1Document42 pagesLetters of Credit-1Glace OngcoyNo ratings yet

- MD and Ceo of BanksDocument8 pagesMD and Ceo of Banksnarra gowthamNo ratings yet

- Amicorp Trustees Presentation 2013Document26 pagesAmicorp Trustees Presentation 2013Rohan GhallaNo ratings yet

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- Focus4 2E Unit Test Vocabulary Grammar UoE Unit4 GroupA B ANSWERSDocument1 pageFocus4 2E Unit Test Vocabulary Grammar UoE Unit4 GroupA B ANSWERSHalil B67% (3)

- Caf 1 Ia ST PDFDocument270 pagesCaf 1 Ia ST PDFFizzazubair rana50% (2)

- Acc Xi See QP With BP, MS-31-43Document13 pagesAcc Xi See QP With BP, MS-31-43Sanjay PanickerNo ratings yet

- Barangay ClearanceDocument2 pagesBarangay Clearancegingen100% (1)

- PD 1517Document8 pagesPD 1517Enp Gus AgostoNo ratings yet