Professional Documents

Culture Documents

Investment Memo - WoW Seabass Sept2004

Uploaded by

Nguyen Hong VIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Memo - WoW Seabass Sept2004

Uploaded by

Nguyen Hong VICopyright:

Available Formats

WAIFS OF WAR FOUNDATION

INVESTMENT MEMORANDUM SEABASS AQUACULTURE FARMING IN THE MEKONG DELTA

PRIVATE & CONFIDENTIAL This Memorandum is strictly Private & Confidential and for use only to those investors who agree to share some of the profits generated with the Waifs of War Foundation. Investment concept This is a unitized investment program enabling both individual private investors and larger corporate or institutional investors to subscribe for units of commercial interest in the growing of sea bass fingerlings to a commercial size that can be readily sold in the domestic wholesale and international export markets. High yields and minimum returns The program offers attractively high yields on investment that is realized at two six month intervals per year when the seabass are harvested for commercial sale. The program has an exceptionally low risk factor, however, the program does bear certain risks of which all investors should be aware. This program undertakes to provide both a minimum return and commercial insurance protection to protect the investment in the event that certain risks materialize that are beyond the ability of management to control. Further details of these risks are set out in the following information together with Managements proposals to minimize and mitigate such risks. Units of investment: Each unit of investment is set at $60,000. The Investor may subscribe for any number of units to suit their particular interests. The Investor should consider the benefits of co-investment in groups or larger numbers of units to lower Management costs, which will improve their returns on invested monies.

The investment: Each unit sum subscribed will provide the investor with the following:

Use of a two (2) cage raft of suitable dimension and equipped to enable the successful growing of sea bass to a commercial size that can be sold in the domestic market or processed for sale in the international seafood markets. The supply of 20,000 fingerlings per cage. Feed and health products to enable the successful grow out of the fingerlings. Management, supervision and raft maintenance. Insurance protection against commercial risks. The application of leading technology in aquaculture farming.

High returns: The Investor can expect to receive a profit distribution within one month of each harvest cycle equal to at least 12.5% of the initial investment at six monthly intervals thus offering a 25% return on each invested unit per year. Profit distributions could be greater depending on market prices at each harvest for domestic or export sale and in the Managers ability to grow out the fingerlings with minimal mortality. A provision of 30% mortality is budgeted for, above which investors will receive either insurance protection for excess loss or a replacement of fingerlings lost above the 30% norm set. The Manager: Operational management of the program will be undertaken under a management contract by LiG Products Ltd (LiG). LiG is owned and operated by an American Aquaculture Specialist known for his success in this industry, who presently holds the following appointments or has undertaken the following activities in the industry:

Chairman of the "Deep-sea Fishing Committee" of the ASIAN Fishing Federation. (AFF) Senior Advisor to the "Vietnam Aquaculture Alliance of Vietnam" (VAA) Senior Advisor to the "Vietnam Fisheries Society" (VinaFis) Co-Chairman of the "Vietnam-American Union for Promotion of Fisheries Development" Appointed by the Danish Consul to conduct the Fisheries Sector Presentation during the Danish Days Seminar for two years. Vice Chairman of the Agriculture / Fisheries Committee of Amcham. Organizer of the 1st Seafood Seminar of Amcham in Vietnam.

Financial management of the investment project will be the responsibility of an industry recognized Chartered Accountant or Certified Public Accountant. Management remuneration: Management will be compensated primarily through the successful sale of harvested products at each harvest cycle. It will also be remunerated by an incentivized system whereby it will share in any profit distributions to investors that exceed the minimum return of 25% per annum by sharing in any excess above 25% at 20% of the excess above 25% based on an initial investment of about $60,000 per 2 cage raft set. Management charges will be as follows: The Management Fee is inclusive of all labor, supervision, insurance, raft maintenance, technology application and general overheads. Source of fingerlings: The primary raw material is the supply of sea bass fingerlings for growing purposes. These will be supplied by an associated nursery in which LiG has a commercial interest. Suitably fertilized eggs will be secured from a school of breeding seabass that have been developed over the past nine years by LiG and presently comprise 27 mature seabass breeders of which 20 are female and capable of producing between 45M to 65M fry per year. Fingerlings will be supplied at normal arms length prices obtainable in the open market. An alternative competitive supply source has been arranged should a situation arise whereby the nursery is unable to supply fingerlings when required for grow out purposes. Investor protection: The fry will be developed at the LiG nursery and when attaining the suitable size of approximating 4 cm to 6 cm, will be sold to the project for growing to commercial size. Furthermore, there will be an undertaking from the nursery that should the level of mortality at the growing stage exceed 30%, then the excess loss will be either covered by commercial insurance or replaced by the supply of additional fingerlings for growing out again. In this way, the Investor will be afforded some comfort and protection that its investment will yield the anticipated returns indicated in this Memorandum. Markets It is expected that most of the products will be sold internationally. LiG will undertake the management of the fish cage farm under a contractual arrangement and will also be empowered to make sales in the local market in Vietnamese Dong and to export market which will optimize the returns to investor.

PRO FORMA FINANCIAL RESULTS SEABASS FARMING

No. of 2 x cage rafts 1 Notes: 10 50 100

( Expressed in US$) INVESTMENT 60,000 600,000 3,000,000 6,000,000 ANNUALIZED RESULTS BASED ON TWO HARVEST CYCLES PER YEAR 114,000 1,140,000 5,700,000 11,400,000 1.

Sales

Cost of sales and expenses: Fingerlings Feed Processing costs Mgt & Opns Fees TOTAL COSTS NET PROFIT Annual return on Investment Minimum return Excess return Investor share of excess Management incentive share Total return to Investor 20,000 28,000 22,000 28,500 98,500 15,500 200,000 280,000 220,000 228,000 928,000 212,000 1,000,000 1,400,000 1,100,000 997,500 4,497,500 1,202,500 2,000,000 2,800,000 2,200,000 1,425,000 8,425,000 2,975,000 2. 3. 4. 5.

25.83% 25.00% 0.83% 0.42%

35.33% 25.00% 10.33% 5.68%

40.08% 25.00% 15.08% 9.80%

49.58% 25.00% 24.58% 17.20%

0.41% 25.42%

4.65% 30.68% 34.80%

5.28% 42.20%

7.38%

Notes to Pro Forma Financial Results: 1. Based on export sales at approx. $5.50 per Kg. in filleted form after processing and allowing for 20% mortality during growing and 50% weight remaining after processing. Sale of waste material is included in sales. 2. Cost of 40,000 fingerlings at $0.25 per fingerling per raft per six month growing period. 3. Feed costs per 40,000 fingerlings at 2 Kg per fingerling per growing period.

4. Processing costs include labor, freezing, packing, inspection, delivery, stow and processing management at $1.00 per Kg. 5. Management charges are based on a % of sales and include labor, security, insurance, technology application, management, supervision, general overheads of this aquaculture project and raft maintenance at a rate noted herein. NB: Some of the harvested seabass may also be sold in fresh form in the domestic wholesale market at prices averaging $2 per kilo, but will not require processing. This will eliminate the 50% waste in weight that derives from processing into frozen fillets for the export markets and some $0.60 per Kg of the processing charges. Most of the production however, is expected to be exported.

Seabass species: The species of seabass that will be farmed (Lates Calcarifer) is one of two known species in the world. The other, known as Chilean Black Seabass, is found in South America. The particular species selected has a known worldwide market appeal and is commonly found on Chinese restaurant menus and in the US and European market place. Historically, the species has been sea caught almost to extinction but the opportunity now arises through proven aquaculture techniques to farm seabass successfully and to thereby provide a sustainable source of supply to satisfy world market demand. Seabass offers the consumer an alternative flavor in seafood to tuna and salmon that are presently the best-known and most popular fish dishes. Seabass can be served in many ways and to cater for ethnic tastes. Customers: Owing to its broad market appeal, seabass is in high demand in restaurants, supermarket chains and in the wholesale and fresh retail markets. The company has a growing list of customer prospects to supply as soon as volume production starts up. Processing: The management has arranged for the processing of the harvested seabass with leading seafood factories that are suitably equipped and accredited under HACCP standards that will meet the demands of major exports markets for quality control and other export compliant issues. Risks associated with seabass farming: The following are the most likely risks associated with seabass farming. Storm, fire, tempest and flooding. Water contamination from oil and chemical spills etc. Theft Vandalism Disease outbreak Above normal mortality rate of the seabass fingerlings. Major variations in selling prices and processing costs.

All of these risks will be insured by a leading insurer against possible loss. Excessive mortality will be catered for by both commercial risk insurance and the restocking of lost fingerlings by the supplier nursery if mortality levels exceed 30%. Selling prices and

costs of processing and operations will be tightly controlled by management as part of its intimate knowledge of the markets and the industry. Management will be primarily recompensed on a success basis together with the investors at each harvest period.

Other terms and conditions of investment 1. Monthly reports will be sent to the Investor & all investors providing a series of progress reports during the growing period leading up to harvest. This will include size and weight measurements, mortality rates, feed consumption and topical industry data. At each harvest, the Investor can expect to receive a full financial and operating report on his cage production, weight harvested, selling prices, operating costs and a general financial accounting of his profits from the harvest. A Investor representative will be allowed to visit and inspect Investors cages at any time with 48 hours notice to the Manager for transportation & reception to be arranged. The Investor may elect at each harvest to continue its investment or may withdraw after any harvest according to their own plan.

2.

3. 4.

Company details Waifs of War Foundation is registered in Australia and Vietnam. Managers Office: LiG Products Ltd; 6th Floor; 24 Le Loi Street; District 1; Ho Chi Minh City; Vietnam. Tel: (84) 90 380 4321, (848) 829 5869; Fax: (848) 825 1421; Email: LiG1@fmail.vnn.vn HSBC: The Metropolitan: 235 Dong Khoi Street: District 1: Ho Chi Minh City: Vietnam and HSBC: Head Office Central; Hong Kong Ernst & Young: Saigon Riverside Office Center: 8/F 4A Ton Duc Thang: District 1: Ho Chi Minh City: Vietnam Pacific Law LLC: Me Linh Point: Suite 1403A: 2 Ngo Duc Ke: District 1: Ho Chi Minh City: Vietnam Vietnam International Assurance: 5B Ton Duc Thang Blvd: District 1: Ho Chi Minh City: Vietnam

Bankers:

Auditors: Lawyers: Insurers:

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Guide To Vietnam's Supply Chains: From Dezan Shira & AssociatesDocument12 pagesA Guide To Vietnam's Supply Chains: From Dezan Shira & AssociatesVân ĂnggNo ratings yet

- Coastal Marine Biodiversity of VietnamDocument89 pagesCoastal Marine Biodiversity of Vietnamhoang ngoc KhacNo ratings yet

- Writing Task 1Document5 pagesWriting Task 1Ngọc NấmNo ratings yet

- SSI Vietnam - Market - Outlook - 2020 - The - Elusive - Cheese - Hunt - 20200124Document147 pagesSSI Vietnam - Market - Outlook - 2020 - The - Elusive - Cheese - Hunt - 20200124Hoang Nguyen MinhNo ratings yet

- Vietnam Furniture IndustryDocument4 pagesVietnam Furniture IndustryAlexNguyenNo ratings yet

- Báco Cáo MCDocument42 pagesBáco Cáo MCThị Bình NguyễnNo ratings yet

- Hanoi's Rich History and Transformation to a Modern Asian CityDocument13 pagesHanoi's Rich History and Transformation to a Modern Asian CityLiubov ZaichenkoNo ratings yet

- Đề MINH HỌA Số 02 Luyện Thi Tốt Nghiệp THPT 2023Document8 pagesĐề MINH HỌA Số 02 Luyện Thi Tốt Nghiệp THPT 2023Nguyen Thi Thuy Hanh (FE FPL HN)No ratings yet

- Wpqr-Fcaw 11Document2 pagesWpqr-Fcaw 11Nguyễn Hoàng DũngNo ratings yet

- Thayer President Biden To Visit Vietnam - Scene Setter - 5Document3 pagesThayer President Biden To Visit Vietnam - Scene Setter - 5Carlyle Alan ThayerNo ratings yet

- Duy Tan University Grade Report for Semester 1 2019-2020Document6 pagesDuy Tan University Grade Report for Semester 1 2019-2020Lê Phan Ngọc HàNo ratings yet

- HaiPhongVIP Blog and Facebook PageDocument229 pagesHaiPhongVIP Blog and Facebook PagePhương CúcNo ratings yet

- STT Tên Khách Hàng Số Điện ThoạiDocument10 pagesSTT Tên Khách Hàng Số Điện ThoạiTùng MậpNo ratings yet

- Formulating Human Settlements - Informalization of Formal Housing (KTT Vietnam)Document4 pagesFormulating Human Settlements - Informalization of Formal Housing (KTT Vietnam)Rashela DycaNo ratings yet

- LCASEAN - CASE STUDY 1Document11 pagesLCASEAN - CASE STUDY 1bnnrghq9hxNo ratings yet

- BUSM4566 Tourism Planning and Resource ManagementDocument6 pagesBUSM4566 Tourism Planning and Resource ManagementHuỳnh Ngọc TuyềnNo ratings yet

- BÀI TẬP PHRASAL VERBSDocument6 pagesBÀI TẬP PHRASAL VERBSMs ArmyNo ratings yet

- Oxy Marketing PlanDocument8 pagesOxy Marketing PlanFlora NguyễnNo ratings yet

- Thayer Vietnam: Military Intelligence in Domestic AffairsDocument3 pagesThayer Vietnam: Military Intelligence in Domestic AffairsCarlyle Alan ThayerNo ratings yet

- De Thi Mon Dieu Khien Qua Trinh PCTR421929Document2 pagesDe Thi Mon Dieu Khien Qua Trinh PCTR421929Phi Cao TanNo ratings yet

- Session 4 - 6Document19 pagesSession 4 - 6Mai Anh LêNo ratings yet

- PwC Vietnam IT Auditor JobDocument2 pagesPwC Vietnam IT Auditor JobHoàng MinhNo ratings yet

- Data Korean Company 2Document6 pagesData Korean Company 2Jack JackNo ratings yet

- Group 7 - Final Product (Version 10102020)Document105 pagesGroup 7 - Final Product (Version 10102020)Nguyen Hoang Duyen KhanhNo ratings yet

- Tu Vung - 1 - 11 - PloaiDocument29 pagesTu Vung - 1 - 11 - Ploaiduc anhNo ratings yet

- Genocide by Proxy: Cambodian Pawn On A Superpower ChessboardDocument408 pagesGenocide by Proxy: Cambodian Pawn On A Superpower ChessboardAlessandro do Carmo SilvaNo ratings yet

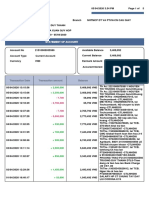

- Statement of Account: Transaction Amount Balance Transaction Details Transaction DateDocument5 pagesStatement of Account: Transaction Amount Balance Transaction Details Transaction DatehyhNo ratings yet

- Btec HND in Business (Finance) : Assignment Cover SheetDocument27 pagesBtec HND in Business (Finance) : Assignment Cover SheetViệt PhongNo ratings yet

- (Class) - (Team) Transcript-1Document2 pages(Class) - (Team) Transcript-1Quốc HuyNo ratings yet

- Ngày 37Document7 pagesNgày 37Dang LinhNo ratings yet