Professional Documents

Culture Documents

Final PNB Bank

Uploaded by

Mitesh SonegaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final PNB Bank

Uploaded by

Mitesh SonegaraCopyright:

Available Formats

A

Summer internship Project report on CREDIT RISK MANAGEMENT AT PUNJAB NATIONAL BANK Submitted to the

Gahlot Institute Of Management Studies And Research

University of Mumbai

In partial fulfilment of the Requirement for the degree of

Master of Management Studies By SHAIKH AHMED MOHD Batch ( 2011-12)

Date : 28/07/2011 Dear sir,

This is to certify that Mr. Shaikh Ahmed Mohammed has completed his training For 2 Months at our office and worked for his project on credit risk management from 02nd May 2011 to 30th June 2011. We wish him all the best for his future.

Authorised signatory

PNB Bank Ltd.

DECLARATION

I hereby declare that project titled Credit risk Management at Punjab national bank is an original piece of research work carried out by me under the guidance and supervision of Mr.Suhas Khamkar The information has been collected from genuine & authentic sources. The work has been submitted in partial fulfillment of the requirement of MMS to our college.

Place: Date:

Signature: Name of the students:

PUNJAB NATIONAL BANK

ACKNOWLEDGEMENT

Perseverance inspiration and motivation have always played a key role in success of any venture. I hereby express my deep sense of gratitude to all the personalities involved directly and indirectly in my project work. I would thank to God for their blessing and my parents also for their valuable suggestion and support in my project report. I would also like to thank our friends and those who have helped us during this project directly or indirectly. Last but not the least; I would like to express my sincere gratitude to all the faculty members who have taught me in my entire MBA curriculum and our Director B.N.LAHIRI who has always been a source of guidance, inspiration and motivation. However, I accept the sole responsibility for any possible errors of omission and would be extremely grateful to the readers of this project report if they bring such mistakes to my notice.

SHAIKH AHMED MOHD

PUNJAB NATIONAL BANK

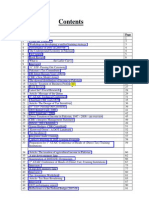

TABLE OF CONTENTS

Sr.No. 1. 2.

3.

Particulars Board of directors.. Executive Summary... Company Profile........ Objective of the study Data collection Method.. a. Primary data b. Secondary data

Page no. 5 8 16 23 24

4. 5.

6. 7. 8. 9. 10. 11. 12. 13. 14. 15.

Industrial Profile. Corporate Mission... PNB Bank founding principles... Awards. Punjab National Bank Services Deposit Schemes... Loans. Credit Risk Management in Banks... Credit Risk Management at PNB. Low & High Credit Risk Ratings.

26 28 29 30 34 39 41 47 52 58

a. Introduction

PUNJAB NATIONAL BANK

16. 17. 18. 19. 20.

Risk Managements Analysis of Financial Statements.. Findings. Recommendations. Bibliography..

61 64 67 68 69

PUNJAB NATIONAL BANK

Board of Directors

PUNJAB NATIONAL BANK

Shri. K.R.Kamath Chairman & Managing Director and Dy. Chairman of Indian Banks Association

Shri. Rakesh Sethi Executive Director

Smt. Usha Ananthasubramanian Executive Director

Directors

Smt. Ravneet Kaur Govt. of India Nominee Director

Shri. Jasbir Singh Reserve Bank of India Nominee Director

Shri. Vinod Kumar Mishra Part-time non-official Director

Shri. Tribhuwan Nath Chaturvedi Share Holder Director

PUNJAB NATIONAL BANK

Executive Summary Topic: Credit risk Management at Punjab national bank About the Punjab national bank:

Origin Punjab under the British especially after annexation in 1849 witnessed a period of rapid development giving rise to a new educated class fired with a desire for freedom from the yoke of slavery. Amongst the cherished desires of this new class was also an overriding ambition to start a Swadeshi Bank with Indian Capital and management representing all sections of the Indian community. The idea was first mooted by Rai Mool Raj of Arya Samaj who, as reported by Lal Lajpat Rai, had long cherished the idea that Indians should have a national bank of their own. He felt keenly "the fact that the Indian capital was being used to run English banks and companies, the profits accruing from which went entirely to the Britishers whilst Indians had to contend themselves with a small interest on their own capital". At the instance of Rai Mool Raj, Lala Lajpat Rai sent round a circular to selected friends insisting on an Indian Joint Stock Bank as the first special step in constructive Swadeshi. Lala Harkrishan Lal who had returned from England with ideas regarding commerce and industry, was eager to give them practical shape. On May 23, 1894, the efforts materialized. The founding board was drawn from different parts of India professing different

9

PUNJAB NATIONAL BANK

faiths and a varied back-ground with, however, the common objective of providing country with a truly national bank which would further the economic interest of the country.

The Bank opened for business on 12 April, 1895. The first Board of 7 Directors comprised of Sardar Dayal Singh Majithia, who was also the founder of Dayal Singh College and the Tribune; Lala Lalchand one of the founders of DAV College and President of its Management Society; Kali Prosanna Roy, eminent Bengali pleader who was also the Chairman of the Reception committee of the Indian National Congress at its Lahore session in 1900; Lala Harkishan Lal who became widely known as the first industrialist of Punjab; EC Jessawala, a well known Parsi merchant and partner of Jamshedji & Co. of Lahore; Lala Prabhu Dayal, a leading Rais, merchant and philanthropist of Multan; Bakshi Jaishi Ram, an eminent Civil Lawyer of Lahore; and Lala Dholan Dass, a great banker, merchant and Rais of Amritsar. Thus a Bengali, Parsi, a Sikh and a few Hindus joined hands in a purely national and cosmopolitan spirit to found this Bank which opened its doors to the public on 12th of April 1895. They went about it with a Missionary Zeal. Sh. Dayal Singh Majithia was the first Chairman, Lala Harkishan Lal, the first secretary to the Board and Shri Bulaki Ram Shastri Barrister at Lahore, was appointed Manager. A Maiden Dividend of 4% was declared after only 7 months of operation. Lala Lajpat Rai was the first to open an account with the bank which was housed in the building opposite the Arya Samaj Mandir in Anarkali in Lahore. His younger brother joined the Bank as a Manager. Authorised total capital of the Bank was Rs. 2 lakhs, the working capital was Rs. 20000. It had total staff strength of nine and the total monthly salary amounted to Rs. 320.

10

PUNJAB NATIONAL BANK

The first branch outside Lahore was opened in Rawalpindi in 1900. The Bank made slow, but steady progress in the first decade of its existence. Lala Lajpat Rai joined the Board of Directors soon after. in 1913, the banking industry in India was hit by a severe crisis following the failure of the Peoples Bank of India founded by Lala Harkishan Lal. As many as 78 banks failed during this crisis. Punjab National Bank survived. Mr. JH Maynard, the then Financial Commissioner, Punjab, remarked...."Your Bank survived...no doubt due to good management". It spoke volumes for the measure of confidence reposed by the public in the Bank's management. The years 1926 to 1936 were turbulent and loss ridden ones for the banking industry the world over. The 1929 Wall Street crash plunged the world into a severe economic crisis. It was during this period that the Jalianwala Bagh Committee account was opened in the Bank, which in the decade that followed, was operated by Mahatma Gandhi and Pandit Jawaharlal Nehru. The five years from 1941 to 1946 were ones of unprecedented growth. From a modest base of 71, the number of branches increased to 278. Deposits grew from Rs. 10 crores to Rs. 62 crores. On March 31, 1947, the Bank officials decided to leave Lahore and transfer the registered office of the Bank to Delhi and permission for transfer was obtained from the Lahore High Court on June 20, 1947. PNB was then housed in the precincts of Sreeniwas in the salubrious Civil Lines, Delhi. Many a staff member fell victim to the widespread riots in the discharge of their duties. The conditions deteriorated further. The Bank was forced to close 92 offices in West Pakistan constituting 33 percent of the total number and having 40% of the total deposits. The Bank, however, continued to maintain a few caretaker branches.

11

PUNJAB NATIONAL BANK

The Bank then embarked on its task of rehabilitating the displaced account holders. The migrants from Pakistan were repaid their deposits based upon whatever evidence they could produce. Such gestures cemented their trusts in the bank and PNB became a symbol of Trust and a name you can bank upon. Surplus staff posed a big problem. Fast expansion became a priority. The policy paid rich dividends by opening up an era of phenomenal growth. In 1951, the Bank took over the assets and liabilities of Bharat Bank Ltd. and became the second largest bank in the private sector. In 1962, it amalgamated the Indo-Commercial Bank with it. From its dwindled deposits of Rs. 43 crores in 1949 it rose to cross the Rs. 355 crores mark by the July 1969. Its number of offices had increased to 569 and advances from Rs. 19 crores in 1949 to Rs. 243 crores by July 1969 when it was nationalised. Since inception in 1895, PNB has always been a "People's bank" serving millions of people throughout the country and also had the proud distinction of serving great national leaders like Sarvshri Jawahar Lal Nehru, Gobind Ballabh Pant, Lal Bahadur Shastri, Rafi Ahmed Kidwai, Smt. Indira Gandhi etc. amongst other who banked with us.

12

PUNJAB NATIONAL BANK

Punjab Keshari Lala Lajpat Rai (Saluting the spirit of our founding father)

(1865-1928)

The Life and Times of Lala Lajpat Rai There are few leaders of the pre-independence era who, after having plunged themselves into the political struggle, continued to take an active interest in social, cultural and educational work. Lala Lajpat Rai was one of such leaders. Born on 28th January, 1865 at a small village, Dhudike in the Ferozepur district of Punjab, he belonged to the Agarwal Baniya caste and it was perhaps because of this, in addition to taking part in social and political life of the country, he took keen interest in industrial and financial matter also. His father was a teacher of Persian and Urdu in a government school. Having passed the final examination in Law from Punjab University, he started his practice in1883, when he was barely 18 years old. Endowed with a rich legacy of moral and intellectual background, Lala Lajpat Rai had benefit of education in the practical rationalism of western science combined with the religious purity and moral elevation of Eastern literature that put on him the hallmark of true culture. While sympathizing with and aiding every movement made for progress, Lala Lajpat Rai identified himself very closely with

13

PUNJAB NATIONAL BANK

Arya Samaj, in which he found ample scope for the exercise of his patriotism, philanthropy and religious zeal.

Having qualified as a pleader, Lala Lajpat Rai started practice at Hissar and soon became a leading lawyer of the district. He organized the Arya Samaj there and put it on proper lines. In 1892, he transferred his practice to the wider field at Lahore.Education, both secular and religious, was in Lala Lajpat Rais view an important factor in national development. He took part in the foundation of the D.A.V. College at Lahore. Lalaji and Politics Lala Lajpat Rai always felt drawn towards politics. It was in 1888 that he joined the Indian National Congress when it met at Allahabad under the presidency of Mr. G. Yule. In 1905, the Indian National Congress Committee having recognized in him an austere, sincere and selfless devoted worker selected him as one of its delegates to place before the British, the political grievances of the Indian people. He met the expenses of his trip from his own pocket. He along with Gokhale carried on the political campaign in various parts of England and brought home to the mind of the British, the evils of an unsympathetic and bureaucratic government under which India was labouring and pleaded in eloquent language, adding facts and figures in supporting their contention, cause of the half starving and half dying people of India. Lala Lajpat Rai created an impression on the English Populace. After his return from England, he was busy devising and organizing ways and means for political advancement and industrial emancipation of the country. The movement of Swadeshi was in the offing and he put his heart and soul into it. He preached the message of Swadeshi to the people of Punjab and made it very popular. This naturally enraged the bureaucracy and he came to be regarded as a revolutionary by the Britishers and the AngloIndian press. He was openly dubbed as a Revolutionary and an instigator of the armed forces.

14

PUNJAB NATIONAL BANK

The Jalianwala Bagh tragedy and the Government's denial to censure the conduct of its officers made him a complete non cooperator. He lost his faith in the British and threw himself whole heartedly into the non-cooperation movement.In 1925, he joined the Swaraj Party and became its deputy leader. He took active part in the deliberations of the debates of the Assembly. It was he, who moved the resolution for the Boycott of the Simon Commission in the Assembly. It was while leading the boycott procession at Lahore on the 30th October, 1928 that he received lathi blows on his chest which ultimately brought about his death on the 17th November, 1928. Lala Lajpat Rai and PNB Lalaji was keenly concerned with the fact that though Indian capital was being used to run English Banks and companies, the profits went entirely to the British, while Indians had to contend themselves with a small interest on their capital. He echoed this sentiment in one of his writing while concurring with Rai Mul Raj of Arya Samaj who had long cherished the idea that Indians should have a National Bank of their own. At the instance of Rai Mul Raj, Lala Lajpat Rai sent a circular to selected friends insisting on an Indian joint stock Bank as the first step in constructive Swadeshi and the response was satisfactory After filing and registering the memorandum and Articles of Association on 19 May, 1894, the bank was incorporated under Act VI of the 1882 Indian Companies Act. The prospectus of the bank was published in the Tribune, and the Urdu Akhbar-e-Am and Paisa Akhbar. On 23rd May, 1894, the founders met at the Lahore residence of Sh. Dyal Singh Majithia, the first Chairman of PNB, and resolved to go ahead with the scheme.

15

PUNJAB NATIONAL BANK

They decided to hire a house in the famous Anarkali Bazar of Lahore opposite the post office and near well known stores of Rama Brothers.On 12th April 1895, the Bank opened for business, a day before the great Punjab festival of Baishakhi. The essence of the Banks culture was clear at this first meeting itself.

The fourteen original shareholders and seven directors took only a modest number of shares; the control of the Bank was to lie with the large, dispersed shareholders, a purely professional approach that was as uncommon then as it is today.

16

PUNJAB NATIONAL BANK

Company Profile

With over 60 million satisfied customers and more than 5100 offices including 5 overseas branches, PNB has continued to retain its leadership position amongst the nationalized banks. The bank enjoys strong fundamentals, large franchise value and good brand image. Besides being ranked as one of India's top service brands, PNB has remained fully committed to its guiding principles of sound and prudent banking. Apart from offering banking products, the bank has also entered the credit card, debit card; bullion business; life and non-life insurance; Gold coins & asset management business, etc. PNB has earned many awards and accolades during the year in appreciation of excellence in services, Corporate Social Responsibility (CSR) practices, transparent governance structure, best use of technology and good human resource management. Since its humble beginning in 1895 with the distinction of being the first Swadeshi Bank to have been started with Indian capital, PNB has achieved significant growth in business which at the end of March 2011 amounted to Rs 5,55,005 crore. PNB is ranked as the 2nd largest bank in the country after SBI in terms of branch network, business and many other parameters. During the FY 2010-11, with 39.16% share of CASA to domestic

17

PUNJAB NATIONAL BANK

deposits, the Bank achieved a net profit of Rs 4433 crore. Bank has a strong capital base with capital adequacy ratio of 12.42% as on Mar11 as per Basel II with Tier I and Tier II capital ratio at 8.44% and 3.98% respectively. As on March11, the Bank has the Gross and Net NPA ratio of 1.79% and 0.85% respectively. During the FY 2010-11, its ratio of Priority Sector Credit to Adjusted Net Bank Credit at 40.67% & Agriculture Credit to Adjusted Net Bank Credit at 19.30% was also higher than the stipulated requirement of 40% & 18% respectively. The Bank has been able to maintain its stakeholders interest by posting an improved NIM of 3.96% in Mar11 (3.57% Mar10). The Earning per Share improved to Rs 140.60 (Rs 123.86 Mar10) while the Book value per share improved to Rs 661.20 (Rs 514.77 Mar10). Punjab National Bank continues to maintain its frontline position in the Indian banking industry. In particular, the bank has retained its NUMBER ONE position among the nationalized banks in terms of number of branches, Deposit, Advances, total Business, Assets, Operating and Net profit in the year 2010-11. The impressive operational and financial performance has been brought about by Banks focus on customer based business with thrust on CASA deposits, Retail, SME & Agri Advances and with more inclusive approach to banking; better asset liability management; improved margin management, thrust on recovery and increased efficiency in core operations of the Bank. The performance highlights of the bank in terms of business and profit are shown below:

18

PUNJAB NATIONAL BANK

Rs. In Crore Parameters OperatingProfit NetProfit Deposit Advance TotalBusiness Mar'09 5690 3091 209760 154703 364463 Mar'10 7326 3905 249330 186601 435931 Mar'11 9056 4433 312899 242107 555005 CAGR(%) 26.16 19.76 22.14 25.10 23.40

Bank always looked at technology as a key facilitator to provide better customer service and ensured that its IT strategy follows the Business strategy so as to arrive at Best Fit. The Bank has made rapid strides in this direction. All branches of the Bank are under Core Banking Solution (CBS) since Dec08, thus covering 100% of its business and providing Anytime Anywhere banking facility to all customers including customers of more than 3200 rural & semi urban branches. The Bank has also been offering Internet banking services to its customers which also enables on line booking of rail tickets, payment of utilities bills, purchase of airline tickets, etc. Towards developing a cost effective alternative channels of delivery, the Bank with 5050 ATMs has the largest ATM network amongst Nationalized Banks.

With the help of advanced technology, the Bank has been a frontrunner in the industry so far as the initiatives for Financial Inclusion is concerned. With its policy of inclusive growth,the Banks mission is Banking for Unbanked.

19

PUNJAB NATIONAL BANK

The Bank has launched a drive for biometric smart card based technology enabled Financial Inclusion with the help of Business Correspondents/Business Facilitators (BC/BF) so as to reach out to the last mile customer. The Bank has started several innovative initiatives for marginal groups like rickshaw pullers, vegetable vendors, dairy farmers, construction workers, etc. Bank has launched a welfare scheme of adoption of village viz., PNB VIKAS. Under the scheme, Bank has selected 117 villages (60 in lead districts and 57 in non lead district) in different circles for all-round improvement in the living standards of the villagers. Besides, Bank has formed PNB PRERNA, an association of the wives of the Banks senior management. The association through its voluntary initiatives has undertaken activities like distribution of food to the poor and needy, provision of computers, books, stationary items to poor girl students at various orphanages and schools etc. Backed by strong domestic performance, the Bank is planning to realize its global aspirations. Bank has opened one branch each at Kabul and Dubai, two branches at Hong Kong and an Off Shore Banking Unit at Mumbai. In addition to the above, Bank has Representative offices at Almaty, Dubai, Shanghai and Oslo, a wholly owned subsidiary in UK with 7 branches and a subsidiary each in Kazakhstan & Bhutan, and joint venture with Everest Bank Ltd. Nepal. During the year, Bank acquired majority equity stake of 63.64% in Dana Bank of Kazakhstan.

Fired by the spirit of nationalism and founded on the idea that Indians should have a national bank of their own, Punjab National Bank Ltd was the result of the efforts of far-sighted visionaries and patriots, among

20

PUNJAB NATIONAL BANK

whom were persons like Lala Lajpat Rai, Mr. E C Jessawala, Babu Kali Prasono Roy, Lala Harkishan Lal and Sardar Dyal Singh Majithia. Incorporated under the Act VI of 1882, Indian Companies Act, the Bank commenced operations on April 12, 1895 from Lahore, with an authorised total capital of Rs 2 lac and working capital of Rs 20,000. Prophetically, the Bank chose "Stability" as its telegraphic address, as the future course of events were to prove - the Bank withstood various financial crises including the trauma in the form of partition of India when the Bank had to close 92 offices (33%) in west Pakistan which constituted 40% of its deposits and 15 of its staff fell victims to the frenzy. The registered office was shifted to Delhi and the Bank honoured all the deposit claims of the refugees even on the basis of whatever little evidence they could produce. Subsequently, the Bank registered impressive performance and grew from strength to strength. A pioneer throughout, the Bank distinguished itself by appointing auditors in 1895 long before it was mandatory; introduced the "teller" system in 1944 (another first ); established profit sharing bonus, provident fund and voluntary outside audit well before they formed keystones of good management.

Nationalisation came in 1969 which unleashed a new chapter in the long history of the Bank. Keeping with the economic ideology of catalyzing development and amelioration of poverty by funding various self-employment schemes, PNB expanded its presence rapidly in unbanked areas. The Bank donned the role of a facilitator in providing the vital input of credit and consistently exceeded the national goals in

21

PUNJAB NATIONAL BANK

respect of priority sector lending. With its large presence throughout the country and with a view to strengthening the rural credit delivery system, the Bank sponsored Regional Rural Banks (RRBs). PNB has established itself firmly as one of the premier banking institutions in the country with a long tradition of sound and prudent banking. The bank's growth has been aided by take-over/merger of 7 private sector banks during different periods in its history. The first ever and the only merger of a nationalized bank with PNB was in 1993, viz., New Bank of India. By late 1980s when the first whiff of liberalization came about, the Bank initiated strategic moves towards diversification; and in 2002, 20% of government ownership was disinvested through a very successful IPO to the public. In 2003, the erstwhile Nedungadi Bank Ltd (e-NBL), a Kerala based private bank was amalgamated with Punjab National Bank. This was the seventh merger in PNBs history of more than 115 years. PNBs management team has been quite successful in managing the mergers and ensuring the integration process in a smooth and effective manner.

It may be added that no other bank in the nationalized bank group has a track-record of so many mergers. This has improved the franchise value of the Bank, particularly, in the relatively underrepresented Kerala region. In order to meet future capital requirements on account of implementation of Basel II norms, in March 2005, the Bank came out with Follow-on Public Offer (FPO) through the book building process, reducing the shareholding of Govt of India to 57.8%.

22

PUNJAB NATIONAL BANK

Punjab

National

Bank

with

more

than 5000

domestic

offices

including Extension Counters has the largest network amongst the nationalized banks i.e. next only to SBI. The bank has a strong franchise value and provides a host of financial products and services, both to the retail customer and corporate business. It has continued to fulfill its social responsibilities and made significant progress in adoption of technology, keeping with its objective of transforming itself into a techno-savvy Bank. During 2008-09, the Bank achieved the landmark of becoming the largest Nationalized Bank to bring ALL BRANCHES/EXTENSION COUNTERS into Core Banking Solution (CBS). The strong franchise enjoyed by the Bank, combined with its technological capabilities provides the Bank competitive advantages. The Bank also continues to discharge its social obligations and addresses environmental concerns with added vigour, which include free medical camps, distribute artificial limbs, tree plantation and blood donation camps, besides donations to Hospitals, Schools etc. The Bank supports various societies, charitable institutions and NGO /organisations working for the benefit of downtrodden, weaker sections

of society, orphans, underprivileged, spastics, handicapped, mentally retarded children, women in shelter homes, etc. The Bank also contributes for fighting diseases like diabetes, tuberculosis, AIDS, leprosy etc. Donations are also extended for purchase of water coolers, ambulances and building infrastructure facilities at hospitals/schools.

23

PUNJAB NATIONAL BANK

About the topic

Credit risk is defined as the possibility of losses associated with diminution in the credit of quality of borrowers or counter parties. In a banks portfolio, losses stem from outright default due to inability or unwillingness of a customer or counter party to meet commitments in relation to lending, trading, settlement and other financial transactions. As credit risk is one of the challenging tasks to banks I have selected this topic for my study in order to know the various types of risk and the types of strategies the banks use to mitigate the risk. OBJECTIVES OF THE STUDY: 1. To know the methods to be implemented in banks.

2. To know the various methods used by bank to mitigate credit risk. 3. To know the various types of credit risk in bank. 4. To know the executing methods used in managing credit risk.

24

PUNJAB NATIONAL BANK

DATA COLLECTION METHOD Primary data: Primary data collected through the interaction with chief manager, senior manager and bank staff. Secondary Data: Secondary data collected from bank circulars, bank guidelines book and internet. Brief Findings Current system of credit risk management Punjab national bank has a system of checks and balance in place of extension of credit. The aspect covered under the present system is multiple credit approvals, independt audit and risk review and risk rating system for various categories of system and corresponding pricing mechanism. The bank maintains a diversified portfolio of risk assets, and ensures on going control of risk considerations .All credit exposures above RS 5 Crores are assigned risk waiting assigned by domestic credit rating agencies recognized by RBI The credit risk management system at the branch level has been maped out in detail

25

PUNJAB NATIONAL BANK

1. Internal rating based (IRB) approach the standardized approach adopted so far, provides incentives to banks improving their credit risk management techniques.

2. Banks may have discretion and flexibility in defining the exposure

classes, such as corporate, project finance, etc.

3. Unless suitable modified, the adoption of the new Accord in its present format would result in significant increase in the capital charge for banks.

LIMITATIONS 1.The study restricted to only one branch.

2.

The time constraint was a limiting factor, as more time required carrying out study on other aspects of the topic.

3.Due to secrecy it is difficult obtain actual facts and figures of advances of branches.

26

PUNJAB NATIONAL BANK

INDUSTRIAL PROFILE Overview: The enhanced role of the banking sector in the Indian economy, the increasing levels of deregulation along with the increasing level of the competition have facilitated globalization of the Indian banking system and placed numerous demands on banks. Operating in this demanding environment has exposed banks to various challenges. The last decade has witnessed major changes in the financial sector-new banks, new financial institutions, new instruments, new windows and new opportunities- and, along with all this, new challenges. While deregulation has opened up new vistas for banks to augment revenues, it has entailed greater competition and consequently greater risks. Demands for new products, particularly derivatives, has required banks to diversify their product mix and also effect rapid changes in their processes and operations in order to remain competitive in the globalize environment. The benefits of globalization have been well documented and are being increasingly recognized. Globalization of domestic banks has also been facilitated by tremendous advancement in information and communication technology. Globalization has thrown up lot of opportunities but accompanied by concomitant risk. There is a growing realization that the ability of countries to conduct business across national borders and the ability to cope with the possible downside risks would depend, inter alia, on the soundness of the financial system and the strength of the individual participants. Adoptaion of appropriate prudential, regulatory, supervisory, and technological framework on par with international best practices enables strengthening of the domestic

27

PUNJAB NATIONAL BANK

banking system, which would help in fortifying it against the risks that might arise out of globalization in India we had strengthened the banking sector to face the pressures that may arise out of globalization by adopting the banking sector reforms in a calibrated Mann followed the twin governing principles of nondisruptive progress and consultative process 1. Legal prescriptions for ownership and governance of banks in banking regulation Act, 1949 have been supplemented regulatory prescriptions issued by RBI from time to time.

Application of advanced technology: Technology is a key driver in the banking industry, which creates new business modules and process, and also revolutionizes distribution channels. Banks which have made in adequate investment in technology have consequently faced and erosion of there market shares. The beneficiaries are those banks which have invested in technology. Adoption of technology also enhanced the quality of risk management systems in banks. Recognizing the benefits of modernizing their technology infrastructure banks is taking the right initiatives. While doing so, banks have four options to choose from: they can build a new system those selves, or buy best of he modules, or buy a comprehensive solution, or outsource. In this context banks need to clearly define their core competencies to be sure that they are investing in the areas that will distinguish them from other market players, and give them a competitive advantage. The global challenges which banks face or not confined only to the global banks. These aspects are also highly relevant for banks which are part of a globalized banking system. Further, over coming

28

PUNJAB NATIONAL BANK

these challenges by the other banks is excepted to not only stand them in good stead during difficult times but also augurs well for the banking

The Mission

Our mission is to groom professionals of tomorrow by Imparting high quality education in Management and Information Technology Developing intellectual capabilities through a challenging Curriculum Providing training and development services Fostering research Extending consultancy services to the industry Disseminating information through the publication of books, journals and magazines.

The Vision

To be an Institute of Academic Excellence known for total commitment to superiority in management and IT education and research with a holistic concern for quality of life, environment, society and ethics. Punjab national bank Founding Principles 1. To remove Superstition and ignorance. 2. To spread education among all to sub -serve the first principle. 3. To inculcate the habit of thrift and savings.

4.

To transform the financial institution not only as the financial heart of the community but the social heart as well.

5. To assist the needy.

29

PUNJAB NATIONAL BANK

6. To work with sense of service and dedication.

7.

To develop a concern for fellow human being and sensitivity to the surroundings with a view to make changes/remove hardships and sufferings.

30

PUNJAB NATIONAL BANK

Awards

Awards & Achievements of Punjab National Bank in Recent Times

Shri K.R. Kamath, Chairman & Managing Director, PNB receiving RBI Rajbhasha Awards from Dr. D.Subbarao, Governor, RBI. Other PNB Awarded Rajbhasha dignitaries present on the dias are Awards RBI Dy. Governors Dr. K.C.Chakraborthy and Dr. Subir Gokarn. Honble President of India Smt. Pratibha Devisingh Patil giving SCOPE Best Managed Bank Gold Trophy Award to Sh. K.R. Kamath, PNB adjudged Best Managed CMD- PNB. Seen in picture are Sh. Bank by SCOPE Praful Patel- Union Minister for Heavy Industries, Sh. A Sai Prathap, Minister of State & Sh. M.V. Tanksale, ED- PNB. Won Second Prize under the category of "Best Wind Power Wind Power India 2011 Awards Project Financier" 2011 by World Institute of Sustainable Energy. Punjab National Bank declared winner of "SKOCH Challenger Award on Financial Inclusion". Sh. PNB Awarded SKOCH M.V. Tanksale and Shri Rakesh Challenger Award 2011 on Sethi, EDs, PNB receiving award Financial Inclusion from Dr. C Rangarajan, Chairman of the Prime Minister's Economic Advisory Council, at a function held at New Delhi. PNB Awarded Best Technology Punjab National Bank declared winner of "Best Technology Bank Bank 2010 2010". Sh. M.V. Tanksale, ED, PNB

31

PUNJAB NATIONAL BANK

PNB AWARDED GOLDEN PEACOCK AWARD FOR TRAINING PRESS RELEASE PNB AWARDED NIRYAT BANDHU BRONZE TROPHY PRESS RELEASE Hindi PRESS RELEASE English PNB Received Excellent Performance in Lending Under PMEGP Scheme award SME PRESS RELEASE Hindi MSME PRESS RELEASE

K,R.Kamath, CMD, PNB is receiving the Best Bank Award

Outlook Money Award 2010 Outlook Money Award 2010

and Sh. Ajay Misra, GM, PNB receiving award from Honble ExPresident of India Sh. A.P.J Abdul Kalam at the Banking Technology Conference held at Mumbai. PNB declared winner of the Golden Peacock Awards for Training. Smt. Sushma Bali, GM and Sh. J.P. Kapoor, DGM, PNB receiving award from Hon'ble Sh. K Sankaranarayanan, Governor of Maharashtra and Sh. P.N. Bhagwati Ex-Chief Justice of India. Sh. K.R.Kamath, CMD, PNB receiving Niryat Bandhu Award from Honble Sh. Jyotiraditya Scindia, Minister of State for Commerce and Industry. Seen in the picture is Sh. S.K.Dubey, GM, PNB. Sh. Nagesh Pydah, Executive Director, PNB receiving 'excellent performance in lending under PMEGP scheme' award from Sh. Dinsha Patel, MoS (Independent Charge) and Sh. Dinesh Rai, Secretary, Ministry of Micro, Small & Medium Enterprises. at Hyderabad from Shri D. Subbarao, Governor, RBI . Dr. K.C. Chakrabarty, Dy. Governor, RBI, Mr. Samba Murthy, Director, IDRBT, Mr. S Ganesh Kumar, CGM, IDRBT and Mr. Ajay Misra, GM, PNB are also seen in the photograph. Outlook Money Award for the year 2010 for "Best Home Loan Provider" Outlook Money Award for the year 2010 for "Best Education Loan Provider"

2nd prize of Indira Gandhi Rajbhasha Shield by Dept. of Indian Official for promoting Hindi for the year Language, Ministry of Home Affairs, 2008-09. GOI

32

PUNJAB NATIONAL BANK

Gold trophy of SCOPE Meritorious By Standing Conference of Public Award for Excellence in Corporate Enterprises. Governance in 2009 5th Social and Corporate Governance Award Under the Category of "Best By Bombay Stock Exchange for Corporate Social Responsibility 2010 Practice" Skoch Awards 2010 for By Skoch for 2010 "Computerisation of RRBs" Global HR Excellance Award 2010 for the outstanding Contribution to World HRD Congress the cause of Education Asia Best Employer Brand Award" By World HRD Congress for 2010 for Excellence in Training Award for Brand Excellance" under By CMO Asia for 2010 Banking & Financial Services "CSR Excellence Award 2010" By ASSOCHAM For Livelihood Linkage of the milk Skoch Challenge Award 2010 producers in Bulandshahr District, Uttar Pradesh Best use of Technology for Financial By IDRBT. Inclusion for 2009-10. Best Employer Brand Award By Employer Branding Institute, Regional Round Award WinnersIndia Indore Golden Peacock Award for By Institute of Directors for 2009. Excellence in Corporate Governance By Dainik Bhaskar in association India Pride Awards for excellence in with Daily News and Analysis for PSU 2009. Dun & Bradstreet Award for Priority Sector Lending By Dun & Bradstreet for 2009. including Financial Inclusion. By Khadi & Village Industry National Award for Excellence in Commission, Ministry of Micro, Lending for Institutional Finance in Small & Medium Enterprises, Govt. Propagating KVI Programmes in of India, (Interest Subsidy Eligibility NATIONAL LEVEL Certificate Scheme) for 2009. National Award for Excellence in By Khadi & Village Industry Lending for Institutional Finance for Commission, Ministry of Micro, Propagating KVI Programmes in Small & Medium Enterprises, Govt. CENTRAL ZONE of India(Prime Minister Employment

33

PUNJAB NATIONAL BANK

Generation Programme) for 2009. By Khadi & Village Industry National Award for Excellence in Commission, Ministry of Micro, Lending for Institutional Finance in Small & Medium Enterprises, Govt. Propagating KVI Programmes in of India(Interest Subsidy Eligibility NORTH ZONE Certificate Scheme) for 2009. By Khadi & Village Industry National Award for Excellence in Commission, Ministry of Micro, Lending for Institutional Finance in Small & Medium Enterprises, Govt. Propagating KVI Programmes in of India(Interest Subsidy Eligibility CENTRAL ZONE Certificate Scheme) for 2009.

PUNJAB NATIONAL BANK SERVICES

34

PUNJAB NATIONAL BANK

Anywhere Banking: Anywhere Banking is a technology-based, customer-friendly service designed to provide greater convenience to our customers. With Anywhere Banking facility,once customer has an account with any of the select branches, Customer can operate it From any other designated branch across 85 cities. FACILITIES: Individuals I joint account holders (operated severally) maintaining Current I 58 I OD Accounts: I. Withdrawal of cash 2. Remittance of cash 3. Transfer of funds 4. Balance enquiry 5. Issue of mini statement 6. Depositing local cheques for collection 7. Purchase of Demand draft Firmsl Companies I Other Bodies maintaining Current I OD I OCC Accounts: 1. Transfer of funds between accounts; from one Anywhere Banking branch to another anywhere banking branch. 2. Depositing of local cheques for collection and crediting to the respective account at any Anywhere Banking branch.

FEATURES:

35

PUNJAB NATIONAL BANK

1. Cash withdrawal upto Rs.50, OOO/ - per occasion 2. Transactions permitted on production of ident ity card issued exclusively for ANYWHERE BANKING facility 3. Facilities of both intra-city and inter-city transactions. 4. HOME CLEARING - on line debit of cheques drawn on our own A WB branches within the city / clearing zone. Tele services Access information about your account right from your home, office or from anywhere over telephone. A round the clock teller answering the enquiries from anywhere presenting voice information at any time. You can make the following enquiries/requests over telephone: Balance in the account including clear balance. Last five transactions in the account. Request for cheque book. Request for pass sheet. Change in pass word. Fax on demand. Note: The facility is password protected to ensure secrecy. Ask your Branch Manager for details and enroll today itself the service 'is absolutely lice of cost Personal Banking: Deposits

36

PUNJAB NATIONAL BANK

Savings Bank Account

Current Account

SERVICES

CBS (Core Banking Services) ATM Service | Safe Deposit | Service Charges CBS ( Core Banking Solution) Core Banking Solution (CBS) is networking of branches, which

enables Customers to operate their accounts, and avail banking services from any branch of the Bank on CBS network, regardless of where he maintains his account. The customer is no more the customer of a Branch. He becomes the Banks Customer. Thus CBS is a step towards enhancing customer convenience through anywhere and anytime Banking. All CBS branches are inter-connected with each other. Therefore, Customers of CBS branches can avail various banking facilities from any other CBS branch located any where in the world. These services are: To make enquiries about the balance; debit or credit entries in the account.

37

PUNJAB NATIONAL BANK

To obtain cash payment out of his account by tendering a cheque. To deposit a cheque for credit into his account. To deposit cash into the account. To deposit cheques / cash into account of some other person who has account in a CBS branch.

To get statement of account To transfer funds from his account to some other account his own or of third party, provided both accounts are in CBS branches.

To obtain Demand Drafts or Bankers Cheques from any

branch on CBS amount shall be online debited to his account.

ATM (Automated Teller Machine) Service:The Bank's 17 ATM of 14 branches of the Bank are connected to Central ATM Switch at Data Center and Customers are able to do all the transactions through any of the Branches of the Bank in Thane, Navi Mumbai & Pune. By using ATM Customer can

38

PUNJAB NATIONAL BANK

transfter their fund from one Branch account to Other Branch account by ATM Link Process.

Safe Deposit Locker Keep your valuables safe with Punjab national bank Senior Citizen 0.75% Additional Interest to Senior Citizen Service Charges

Outward ClearingRs 60/Upto Rs 1 lac Rs 120/Above Rs 1 lac - Rs 0.25% of the amount Upto Rs 50,000/- No charges Above Rs 50000 to Rs 1 lac - Rs 0.10% of the amount9 Locker Rent Rs 300/Applicable as per Size of locker 12Cheque purchase commissionRs 3 per Thousand 13Safe CustodyRs 50 per Month14LCMaximum Int. Rate on Loan plus 2% more15Solvency CertificateUp to Rs 2 lac Rs 400/Above Rs 2 lacs 0.20% of the amount Maximum Rs 3000/- 16Pay Order / D D CancellationRs 30/-

39

PUNJAB NATIONAL BANK

DEPOSIT SCHEMES

Fixed Deposit Recurring Deposit Reinvestment Deposit Monthly / Quarterly Interest Scheme

40

PUNJAB NATIONAL BANK

Fixed Deposit Interest Rate

15 to 45 days4.50%46 to 90 days5.50%91 to 180 days6.00%181days to below 1 year7.00%1 year & below 18months7.75%18months & below 2 years 8.50%2 years upto 3 years8.25%Above 3 year 8.00%For senior citizen additional 0.75% Interest (On all Fixed Deposits above 1 year)

Recurring depositInterest Rate

1 year & below 18months7.75%18months & below 2 years

8.50%2 years upto 3 years8.25%Above 3 years8.00%For senior citizen additional 0.75% Interest

Reinvestment DepositInterest Rate

1 year & below 18months7.75%18months & below 2 years 8.50%2

years upto 3 years8.25%Above 3 years 8.00%For senior citizen additional 0.75% Interest Montly / Quarterly Interest Deposit

LOANS

Housing Loans |

41

PUNJAB NATIONAL BANK

Vehicle Loan | Article Loan | Term Loan For Business | Builders & Contractors

Housing Loans

Purpose:Purchase flat or Construction of HouseRate of interest:@ 10.50% p.a. upto Rs 25 lakhs for 5 years.:@ 11.00% p.a. upto Rs 25 lakhs for 5yr-15yr.:@ 11.00% p.a. above Rs 25 lakhs for 5 years:@ 11.50% p.a. above Rs 25 lakhs for 5yr-15yr.Eligibility:Individual.Security :Mortgage of Flat Purchased / House constructed Repayment:Maximum Upto 15 years.E. M. I. per Rs. 1 LakhRate of Interest10.50%11.00%11.50%5 years2149 2174 2199 10 years-1378140615 years-11371168

Vehicle Loan

NEW VEHICLE (Commercial Use)Rate of Interest:@ 12.00% p.a. Loan Amount :80% of Invoice Value + Registration Charges + InsuranceOLD VEHICLEIn case of Old Vehicle upto 5 years:50% of Agreement value or valuation whichever is less.Rate of Interest:Upto Rs 2 lakh @ 13.75 % p.a. Above Rs 2 lakh @ 15.00% p.a.Security:Vehicle & Salary/Income.Repayment :Maximum 5 years*Conditions Apply

TERM LOAN FOR BUSINESS

42

PUNJAB NATIONAL BANK

Purpose:Business Expansion Purchasing Machinery Raw Material Setting New ProjectRate of InterestLOAN AMOUNT INTERESTMEDIUM TERM BUSINESS & SMALL SCALE IND. Upto Rs 50 Lacs13.50%ABOVE Rs 50 Lacs upto 3 crores13.00%ABOVE Rs 3 crore 12.00% Eligibility:Individual / Firm / Partnership Firm / Company etcLoan Amount:As per requirementMargin :30%**Conditions Apply

TERM LOAN FOR BUILDERS & CONTRACTORS Purpose:Business Expansion Purchasing Machinery Raw Material Setting New ProjectRate of InterestLOAN AMOUNT INTERESTAny Amount15.00% Eligibility:Individual / Firm / Partnership Firm / Company etcLoan Amount:As per requirementMargin :30%*Repayment :Maximum 7 years.

Article Loan

43

PUNJAB NATIONAL BANK

Purpose:Purchase of Furniture & Fixtures, Electronic / Consumable Appliances etc.Rate of Interest:@14% p.a.Eligibility:IndividualLoan Amount:Maximum upto Rs. 5 lacs.Margin:30% *.Security :Article / Furniture / Immovable PropertyRepayment:Upto 5 years.

Education loan

To brighten the future of bright & committed students by

extending financial assistance to pursue higher professional / technical courses studies in India & Abroad through Educational Universities / Institutes / Organisations of good reputation & recognition.

Purpose:Higher Education. Rate of Interest :Upto Rs. 10 Lacs @ 10% p.a. Above Rs. 10 Lacs & Upto Rs. 20 Lacs @11% p.aLoan Amount:Upto Rs. 10 Lacs for studies in India. Upto Rs. 20 Lacs for studies in Abroad. Security:Collateral security owned by Parents or Guarantor. 'Whole Life' Insurance Policy on the life of the student, for the amount of loan.Repayment :Max. 120 months, including moratorium period

Professional Loan

44

PUNJAB NATIONAL BANK

Criteria:Doctor

Advocate Architect CA & EngineerRate of Interest LOAN AMOUNT INTEREST UPTO Rs 10 Lacs12.50%ABOVE Rs 10 Lacs To Upto Rs 50 Lacs12.00%ABOVE Rs 50 Lacs12.50% Eligibility:Individual / Firm / Partnership Firm / Company etcLoan Amount:As per requirementMargin :30%**Conditions Apply

General Facilities

-Safe Custody Services -Safe Deposits Locker -Nomination facility Other Services/Facilities

45

PUNJAB NATIONAL BANK

PLANNING AND DEVELOPMENT WING 1. Development Section. 2. Economic Research Section. 3. Management Information and Planning Section. 4. Customer Service Section. 5. Publicity and Public Relations Section. 6. Corporate Merchant Banking Division. 7. Marketing, Research & Product Development Section. 8. Corporate Cash Management Services.

FINANCIAL AND GENERAL ADMINISTRATION WING: a) General Administration Department 1. 2. 3. 4. 5. 6 7 8 9 Furniture and Bills Section. Premises, Policy and Administration Section. Technical Cell. Records and Tappal Section. Premises and Estate Section. Printing Section. Stationery Section. Central Security Cell. Estate Policy and Control Section.

46

PUNJAB NATIONAL BANK

b) Accounts and Taxation Department 1. 2. 3. 4. 5. 6. 7. 8. 9. Balance Sheet and Central Accounts Section. Staff Provident Fund. Staff Welfare Fund. Pension Fund. Government Accounts Section. Executor, Trustee and Taxation Section. DD Reconciliation Section. ATM and Debit Card Reconciliation Section.

DEPARTMENT OF INFORMATION TECHNOLOGY- WING' 1. 2. 3. 4. 5. 6. 7. 8. 9. Planning Establishment & Training Group. Administrative Software Group. Service Units Software Group. Branch Software Group. Delivery Channel & Communication Group. Procurement Group. Payment System Group. New Projects Group. Core Banking Group.

47

PUNJAB NATIONAL BANK

Credit Risk Management in Banks An Overview The financial sector especially the banking industry III most emerging economiesincluding India is passing through a process of change. As the financial activity has become a major economic activity in most economies, any disruption or imbalance in its infrastructure will have significant impact on the entire economy. By developing a sound financial system, the banking industry can bring stability within the financial markets. Deregulation in the financial sector had widened the products range in the developed markets. Some of the new products introduced are LBOs, structured transaction, credit cards, housing finance, derivatives and various off balance sheet items. Thus new vistas have created multiple sources for banks to generate higher profits than the traditional financial intermediation. Simultaneously they have opened new areas of risk also. Many unknown issues that are intricately related to new products have exposed banks to various risks across the globe and India is no exception.

48

PUNJAB NATIONAL BANK

During the past decade, the Indian banking industry continued to respond to the emerging challenges of competition, risks and uncertainties. Risks originate in the forms of customer default, funding a gap or adverse movements of markets.

Measuring and quantifying risks is neither easy nor intuitive. Our regulators have made some sincere attempts to bring prudential and supervisory norms conforming with international bank practices with an intention to strengthen the stability of the banking system. Banks in general face the following risk:

Liquidity Foreign E xchange C redit M arket Intrestrate Operational

The industry has undergone drastic changes in the last three

decades. Horizontal expansion of the financial markets, deregulation across the globe in financial markets and stiff competition have led the banks to multiply their activities. Increased activities in the industry have exposed the banks to more uncertainties and more risks.

49

PUNJAB NATIONAL BANK

Risk Management in Banks is broadly divided into six sections: Funds Management is a major activity of the banks. Liquidity management is an integral part of funds management. Banks mobilize the deposits and deploy funds in advances and investments. Banks also float funds through various subsidiary services extended to their clients. There will be always a time gap between the availability of resources and their deployment. Hence banks will often swing between excess liquidity and liquidity crunch in their funds position. Liquidity management essentially deals with efficient handling of inflows and outflows of funds. Section -I discusses the liquidity management in banks in India and across the globe.

Cash Management is a subset of the entire funds management.

The lead time is reduced in collection of cheques and other instruments by the banks, if they introduce efficient cash management services. From the bank's point of view it increases the fee based income. Cash management services are one innovative product introduced by the banks in the recent times. Section-II discusses the cash management techniques adopted by banks and corporate clients.

Credit risk is as old as money. When the default rate increases in

50

PUNJAB NATIONAL BANK

the portfolio of the bank< it may lead to its total collapse. To circumvent the c re d it risk, the system tries to design innovative products. Section-III discusses the credit risk management in banks.

The Baslc committee defines the operational risk as "the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems or from external events". This defination excludes operational: risk but includes legal risk. Such operational risks can be broadly classified into four categories as information technology risk, human resource risk, loss to assets risk and .'relationship risk. Quantification of operational risk is a major challenge to the .risk management group of the bank: Section IV attempts to elucidate few issues involved in the operational risk management.

51

PUNJAB NATIONAL BANK

One of the core activities of the regulators is proper

of the

system. The Basle committee had set certain guidelines for the bank s. The Reserve Bank of India had set up an advisory committee under the chainn:Ulship of M S Verma and the committee had submitted its report in May 2001. The committee recommended corporate governance, internal controls, risk management, loan accounting transparency and disclosures, financial conglomerates and cross border banking supervision. The supervisor should provide a safety net to the financial system. Section -V discusses the important issues of any risk management technique.

52

PUNJAB NATIONAL BANK

Credit

Risk

Management

at

Punjab

national bank Introduction

Credit risk is defined as the possibility of losses associated with diminution in the credit quality of borrowers or counter parties. In a bank's portfolio, losses stem from outright default due to inability or unwillingness of a customer or counter party to meet commitments in relation to lending, trading, settlement and other financial transactions. Alternatively, losses result from reduction in portfolio value arising from actual or perceived deterioration in credit quality. Credit risk emanates from a bank's dealings with an individual, corporate, bank, financial institution or a so vereign. Credit risk takes in the following forms: 1. In the case of direct lending: principal/and or interest amount not be repaid; 2. In the case of guarantees or letters of credit: funds not forthcoming from the constituents upon crystallization 0 f the liability. 3. In the case of treasury operations: the payment or series of payments due from the counter parties under the respective contracts may not be forthcoming or ceases; 4. In the case of securities trading businesses: funds/ securities settlement may not be effected.

53

PUNJAB NATIONAL BANK

Credit Risk Management

In this backdrop, it is imperative that Punjab national bank has credit risk management system, which is sensitive and responsive to these factors. The effective management of credit risk is a critical component of comprehensive risk management and ie essential for the long-term success of Punjab national banking organisation. Credit risk managemnt encompasses identification, measurement, monitoring and control of the credit risk sources.

54

PUNJAB NATIONAL BANK

Punjab national bank has system of checks and balances in place for extension of 1. 2. credit viz.:

Separation of credit risk management from credit sanction Multiple credit approvers making financial sanction subject to approvals at various stages viz. credit ratings, risk approvals, credit approval grid, etc.

3.

An independent audit and risk review function. level of authority required to approve credit will increase as amounts and transaction risks increase and as risk ratings worsen.

4. The

5. 6.

Every obligor and facility must be assigned a risk rating. Mechanism to price facilities depending on the risk grading of the customer, and to attribute accurately the associated risk weightings to the facilities.

7. Banks

ensure that there are consistent standards for the origination,

documentation and maintenance for extensions of credit 8. 9. Banks has a consistent approach towards early problem recognition, the classification of problem exposures, and remedial action. Banks maintain a diversified portfolio of risk assets; have a system to conduct regular analysis of the portfolio and to ensure ongoing control of risk concentrations. 10. Credit risk limits include, obligor limits and concentration limits by industry or geography. The Boards should authorize efficient and effective credit approval processes for operating within the approvall imits.

55

PUNJAB NATIONAL BANK

11. Bank has systems and procedures for monitoring financial performance of customers and for controlling outstanding within limits. 12. A conservative policy for provisioning in respect of non -performing advances adopted adopted.

13.

Bank has an experience, judgment and commitment to technical development.

14. Banks should have a clear, well-documented scheme of delegation of powers for credit sanction. Treatment of Credit risk at bank. The unsecured portion of NPA accounts net of specific provisions is also to be subject to risk weighting mechanism; unsecured portion means the NPA amount obtained after deducting the eligible and guarantee amounts. Factors considered for sanction loans: 1) 2) 3) 4) 5) Individual Capacity. Securities Additional securities Prompt repayment of L02. Deposits in Banks

Individual Capacity: Bank considers individual capacity h) repayment of loan with term or agreed term with bank and also considers his transaction with bank if any.

56

PUNJAB NATIONAL BANK

Securities: Bank considers securities of borrowers while lending money to him. Ex: Shares cel1ificate, Insurance policies Additional Securities: Banks consider or accept additional securities like land, home and other securities while sanctioning new loan to customers when customers has existing loan in bank. Prompt repayment of Loan: Existing transaction or previous transact ion consider while grant new loan to customers/ Clients. His prompt repayment of loan consider for new loans. Bank Deposits Bank deposits with bank or any other banks consider as security for loans. Existing Credit Risk Management at Punjab national bank

Follow up clients/Customers. Recovery systems. Review of loan. Additional securities Providing additional loans to make repayment of existing loans. Loan Review Mechanism.

57

PUNJAB NATIONAL BANK

Low and High credit risk ratings. Low interest rate for high credit rating companies High interest rate for low credit rating companies Single/group borrower limits Authorities to branches Authorities to Committees.

Following Up customers/Clients: Bank remind borrowers to repay loan and interest according to term and condition which he has agreed while taking loan from banks, and also ensure that ifhe fails to pay the loanwhat is next step of banks. Recovery Systems: Bank directly collect dues from customers. They have separate department, which look \after all matters related to recovery of loan. Review of loan: If the amount not recovered within specified term mentioned as per the policy of bank, bank goes for review of loan if required. Additional Securities: Additional securities will be taken from the customer in two situations: 1) If existing loan extended by the bank. 2) When additional loan is given to the customer in addition to existing loan.

58

PUNJAB NATIONAL BANK

Low and High credit risk ratings. Interest rate is depend on credit worthyness of the company, if the credit worthy ness of the company is high he will be charged low interest, opposite is the case for low credit worthiness Following Securities as eligible for treatment as Credit risk mitigates: 1) Bank Deposits 2) Gold Jewellery ( Benchmarked to 99.99 purity) 3) State Govt securities 4) Central Govt securities 5) National Saving Certificates 6) Life Insurance Policies 7) Equities ( Including convertible bonds) 8) Mutual fund securities 9) Land and Building 10) Plant and Machinery

59

PUNJAB NATIONAL BANK

Guarantors Types

State Government Central Government Public Sector Entities Banks Primary Dealers Corporate

Techniques for Measuring Credit Risk In the measurement of credit risk, models may be classified along three different dimensions: 1. The techniques employed, 2. The domain of applications in the credit process and 3. The products to which they are applied. Techniques: The following are the more commonly used techniques:

1.

Econometric

Techniques

such

as

linear

and

multiple

discriminate analysis, Multiple regression, logic analysis and probability of default, etc.

2.

Neural networks are computer-based systems that use the same data employed in the econometric techniques but arrive at the

60

PUNJAB NATIONAL BANK

decision model using alternative implementations of a trial and error

Depth of Reviews The loan reviews should focus on: Approval process; Accuracy and timeliness of credit ratings assigned by loan officers; Adherence to internal policies and procedures, and applicable

laws / regulations;

Compliance with loan convents;

Post-sanction follow-up; Sufficiency of loan documentation; Portfolio quality; and Recommendations for improving portfolio quality

Collection strategies: Credit models may be used in deciding on the best collection or workout strategy to pursue. If, for example, a credit model indicates that a borrower is experiencing short term liquidity problems rather than a decline in credit fundamentals, then an appropriate workout may be devised.

61

PUNJAB NATIONAL BANK

RISK MANAGEMENT The Bank has initiated implementation of parallel run of new capital adequacy framework under Basel II during the year and is fully geared for a smooth switchover within the RBI prescribed time schedule, The Bank's Board has been driving the policy initiatives and putting appropriate strategies in place for effectively managing the Credit, Market and Operational risks, Top Executive Risk Committees, headed by the Chairman & Managing Director, are in place to effectively address all issues related to the management and mitigation of various business/control risks. CORPORATE SOCIAL RESPONSIBILITIES) RURAL DEVELOPMENT Rural Development and Self-Employment Training Institutes (RUDSETls) co-sponsored by the Bank have been engaged in providing training to rural youths to pursue various self-employment activities. RUDSETls, numbering 20 across India, have so far trained I .87lakh unemployed youth, with a settlement rate of 67%. The Bank, under Punjab national bank Centenary Rural Development Trust, has promoted 14 self-employment training institutes. These institutes have so far trained 56520 rural youth, with an impressive settlement rate of72%. The Trust is also extending support to Society for the Educational and Economic Development (SEED), a voluntary organization workingforthe welfare of socially marginalized children.

The Bank's 'Rural Clinic Services' scheme has assisted doctors in opening 21 additional clinics during 2006-07, taking the total of such

62

PUNJAB NATIONAL BANK

clinics to 493 across India. Under 'Jalayoga', a scheme for facilitating

availability of safe drinking water in rural areas, the Bank has completed 35 projects so far. Tapping the spirit of voluntarism among its employees, the Bank, under the Rural Service Volunteer Scheme, has assisted 500 villages, benefiting over 2 lakh families since its inception in 1985. As a responsible corporate social citizen, the Bank has donated hi-tech and solar powered 'Mobile Sales Van' to assist women entrepreneurs, SHGs and artisans in their entrepreneurial ventures. CUSTOMER ORIENTATION The Bank, during the year, introduced several new measures towards further improving customer centricity and service quality to

match

the

competitive

market

conditions

and

customer

expectations. In a noteworthy initiative, the Bank has implemented 'Six Sigma' project for enhancing the knowledge base of its frontline staff on products and services. Keeping track of services quality at branches has been a hallmark of the Bank's unprecedented customer orientation. During the

year, customer survey from a sample of 25 branches each in five metros, viz., Bangalore, Chennai, Delhi, Kolkata and Hyderabad, covering 10000 customers was conducted by consultant of repute to

63

PUNJAB NATIONAL BANK

further improve the level of customer service. Further, as a member of Banking Codes and Standards Board of India (BCSBI), set up by RBI, the Bank has brought out a booklet on "Code of Commitment to Customers" to create awareness among the customers as well as staff about the Uniform Fair Practice Code used as benchmark standard by all banks in India. HUMAN RESOURCES DEVELOPMENT Knowledge enrichment for employees continued to be a top priority for the Bank during FY07. Close on the heels of achieving the one lakh mark in training/re-skilling during its centenary year, 2006-07 featured the tally moving up further to 1,09,661 covering diverse functional areas. During the year, the Bank effected a major organizational restructuring exercise for grater business focus and expeditious decision making, apart from moves to decentralize operational activities.

The Bank also adopted a fast track promotion policy and implemented cash incentive scheme for high performers. Punjab national bank is also the only Bank in the country to have formed 'Club 2020' a group, comprising young talent, to spearhead strategic changes in the fast changing banking environment. Focus on specialized expertise led to recruitment of 541 officers through campus and direct recruitment in diverse areas like marketing, financial analysis and risk management. Continued focus on quality drive enhanced the number of ISO 900I Certified Branches and Administrative Offices to 805 and 14 respectively as at March 2007.

64

PUNJAB NATIONAL BANK

Analysis of the financial statement

Financial statements and reports are the tools which provides information of the firms financial affairs. This information is required for financial analysis & decision making. It assesses the financial status of organization which is prepared with help of accounting principle. Financial statement has mainly as follow: Balance sheet Profit & loss account

Profit and Loss account:Meaning:- profit and loss account is one of the essential document which shows the summary of revenues, expenses and net income of the firm during the particular financial period.

Functions of the Profit and Loss account: It gives a concise summary of the firms revenue and expenses during the particular period. It measures the firms profitability. It represents the activity of the firm.

65

PUNJAB NATIONAL BANK

Ratio Analysis:Ratios are classified into four parts like:1. Liquidity ratios 2. Activity ratios 3. leverage ratios 4. profitability ratios

Limitations of the analysis: There are no standard formula fixed to judge the performance. Since

management problems are so complex that they cannot be reduced to a formula.

Forming of the ratio should be made with care.

due to price fluctuation it may distort the result

there are chances of making window dressing in

the

financial

statements of the firm, it has some limitation for Credit officer has to consider the financial statements and reports which produce information of the firms financial affairs. These are prepared with help of accounting principle. It helps in decision making.

66

PUNJAB NATIONAL BANK

The main financial statements are 1. balance sheet 2. profit and loss account

3. funds flow and cash flow statements

These financial statements will help the credit officer to calculate the following to ratios to make the credit rating 1. liquidity ratio

2. activity ratio

3. leverage ratio 4. profitability ratio

67

PUNJAB NATIONAL BANK

Findings

1. The proposed standardized Basel2 to approach does not fits the

needs

of

smaller

banking

organization

engaged primarily

traditional banking.

2. The current nor proposed capital frameworks yet address what is

perhaps the most critical risk factor for the smaller banks geographic and sectoral concentrations of credit risk.

3. Internal ratting based approach provides positive incentives to banks in improving their credit risk management techniques. 4. Banks may have discretion and flexibility in defining the exposure classes that which corporate, project finance, etc. 5. Unless suitably modified the adoption of the new accord in its present format would result in significant increase in the capital charge for bank. 6. Additional cost of capital will increase to the bank and bank may go for capital market to raise the found. 7. Bank as well documented schemes delegation powers for credit sanction.

68

PUNJAB NATIONAL BANK

Recommendations

1.

The bank will now have to adopt the credit risk assessment system which is an international standard specified for the banking system.

2. Due to increased sensitivity towards risk under the new norms, the risk will come down significantly. This will lead to an increase in the regulatory capitalization levels, which will increase the cost of capital, which may be passed on to the customers. 3. The banks will have to exercise due care in maintaining the portfolio of risk assets in order not to increase unduly the required regulatory capitalization level. This may in turn in duce conservatism in the bank in taking of risky portfolio of advances, a danger they have to guard against. It will indeed be a delicate balancing task.

69

PUNJAB NATIONAL BANK

BIBLIOGRAPHY

1 Bank circulars. 2 Internal magazines. www.mis.org. www.punjabnationalbankindia.com. 5 www.rbi.org.in.

70

You might also like

- Punjab National Bank: HistoryDocument5 pagesPunjab National Bank: HistoryPayal SikkaNo ratings yet

- Customer Satisfaction of Saving Account Holders at Punjab National BankDocument59 pagesCustomer Satisfaction of Saving Account Holders at Punjab National BankHitesh MendirattaNo ratings yet

- Job Satisfaction of Employees Punjab National BankDocument48 pagesJob Satisfaction of Employees Punjab National BankChandan Srivastava50% (2)

- Study on Loan Appraisal Process at PNBDocument71 pagesStudy on Loan Appraisal Process at PNBNAVPREET SINGHNo ratings yet

- Research Project Report: ON "Non Performing Assest"Document92 pagesResearch Project Report: ON "Non Performing Assest"shagunNo ratings yet

- Project 2Document66 pagesProject 2Richa MittalNo ratings yet

- Summer Training Report: Cost Reduction or Increase in Revenue of Punjab National BankDocument46 pagesSummer Training Report: Cost Reduction or Increase in Revenue of Punjab National BankDeepu SinghNo ratings yet

- Summer Internship Project ON Retail Loans of The Bank of Rajasthan LTDDocument50 pagesSummer Internship Project ON Retail Loans of The Bank of Rajasthan LTDavneegoelNo ratings yet

- Training and Development Punjab National Bank PNBDocument63 pagesTraining and Development Punjab National Bank PNBChandan Srivastava100% (9)

- Project 1Document99 pagesProject 1Ujjawal JayswalNo ratings yet

- Project Report On SbiDocument29 pagesProject Report On SbiRitesh Bhatia67% (3)

- Allied Bank Internship ReportDocument76 pagesAllied Bank Internship Reportali ijaz asim50% (2)

- Net Banking Services of Punjab National BankDocument64 pagesNet Banking Services of Punjab National BankPooja BoisaNo ratings yet

- Our Banking System Today:: Bank DefinitionDocument98 pagesOur Banking System Today:: Bank DefinitionAtif SattarNo ratings yet

- Net Banking Services of Punjab National BankDocument42 pagesNet Banking Services of Punjab National BankPooja BoisaNo ratings yet

- Project Report ON "To Study of Npa Management": Rode Santosh FakiraDocument67 pagesProject Report ON "To Study of Npa Management": Rode Santosh FakiraTejashree GadhaveNo ratings yet

- Allied Bank Internship Report SummaryDocument79 pagesAllied Bank Internship Report Summarywamiq noorNo ratings yet

- AcknowledgementsDocument38 pagesAcknowledgementsBorat SagdiyevNo ratings yet

- Comparative Analysis of BanksDocument31 pagesComparative Analysis of BanksRohit SoniNo ratings yet

- Study of Deposit Schemes of Bank of IndiaDocument69 pagesStudy of Deposit Schemes of Bank of IndiaMegha JerathNo ratings yet

- Financial Analysis On SBI - OkDocument87 pagesFinancial Analysis On SBI - OkAbhishek75% (4)

- Allied Bank Limited Internship ReportDocument77 pagesAllied Bank Limited Internship ReportMuhammadUmairNo ratings yet

- Economics ProjectDocument28 pagesEconomics ProjectSanstubh SonkarNo ratings yet

- Project Report ON "To Study of Npa Management"Document64 pagesProject Report ON "To Study of Npa Management"Dhiraj KokareNo ratings yet

- Allied Bank LTDDocument105 pagesAllied Bank LTDShaukat KhanNo ratings yet

- Ramiz Latif: FMA SDocument61 pagesRamiz Latif: FMA Swaqas_ashraf88No ratings yet

- History of Banking in India: Key Points To Remember: Published On Wednesday, January 25, 2017Document21 pagesHistory of Banking in India: Key Points To Remember: Published On Wednesday, January 25, 2017Rajesh VishwakarmaNo ratings yet

- Banking Sector OverviewDocument18 pagesBanking Sector OverviewashdreamNo ratings yet

- A Study On Deposit Mobilisation of CSBDocument33 pagesA Study On Deposit Mobilisation of CSBDeepthi Radhakrishnan100% (2)

- A COMPARATIVE ANALYSIS OF "SERVICES GIVEN BY PUBLIC BANK AND PRIVATE BANKS FinanceDocument95 pagesA COMPARATIVE ANALYSIS OF "SERVICES GIVEN BY PUBLIC BANK AND PRIVATE BANKS FinanceParidhiNo ratings yet

- Khushabu Singh B 66Document24 pagesKhushabu Singh B 66smellsinghNo ratings yet

- Banking Law - PDF ProjectDocument18 pagesBanking Law - PDF ProjectNilotpal RaiNo ratings yet

- Challenges For Public Sector Banks in IndiaDocument63 pagesChallenges For Public Sector Banks in IndiaKahkashan Anjum100% (8)

- Amarjeet 4 Sem ProjectDocument78 pagesAmarjeet 4 Sem ProjectHarishankar PareekNo ratings yet

- PROJECT On Finance OBC BANK by KaranDocument38 pagesPROJECT On Finance OBC BANK by KaranAkshay SinghNo ratings yet

- Punjab National BankDocument4 pagesPunjab National BankRicky KishoreNo ratings yet

- Loan Products of SBIDocument46 pagesLoan Products of SBIvinodksrini007No ratings yet

- PNB Industrial Report InsightsDocument42 pagesPNB Industrial Report InsightsDeepu SinghNo ratings yet

- HDFC Bank PDFDocument73 pagesHDFC Bank PDFpriyadarshini100% (1)

- Avinash Purohit FINACIAL REPORTDocument93 pagesAvinash Purohit FINACIAL REPORTAvi PurohitNo ratings yet

- Acknowledgements 120310030904 Phpapp02Document39 pagesAcknowledgements 120310030904 Phpapp02neelaNo ratings yet

- "General Banking Operations": "Punjab National Bank"Document59 pages"General Banking Operations": "Punjab National Bank"16july1994No ratings yet

- Internship ReportDocument66 pagesInternship ReportAbdul Mateen MateenNo ratings yet

- BOB Summer Project RevisedDocument34 pagesBOB Summer Project RevisedSudeep DakuaNo ratings yet

- Rubika Final ProjectDocument73 pagesRubika Final ProjectRubika MunusamyNo ratings yet

- Alok ReportDocument89 pagesAlok ReportMohammad QadirNo ratings yet

- Rural Banking in India: An AnalysisDocument72 pagesRural Banking in India: An AnalysisbindiyapatelNo ratings yet

- NSBL Final Report DDPDocument79 pagesNSBL Final Report DDPKhatiwadarozNo ratings yet

- AcknowledgementDocument22 pagesAcknowledgementMathew AbrahamNo ratings yet

- History of Banking in Pakistan: From Establishment to PrivatizationDocument18 pagesHistory of Banking in Pakistan: From Establishment to Privatizationshahzad AhmadNo ratings yet

- A Research Report On SbiDocument45 pagesA Research Report On SbiSonu LovesforuNo ratings yet

- Summer Training HDFC BankDocument98 pagesSummer Training HDFC BankGurpreet Singh100% (1)

- Banks Types and Performance StudyDocument49 pagesBanks Types and Performance Studykrushna multiservicesNo ratings yet

- Pandemonium: The Great Indian Banking TragedyFrom EverandPandemonium: The Great Indian Banking TragedyRating: 5 out of 5 stars5/5 (4)

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Executive SummeryDocument64 pagesExecutive Summeryrenju5613No ratings yet

- N R NarayanamurtyDocument29 pagesN R NarayanamurtyMitesh SonegaraNo ratings yet

- Sarfaesi ActDocument44 pagesSarfaesi ActChiramel Mathew SimonNo ratings yet

- Comparative Analysis of Home Loan in UTI BankDocument95 pagesComparative Analysis of Home Loan in UTI BankMitesh SonegaraNo ratings yet

- Canara BankDocument94 pagesCanara BankMitesh Sonegara100% (1)

- The Tyler Group Wealth ManagementDocument16 pagesThe Tyler Group Wealth ManagementhuberthvargasNo ratings yet

- Applied Economics PPT 3Document9 pagesApplied Economics PPT 3Angel AquinoNo ratings yet

- Nikon Annual ReportDocument15 pagesNikon Annual Reportksushka89No ratings yet

- February 6, 2013Document12 pagesFebruary 6, 2013The Delphos HeraldNo ratings yet

- Real OptionsDocument46 pagesReal OptionsAlex WilsonNo ratings yet

- Property Arts. 484 490Document7 pagesProperty Arts. 484 490Nhaz PasandalanNo ratings yet