Professional Documents

Culture Documents

Chapter 1 HW

Uploaded by

Valerie Bodden KlugeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 HW

Uploaded by

Valerie Bodden KlugeCopyright:

Available Formats

Valerie Bodden K.

(10-0014) Financial Markets and Institutions (UNIBE) Professor Bairan September 8, 2011 Chapter 1 Review Questions 1) What is the difference between a financial asset and a tangible asset? The difference between a tangible asset and a financial asset is that a tangible asset is basically one whose value depends on a physical property, while a financial asset, considered an intangible asset, represents a legal claim of some future benefits or cash flows. 2) What is the difference between the claim of a debt holder of general Motors and an equity holder of General Motors? When a debt holder establishes a claim, he establishes it by contract that specifies the amount and timing of periodic payment in the form of interest, as well as the maturity. The debt holder plays the part of an creditor. In the case of a default he would have a prior claim on firm assets over the equity-holder. The equity holder has a Residencial claim to assets and income. 3) What is the basic principle in determining the cash flow of a financial asset? The present value of the expected cash flow is the price of any financial asset. The basic variables when determining the price of an asset are: expected cash flows, timing of cash flows and discount rates. 4) Why is it difficult to determine the cash flow of a financial asset? It is difficult to determine the cash flow of a financial asset because of several accounting measures, the existing possibility of default of the issuer, and the embedded options in the security. 5) Why are the characteristics of an issuer important in determining the price of a financial asset?

The characteristics of an issuer are important when determining the price of a financial asset because they determine the issuers creditworthiness and they have an impact on the required rate of return for that asset. 6) What are the two principal roles of financial assets? 1. To transfer funds from surplus spending units to deficit spending units. 2. To redistribute risk among people or institutions that seek to provide funds. Fund providers share the risks of expected cash flow generated by tangible assets. 7) In September 1990, a study by the US Congress Office of Technology Assessment, entitled electric Bulls and Bears: US Securities Markets and Information Technology included this statement: a. Securities markets have five basic functions in a capitalistic economy: a. They make it possible for corporations and governmental units to raise capital b. They help to allocate capital towards productive uses c. They provide an opportunity for people to increase their savings by investing in them d. They reveal investors judgments about the potential earning capacity of corporations this giving guidance to corporate managers. e. They generate employment and income For each of these functions cited above, explain how financial markets perform each function. a. Transferring funds from those who have surplus funds to invest to those who need funds b. Transferring funds in a way that redistributes the unavoidable risk associated with the cash flow generated by tangible assets. c. Determining the price of financial assets d. Providing a mechanism for an investor to sell a financial asset 8) Explain the difference between each of the following: a. Money market and capital market

b. Primary market and secondary market c. Domestic market and foreign market d. National market and Euromarkets a. The money market is a financial market of short-term instruments (1 year) while capital market are for long term debts (1+ year). b. The primary market deals with newly issued financial claims, on the other hand, secondary market deals with the trading of season issues. c. The domestic market is the national market, where foreign deals with international securities and their trade. d. In a national market, securities are traded in one country and must follow the rules of that country in specific. 9) Indicate whether each of the following instruments trade I the money market or the capital market. a. General Motors Acceptance Corporation issues a financial instrument with four months to maturity. b. The U.S. Treasury issues a security with 10 years to maturity c. Microsoft Corporation issuers common stock d. The State of Alaska issues a financial instrument with eight months to maturity. a. GMAC issues trades in the money market b. US security trades in the capital market c. Microsoft stock trades in the capital market d. State of Alaska security trades in the money market 10) A U.S. investor who purchases the bonds issued by the government of France made the following comment Assuming that the French government does not default, I know what the cash flow of the bond will be. Explain why you agree or disagree with this statement. I would disagree with this statement.

11) A U.S. investor who purchases the bonds issued by the U.S. government made the following statement: By buying this debt instrumental I am not exposed to default risk or purchasing power risk. Explain why you agree or disagree with this statement. This is false, because there is no credit risk of US government securities. Although, it is not free of purchasing power or inflation risk. There is also price risk. 12) In January 1992, Atlantic Richfield Corporation, a U.S.-based corporation, issued $250 million of bonds in the U.S. From the perspective of the U.S. financial market, indicate whether this issue is classified as being issued n the domestic market, the foreign market or offshore market. Corporate bonds issued by A.C. are in the domestic market. On the other hand, investors can be foreign markets. 13) In January 1992, the Korea Development Bank issued $500 million of bonds in the U.S. From the perspective of the U.S. financial markets, issued whether this issue is classified as being issued in the domestic market, the foreign market, or the offshore market. It is a domestic issue. 14) Give three reasons for the trend toward greater integration of financial markets throughout the world. a. Deregulation of financial markets to permit greater participants from other different countries b. Technological innovations to provide globally-available information and to speed transactions c. Institutionalization 15) What is meant by the institutionalization of capital markets? Institutionalization means the dominance of large institutional investors such as pension funds, investment companies. 16) a. What are the two basic types of derivative instruments? Futures and option contracts

b. Derivative markets are nothing more than legalized gambling casinos and serve no economic function. Comment on this statement. Derivatives serve an important economic function that permit hedging. 17) What is the economic rationale for the widespread use of disclosure regulation? Disclosure mitigate the potential for fraud by the issuer. 18) What is meant by market failure? Market failure is when market cannot produce its goods or services efficiently. 19) What is the major long-term regulatory reform that the U.S. department of the Treasure has proposed? The proposal is to replace the prevailing complex array of regulators with a regulatory system based on functions. 20) Why does increased volatility in financial markets with respect to the price of financial assets, interest rates, and exchange rates foster financial innovation? Increased volatility of the prices of financial assets has fostered innovation as investors and institutions.

You might also like

- Maricalum vs. FlorentinoDocument7 pagesMaricalum vs. FlorentinoisaaabelrfNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- Chapter 3 - Tutorial - With Solutions 2023Document34 pagesChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- CH 06Document22 pagesCH 06Kreatif TuisyenNo ratings yet

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Document10 pagesThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNo ratings yet

- The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesFrom EverandThe Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesNo ratings yet

- CH 1Document81 pagesCH 1Michael FineNo ratings yet

- Property Plant Equipment: Sukhpreet KaurDocument79 pagesProperty Plant Equipment: Sukhpreet KaurJeryl AlfantaNo ratings yet

- Balance of Payments Multiple Choice QuestionsDocument11 pagesBalance of Payments Multiple Choice QuestionsSagar100% (1)

- 115 Baltazar v. Lingayen GulfDocument2 pages115 Baltazar v. Lingayen GulfErika Potian0% (1)

- MC Practice Ch 16 Capital StructureDocument3 pagesMC Practice Ch 16 Capital Structurebusiness docNo ratings yet

- Test Bank For Financial Markets and Institutions 7th Edition by SaundersDocument7 pagesTest Bank For Financial Markets and Institutions 7th Edition by SaundersKiara Mas100% (1)

- What is a Corporation - Legal Business Structure ExplainedDocument2 pagesWhat is a Corporation - Legal Business Structure ExplainedShin Darren BasabeNo ratings yet

- CH 5Document83 pagesCH 5Von BerjaNo ratings yet

- Capital Structure Analysis of Cement Industry in BangladeshDocument19 pagesCapital Structure Analysis of Cement Industry in Bangladeshamanur rahmanNo ratings yet

- Quiz Chapter 18Document5 pagesQuiz Chapter 18Steve Smith FinanceNo ratings yet

- Exam2 FIN4504 Spring2022Document10 pagesExam2 FIN4504 Spring2022Eduardo VillarrealNo ratings yet

- Meyad DiribaDocument86 pagesMeyad Diribatech storeNo ratings yet

- Chapter 04 - IfRS Part IDocument11 pagesChapter 04 - IfRS Part IDianaNo ratings yet

- 8318 - Making Investment Decision - Case StudyDocument1 page8318 - Making Investment Decision - Case Studyanon_593009167No ratings yet

- Stock ValuationDocument79 pagesStock ValuationRodNo ratings yet

- Syllabus-Operational Level ICMABDocument27 pagesSyllabus-Operational Level ICMABMuhammad Ziaul Haque50% (2)

- International Economics Chapter 3 MCQsDocument25 pagesInternational Economics Chapter 3 MCQsAli AlshehhiNo ratings yet

- Tutorial 1 Chapter 7Document8 pagesTutorial 1 Chapter 7Aqila Syakirah IVNo ratings yet

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimeNo ratings yet

- Wahlen 8e Chapter 03 Test EditedDocument9 pagesWahlen 8e Chapter 03 Test EditedDyenNo ratings yet

- INTERMEDIATE ACCOUNTING CASE STUDIESDocument2 pagesINTERMEDIATE ACCOUNTING CASE STUDIESSharadPanchal0% (1)

- Chapter 7. Translation of Foreign Currency Financial StatementDocument37 pagesChapter 7. Translation of Foreign Currency Financial Statementnguyễnthùy dươngNo ratings yet

- CH 01Document12 pagesCH 01xyzNo ratings yet

- Test Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo ErhemjamtsDocument23 pagesTest Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo Erhemjamtsreem.alrshoudiNo ratings yet

- Test Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraDocument24 pagesTest Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Pererajaperstogyxp94cNo ratings yet

- Chapter 8 Case Studies on Inventory Valuation and Accounts ReceivableDocument17 pagesChapter 8 Case Studies on Inventory Valuation and Accounts ReceivableAhmadYaseenNo ratings yet

- TB Special - PDF 15 & 16Document12 pagesTB Special - PDF 15 & 16Rabie HarounNo ratings yet

- Financial Markets Finals FinalsDocument6 pagesFinancial Markets Finals FinalsAmie Jane MirandaNo ratings yet

- Consolidated Financial Statements - Intra-Entity Asset TransactionsDocument15 pagesConsolidated Financial Statements - Intra-Entity Asset TransactionsAdi Putra Pratama NNo ratings yet

- Week Seven - Translation of Foreign Currency Financial StatementsDocument28 pagesWeek Seven - Translation of Foreign Currency Financial StatementsCoffee JellyNo ratings yet

- Wollongong Spring 2022 ECON339 ExamDocument8 pagesWollongong Spring 2022 ECON339 ExamJahanzaib AhmedNo ratings yet

- Risks and Rate of ReturnDocument79 pagesRisks and Rate of ReturnDaniel Hunks100% (1)

- NBFI-Course Outline-2020Document2 pagesNBFI-Course Outline-2020Umair NadeemNo ratings yet

- StudentDocument33 pagesStudentKevin Che100% (2)

- Answwr of Quiz 5 (MBA)Document2 pagesAnswwr of Quiz 5 (MBA)Wael_Barakat_3179No ratings yet

- Bank's Financial Statements ExplainedDocument6 pagesBank's Financial Statements ExplainedMohamed AmirNo ratings yet

- 9Document16 pages9edmarianNo ratings yet

- Accounting Textbook Solutions - 43Document19 pagesAccounting Textbook Solutions - 43acc-expertNo ratings yet

- Chapter 6 Practice QuizDocument5 pagesChapter 6 Practice QuizJialu GaoNo ratings yet

- Test Bank to Accompany Microeconomics Se-đã Chuyển ĐổiDocument31 pagesTest Bank to Accompany Microeconomics Se-đã Chuyển ĐổiThiện Lê ĐứcNo ratings yet

- TB Chapter02Document54 pagesTB Chapter02Dan Andrei BongoNo ratings yet

- MngEcon06 Ch02Document55 pagesMngEcon06 Ch02dmkelompok3 exNo ratings yet

- Accounting For Merchand ch3Document14 pagesAccounting For Merchand ch3Ealshady HoneyBee Work Force100% (1)

- Tutorial 1Document2 pagesTutorial 1musicslave96No ratings yet

- Multiple Choice Questions Financial MarketsDocument16 pagesMultiple Choice Questions Financial Marketshannabee00No ratings yet

- Investments and Fair Value SolutionsDocument32 pagesInvestments and Fair Value Solutionssarah zahid100% (1)

- Test Bank For International Trade, 5e Robert Feenstra, Alan Taylor Test BankDocument32 pagesTest Bank For International Trade, 5e Robert Feenstra, Alan Taylor Test BankNail BaskoNo ratings yet

- Chapter 7Document13 pagesChapter 7lov3m3No ratings yet

- Chapter 15 Transfer Pricing QDocument9 pagesChapter 15 Transfer Pricing QMaryane AngelaNo ratings yet

- Money Banking Practice Questions and AnswersDocument3 pagesMoney Banking Practice Questions and AnswersNihad RüstəmsoyNo ratings yet

- Accounting Test Prep 1Document9 pagesAccounting Test Prep 1Swathi ShekarNo ratings yet

- CHAPTER 3 INVESTMENTSDocument13 pagesCHAPTER 3 INVESTMENTSEy EmNo ratings yet

- Portofolio ManagementDocument6 pagesPortofolio ManagementAziza FrancienneNo ratings yet

- Testbank - Multinational Business Finance - Chapter 12Document15 pagesTestbank - Multinational Business Finance - Chapter 12Uyen Nhi NguyenNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Financial InstitutionsDocument17 pagesFinancial InstitutionsNikolaiNo ratings yet

- PYETJE Tregje FinanciareDocument4 pagesPYETJE Tregje FinanciarepavligjinkoNo ratings yet

- Chương 2Document11 pagesChương 2Tran NganNo ratings yet

- Financial Goals and Corporate GovernanceDocument32 pagesFinancial Goals and Corporate GovernanceHazel Joy BufeteNo ratings yet

- Porter'S Five Forces ModelDocument20 pagesPorter'S Five Forces ModelLuan VoNo ratings yet

- Finvasia Client Guidance NSE BSE 2016Document18 pagesFinvasia Client Guidance NSE BSE 2016tommyNo ratings yet

- MicroCap Review Winter/Spring 2017Document96 pagesMicroCap Review Winter/Spring 2017Planet MicroCap Review MagazineNo ratings yet

- All Weather CritiqueDocument3 pagesAll Weather Critiqueibs_hyder100% (2)

- Chap - 4 The Industry and Market EnvioronmentDocument38 pagesChap - 4 The Industry and Market EnvioronmentMd. Mamunur RashidNo ratings yet

- Marketing Analysis of Indonesia Concerning Microwave OvensDocument29 pagesMarketing Analysis of Indonesia Concerning Microwave OvensMindy Wiriya SarikaNo ratings yet

- Introduction To Accounting and BusinessDocument66 pagesIntroduction To Accounting and BusinessRyan AdhitrieNo ratings yet

- Module 4 - The Essence of Financial StatementsDocument31 pagesModule 4 - The Essence of Financial StatementsBellela DumpNo ratings yet

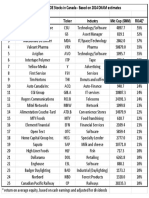

- High ROE Stocks in Canada 2014Document1 pageHigh ROE Stocks in Canada 2014PattyPattersonNo ratings yet

- Advertisement and Promotion Strategy of Jamuna Bank Ltd.Document60 pagesAdvertisement and Promotion Strategy of Jamuna Bank Ltd.SAEID RAHMANNo ratings yet

- Tax Assignment For Mar 7Document3 pagesTax Assignment For Mar 7Marie Loise MarasiganNo ratings yet

- Nishtha (FMCG Industry)Document17 pagesNishtha (FMCG Industry)Nishtha BansalNo ratings yet

- A Profile of The Philippine Pharmaceutical SectorDocument72 pagesA Profile of The Philippine Pharmaceutical SectorTin SagmonNo ratings yet

- May 10Document52 pagesMay 10Assaad ChughtaiNo ratings yet

- Solved Suppose That A Consumer With An Income of 1 000 FindsDocument1 pageSolved Suppose That A Consumer With An Income of 1 000 FindsM Bilal SaleemNo ratings yet

- Iapm Assignment-Wps OfficeDocument4 pagesIapm Assignment-Wps OfficeTushar AroraNo ratings yet

- Strategy Formulation and Implementation For An Expansion Strategy BlaBlaCar Middle East Aboud KhederchahDocument9 pagesStrategy Formulation and Implementation For An Expansion Strategy BlaBlaCar Middle East Aboud KhederchahaboudgkNo ratings yet

- P/E ratio reduction with earnings growthDocument5 pagesP/E ratio reduction with earnings growthMrigank MauliNo ratings yet

- Corporate Governance: PART 3 Strategic Actions: Strategy ImplementationDocument36 pagesCorporate Governance: PART 3 Strategic Actions: Strategy ImplementationBaba YagaNo ratings yet

- AfmDocument10 pagesAfmPrashanth GowdaNo ratings yet

- 25 Surprising Facts About Warren BuffettDocument14 pages25 Surprising Facts About Warren BuffettRushabh KapadiaNo ratings yet

- (EDUCBA) Finance Analyst Courses PDFDocument12 pages(EDUCBA) Finance Analyst Courses PDFMudit NawaniNo ratings yet

- Samsung Conference - EngDocument14 pagesSamsung Conference - Engramannamj4No ratings yet

- Objectives of Business Firm-FinalDocument43 pagesObjectives of Business Firm-FinalId Mohammad100% (3)

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet