Professional Documents

Culture Documents

Intro

Uploaded by

Sahil GulatiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intro

Uploaded by

Sahil GulatiCopyright:

Available Formats

A project is som

Today the b a s e o f t h e c o u n t r y e c o n o m i c d e v e l o p m e n t a n d t r a d e i s d e p e n d i n g u p o n b a n k i n g a n d c r e d i t structure of economy. A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower. The borrower initially receives an amount o f money from the lender, which they are obligated to pay back, but not a l w a ys i n r e g u l a r installments, to the lender. The loan is generally provided at a cost, referred to as interest on the debt. A borrower may be subject to certain restrictions known as loan covenants under the terms of the loan. Acting as a provider of loans is one of the principal tasks for financial institutions. Bank loans and credit are one way to increase the money supply. Now a days loans are easily available and the rate of interest at which they are available at very reasonable rate.

Government too is encouraging people to take loans for certain purpose F o r example, government is encouraging people to take housing loans by giving tax concessions. R u n n i n g a b u s i n e s s i s n e v e r a n e a s y t a s k . O n e i s b o u n d t o f a c e f i n a n c i a l h i c c u p s d u r i n g t h e process. Whether someone is a new generation entrepreneur venturing into a new business or an established businessman planning for a business expansion, whether its money required for an immediate official expansion or it could be the time of recession, when payments don't come on time but the expenditures can't wait, the business loans ease our way through a scary road of financial crisis and open the world of new business heights for you. Financial institutions like banks offer the business loan to bail us out. I have undertaken a study at Retail Loan Factory, Bank of Baroda which deals with preparation of loan proposals.

Project Description The title of the project is Credit Analysis in Retail Loan Factory of Bank of Baroda. This project deals with reviewing the credit worthiness of the borrower before sanctioning of a loan. It deals with analysis of the data provided by the company and following all the formalities as under the norms of the bank and finally making a loan appraisal after analyzing the credit worthiness of the borrower. As I am student of financial management, I taken keen interest in areas concerned with the banking. As banks play a vital role in economic development, credit creation and overall up liftmen of common people. I thought it would fit to select a subject having focus attention of

many banks operating in our country. In my project, I am focusing light on the extent what are the procedure of bank of baroda sanctioning the loan. The project deals with first getting the loan proposals from the clients and making the appraisal note. It gives a practical insight of the procedures followed by the bank in ascertaining the creditworthiness of the borrower. They first collect all the documents required and then start the analyzing procedure by making LAPs entry, verification of the documents and also with the help of CIBIL report we can ascertain the creditability history of the borrower and after feeding the detail in Lap and knowing the CIBIL report ranking is given to borrower and based upon this ranking we decide whether to sanctioned the loan or not. Certain scores are given to the applicant and if the applicant score is above the cut off score he/she is granted loan.

You might also like

- Sarfaesi ActDocument68 pagesSarfaesi ActkarteekjrNo ratings yet

- Table of Content: Sr. No Content Page No. 1 Executve Summary 2 3 Profile of The Organization 4 Research Methodology 5 6 7Document11 pagesTable of Content: Sr. No Content Page No. 1 Executve Summary 2 3 Profile of The Organization 4 Research Methodology 5 6 7Přẳshẳɳţ PẳţīłNo ratings yet

- TABLE OF CONTENTS AND EXECUTIVE SUMMARYDocument11 pagesTABLE OF CONTENTS AND EXECUTIVE SUMMARYPřẳshẳɳţ PẳţīłNo ratings yet

- Banks Loan GuideDocument76 pagesBanks Loan GuidePreshu FuriaNo ratings yet

- Understanding Loans and AdvancesDocument51 pagesUnderstanding Loans and AdvancesNaveen KNo ratings yet

- Credit Analysis Purpose and Factors To Be Considered An OverviewDocument69 pagesCredit Analysis Purpose and Factors To Be Considered An OverviewLily SequeiraNo ratings yet

- Project Report of Lok Nath BhusalDocument69 pagesProject Report of Lok Nath BhusalManoj Yadav100% (1)

- Loan and AdvancesDocument9 pagesLoan and AdvancesSumit NaugraiyaNo ratings yet

- Loan Discounts Finance 7Document41 pagesLoan Discounts Finance 7Elvie Anne Lucero ClaudNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceSandesh UdhaneNo ratings yet

- Basic principles of bank lending under 40 charactersDocument2 pagesBasic principles of bank lending under 40 charactersAnurag Shekhawat0% (1)

- Loans and Advances: Aishwarya ParthasarathyDocument31 pagesLoans and Advances: Aishwarya ParthasarathyNikita Rane InamdarNo ratings yet

- Credit AppraisalDocument89 pagesCredit AppraisalSkillpro KhammamNo ratings yet

- Credit Guides (4)Document35 pagesCredit Guides (4)Subramanian NadarNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- Name: Dharshini S College: Sri Krishna College of Technology Topic: BankingDocument25 pagesName: Dharshini S College: Sri Krishna College of Technology Topic: BankingDharshini SelvarajNo ratings yet

- Functions of Commercial BanksDocument10 pagesFunctions of Commercial BanksGaganjot KaurNo ratings yet

- GanuDocument39 pagesGanuRushikesh JagtapNo ratings yet

- Research Design and Debt Recovery ManagementDocument24 pagesResearch Design and Debt Recovery ManagementSreenivas100% (1)

- Loan Syndication GuideDocument49 pagesLoan Syndication GuideShruthi ShettyNo ratings yet

- Loan SyndicationDocument36 pagesLoan SyndicationSatish Tiwari100% (1)

- SCFS Cooperative Bank LTDDocument64 pagesSCFS Cooperative Bank LTDLïkïth RäjNo ratings yet

- ProjectDocument8 pagesProjectYograj PawarNo ratings yet

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFDocument28 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFMOHAMMED KHAYYUMNo ratings yet

- Loans & Advances Study at Ujjivan BankDocument75 pagesLoans & Advances Study at Ujjivan Banksachin mohanNo ratings yet

- What Is A Bank?Document6 pagesWhat Is A Bank?Bhabani Sankar DashNo ratings yet

- Credit Risk AssessmentDocument8 pagesCredit Risk Assessmentmahita_m4a3081No ratings yet

- Assignment Writer - AssignmentGPT AIDocument1 pageAssignment Writer - AssignmentGPT AIakshatbahuguna487No ratings yet

- Mastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtFrom EverandMastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtNo ratings yet

- Chapter One: 1.1 Background of The StudyDocument33 pagesChapter One: 1.1 Background of The StudyCA Aadesh KandelNo ratings yet

- Credit Appraisal For Term Loan and Working Capital AssessmentDocument64 pagesCredit Appraisal For Term Loan and Working Capital AssessmentTaran Deep Singh100% (2)

- Dipali Project ReportDocument58 pagesDipali Project ReportAshish MOHARENo ratings yet

- Name-Madona Dkhar Class - MBA 2 Sem ID/Enrollment no:18FMPCMSD 01017 Topic: Loans and AdvanceDocument4 pagesName-Madona Dkhar Class - MBA 2 Sem ID/Enrollment no:18FMPCMSD 01017 Topic: Loans and AdvanceMadona DkharNo ratings yet

- Term Paper On Credit ManagementDocument7 pagesTerm Paper On Credit Managementea428adh100% (1)

- Unit 2 Trade Credit RiskDocument15 pagesUnit 2 Trade Credit Risksaurabh thakurNo ratings yet

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- Report On Working Capital Loan (Prime Bank)Document29 pagesReport On Working Capital Loan (Prime Bank)rrashadatt100% (3)

- A Navigator Study On Responsible Lending For India'Document6 pagesA Navigator Study On Responsible Lending For India'Ni007ckNo ratings yet

- Debt MarketDocument104 pagesDebt MarketOmkar Rohekar100% (1)

- Banks' Lending Functions and Loan ProductsDocument26 pagesBanks' Lending Functions and Loan ProductsAshish Gupta100% (1)

- Project ReportDocument77 pagesProject ReportPiyush MaheshwariNo ratings yet

- Restrictions on loans and advances by banksDocument28 pagesRestrictions on loans and advances by banksleela naga janaki rajitha attiliNo ratings yet

- Loan PredictionDocument37 pagesLoan PredictionManashi DebbarmaNo ratings yet

- Sunu Finale Blackbook 2309Document70 pagesSunu Finale Blackbook 2309Tanvi PawarNo ratings yet

- Internship Report On Credit Policy of Brac Bank LTDDocument54 pagesInternship Report On Credit Policy of Brac Bank LTDwpushpa23No ratings yet

- BBA 1 Banking CRM AssigmnentDocument10 pagesBBA 1 Banking CRM Assigmnentkotit35No ratings yet

- Credit Appraisal IBDocument48 pagesCredit Appraisal IBHenok mekuriaNo ratings yet

- Loan Management Literature ReviewDocument4 pagesLoan Management Literature Reviewixevojrif100% (1)

- Bank Credit Loans TrustDocument8 pagesBank Credit Loans TrustN.O. Vista100% (1)

- Consumer FinanceDocument15 pagesConsumer Financechaudhary9267% (3)

- Credit Appraisal Process & Financial ParametersDocument35 pagesCredit Appraisal Process & Financial ParametersAbhishek Barman100% (1)

- Credit Appraisal For Term Loan And: Working Capital FinancingDocument93 pagesCredit Appraisal For Term Loan And: Working Capital FinancingRohit AggarwalNo ratings yet

- Modern Banking Trends ResearchDocument55 pagesModern Banking Trends ResearchYashasvi ShekhawatNo ratings yet

- Sunaina 2023 BlackbookDocument70 pagesSunaina 2023 BlackbookTanvi PawarNo ratings yet

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Individual Assgn Investment QamaDocument1 pageIndividual Assgn Investment QamaPuteri Noor SyahiraNo ratings yet

- Loans &advances (Mantu) - Project - 1-2Document48 pagesLoans &advances (Mantu) - Project - 1-2Shivu BaligeriNo ratings yet

- Everything You Need to Know About Bank FunctionsDocument15 pagesEverything You Need to Know About Bank FunctionsppperfectNo ratings yet

- Lecture 3 - Loans - AdvancesDocument16 pagesLecture 3 - Loans - AdvancesYvonneNo ratings yet

- PDTHEANTDocument25 pagesPDTHEANTSahil GulatiNo ratings yet

- CWE Clerks III AdvtDocument31 pagesCWE Clerks III Advtmahendernayal0070% (1)

- CTR Declaration (131,151,152)Document1 pageCTR Declaration (131,151,152)discvrNo ratings yet

- CAS Explained: What is Cash Sales and the Cash Conversion CycleDocument2 pagesCAS Explained: What is Cash Sales and the Cash Conversion CycleSahil GulatiNo ratings yet

- Booking ReceiptDocument1 pageBooking ReceiptKaran MalhotraNo ratings yet

- ResearchDocument2 pagesResearchSahil GulatiNo ratings yet

- CAS Explained: What is Cash Sales and the Cash Conversion CycleDocument2 pagesCAS Explained: What is Cash Sales and the Cash Conversion CycleSahil GulatiNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummarySahil GulatiNo ratings yet

- Urban DesignDocument22 pagesUrban DesignAbegail CaisedoNo ratings yet

- Appendix A Sample Format For A Letter Ruling RequestDocument4 pagesAppendix A Sample Format For A Letter Ruling RequestJohn Erickson YapNo ratings yet

- Action Plan To Control The BreakagesDocument1 pageAction Plan To Control The BreakagesAyan Mitra75% (4)

- FABTEKDocument11 pagesFABTEKKarthik ArumughamNo ratings yet

- 1.1 Introduction To PartnershipDocument5 pages1.1 Introduction To PartnershipXyril MañagoNo ratings yet

- Corporate Governance Assignment by JunaidDocument3 pagesCorporate Governance Assignment by JunaidTanzeel HassanNo ratings yet

- Chap 04Document87 pagesChap 04Tùng NguyễnNo ratings yet

- Distributor Agreement CleanDocument16 pagesDistributor Agreement CleanMd. Akmal HossainNo ratings yet

- Pay Out DecisionDocument19 pagesPay Out DecisiondawncpainNo ratings yet

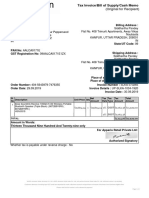

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Satyam SinghNo ratings yet

- IGNOU MBS MS-09 Solved Assignments 2010Document19 pagesIGNOU MBS MS-09 Solved Assignments 2010jayakumargarudaNo ratings yet

- ENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorDocument2 pagesENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorOussama AmaraNo ratings yet

- B Plan Mobile SalonDocument4 pagesB Plan Mobile SalonShristi Gupta100% (1)

- Using Oracle Business Intelligence Cloud Service PDFDocument274 pagesUsing Oracle Business Intelligence Cloud Service PDFDilip Kumar AluguNo ratings yet

- Tutorial Chapter 4 Product and Process DesignDocument29 pagesTutorial Chapter 4 Product and Process DesignNaKib NahriNo ratings yet

- MTC Strategic Plan 2012 To 2016Document42 pagesMTC Strategic Plan 2012 To 2016Ash PillayNo ratings yet

- Presentacion Evolucion Excelencia Operacional - Paul Brackett - ABBDocument40 pagesPresentacion Evolucion Excelencia Operacional - Paul Brackett - ABBHERMAN JR.No ratings yet

- Sally Yoshizaki Vs Joy Training Case DigestDocument5 pagesSally Yoshizaki Vs Joy Training Case DigestPebs DrlieNo ratings yet

- PD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016Document36 pagesPD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016DaraNo ratings yet

- General Awareness 2015 For All Upcoming ExamsDocument59 pagesGeneral Awareness 2015 For All Upcoming ExamsJagannath JagguNo ratings yet

- MTAP Saturday Math Grade 4Document2 pagesMTAP Saturday Math Grade 4Luis SalengaNo ratings yet

- Fusion Human Capital Management: An Oracle White Paper October 2013Document20 pagesFusion Human Capital Management: An Oracle White Paper October 2013subbaraocrmNo ratings yet

- Kalyan Pharma Ltd.Document33 pagesKalyan Pharma Ltd.Parth V. PurohitNo ratings yet

- Master of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramDocument20 pagesMaster of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramThilli KaniNo ratings yet

- Ihc Insight Aug 2015Document21 pagesIhc Insight Aug 2015Advan ZuidplasNo ratings yet

- Isaca Cisa CoursewareDocument223 pagesIsaca Cisa Coursewareer_bhargeshNo ratings yet

- The Polka-Unilever Merger in PakistanDocument1 pageThe Polka-Unilever Merger in PakistanirfanNo ratings yet

- Important Banking abbreviations and their full formsDocument10 pagesImportant Banking abbreviations and their full formsSivaChand DuggiralaNo ratings yet

- CH 09Document35 pagesCH 09ReneeNo ratings yet

- Scope and Methods of EconomicsDocument4 pagesScope and Methods of EconomicsBalasingam PrahalathanNo ratings yet