Professional Documents

Culture Documents

Q2FY12 Results Tracker 13.10.11

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q2FY12 Results Tracker 13.10.11

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

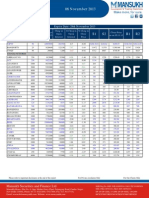

Results Tracker

Q2FY12

Thursday, 13 Oct 2011 make more, for sure.

Results to be Declared on 13th Oct 2011

COMPANIES NAME

AP Paper ASAHI IND Avantel Jaybharat Tex Kajaria Cerm KSL Inds Piramal Life Praj Inds Transwarranty Fin VST Inds

Results Announced on 12th Oct 2011 (Rs Million)

Infosys

Quarter ended 201109 Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%) 74700 3920 27420 0 27420 2010 25410 7190 0 18220 2870 36.71 201009 64250 2480 24240 0 24240 1870 22370 5960 0 16410 2870 37.73 % Var 16.26 58.06 13.12 0 13.12 7.49 13.59 20.64 0 11.03 0 -2.71 Year to Date 201109 143750 8070 52310 0 52310 3920 48390 13630 0 34760 2870 36.39 201009 121830 4980 45230 0 45230 3670 41560 10840 0 30720 2870 37.13 % Var 17.99 62.05 15.65 0 15.65 6.81 16.43 25.74 0 13.15 0 -1.98 Year ended 201103 253850 11470 95610 0 95610 7400 88210 23780 0 64430 2870 37.66 201003 211400 9190 82790 0 82790 8070 74720 17170 0 57550 2870 39.16 % Var 20.08 24.81 15.48 0 15.48 -8.3 18.05 38.5 0 11.95 0 -3.83

The revenue for the September 2011 quarter is pegged at Rs. 74700.00 millions, about 16.26% up against Rs. 64250.00 millions recorded during the year-ago period.The Company has registered profit of Rs. 18220.00 millions for the quarter ended September 2011, a growth of 11.03% over Rs. 16410.00 millions millions achieved in the corresponding quarter of last year.OP of the company witnessed a marginal growth to 27420.00 millions from 24240.00 millions in the same quarter last year.

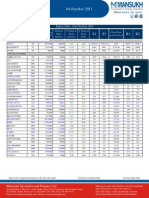

Pennar Industries

Quarter ended Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%) 201109 2381.25 1.45 303.22 23.94 279.28 31.78 247.5 87.3 7.7 160.2 610.12 11.59 201009 2403.42 1 325.71 28.2 297.5 27.22 270.28 99.75 19.26 170.53 610.12 12.33 % Var -0.92 45 -6.9 -15.11 -6.12 16.75 -8.43 -12.48 -60.02 -6.06 0 -5.97 Year to Date 201109 5035.4 3.88 640.08 50.4 589.68 63.65 526.03 187 15.4 339.03 610.12 12.71 201009 4906.07 2.19 647.15 60.8 586.33 54.14 532.19 197.01 38.52 335.18 610.12 13.19 % Var 2.64 77.17 -1.09 -17.11 0.57 17.57 -1.16 -5.08 -60.02 1.15 0 -3.63 Year ended 201103 10720.94 10.62 1341.41 102.89 1238.52 111.55 1126.97 432.34 57.78 694.63 610.12 11.39 201003 7712.93 4.17 1094.35 113.71 980.64 123.91 856.74 356.04 127.2 500.7 610.12 13.11 % Var 39 154.68 22.58 -9.52 26.3 -9.97 31.54 21.43 -54.58 38.73 0 -13.18

The revenue slipped marginally during the September 2011 quarter. A decline of about Rs. 2381.25 millions was observed as compared to Rs. 2403.42 millions during the corresponding quarter last year.The Net Profit of the company registered a slight decline of -6.06% to Rs. 160.20 millions from Rs. 170.53 millions.A decline of 303.22 millions was observed in the OP in the quarter ended September 2011 from 325.71 millions on QoQ basis.

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

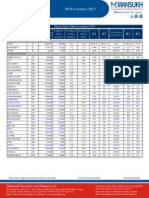

Results Tracker

Q2FY12 make more, for sure.

Data Source : ACE Equity

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

You might also like

- Results Tracker 18.07.2012Document2 pagesResults Tracker 18.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 12.01.12Document2 pagesResults Tracker 12.01.12Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 17.07.2012Document2 pagesResults Tracker 17.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 11.07.2012Document2 pagesResults Tracker 11.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 10.07.2012Document2 pagesResults Tracker 10.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 14.10.11Document3 pagesQ2FY12 Results Tracker 14.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 12.07.2012Document2 pagesResults Tracker 12.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 10.01.13Document2 pagesResults Tracker 10.01.13Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 19 July 2012Document4 pagesResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionDocument5 pagesQ2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Annual Report 2010 11Document80 pagesAnnual Report 2010 11infhraNo ratings yet

- Cebbco Spa 030412Document3 pagesCebbco Spa 030412RavenrageNo ratings yet

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument15 pagesPak Elektron Limited: Condensed Interim FinancialImran RjnNo ratings yet

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- GmmpfaudlerDocument16 pagesGmmpfaudlerJay PatelNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Corporate Actions Released Year 2011 - ProshareDocument108 pagesCorporate Actions Released Year 2011 - ProshareProshareNo ratings yet

- Daily Derivative Report 11.09.13Document3 pagesDaily Derivative Report 11.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- HDFCDocument78 pagesHDFCsam04050No ratings yet

- Daily Derivative Report 30.09.13Document3 pagesDaily Derivative Report 30.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- BIMBSec - TM 1QFY12 Results Review - 20120531Document3 pagesBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- HDFC Bank AnnualReport 2012 13Document180 pagesHDFC Bank AnnualReport 2012 13Rohan BahriNo ratings yet

- Daily Derivative Report 19.09.13Document3 pagesDaily Derivative Report 19.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- Ratios Analysis: Lahore Leads UniversityDocument24 pagesRatios Analysis: Lahore Leads UniversityZee ShanNo ratings yet

- 2011 Consolidated All SamsungDocument43 pages2011 Consolidated All SamsungGurpreet Singh SainiNo ratings yet

- Quarterly Report March 31, 2012Document38 pagesQuarterly Report March 31, 2012Zubair Ahmad BhuttaNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- 1st Quarter ReportDocument9 pages1st Quarter ReportammarpkrNo ratings yet

- NIC Annual Statistics Review 2010-2011Document14 pagesNIC Annual Statistics Review 2010-2011ddh21No ratings yet

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyNo ratings yet

- China Telecom: Smartphones For All Segments and SeasonsDocument4 pagesChina Telecom: Smartphones For All Segments and SeasonsNate Joshua TanNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- Rs 490 Hold: Key Take AwayDocument5 pagesRs 490 Hold: Key Take AwayAnkush SaraffNo ratings yet

- Daily Technical Report: Sensex (16846) / NIFTY (5110)Document4 pagesDaily Technical Report: Sensex (16846) / NIFTY (5110)Angel BrokingNo ratings yet

- CTC - Corporate Update - 10.02.2014Document6 pagesCTC - Corporate Update - 10.02.2014Randora LkNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- 5.1 Role of Commercial BanksDocument5 pages5.1 Role of Commercial Banksbabunaidu2006No ratings yet

- XXX Marketing StrategyDocument9 pagesXXX Marketing StrategyJoel MitchellNo ratings yet

- Factors Causing Enron'S Collapse: An Investigation Into Corporate Governance and Company CultureDocument9 pagesFactors Causing Enron'S Collapse: An Investigation Into Corporate Governance and Company CultureMilleng StrauiaNo ratings yet

- Eli Lilly & CoDocument14 pagesEli Lilly & Corohitmahnot1989100% (3)

- THE TIMES BUSINESS - UK - JUNE 13 TH 2021Document14 pagesTHE TIMES BUSINESS - UK - JUNE 13 TH 2021Pepe LuisNo ratings yet

- Absa Personal Share Portfolio One PDFDocument2 pagesAbsa Personal Share Portfolio One PDFmarko joosteNo ratings yet

- Financial and Strategic Analysis of First Udl ModarabaDocument16 pagesFinancial and Strategic Analysis of First Udl ModarabaFaria AlamNo ratings yet

- Euronext Derivatives How The Market Works-V2 PDFDocument106 pagesEuronext Derivatives How The Market Works-V2 PDFTomNo ratings yet

- Quant Checklist 172 PDF 2022 by Aashish AroraDocument79 pagesQuant Checklist 172 PDF 2022 by Aashish Arorarajnish sharmaNo ratings yet

- Klse 20180306Document46 pagesKlse 20180306Edwin AngNo ratings yet

- Principles of Accounts: Paper 7110/01 Multiple ChoiceDocument5 pagesPrinciples of Accounts: Paper 7110/01 Multiple ChoiceNanda SinghNo ratings yet

- Week 4 An Overview of Corporate FinancingDocument40 pagesWeek 4 An Overview of Corporate FinancingPol 馬魄 MattostarNo ratings yet

- ch1 Notes CfaDocument18 pagesch1 Notes Cfaashutosh JhaNo ratings yet

- A Nation Without Education Is Little More Than A Gathering ofDocument3 pagesA Nation Without Education Is Little More Than A Gathering ofĀLįįHaiderPanhwerNo ratings yet

- Managing the Finance Function for Engineering FirmsDocument6 pagesManaging the Finance Function for Engineering FirmsGillianne Mae VargasNo ratings yet

- Trade War Between US and ChinaDocument1 pageTrade War Between US and ChinaRajarshi MaityNo ratings yet

- Capital Structure Theories VivaDocument43 pagesCapital Structure Theories VivaPuttu Guru PrasadNo ratings yet

- Macro Tutorial 1 (Jan 10, 2018)Document4 pagesMacro Tutorial 1 (Jan 10, 2018)shashankNo ratings yet

- 3 - Gordon Scott - Technical Analysis Modern Perspectives PDFDocument45 pages3 - Gordon Scott - Technical Analysis Modern Perspectives PDFrfernandezNo ratings yet

- MAS ADVISORY SERVICES GUIDEDocument3 pagesMAS ADVISORY SERVICES GUIDEchowchow123No ratings yet

- Proposal Preparation of Manganese Ore and Copper OreDocument17 pagesProposal Preparation of Manganese Ore and Copper OreleniucvasileNo ratings yet

- KBC Trial BalanceDocument9 pagesKBC Trial Balanceapi-2486948440% (1)

- Commercial Banking FunctionsDocument26 pagesCommercial Banking FunctionsMd Mohsin AliNo ratings yet

- FN1024 Za - 2019Document7 pagesFN1024 Za - 2019cookieproductorNo ratings yet

- ToA.1830 - Accounting Changes and Errors - OnlineDocument3 pagesToA.1830 - Accounting Changes and Errors - OnlineJolina ManceraNo ratings yet

- AGPM Business PlanDocument10 pagesAGPM Business PlanOlome EmenikeNo ratings yet

- 2 Taxation of International TransactionsDocument7 pages2 Taxation of International TransactionssumanmehtaNo ratings yet

- Alemayehu Geda: Department of Economics Addis Abeba University EmailDocument38 pagesAlemayehu Geda: Department of Economics Addis Abeba University Emailassefa mengistuNo ratings yet

- AssesmentDocument31 pagesAssesmentLoudie ann MarcosNo ratings yet

- 12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFDocument20 pages12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFAlexis Gonzalez PerezNo ratings yet