Professional Documents

Culture Documents

BPR Article 3 - New

Uploaded by

Saravana Kumar MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BPR Article 3 - New

Uploaded by

Saravana Kumar MCopyright:

Available Formats

Business process re-engineering: A tool to further banks' strategic goals In a volatile global world, organisations enhance competitive advantage

through business process re-engineering (BPR) by radically redesigning selected processes. BPR implies transformed processes that together form a component of a larger system aimed at enabling organisations to empower themselves with contemporary technologies, business solutions and innovations. Michael Hammer and James Champy's definition "the fundamental reconsideration and radical redesign of organisational processes, in order to achieve drastic improvement of current performance in cost, service and speed'' (Reengineering the Corporation: A manifesto for Business Revolution, 1993) enjoys a fair measure of consensus. The multiplier effects of BPR provide an impetus to the industry through impressive success across companies. For example, radical and fundamentally new BPR ways enabled Motorola to slash order fulfilment for paging devices from 30 days or more to 28 minutes and progressive insurance to slash the claims settlement from 31 days to 4 hours. Honing a concept Today's business computing with multi-tasking and background processing demands intelligent and prudent solutions. This blueprint for change is also necessary to keep systems responsive and users operating at peak efficiency. "In the early 1990s, as businesses were busy reinventing themselves, they focussed on reorienting their departmental functions into enterprise business processes This process, known as reengineering, depended on new enterprise software products that had the ability to share data on customers, products, and suppliers with all members of the enterprise. The rise of enterprise resource planning (ERP) software and relational databases was in direct response to this need." The new growth formula BPR benefits customers through significantly reduced transaction time, flexibility in servicing and improved value chain of service. Banks are benefited by increased volume of business and higher productivity, reduced operating cost leading to higher profitability, improved employee loyalty and sense of belongingness and establishment of "Bank within a Branch'' concept. mployees benefit through empowerment leading to higher job satisfaction, effective job rotation as an additional incentive and effective interface with customers as work load is evenly distributed. The resounding success of value players such as, Dell Inc., Cisco Systems Inc., Wal-Mart Stores Inc., Target, Aldi, ASDA, E*Trade Financial, JetBlue Airways, Ryanair and Southwest Airlines clearly shows that apart from technological competence, the process of `work' itself also changes.

Changing dynamics of banking and financial institutions market in India forced players at all levels to reengineer their operations and functions to meet the emerging challenges of slashing operating cost, outsourcing, portfolio investment, payments and settlements systems, consolidation and cooperation. Innovative banking practices enabled Indian banks to incorporate strategic innovative customer-centric schemes to bridge the service and product gap inherent in the banking system. The major differentiating parameter that distinguishes the new private sector banks in India from other banks in the system is the high level of service. Such far-reaching changes are basically aimed at maintaining long-term profitability and strengthening the competitive edge of banks in conformity with transforming market realities.. Long way to go Easier access to information, availability of cheaper and easier funds, reduced inventory levels, reduction in direct administrative employment and customisation of product/service unmistakably reveals that a successful company requires a threshold level of performance in terms of three key parameters customer service, product innovation and operational excellence and a clear leadership in one dimension. Given the interplay between BPR and sustainable economic growth for banks and financial institutions, development strategies must be broadened to incorporate these three critical dimensions for secular dynamic change and structural transformation. We need to adopt effective strategies for consolidating core competencies and exploring new options for sustained fast-track development on an ongoing basis and effecting midcourse correction, wherever necessary. Accordingly, BPR in India must constitute a focal area of ongoing banking reforms.

You might also like

- AnjenDocument5 pagesAnjenSaravana Kumar MNo ratings yet

- Advanced Excel TipsDocument34 pagesAdvanced Excel TipsSatish NamballaNo ratings yet

- Soy Protein 2007 PDFDocument20 pagesSoy Protein 2007 PDFSaravana Kumar MNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- InfyDocument17 pagesInfySaravana Kumar MNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- IT OverviewDocument13 pagesIT OverviewSaravana Kumar MNo ratings yet

- DHARMADocument2 pagesDHARMASaravana Kumar MNo ratings yet

- Overcoming obstacles through hard work and persistenceDocument2 pagesOvercoming obstacles through hard work and persistenceSaravana Kumar MNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case No. 23 - Maderada Vs MediodeaDocument3 pagesCase No. 23 - Maderada Vs MediodeaAbbyAlvarezNo ratings yet

- SOP For Master of Business Administration: Eng. Thahar Ali SyedDocument1 pageSOP For Master of Business Administration: Eng. Thahar Ali Syedthahar ali syedNo ratings yet

- Software Quality Assurance FundamentalsDocument6 pagesSoftware Quality Assurance FundamentalsTrendkill Trendkill TrendkillNo ratings yet

- 1-C 2-D3-E4-A5-B6-E7-D8-A9-D10-BDocument36 pages1-C 2-D3-E4-A5-B6-E7-D8-A9-D10-BJewel Emerald100% (4)

- Find optimal solution using Voggel's and modi methodsDocument7 pagesFind optimal solution using Voggel's and modi methodsFrew Tadesse FreNo ratings yet

- Da Vinci CodeDocument2 pagesDa Vinci CodeUnmay Lad0% (2)

- UntitledDocument12 pagesUntitledSolomon JoysonNo ratings yet

- Pinagsanhan Elementary School Kindergarten AwardsDocument5 pagesPinagsanhan Elementary School Kindergarten AwardsFran GonzalesNo ratings yet

- Determining Audience NeedsDocument5 pagesDetermining Audience NeedsOrago AjaaNo ratings yet

- Agrade CAPSIM SECRETS PDFDocument3 pagesAgrade CAPSIM SECRETS PDFAMAN CHAVANNo ratings yet

- HDFC BankDocument6 pagesHDFC BankGhanshyam SahNo ratings yet

- 5 6271466930146640792Document1,225 pages5 6271466930146640792Supratik SarkarNo ratings yet

- Base Rates, Base Lending/Financing Rates and Indicative Effective Lending RatesDocument3 pagesBase Rates, Base Lending/Financing Rates and Indicative Effective Lending Ratespiscesguy78No ratings yet

- When The Rule of Law PrevailsDocument3 pagesWhen The Rule of Law PrevailsMarianne SasingNo ratings yet

- The Power of Habit by Charles DuhiggDocument5 pagesThe Power of Habit by Charles DuhiggNurul NajlaaNo ratings yet

- Chapter-10 E-Commerce Digital Markets, Digital GoodsDocument18 pagesChapter-10 E-Commerce Digital Markets, Digital GoodsHASNAT ABULNo ratings yet

- Indian Leadership Philosophy Focused on Integrity and ServiceDocument13 pagesIndian Leadership Philosophy Focused on Integrity and ServicesapkotamonishNo ratings yet

- Leave Travel Concession PDFDocument7 pagesLeave Travel Concession PDFMagesssNo ratings yet

- Intestate of Luther Young v. Dr. Jose BucoyDocument2 pagesIntestate of Luther Young v. Dr. Jose BucoybearzhugNo ratings yet

- RA 8293 Key Provisions on Compulsory Licensing and Patent RightsDocument30 pagesRA 8293 Key Provisions on Compulsory Licensing and Patent RightsPrincessNo ratings yet

- Invitation to Kids Camp in Sta. Maria, BulacanDocument2 pagesInvitation to Kids Camp in Sta. Maria, BulacanLeuan Javighn BucadNo ratings yet

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroNo ratings yet

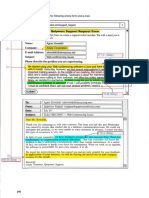

- I I I I I I I: Quipwerx Support Request FormDocument2 pagesI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNo ratings yet

- FAA Airworthiness Directive for Airbus AircraftDocument2 pagesFAA Airworthiness Directive for Airbus AircraftMohamad Hazwan Mohamad JanaiNo ratings yet

- Course Code: DMGT402: COURSE TITLE: Management Practices & Organizational BehaviorDocument1 pageCourse Code: DMGT402: COURSE TITLE: Management Practices & Organizational Behaviortanvirpal singh DhanjuNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- Forecasting - Penilaian BisnisDocument63 pagesForecasting - Penilaian BisnisyuliyastutiannaNo ratings yet

- Tender18342 PDFDocument131 pagesTender18342 PDFKartik JoshiNo ratings yet

- Liberal Arts Program: Myanmar Institute of TheologyDocument6 pagesLiberal Arts Program: Myanmar Institute of TheologyNang Bu LamaNo ratings yet

- Show Me My Destiny LadderDocument1 pageShow Me My Destiny LadderBenjamin Afrane NkansahNo ratings yet