Professional Documents

Culture Documents

GAO Financial Disclosure Letter 10132011

Uploaded by

Sunlight FoundationCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GAO Financial Disclosure Letter 10132011

Uploaded by

Sunlight FoundationCopyright:

Available Formats

The Honorable Gene Dodaro Comptroller General of the United States U.S.

Government Accountability Office 441 G Street, NW Washington, DC 20548 October 13, 2011 Dear Mr. Dodaro: We are writing to urge the GAO to meet its statutory obligation to review the personal financial disclosure system created under the Ethics in Government Act. Specifically, GAO should evaluate whether the executive, legislative, and judicial branches are meeting their obligations to publicly release personal financial disclosure information, whether the systems put in place could be improved, and whether the law itself should be updated. In the 1970s and '80s, GAO often evaluated how government carried out its reporting and disclosure responsibilities.1 In 1989, the Ethics Reform Act formalized that obligation by requiring GAO to "regularly ... conduct a study to determine whether the provisions of this title [Financial Disclosure Requirement of Federal Personnel] are being carried out effectively."2 Between 1989 and 1994, GAO carried out nine studies. In the 17 years since, GAO has released only a single report on this topic, and that was at Congress's request.3 GAO oversight is essential to preserving an effective disclosure system for personal assets. Federal personal financial disclosure requirements were created to promote accountability in high-level officials in all three branches of government. The law requires officials to publicly report financial interests and activities in order to avoid conflicts of interest and promote trust in government. There is much for GAO to evaluate. Do personal financial disclosure reports ask the right questions to permit identification of potential conflicts of interest? Are reports submitted in appropriate formats that permit computer analysis, promote quick identification of data quality problems, and allow real-time release to the public on the Internet? Can the burden on filers and ethics officers be reduced? Should the law be updated to bring the personal financial disclosure system into the 21st century? We welcome the opportunity to discuss this with you further. Please do not hesitate to contact Sunlight policy director, John Wonderlich, at 202-742-1520- x 234 or jwonderlich@sunlightfoundation.com. With best regards, Ellen Miller

1 2 3

http://www.opencongress.org/wiki/GAO_Review_of_Financial_Disclosure_Reports See 5 App. U.S.C. 108. "Federal Judiciary: Assessing and Formally Documenting Financial Disclosure Procedures Could Help Ensure Balance between Judges' Safety and Timely Public Access," June 30, 2004, GAO-04-696NI, unavailable from GAO but available at http://www.famguardian.org/PublishedAuthors/Govt/GAO/GAO-04-696NI.pdf.

You might also like

- Information SessionDocument2 pagesInformation SessionSunlight FoundationNo ratings yet

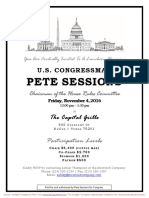

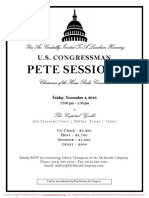

- LuncheonDocument4 pagesLuncheonSunlight FoundationNo ratings yet

- Luncheon For Republican Governors AssociationDocument2 pagesLuncheon For Republican Governors AssociationSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Birthday CelebrationDocument3 pagesBirthday CelebrationSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- Private Screening of Jason Bourne For Pete SessionsDocument2 pagesPrivate Screening of Jason Bourne For Pete SessionsSunlight FoundationNo ratings yet

- FundraiserDocument1 pageFundraiserSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

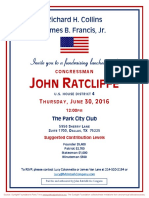

- Reception For John RatcliffeDocument1 pageReception For John RatcliffeSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PVO Standards GuidanceDocument8 pagesPVO Standards GuidanceInterActionNo ratings yet

- Court Decides Case on Merits Despite Improper RemedyDocument3 pagesCourt Decides Case on Merits Despite Improper RemedyFay FernandoNo ratings yet

- Jeffrey Reso Dayap v. Sendiong PDFDocument1 pageJeffrey Reso Dayap v. Sendiong PDFMaria ResperNo ratings yet

- CG ResumeDocument1 pageCG Resumececi317No ratings yet

- Power and InterdependenceDocument2 pagesPower and Interdependencedillards81100% (1)

- Philippine Courts, Justices and Judges: Politics and Governance With The New ConstitutionDocument11 pagesPhilippine Courts, Justices and Judges: Politics and Governance With The New ConstitutionDominick DiscargaNo ratings yet

- The Diocese of Bacolod vs. ComelecDocument4 pagesThe Diocese of Bacolod vs. ComelecJay-r Tumamak83% (6)

- 182-General Milling Corporation v. Viajar G. R. No. 181738 January 30, 2013Document7 pages182-General Milling Corporation v. Viajar G. R. No. 181738 January 30, 2013Jopan SJNo ratings yet

- 7 Maquiling v. COMELEC, 700 SCRA 367 G.R. No. 195649, July 2, 2013 (Foreign Laws How Presented)Document16 pages7 Maquiling v. COMELEC, 700 SCRA 367 G.R. No. 195649, July 2, 2013 (Foreign Laws How Presented)EK ANGNo ratings yet

- Filipino Citizenship SynthesisDocument17 pagesFilipino Citizenship SynthesisColee StiflerNo ratings yet

- Estrada vs. SandiganbayanDocument6 pagesEstrada vs. SandiganbayanRoxan Desiree T. Ortaleza-TanNo ratings yet

- Promoting and Educating Customers: ErvicesDocument28 pagesPromoting and Educating Customers: ErvicesrahilkatariaNo ratings yet

- Dissecting Anti-Terror Bill in The Philippines: A Swot AnalysisDocument15 pagesDissecting Anti-Terror Bill in The Philippines: A Swot AnalysisAdie LadnamudNo ratings yet

- Do You Think That The Philippines Have Achieved The Goals and Functions of A Health SystemDocument3 pagesDo You Think That The Philippines Have Achieved The Goals and Functions of A Health SystemPittzman Acosta0% (1)

- Due Process and Publication of Presidential DecreesDocument256 pagesDue Process and Publication of Presidential DecreesJCNo ratings yet

- Criminal Procedure CodeDocument2 pagesCriminal Procedure Codeswayam72270% (1)

- Digital Campaign Plan for 2020 ElectionDocument9 pagesDigital Campaign Plan for 2020 ElectionBright SamuelNo ratings yet

- Nambi Narayanan Vs Siby Mathew & Ors.Document3 pagesNambi Narayanan Vs Siby Mathew & Ors.Live LawNo ratings yet

- Communication and ConflictDocument6 pagesCommunication and ConflictTijani MammanNo ratings yet

- Presumption Under POCSO Act: Resumption To FfencesDocument7 pagesPresumption Under POCSO Act: Resumption To FfencesamanNo ratings yet

- Kerala rules on dangerous and offensive trade licensesDocument3 pagesKerala rules on dangerous and offensive trade licensesPranav Narayan GovindNo ratings yet

- SKIPS PGDM Fundamentals of Marketing Management Session PlanDocument3 pagesSKIPS PGDM Fundamentals of Marketing Management Session PlanKD GaDhiaNo ratings yet

- Financing Philippine Local GovernmentDocument37 pagesFinancing Philippine Local GovernmentJaycee TualaNo ratings yet

- Anti Terrorism EssayDocument3 pagesAnti Terrorism EssaynikNo ratings yet

- People v. Roluna DigestDocument1 pagePeople v. Roluna DigestJoshua Panlilio100% (1)

- G O-304Document2 pagesG O-304Narii PrassiiNo ratings yet

- 3E5205 Gallagher Contractor Conduct PolicyDocument4 pages3E5205 Gallagher Contractor Conduct PolicybsdygswdywNo ratings yet

- Compunere EnglezaDocument2 pagesCompunere EnglezaIrina SpătaruNo ratings yet

- Drug-Free Workplace PolicyDocument5 pagesDrug-Free Workplace PolicyRez BasilaNo ratings yet

- Reflection Paper: Youth Policy Formulation Manual Summary:: Page - 1Document8 pagesReflection Paper: Youth Policy Formulation Manual Summary:: Page - 1Juan Carlo CastanedaNo ratings yet