Professional Documents

Culture Documents

Annual Quarterly View Ratios

Uploaded by

shampy0021Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Quarterly View Ratios

Uploaded by

shampy0021Copyright:

Available Formats

annual

quarterly

View Ratios

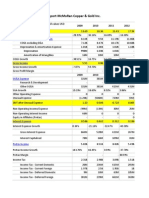

Fiscal year is October-September. All

values USD Millions.

2006

Sales/Revenue

$19,315 $24,006 $32,479 $36,286 $65,067

Sales Growth

Cost of Goods Sold (COGS) incl. D&A

13,717 15,852 21,334 23,469 39,498

2007

2008

2009

2010

24.29% 35.30% 11.72% 79.32%

COGS excluding D&A

13,492 15,535 20,861 22,766 38,471

Depreciation & Amortization

Expense

225

317

473

703

1,027

Depreciation

180

249

363

577

815

Amortization of Intangibles

45

68

110

126

212

COGS Growth

15.56% 34.58% 10.01% 68.30%

Gross Income

5,598

8,154

Gross Income Growth

45.66% 36.68% 15.00% 99.49%

Gross Profit Margin

5-year trend

11,145 12,817 25,569

39.30% NA

annual

quarterly

View Ratios

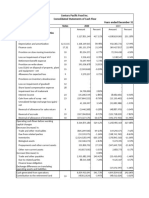

Assets

Fiscal year is October-September. All values

USD Millions.

Cash & Short Term Investments

2006

2007

2008

2009

2010

$10,110 $15,386 $24,490 $23,501 $25,620

Cash Only

200

256

368

1,139

1,690

Short-Term Investments

9,910

15,130 24,122 22,362 23,930

5-year trend

Fiscal year is October-September. All values

USD Millions.

2006

Cash & Short Term Investments Growth -

2007

2008

2009

2010

52.19% 59.17% -4.04% 9.02%

Cash & ST Investments / Total Assets

58.76% 60.70% 61.89% 43.64% 34.08%

Total Accounts Receivable

2,845

4,029

4,704

5,057

9,924

1,593

2,392

2,422

3,361

5,510

Accounts Receivables, Gross

1,645

2,439

2,469

3,413

5,565

Bad Debt/Doubtful Accounts

(52)

(47)

(47)

(52)

(55)

1,252

1,637

2,282

1,696

4,414

Accounts Receivable Growth

41.62% 16.75% 7.50% 96.24%

Accounts Receivable Turnover

6.79

5.96

6.90

7.18

6.56

Inventories

270

346

509

455

1,051

Finished Goods

270

346

509

455

1,051

Work in Progress

Raw Materials

Progress Payments & Other

1,284

2,195

4,987

7,252

5,083

Prepaid Expenses

208

417

2,406

4,012

157

Miscellaneous Current Assets

1,076

1,778

2,581

3,240

4,926

Accounts Receivables, Net

Other Receivables

Other Current Assets

Total Current Assets

5-year trend

14,509 21,956 34,690 36,265 41,678

Operating Activities

Fiscal year is October-September. All values

USD Millions.

2006

2007

2008

2009

2010

Net Income before Extraordinaries

$1,989 $3,496

$4,834 $5,704 $14,013

Net Income Growth

75.77% 38.27% 18.00% 145.67%

Depreciation, Depletion & Amortization

225

317

473

703

1,027

5-year trend

Fiscal year is October-September. All values

USD Millions.

2006

2007

2008

2009

2010

Depreciation and Depletion

180

249

363

577

815

Amortization of Intangible Assets

45

68

110

126

212

Deferred Taxes & Investment Tax Credit 53

78

(368)

(519)

1,440

Deferred Taxes

53

78

(368)

(519)

1,440

Investment Tax Credit

Other Funds

174

254

538

736

903

Funds from Operations

2,441

4,145

5,477

6,624

17,383

Extraordinaries

Changes in Working Capital

(221)

1,325

4,119

3,535

1,212

Receivables

(357)

(385)

(785)

(939)

(4,860)

Inventories

(105)

(76)

(163)

54

(596)

Accounts Payable

1,611

1,494

596

92

6,307

Income Taxes Payable

Other Accruals

Other Assets/Liabilities

(1,370) 292

4,471

4,328

361

Net Operating Cash Flow

2,220

5,470

9,596

10,159 18,595

Net Operating Cash Flow Growth

146.40% 75.43% 5.87% 83.04%

Net Operating Cash Flow / Sales

11.49% 22.79% 29.54% 28.00% 28.58%

5-year trend

Investing Activities

2006

2008

2009

(657) (986)

(1,199)

(1,213)

(2,121)

Capital Expenditures (Fixed

Assets)

(657) (735)

(1,091)

(1,144)

(2,005)

Capital Expenditures (Other

Assets)

(108)

(69)

(116)

Capital Expenditures

2007

(251)

2010

5-year trend

2006

Capital Expenditures Growth

Capital Expenditures / Sales

2007

2008

-50.08%

2009

2010

-21.60% -1.17%

-74.86%

-3.40% -4.11%

-3.69%

-3.34%

-3.26%

Net Assets from Acquisitions

(220)

(638)

Sale of Fixed Assets & Businesses

40

Purchase/Sale of Investments

1,032 (2,312)

(6,760)

(16,147) (11,093)

Purchase of Investments

(7,280) (11,736)

(23,003) (46,825) (57,811)

Sale/Maturity of Investments

8,312 9,424

16,243

30,678

46,718

Other Uses

(58)

(10)

(74)

(2)

Other Sources

49

Net Investing Cash Flow

357

(3,249)

(8,189)

(17,434) (13,854)

Net Investing Cash Flow Growth

-1,010.08% -152.05% -112.90% 20.53%

Net Investing Cash Flow / Sales

1.85% -13.53%

5-year trend

-25.21% -48.05% -21.29%

Financing Activities

2006

Cash Dividends Paid - Total

2007

2008

2009

2010

Common Dividends

Preferred Dividends

(37)

362

359

393

912

Change in Capital Stock

Repurchase of Common &

Preferred Stk.

(355) (3)

(124)

(82)

Sale of Common & Preferred

Stock

318

365

483

475

912

Proceeds from Stock Options

Other Proceeds from Sale of

Stock

318

365

483

475

912

Issuance/Reduction of Debt, Net

5-year trend

2006

2007

2008

2009

2010

Change in Current Debt

Change in Long-Term Debt

Issuance of Long-Term Debt

Reduction in Long-Term Debt

361

377

757

270

345

Other Uses

(406)

Other Sources

361

377

757

270

751

Net Financing Cash Flow

324

739

1,116

663

1,257

Net Financing Cash Flow Growth

128.09% 51.01% -40.59% 89.59%

Net Financing Cash Flow / Sales

1.68% 3.08%

3.44% 1.83%

1.93%

Miscellaneous Funds

Net Change in Cash

2,901 2,960

2,523

(6,612) 5,998

Free Cash Flow

1,563 4,735

8,505

9,015

Other Funds

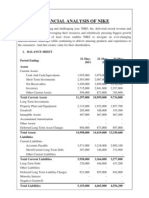

Valuation

P/E Current

25.70

P/E Ratio (including extraordinary items) 15.47

Price to Sales Ratio

4.09

Price to Book Ratio

5.60

Price to Cash Flow Ratio

14.54

Enterprise Value to EBITDA

16.81

Enterprise Value to Sales

3.23

Total Debt to Enterprise Value

0.00

Total Debt to EBITDA

0.00

16,590

5-year trend

EPS (recurring)

14.93

EPS (basic)

15.41

EPS (diluted)

15.15

Efficiency

Revenue/Employee

1.32

Income Per Employee 0.28

Receivables Turnover 8.69

Total Asset Turnover 1.01

Liquidity

Current Ratio 2.01

Quick Ratio 1.96

Cash Ratio

1.24

Profitability

Gross Margin

39.30

Operating Margin

28.08

Pretax Margin

28.49

Net Margin

21.54

Return on Assets

21.72

Return on Equity

37.06

Return on Total Capital

37.06

Return on Invested Capital 37.06

Capital Structure

Total Debt to Total Equity

0.00

Total Debt to Total Capital

0.00

Total Debt to Total Assets

0.00

Long-Term Debt to Equity

0.00

Long-Term Debt to Total Capital 0.00

Long-Term Debt to Assets

0.00

You might also like

- Consolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedDocument6 pagesConsolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedMbanga PennNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document58 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3ch0% (1)

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document71 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNo ratings yet

- Assignment Ratio - A4 SizeDocument4 pagesAssignment Ratio - A4 SizekakurehmanNo ratings yet

- Important Highlights of PT Intiland Development Tbk Annual Report 2010Document2 pagesImportant Highlights of PT Intiland Development Tbk Annual Report 2010adityahrcNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Sewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Document6 pagesSewanee Manufacturing Inc. Summary Historical Operating and Balance Sheet ($ in Millions, Fiscal Year Ending December 31)Tran LyNo ratings yet

- Cielo S.A. and SubsidiariesDocument81 pagesCielo S.A. and Subsidiariesb21t3chNo ratings yet

- Income StatementDocument1 pageIncome StatementKathryn Krizelle WongNo ratings yet

- SMC Financial StatementDocument4 pagesSMC Financial StatementHoneylette Labang YballeNo ratings yet

- Financial Analysis of Automobile Companies Solvency RatiosDocument11 pagesFinancial Analysis of Automobile Companies Solvency RatiosAnuj BehlNo ratings yet

- Financial Statements Year Ended Dec 2010Document24 pagesFinancial Statements Year Ended Dec 2010Eric FongNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Housing Bank for Trade and Finance Financial StatementsDocument10 pagesHousing Bank for Trade and Finance Financial StatementsFadi MashharawiNo ratings yet

- Four Year Financial Performance ReviewDocument15 pagesFour Year Financial Performance ReviewRahmati RahmatullahNo ratings yet

- Year 0 1 2 3 Income StatementDocument56 pagesYear 0 1 2 3 Income StatementKhawaja Khalid MushtaqNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- PepsiCo's Quaker BidDocument54 pagesPepsiCo's Quaker Bidarjrocks23550% (2)

- MCB Bank Limited 2007 Financial Statements ReviewDocument83 pagesMCB Bank Limited 2007 Financial Statements Reviewusmankhan9No ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Macy's 10-K AnalysisDocument39 pagesMacy's 10-K Analysisapb5223No ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- Honda Year at GlanveDocument1 pageHonda Year at GlanveAjmal KhanNo ratings yet

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNo ratings yet

- Fianancial StatementsDocument84 pagesFianancial StatementsMuhammad SaeedNo ratings yet

- Mindtree ValuationDocument74 pagesMindtree ValuationAmit RanderNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- Financial Performance: 10 Year RecordDocument1 pageFinancial Performance: 10 Year RecordnitishNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- Sample Assign From 2018 Student - Rated Excellent For AnalysisDocument11 pagesSample Assign From 2018 Student - Rated Excellent For AnalysisŁøuiša ŅøinñøiNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- COH 3-Statement ModelDocument21 pagesCOH 3-Statement ModelKento OkamotoNo ratings yet

- Good Possibility StocksDocument373 pagesGood Possibility Stockskarkas1No ratings yet

- Financial Analysis of NikeDocument5 pagesFinancial Analysis of NikenimmymathewpkkthlNo ratings yet

- FM S 2012 HW5 SolutionDocument49 pagesFM S 2012 HW5 SolutionInzhu SarinzhipNo ratings yet

- Financial Reporting: Consolidated Statements and NotesDocument66 pagesFinancial Reporting: Consolidated Statements and NotesJorge LazaroNo ratings yet

- Century Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisDocument5 pagesCentury Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisKei SenpaiNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- ITC Ten Years at GlanceDocument1 pageITC Ten Years at Glancevicky_maddy248_86738No ratings yet

- New Heritage Doll Company Financial AnalysisDocument42 pagesNew Heritage Doll Company Financial AnalysisRupesh Sharma100% (6)

- ABB Power Systems & Automation CompanyDocument13 pagesABB Power Systems & Automation CompanyMohamed SamehNo ratings yet

- Example of Financial TemplateDocument2 pagesExample of Financial Templatezeus33No ratings yet

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNo ratings yet

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalNo ratings yet

- Financial Analysis of Top Pakistan Cement CompaniesDocument21 pagesFinancial Analysis of Top Pakistan Cement CompaniesSyedFaisalHasanShahNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Six Years at A Glance: Operating Results 2011 2010 2009Document13 pagesSix Years at A Glance: Operating Results 2011 2010 2009Chaudhry EzHarNo ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Financial Markets: A Beginner's ModuleDocument2 pagesFinancial Markets: A Beginner's Moduledavidd121No ratings yet

- CA April 2012Document10 pagesCA April 2012Teja CHNo ratings yet

- FDSFDocument1 pageFDSFshampy0021No ratings yet

- HistoryDocument11 pagesHistoryFlorina PatrascuNo ratings yet

- RITUDocument3 pagesRITUshampy0021No ratings yet

- TQ - Ans - WK 12Document9 pagesTQ - Ans - WK 12KateNo ratings yet

- Project Report On Ratio Analysis of Kamal Solvent Extractions PVT Ltd.Document48 pagesProject Report On Ratio Analysis of Kamal Solvent Extractions PVT Ltd.Kapil MishraNo ratings yet

- AYN 411 2019 Semester 1 Group Oral Presentation: Business Risk Analysis On BHP Group LimitedDocument27 pagesAYN 411 2019 Semester 1 Group Oral Presentation: Business Risk Analysis On BHP Group LimitedSona GAONo ratings yet

- Income Tax Record KeepingDocument4 pagesIncome Tax Record KeepingMarc Darrell Masangcay OrozcoNo ratings yet

- CH 5 Practice Questions SolutionsDocument24 pagesCH 5 Practice Questions SolutionsChloe IbrahimNo ratings yet

- Casestudy RestaurantDocument13 pagesCasestudy RestaurantAbhishek RastogiNo ratings yet

- BUDIDocument3 pagesBUDIdennyaikiNo ratings yet

- FY22 UG Financial Proforma InstructionsDocument9 pagesFY22 UG Financial Proforma InstructionsBobby ChristiantoNo ratings yet

- Starting and Running A Catering BusinessDocument264 pagesStarting and Running A Catering Businessemargentino100% (4)

- JP Morgan Financial StatementsDocument8 pagesJP Morgan Financial StatementsTamar PirtskhalaishviliNo ratings yet

- List of Accounts SAP Hel-ExportDocument216 pagesList of Accounts SAP Hel-ExportEnrique MarquezNo ratings yet

- House Bill 172Document37 pagesHouse Bill 172WSYX/WTTENo ratings yet

- A Permanent Difference Between Taxable Income and Accounting Profits Results When A RevenueDocument4 pagesA Permanent Difference Between Taxable Income and Accounting Profits Results When A Revenuerohanfyaz00No ratings yet

- zMSQ-07 - Financial Statement AnalysisDocument13 pageszMSQ-07 - Financial Statement AnalysisHania M. CalandadaNo ratings yet

- Analysis Costco & Walt-Mart (Ratios) FinalDocument33 pagesAnalysis Costco & Walt-Mart (Ratios) FinalVerónica Aguilar Villacís100% (1)

- Chapter 1 - An Overview of Bank and Their ServiceDocument7 pagesChapter 1 - An Overview of Bank and Their ServiceDewan AlamNo ratings yet

- Chapter 12 - Solution Manual PDFDocument49 pagesChapter 12 - Solution Manual PDFNatalie ChoiNo ratings yet

- 12sm Accountancy Eng 2021 22Document512 pages12sm Accountancy Eng 2021 22Piyush ChhajerNo ratings yet

- Intercompany Cross Charges TrainingDocument16 pagesIntercompany Cross Charges TrainingNatasha BhalothiaNo ratings yet

- Tax Invoice: Gross Invoice Total Minus Outstanding AmountDocument6 pagesTax Invoice: Gross Invoice Total Minus Outstanding AmountshahsebatiNo ratings yet

- Practice QuestionsDocument353 pagesPractice QuestionsAwais MehmoodNo ratings yet

- PUREGOLD PRICE CLUB INC FINANCIAL STATEMENT ANALYSISDocument90 pagesPUREGOLD PRICE CLUB INC FINANCIAL STATEMENT ANALYSISHanz SoNo ratings yet

- 1999 BIR RulingsDocument74 pages1999 BIR Rulingschris cardinoNo ratings yet

- Financial Analysis of WiproDocument80 pagesFinancial Analysis of WiproSanchit KalraNo ratings yet

- Part-2 Cash Flow Apex Footwear Limited Growth RateDocument11 pagesPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630No ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- CarlsbergDocument11 pagesCarlsbergThayaa BaranNo ratings yet

- Accounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPADocument13 pagesAccounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPACarlo manejaNo ratings yet

- Module 2Document28 pagesModule 2Jiane SanicoNo ratings yet

- Penman 5ed Chap012Document28 pagesPenman 5ed Chap012Hirastikanah HKNo ratings yet