Professional Documents

Culture Documents

Fiji National University ACC501 Computerized Accounting

Uploaded by

Roy GastroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fiji National University ACC501 Computerized Accounting

Uploaded by

Roy GastroCopyright:

Available Formats

FIJI NATIONAL UNIVERSITY ACC501: Computerized Accounting Tutorial: Week 4

DISCUSSION 1-1 Define and describe the 3 types of transaction? 1-2 Illustrate and briefly describe the basic accounting cycle? 1-3 What is a chart of accounts? 1-4 Briefly explain double-entry accounting with an example? 1-5 Debits are bad and credits are good for the business. Dou you agree? Why or why not? EXERCISE 2-1 Transaction Analysis For each of the following transactions, indicate whether the accounts affected are an asset, a liability, equity, an income or an expense. Also indicate whether the accounts are being increased or decreased and whether the increase or decrease is a debit or credit. Example: Paid for advertising Increase an expense [debit], decrease an asset [credit] 1. Owner invested cash. 2. Paid creditor by cheque. 3. Cash payments made for insurance 6 months in advance. 4. Purchased supplies on account. 5. Sold a vehicle for cash. 6. Invoiced a customer for services performed. 7. Owner withdrew from business bank account for private use. 8. Received payment on an account receivable. 9. Issued cheque and took out loan to purchase machinery. 10. Paid for an advertisement aired on television.

2-2 Journal Entries The following transactions occurred in Collins Print Shop. 1. 2. 3. 4. 5. 6. 7. 8. P. Collins, owner, transferred $1700 in cash to the business. Collins hired a new employee at an annual salary of $13 400. The shop completed an order and invoiced the customer $125. The shop purchased a piece of equipment for $9400, paid $1200 by cheque and signed a 1 year, 10% loan payable for the reminder. Collins Print Shop signed an agreement with the secondary school to print 4900 programs for $1290. The business paid $700 to a creditor for paper purchased on credit. The shop paid $600 for rent of the premises. P. Collins withdrew $480 from the business for personal use.

Required: Prepare journal entries for transactions above [1-8]. PROBLEM 3-1 Journal Entries, Ledger and Trial Balance. The 31 may, 2011 trial balance of Joel Tan, Physiotherapist is shown below. Ignore GST. JOEL TAN, PHYSIOTHERAPIST Trial Balance As at 31 May 2007 Account Debit Cash at Bank $9630 Accounts Receivable 4338 Supplies 1116 Prepaid Insurance 738 Furniture and Equipment 23688 Accounts Payable Electricity Account Payable Unearned Revenue J. Tan, Capital J. Tan, Drawings 14652 Services Revenue Salary Expense 15484 Electricity Expense 860 Rent Expense 2124 $72630

Credit

$882 860 264 28624 42000

$72630

The following transactions were completed during June. June 1 Purchased supplies on credit for $523. 3 Received $2 220 from payments on account. 6 Paid the electricity expense of $860, previously recorded. 10 Performed services for $200 that was recorded previously as unearned revenue. 14 Recorded revenue of $16 235 in cash and $1 245 on account. Paid salaries $7 320. 20 Purchased furniture for $1400 and paid by cheque. 23 Paid creditors $640 by cheque. 24 Withdrew $8 000 from the business for personal use. 26 Purchased insurance policy for $420 to cover business assets. 27 Received $1 200 from patients as payment on account. 29 Recorded revenue of $14 360 in cash and $21 000 on credit. 30 Paid rent $2 450. Required: A. Prepare journal entries to record each transaction. B. Post the journal entries to ledger accounts [ Enter the 31 may balances] C. Prepare a trial balance as at 30 June, 2011.

~ THE END ~

You might also like

- The Essence of Success - Earl NightingaleDocument2 pagesThe Essence of Success - Earl NightingaleDegrace Ns40% (15)

- Lesson 4-2Document28 pagesLesson 4-2Alexis Nicole Joy Manatad86% (7)

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- Lesson 2 (Basic Accounting Equation)Document47 pagesLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Accounting Final SyllabusDocument8 pagesAccounting Final SyllabusRoufRobin0% (1)

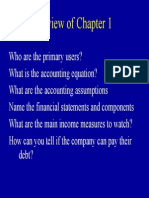

- Review of Ch 1 & 2 Key ConceptsDocument46 pagesReview of Ch 1 & 2 Key ConceptsBookAddict721No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- Etp ListDocument33 pagesEtp ListMohamed MostafaNo ratings yet

- Sec of Finance Purisima Vs Philippine Tobacco Institute IncDocument2 pagesSec of Finance Purisima Vs Philippine Tobacco Institute IncCharlotte100% (1)

- Books 2738 0Document12 pagesBooks 2738 0vinoohmNo ratings yet

- Quality Risk ManagementDocument29 pagesQuality Risk ManagementmmmmmNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- Lesson3-Posting & Balance TransactionDocument21 pagesLesson3-Posting & Balance TransactionQu'est Ce-QueNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- Homework QuestionsDocument17 pagesHomework QuestionsANo ratings yet

- ACCOUNTING FOR DECISION MAKING MID TERM EXAMDocument5 pagesACCOUNTING FOR DECISION MAKING MID TERM EXAMumer12No ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Act1 - Eco1Document2 pagesAct1 - Eco1cedricdimaligalig51No ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Lecture 6 Exercise Financial AccountinngDocument34 pagesLecture 6 Exercise Financial AccountinngNaeem KhanNo ratings yet

- Chapter 3 practice journal entriesDocument6 pagesChapter 3 practice journal entriesRosa Julia LawrenceNo ratings yet

- Chapter 1 - 2 Problems Problem 1: RequiredDocument5 pagesChapter 1 - 2 Problems Problem 1: RequiredManpreet SinghNo ratings yet

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- Exercise For Chapter 2Document2 pagesExercise For Chapter 2Bui AnhNo ratings yet

- 7110 w06 QP 1Document12 pages7110 w06 QP 1mstudy123456No ratings yet

- Assignment 1Document8 pagesAssignment 1SaidurRahamanNo ratings yet

- Accounting Basics - Debit and Credit Rules ExplainedDocument4 pagesAccounting Basics - Debit and Credit Rules ExplainedRuvie Mae Paglinawan100% (1)

- 2.recording ProcessDocument30 pages2.recording Processwpar815No ratings yet

- 07 Case StudiesDocument4 pages07 Case Studiesravitarun31No ratings yet

- This Activity Contains 30 QuestionsDocument19 pagesThis Activity Contains 30 QuestionsSylvan Muzumbwe MakondoNo ratings yet

- Compilation of IFA QuestionsDocument67 pagesCompilation of IFA QuestionsBugoy CabasanNo ratings yet

- Accounting records for new businessDocument21 pagesAccounting records for new businessVismaya SNo ratings yet

- Modyul 1 (Ikatlong Markahan)Document29 pagesModyul 1 (Ikatlong Markahan)delgadojudithNo ratings yet

- Problems Set CDocument5 pagesProblems Set CDiem Khoa PhanNo ratings yet

- U04L1 - HandoutDocument5 pagesU04L1 - HandoutnemeNo ratings yet

- RUBRICS (Ict - eXAM) Final ExaminationDocument4 pagesRUBRICS (Ict - eXAM) Final ExaminationEugene LoyolaNo ratings yet

- New TQDocument7 pagesNew TQroseregineNo ratings yet

- ACC203 Exam I Notes-1Document7 pagesACC203 Exam I Notes-1mariamghader80No ratings yet

- 1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4Document4 pages1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4张兆宇No ratings yet

- Accounting As Basis For Managment DecisionDocument18 pagesAccounting As Basis For Managment DecisionRey ViloriaNo ratings yet

- Journals and LedgersDocument6 pagesJournals and Ledgersayushsapkota907No ratings yet

- CH 03Document8 pagesCH 03waresh360% (1)

- Accounts of Advocates PDFDocument23 pagesAccounts of Advocates PDFfelixmuyove100% (9)

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Topic 5Document20 pagesTopic 5Janely BucogNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocument3 pagesRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- Identifying Accountable TransactionsDocument3 pagesIdentifying Accountable TransactionsCherry RodriguezNo ratings yet

- Please prepare the journal entries for the above transactionsDocument37 pagesPlease prepare the journal entries for the above transactionsAltheaNo ratings yet

- Chapter 01 02 Selected MCQsDocument7 pagesChapter 01 02 Selected MCQsLe Hong Phuc (K17 HCM)No ratings yet

- Fo A I Assignment1Document2 pagesFo A I Assignment1solomon tadeseNo ratings yet

- Lecture Notes Chapters 1-4Document32 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- Individual AssignementDocument7 pagesIndividual Assignementgemechu67% (3)

- Starting a Business: Accounting BasicsDocument64 pagesStarting a Business: Accounting BasicsRenmar CruzNo ratings yet

- ExerciseDocument4 pagesExerciseICS TEAM50% (2)

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- Analyzing Business TransactionsDocument13 pagesAnalyzing Business TransactionsEricJohnRoxasNo ratings yet

- Test Content ReviewDocument40 pagesTest Content ReviewFat AjummaNo ratings yet

- Vydyne® R533H NAT: Ascend Performance Materials Operations LLCDocument4 pagesVydyne® R533H NAT: Ascend Performance Materials Operations LLCJames FaunceNo ratings yet

- Human Resource Management: Chapter One-An Overview of Advanced HRMDocument45 pagesHuman Resource Management: Chapter One-An Overview of Advanced HRMbaba lakeNo ratings yet

- Dewatering Construction Sites Below Water TableDocument6 pagesDewatering Construction Sites Below Water TableSOMSUBHRA SINGHANo ratings yet

- Tita-111 2Document1 pageTita-111 2Gheorghita DuracNo ratings yet

- Rtlo 18918B 1202Document42 pagesRtlo 18918B 1202gustavomosqueraalbornozNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- Frequency Meter by C Programming of AVR MicrocontrDocument3 pagesFrequency Meter by C Programming of AVR MicrocontrRajesh DhavaleNo ratings yet

- 04 Activity 2Document2 pages04 Activity 2Jhon arvie MalipolNo ratings yet

- DX133 DX Zero Hair HRL Regular 200 ML SDS 16.04.2018 2023Document6 pagesDX133 DX Zero Hair HRL Regular 200 ML SDS 16.04.2018 2023Welissa ChicanequissoNo ratings yet

- Vallance - Sistema Do VolvoDocument15 pagesVallance - Sistema Do VolvoNuno PachecoNo ratings yet

- Assignment 2 - p1 p2 p3Document16 pagesAssignment 2 - p1 p2 p3api-31192579150% (2)

- Verifyning GC MethodDocument3 pagesVerifyning GC MethodHristova HristovaNo ratings yet

- Congress Policy Brief - CoCoLevyFundsDocument10 pagesCongress Policy Brief - CoCoLevyFundsKat DinglasanNo ratings yet

- Data SheetDocument14 pagesData SheetAnonymous R8ZXABkNo ratings yet

- 2 - Nested IFDocument8 pages2 - Nested IFLoyd DefensorNo ratings yet

- NDU Final Project SP23Document2 pagesNDU Final Project SP23Jeanne DaherNo ratings yet

- Nuxeo Platform 5.6 UserGuideDocument255 pagesNuxeo Platform 5.6 UserGuidePatrick McCourtNo ratings yet

- Jenga Cash Flow Solution: InstructionsDocument1 pageJenga Cash Flow Solution: InstructionsPirvuNo ratings yet

- HetNet Solution Helps Telcos Improve User Experience & RevenueDocument60 pagesHetNet Solution Helps Telcos Improve User Experience & RevenuefarrukhmohammedNo ratings yet

- Factors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawatDocument26 pagesFactors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawathumeragillNo ratings yet

- Wheat as an alternative to reduce corn feed costsDocument4 pagesWheat as an alternative to reduce corn feed costsYuariza Winanda IstyanNo ratings yet

- HPE Alletra 6000-PSN1013540188USENDocument4 pagesHPE Alletra 6000-PSN1013540188USENMauricio Pérez CortésNo ratings yet

- GE Supplier Add Refresh FormDocument1 pageGE Supplier Add Refresh FormromauligouNo ratings yet

- ASM Architecture ASM Disk Group AdministrationDocument135 pagesASM Architecture ASM Disk Group AdministrationVamsi ChowdaryNo ratings yet

- BCM Risk Management and Compliance Training in JakartaDocument2 pagesBCM Risk Management and Compliance Training in Jakartaindra gNo ratings yet