Professional Documents

Culture Documents

Accountancy March 2008 Eng

Uploaded by

Prasad C MOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy March 2008 Eng

Uploaded by

Prasad C MCopyright:

Available Formats

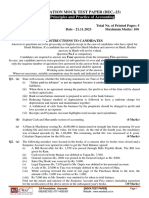

Total No.

of Questions : 24

Code No. March, 2008

30

ACCOUNTANCY

Time : 3 Hours 15 Minutes ( English Version ) SECTION A Answer any eight questions, each carrying two marks. 1. 2. 3. What is statement of affairs ? State any two rules to be followed in the absence of partnership deed. Mention any two factors which determine the goodwill of a partnership firm. 4. Give the journal entry to close partners loan account on dissolution of firm. 5. 6. What is issue of shares at a premium ? Give an example. Under what heading do you show the following in Companys Balance Sheet ? a) b) 7. 8. Forfeited Shares Account Preliminary Expenses. 8 2 = 16 Max. Marks : 100

State any two causes of depreciation. Bring out any two differences between Receipts and Payments account and Income and Expenditure account.

9.

What is data processing ?

10. State any two features of computerised accounting. SECTION B Answer any three questions, each carrying six marks. 3 6 = 18

11. Vikas, a partner in a firm has withdrawn the following amounts during the year ended 31. 12. 2007 : Rs. 6,000 on 31. 03. 2007 Rs. 10,000 on 01. 07. 2007 Rs. 4,000 on 31. 10. 2007 Rs. 1,000 on 31. 12. 2007. Calculate interest on drawings at 6% per annum under product method.

12. Vidya and Vani were partners sharing profits and losses in the ratio of 3:2. They admit Vijaya as a new partner. The new profit sharing is agreed to be 4 : 3 : 2. Calculate the sacrifice ratio of the old partners. 13. Asha, Usha and Nisha were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31. 12. 2006 their Balance Sheet is as follows : Liabilities Creditors Reserve Fund Bills Payable Capitals : Asha Usha Nisha 40,000 20,000 10,000 70,000 Rs. 20,000 10,000 10,000 Assets Cash at Bank Debtors Stock Furniture Buildings Rs. 10,000 30,000 20,000 10,000 40,000

1,10,000

1,10,000

Usha died on 30. 04. 2007. Ushas executors entitled to claim the following: i) ii) iii) iv) v) Her capital as on the date of last Balance Sheet Her share of Reserve Fund Salary Rs. 500 per month Her share of goodwill. Firms goodwill was valued at Rs.20,000. Her share of profit upto the date of death on the basis of previous years profit which was Rs. 24,000. Prepare Ushas Capital Account and ascertain the amount payable to her executors.

14. The Laxmi Company Ltd. issued 10,000 equity shares of Rs.10 each. The amount payable was as follows : On application Rs. 2 On allotment Rs. 3 On 1st & Final Call Rs. 5. All the shares were subscribed and all the money received except the 1st&Final Call on 200 shares. Give Journal entries for issue of shares in the books of the Company. 15. Briefly explain six disadvantages of Computerised Accounting.

SECTION C Answer any four from the following questions, each carrying fourteen marks : 4 14 = 56

16. Mr. Vivek a retail trader has kept his books of accounts under single entry system. The following information is available from his books : Particulars 01. 01. 2007 Rs. 15,000 20,000 25,000 30,000 10,000 15,000 40,000 31. 12. 2007 Rs. 30,000 35,000 40,000 20,000 15,000 40,000 20,000 10,000

Bank Balance Stock in trade Debtors Creditors Investments Furniture Building Motor Vehicle ( 01. 07. 2007 ) Bank overdraft

During the year, he withdrew Rs. 15,000 cash and goods worth Rs.5,000 for his household purpose.

Adjustments : i) ii) iii) iv) v) Write off bad debts Rs. 1,000 and maintain R.D.D. at 5% on debtors. Depreciate Furniture and Motor vehicles at 10%. Appreciate Building at 20%. Interest on overdraft outstanding Rs. 500. Allow interest on capital at 8% p.a.

Prepare : a) b) c) Statement of affairs Statement showing profit or loss Revised statement of affairs as on 31. 12. 2007.

17. Naveen, Nutan and Praveen were partners in a business sharing profits and losses in the ratio of 4 : 3 : 1 respectively. Their Balance Sheet as on 31. 12. 2006 was as follows : Balance Sheet as on 31. 12. 2006 Liabilities Creditors General Reserve Bills Payable Capitals : Naveen Nutan Praveen 25,000 15,000 10,000 50,000 1,02,000 Nutan retired on the above data subject to the following terms : a) b) c) d) Machinery be depreciated by 5%. That stock be appreciated by 10% A bad debts reserve is to be created at 5% on debtors. The goodwill of the firm be valued at Rs. 8,000 and same should be shown in the Balance Sheet of the continuing partners. Rs. 28,000 4,000 20,000 Assets Cash at Bank Bills Receivable Debtors Stock Machinery Furniture Profit & Loss A/c Rs. 7,000 9,000 20,000 30,000 24,000 10,000 2,000 1,02,000

e)

That the total capital of the new firm be fixed at Rs. 50,000 between Naveen and Praveen. The new profit sharing ratio of the remaining partners was agreed at 6 : 4. The capital adjustments are to be made in cash.

Prepare : i) ii) iii) Revaluation Account Partners Capital Accounts Balance Sheet of Continuing Partners.

18. Shruti, Shilpa and Shreya were partners in a firm, sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet on the date of dissolution was as follows : Balance Sheet as on 31. 12. 2006 Liabilities Creditors Bills Payable Shreyas loan General Reserve Capitals : Shruti Shilpa Shreya 40,000 30,000 20,000 90,000 1,58,000 The assets realised as follows : a) Debtors realised 10% less than the book value, the stock realised 15% more than the book value, building realised Rs.60,000. b) c) d) e) The furniture was taken over by Shruti at Rs. 20,000. The machinery was taken over by Shilpa at Rs. 15,000. Creditors and bills payable were paid off at a discount of 5%. Cost of dissolution amounted to Rs. 1,500. 1,58,000 Rs. 30,000 20,000 8,000 10,000 Assets Cash at Bank Debtors Stock Furniture Machinery Building Rs. 6,000 30,000 30,000 22,000 20,000 50,000

Prepare : i) ii) iii) 19. i) ii) iii) Realisation Account Partners Capital Accounts Bank Account.

On 01. 01. 2002, a firm bought Machine X costing Rs. 28,000 and spent Rs.2,000 for its installation. Machine Y was purchased on 01. 07. 2003 for Rs. 40,000. Machine X was sold on 30. 04. 2004 for Rs. 23,000.

Depreciation is to be charged at 10% per annum under Diminishing Balance Method. Show (i) Machinery Account and (ii) Depreciation Account for 4 years ending on 31. 12. 2005. 20. The following is the Balance Sheet of Public Library, Mysore, as on 01.01.2006 was as follows : Balance Sheet as on 01. 01. 2006 Liabilities Outstanding Rent Capital fund Rs. 200 23,800 Books Furniture Outstanding Subscriptions 24,000 Assets Cash in hand Rs. 1,400 14,000 8,000 600 24,000

Receipts and Payments Account for the year ending 31. 12. 2006 Receipts To Cash Balance ,, Subscriptions ,, Entrance Fees ,, Donations ,, Sale of old papers ,, Sundry Receipts Rs. 1,400 12,000 2,000 4,000 1,000 600 Payments By Rent ,, Printing & Stationery ,, Office Expenses ,, Books bought ( 01. 07. 2006 ) ,, Investment in Securities ,, Closing Balance 21,000 10,000 2,000 2,600 21,000 Rs. 2,400 1,200 2,800

Adjustments : i) ii) Outstanding rent on 31. 12. 2006 was Rs. 300. Subscriptions outstanding for the year 2006 amounted to Rs. 400 and Received in advance for the year 2007 was Rs. 800. iii) iv) Half of Entrance fees and entire donations are to be capitalised. Depreciation 10% per annum on Books and 5% per annum on Furniture is to be calculated. Prepare Income and Expenditure Account for the year ending

31. 12. 2006 and also Balance Sheet as on that date. 21. From the following Trial Balance of the Arunodaya Company Ltd. prepare company final accounts as on 31. 03. 2007 in the prescribed form : Trial Balance as on 31. 03. 2007 Particulars Debit Rs. Credit Rs.

Called up Capital ( 20,000 shares of Rs. 5 each ) Calls-in-arrears Stock on 01. 04. 2006 Purchases and Sales Returns Freight Salaries Director's fees Preliminary expenses Debtors and Creditors Furniture Building Goodwill Investments Interest on Investments P & L Appropriation A/c 4,000 34,000 1,05,000 8,000 6,000 15,000 9,800 12,000 24,000 20,000 50,000 64,000 34,000 1,00,000 2,08,000 5,000 28,000 3,000 20,000 Contd.

Particulars Reserve Fund Bad debts Cash at Bank 10% Debentures Dividend

Debit Rs. 3,200 35,000 26,000 4,50,000

Credit Rs. 30,000 56,000 4,50,000

Adjustments : a) b) c) d) e) Closing stock was valued at Rs. 30,000. Transfer Rs. 5,000 to Reserve Fund. Half of Preliminary expenses should be written off. Provide for outstanding debenture Interest for full year. Provide for Reserve for doubtful debts at 5%. SECTION D ( Practical Oriented Questions ) Answer any two of the following questions. Each question carries five marks : 2 5 = 10

22. Prepare Capital Accounts of two partners under Fluctuating Capital System with five imaginary figures. 23. Prepare a Revaluation Account with five imaginary figures. 24. Classify the following Receipts into Capital and Revenue : a) b) c) d) e) Life membership fees Sale of old sports materials Subscriptions Tuition fees Prize amount Rs. 1 lakh received from Lottery.

You might also like

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- 2nd PU Business Studies Model QP 5Document12 pages2nd PU Business Studies Model QP 5Prasad C M83% (6)

- 2nd PU Business Studies Model QP 3Document12 pages2nd PU Business Studies Model QP 3Prasad C M100% (1)

- 2nd PU Business Studies Model QP 2Document9 pages2nd PU Business Studies Model QP 2Prasad C M100% (2)

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- 3hr Paper 4feb 2010Document3 pages3hr Paper 4feb 2010Bhawna BhardwajNo ratings yet

- XII Acct Sample Paper SolvedDocument5 pagesXII Acct Sample Paper SolvedDeepakPhalkeNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Chapter - Partnership Accounts If There Is No Partnership DeedDocument8 pagesChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- c2 Partnership ProblemsDocument6 pagesc2 Partnership ProblemsSiva SankariNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- Accounting Final Sendup 2013Document3 pagesAccounting Final Sendup 2013Mozam MushtaqNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Document5 pagesCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- 9 Partnership Question 4Document7 pages9 Partnership Question 4kautiNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- Introduction To Partnership AccountsDocument20 pagesIntroduction To Partnership Accountsanon_672065362100% (1)

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- Acc Ws Dissolution of Part - FirmDocument12 pagesAcc Ws Dissolution of Part - FirmDhivegaNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- Half Yearly Examination 2011-12 Accounting Class XI-XIIDocument3 pagesHalf Yearly Examination 2011-12 Accounting Class XI-XIISk SinghNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- CBSE Sample Paper Accountancy Class 12 SolvedDocument16 pagesCBSE Sample Paper Accountancy Class 12 SolvedShreya PalejkarNo ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Sale of Partnership To A Limited CompanyDocument5 pagesSale of Partnership To A Limited CompanyRonel Buhay100% (1)

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Accounts Paper I PDFDocument6 pagesAccounts Paper I PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- AccountancyDocument18 pagesAccountancyMeena DhimanNo ratings yet

- Foundation Major Test – 1 Accounting Principles and PracticeDocument5 pagesFoundation Major Test – 1 Accounting Principles and PracticesonubudsNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Paper - 1: Advanced AccountingDocument19 pagesPaper - 1: Advanced AccountingZamda HarounNo ratings yet

- Accounts Paper Ii PDFDocument6 pagesAccounts Paper Ii PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- 2nd PUC Physics Mid Term Nov 2015 PDFDocument1 page2nd PUC Physics Mid Term Nov 2015 PDFPrasad C M82% (11)

- 2nd PUC English Mid Term Nov 2015 PDFDocument4 pages2nd PUC English Mid Term Nov 2015 PDFPrasad C M78% (9)

- 2nd PUC PhysicsJan 2016 PDFDocument2 pages2nd PUC PhysicsJan 2016 PDFPrasad C M90% (10)

- 2nd PUC Kannada Mide Term Nov 2015 PDFDocument2 pages2nd PUC Kannada Mide Term Nov 2015 PDFPrasad C M100% (5)

- 2nd PUC Chemistry Jan 2016 PDFDocument2 pages2nd PUC Chemistry Jan 2016 PDFPrasad C M83% (6)

- 2nd PUC Kannada Jan 2016 PDFDocument2 pages2nd PUC Kannada Jan 2016 PDFPrasad C M81% (16)

- 2nd PUC English Jan 2016 PDFDocument4 pages2nd PUC English Jan 2016 PDFPrasad C M86% (14)

- 2nd PUC Mathematics Mid Term Nov 2015 PDFDocument3 pages2nd PUC Mathematics Mid Term Nov 2015 PDFPrasad C M60% (10)

- 2nd PUC Biology Jan 2016 PDFDocument2 pages2nd PUC Biology Jan 2016 PDFPrasad C M89% (9)

- 2nd PUC Mathematics Jan 2016 PDFDocument2 pages2nd PUC Mathematics Jan 2016 PDFPrasad C M100% (3)

- 2nd PUC Chemistry Mid Term Nov 2015 PDFDocument2 pages2nd PUC Chemistry Mid Term Nov 2015 PDFPrasad C M100% (8)

- 2nd Sem DIP Electrical Circuits - Dec 2015 PDFDocument3 pages2nd Sem DIP Electrical Circuits - Dec 2015 PDFPrasad C M100% (1)

- 2nd Sem DIP Applied Maths 2 - Dec 2015 PDFDocument4 pages2nd Sem DIP Applied Maths 2 - Dec 2015 PDFPrasad C M89% (9)

- 2nd Sem DIP Appied Mathematics 2 - May 2015 PDFDocument4 pages2nd Sem DIP Appied Mathematics 2 - May 2015 PDFPrasad C M100% (8)

- 2nd Sem DIP Electrical Circuits - May 2011 PDFDocument3 pages2nd Sem DIP Electrical Circuits - May 2011 PDFPrasad C MNo ratings yet

- 2nd PUC Biology Mid Term Nov 2015 PDFDocument1 page2nd PUC Biology Mid Term Nov 2015 PDFPrasad C M78% (9)

- 2nd Sem DIP Electrical Circuits - May 2013 PDFDocument3 pages2nd Sem DIP Electrical Circuits - May 2013 PDFPrasad C M100% (2)

- 1st Year DIP Communication Skills in English - Dec 2015 PDFDocument4 pages1st Year DIP Communication Skills in English - Dec 2015 PDFPrasad C M100% (7)

- 2nd Sem DIP Electrical Circuits - May 2015 PDFDocument4 pages2nd Sem DIP Electrical Circuits - May 2015 PDFPrasad C M100% (1)

- 2nd Sem DIP Electrical Circuits - May 2010 PDFDocument3 pages2nd Sem DIP Electrical Circuits - May 2010 PDFPrasad C MNo ratings yet

- 2nd Sem DIP Electrical Circuits - Dec 2014 PDFDocument3 pages2nd Sem DIP Electrical Circuits - Dec 2014 PDFPrasad C MNo ratings yet

- 2nd Sem DIP Electronics 1 - Dec 2015 PDFDocument3 pages2nd Sem DIP Electronics 1 - Dec 2015 PDFPrasad C MNo ratings yet

- 2nd Sem DIP Electrical Circuits - Dec 2012 PDFDocument4 pages2nd Sem DIP Electrical Circuits - Dec 2012 PDFPrasad C MNo ratings yet

- 2nd Sem DIP Electrical Circuits - Dec 2013 PDFDocument3 pages2nd Sem DIP Electrical Circuits - Dec 2013 PDFPrasad C M100% (1)

- 2nd SEM Electronics 1 - May 2012 PDFDocument2 pages2nd SEM Electronics 1 - May 2012 PDFPrasad C MNo ratings yet

- 2nd SEM Electronics 1 - May 2011 PDFDocument2 pages2nd SEM Electronics 1 - May 2011 PDFPrasad C MNo ratings yet

- 2nd SEM Electronics 1 - Nov 2011 PDFDocument3 pages2nd SEM Electronics 1 - Nov 2011 PDFPrasad C MNo ratings yet

- 2nd SEM Electronics 1 - Dec 2014 PDFDocument3 pages2nd SEM Electronics 1 - Dec 2014 PDFPrasad C MNo ratings yet

- Living and Dying With AsbestosDocument6 pagesLiving and Dying With AsbestosYanto100% (1)

- Garcia V JomouadDocument1 pageGarcia V JomouadCinNo ratings yet

- Barry LyndonDocument7 pagesBarry Lyndon212735No ratings yet

- Lok Adalats, DRT, Sarafesi ActiDocument17 pagesLok Adalats, DRT, Sarafesi ActiRaman Kumar SrivastavaNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheetdiscreetmike50No ratings yet

- Bhu Mba 2v Financial Management NotesDocument248 pagesBhu Mba 2v Financial Management NotesJayanth Samavedam100% (1)

- Trust Receipts Remedies (3) PNB Vs PINEDADocument3 pagesTrust Receipts Remedies (3) PNB Vs PINEDAAlejandro de LeonNo ratings yet

- Csec Poa Paper2 Jan2015Document21 pagesCsec Poa Paper2 Jan2015Rochelle Spaulding100% (1)

- Different Kinds of ObligationsDocument4 pagesDifferent Kinds of ObligationsRichmond Robles100% (2)

- Consent and WaiverDocument2 pagesConsent and WaiverLegal FormsNo ratings yet

- Gregory Owens Chapter 7 Bankruptcy PetitionDocument39 pagesGregory Owens Chapter 7 Bankruptcy Petitiondavid_lat100% (1)

- Notice For 2nd CoC Meeting - of Puma Realtors P LTDDocument15 pagesNotice For 2nd CoC Meeting - of Puma Realtors P LTDchamanchandelNo ratings yet

- TP Act NotesDocument10 pagesTP Act Notesgaurav0% (1)

- Ind ChallengeDocument228 pagesInd ChallengePanzi Aulia RahmanNo ratings yet

- Perlas - Ong Yong vs. David TiuDocument2 pagesPerlas - Ong Yong vs. David TiuKen Aliudin100% (1)

- Digests EditedDocument4 pagesDigests EditedRen ConchaNo ratings yet

- Material Adverse Change ClausesDocument4 pagesMaterial Adverse Change ClausesAsad AbbasNo ratings yet

- Business Ethics of Lehman BrothersDocument7 pagesBusiness Ethics of Lehman BrothersPawanJariwalaNo ratings yet

- Commercial Lien On David Malpass, President of The World Bank, and Jerome Powell, Chair of The Federal ReserveDocument25 pagesCommercial Lien On David Malpass, President of The World Bank, and Jerome Powell, Chair of The Federal Reservekaren hudes100% (2)

- Surana and Surana National Corporate Law Moot Court Competition, 2019Document28 pagesSurana and Surana National Corporate Law Moot Court Competition, 2019Khushi AgarwalNo ratings yet

- Clause 16Document15 pagesClause 16floc79100% (1)

- Melendrez v. D & I Investment, Inc.Document75 pagesMelendrez v. D & I Investment, Inc.davidchey4617No ratings yet

- APC Ch6solDocument22 pagesAPC Ch6solAnonymous LusWvy100% (8)

- Examiners’ report 2014: Land law questions analyzedDocument16 pagesExaminers’ report 2014: Land law questions analyzedGen AditiyaNo ratings yet

- BBSA4103 AnswerDocument15 pagesBBSA4103 AnswerKreatif TuisyenNo ratings yet

- 1 Chattel Mortgage PNB v. Manila InvestmentDocument1 page1 Chattel Mortgage PNB v. Manila InvestmentMona Liza Sulla PerezNo ratings yet

- Agreement For Accord and Satisfaction by Refinancing Debtor's Property in Name of CreditorDocument2 pagesAgreement For Accord and Satisfaction by Refinancing Debtor's Property in Name of CreditorcefuneslpezNo ratings yet

- A Dissertation ReportDocument42 pagesA Dissertation ReportKapil ChoudharyNo ratings yet

- Bankruptcy OutlineDocument63 pagesBankruptcy OutlinezumiebNo ratings yet