Professional Documents

Culture Documents

Persistent Systems

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Persistent Systems

Uploaded by

Angel BrokingCopyright:

Available Formats

2QFY2012 Result Update | IT

October 17, 2011

Persistent Systems

Performance highlights

Y/E March (` cr) Net revenue EBITDA EBITDA margin (%) PAT

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg (qoq) 6.4 13.1 112bp 17.6 2QFY11 187 43 23.0 36 % chg (yoy) 27.4 5.4 (397)bp (9.5)

`324 12 Months

2QFY12 238 45 19.0 32

1QFY12 224 40 17.9 28

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

IT 1,295 0.7 504/337 35,272 10 17,025 5,118 PERS.BO PSYS@IN

For 2QFY2012, Persistent Systems (Persistent) reported numbers that were almost in-line with our as well as street expectations on the revenue front; however, it outperformed the street as well as our expectations on the operating and profitability front. Though management has maintained its PAT guidance for FY2012 of having it at least flat yoy despite the surge in tax rates to 31% from 7% in FY2011, but its commentary has turned highly cautious. Persistent is into pure-play offshore product development (OPD), which is highly discretionary in nature and, thus, poses a huge risk for the company if any slowdown kicks in the economies. We recommend Neutral on the stock. Quarterly highlights: For 2QFY2012, Persistent reported revenue of US$51.5mn, up 3.1% qoq, majorly led by volume growth. In INR terms, revenue came in at `238.2cr, up by whopping 6.4% qoq. Despite giving wage hikes, EBITDA margin grew by 112bp qoq to 19.0%, aided by higher INR revenue growth due to qoq depreciating INR, lower SG&A expenses and wage hikes not applicable for the full employee base. PAT came in at `32.4cr, aided by higher other income due to tax-free dividend of `1.2cr, which led to lower tax outgo as well. Outlook and valuation: Persistent, due to its niche focus on OPD, is exposed to a high amount of risk if any slowdown kicks in the developed economies. This, along with the cautious commentary by management, poses a downside risk to managements guidance of 29% yoy revenue growth in FY2012. Thus, we have trimmed our USD revenue growth estimates for FY2012 to 24.1% from 30.0% earlier. Over FY2011-13E, the company is expected to record USD and INR revenue CAGR of 18.9% and 19.4%, respectively. On the EBITDA margin front, we expect margin to dip to 19.9% for FY2012 and remain at 20.0% in FY2013 from 20.4% in FY2011, as we do not expect higher growth in high-margin IP-led revenue (due to its lumpy nature). Thus, over FY2011-13E, we expect the company to record EBITDA and PAT CAGR of 18.2% and 2.5%, respectively. We value the stock at 9x FY2013 EPS, which gives us a target price of `330, and recommend Neutral on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 39.0 26.5 5.7 28.9

Abs. (%) Sensex Persistent

3m (8.3) (14.9)

1yr (15.4) (24.1)

3yr 70.7 -

Note: Listed on April 6,2010

Key financials (Indian GAAP, Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2010 601 1.2 115 74.0 24.3 32.1 10.1 1.8 18.0 17.5 1.6 6.5

FY2011 776 29.1 140 21.5 20.4 34.9 9.3 1.7 18.7 15.5 1.2 6.0

FY2012E 983 26.7 125 (10.4) 19.9 31.3 10.3 1.5 14.6 16.1 1.0 5.0

FY2013E 1,107 12.6 147 17.2 20.0 36.7 8.8 1.3 14.8 15.8 0.8 4.2

Srishti Anand

+91 22 39357800 Ext: 6820 srishti.anand@angelbroking.com

Ankita Somani

+91 22 39357800 Ext: 6819 ankita.somani@angelbroking.com

Please refer to important disclosures at the end of this report

Persistent | 2QFY2012 Result Update

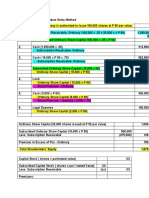

Exhibit 1: 2QFY2012 performance (Indian GAAP, Consolidated)

Y/E March (` cr) Net revenue Cost of revenue Gross profit S&M expenses G&A expenses EBITDA Depreciation EBIT Other income Forex gain/(loss) PBT Income tax PAT EPS Gross margin (%) EBITDA margin (%) EBIT margin (%) PAT margin (%)

Source: Company, Angel Research

2QFY12 238 150 89 17 27 45 14 31 7 6 45 13 32 8.1 37.2 19.0 13.2 12.9

1QFY12 224 140 83 18 26 40 13 27 6 6 40 12 28 6.9 37.3 17.9 12.3 11.7

% chg (qoq) 6.4 6.5 6.4 (5.7) 4.2 13.1 10.3 14.4

2QFY11 187 108 79 17 19 43 10 33 4 2

% chg (yoy) 27.4 38.4 12.3 (1.7) 40.5 5.4 38.6 (4.7)

1HFY12 462 290 172 34 52 85 27 59 14 13

1HFY11 368 220 148 31 39 77 20 58 7 11 76 6 70 17.6 40.1 21.0 15.7 18.2

% chg (yoy) 25.5 31.6 16.5 9.9 33.8 10.4 34.2 2.2

12.7 1.9 17.6 17.6 (3)bp 112bp 91bp 121bp

39 3 36 9.0 42.2 23.0 17.6 18.6

16.0 313.4 (9.5) (9.6) (500)bp (397)bp (444)bp (570)bp

85 25 60 15.0 37.2 18.5 12.7 12.3

12.0 345.0 (14.7) (14.6) (289)bp (254)bp (291)bp (592)bp

Exhibit 2: Actual vs. Angel estimates

(` cr) Net revenue EBITDA margin (%) PAT

Source: Company, Angel Research

Actual 238 19.0 32

Estimate 241 15.4 26

% Var (1.2) 364bp 24.1

Revenue momentum continues

For 2QFY2012, Persistent reported revenue of US$51.5mn, up 3.1% qoq, primarily led by volume growth of ~2.4% qoq. The companys offshore billing rate was flat qoq at US$3,771 per person per month (ppm); however, there was a slight decrease in onsite billing rates to US$12,665 ppm from US$13,033 ppm due to higher fixed price contracts. As such, management indicated that pricing will be stable going ahead. In INR terms, revenue growth was robust at 6.4% qoq to `238.2cr higher growth as against USD revenue due to qoq INR depreciation against USD in 2QFY2012.

October 17, 2011

Persistent | 2QFY2012 Result Update

Exhibit 3: Trend in revenue growth (qoq)

54 50 46 6.7 43.2 40.5 3.1 2.6 8.8 47.0 6.3 51.5 11 9 7 5 3 1 2QFY11 3QFY11 4QFY11 1QFY12 qoq growth (%) 2QFY12 Revenue (US$mn)

Source: Company, Angel Research

50.0

(US$ mn)

38 34 30

Exhibit 4: Trend in billing rates (qoq)

14,000 12,000 12,470 12,896 12,746 13,033 12,665

(US$/ppm)

10,000 8,000 6,000 4,000 2,000 2QFY11 3QFY11 Onsite 4QFY11 Offshore 1QFY12 2QFY12 3,601 3,661 3,723 3,770 3,771

Source: Company, Angel Research

Industry wise, the companys growth was led by the lifesciences and healthcare segment (contributing 10.6% to revenue), revenue of which grew by 10.4% qoq. Revenue from the telecom and wireless segment (contributing 22.0% to revenue) grew by 2.1% qoq, majorly led by European clients. The anchor industry segment infrastructure and systems (contributed 67.4% to revenue) continued its revenue traction and grew by 2.3% qoq.

Exhibit 5: Growth trend in industry segments

% to revenue Infrastructure and systems Telecom and wireless Lifesciences and healthcare

Source: Company, Angel Research

% chg (qoq) 2.3 2.1 10.4

% chg (yoy) 23.5 39.9 27.2

67.4 22.0 10.6

Geography wise, the companys growth was again led by Europe, revenue from which grew by 8.9% qoq as ramp-ups happened in revenue from few European clients. North America continued to grow during this quarter as well at 2.1% qoq.

October 17, 2011

(%)

42

Persistent | 2QFY2012 Result Update

Exhibit 6: Growth trend in geographies

% to revenue North America Europe Asia-Pacific

Source: Company, Angel Research

% chg (qoq) 2.1 8.9 6.9

% chg (yoy) 22.0 65.8 52.0

82.0 7.8 10.2

Revenue contribution from IP-led services increased in 2QFY2012 to 7.6% from 6.1% in 1QFY2012. Management indicated that it foresees IP-led revenue to be substantially higher in 2HFY2012 as compared to 1HFY2012 and expects IP-led revenue to touch US$25mn by the end of FY2012 i.e., whopping 68% yoy growth.

Hiring and utilization

Persistent continued its modest hiring trend and added 280 net employees during the quarter. In the technical employee base of the company, 291 net employees were added; however, there was a slight reduction in sales and support employee base. Attrition rate (LTM basis) declined significantly in 2QFY2012 to 17.7% from 18.4% in 1QFY2012. The company added 632 new graduates during the quarter.

Exhibit 7: Employee metrics

Particulars Technical Sales Rest Total Net addition Attrition LTM (%)

Source: Company, Angel Research

2QFY11 4,907 87 287 5,281 370 18.6

3QFY11 5,070 94 296 5,460 179 21.5

4QFY11 5,950 108 302 6,360 900 19.6

1QFY12 6,178 119 323 6,620 260 18.4

2QFY12 6,469 113 318 6,900 280 17.7

Net utilization (excluding resources in IP-led work) increased by 110bp qoq to 73.8%. For computing utilization, the company does not account for freshers added till they complete three months in the company. So despite adding freshers in 2QFY2012, the companys utilization level increased on a qoq basis. However, in 3QFY2012, we expect utilization to dip due to intake of freshers in the system. Management expects utilization to inch up and reach 7577% over the next 3-4 quarters.

October 17, 2011

Persistent | 2QFY2012 Result Update

Exhibit 8: Utilization trend

75 74 74 73 72.7 71.7 71.0 73 72 72 71 71 70 2QFY11 3QFY11 4QFY11 Utilisation (%)

Source: Company, Angel Research

74.2

73.8

(%)

1QFY12

2QFY12

Margin profile

In 2QFY2012, the companys EBITDA and EBIT margins increased by 112bp and 91bp qoq to 19.0% and 13.2%, respectively, despite giving wage hikes (7-8% for offshore employees and 4% for onsite employees) from July 1, 2011. This was because of higher INR revenue growth due to qoq depreciating INR, lower SG&A expenses and wage hikes not applicable for the full employee base. For the full year, the company expects margins to remain stable at FY2011 levels.

Exhibit 9: Margin profile

45 40 35 30

(%)

42.2

39.1

37.4

37.3

37.2

25 20 15 10 5

23.0

21.9 17.9 17.9

19.0

17.6

16.5 12.3 12.3 1QFY12 EBIT margin 13.2 2QFY12

2QFY11

3QFY11

4QFY11 EBITDA margin

Gross margin

Source: Company, Angel Research

For 2QFY2012, PAT came in at `32.4cr, up by whopping 17.6% qoq on the back of higher other income due to tax-free dividend of `1.2cr. This along with slight write-backs led to lower tax outgo keeping the effective tax rate for the quarter at 28.2% vs. 31.1% in 1QFY2012. For FY2012, the company expects tax rate to be at 30%.

October 17, 2011

Persistent | 2QFY2012 Result Update

Client pyramid

The client metrics of the company saw a qualitative movement with one new client getting added in the <US$1mn revenue bracket and 13 new clients getting added in the US$1mn3mn revenue bracket. In 2QFY2012, Persistent added 37 new clients. The total active client base of the company increased to 253 from 239 in 1QFY2012.

Exhibit 10: Client metrics

Particulars Customers billed <US$1mn US$1mn-3mn >US$3mn

Source: Company, Angel Research

2QFY11 201 171 21 9

3QFY11 207 169 29 9

4QFY11 229 194 26 9

1QFY12 239 198 32 9

2QFY12 253 211 32 10

Outlook and valuation

Persistent, due to its niche focus on OPD, is exposed to a high amount of risk as most of its revenue is discretionary in nature and, therefore, it is a threat to the companys revenue profile if any slowdown kicks in the developed economies. This, along with the cautious commentary by management, poses a downside risk to managements guidance of 29% yoy revenue growth in FY2012. Thus, we have trimmed our USD revenue growth for FY2012 to 24.1% from 30.0% earlier. Over, FY2011-13E, the company is expected to record USD and INR revenue CAGR of 18.9% and 19.4%, respectively. On the EBITDA margin front, we expect margin to dip to 19.9% for FY2012 and remain flat yoy to 20.0% in FY2013 from 20.4% in FY2011, as we do not expect higher growth in IP-led revenue (due to its lumpy nature), which is a high-margin business. On the bottom-line front, the company maintained its guidance of flat yoy PAT for FY2012, despite higher tax rates of 30% from 7.1% in FY2011, which we expect is tough to achieve without higher growth in IP-led revenue. Management expects IP-led revenue to touch US$25mn by the end of FY2012 i.e., whopping 68% yoy growth, which appears very difficult to be achieved given that the company has got only US$9.7mn revenue from IPs in 1HFY2012, considering managements watchful commentary on deal renewals. Thus, over FY2011-13E, we expect the company to record EBITDA and PAT CAGR of 18.2% and 2.5%, respectively. At the CMP of `324, the stock is trading at 8.8x FY2013E EPS of `36.7. We value the stock at 9x FY2013 EPS i.e., 50% discount to Infosys, which gives us a target price of `330, and recommend Neutral on the stock.

October 17, 2011

Persistent | 2QFY2012 Result Update

Exhibit 11: Key assumptions

FY2012 Revenue growth USD terms (%) USD-INR rate Revenue growth INR terms (%) EBITDA margin (%) Tax rate (%) EPS growth (%)

Source: Company, Angel Research

FY2013 13.9 46.0 8.2 20.0 31.0 17.2

24.1 46.5 8.1 19.9 30.3 (10.3)

Exhibit 12: Change in estimates

FY2012E Parameter (` cr) Net revenue EBITDA Other income PBT Tax PAT Earlier estimates 980 180 40 186 58 128 Revised estimates 983 196 28 180 55 125 (3.3) (5.5) (2.3) Variation (%) 0.3 8.7 Earlier estimates 1,117 213 36 197 61 136 FY2013E Revised estimates 1,107 221 43 213 66 147 7.8 7.8 7.8 Variation (%) (0.9) 4.0

Source: Company, Angel Research

Exhibit 13: One-year forward PE(x) chart

700 600 500

(`)

400 300 200

Dec-10

Apr-10

Apr-11

Aug-10

Aug-11

Oct-10

Feb-11

Price

Source: Company, Angel Research

16x

14x

12x

10x

8x

October 17, 2011

Oct-11

Jun-10

Jun-11

Persistent | 2QFY2012 Result Update

Exhibit 14: Recommendation summary

Company HCL Tech Hexaware Infosys Infotech Enterprises KPIT Cummins Mahindra Satyam Mindtree Mphasis NIIT Persistent TCS Tech Mahindra Wipro Buy Neutral Neutral Neutral Reduce Accumulate Accumulate Accumulate Accumulate Neutral Accumulate Buy Neutral Reco CMP (`) 439 90 2,747 118 169 73 387 340 50 324 1,120 586 357 Tgt. price (`) 558 2,837 154 79 414 382 57 1,220 734 Upside (%) 27.2 (9.0) 7.9 7.1 12.3 14.3 8.9 25.4 Target P/E (x) 15.0 11.0 18.0 8.0 10.0 11.0 10.0 11.5 8.2 9.0 20.0 9.0 15.3 FY2013E EBITDA (%) 17.2 15.3 30.6 15.1 15.3 14.6 13.9 15.5 13.8 20.0 28.7 16.3 18.3 FY2013E P/E (x) 11.6 11.4 17.4 7.9 11.0 10.2 9.4 8.6 7.2 8.8 18.4 7.2 14.6 FY2011-13E EPS CAGR (%) 24.3 66.0 14.8 8.8 16.5 30.4 28.4 0.4 11.2 2.5 17.0 28.5 6.1 FY2013E RoCE (%) 20.3 16.2 24.0 9.0 18.7 10.8 17.1 13.4 12.4 15.8 29.8 13.6 12.9 FY2013E RoE (%) 22.4 18.0 22.5 8.1 16.4 13.5 15.5 14.5 16.6 14.8 30.9 20.2 18.7

Source: Company, Angel Research

October 17, 2011

Persistent | 2QFY2012 Result Update

Profit and loss statement (Indian GAAP, Consolidated)

Y/E March (` cr) Net sales Direct costs % of net sales Gross profit % of net sales S&M expenses % of net sales G&A expenses % of net sales EBITDA % of net sales Depreciation EBIT Other income Forex gain/(loss) Profit before tax Provision for tax % of PBT PAT Extraordinary expenses Final PAT EPS (`) FY2010 601 337 56.1 264 43.9 46 7.7 71 11.9 146 24.3 34 113 8 3 124 9 7.3 115 115 32.1 FY2011 776 472 60.9 304 39.1 62 8.0 83 10.8 158 20.4 42 116 17 17 150 11 7.1 140 140 34.9 FY2012E 983 611 62.2 372 37.8 71 7.2 106 10.7 196 19.9 56 139 28 12 180 55 30.3 125 125 31.3 FY2013E 1,107 697 62.9 410 37.1 81 7.3 108 9.7 221 20.0 64 157 43 13 213 66 31.0 147 147 36.7

October 17, 2011

Persistent | 2QFY2012 Result Update

Balance sheet (Indian GAAP, Consolidated)

Y/E March (` cr) Liabilities Share capital ESOP outstanding Reserves and surplus Hedge reserves Total shareholders' funds Deferred payment liability Total liabilities Assets Gross block - fixed assets Accumulated depreciation Net block Capital work-in-progress Total fixed assets Investments Deferred tax assets, net Current assets Sundry debtors Cash and bank balance Other current assets Loans and advances Less: - Current liab. and provisions Current liabilities Provisions Net current assets Total assets 148 32 255 644 121 40 207 750 174 50 170 864 197 58 219 994 136 192 34 72 158 100 23 87 194 65 25 110 212 109 28 124 371 188 183 48 232 156 1 454 228 226 60 287 250 6 654 284 370 68 438 250 6 804 348 456 68 524 250 0 40 3 580 16 639 5 644 40 3 696 8 747 3 750 40 4 805 13 861 3 864 40 4 935 12 991 3 994 FY2010 FY2011 FY2012E FY2013E

October 17, 2011

10

Persistent | 2QFY2012 Result Update

Cash flow statement (Indian GAAP, Consolidated)

Y/E March (` cr) Pre tax profit from operations Depreciation Pre tax cash from operations Other income/prior period ad Net cash from operations Tax Cash profits (Inc)/dec in Current assets Current liabilities Net trade working capital Cashflow from operating activities (Inc)/dec in fixed assets (Inc)/dec in investments (Inc)/dec in deferred tax assets Inc/(dec) in deferred payment liab. Cashflow from investing activities Inc/(dec) in debt Inc/(dec) in equity/premium Dividends Cashflow from financing activities Cash generated/(utilised) Cash at start of the year Cash at end of the year (81) 88 7 156 (48) (68) 1 5 (110) 132 (2) 129 175 17 192 (25) (19) (44) 138 (97) (94) (5) (2) (198) (6) (26) (32) (92) 192 100 (61) 64 3 184 (207) 0 (0) (0) (207) 5 (16) (12) (35) 100 65 (35) 30 (5) 206 (150) 6 (145) (1) (16) (17) 44 65 109 FY2010 113 34 146 11 158 9 149 FY2011 116 42 158 34 193 11 182 FY2012E 139 56 196 41 236 55 182 FY2013E 157 64 221 55 276 66 210

October 17, 2011

11

Persistent | 2QFY2012 Result Update

Key ratios

Y/E March Valuation ratio (x) P/E (on FDEPS) P/CEPS P/BVPS Dividend yield (%) EV/Sales EV/EBITDA EV/Total assets Per share data (`) EPS Cash EPS Dividend Book value Dupont analysis Tax retention ratio (PAT/PBT) Cost of debt (PBT/EBIT) EBIT margin (EBIT/Sales) Asset turnover ratio (Sales/Assets) Leverage ratio (Assets/Equity) Operating ROE Return ratios (%) RoCE (pre-tax) Angel RoIC RoE Turnover ratios (x) Asset turnover (fixed assets) Receivables days Payable days 2.7 73 120 3.0 69 104 2.7 72 104 2.3 70 103 17.5 45.7 18.0 15.5 34.1 18.7 16.1 29.0 14.6 15.8 27.8 14.8 0.9 1.1 0.2 0.9 1.0 18.0 0.9 1.3 0.1 1.0 1.0 18.7 0.7 1.3 0.1 1.1 1.0 14.6 0.7 1.4 0.1 1.1 1.0 14.8 32.1 41.4 0.6 178.1 34.9 45.5 5.5 186.8 31.3 45.4 3.5 215.2 36.7 52.6 3.5 247.6 10.1 7.8 1.8 0.2 1.6 6.5 1.5 9.3 7.1 1.7 1.7 1.2 6.0 1.3 10.3 7.1 1.5 1.1 1.0 5.0 1.1 8.8 6.2 1.3 1.1 0.8 4.2 0.9 FY2010 FY2011 FY2012E FY2013E

October 17, 2011

12

Persistent | 2QFY2012 Result Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Persistent No No No No

Note: We have not considered any Exposure below `1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

October 17, 2011

13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Suryaa Hotel Bal SheetDocument3 pagesSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Maintain Inventory RecordsDocument16 pagesMaintain Inventory Recordsjoy xoNo ratings yet

- Asset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White PaperDocument7 pagesAsset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White Papervarachartered283No ratings yet

- STT-ExplosiveProfitGuide v1c PDFDocument23 pagesSTT-ExplosiveProfitGuide v1c PDFIoannis Michelis100% (2)

- SFAD Final Term Report - E-InteriorsDocument16 pagesSFAD Final Term Report - E-Interiorsstd32794No ratings yet

- Tutorial 7 Financial Instrument (Q) CRCIDocument2 pagesTutorial 7 Financial Instrument (Q) CRCIts tanNo ratings yet

- Discounted Cash Flow (DCF) Valuation: Capital Asset Pricing Model (CAPM)Document4 pagesDiscounted Cash Flow (DCF) Valuation: Capital Asset Pricing Model (CAPM)Henry WangNo ratings yet

- Technical Rooms DetailDocument24 pagesTechnical Rooms Detailconsultnadeem70No ratings yet

- Understanding the Importance of Accurate Binomial Option Pricing ModelsDocument17 pagesUnderstanding the Importance of Accurate Binomial Option Pricing ModelsresbickrayNo ratings yet

- Answers To Final Exam Revision Practice QDocument5 pagesAnswers To Final Exam Revision Practice QMinSu YangNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Project Evaluation Techniques Non-Discounted Cash FlowDocument3 pagesProject Evaluation Techniques Non-Discounted Cash FlowYameteKudasaiNo ratings yet

- October2012 PDFDocument40 pagesOctober2012 PDFKhairul MuzafarNo ratings yet

- Additional Subscription by Way of Shares of StockDocument3 pagesAdditional Subscription by Way of Shares of Stockregine rose bantilanNo ratings yet

- MCQ 501Document90 pagesMCQ 501haqmalNo ratings yet

- 620000977631310-VAL APLNoticeDocument2 pages620000977631310-VAL APLNoticesiti awangNo ratings yet

- 11Document3 pages11samuel debebeNo ratings yet

- Forex Secret Manual System Readme PDFDocument15 pagesForex Secret Manual System Readme PDFLucky LuckNo ratings yet

- Answers To The Chapter ExercisesDocument14 pagesAnswers To The Chapter ExercisesSamina MahmoodNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Philippine Management Review 2020, Vol. 27, 17-36Document20 pagesPhilippine Management Review 2020, Vol. 27, 17-36stephen_palmer_uy6978No ratings yet

- Certificate of Balance Statement Cheque Copy History Report Request Form (160112) - BlankFormDocument1 pageCertificate of Balance Statement Cheque Copy History Report Request Form (160112) - BlankFormFernando Antúnez GarcíaNo ratings yet

- Beneish's M-Score: The Detection ofDocument23 pagesBeneish's M-Score: The Detection ofraghavendra_20835414No ratings yet

- Negotiation and Selling SkillsDocument18 pagesNegotiation and Selling SkillsTanvi JuikarNo ratings yet

- Difference Between Financial & Managerial AccountingDocument3 pagesDifference Between Financial & Managerial AccountingAnisa LabibaNo ratings yet

- Numbers 14 and 15 AccountingDocument3 pagesNumbers 14 and 15 Accountingelsana philipNo ratings yet

- Executive Summary - HeinzDocument1 pageExecutive Summary - HeinzSibiya Zaman AdibaNo ratings yet

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Trading Chart Patterns - Trading Guides - CMC MarketsDocument12 pagesTrading Chart Patterns - Trading Guides - CMC MarketsRohit PurandareNo ratings yet

- Chapter 15Document19 pagesChapter 15diane camansagNo ratings yet

- Garp MarchDocument5 pagesGarp MarchZerohedgeNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)