Professional Documents

Culture Documents

Mark Stopa Esq - A Game-Changer On Motions To Dismiss

Uploaded by

winstons2311Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mark Stopa Esq - A Game-Changer On Motions To Dismiss

Uploaded by

winstons2311Copyright:

Available Formats

A Game-Changer on Motions to Dismiss

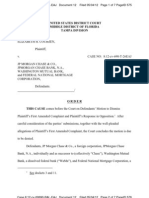

Posted on October 20, 2011 by Mark Stopa As a foreclosure defense attorney with foreclosure cases in many different counties before a wide array of judges, Ive seen a significant difference in opinion, even among judges, about the merits of motions to dismiss in foreclosure cases. Perhaps the biggest reason for the wide variety of opinions is the absence of case law from Floridas appellate courts on the issue. The problem is largely procedural an order denying a motion to dismiss is not appealable until the end of the case, and by the time a foreclosure case is over, the homeowners best argument for appeal likely isnt whether the Complaint stated a cause of action, but the propriety of the foreclosure itself. What has resulted is an unusual dynamic where Florida circuit judges have been ruling on thousands upon thousands of motions to dismiss without clear direction from Floridas appellate courts on what it takes for a bank to state a cause of action and survive a motion to dismiss. Thats not an indictment of anyone there just havent been appellate decisions that clearly address this standard. Suffice it to say I was elated to read this opinion from Floridas Second District Court of Appeal. Here is the key language http://www.scribd.com/doc/69517251/4DCA-FELTUSvUSBANK-Lost-Note-Fraud-Affidavit-Rule -1-190-a On November 18, 2009, U.S. Bank filed another copy of the Note as a supplemental exhibit to its complaint. In contrast to the copy attached to the complaint that contained no endorsements, this copy contained two endorsements We view U.S. Banks filing of a copy of the note that it later asserted was an original note as a supplemental exhibit to its complaint to reestablish a lost note as an attempt to amend its complaint in violation of Florida Rule of Civil Procedure 1.190(a). U.S. Bank did not seek leave of court or the consent of Feltus to amend its complaint. A pleading filed in violation of Rule 1.190(a) is a nullity, and the controversy should be determined based on the properly filed pleadings. See Warner-Lambert Co. v. Patrick, 428 So. 2d 718 (Fla. 4th DCA 1983). Why is this language so significant? Think about it. How many instances are there in foreclosure cases where the note attached to the Complaint contains no indorsement, but the bank later files an indorsement that contains one, then tries to defeat a motion to dismiss by asking the court to consider the subsequently-filed indorsement? I see this all of the time perhaps the majority of cases. The Note attached to the complaint typically has no indorsement, yet the note filed thereafter does. When I argue a motion to dismiss, I argue the court must stay within the confines of the four-corners of the complaint (black-letter law), which means the court can consider only the note attached to the complaint, not the note subsequently filed with an indorsement. Bank lawyers, by contrast, want judges to consider the subsequently-filed note, arguing we filed the original note, indorsed in blank, so we are the holder. Ive argued the impropriety of this argument before from the standpoint of standing at inception, i.e. if the bank lacked an indorsement when it filed the suit, it cannot cure that deficiency by obtaining the requisite indorsement thereafter. See Progressive Express Ins. Co. v. McGrath Community Chiro., 913 So. 2d 1281, 1285 (Fla. 2d DCA 2005) (the plaintiffs lack of standing at the inception of the case is not a defect that may be cured by the acquisition of standing after the case is filed.). In its recent opinion, the Second District goes a step further. Its not merely an issue of the bank lacking standing at the inception of the case. The court is not even allowed to consider the subsequently-filed note without the bank amending its complaint. References to the subsequently-filed note, for pleading purposes, are a nullity. Everyone should be citing Feltus v. U.S. Bank when arguing motions to dismiss. Its time that

banks stopped getting away with amending their pleadings via the filing of a note that contravenes the note attached to their complaints without leave of court and without the consent of all defendants. See Fla.R.Civ.P. 1.190. In other words, as soon as a banks lawyer has to resort to referencing a note that is not attached to the complaint when opposing a motion to dismiss, that shows the bank has failed to state a cause of action and either needs to amend its complaint or suffer a dismissal without leave to amend, as in Progressive. Mark Stopa

www.stayinmyhome.com

You might also like

- Motion For Rehearing (Final) r1Document46 pagesMotion For Rehearing (Final) r1jamcguireNo ratings yet

- Petition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257From EverandPetition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257No ratings yet

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActFrom EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413From EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413No ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- How one of my Pro-se cases got destroyed by federal rogue judgesFrom EverandHow one of my Pro-se cases got destroyed by federal rogue judgesNo ratings yet

- U.S. Bank National Association As Trustee v. Toni Ascenzia Et AlDocument3 pagesU.S. Bank National Association As Trustee v. Toni Ascenzia Et AlForeclosure Fraud100% (3)

- A159998 OpinionDocument12 pagesA159998 OpinionDinSFLANo ratings yet

- Glaski Affidavit Thomas Adams 5 15Document8 pagesGlaski Affidavit Thomas Adams 5 15raphinologyNo ratings yet

- Response To San Diego Home Funding LLCDocument17 pagesResponse To San Diego Home Funding LLCNick CruzNo ratings yet

- f01c 0808781Document72 pagesf01c 0808781Dylan SavageNo ratings yet

- Motion For Sanction of Dismissal With Prejudice-Robot Signers-Fraud On The CourtDocument10 pagesMotion For Sanction of Dismissal With Prejudice-Robot Signers-Fraud On The Courtwinstons2311100% (1)

- BankUnited Fraud - Albertelli Law S Wrongful Foreclosure ActionDocument22 pagesBankUnited Fraud - Albertelli Law S Wrongful Foreclosure ActionAlbertelli_LawNo ratings yet

- Wayne County, Michigan Mortgage Foreclosure Sherrif Sales Order and Opinion 2:09-cv-14328-2Document16 pagesWayne County, Michigan Mortgage Foreclosure Sherrif Sales Order and Opinion 2:09-cv-14328-2Beverly TranNo ratings yet

- Johnnie M. Hayes v. U.S. Bank National Association, 11th Cir. (2016)Document9 pagesJohnnie M. Hayes v. U.S. Bank National Association, 11th Cir. (2016)Scribd Government DocsNo ratings yet

- HARVEY V. HSBC - April Charney Esq. Appeal Brief - PSADocument46 pagesHARVEY V. HSBC - April Charney Esq. Appeal Brief - PSAwinstons2311No ratings yet

- Defendants Motion For Summary JudgmentDocument13 pagesDefendants Motion For Summary JudgmentGuy Madison NeighborsNo ratings yet

- (20-22398 24) Defendants' Motion For Rehearing and To Vacate Judgment DE 131Document4 pages(20-22398 24) Defendants' Motion For Rehearing and To Vacate Judgment DE 131larry-612445No ratings yet

- Bankruptcy Appellate Panel Analyzes Standing Requirements for Mortgage Assignee and ServicerDocument39 pagesBankruptcy Appellate Panel Analyzes Standing Requirements for Mortgage Assignee and ServicerVasu VijayraghavanNo ratings yet

- Response Brief of Quality Loan Service CorpDocument24 pagesResponse Brief of Quality Loan Service CorpLee Perry100% (1)

- USCOURTS Ilnd 1 - 16 CV 02895 1Document15 pagesUSCOURTS Ilnd 1 - 16 CV 02895 1DinSFLANo ratings yet

- LocalRules BK S CADocument144 pagesLocalRules BK S CARobert Salzano100% (1)

- Motion To Set Aside EloyDocument3 pagesMotion To Set Aside EloyIleana PalominoNo ratings yet

- Yvanova v New Century Loses Appeal AgainDocument6 pagesYvanova v New Century Loses Appeal AgainFAQMD2No ratings yet

- Affirmative Defenses MNDocument10 pagesAffirmative Defenses MNFrank KaylorNo ratings yet

- Automatic Dissolution of Lis Pendens Notice, Rule 1.420 (F)Document14 pagesAutomatic Dissolution of Lis Pendens Notice, Rule 1.420 (F)Albertelli_Law100% (1)

- William Roberts Vs America's Wholesale Lender Appellant's OpeningDocument23 pagesWilliam Roberts Vs America's Wholesale Lender Appellant's Openingforeclosurelegalrigh100% (1)

- Assignment - Contract LawsDocument3 pagesAssignment - Contract LawsMukul Sharda100% (1)

- LNV Corporation vs. Catherine GebhardtDocument20 pagesLNV Corporation vs. Catherine Gebhardtbealbankfraud100% (2)

- ABCs of Legal Analysis of RMBS SecuritizationsDocument6 pagesABCs of Legal Analysis of RMBS SecuritizationsHenoAlambreNo ratings yet

- Morgan V Ocwen, MERSDocument15 pagesMorgan V Ocwen, MERSForeclosure Fraud100% (2)

- 2020-4-20 Petition For Writ of Certiorari FILEDDocument13 pages2020-4-20 Petition For Writ of Certiorari FILEDCasey FrizzellNo ratings yet

- Robo-Signing Gems VIIIDocument34 pagesRobo-Signing Gems VIIIizraul hidashiNo ratings yet

- Notice of Appeal in The TJ HS Admissions CaseDocument2 pagesNotice of Appeal in The TJ HS Admissions CaseABC7NewsNo ratings yet

- C C C CCCCCCC CC CDocument4 pagesC C C CCCCCCC CC CAdriana Paola GuerreroNo ratings yet

- LPS - Ron Wilson - Memo of Law Supporting Motion For ReliefDocument20 pagesLPS - Ron Wilson - Memo of Law Supporting Motion For ReliefForeclosure Fraud100% (1)

- Got $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing ConductDocument21 pagesGot $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing Conduct83jjmackNo ratings yet

- Federal V StateDocument2 pagesFederal V StateMortgage Compliance Investigators100% (1)

- BANA V - Nash Final - JudgmentDocument4 pagesBANA V - Nash Final - Judgmentdeliverychic100% (1)

- Affidavit Summary JudgmentDocument2 pagesAffidavit Summary JudgmentAdrian ReyesNo ratings yet

- Foreclosure Defense: Know The Law, The Rules of Evidence, The Rules, The Fact and Don't Give Up.Document2 pagesForeclosure Defense: Know The Law, The Rules of Evidence, The Rules, The Fact and Don't Give Up.Allen Kaul100% (1)

- Debtors (Rebecca Fleury's) Response To Motion To Dismiss-Fleury Chapter 7 BankruptcyDocument4 pagesDebtors (Rebecca Fleury's) Response To Motion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718No ratings yet

- Schwartzwald (Ohio Supreme Court) BriefDocument110 pagesSchwartzwald (Ohio Supreme Court) BriefJohn Reed100% (2)

- Capacity Cases Compendium From Matt Weidner Esq.Document81 pagesCapacity Cases Compendium From Matt Weidner Esq.winstons2311No ratings yet

- Motion To Remand To State Court Re ForeclosureDocument22 pagesMotion To Remand To State Court Re Foreclosurejohngault100% (2)

- Appellants Response To DCA Order To Show CauseDocument180 pagesAppellants Response To DCA Order To Show CauseJohn CarrollNo ratings yet

- United States District Court District of New Jersey: PlaintiffDocument22 pagesUnited States District Court District of New Jersey: PlaintiffMostly Stolen ProductionsNo ratings yet

- BoA Initial Brief - Nash AppealDocument32 pagesBoA Initial Brief - Nash AppealpsaperstoneNo ratings yet

- In Re Veal 9th Cir. Bankruptcy Appellate Opinion 10 Jun 2011Document46 pagesIn Re Veal 9th Cir. Bankruptcy Appellate Opinion 10 Jun 2011William A. Roper Jr.100% (1)

- Motion To Disqualify JudgeDocument8 pagesMotion To Disqualify Judgewinstons2311No ratings yet

- BAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.Document21 pagesBAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.Tim Bryant100% (4)

- JPMC v. Butler WDocument6 pagesJPMC v. Butler WDinSFLANo ratings yet

- Lopez v. JP Morgan Chase Huey Jen Chui Vice President Wamu Robo Signer 10-24-12 WWW - Courts.ca - Gov - OpinionsDocument19 pagesLopez v. JP Morgan Chase Huey Jen Chui Vice President Wamu Robo Signer 10-24-12 WWW - Courts.ca - Gov - Opinionstraderash1020No ratings yet

- ComplaintDocument6 pagesComplainthdcottonNo ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151No ratings yet

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)From EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No ratings yet

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- Transcript - Deustche Bank v. Mischenko - Failure of Condition PrecedentDocument119 pagesTranscript - Deustche Bank v. Mischenko - Failure of Condition Precedentwinstons2311100% (2)

- FL Trial Hearing Transcript - Foreclosure Defense in A Nut ShellDocument178 pagesFL Trial Hearing Transcript - Foreclosure Defense in A Nut Shellwinstons231167% (3)

- Mort Is Non Negotiable Initial-BriefDocument42 pagesMort Is Non Negotiable Initial-Briefscribd6099No ratings yet

- FL Appeal - ReplyBrief 1 - Can Servicer Foreclose ?Document16 pagesFL Appeal - ReplyBrief 1 - Can Servicer Foreclose ?winstons2311No ratings yet

- Initial Brief Appeal Order Vacating DismissalDocument30 pagesInitial Brief Appeal Order Vacating Dismissalwinstons231150% (2)

- FL Trial Hearing Transcript - Foreclosure Defense in A Nut ShellDocument178 pagesFL Trial Hearing Transcript - Foreclosure Defense in A Nut Shellwinstons231167% (3)

- American Home Mortgage ForeclosureTrial Transcript - Case DismissedDocument109 pagesAmerican Home Mortgage ForeclosureTrial Transcript - Case Dismissedwinstons2311100% (1)

- FL - Hearing Transcript - The Issue of Complaint VerificationDocument16 pagesFL - Hearing Transcript - The Issue of Complaint Verificationwinstons2311100% (2)

- Motion To Dismiss Amended ComplaintDocument13 pagesMotion To Dismiss Amended Complaintwinstons2311100% (3)

- FL Motion To Dismiss Foreclosure Complaint - Failure To Post Cost BondDocument7 pagesFL Motion To Dismiss Foreclosure Complaint - Failure To Post Cost Bondwinstons2311100% (2)

- HARVEY V. HSBC - April Charney Esq. Appeal Brief - PSADocument46 pagesHARVEY V. HSBC - April Charney Esq. Appeal Brief - PSAwinstons2311No ratings yet

- First Amendment Foundation Motion To Intervene - HSBC v. Lopez .Document21 pagesFirst Amendment Foundation Motion To Intervene - HSBC v. Lopez .winstons2311100% (1)

- April Charney - Motion To Dismiss Florida ForeclosureDocument3 pagesApril Charney - Motion To Dismiss Florida Foreclosurewinstons2311No ratings yet

- 4 DCA - Acosta v. Deusche Bank - Rule 1.540 (B)Document3 pages4 DCA - Acosta v. Deusche Bank - Rule 1.540 (B)winstons2311No ratings yet

- Arizona $50M Foreclosure Fund Sweep Complaint For Declaratory and Injunctive ReliefDocument11 pagesArizona $50M Foreclosure Fund Sweep Complaint For Declaratory and Injunctive Reliefwinstons2311No ratings yet

- Memo Support MTD For Unverified Complaint Supplement 11Document5 pagesMemo Support MTD For Unverified Complaint Supplement 11winstons2311100% (1)

- Courson v. Jpmorgan Chase Middle District Case For Motion To DismissDocument7 pagesCourson v. Jpmorgan Chase Middle District Case For Motion To DismissbrownwyNo ratings yet

- Emergency Motion For Stay Pending AppealDocument2 pagesEmergency Motion For Stay Pending Appealwinstons2311100% (4)

- Motion To Dismiss Complaint, Motion To Vacate Clerks Default and in The Alternative Motion For Summary JudgmentDocument9 pagesMotion To Dismiss Complaint, Motion To Vacate Clerks Default and in The Alternative Motion For Summary JudgmentForeclosure Fraud100% (1)

- April Charney - Defendants Memorandum Opposition Plaintiffs Motion Strike Florida Foreclosure DefenseDocument10 pagesApril Charney - Defendants Memorandum Opposition Plaintiffs Motion Strike Florida Foreclosure Defensewinstons2311No ratings yet

- Killer QWR Qualified Written RequestDocument20 pagesKiller QWR Qualified Written Requestwinstons2311100% (10)

- Initial Brief Appeal Order Vacating DismissalDocument30 pagesInitial Brief Appeal Order Vacating Dismissalwinstons231150% (2)

- April Charney Emergency Motion To Stop Foreclosure Sale 1Document10 pagesApril Charney Emergency Motion To Stop Foreclosure Sale 1winstons2311100% (2)

- Motion To Quash-Vacate JudgmentDocument13 pagesMotion To Quash-Vacate Judgmentwinstons2311100% (1)

- Motion For Contempt Bank Violated InjunctionDocument6 pagesMotion For Contempt Bank Violated Injunctionwinstons231150% (2)

- Capacity Cases Compendium From Matt Weidner Esq.Document81 pagesCapacity Cases Compendium From Matt Weidner Esq.winstons2311No ratings yet

- Court Order Dismissing Foreclosure Lawsuit - Standing at InterceptionDocument2 pagesCourt Order Dismissing Foreclosure Lawsuit - Standing at Interceptionwinstons2311No ratings yet

- Petition For Writ of Certiorari From A Non-Final OrderDocument21 pagesPetition For Writ of Certiorari From A Non-Final Orderwinstons2311100% (1)

- Foreclosure - Motion For Rehearing Reconsideration Saxon v. JordanDocument56 pagesForeclosure - Motion For Rehearing Reconsideration Saxon v. Jordanwinstons2311100% (5)

- DEFENDANT'S ANSWER, AFFIRMATIVE DEFENSES, AND MOTION TO DISMISS PLAINTIFF'S AMENDED COMPLAINT - ForeclosureDocument14 pagesDEFENDANT'S ANSWER, AFFIRMATIVE DEFENSES, AND MOTION TO DISMISS PLAINTIFF'S AMENDED COMPLAINT - Foreclosurewinstons2311No ratings yet

- Your Guide To Starting A Small EnterpriseDocument248 pagesYour Guide To Starting A Small Enterprisekleomarlo94% (18)

- Chapter 2Document16 pagesChapter 2golfwomann100% (1)

- Cease and Desist DemandDocument2 pagesCease and Desist DemandJeffrey Lu100% (1)

- This Content Downloaded From 181.65.56.6 On Mon, 12 Oct 2020 21:09:21 UTCDocument23 pagesThis Content Downloaded From 181.65.56.6 On Mon, 12 Oct 2020 21:09:21 UTCDennys VirhuezNo ratings yet

- Baker Jennifer. - Vault Guide To Education CareersDocument156 pagesBaker Jennifer. - Vault Guide To Education Careersdaddy baraNo ratings yet

- 27793482Document20 pages27793482Asfandyar DurraniNo ratings yet

- Taiping's History as Malaysia's "City of Everlasting PeaceDocument6 pagesTaiping's History as Malaysia's "City of Everlasting PeaceIzeliwani Haji IsmailNo ratings yet

- Approvalsand Notificationsfor Authorisersand RequisitionersDocument15 pagesApprovalsand Notificationsfor Authorisersand RequisitionersSharif AshaNo ratings yet

- Admin Project1 RecuitmentDocument18 pagesAdmin Project1 Recuitmentksr131No ratings yet

- Understanding Risk and Risk ManagementDocument30 pagesUnderstanding Risk and Risk ManagementSemargarengpetrukbagNo ratings yet

- IMMI Refusal Notification With Decision Record-4Document6 pagesIMMI Refusal Notification With Decision Record-4SHREYAS JOSHINo ratings yet

- Simple Present: Positive SentencesDocument16 pagesSimple Present: Positive SentencesPablo Chávez LópezNo ratings yet

- The Christian WalkDocument4 pagesThe Christian Walkapi-3805388No ratings yet

- Introduction To World Religion and Belief Systems: Ms. Niña A. Sampaga Subject TeacherDocument65 pagesIntroduction To World Religion and Belief Systems: Ms. Niña A. Sampaga Subject Teacherniña sampagaNo ratings yet

- MBA Capstone Module GuideDocument25 pagesMBA Capstone Module GuideGennelyn Grace PenaredondoNo ratings yet

- Navarro v. SolidumDocument6 pagesNavarro v. SolidumJackelyn GremioNo ratings yet

- Disadvantages of PrivatisationDocument2 pagesDisadvantages of PrivatisationumamagNo ratings yet

- Prospero'sDocument228 pagesProspero'sIrina DraganescuNo ratings yet

- Aznar V CitibankDocument3 pagesAznar V CitibankDani LynneNo ratings yet

- Different Western Classical Plays and Opera (Report)Document26 pagesDifferent Western Classical Plays and Opera (Report)Chaorrymarie TeañoNo ratings yet

- Uppers Various Info DatabaseDocument54 pagesUppers Various Info DatabaseJason BexonNo ratings yet

- System C Medway Proxima 0519Document4 pagesSystem C Medway Proxima 0519qy6jnrjzmcNo ratings yet

- Week-9 Ethics and Codes of Professional ConductDocument14 pagesWeek-9 Ethics and Codes of Professional Conductapi-3737023No ratings yet

- Airline Operation - Alpha Hawks AirportDocument9 pagesAirline Operation - Alpha Hawks Airportrose ann liolioNo ratings yet

- The Ten Commandments of Financial FreedomDocument1 pageThe Ten Commandments of Financial FreedomhitfaNo ratings yet

- Stores & Purchase SopDocument130 pagesStores & Purchase SopRoshni Nathan100% (4)

- Ca NR 06 en PDFDocument251 pagesCa NR 06 en PDFZafeer Saqib AzeemiNo ratings yet

- 320-326 Interest GroupsDocument2 pages320-326 Interest GroupsAPGovtPeriod3No ratings yet

- Risk Management in Banking SectorDocument7 pagesRisk Management in Banking SectorrohitNo ratings yet

- HRM-4211 Chapter 4Document10 pagesHRM-4211 Chapter 4Saif HassanNo ratings yet